Global Aqueous Polyurethane Dispersion Market

Market Size in USD Billion

CAGR :

%

USD

2.42 Billion

USD

3.46 Billion

2024

2032

USD

2.42 Billion

USD

3.46 Billion

2024

2032

| 2025 –2032 | |

| USD 2.42 Billion | |

| USD 3.46 Billion | |

|

|

|

|

Aqueous Polyurethane Dispersion Market Size

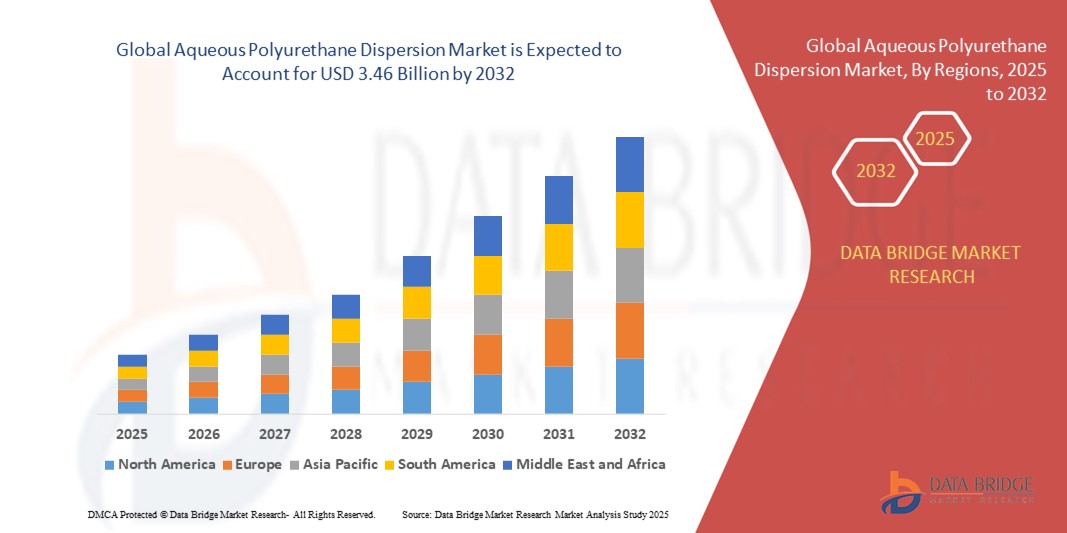

- The global aqueous polyurethane dispersion market size was valued at USD 2.42 billion in 2024 and is expected to reach USD 3.46 billion by 2032, at a CAGR of 4.60% during the forecast period

- The market growth is largely fuelled by the rising demand for eco-friendly coatings and adhesives across industries such as automotive, construction, and textiles. Increasing environmental regulations and consumer preference for sustainable products are further driving the adoption of aqueous polyurethane dispersions

- In addition, growing investments in research and development to improve product durability and performance are expected to create new growth opportunities in the market

Aqueous Polyurethane Dispersion Market Analysis

- The market is segmented based on type, application, and region, with growing demand observed in coatings, adhesives, textiles, and leather finishing

- Technological advancements and innovations in waterborne polyurethane formulations are enhancing product performance and expanding application areas, thus contributing to market growth

- Asia-Pacific dominated the global aqueous polyurethane dispersion market with the largest revenue share of 38.5% in 2024, driven by rapid industrialization, expanding automotive and construction sectors, and increasing demand for eco-friendly coatings and adhesives in countries such as China, India, and Japan

- North America region is expected to witness the highest growth rate in the global aqueous polyurethane dispersion market, driven by strong environmental policies, increased adoption in automotive and healthcare sectors, and rising consumer preference for sustainable products

- The component polyurethane segment dominated the market with the largest revenue share in 2024, attributed to its ease of use and versatility across multiple applications. This type is preferred for its straightforward formulation and broad compatibility with various substrates

Report Scope and Aqueous Polyurethane Dispersion Market Segmentation

|

Attributes |

Aqueous Polyurethane Dispersion Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Increasing Demand for Sustainable and Eco-Friendly Coating Solutions |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aqueous Polyurethane Dispersion Market Trends

