Global Automotive Cyber Security Market

Market Size in USD Billion

CAGR :

%

USD

3.07 Billion

USD

13.90 Billion

2024

2032

USD

3.07 Billion

USD

13.90 Billion

2024

2032

| 2025 –2032 | |

| USD 3.07 Billion | |

| USD 13.90 Billion | |

|

|

|

|

Automotive Cyber Security Market Analysis

The automotive cybersecurity market is rapidly evolving due to the increasing integration of digital technologies, connectivity, and autonomous systems in modern vehicles. As vehicles become more connected through systems such as in-car Wi-Fi, infotainment, telematics, and vehicle-to-everything (V2X) communications, the risk of cyber-attacks rises, leading to heightened demand for robust cybersecurity solutions. The market encompasses a range of security measures, including intrusion detection systems (IDS), encryption, firewalls, secure over-the-air updates, and advanced threat monitoring. Advancements in automotive cybersecurity are centered on the development of multi-layered security solutions that offer real-time threat detection, secure communication protocols, and enhanced vehicle-to-cloud security. In response to emerging challenges, companies are investing in machine learning and AI-based systems to predict and counteract cyber threats before they cause harm. Additionally, the rise of autonomous vehicles has introduced new complexities, as they rely heavily on connected systems and sensors, increasing their vulnerability to malicious attacks. As the industry grows, governments and regulatory bodies are enforcing stricter regulations to ensure vehicle manufacturers prioritize cybersecurity in their design and development processes. With the increasing reliance on connected technologies, the automotive cybersecurity market is expected to witness continued growth and innovation, driven by the need for more secure, resilient vehicle systems.

Automotive Cyber Security Market Size

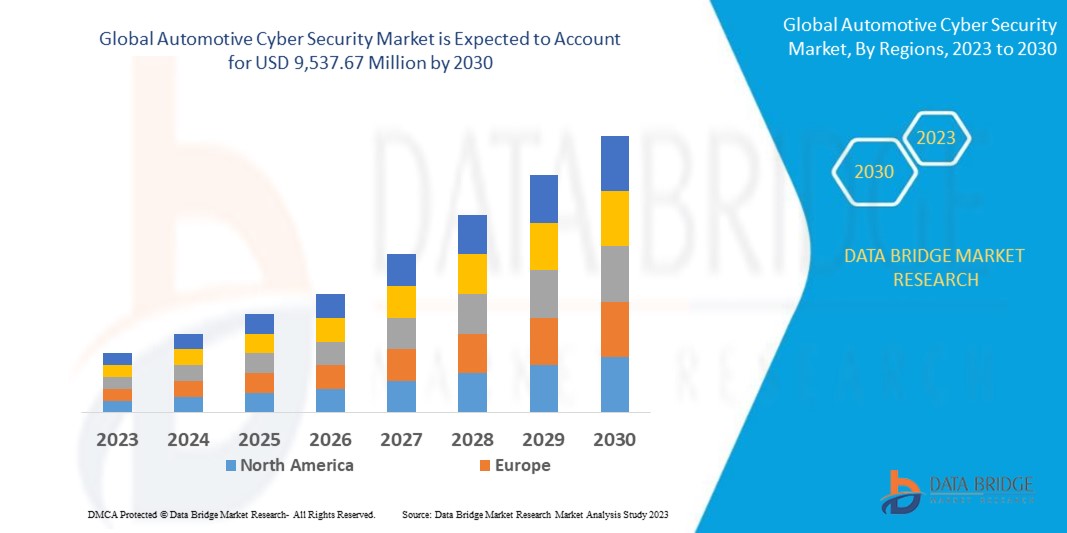

The global automotive cyber security market size was valued at USD 3.07 billion in 2024 and is projected to reach USD 13.90 billion by 2032, with a CAGR of 20.73% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Automotive Cyber Security Market Trends

“Rise of Intrusion Detection Systems (IDS) Integrated with Vehicle-to-Everything (V2X) Communication Technologies”

The automotive cybersecurity market is experiencing significant growth due to the increasing adoption of connected and autonomous vehicles, driving the need for advanced security solutions. One notable trend is the rise of intrusion detection systems (IDS) integrated with vehicle-to-everything (V2X) communication technologies. These systems are designed to detect and neutralize cyber threats in real time by continuously monitoring vehicle networks and external communications. For instance, in 2023, HL Mando Corporation partnered with Argus Cyber Security to integrate its CAN Intrusion Detection System into the company's electrification systems, such as brakes and steering. This trend highlights the industry's focus on enhancing cyber resilience in vehicles, especially as advanced technologies such as autonomous driving and connected infrastructure increase the vulnerability to cyber-attacks. As cyber threats become more sophisticated, automotive manufacturers are incorporating multi-layered security protocols, including encryption, secure communication, and over-the-air software updates, to safeguard both vehicle data and user privacy.

