Global Botanical Skin Care Ingredients Market

Market Size in USD Billion

CAGR :

%

USD

1.32 Billion

USD

2.47 Billion

2024

2032

USD

1.32 Billion

USD

2.47 Billion

2024

2032

| 2025 –2032 | |

| USD 1.32 Billion | |

| USD 2.47 Billion | |

|

|

|

|

Botanical Skin Care Ingredients Market Size

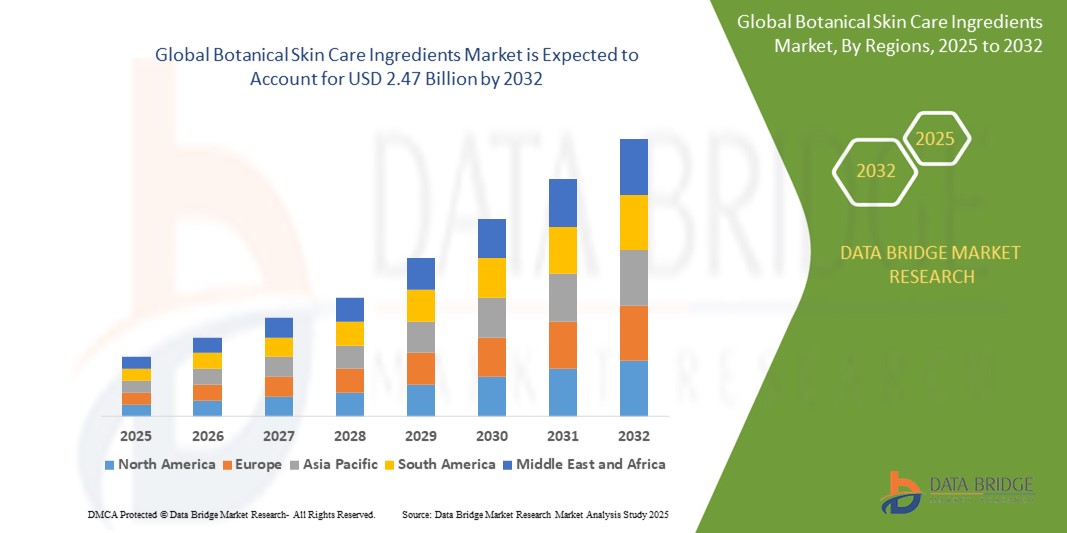

- The global botanical skin care ingredients market size was valued at USD 1.32 billion in 2024 and is expected to reach USD 2.47 billion by 2032, at a CAGR of 8.20% during the forecast period

- The market growth is largely fueled by increasing consumer awareness around clean beauty and the rising demand for natural, plant-based ingredients in personal care products, especially in skin care formulations. This shift is driven by health-conscious lifestyles and a growing preference for chemical-free, sustainably sourced solutions that align with environmental and ethical values

- Furthermore, the expanding influence of traditional botanical systems such as Ayurveda, Traditional Chinese Medicine, and herbalism in modern skincare, coupled with scientific validation of plant-derived actives, is accelerating the adoption of botanical ingredients. These converging trends are significantly enhancing market momentum and driving innovation across skin care categories

Botanical Skin Care Ingredients Market Analysis

- Botanical skin care ingredients are naturally derived plant-based compounds including extracts, oils, butters, and actives that are used in formulations for moisturization, soothing, anti-aging, and protection. These ingredients offer functional benefits while meeting the rising consumer demand for clean-label, cruelty-free, and eco-conscious personal care products

- The growing popularity of organic and vegan skincare, combined with increased regulatory support for natural cosmetics and a surge in demand for transparency in product formulations, is fueling robust growth in this market. Leading brands are investing in innovative plant-based actives and sourcing strategies to meet evolving consumer expectations and maintain competitive advantage

- North America dominated the botanical skin care ingredients market with a share of 35.3% in 2024, due to rising consumer inclination toward natural and organic personal care products and increasing demand for clean-label skincare formulations

- Asia-Pacific is expected to be the fastest growing region in the botanical skin care ingredients market with a share of during the forecast period due to increasing disposable incomes, rapid urbanization, and rising beauty consciousness in countries such as China, Japan, South Korea, and India

