Global Bariatric Medical Devices Market

Market Size in USD Million

CAGR :

%

USD

1,921.19 Million

USD

3,256.86 Million

2024

2032

USD

1,921.19 Million

USD

3,256.86 Million

2024

2032

| 2025 –2032 | |

| USD 1,921.19 Million | |

| USD 3,256.86 Million | |

|

|

|

|

Bariatric Medical Devices Market Analysis

The global prevalence of obesity is steadily increasing, with over 650 million adults worldwide classified as obese, representing approximately 13% of the adult population. In the United States, about 42% of adults are considered obese, making it a significant public health concern. Similarly, in Europe, over 30% of the adult population is affected by obesity, highlighting its widespread impact. Meanwhile, in the Asia-Pacific region, countries such as China and India are witnessing a surge in obesity rates, driven by rapid urbanization, sedentary lifestyles, and shifts toward high-calorie diets. This growing obesity epidemic is fueling the demand for bariatric medical devices, as more individuals seek effective interventions for weight management and obesity-related health issues. The trend emphasizes the urgent need for innovative and efficient solutions in the global healthcare market, further driving advancements in bariatric medical technology.

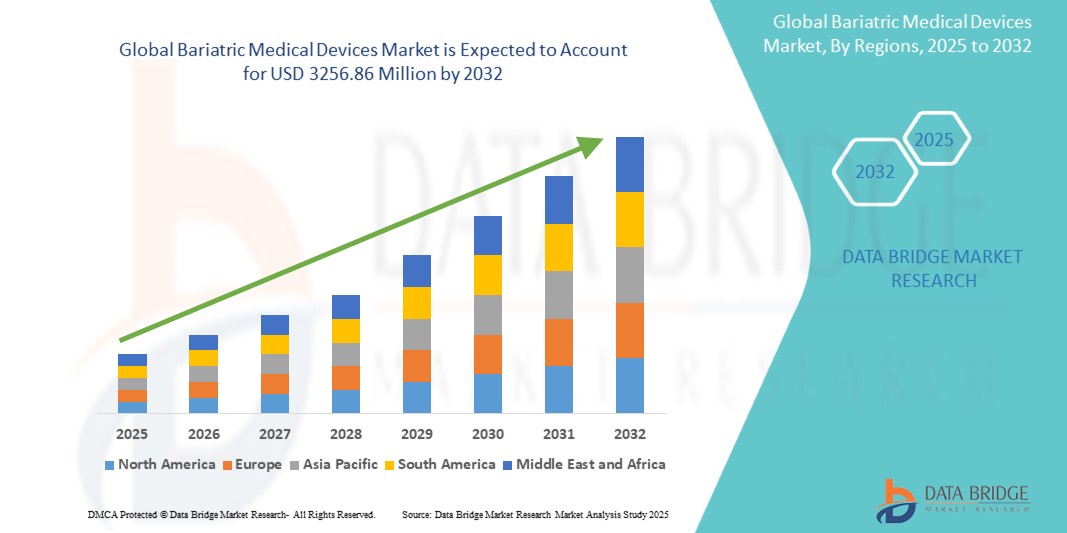

Bariatric Medical Devices Market Size

Global bariatric medical devices market size was valued at USD 1921.19 million in 2024 and is projected to reach USD 3256.86 million by 2032, with a CAGR of 6.80% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Bariatric Medical Devices Market Trends

“Shift Toward Non-invasive Solutions”

The shift toward non-invasive solutions in the bariatric medical devices market is becoming more noticeable as patients increasingly opt for procedures that involve less risk and faster recovery times. Endoscopic procedures and gastric balloons are gaining popularity due to their minimally invasive nature, offering effective weight loss results with no need for surgical incisions. These methods are seen as appealing alternatives to traditional bariatric surgeries such as gastric bypass or sleeve gastrectomy, which involve more complex operations and longer recovery periods. Non-surgical options are often associated with lower complication rates, fewer hospital stays, and quicker returns to normal activities. This trend reflects a growing preference for treatments that prioritize convenience and safety, particularly for patients hesitant about undergoing more invasive procedures. As awareness about these options spreads, more individuals are choosing non-invasive treatments to manage obesity effectively.

Report Scope and Bariatric Medical Devices Market Segmentation

|

Attributes |

Bariatric Medical Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa, Brazil, Argentina, Rest of South America |

|

Key Market Players |

Johnson & Johnson Services, Inc. (U.S.), Medtronic (Ireland), Cook Medical (U.S.), Boston Scientific (U.S.), Hoya Corporation (Japan), Apollo Endosurgery (U.S.), B. Braun SE (Germany), EndoGastric Solutions (U.S.), Stryker Corporation (U.S.), Intuitive Surgical (U.S.), Neogastric, LLC (U.S.), Teleflex Incorporated (U.S.), BaroSense Inc. (U.S.), Zimmer Biomet (U.S.), AbbVie Inc. (U.S.), Cook Medical (U.S.), Medi-Globe GmbH (Germany), among others. |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Bariatric Medical Devices Market Definition

Bariatric medical devices are specialized tools designed to aid in the treatment and management of obesity. These devices assist in weight loss by supporting surgical or non-surgical interventions. Bariatric devices include options such as gastric bands, balloons, and sleeve gastrectomy devices, which help reduce the stomach's capacity, limit food intake, or alter digestion. These devices can be either implanted surgically or used in non-invasive treatments, such as endoscopic procedures. They aim to reduce the health risks associated with obesity, such as diabetes, hypertension, and cardiovascular diseases. Bariatric medical devices are increasingly utilized as part of comprehensive weight management programs to improve patient outcomes and support long-term weight loss goals.