Rising Preference for Environmentally Friendly Coatings and Adhesives

- The increasing shift toward waterborne and low-VOC aqueous polyurethane dispersions (PUDs) is reshaping the coatings and adhesives industry by offering eco-friendly alternatives to solvent-based products. These dispersions reduce harmful emissions, meeting stricter environmental regulations while maintaining high performance in applications such as automotive, furniture, and textiles. This trend is accelerating the adoption of PUDs globally

- Demand for aqueous polyurethane dispersions is rising in emerging markets, where industries seek sustainable solutions aligned with regulatory and consumer pressures. Growth in construction and automotive sectors in regions with limited environmental oversight is driving increased use of these dispersions. In addition, ongoing R&D has improved product properties such as durability and flexibility, broadening application scope

- The affordability and versatility of aqueous polyurethane dispersions are making them preferred choices for manufacturers aiming to reduce environmental impact without compromising quality. Their ease of application and compatibility with various substrates encourage widespread adoption in both industrial and consumer goods sectors

- For example, in 2023, several European automotive manufacturers reported significant reductions in VOC emissions after switching to aqueous polyurethane coatings for interior and exterior components. This switch not only improved compliance with environmental norms but also enhanced coating durability and finish quality

- While demand is growing steadily, the market’s expansion depends on continued innovation to enhance performance and cost-effectiveness, alongside efforts to educate end-users on the benefits of aqueous-based systems. Manufacturers focusing on localized formulations and scalable production are best positioned to capitalize on this trend

Aqueous Polyurethane Dispersion Market Dynamics

Driver

Stringent Environmental Regulations and Growing Sustainability Awareness

• Increasing global regulations aimed at reducing volatile organic compounds (VOCs) and hazardous emissions are propelling the shift toward aqueous polyurethane dispersions. Governments and regulatory bodies worldwide are enforcing stricter standards for coatings and adhesives, pushing manufacturers to adopt greener alternatives

• Rising environmental consciousness among consumers and industries alike is driving demand for sustainable materials. End-users in automotive, construction, and textiles prefer aqueous polyurethane dispersions due to their lower environmental footprint and regulatory compliance

• Investments in research and development are enhancing the functional properties of aqueous polyurethane dispersions, such as improved abrasion resistance and elasticity, further expanding their adoption across diverse applications

• For instance, in 2022, the European Union’s updated VOC regulations accelerated the replacement of solvent-based coatings with aqueous polyurethane systems, significantly increasing market demand across the region

• While regulatory support and sustainability trends fuel growth, market players must address challenges related to product cost and performance consistency to sustain adoption rates globally

Restraint/Challenge

Higher Production Costs and Performance Limitations Compared to Solvent-Based Systems

• The comparatively higher production costs of aqueous polyurethane dispersions, driven by complex formulations and water management requirements, limit their affordability for some end-use sectors, especially in price-sensitive emerging markets

• Certain performance limitations, such as slower drying times and lower chemical resistance compared to solvent-based coatings, pose challenges in applications requiring rapid curing and extreme durability. These factors sometimes restrict broader use in demanding industrial environments

• Supply chain complexities involving raw material availability and specialized manufacturing equipment also hinder scalability and cost reduction efforts. In many developing regions, limited infrastructure complicates the adoption of aqueous-based systems

• For example, in 2023, manufacturers in Southeast Asia reported challenges in replacing solvent-based coatings in fast-paced industrial processes due to drying time and cost constraints, delaying market penetration despite environmental benefits

• Addressing these barriers requires ongoing innovation in formulation technology, process optimization, and increased awareness among end-users about long-term benefits, enabling aqueous polyurethane dispersions to realize their full market potential

Aqueous Polyurethane Dispersion Market Scope

The market is segmented on the basis of type, product, application, chemistry, solid content, and end-use industry.

- By Type

On the basis of type, the global aqueous polyurethane dispersion market is segmented into component polyurethane, two-component polyurethane, and urethane-modified. The component polyurethane segment dominated the market with the largest revenue share in 2024, attributed to its ease of use and versatility across multiple applications. This type is preferred for its straightforward formulation and broad compatibility with various substrates.

The two-component polyurethane segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for high-performance coatings and adhesives that offer superior mechanical and chemical resistance. Its growing adoption in automotive and industrial applications supports this expansion.

