Supply Chain Ecosystem Analysis now part of DBMR Reports

Global Automotive Testing Inspection and Certification (TIC) Market, By Service Type (Testing Services, Inspection Services, Certification Services, Other), Sourcing Type (In-House, Outsourced), Application (Electrical Systems and Components, Telematics, Vehicle Inspection Services, Homologation Testing, Interior and Exterior Materials, Others) – Industry Trends and Forecast to 2029.

Rising pollution levels as a result of unprecedented vehicular population growth have compelled regulatory authorities to enact stringent vehicular emission regulations. The emergence of electric and autonomous vehicles has facilitated growth in the automotive sector. Electric vehicles have aided automakers in meeting stringent vehicle emission regulations. Rising vehicular pollution drives the need for automobile testing, inspection, and certification to ensure regulatory compliance. In recent years, there has been a greater emphasis on quality control for automotive manufacturing operations, as well as additional safety and testing measures.

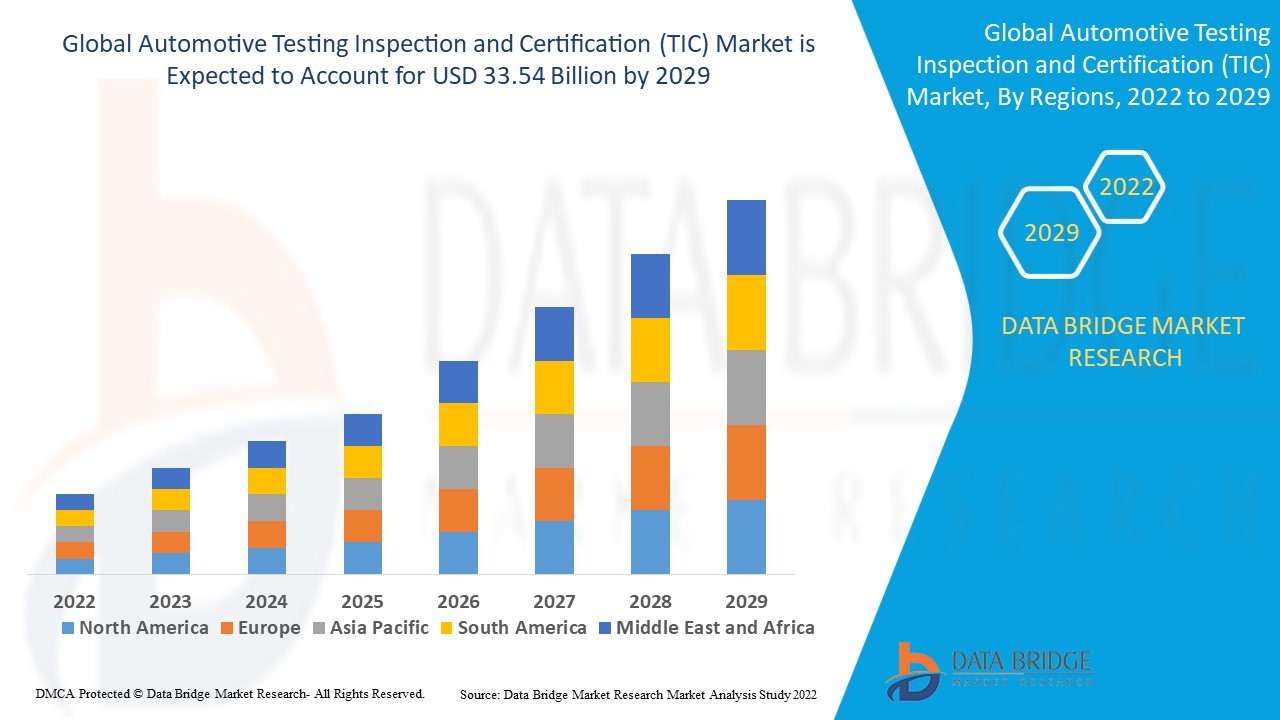

Data Bridge Market Research analyses that the automotive testing inspection and certification (TIC) market which was growing at a value of 17.85 billion in 2021 and is expected to reach the value of USD 33.54 billion by 2029, at a CAGR of 8.20% during the forecast period of 2022-2029. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014 - 2019)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Service Type (Testing Services, Inspection Services, Certification Services, Other), Sourcing Type (In-House, Outsourced), Application (Electrical Systems and Components, Telematics, Vehicle Inspection Services, Homologation Testing, Interior and Exterior Materials, Others)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