Report Scope and Automotive Cyber Security Market Segmentation

|

Attributes |

Automotive Cyber Security Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

HARMAN International (U.S.), PlaxidityX Ltd (Israel), Karamba Security (U.S.), Broadcom (U.S.), BlackBerry Limited (Canada), GUARDKNOX (Israel), NXP Semiconductors (Netherlands), Aptiv (Ireland), Continental AG (Germany), Lear Corp. (U.S.), Intel Corporation (U.S.), ETAS (Germany), Upstream Security Ltd. (U.S.), Trillium Secure, Inc (U.S.), JFrog Ltd (U.S.), Autotalks (Israel), OnBoard (U.S.), and Cybellum (Israel) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Cyber Security Market Definition

Automotive cybersecurity refers to the set of practices, technologies, and strategies designed to protect vehicles and their connected systems from cyber threats, unauthorized access, and malicious attacks. It involves securing critical vehicle components such as infotainment systems, telematics, autonomous driving technologies, and vehicle-to-everything (V2X) communications from vulnerabilities that could lead to data breaches, system failures, or safety risks. Automotive cybersecurity includes measures such as encryption, intrusion detection systems (IDS), firewalls, secure software updates, and threat monitoring to ensure the confidentiality, integrity, and availability of vehicle systems and data. With the increasing connectivity of vehicles, robust cybersecurity is essential to protect both the vehicle and its occupants from potential cyber risks.

Automotive Cyber Security Market Dynamics

Drivers

- Increasing Adoption of Connected Technologies in Vehicles

The increasing adoption of connected technologies in vehicles, such as in-car Wi-Fi, infotainment systems, telematics, and vehicle-to-everything (V2X) communications, has led to more entry points for potential cyber-attacks, significantly driving the demand for advanced automotive cybersecurity solutions. For instance, a study by the U.S. Department of Transportation revealed that by 2023, more than 90% of vehicles would be connected to some form of network, making them vulnerable to hacking. This growing network of connected systems underscores the need for robust cybersecurity measures to secure vehicle data and prevent potential malicious attacks. As connectivity continues to expand, the automotive cybersecurity market is expected to grow rapidly, driven by the need to safeguard increasingly complex vehicle networks.

- Rise in Cyber Threats Targeting Vehicles

The rise in cyber threats targeting vehicles has become a significant driver for the automotive cybersecurity market as vehicles grow more digital and autonomous. High-profile incidents, such as the 2015 hacking of a Jeep Cherokee by cybersecurity researchers, demonstrated the vulnerabilities of connected vehicles when they remotely accessed the vehicle’s control systems. This hack, which involved taking control of the vehicle’s steering and braking functions, raised alarms about the potential for cybercriminals to exploit vehicle networks. Similarly, in 2020, researchers were able to remotely hack Tesla vehicles, highlighting the increasing sophistication of cyber-attacks targeting automotive systems. Such incidents have prompted manufacturers to invest heavily in advanced cybersecurity solutions, including intrusion detection systems, secure over-the-air updates, and encryption technologies, to protect vehicles from malicious attacks. As cyber threats continue to evolve, the demand for automotive cybersecurity solutions is expected to grow, positioning security as a critical priority for the automotive industry.

Opportunities

- Increasing Regulatory Requirements

Regulatory requirements are becoming a major driver for the growth of the automotive cybersecurity market as governments and regulatory bodies enforce stricter standards to protect vehicles from cyber threats. For Instance, the European Union introduced UN Regulation No. 155, which mandates that all new vehicles sold in the EU must be equipped with robust cybersecurity measures, including secure software development, vulnerability detection, and incident response protocols. This regulation, effective from July 2022, ensures that manufacturers prioritize cybersecurity throughout the vehicle lifecycle, from design to production. Additionally, the U.S. National Highway Traffic Safety Administration (NHTSA) has also been pushing for higher cybersecurity standards, encouraging automakers to adopt best practices in vehicle security. As these regulatory requirements become more widespread, they create a significant market opportunity for companies providing advanced cybersecurity solutions such as encryption, intrusion detection, and over-the-air software update capabilities. The need to comply with these regulations is expected to accelerate the adoption of automotive cybersecurity systems, creating sustained demand in the market.

- Increasing Development of Autonomous Vehicles

The development of autonomous vehicles is driving significant growth in the automotive cybersecurity market, as these vehicles introduce new complexities in vehicle security. Autonomous vehicles rely heavily on interconnected systems, sensors, artificial intelligence (AI), and vehicle-to-everything (V2X) communication to navigate and make decisions in real time. This increased connectivity exposes them to a greater risk of cyber-attacks. For instance, in 2019, researchers demonstrated the vulnerability of autonomous vehicles by successfully hacking into a car’s system and manipulating its sensors, leading to safety concerns and highlighting the need for robust cybersecurity. As autonomous vehicles become more prevalent, the demand for specialized cybersecurity solutions to protect these vehicles from potential threats such as remote hacking, data breaches, and system manipulation—is growing. This creates a substantial market opportunity for companies developing advanced encryption, intrusion detection, and secure AI-based technologies to safeguard autonomous vehicles, ensuring their safe integration into public roads and transportation networks.

