Global Automotive Exterior Trim Parts Market, By Product Type (Front Bumpers, Rear Bumpers, Outside Rear View Mirrors (ORVM), Rocker Panels (Under Panels), Radiator Grills, Wheel Arch Claddings (Fender Liners), Outside Door Handles, Exterior Car Door Trims, Mud Guards, and Exterior Trim Parts), Vehicle Type (Passenger Cars, Commercial Vehicles, and Heavy Trucks and Buses), Sales Channel (First Fit, and Replacement) - Industry Trends and Forecast to 2031.

Automotive Exterior Trim Parts Market Analysis and Size

Protection in the automotive exterior trim parts market helps with in the strategic use of components such as bumper guards, door edge guards, and mud flaps to shield vehicles from external damage. These parts are designed to safeguard the exterior surfaces from scratches, dents, and debris impact, thereby preserving the aesthetic appeal and structural integrity of automobiles. Manufacturers enhance vehicle durability while ensuring customer satisfaction through sustained appearance and functionality.

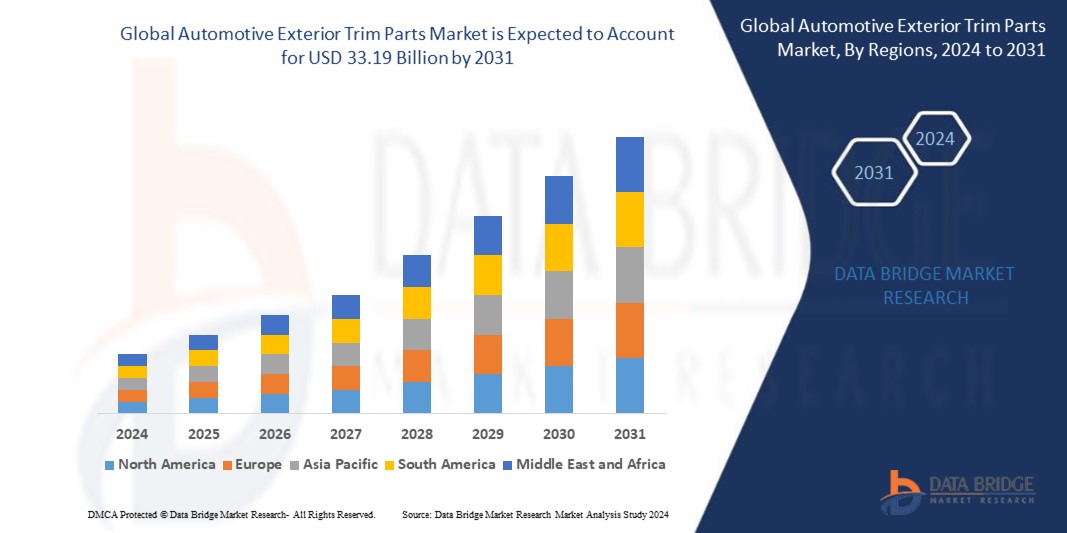

Global automotive exterior trim parts market size was valued at USD 22.12 billion in 2023 and is projected to reach USD 33.19 billion by 2031, with a CAGR of 5.20% during the forecast period of 2024 to 2031. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Automotive Exterior Trim Parts Market Scope and Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024-2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Product Type (Front Bumpers, Rear Bumpers, Outside Rear View Mirrors (ORVM), Rocker Panels (Under Panels), Radiator Grills, Wheel Arch Claddings (Fender Liners), Outside Door Handles, Exterior Car Door Trims, Mud Guards, and Exterior Trim Parts), Vehicle Type (Passenger Cars, Commercial Vehicles, and Heavy Trucks and Buses), Sales Channel (First Fit, and Replacement)

