Global Automotive Sensors Camera Technologies Market

Market Size in USD Billion

CAGR :

%

USD

9.54 Billion

USD

27.19 Billion

2024

2032

USD

9.54 Billion

USD

27.19 Billion

2024

2032

| 2025 –2032 | |

| USD 9.54 Billion | |

| USD 27.19 Billion | |

|

|

|

|

Automotive Sensor and Camera Technologies Market Size

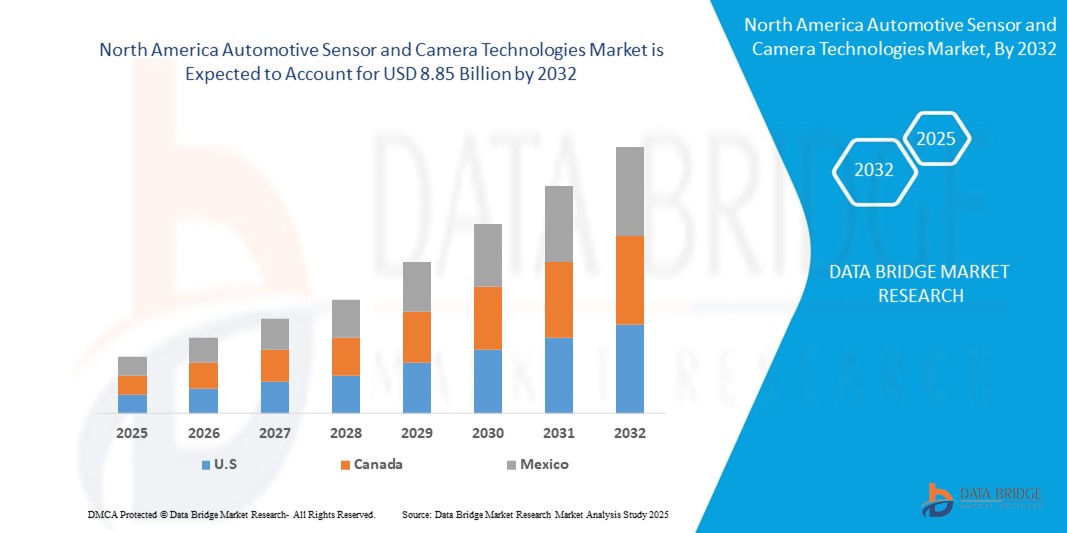

- The global Automotive Sensor and Camera Technologies Market size was valued at USD 9.54 billion in 2024 and is expected to reach USD 27.19 billion by 2032, at a CAGR of 12.34% during the forecast period

- This growth is driven by factors such as the Advancements in Autonomous Driving, Regulatory Mandates and Safety Standards, and Consumer Demand for Enhanced Safety Features

Automotive Sensor and Camera Technologies Market Analysis

- A sensor refers to the electronic device that detects and reacts to some sort of input from the physical condition. The specific data could be anything in heat, moisture, light, or weight, among other great number of other environmental phenomena.

- The output is usually a signal that is converted to human-readable display at the sensor location or transmitted electronically over a network for reading or further processing. A camera is defined as a hardware device that is used to capture images and videos.

- Europe dominates the automotive sensor and camera technologies market due to the presence of automobile manufacturers and high adoption of light-duty vehicles within the region.

- Asia-Pacific is expected to witness significant growth during the forecast period of 2025 to 2032 because of the entry of luxury car manufacturers and rising concerns over vehicle safety in the region.

- Single View System segment is expected to dominate the market with a market share of 55.21% due to its ability to provide a comprehensive and clear view of the surroundings. This system enhances vehicle safety by offering a simple yet effective solution for monitoring critical areas around the vehicle.

Report Scope and Automotive Sensor and Camera Technologies Market Segmentation

|

Attributes |

Automotive Sensor and Camera Technologies Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automotive Sensor and Camera Technologies Market Trends

“Growing Use of Multi-Camera Systems for Full Vehicle Surround View”

- Car manufacturers are increasingly installing multiple cameras in vehicles to give drivers a full 360-degree view of their surroundings. These systems help with safer parking, better obstacle detection, and support for safety technologies like lane keeping and blind spot monitoring.