- Organic segment dominated the market with a market share of 52.9% in 2024, due to the global trend toward clean beauty, eco-certification, and consumer preference for pesticide-free, sustainably sourced ingredients. Organic botanical skin care is perceived as safer and more environmentally responsible, often commanding premium pricing and brand loyalty

Report Scope and Botanical Skin Care Ingredients Market Segmentation

|

Attributes |

Botanical Skin Care Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Botanical Skin Care Ingredients Market Trends

“Increasing Consumer Preference for Natural and Organic Products”

- The botanical skin care ingredients market is experiencing robust growth as consumers increasingly seek natural and organic alternatives to synthetic ingredients, driven by a desire for safer, cleaner, and more environmentally friendly products

- For instance, companies such as Givaudan, Symrise, and BASF are expanding their portfolios with botanical extracts such as aloe vera, green tea, and chamomile, catering to the rising demand for clean beauty and wellness-focused skin care

- Transparency in ingredient sourcing and sustainable supply chains is becoming a key differentiator, with consumers gravitating toward brands that emphasize ethical sourcing and environmentally responsible practices

- Technological advancements in extraction and formulation are enhancing the efficacy and stability of botanical ingredients, enabling the development of products that deliver targeted benefits such as hydration, anti-aging, and skin brightening

- The popularity of plant-based, vegan, and cruelty-free products is further fueling the adoption of botanical ingredients in skin care, with brands leveraging these trends to appeal to ethically conscious consumers

- In conclusion, the convergence of health and wellness trends, sustainability, and innovation is positioning botanical skin care ingredients as a core segment in the evolving beauty and personal care industry

Botanical Skin Care Ingredients Market Dynamics

Driver

“Growing Consumer Preference for Anti-Aging Solutions”

- The rising demand for effective anti-aging solutions is a primary driver, as consumers seek products that address wrinkles, fine lines, and skin elasticity using natural, plant-based ingredients

- For instance, companies such as Croda International, Kerry Group, and Indena are incorporating botanical extracts rich in antioxidants, vitamins, and peptides—such as green tea, ginseng, and sea buckthorn—into anti-aging creams, serums, and masks

- The shift toward preventive skin care and the popularity of multi-functional products is encouraging brands to innovate with botanical formulations that promise both immediate and long-term benefits

- Consumer awareness of the link between lifestyle, skin health, and aging is driving the adoption of botanical ingredients perceived as safer and more holistic for daily use

- Regulatory support for natural and organic claims, along with growing investment in research and development, is further accelerating the integration of botanicals in anti-aging skin care solutions

Restraint/Challenge

“Rising Cost Considerations”

- The higher costs associated with sourcing, processing, and certifying botanical ingredients can limit their adoption, especially for brands targeting price-sensitive consumers

- For instance, companies such as Symrise and Givaudan face challenges related to premium pricing of botanical extracts due to climate variability, seasonal supply, and sustainable harvesting requirements

- Supply chain disruptions, including transportation delays and trade restrictions, can further impact the availability and cost stability of key botanical ingredients

- The need for rigorous quality control, certification, and compliance with evolving regulatory standards adds to production costs, affecting market penetration in some regions

- Intense competition from alternative products and synthetic ingredients, coupled with consumer price sensitivity, may constrain the growth of botanical skin care ingredients in certain segments

Botanical Skin Care Ingredients Market Scope

The market is segmented on the basis of form, product type, primary ingredient, grade, nature, and end use.

- By Form

On the basis of form, the botanical skin care ingredients market is segmented into liquid, gel, waxes, powder, and others. The liquid segment accounted for the largest revenue share in 2024, primarily due to its superior solubility, ease of formulation blending, and rapid absorption properties. Liquids are preferred by manufacturers for their compatibility with a wide range of cosmetic applications, including serums, toners, and facial oils. Their ability to deliver active botanicals effectively and uniformly into the skin makes them highly suitable for premium skin care products.