Bariatric Medical Devices Market Dynamics

Drivers

- Increase in Obesity Rates

The rising prevalence of obesity, especially in regions such as North America, Europe, and parts of Asia-Pacific, is significantly driving the demand for bariatric medical devices. In these regions, obesity rates are escalating due to lifestyle factors such as poor diet, lack of physical activity, and increasing urbanization. As obesity-related health risks, including diabetes, hypertension, and cardiovascular diseases rise more, individuals are seeking effective weight-loss solutions. Bariatric surgeries, such as gastric bypass and sleeve gastrectomy, as well as non-surgical options such as gastric balloons and endoscopic devices, are becoming more common. This shift is leading to a surge in the use of advanced bariatric devices that offer long-term weight loss and improved quality of life. Furthermore, the growing acceptance of bariatric treatments and expanding healthcare infrastructure in emerging markets are contributing to the market's expansion globally. For Instance, in March 2024, according to an article published by WHO, over one billion people worldwide are living with obesity, and adult obesity rates have more than doubled. Additionally, 43% of adults were overweight in 2022. This increasing prevalence is expected to drive demand for bariatric medical devices, as more individuals seek solutions to manage obesity-related health risks, fueling growth in the market for weight-loss treatments.

- Technological Advancements in Bariatric Treatments

Technological advancements in bariatric treatments are revolutionizing the field, enhancing both surgical and non-surgical weight-loss options. Minimally invasive procedures, such as laparoscopic and robotic-assisted surgeries, are gaining traction because they require smaller incisions, reduce recovery time, and lower complication risks compared to traditional surgery. These innovations enable faster patient recovery and improved surgical precision, driving their increased adoption. Additionally, non-surgical solutions such as gastric balloons and endoscopic devices are expanding treatment options for individuals who prefer less invasive alternatives. These devices are easier to administer, involve minimal downtime, and show effective weight-loss results, making them an appealing choice for patients. As a result, the market for bariatric medical devices is seeing heightened demand, driven by improved patient outcomes and broader access to advanced technologies. This trend reflects a shift toward more efficient, patient-friendly weight-loss solutions across the globe. In January 2024, according to an article published by NCBI, robotic surgery, with its advanced visualization and the use of specialized instruments, is revolutionizing medical interventions. This evolving field is expected to drive the growth of bariatric medical devices, as these technologies offer precision, minimal invasiveness, and quicker recovery times, making them increasingly popular in weight-loss surgeries and other medical procedures.

Opportunities

- Rising Awareness and Education

As awareness of obesity and its associated health risks grows, more individuals are seeking medical interventions for weight management. Public health campaigns, alongside efforts from healthcare professionals to educate the public, are playing a significant role in raising awareness about the dangers of obesity. These initiatives emphasize the importance of early intervention and the benefits of bariatric treatments. The growing recognition of the long-term health complications related to obesity, such as heart disease, diabetes, and sleep apnea, has led to a broader acceptance of bariatric procedures. As a result, more patients are considering medical solutions such as bariatric surgery and non-invasive weight-loss treatments. The increased awareness is fostering a larger patient base, providing an opportunity for bariatric medical device manufacturers to cater to this growing demand and expand their market reach. This trend not only helps reduce obesity-related health risks but also supports the ongoing development of innovative weight-loss solutions. In August 2024, according to an article published by Royal College of Surgeons of England, approximately 5,000 people from the UK travel abroad each year for bariatric surgery, mainly to Turkey, Eastern Europe, or the Middle East, which is comparable to the 4,500 bariatric surgeries performed annually in the NHS (2021–2022). This trend highlights rising awareness of bariatric procedures, as more individuals seek weight-loss solutions, even outside their home countries. The growing number of patients opting for surgeries abroad presents an opportunity for the bariatric medical devices market by expanding access to treatment options and fostering the global demand for innovative weight-loss solutions. This is a clear reflection of the increasing awareness and education around obesity and its management.

- Increased Government and Insurance Support

Governments in several regions, especially North America and Europe, are increasingly acknowledging the long-term healthcare benefits of addressing obesity early. By recognizing the significant reduction in healthcare costs and improving public health, these governments are expanding insurance coverage for bariatric surgeries and medical devices. Policies are evolving to support a wider range of weight-loss treatments, including gastric balloons, robotic-assisted surgeries, and traditional bariatric surgeries. This shift is making these treatments more accessible to a broader patient population, especially those who may have previously struggled with high out-of-pocket costs. The expansion of insurance reimbursements is also fostering the adoption of advanced, effective, and cost-efficient treatments, as insurers understand that these solutions can reduce the long-term financial burden associated with obesity-related complications such as diabetes and heart disease. Consequently, this support is contributing to the growth of the bariatric medical devices market, making treatments more widely available and accepted.