Restraints/Challenges

- Increasing Complexity of Modern Vehicle Systems

The increasing complexity of modern vehicle systems is a major challenge in the automotive cybersecurity market, as vehicles now integrate advanced technologies such as autonomous driving, IoT, and connected car systems, all of which open up multiple potential entry points for cyberattacks. For instance, autonomous vehicles, equipped with sensors, cameras, and communication networks, rely heavily on secure software to navigate safely. A vulnerability in any of these interconnected systems could lead to disastrous consequences, as seen in high-profile hacking incidents where researchers successfully manipulated car systems remotely. As vehicles become more complex, securing every component from in-vehicle systems to cloud-based platforms becomes an increasingly difficult task. This growing vulnerability drives the need for more robust cybersecurity solutions, highlighting the challenge faced by manufacturers and cybersecurity firms in staying ahead of evolving threats.

- Regulatory and Compliance Issues

Regulatory and compliance issues are a significant challenge for the automotive cybersecurity market, as vehicle manufacturers must navigate a complex landscape of country-specific regulations and standards. For instance, the United Nations Economic Commission for Europe (UNECE) introduced WP.29, a regulation mandating automotive cybersecurity measures for all new vehicle models in participating regions, including parts of Europe, Japan, and South Korea. WP.29 requires manufacturers to implement robust cybersecurity management systems and to continually monitor, detect, and respond to cyber threats throughout the vehicle's lifecycle. However, because WP.29 does not apply globally, manufacturers selling vehicles in other regions, such as the U.S., must adapt their security practices to meet different, often less prescriptive, regulatory requirements. This regional disparity creates a significant market challenge thus, companies must balance compliance with multiple standards across different markets while ensuring consistent security practices, which can drive up costs, complicate production processes, and delay time-to-market.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Automotive Cyber Security Market Scope

The market is segmented on the basis of security, form, application, vehicle type, offering, and electric vehicle type. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Security

- Endpoint

- Application

- Wireless Network

Form

- In-Vehicle

- External Cloud Services

Application

- ADAS and Safety

- Body Control and Comfort

- Infotainment

- Telematics

- Powertrain Systems

- Communication Systems

Vehicle Type

- Passenger Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Offering

- Software

- Hardware

Electric Vehicle Type

- Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle (HEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

Automotive Cyber Security Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, security, form, application, vehicle type, offering, and electric vehicle type as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America, home to numerous leading automotive and technology companies, plays a key role in the development of advanced vehicles and connectivity solutions, fueling the demand for strong cybersecurity measures to protect these innovations. As a result, the region currently leads the global automotive cybersecurity market. The U.S., in particular, is at the forefront of technological innovation, driving advancements in both automotive technologies and cybersecurity solutions. Many top cybersecurity firms and research institutions in the U.S. are actively engaged in creating state-of-the-art automotive cybersecurity technologies, further supporting the market's growth and evolution.

Asia-Pacific is anticipated to experience substantial growth in the global automotive cybersecurity market, driven by increasing awareness of technological advancements and their benefits. As consumers become more informed about the importance of cybersecurity in vehicles, the demand for secure automotive solutions is expected to rise. Additionally, government policies and initiatives aimed at enhancing vehicle security are likely to strengthen during the forecast period from 2025 to 2032. These factors combined will significantly boost the region's automotive cybersecurity market growth.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Automotive Cyber Security Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Automotive Cyber Security Market Leaders Operating in the Market Are:

- HARMAN International (U.S.)

- PlaxidityX Ltd (Israel)

- Karamba Security (U.S.)

- Broadcom (U.S.)

- BlackBerry Limited (Canada)

- GUARDKNOX (Israel)

- NXP Semiconductors (Netherlands)

- Aptiv (Ireland)

- Continental AG (Germany)

- Lear Corp. (U.S.)

- Intel Corporation (U.S.)

- ETAS (Germany)

- Upstream Security Ltd. (U.S.)

- Trillium Secure, Inc (U.S.)

- JFrog Ltd (U.S.)

- Autotalks (Israel)

- OnBoard (U.S.)

- Cybellum (Israel)

Latest Developments in Automotive Cyber Security Market

- In February 2023, ETAS, a subsidiary of Robert Bosch GmbH, introduced ESCRYPT C_ycurRISK, a software tool designed for threat analysis and risk assessment. This tool helps automotive OEMs and suppliers identify security vulnerabilities during vehicle development, systematically mitigating cyber risks

- In January 2023, HL Mando Corporation partnered with Argus Cyber Security to implement the Argus CAN Intrusion Detection System (IDS) solution in HL Mando's electrification products, such as brakes and steering systems, starting in January 2023

- In October 2022, NTT Communications Corporation, in collaboration with DENSO Corporation, began developing Vehicle Security Operation Center (VSOC1) technology to counter the growing threat of sophisticated cyber-attacks targeting vehicles

- In November 2022, Garrett Motion Inc. launched multi-layered intrusion detection systems (IDS) for both on-and-off-board vehicle security, designed to identify cyber threats and assist OEMs in strengthening vehicle protection

- In November 2021, NXP Semiconductors joined forces with Ford Motor Company to enhance the driver experience, convenience, and services, including the ability to perform over-the-air updates across its global fleet, covering vehicles such as the 2021 Ford F-150 pickup, Mustang Mach-E, and Bronco SUVs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.