The gel segment is projected to witness the fastest growth from 2025 to 2032, driven by rising demand for lightweight, non-greasy formulations that offer a cooling and hydrating effect. Gel-based botanical products are gaining popularity among consumers with oily or acne-prone skin, and their fast-absorbing texture makes them ideal for daily use, especially in tropical and humid climates.

- By Product Type

On the basis of product type, the market is divided into natural emollients and emulsifiers, natural plant oils, resin extracts, natural plant extracts, natural fragrances, active ingredients, and others. The natural plant extracts segment held the largest market share in 2024, owing to growing consumer trust in traditional herbal remedies and the increasing scientific validation of plant-based actives. These extracts offer a wide range of therapeutic benefits including anti-inflammatory, antioxidant, and skin-soothing effects, making them a staple in skin care formulations.

The active ingredients segment is expected to register the fastest CAGR from 2025 to 2032, fueled by rising consumer awareness around ingredient efficacy and demand for targeted skin care solutions such as anti-aging, anti-acne, and skin-brightening treatments. Botanical actives such as bakuchiol, licorice root, and centella asiatica are witnessing strong interest due to their clinically-backed skin performance and natural origin.

- By Primary Ingredient

On the basis of primary ingredient, the market is categorized into grain extracts, nut butters, floral extracts, tea extracts, fruit and vegetable extracts, herbal extracts, and others. The herbal extracts segment led the market in 2024, supported by a long-standing global tradition of herbal medicine in skin care and increasing demand for naturally derived, functional botanicals. Herbs such as aloe vera, turmeric, and neem are widely used due to their antimicrobial and healing properties.

The fruit and vegetable extracts segment is forecasted to grow at the fastest rate through 2032, driven by the rising inclusion of vitamin-rich, antioxidant-packed fruits such as berries, cucumber, and pomegranate in skin care. These ingredients appeal to health-conscious consumers seeking nutrient-dense and visibly revitalizing skin care routines.

- By Grade

On the basis of grade, the market is segmented into food, cosmetic, pharmaceutical, and others. The cosmetic grade segment held the dominant share in 2024, attributed to its widespread application across skin maintenance, decorative cosmetics, and personal care categories. Cosmetic-grade botanical ingredients are specifically processed for topical safety, efficacy, and regulatory compliance, making them a top choice for brands across the globe.

The pharmaceutical grade segment is anticipated to witness the highest CAGR from 2025 to 2032, driven by increasing demand for cosmeceuticals and dermatology-aligned formulations. With a focus on skin disorders, inflammation, and barrier repair, pharmaceutical-grade botanicals are attracting both consumers and dermatologists seeking clinical-grade natural alternatives.

- By Nature

On the basis of nature, the market is bifurcated into organic and conventional. The organic segment led the market revenue with a share of 52.9% in 2024, supported by the global trend toward clean beauty, eco-certification, and consumer preference for pesticide-free, sustainably sourced ingredients. Organic botanical skin care is perceived as safer and more environmentally responsible, often commanding premium pricing and brand loyalty.

The conventional segment is expected to register faster growth over the forecast period, driven by its affordability, stable supply chains, and broader availability. Many brands catering to mass and mid-range markets rely on conventionally sourced botanicals to balance performance and cost, especially in price-sensitive regions.

- By End Use

On the basis of end use, the market is divided into skin maintenance and care, decorative cosmetics, cleansing products, odor improvement products, hair remover products, and others. The skin maintenance and care segment accounted for the largest share in 2024, driven by rising consumer focus on preventive skin health, anti-aging routines, and daily hydration. Botanical ingredients offering moisturizing, soothing, and brightening benefits are particularly valued in moisturizers, serums, and face masks.

The decorative cosmetics segment is projected to exhibit the fastest growth from 2025 to 2032, driven by the rising penetration of natural ingredients in color cosmetics. The demand for botanical-based foundations, lipsticks, and blushes is growing as consumers seek cleaner formulations that blend skin care and makeup benefits, particularly among Gen Z and millennial demographics.