- By combining input from several cameras, vehicles can more accurately identify nearby objects, people, or potential hazards. This technology is becoming a key part of modern cars as buyers look for better safety features and governments introduce stricter vehicle safety standards. As a result, demand for multi-camera setups is rising across the industry.

- For instance, in 2024 some major car brands began using AI-driven camera systems to improve how driver-assist features work, offering smoother, more reliable performance and better decision-making in complex driving situations.

Automotive Sensor and Camera Technologies Market Dynamics

Driver

“Rising Demand for Safer Vehicles”

- Vehicle safety has become a top priority for both carmakers and consumers. People are increasingly looking for vehicles that can help prevent accidents, especially with features like lane departure warnings, adaptive cruise control, and automatic emergency braking.

- These safety functions depend heavily on cameras and sensors to monitor the road, detect obstacles, and alert the driver in real time. Governments around the world are also passing laws that require new vehicles to meet certain safety standards, which often include the use of advanced driver assistance systems (ADAS).

- This growing need for safer, smarter vehicles is significantly boosting demand for high-performance sensors and camera systems in cars.

For instance,

- In April 2025 Tesla and other automakers updated their ADAS packages to include more cameras and ultrasonic sensors, giving drivers better hazard detection and boosting crash avoidance features in new models.

Opportunity

“ADAS and Autonomous Vehicles Driving Demand”

- The rising focus on vehicle safety and automation is creating big opportunities for the automotive sensor and camera technology market. Systems like ADAS (Advanced Driver Assistance Systems) rely heavily on sensors and cameras to power features such as lane-keeping, smart cruise control, and automatic braking.

- As carmakers push toward self-driving cars, the need for these technologies grows rapidly. A great example of this shift is Mercedes-Benz teaming up with Luminar Technologies to add next-gen lidar sensors to its vehicles, aiming to improve autonomous driving functions.

For instance,

- In April 2025, Mercedes-Benz partnered with Luminar to bring high-performance lidar sensors into its cars, marking a key step toward more advanced autonomous vehicle capabilities.

Restraint/Challenge

“Data Privacy and Cybersecurity Concerns”

- As modern cars become more connected and camera-reliant, concerns about data privacy and cybersecurity are becoming more serious. Vehicles equipped with advanced sensors and cameras collect large amounts of data—about road conditions, passengers, and driving habits.

- Additionally, regulations around data protection vary across regions, making it complicated for global carmakers to ensure full compliance. These risks can slow down consumer trust and adoption of highly automated, camera-driven technologies.

For instance,

- In March 2025, A European car brand faced scrutiny after customers raised concerns about facial recognition data collected through in-cabin cameras used for driver monitoring, prompting an internal review of its data policies.

Automotive Sensor and Camera Technologies Market Scope

The market is segmented on the basis view type, technology, application and vehicle type.

|

Segmentation |

Sub-Segmentation |

|

View type |

|

|

Technology |

|

|

Application |

|

|

Vehicle type |

|

In 2025, the Single View System is projected to dominate the market with a largest share in segment

In 2025, the Single View System is expected to lead the automotive sensor and camera technologies market, accounting for the largest share of 55.21% in its segment. This dominance is driven by its widespread adoption in standard driver assistance features like rear-view and front-view cameras. Automakers prefer single-view systems for their cost-effectiveness and ease of integration, especially in economy and mid-range vehicles. These systems offer a reliable way to improve safety without significantly increasing vehicle costs. Their growing inclusion in compliance with global safety regulations also supports their market leadership. As entry-level cars continue to dominate sales globally, demand for these systems is set to stay strong through 2025.

The Multi Camera System is expected to account for the largest share during the forecast period in market

In 2025, The Multi Camera System is projected to hold the largest share of 49.61% in the automotive sensor and camera technologies market during the forecast period. This growth is driven by the rising demand for 360-degree vision, essential for advanced driver assistance and autonomous driving functions. These systems combine inputs from multiple cameras to create a comprehensive view of the vehicle’s surroundings, improving safety and situational awareness. High-end and electric vehicles are increasingly adopting this technology to offer premium features like automatic parking and obstacle detection. As vehicle safety standards evolve and consumer expectations rise, multi-camera systems are becoming a key differentiator in modern vehicles.

