Global Automotive Exterior Trim Parts Market

Market Size in USD Billion

CAGR :

%

USD

23.27 Billion

USD

34.91 Billion

2024

2032

USD

23.27 Billion

USD

34.91 Billion

2024

2032

| 2025 –2032 | |

| USD 23.27 Billion | |

| USD 34.91 Billion | |

|

|

|

|

Automotive Exterior Trim Parts Market Size

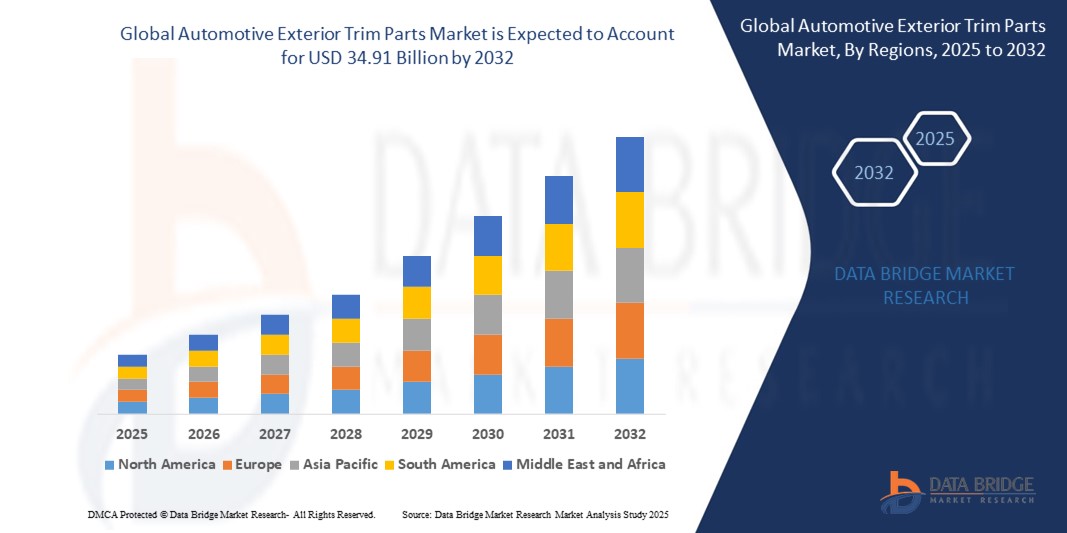

- The global automotive exterior trim parts market size was valued at USD 23.27 billion in 2024 and is expected to reach USD 34.91 billion by 2032, at a CAGR of 5.20% during the forecast period

- The market growth is primarily driven by increasing vehicle production, rising demand for aesthetically appealing and lightweight vehicle components, and advancements in automotive design and materials technology

- In addition, growing consumer preference for customized and premium exterior trim parts, coupled with the rising adoption of electric vehicles (EVs) requiring specialized lightweight trims, is significantly boosting the industry’s growth

Automotive Exterior Trim Parts Market Analysis

- Automotive exterior trim parts, including bumpers, mirrors, and door trims, enhance vehicle aesthetics, functionality, and safety while contributing to aerodynamic efficiency and fuel economy

- The escalating demand for these components is fueled by increasing vehicle personalization trends, growing automotive production in emerging markets, and the need for durable, lightweight materials to meet stringent emission regulations

- North America dominated the automotive exterior trim parts market with the largest revenue share of 38.5% in 2024, driven by high vehicle ownership rates, advanced manufacturing infrastructure, and the presence of major automotive OEMs and suppliers in the U.S. and Canada

- Asia-Pacific is expected to be the fastest-growing region during the forecast period due to rapid urbanization, increasing disposable incomes, and expanding automotive manufacturing in countries such as China, India, and Japan

- The front bumpers segment dominated the largest market revenue share of 45% in 2024, driven by its critical role in vehicle safety, aesthetics, and crash protection. Front bumpers incorporate advanced materials such as impact-resistant polymers and sensors, enhancing both functionality and design. Their widespread use across all vehicle types, particularly passenger cars, contributes to their dominance

Report Scope and Automotive Exterior Trim Parts Market Segmentation

|

Attributes |

Automotive Exterior Trim Parts Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Exterior Trim Parts Market Trends

“Increasing Adoption of Lightweight and Sustainable Materials”