- By Product

On the basis of product, the market is segmented into water-based dispersion and solvent-based dispersion. The water-based dispersion segment held the largest market share in 2024, fueled by rising environmental regulations and the global shift towards sustainable, low-VOC coatings and adhesives. Water-based dispersions offer reduced toxicity and enhanced safety during application.

The solvent-based dispersion segment is expected to witness the fastest growth rate from 2025 to 2032, supported by its superior drying speed and resistance properties, making it suitable for specialized industrial uses.

- By Application

On the basis of application, the market is segmented into PUD leather finishing agents, PUD coating agents, PUD water-based glue, waterborne wood coating, water-based paint, textile finishing, and others. The PUD coating agent segment dominated the market in 2024 due to extensive use in automotive, furniture, and industrial coatings.

The waterborne wood coating segment is expected to witness the fastest growth rate from 2025 to 2032, driven by demand in furniture and construction sectors for eco-friendly finishes that provide durability and aesthetic appeal.

- By Chemistry

Based on chemistry, the market is segmented into acrylic-based, methacrylate-based, ester-based, and hybrid. The acrylic-based segment accounted for the largest share in 2024, supported by its excellent weather resistance, clarity, and adhesion properties across diverse applications.

Hybrid chemistry is expected to witness the fastest growth rate from 2025 to 2032 owing to its ability to combine the advantages of multiple chemistries, offering enhanced performance characteristics tailored to specific end-use requirements.

- By Solid Content

On the basis of solid content, the market is segmented into below 30%, 30-40%, 40-50%, and above 50%. The 30-40% solid content segment dominated in 2024, balancing ease of application with performance, and is commonly used in coatings and adhesives.

The above 50% solid content segment is expected to witness the fastest growth rate from 2025 to 2032 as industries seek higher solids dispersions to improve efficiency and reduce drying times.

- By End-Use Industry

On the basis of end-use industry, the market is segmented into apparel and footwear, automotive and transportation, construction and building, medical and healthcare, electronics and appliances, and others. The automotive and transportation segment led the market in 2024, driven by increasing use of aqueous polyurethane dispersions in vehicle coatings and interiors for enhanced durability and environmental compliance.

The construction and building segment is expected to witness the fastest growth rate from 2025 to 2032, supported by rising demand for sustainable coatings and adhesives in commercial and residential infrastructure projects.

Aqueous Polyurethane Dispersion Market Regional Analysis

• Asia-Pacific dominated the global aqueous polyurethane dispersion market with the largest revenue share of 38.5% in 2024, driven by rapid industrialization, expanding automotive and construction sectors, and increasing demand for eco-friendly coatings and adhesives in countries such as China, India, and Japan.

• Consumers and manufacturers in the region prioritize sustainability and regulatory compliance, boosting the adoption of water-based dispersions over solvent-based alternatives. Growing government initiatives promoting green technologies further support market growth.

China Aqueous Polyurethane Dispersion Market Insight

The China aqueous polyurethane dispersion market accounted for the largest revenue share in Asia-Pacific in 2024, fueled by strong demand from automotive, packaging, and construction industries. The country’s rapid urbanization, rising disposable incomes, and increasing environmental regulations are accelerating the shift toward sustainable coating solutions. Robust domestic manufacturing capabilities and growing exports also contribute to market expansion.

Japan Aqueous Polyurethane Dispersion Market Insight

Japan’s aqueous polyurethane dispersion market is expected to witness the fastest growth rate from 2025 to 2032, driven by technological innovation, stringent environmental standards, and rising demand from automotive and electronics industries. The market benefits from strong R&D capabilities and consumer preference for eco-friendly products. In addition, the country’s focus on lightweight, durable coatings enhances adoption across various sectors.

North America Aqueous Polyurethane Dispersion Market Insight

The North America market is expected to witness the fastest growth rate from 2025 to 2032, driven by stringent environmental regulations and strong demand from automotive, medical, and electronics sectors. The region’s emphasis on reducing volatile organic compound (VOC) emissions is promoting the adoption of aqueous polyurethane dispersions. In addition, technological advancements and investments in R&D support product innovation and market growth.

U.S. Aqueous Polyurethane Dispersion Market Insight

The U.S. aqueous polyurethane dispersion market is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing focus on sustainable manufacturing and regulatory compliance. Growing demand in automotive coatings, footwear, and textile finishing, along with strong innovation ecosystems, are driving market expansion. Consumer preference for environmentally friendly products further boosts adoption.