Botanical Skin Care Ingredients Market Regional Analysis

- North America dominated the botanical skin care ingredients market with the largest revenue share of 35.3% in 2024, driven by rising consumer inclination toward natural and organic personal care products and increasing demand for clean-label skincare formulations

- Consumers across the region are becoming more conscious of product labels, actively seeking botanical and chemical-free options that offer both efficacy and safety for long-term skin health

- The market growth is also supported by well-established beauty brands integrating botanical actives, high disposable incomes, and strong retail distribution networks including both online and offline platforms

U.S. Botanical Skin Care Ingredients Market Insight

The U.S. captured the largest share within North America in 2024, driven by a well-established clean beauty movement and increasing consumer preference for skincare solutions derived from herbal and plant-based sources. With high levels of disposable income and a strong digital commerce ecosystem, U.S. consumers are heavily influenced by trends in ingredient safety, wellness alignment, and product sustainability. The growing popularity of functional botanicals such as aloe vera, rosehip, green tea, and bakuchiol in anti-aging, moisturizing, and sensitive skin care segments is driving strong growth. In addition, increasing demand for cruelty-free, vegan, and eco-certified skincare products is reinforcing the dominance of botanical ingredients in the U.S. market.

Europe Botanical Skin Care Ingredients Market Insight

Europe is expected to witness substantial growth in the botanical skin care ingredients market over the forecast period, supported by stringent regulations governing cosmetic safety and consumer preferences for sustainably sourced, high-efficacy natural ingredients. European consumers are deeply invested in the safety, origin, and ecological impact of their skincare products, prompting manufacturers to adopt botanical actives that meet COSMOS, Ecocert, and other organic certifications. Markets such as France, Germany, and Italy are leading the region's growth, with an increasing shift toward science-backed herbal extracts and bio-based active compounds. This growth is also fueled by the cultural alignment with herbal beauty traditions and a growing emphasis on ingredient innovation in both mainstream and niche skincare brands.

U.K. Botanical Skin Care Ingredients Market Insight

The U.K. market is projected to grow at a notable CAGR during the forecast period, propelled by the rising popularity of natural and vegan beauty products and the country's strong inclination toward clean and ethical skincare. British consumers are showing a strong shift away from synthetic chemicals and parabens, instead opting for transparent formulations that feature botanical ingredients such as chamomile, calendula, rose, and elderflower. The expansion of direct-to-consumer brands, digital marketing, and retailer support for clean beauty labels is helping botanical skincare gain further traction in both the mass and prestige categories.

Germany Botanical Skin Care Ingredients Market Insight

Germany is expected to exhibit strong and consistent growth in the botanical skin care ingredients market, backed by its tradition of herbal medicine and a highly informed consumer base. The country is known for its preference for certified natural cosmetics, with botanical ingredients such as witch hazel, marigold, and arnica forming the backbone of many dermatologically tested products. Germany’s regulatory transparency, innovation in formulation, and consumer preference for sustainability and skin sensitivity make it a leading market for botanical ingredient adoption. This focus is further supported by a thriving organic beauty sector and local manufacturers specializing in plant-based extracts.

Asia-Pacific Botanical Skin Care Ingredients Market Insight

Asia-Pacific is poised to register the fastest CAGR from 2025 to 2032, driven by increasing disposable incomes, rapid urbanization, and rising beauty consciousness in countries such as China, Japan, South Korea, and India. The market is heavily influenced by traditional practices such as Ayurveda, Traditional Chinese Medicine (TCM), and Kampo, which emphasize the use of herbs, floral waters, and plant oils for skin health. Consumers across the region are showing heightened interest in skin-brightening, anti-aging, and anti-pollution botanical formulations. In addition, Asia-Pacific is a major hub for raw ingredient cultivation and processing, which ensures supply chain stability and price competitiveness for botanical skincare manufacturers.

Japan Botanical Skin Care Ingredients Market Insight

Japan is emerging as a key market for botanical skin care ingredients, driven by its long-standing cultural appreciation for natural, minimalistic beauty routines. Japanese consumers favor formulations that are gentle, effective, and derived from trusted botanical sources such as green tea, rice bran, yuzu, and sakura. The country's advanced R&D capabilities and strong presence of cosmeceutical brands are accelerating the adoption of active botanicals in both traditional and high-tech skin care products. Moreover, Japan’s aging population is contributing to demand for anti-aging and sensitive-skin products that leverage natural ingredients known for their restorative and calming properties.

