Global Bottled Water Market

Market Size in USD Billion

CAGR :

%

USD

344.51 Billion

USD

578.78 Billion

2024

2032

USD

344.51 Billion

USD

578.78 Billion

2024

2032

| 2025 –2032 | |

| USD 344.51 Billion | |

| USD 578.78 Billion | |

|

|

|

|

Bottled Water Market Size

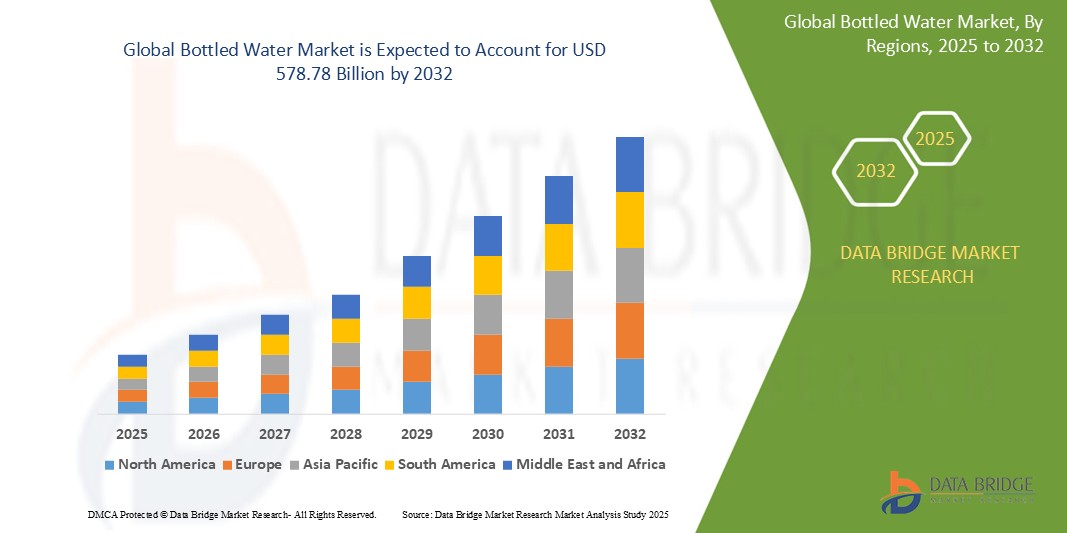

- The global bottled water market size was valued at USD 344.51 billion in 2024 and is expected to reach USD 578.78 billion by 2032, at a CAGR of 6.70% during the forecast period

- The market growth is largely fuelled by the market growth is largely fuelled by rising health consciousness, increasing demand for safe and convenient drinking water, and a shift away from sugary beverages among consumers

- Growing urbanization and a rising number of on-the-go consumers are boosting demand for bottled water as a portable and accessible hydration option

Bottled Water Market Analysis

- The bottled water market is experiencing consistent growth due to increasing consumer preference for packaged hydration solutions. Rising awareness of quality and purity standards is influencing purchase decisions and shaping product innovations

- Premium and functional bottled water categories are expanding as consumers seek added value and health-related benefits. Brands are introducing products with minerals, vitamins, and unique packaging to enhance appeal and support differentiation

- Asia-Pacific bottled water market dominates the global market with the largest revenue share of 46.1% in 2024. This dominance is supported by its large population, rapid urbanization, and increasing awareness of the importance of clean drinking water

- Europe region is expected to witness the highest growth rate in the global bottled water market, driven by rising health awareness and increasing demand for premium and functional water products

- The purified water segment is anticipated to hold the largest market revenue share, driven by its widespread accessibility, affordability, and the perception of enhanced safety due to various filtration processes. Consumers prioritize it for daily hydration due to its consistent taste and economical price

Report Scope and Bottled Water Market Segmentation

|

Attributes |

Bottled Water Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bottled Water Market Trends

“Rise of Functional and Enhanced Bottled Water”

- Functional bottled water infused with vitamins, minerals, and antioxidants is becoming a top choice for health-conscious consumers

- For instance, Glaceau Vitaminwater offers flavored hydration with added nutrients targeting energy and immunity support

- Enhanced hydration products appeal to on-the-go individuals who seek wellness without compromising convenience

- Products often include callouts such as "supports immunity" or "boosts metabolism" right on the front label for quick recognition

- Younger consumers in urban environments are driving the shift toward lifestyle-oriented water choices

- Unique packaging designs and creative marketing campaigns are helping functional water stand out among traditional bottled options

Bottled Water Market Dynamics

Driver

“Increasing Health Awareness and Preference for Safe Drinking Water”

- Growing global awareness of health and wellness is prompting consumers to replace sugary drinks with bottled water

- For instance, many gyms and fitness centers now promote bottled water as the primary hydration option over sports or energy drinks

- Concerns over the safety and quality of tap water in several regions are driving people to choose bottled water as a trusted source

- In areas with aging infrastructure or contamination issues, bottled water offers a reliable and immediate solution for safe hydration