|

|

Countries Covered

|

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa

|

|

Market Players Covered

|

AISIN CORPORATION (Japan), CIE Automotive (Spain), DURA (U.S.), Ficosa Internacional SA (Spain), GEDIA Automotive Group (U.S.), Gronbach (Germany), HAYASHI TELEMPU CORPORATION (Japan), IDEAL Automotive GmbH (Germany), KASAI KOGYO CO., LTD. (Japan), KIRCHHOFF Automotive (Germany), Knauf Industries (Germany), Novares (France), NVH KOREA INC. (South Korea), SMR Deutschland GmbH (Germany), TOYOTA BOSHOKU CORPORATION (Japan), Plastic Omnium (France), HUTCHINSON (France), Magna International Inc. (France)

|

|

Market Opportunities

|

|

Market Definition

Automotive exterior trim parts are components designed to enhance the aesthetics and functionality of a vehicle's outer appearance. They include elements such as door handles, side moldings, grilles, and bumper trims. These parts not only contribute to the vehicle's visual appeal but also provide protection against scratches, dents, and other damages.

Automotive Exterior Trim Parts Market Dynamics

Drivers

- Increasing Consumer Preferences Leads to Rise in Adaption of Exterior Trim Parts

Shifts in consumer tastes towards sleek designs, customizable options, and premium aesthetics directly influence the demand for exterior trim components such as chrome accents, body-colored trims, and unique styling elements. Manufacturers closely monitor consumer trends to align their product offerings with evolving preferences, thereby staying competitive in the market. Additionally, the desire for individualization and personalization prompts consumers to seek aftermarket trim parts, further stimulating market growth.

- Growing Material Innovations Leads to the Enhancement of Fuel Efficiency

Advancements in lightweight materials such as composites, carbon fiber, and advanced plastics enable manufacturers to create trim parts that enhance fuel efficiency without sacrificing durability or aesthetics. These innovations also offer opportunities for customization, allowing for unique designs and styles to meet consumer preferences. These material innovations play a crucial role in shaping the competitiveness and growth of the automotive exterior trim parts industry.

Opportunities

- Growing Demand for Eco-Friendly Solutions leads to the Adoption of Energy-Efficient Manufacturing Processes

Developing trim parts using sustainable materials such as recycled plastics, natural fibres, or bio-based composites, manufacturers can align with consumer preferences for environmentally responsible products. Additionally, the adoption of energy-efficient manufacturing processes and designs that reduce vehicle weight can contribute to lower fuel consumption and emissions. Embracing environmental considerations addresses regulatory requirements, enhances brand reputation, and fosters customer loyalty in an increasingly eco-conscious market.

- Increasing Demand among the Automakers to Enhance the Functionality of Vehicles

Automakers are increasingly integrating advanced technologies such as sensors, cameras, and lighting elements into exterior trim parts to offer functionalities such as adaptive lighting, parking assistance, and blind-spot detection. This trend enhances vehicle functionality and elevates the overall driving experience and safety features. As a result, there is a growing need for innovative exterior trim parts that can accommodate these technological advancements, driving market growth and opening avenues for manufacturers to capitalize on this demand.

Restraints/Challenges

- High Manufacturing Expenses Limits Investment in Research and Development for New Technologies

The high cost pressure often leads to compromises in material quality, design complexity, and production processes, impacting the overall durability and aesthetics of trim parts. Manufacturers may face challenges in offering innovative features or premium materials while maintaining competitive pricing. Additionally, cost constraints can limit investment in research and development for new technologies or materials, hindering innovation in the market.

- Stringent Regulations Leads to the Increased Complexity in Supply Chain Management

Stringent regulations encompass various aspects such as vehicle safety, emissions standards, and pedestrian protection requirements, which directly impact the design, materials, and manufacturing processes of exterior trim parts. Compliance with these regulations often necessitates extensive testing, engineering modifications, and additional costs, thereby challenging manufacturers to meet stringent standards while remaining competitive. Moreover, evolving regulatory landscapes across different regions or markets further complicate the compliance process, leading to potential delays in product development and increased complexity in supply chain management.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In July 2023, Novartis' setback in losing patent exclusivity for Entresto mirrors the challenges faced by companies in the automotive exterior trim parts. Just as Novartis' invalidated patent affects its revenue streams, disruptions in intellectual property rights impact automotive manufacturers' ability to maintain market dominance and capitalize on innovative trim part designs