- The Global Automotive Exterior Trim Parts Market is experiencing a significant shift towards the use of lightweight materials such as aluminum, carbon fiber-reinforced plastics, and bio-based composites to enhance fuel efficiency and reduce vehicle emissions

- Advanced manufacturing techniques, such as 3D printing and injection molding, are being utilized to produce complex trim parts with reduced weight while maintaining structural integrity

- Sustainable materials, such as bio-plastics derived from renewable feedstocks such as sugarcane and castor beans, are gaining traction to meet environmental regulations and consumer demand for eco-friendly vehicles

- For instances, companies are developing radiator grills and bumpers with lightweight composites that incorporate sensors for advanced driver assistance systems (ADAS), improving both aesthetics and functionality

- The integration of LED lighting into exterior trim parts, such as grilles and side moldings, is a growing trend, enhancing nighttime visibility and providing a modern, premium aesthetic

- These advancements are making exterior trim parts more appealing to consumers seeking both performance and environmentally conscious designs, driving market growth

Automotive Exterior Trim Parts Market Dynamics

Driver

“Rising Demand for Vehicle Customization and Aesthetic Enhancements”

- Increasing consumer preference for personalized and visually appealing vehicles is a key driver for the Global Automotive Exterior Trim Parts Market

- Exterior trim parts, such as custom front bumpers, radiator grills, and chrome accents, allow consumers to enhance the aesthetic appeal and individuality of their vehicles, particularly in the passenger car and SUV segments

- The growing popularity of SUVs and crossovers, especially in North America and Asia-Pacific, is fueling demand for rugged and stylish trim components such as wheel arch claddings and bumper guards

- Government regulations promoting vehicle safety and pedestrian protection are encouraging the adoption of advanced front and rear bumpers with energy-absorbing materials and integrated sensors

- The proliferation of e-commerce platforms and aftermarket sales channels is making exterior trim parts more accessible, further boosting market growth across vehicle types, including passenger cars, commercial vehicles, and heavy trucks and buses

Restraint/Challenge

“High Production Costs and Regulatory Compliance”

- The high cost of advanced materials, such as carbon fiber and lightweight composites, along with the expenses associated with integrating smart technologies such as sensors and LED lighting, poses a significant barrier to widespread adoption, particularly in cost-sensitive markets

- Manufacturing and installing complex exterior trim parts, such as radiator grills and wheel arch claddings, require specialized processes, increasing production costs for both OEMs and aftermarket suppliers

- Data security and intellectual property concerns arise with the integration of smart components, as exterior trim parts increasingly incorporate ADAS sensors, raising issues about proprietary technology and compliance with global safety standards

- The fragmented regulatory landscape across regions, particularly regarding material standards and safety requirements, complicates operations for manufacturers and suppliers operating in multiple markets, including North America, the dominating region, and Asia-Pacific, the fastest-growing region

- These challenges can limit market expansion, especially in emerging economies where cost sensitivity and regulatory variations are significant factors

Automotive Exterior Trim Parts market Scope

The market is segmented on the basis of product type, vehicle type, and sales channel.

- By Product Type

On the basis of product type, the global automotive exterior trim parts market is segmented into front bumpers, rear bumpers, outside rear view mirrors (ORVM), rocker panels (Under Panels), radiator grills, wheel arch claddings (Fender Liners), outside door handles, exterior car door trims, mud guards, and exterior trim parts. The front bumpers segment dominated the largest market revenue share of 45% in 2024, driven by its critical role in vehicle safety, aesthetics, and crash protection. Front bumpers incorporate advanced materials such as impact-resistant polymers and sensors, enhancing both functionality and design. Their widespread use across all vehicle types, particularly passenger cars, contributes to their dominance.

The outside rear view mirrors (ORVM) segment is expected to witness significant growth, driven by advancements in mirror technology, including integrated cameras, blind-spot detection, and aerodynamic designs. Increasing focus on vehicle safety and driver assistance systems further propels the adoption of technologically advanced ORVMs.

- By Vehicle Type

On the basis of vehicle type, the global automotive exterior trim parts market is segmented into passenger cars, commercial vehicles, and heavy trucks and buses. The passenger cars segment dominated the market revenue share in 2024, attributed to the high volume of passenger vehicle production worldwide and increasing consumer demand for vehicle personalization, comfort, and aesthetic enhancements.