- Urban lifestyles and on-the-go routines are increasing the appeal of bottled water due to its portability and accessibility

- Health-conscious buyers are showing preference for low-calorie, additive-free beverages, which bottled water naturally provides

- Marketing that highlights purity, mineral content, and natural sourcing is boosting demand for premium bottled water products

Restraint/Challenge

“Environmental Concerns and Plastic Waste Issues”

- The bottled water industry is under increasing scrutiny due to its reliance on single-use plastic bottles, which significantly contribute to global pollution

- For instance, millions of plastic bottles end up in oceans annually, threatening marine life and ecosystems

- Environmental groups and conscious consumers are pressuring companies to shift toward more sustainable packaging solutions

- Stricter government regulations on plastic use are influencing production methods and supply chain logistics in the bottled water sector

- Eco-aware consumers are turning to reusable water bottles and home filtration systems as greener alternatives to bottled options

- While some brands are exploring biodegradable and recyclable materials, the industry-wide shift is slow due to high costs and logistical challenges

Bottled Water Market Scope

The global bottled water market is segmented on the basis of type, capacity type, category, packaging type, and distribution channel.

- By Type

On the basis of type, the bottled water market is segmented into purified water, functional water, mineral water, and sparkling/carbonated water. The purified water segment is anticipated to hold the largest market revenue share, driven by its widespread accessibility, affordability, and the perception of enhanced safety due to various filtration processes. Consumers prioritize it for daily hydration due to its consistent taste and economical price.

The functional water segment is expected to witness the fastest growth rate, fueled by increasing consumer awareness of health and wellness benefits, alongside rising demand for beverages offering added vitamins, minerals, and other health-enhancing properties.

- By Capacity Type

On the basis of capacity type, the bottled water market is segmented into 3 Gallon, 5 Gallon, and Others. The 5 Gallon segment held the largest market revenue share, primarily due to its popularity for home and office water delivery systems, offering a cost-effective and convenient solution for bulk consumption. This segment benefits from an established infrastructure for water coolers.

The 3 Gallon segment is expected to witness the fastest growth rate, driven by its more manageable size for smaller households or office spaces, offering a balance between bulk purchasing benefits and ease of handling compared to larger capacities.

- By Category

On the basis of category, the bottled water market is segmented into plain and flavoured. The plain segment accounted for the largest market revenue share, driven by its universal appeal as a fundamental source of hydration and its health benefits, serving as a versatile, calorie-free option for all consumers.

The flavoured segment is expected to witness the fastest growth rate, propelled by evolving consumer preferences for diverse taste experiences, a desire for healthier alternatives to sugary drinks, and continuous innovation in natural and exotic flavor profiles that cater to adventurous palates.

- By Packaging Type

On the basis of packaging type, the bottled water market is segmented into PET, cans, and others. The PET segment held the largest market revenue share of 80.6%, primarily due to its cost-effectiveness, lightweight nature, and convenience for single-serve and on-the-go consumption, making it the most ubiquitous packaging choice across retail channels.

The cans segment is expected to witness the fastest growth rate, driven by growing environmental consciousness and increased consumer preference for recyclable and sustainable packaging solutions, alongside their durability and premium aesthetic appeal.

- By Distribution Channel

On the basis of distribution channel, the bottled water market is segmented into Off-trade, On-trade, online, restaurants/hotels, café, and others. The Off-trade segment held the largest market revenue share of 89.3%, driven by its extensive product selection, competitive pricing, and broad consumer reach for daily and bulk purchases.

The online segment is expected to witness the fastest growth rate, favored by the increasing adoption of e-commerce, the convenience of home delivery, and access to a wider variety of bottled water brands, including specialty and premium options, catering to modern consumer shopping habits.

Bottled Water Market Regional Analysis

- Asia-Pacific bottled water market dominates the global market with the largest revenue share of 46.1% in 2024.

- This dominance is supported by its large population, rapid urbanization, and increasing awareness of the importance of clean drinking water.

- Rising disposable incomes and the popularity of premium and functional bottled water are also significant drivers. The region's expanding retail channels and focus on sustainability further fuel its growth.

Japan Bottled Water Market Insight

The Japan bottled water market is expected to witness the fastest growth rate from 2025 to 2032. This growth is primarily fuelled by a thriving tourism sector, which increases demand for high-quality bottled water. Japanese consumers' growing health consciousness and a preference for pure, distinctly flavored, and mineral-rich varieties further drive the market. Eco-conscious innovations in sustainable packaging, such as bio-PET bottles, are also contributing to market expansion and consumer appeal.

China Bottled Water Market Insight

The China bottled water market is expected to witness the fastest growth rate from 2025 to 2032. This robust growth is driven by increasing health awareness among consumers and a growing middle class with higher disposable incomes. Concerns over tap water quality and widespread urbanization further propel the demand for safe and convenient bottled water. The market also benefits from a shift away from sugary drinks and significant product innovation, especially in purified and sparkling water.