China Botanical Skin Care Ingredients Market Insight

China accounted for the largest revenue share in Asia-Pacific in 2024, fueled by the country’s growing middle class, rapid urban development, and widespread integration of Traditional Chinese Medicine (TCM) into mainstream beauty routines. Chinese consumers are highly engaged with natural and functional ingredients, often selecting skincare products that highlight well-known botanical elements such as ginseng, goji berry, licorice root, and peony extract. The expansion of online beauty platforms, local manufacturing expertise, and government support for the herbal cosmetics industry are further enhancing the visibility and accessibility of botanical skincare across the Chinese market. This dynamic landscape makes China a dominant player in the region's botanical ingredient space.

Botanical Skin Care Ingredients Market Share

The botanical skin care ingredients industry is primarily led by well-established companies, including:

- New Directions Aromatics Inc. (Canada)

- Mountain Rose Herbs (U.S.)

- Indesso (Indonesia)

- Lipoid-Kosmetik (Switzerland)

- The Herbarie at Stoney Hill Farm, Inc. (U.S.)

- Saba Botanical (U.S.)

- Rutland Biodynamics Ltd (U.K.)

- Ambe Phytoextracts Pvt Ltd (India)

- The Green Labs LLC (U.S.)

- BERJÉ INC. (U.S.)

- Linnea SA (Switzerland)

- Prakruti Products (India)

- UMALAXMI BRANDS (India)

- DSM (Netherlands)

- ADM (U.S.)

- Kerry (Ireland)

- GLANBIA plc (Ireland)

- Ribus, Inc. (U.S.)

- HP Ingredients (U.S.)

- Prinova Group LLC (U.S.)

Latest Developments in Global Botanical Skin Care Ingredients Market

- In April 2025, Seppic introduced Ganocalm, a new active ingredient derived from adaptogenic mushrooms, specifically designed to soothe sensitive skin. This launch is expected to strengthen the botanical skin care ingredients market by expanding the range of high-efficacy, fungi-based actives that cater to consumers seeking gentle, natural solutions for reactive and delicate skin types

- In September 2024, Evonik launched CapilAcid and Oleobiota, two sustainably sourced botanical actives developed to address the rising demand for natural and multifunctional personal care ingredients. CapilAcid, extracted from Maqui fruit, offers antioxidant protection for hair, while Oleobiota, derived from the Misiones rainforest, targets sebum regulation for skin. These introductions—stemming from Evonik’s integration of Novachem into its Care Solutions division—are expected to reinforce the market’s shift toward biodiversity-based innovation and sustainable sourcing in both skin and hair care applications

- In March 2024, Archer Daniels Midland Company collaborated with Water.org to address water sanitation challenges, reflecting a commitment to community welfare. This collaboration may indirectly impact botanical skin care by promoting sustainable practices in ingredient sourcing. As water scarcity affects agriculture, including botanical cultivation, initiatives such as this foster responsible sourcing practices, ensuring the availability of key botanicals for skin care formulations

- In October 2022, International Flavors & Fragrances, Inc. invested US$30 million in its Singapore Innovation Center, expanding its global market presence. This investment in research and development involved exploring botanical extracts for skin care formulations leveraging natural ingredients for innovative product lines. The center's focus on innovation could lead to the discovery of new botanical skin care ingredients, enhancing the company's offerings in the beauty industry

- In February 2022, Merck launched two groundbreaking cosmetic ingredients: RonaCare Baobab and RonaCare Hibiscus. Derived from nutrient-rich superfoods, these extracts from the baobab fruit and hibiscus flower meet COSMOS and Halal standards. They are ethically sourced, vegan-friendly, and boast a 100% natural origin, adhering to ISO 16128 guidelines. These innovations signify Merck's commitment to sustainable and inclusive beauty solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Botanical Skin Care Ingredients Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Botanical Skin Care Ingredients Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Botanical Skin Care Ingredients Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.