The commercial vehicles segment is anticipated to witness rapid growth from 2025 to 2032. This growth is fueled by the increasing adoption of durable and aerodynamic exterior trim parts in trucks and buses, driven by the need for improved fuel efficiency, reduced emissions, and enhanced fleet appearance.

- By Sales Channel

On the basis of sales channel, the global automotive exterior trim parts market is segmented into first fit (OEM) and replacement (Aftermarket). The first fit (OEM) segment is expected to hold the largest market revenue share, primarily driven by the direct integration of exterior trim parts during vehicle manufacturing. OEMs increasingly focus on design, quality, and material innovation to differentiate their vehicles.

The replacement (Aftermarket) segment is anticipated to witness robust growth from 2025 to 2032. This is driven by increasing vehicle park, consumer demand for customization and personalization of existing vehicles, and the need for repair or replacement of damaged trim parts. The growing DIY customization trend also contributes to this segment's expansion.

Automotive Exterior Trim Parts Market Regional Analysis

- North America dominated the automotive exterior trim parts market with the largest revenue share of 38.5% in 2024, driven by high vehicle ownership rates, advanced manufacturing infrastructure, and the presence of major automotive OEMs and suppliers in the U.S. and Canada

- Consumers prioritize exterior trim parts for aesthetic appeal, protection against environmental damage, and improved vehicle safety, particularly in passenger and commercial vehicles

U.S. Automotive Exterior Trim Parts Market Insight

The U.S. automotive exterior trim parts market captured the largest revenue share of 75.4% in 2024 within North America, fueled by strong consumer demand for vehicle personalization and advanced safety features. The trend toward integrating technologies such as sensors and cameras in components such as outside rear view mirrors (ORVM) and front bumpers drives market growth. Both OEM and aftermarket segments see significant uptake, supported by regulatory emphasis on vehicle safety and consumer preference for premium aesthetics. The replacement market is particularly strong due to frequent wear and tear of components such as bumpers and mud guards.

Europe Automotive Exterior Trim Parts Market Insight

The Europe automotive exterior trim parts market is expected to witness significant growth, driven by stringent regulations on vehicle safety and emissions, alongside consumer demand for stylish and functional designs. Countries such as Germany and France lead in adoption due to their advanced automotive sectors and focus on innovation. Consumers seek trim parts that enhance aerodynamics, reduce vehicle weight, and improve aesthetics, such as radiator grills and wheel arch claddings. The market benefits from both first-fit installations in new vehicles and replacement demand in retrofit projects, particularly in premium and electric vehicles.

U.K. Automotive Exterior Trim Parts Market Insight

The U.K. market for automotive exterior trim parts is expected to experience robust growth, driven by increasing consumer interest in vehicle aesthetics and functionality in urban and suburban settings. Demand for components such as front bumpers and exterior car door trims is fueled by the need for protection against minor impacts and enhanced visual appeal. Rising awareness of lightweight materials and their benefits for fuel efficiency, combined with evolving safety regulations, encourages adoption of advanced trim parts. The aftermarket segment is particularly strong due to customization trends.

Germany Automotive Exterior Trim Parts Market Insight

Germany is expected to witness significant growth in the automotive exterior trim parts market, attributed to its advanced automotive manufacturing sector and high consumer focus on vehicle aesthetics and efficiency. German consumers prefer technologically advanced trim parts, such as radiator grills and outside door handles with integrated sensors that enhance safety and reduce fuel consumption. The integration of these components in premium and electric vehicles, along with strong aftermarket demand, supports sustained market growth. Germany’s leadership in automotive innovation further drives the adoption of lightweight and durable materials.

Asia-Pacific Automotive Exterior Trim Parts Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate in the automotive exterior trim parts market, driven by expanding automotive production and rising disposable incomes in countries such as China, India, and Japan. Increasing consumer awareness of vehicle aesthetics, safety, and durability boosts demand for components such as front bumpers, rear bumpers, and wheel arch claddings. Government initiatives promoting fuel efficiency and vehicle safety further encourage the adoption of advanced trim parts. The region’s growing middle class and urbanization trends support both OEM and aftermarket segments.