Restraints/Challenges

- High Cost of Bariatric Surgeries and Devices

The high cost of bariatric surgeries and medical devices is a significant barrier to accessibility for many patients. Surgical procedures such as gastric bypass and sleeve gastrectomy often involve high hospital fees, including anesthesia, operating room charges, and post-operative care. Medical devices, such as gastric bands or balloons, can add additional costs. These financial challenges are especially pronounced in low-income regions or among individuals without sufficient health insurance. Although insurance coverage for bariatric procedures is expanding in some regions, affordability remains a problem for many people who cannot afford the out-of-pocket expenses. The overall cost-effectiveness of these treatments needs to improve, particularly in underserved areas, to ensure that more individuals can access the care they need. This financial barrier impacts the widespread adoption of bariatric treatments and may limit the growth of the market in certain populations.

- Patient Safety and Complications Associated with Bariatric Procedures

Patient safety and complications associated with bariatric procedures present a significant challenge in the bariatric medical devices market. While bariatric surgeries, such as gastric bypass and sleeve gastrectomy, offer effective weight loss solutions, they come with inherent risks, including infections, blood clots, and anesthesia-related issues. These complications can discourage patients from opting for these treatments. Non-surgical options, such as gastric balloons, although less invasive, can still lead to risks such as gastric perforation, device migration, or leakage. Furthermore, long-term issues such as nutritional deficiencies or gastrointestinal problems may arise, requiring additional medical interventions and follow-up care. These complications often demand extensive post-operative care, which increases the overall treatment cost and complexity. Managing these risks while ensuring patient safety is a critical challenge for healthcare providers, as the need for careful monitoring and intervention can limit the widespread adoption and success of bariatric procedures and devices.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Bariatric Medical Devices Market Scope

The market is segmented on the basis of type, technology, device material, application, and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Surgical Devices

- Non-Surgical Devices

Technology

- Laparoscopic Bariatric Surgery Devices

- Robotic-Assisted Bariatric Surgery Devices

- Endoscopic Bariatric Surgery Devices

Device Material

- Biocompatible Materials

- Metals

- Polymers

- Other materials

Application

- Obesity Management

- Weight Loss Surgery (WLS)

- Weight Loss Supplements

End-User

- Hospitals

- Specialized Bariatric Centers

- Ambulatory Surgical Centers (ASCs)

- Home Care Settings

Bariatric Medical Devices Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, type, technology, device material, application, and end-user as referenced above.

The countries covered in the market are U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, rest of Middle East and Africa, Brazil, Argentina, and rest of South America.

North America is expected to dominate the market due to high obesity rates, advanced healthcare infrastructure, and strong demand for innovative weight-loss treatments, along with favorable reimbursement policies for bariatric surgeries.

Asia-Pacific is expected to be the fastest growing due to rising obesity rates, increasing urbanization, changing lifestyles, and growing healthcare awareness in countries such as China and India, coupled with expanding access to advanced medical treatments and technologies.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Bariatric Medical Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Bariatric Medical Devices Market Leaders Operating in the Market Are:

- Johnson & Johnson Services, Inc. (U.S.)

- Medtronic (Ireland)

- Cook Medical (U.S.)

- Boston Scientific (U.S.)

- Hoya Corporation (Japan)

- Apollo Endosurgery (U.S.)

- B. Braun SE (Germany)

- EndoGastric Solutions (U.S.)

- Stryker Corporation (U.S.)

- Intuitive Surgical (U.S.)

- Neogastric, LLC (U.S.)

- Teleflex Incorporated (U.S.)

- BaroSense Inc. (U.S.)

- Zimmer Biomet (U.S.)

- AbbVie Inc. (U.S.)

- Cook Medical (U.S.)

- Medi-Globe GmbH (Germany)

Latest Developments in Bariatric Medical Devices Market

- In October 2024, Johnson & Johnson MedTech has introduced the ECHELON ENDOPATH™ Staple Line Reinforcement (SLR), a device designed to enhance staple line strength and minimize complications during bariatric, thoracic, and general surgeries. This innovation will help the company expand its product offerings in the surgical device market and strengthen its position in the bariatric and broader surgical segments by improving patient outcomes and increasing adoption among healthcare providers

- In July 2024, EziSurg's products have gained international recognition, appearing in markets such as France, Italy, the Middle East, and the United States, highlighting the strong performance of Chinese medical device brands globally. This widespread market presence will help the company expand its brand recognition, drive growth in international sales, and strengthen its competitive position in the global medical device industry

- In April 2024, Allurion Technologies, Inc. has announced the U.S. commercial launch of its Virtual Care Suite (VCS), a comprehensive tool designed to support obesity treatment. This move will help the company strengthen its presence in the digital health space, offering patients and healthcare providers a seamless, integrated solution that enhances the patient experience and treatment effectiveness, thus driving adoption and expanding its market share in the growing obesity care sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.