North America Bottled Water Market Insight

North America held a substantial share of 43.3% of the global market in 2024, and is expected to witness high growth, from 2025 to 2035. This growth is driven by the increasing popularity of health-conscious beverages, with consumers opting for calorie-free hydration options such as mineral or flavored waters. The prevalence of on-the-go lifestyles further fuels demand for convenient and portable bottled water. The market also benefits from a strong preference for premium bottled water, including spring and alkaline variants.

U.S. Bottled Water Market Insight

The U.S. bottled water market captured a significant revenue share within North America, accounting for 13.6% of the global bottled water market in 2024. This is primarily propelled by increasing health and wellness trends among consumers and a strong demand for convenient hydration solutions. The market benefits from a shift away from sugary drinks, with a rising preference for purified and sparkling water. In addition, robust product innovation and widespread availability across various retail platforms contribute to its leading position.

Europe Bottled Water Market Insight

The Europe bottled water market is expected to witness the fastest growth rate from 2025 to 2032. This expansion is primarily driven by increasing health consciousness among consumers, a growing desire for safe and clean drinking water, and an escalating demand for convenient, on-the-go hydration solutions. The region is also witnessing a significant shift towards eco-friendly packaging and a rise in flavored and infused waters as consumers seek healthier alternatives to sugary drinks.

U.K. Bottled Water Market Insight

The U.K. bottled water market is expected to witness the fastest growth rate 2025 to 2032. This growth is driven by increasing consumer demand for healthier, convenient beverage options and a shift towards premium and flavored bottled water. The ease of portability and convenience, coupled with growing awareness of waterborne infections, are key factors. In addition, producers are increasingly employing more PET and plant-based water bottles to achieve sustainability goals, positively impacting brand perception.

Germany Bottled Water Market Insight

The Germany bottled water market holding a market share of 3.4% of the global market, and is expected to witness the fastest growth rate from 2025 to 2032. This growth is fuelled by increasing consumer preference for convenient and safe drinking water, rising health consciousness, and urbanization. The shift from sugar-based beverages to healthier alternatives such as bottled water has significantly improved consumption. The market is strongly governed by locally sourced products, recognized for their high quality, and benefits from a well-developed infrastructure.

Bottled Water Market Share

The bottled water industry is primarily led by well-established companies, including:

- PepsiCo (U.S.)

- Nestlé, A.G. (Switzerland)

- The Coca-Cola Company (U.S.)

- CG Roxane, LLC (U.S.)

- Tempo Beverage Ltd (Israel)

- Keurig Dr Pepper Inc. (U.S.)

- Dr Pepper/Seven Up, Inc (U.S.)

- Ferrarelle (Italy)

- SANPELLEGRINO (Italy)

- Reignwood Investments U.K. Ltd (U.K.)

- LaCroix Beverages, Inc. (U.S.)

- GEROLSTEINER BRUNNEN GMBH & CO. KG (Germany)

- Mountain Valley Spring Water (U.S.)

Latest Developments in Global Bottled Water Market

- In August 2024, Flow Beverage Corp. announced the launch of Flow Sparkling Mineral Spring Water, marking its entry into the sparkling water market. This new product line features zero-calorie, zero-sugar beverages in flavors such as Blackberry + Hibiscus and Lemon + Ginger, packaged in 300ml aluminum bottles made from 70% recycled material. Developed in partnership with Kingston Aluminum Technology Inc., the packaging uses 30% less aluminum and requires 60% less energy to produce than traditional options, aligning with Flow's commitment to sustainability. The introduction of this product expands Flow's portfolio and positions the company to meet growing consumer demand for health-conscious, environmentally friendly beverages

- In July 2024, Source Global introduced SKY WTR, a canned water product sourced from air and sunlight, marking a significant advancement in sustainable water production. Utilizing their proprietary Hydropanel technology, the company extracts water vapor from the atmosphere, condenses it using solar energy, and mineralizes it for optimal taste and health benefits. This process produces water without depleting groundwater resources, offering an eco-friendly alternative to traditional bottled water. SKY WTR is packaged in recyclable aluminum cans, aligning with the growing consumer demand for environmentally responsible products. The launch of SKY WTR not only provides a sustainable hydration option but also sets a new standard in the beverage industry, encouraging other companies to explore innovative, resource-efficient solutions

- In February 2024, Gatorade introduced its first unflavored water, Gatorade Water, marking its expansion into the bottled water category. This product is designed to offer hydration with the credibility of the Gatorade brand, featuring alkaline water with a pH of 7.5 or higher and infused with electrolytes for a crisp taste. The bottles are made from 100% recycled plastic, aligning with sustainability goals. Gatorade Water is available in 1L and 700ml sizes, with a sport cap option, and is priced competitively to appeal to active individuals seeking all-day hydration. The launch is supported by a 360-marketing campaign titled "Always in Motion," featuring prominent dancers and choreographers to emphasize the brand's connection to movement and energy. This strategic move positions Gatorade to compete in the growing wellness and hydration market, appealing to consumers looking for healthy, convenient beverage options

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bottled Water Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bottled Water Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bottled Water Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.