|

|

Market Players Covered

|

SGS S.A. (Switzerland), Bureau Veritas S.A. (France), Intertek Group Plc. (U.K.), Dekra SE (Germany), TÜV SÜD (Germany), TÜV Rheinland Ag Group (U.S.), DNV GL (Norway), British Standards Institution (BSI) (U.K.), Norges Elektriske Materiellkontroll (NEMKO) (Norway), Eurofins Scientific SE (Luxembourg), Applus+ (Spain), TÜV Nord Group (Germany), Mistras Group (U.S.), Lloyd’s Register Group Limited (U.K.), and Element Materials Technology Ltd.(U.K.), among others.

|

|

Opportunities

|

|

Market Definition

The process of ensuring that a vehicle or component meets all applicable safety and performance requirements is referred to as "automotive testing, inspection, and certification" (TIC). Crash testing, noise vibration and harshness (NVH) testing, corrosion resistance testing, and emissions certification are all examples of TIC tests and inspections. The goal of TIC is to protect driver and passenger safety while also ensuring that vehicles meet environmental standards.

Drivers

The global automotive industry is governed by a variety of government regulations concerning passenger safety and environmental concerns. These regulations/standards have a direct impact on and influence the design of vehicle components. Strict government regulations require automakers to include safety features such as seatbelts, airbags, and crumple zones in their vehicles. Tariffs and other trade barriers are imposed by major regulatory bodies to penalise and discourage manufacturers from violating emission and safety standards. This compels automakers to create more fuel-efficient vehicles with lower emissions while also including safety features such as anti-skid braking systems (ABS), electronic brake-force distribution (EBD), airbags, and emission control systems such as catalytic converters with turbochargers and exhaust gas recirculation (EGR) systems.

Throughout the last decade, the automotive market in developed countries has remained stable and consistent in terms of production rate. In comparison, several emerging markets, particularly in the Asia Pacific region, have more than doubled their market size in recent years. As the automotive industry shifts away from mature markets and toward emerging markets, emerging markets are expected to hold the key to the modern-day automotive industry's consistent growth. In the early 2000s, emerging economies accounted for only one-fourth of total global automotive production, but by 2015, they accounted for more than half. This indicates that the automobile industry has experienced consistent growth, particularly in emerging economies.

Opportunity

Rising adoption of electric and hybrid vehicles, as well as government mandates for periodic technical inspection (PTI) of vehicles, are creating ample opportunities for the growth of the automotive testing inspection and certification (TIC) market during the forecast period.

Restraints

Varying regulations and standards will impede the growth of the automotive testing inspection and certification (TIC) market during the forecast period.

The deterioration of global vehicle sales and the lengthy lead time required for overseas qualification tests is posing a significant challenge to the growth of the automotive testing inspection and certification (TIC) market.

This automotive testing inspection and certification (TIC) market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the automotive testing inspection and certification (TIC) market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

As a result of coronavirus's spread, manufacturing plants around the world have been shut down, showroom traffic has plummeted, and vehicle sales have plummeted. Major automotive players are among the global automakers who have halted production due to the COVID-19 pandemic. With economic and industrial activity largely halted, a severe demand-side impact is expected, resulting in a sharp decline in vehicle sales volumes. The scenario is expected to have an impact on the market, as its growth is directly related to vehicle production. COVID-19, on the other hand, is hastening the digitalization trend in the automotive TIC market. Automotive TIC companies are increasingly relying on software solutions to conduct audits and damage assessments.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Developments

The automotive testing inspection and certification (TIC) market is segmented on the basis of service type, sourcing type and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Service type

Sourcing type

Application

The automotive testing inspection and certification (TIC) market is analysed and market size insights and trends are provided by country, service type, sourcing type and application as referenced above.

The countries covered in the automotive testing inspection and certification (TIC) market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific dominates the automotive testing inspection and certification (TIC) market because of the easy availability of automotive TIC services and the presence of major automotive manufacturers in the region.

North America is expected to experience the highest growth rate from 2022 to 2029, owing to an increase in demand for electric vehicles, favourable government policies, and an increase in vehicle recalls in this region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

The automotive testing inspection and certification (TIC) market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to automotive testing inspection and certification (TIC) market.

Some of the major players operating in the automotive testing inspection and certification (TIC) market are:

SKU-

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Automotive Testing Inspection And Certification Tic Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Automotive Testing Inspection And Certification Tic Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.