Japan Automotive Exterior Trim Parts Market Insight

Japan’s automotive exterior trim parts market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced components that enhance vehicle safety and aesthetics. The presence of major automotive manufacturers and the integration of trim parts such as radiator grills and outside rear view mirrors in OEM vehicles accelerate market penetration. Rising interest in aftermarket customization, particularly for passenger cars, further contributes to growth. Japan’s focus on innovation ensures the adoption of advanced materials and electronic integration in trim components.

China Automotive Exterior Trim Parts Market Insight

China holds the largest share of the Asia-Pacific automotive exterior trim parts market, propelled by rapid urbanization, rising vehicle ownership, and increasing demand for aesthetic and functional enhancements. The country’s growing middle class and focus on smart mobility drive the adoption of advanced trim parts, such as front bumpers and exterior car door trims, which incorporate lightweight materials and integrated technologies. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility, supporting both first-fit and replacement sales channels.

Automotive Exterior Trim Parts Market Share

The automotive exterior trim parts industry is primarily led by well-established companies, including:

- AISIN CORPORATION (Japan)

- CIE Automotive (Spain)

- DURA (U.S.)

- Ficosa Internacional SA (France)

- GEDIA Automotive Group (U.S.)

- Gronbach (Germany)

- HAYASHI TELEMPU CORPORATION (Japan)

- IDEAL Automotive GmbH (Germany)

- KASAI KOGYO CO., LTD. (Japan)

- KIRCHHOFF Automotive (Germany)

- Knauf Industries (Germany)

- Novares (France)

- NVH KOREA INC. (South Korea)

- SMR Deutschland GmbH (Germany)

- TOYOTA BOSHOKU CORPORATION (Japan)

- Plastic Omnium (France)

- HUTCHINSON (France)

- Magna International Inc. (France)

What are the Recent Developments in Global Automotive Exterior Trim Parts Market?

- In April 2025, a significant sustainability breakthrough, the "Greener Roof," was debuted at Auto Shanghai. This innovation for automotive panoramic roofs aims to reduce CO2e emissions by up to 30% through slimming steel structures, integrating plastics, eliminating aluminum, and minimizing production scrap by 60%, all while enhancing BEV interior space. This highlights a strong push towards eco-friendly materials and manufacturing in exterior trim

- In January 2025, Wideye™ introduced a groundbreaking panoramic all-in-glass roof that seamlessly incorporates a LiDAR sensor into its surface. This innovation enhances the performance of Advanced Driver-Assistance Systems (ADAS) while preserving the vehicle’s streamlined design. The roof’s smooth, curved glass enables discreet sensor placement, aligning with the growing trend of integrating smart technologies into exterior automotive components. By positioning the LiDAR at a higher elevation, the system improves road safety and long-range detection without compromising aesthetics. This advancement reflects the automotive industry's push toward smarter, more elegant sensor integration

- In September 2024, Webasto unveiled the EcoPeak concept, a visionary roof system designed to advance sustainable mobility. This panoramic roof uses biomass-balanced polycarbonate and recycled plastics, reducing weight by up to 40% compared to conventional aluminum-based designs. Integrated solar cells generate around 350 kWh of electricity annually, potentially adding 2,500 km of driving range depending on climate and vehicle type. The roof also features roller blinds made from recycled PET bottles, contributing to a 50% reduction in life-cycle CO₂e emissions. EcoPeak exemplifies the automotive industry's shift toward lightweight, energy-efficient, and eco-conscious exterior trim innovations

- In March 2024, the first smart-tint panoramic sunroof was introduced, featuring embedded sensors that dynamically adjust the glass tint based on sunlight intensity. This innovation significantly improves passenger comfort and reduces the need for cabin cooling, contributing to energy efficiency. By the end of 2024, this technology was adopted in 15% of all-new SUVs, marking a major leap in smart glass integration for automotive exteriors and reinforcing the industry's shift toward intelligent, responsive design elements

- In July 2023, Novartis' setback in losing patent exclusivity for Entresto mirrors the challenges faced by companies in the automotive exterior trim parts. While this specific development from Novartis is not directly an automotive exterior trim part event, the report highlights it as an analogy for how disruptions in intellectual property rights can impact automotive manufacturers' ability to maintain market dominance and capitalize on innovative trim part designs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.