- In November 2021, Lacks Enterprises Inc. collaborated with Texas-based family-owned business GL Automotive LLC to supply exterior trim parts and other components to Toyota Motors North America. This strategic collaboration aimed to enhance manufacturing capabilities and supply chain efficiency, reinforcing Lacks Enterprises' position as a key supplier in the automotive industry

- In January 2021, Toyoda Gosei Co. Ltd. announced the establishment of a new plant in Ohira, Kurokawa-gun, Miyagi, focusing on manufacturing exterior and interior automotive trim parts. Located in close proximity to Toyoda's main consumer Toyota Motor East Japan Inc., the plant aims to bolster production capacity in the Tohoku region, a significant hub for automotive manufacturing, thereby supporting the company's expansion goals and meeting growing market demand

Automotive Exterior Trim Parts Market Scope

The market is segmented on the basis of product type, vehicle type and sales channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Front Bumpers

- Rear Bumpers

- Outside Rear View Mirrors (ORVM)

- Rocker Panels (Under Panels)

- Radiator Grills

- Wheel Arch Claddings (Fender Liners)

- Outside Door Handles

- Exterior Car Door Trims

- Mud Guards

- Exterior Trim Parts

Vehicle Type

- Passenger Cars

- Compact

- Mid-size

- Luxury

- Sedan

- SUV

- Commercial Vehicles

- Heavy Trucks and Buses

Sales Channel

- First Fit

- Replacement

Automotive Exterior Trim Parts Market Regional Analysis/Insights

The market is analysed and market size insights and trends are provided by country, product type, vehicle type and sales channel as referenced above.

The countries covered in the market report are U.S., Canada, Mexico, Germany, France, U.K., Italy, Spain, Switzerland, Netherlands, Russia, Turkey, Belgium, Rest of Europe, Japan, China, South Korea, India, Australia and New Zealand, Singapore, Thailand, Malaysia, Indonesia, Philippines, Rest of Asia-Pacific, South Africa, Israel, U.A.E., Saudi Arabia, Egypt, Rest of Middle East and Africa, Brazil, Argentina and Rest of South America.

North America's dominates in automotive exterior trim parts during the forecast period is primarily attributed to the concentration of numerous manufacturing companies within the region. These companies benefit from established infrastructures, advanced technologies, and skilled labor forces, enabling efficient production and supply chain management. Additionally, North America's robust automotive industry ecosystem fosters innovation and collaboration, further reinforcing its leading position in exterior trim parts manufacturing for automobiles.

The Asia-Pacific is expected to experience fastest development due to a surge in research and development endeavors. This trend is driven by a combination of factors including growing investments in innovation, expanding technological infrastructure, and a rising emphasis on fostering knowledge-based economies. With countries in the region increasingly prioritizing innovation-driven growth strategies, Asia-Pacific is becoming a hub for cutting-edge advancements across various industries, positioning it as a key player in global economic expansion and technological progress.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Automotive Exterior Trim Parts Market Share Analysis

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Some of the major players operating in the market are:

- AISIN CORPORATION (Japan)

- CIE Automotive (Spain)

- DURA (U.S.)

- Ficosa Internacional SA (France)

- GEDIA Automotive Group (U.S.)

- Gronbach (Germany)

- HAYASHI TELEMPU CORPORATION (Japan)

- IDEAL Automotive GmbH (Germany)

- KASAI KOGYO CO., LTD. (Japan)

- KIRCHHOFF Automotive (Germany)

- Knauf Industries (Germany)

- Novares (France)

- NVH KOREA INC. (South Korea)

- SMR Deutschland GmbH (Germany)

- TOYOTA BOSHOKU CORPORATION (Japan)

- Plastic Omnium (France)

- HUTCHINSON (France)

- Magna International Inc. (France)

SKU-