Automotive Sensor and Camera Technologies Market Regional Analysis

“Europe Holds the Largest Share in the Automotive Sensor and Camera Technologies Market”

- Europe holds the largest share in the Automotive Sensor and Camera Technologies Market due to its strong automotive manufacturing base and early adoption of advanced safety features. Leading automakers in countries like Germany, France, and Sweden are heavily investing in autonomous driving and Advanced Driver Assistance Systems (ADAS).

- The region also benefits from strict safety regulations and emissions standards, which drive demand for high-performance sensors and cameras. European governments are actively supporting electric vehicle adoption and smart mobility solutions, further boosting the need for advanced in-vehicle technologies.

- Additionally, the presence of major sensor and component manufacturers contributes to regional dominance. Europe's tech-forward approach continues to push innovation in the automotive space.

“Asia-Pacific is Projected to Register the Highest CAGR in the Automotive Sensor and Camera Technologies Market”

- Asia-Pacific is projected to register the highest CAGR in the Automotive Sensor and Camera Technologies Market due to rapid industrialization, urbanization, and rising vehicle production across countries like China, India, Japan, and South Korea. As demand for connected and autonomous vehicles grows, regional automakers are investing heavily in advanced sensor and camera systems.

- Government support for electric vehicles, stricter safety regulations, and consumer interest in smart driving technologies are fueling this growth. Additionally, the region hosts several key manufacturers and suppliers of automotive electronics, which supports innovation and cost-effective production.

- The growing middle class and increasing vehicle ownership further amplify market expansion. Overall, Asia-Pacific’s dynamic automotive landscape makes it a hotspot for future growth.

Automotive Sensor and Camera Technologies Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- NXP Semiconductors.,

- STMicroelectronics,

- Infineon Technologies AG,

- TE Connectivity.,

- Texas Instruments Incorporated.,

- Sensata Technologies, Inc.,

- Littelfuse Inc.,

- Robert Bosch GmbH,

- Continental AG,

- BorgWarner Inc.,

- Analog Devices, Inc.,

- Sensata Technologies, Inc.,

- DENSO CORPORATION,

- Autoliv Inc.,

- Maxim Integrated,

- Hitachi Astemo Americas, Inc.,

- GMS Instruments BV,

- Broadcom.,

- Piher Sensors & Controls

- Elmos Semiconductor SE

Latest Developments in Global Automotive Sensor and Camera Technologies Market

- In January 2025, NXP Semiconductors introduced the S32K5 series, a line of automotive microcontrollers (MCUs) built on 16nm FinFET technology, integrating magnetic RAM (MRAM). This series is part of NXP's CoreRide platform, offering scalable solutions for zonal and electrification systems, helping automakers design more adaptable and efficient vehicle architectures. The development supports the industry's shift towards software-defined vehicles (SDVs), improving both performance and safety.

- In March 2025 saw STMicroelectronics launch its BrightSense ecosystem, a comprehensive solution aimed at meeting the increased demand for high-definition imaging in ADAS and autonomous vehicle systems. The ecosystem combines image sensors, processing components, and software to facilitate the deployment of robust vision systems that enhance vehicle safety. This solution is designed to be adaptable, allowing automakers to customize it for different needs.

- February 2025 marked the completion of Project GENIAL!, a collaboration led by Infineon Technologies alongside several major players in the automotive industry, such as Robert Bosch GmbH and Eberhard Karls University of Tübingen. Funded by the German Federal Ministry of Education and Research, the project focused on accelerating innovation in automotive electronics and sensor technologies. The aim was to improve the integration of automotive OEMs and their suppliers, fostering advancements in areas such as sensor systems.

- In April 2025, TE Connectivity unveiled an expanded portfolio of advanced sensor solutions for automotive applications. The new products, including pressure, temperature, and position sensors, offer enhanced precision and dependability. These solutions are designed to meet the growing demand for connected vehicles, providing automakers with reliable tools for the development of the next generation of automotive technologies.

- In January 2024, Texas Instruments launched the AWR2544 radar sensor chip, operating at 77GHz and designed for ADAS. The chip is a breakthrough in radar technology, featuring satellite radar architecture, which allows it to work more effectively in environments where traditional sensors might struggle. The chip's launch-on-package (LOP) technology makes it more compact and boosts its range to over 200 meters, contributing to the development of safer, more autonomous vehicles.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Automotive Sensors Camera Technologies Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Automotive Sensors Camera Technologies Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Automotive Sensors Camera Technologies Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.