Europe Aqueous Polyurethane Dispersion Market Insight

The Europe aqueous polyurethane dispersion market is expected to witness the fastest growth rate from 2025 to 2032, driven by strict environmental norms and increasing demand for green coatings in automotive, construction, and packaging industries. Countries such as Germany, France, and the U.K. are key contributors, focusing on reducing VOC emissions and promoting circular economy principles.

Germany Aqueous Polyurethane Dispersion Market Insight

Germany is expected to witness the fastest growth rate from 2025 to 2032, propelled by its advanced automotive industry and strong environmental policies. Demand for high-performance aqueous polyurethane coatings and adhesives is increasing due to regulatory pressure and growing emphasis on sustainable materials. The integration of innovative formulations and growing industrial applications supports market growth.

U.K. Aqueous Polyurethane Dispersion Market Insight

The U.K. aqueous polyurethane dispersion market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing environmental regulations and rising demand from automotive, construction, and textile sectors. The country’s strong focus on sustainability and adoption of green manufacturing practices support the shift toward water-based coatings and adhesives. In addition, growth in e-commerce and retail industries is boosting demand for eco-friendly packaging solutions, further propelling market expansion.

Aqueous Polyurethane Dispersion Market Share

The aqueous polyurethane dispersion industry is primarily led by well-established companies, including:

- VCM Polyurethanes Pvt. Ltd. (India)

- Coim Group (Italy)

- Dow (U.S.)

- UBE Corporation (Japan)

- Siwp (Germany)

- DSM (Netherlands)

- STAHL SOCIALS (Netherlands)

- BASF SE (Germany)

- Covestro AG (Germany)

- Wacker Chemie AG (Germany)

- Huntsman Corporation (U.S.)

- Mitsui Chemicals, Inc. (Japan)

- LANXESS AG (Germany)

- Lubrizol Corporation (U.S.)

- Hexion Inc. (U.S.)

- Evonik Industries AG (Germany)

- Allnex (Belgium)

- Synthomer plc (U.K.)

- Momentive Performance Materials Inc. (U.S.)

Latest Developments in Global Aqueous Polyurethane Dispersion Market

- In November 2024, Lubrizol launched Sancure 20898, a polyurethane dispersion (PUD) tailored for packaging coatings and inks. This product enhances durability and flexibility, making it ideal for high-performance applications. It sets new standards in packaging by improving coating longevity and resistance. The launch strengthens Lubrizol’s position in the specialty coatings market, catering to growing demand for advanced packaging solutions

- In October 2024, LANXESS completed the sale of its Urethane Systems business to UBE Corporation for approximately USD 450 million. The transaction proceeds are being used to reduce LANXESS’s net debt and support its ongoing transformation into a specialty chemicals company. This strategic divestment allows LANXESS to focus on higher-margin businesses. It is expected to improve financial flexibility and strengthen the company’s core portfolio

- In May 2024, BASF announced investments to expand Ultramid and Ultradur production capacities in India. The company also inaugurated a Polyurethane Technical Development Center aimed at accelerating market development and enhancing customer support. These initiatives are designed to strengthen BASF’s presence in the growing Indian market. The expansions align with rising demand for high-performance polymers in automotive, electronics, and industrial sectors

- In May 2024, Dow commenced commercial operations of its new VORATRON adhesive and gap filler production line in Ahlen, Germany. This expansion boosts capacity to meet increasing demand in the e-mobility battery assembly market. The new line supports Dow’s strategic focus on sustainable technologies and electric vehicle growth. It enables faster delivery and innovation tailored to emerging automotive applications

- In February 2021, Lanxess announced the acquisition of a 100% stake in Emerald Kalama Chemical through a bond agreement. This strategic move is expected to enhance Lanxess’s portfolio in specialty chemicals, particularly in the area of preservatives and aroma ingredients. The acquisition is projected to contribute an additional annual EBITDA of approximately USD 30 million, strengthening Lanxess’s market position and enabling expanded offerings to its global customer base. This development is likely to drive growth and competitiveness in the specialty chemicals sector.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Aqueous Polyurethane Dispersion Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Aqueous Polyurethane Dispersion Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Aqueous Polyurethane Dispersion Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.