Global Aluminum Alloy Market, By Product (Wrought Alloy, Cast Alloy), Sensitivity Type (Heat Treatable Alloys, Non Heat-Treatable Alloys), Design Type (2000 Series, 3000 Series, 4000 Series, 5000 Series, 6000 Series, 7000 Series, Others), Strength Type (High Strength, Ultra-High Strength), Application (Transportation, Automotive, Building and Construction, Packaging, Machinery, Electrical, Marine, Consumer Durables, Aerospace, Others Others) – Industry Trends and Forecast to 2030.

Aluminum Alloy Market Analysis and Size

The aluminum alloy market has witnessed substantial growth, primarily driven by the increasing production of aluminum, a crucial component of these alloys. This surge in aluminum output is a pivotal factor boosting market expansion. In addition, the growing demand for lightweight and high-strength materials in industries such as automotive and aerospace further propels the aluminum alloy market's growth trajectory within the forecasted period.

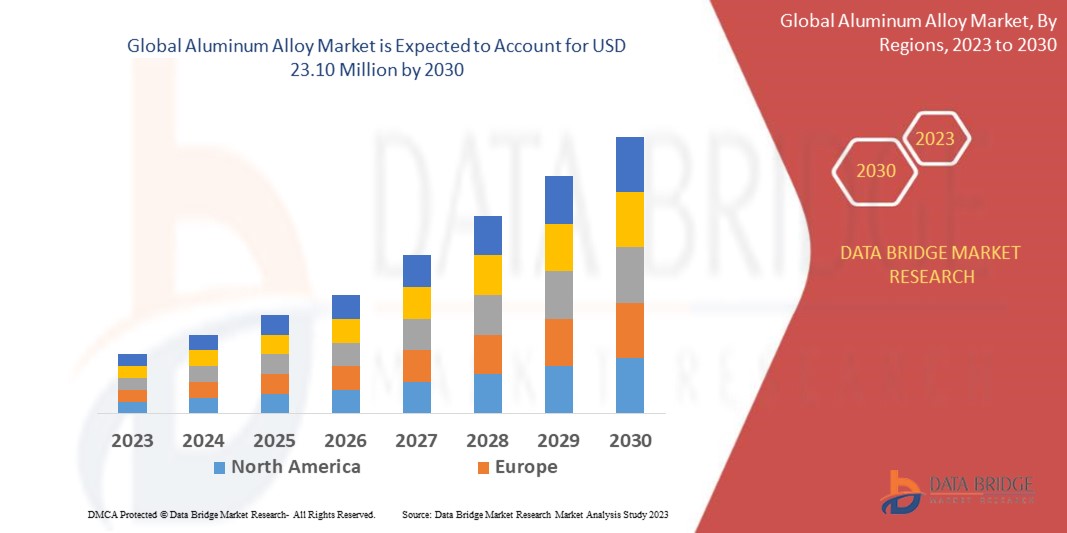

Data Bridge Market Research analyses that the global aluminum alloy market which was USD 15.68 billion in 2022, is expected to reach upto USD 23.10 million by 2030, and is expected to undergo a CAGR of 4.96% during the forecast period of 2023 to 2030. “Wrought Alloy” dominates the type segment of the global aluminum alloy market due to its versatility and widespread use in industries such as automotive, aerospace, and construction, driving continued growth in the aluminum alloy market. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Aluminum Alloy Market Scope and Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015-2020)

|

|

Quantitative Units

|

Revenue in USD Billion , Pricing in USD, Volumes in Units

|

|

Segments Covered

|

Product (Wrought Alloy, Cast Alloy), Sensitivity Type (Heat Treatable Alloys, Non Heat-Treatable Alloys), Design Type (2000 Series, 3000 Series, 4000 Series, 5000 Series, 6000 Series, 7000 Series, Others), Strength Type (High Strength, Ultra-High Strength), Application (Transportation, Automotive, Building and Construction, Packaging, Machinery, Electrical, Marine, Consumer Durables, Aerospace, Others)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific , Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa, Brazil, Argentina and Rest of South America.

|

|

Market Players Covered

|

Alcoa (U.S.), Rio Tinto (Australia), Norsk Hydro (Norway), Rusal (Russia), Novelis (Canada), China Hongqiao Group (China), Emirates Global Aluminium (U.A.E.), South32 (Australia), Constellium (Netherlands), and Vedanta Limited (India)

|

|

Market Opportunities

|

|

Market Definition

Aluminum alloys are compositions of aluminum metal with a higher percentage of aluminum content. Aluminum, a versatile metal, finds applications across various industries such as transportation, aerospace, and electronics. To enhance the properties of pure aluminum and render it suitable for diverse applications, other alloying metals are introduced into the base aluminum metal in the creation of aluminum alloys. This alloying process imparts a range of beneficial characteristics to the resulting materials, making them indispensable in numerous industrial applications.

Global Aluminum Alloy Market Dynamics

Drivers

- Growing Demand in Automotive Sector

The global automotive industry's increasing focus on lightweight materials to improve fuel efficiency and reduce emissions is a significant driver. Aluminum alloys offer the ideal balance of strength and weight, making them vital in automotive manufacturing.

- Expanding Aerospace Applications

The aerospace sector's continuous expansion relies on aluminum alloys due to their high strength-to-weight ratio, corrosion resistance, and durability, driving demand for these materials.

Opportunities

- Rising Sustainability Concerns

As sustainability gains importance, aluminum alloys, being recyclable and energy-efficient, present an opportunity for eco-friendly applications in construction, packaging, and transportation.

- Advancements in Manufacturing Technologies

Emerging manufacturing techniques such as additive manufacturing (3D printing) enable the production of complex aluminum alloy components, opening new opportunities in various industries.

Restraints/Challenges

- Price Volatility

The aluminum alloy market is susceptible to price volatility due to factors such as energy costs and global economic conditions, posing challenges for manufacturers and consumers in terms of planning and cost management.

- Supply Chain Disruptions

Aluminum alloy production can be impacted by supply chain disruptions, including fluctuations in the availability and pricing of raw materials such as bauxite and alumina.

Recent Developments

- In August 2023, Aluminium Bahrain B.S.C. (Alba), the largest aluminum smelter globally outside China, has introduced a new aluminum alloy, 6060.HE, as part of its AA6060 series. Developed in partnership with the University of Bahrain and Bahrain Aluminum Extrusion Company (BALEXCO), this alloy enhances the extrusion process, elevating the quality and performance of extruded products.

- In March 2021, the Ronal Group, a prominent manufacturer of lightweight alloy wheels, introduced a novel aluminum alloy wheel called the Ronal R67. This innovative design incorporates five sleek openings and five distinct double spokes, enhanced by vibrant design elements. The wheel's construction ensures optimal air circulation and adds a sporty flair to its appearance.

Global Aluminum Alloy Market Scope

The global aluminum alloy market is segmented on the basis of product, sensitivity type, design type, strength type and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Wrought Alloy

- Cast Alloy

Sensitivity Type

- Heat Treatable Alloys

- Non Heat-Treatable Alloys

Design Type

- 2000 Series

- 3000 Series

- 4000 Series

- 5000 Series

- 6000 Series

- 7000 Series

- Others

Strength Type

- High Strength

- Ultra-High Strength

Application

- Transportation

- Automotive

- Building and Construction

- Packaging

- Machinery

- Electrical

- Marine

- Consumer Durables

- Aerospace

- Others

Global Aluminum Alloy Market Regional Analysis/Insights

The global aluminum alloy market is analysed and market size insights and trends are provided by product, sensitivity type, design type, strength type and application referenced above.

The countries covered in the global aluminum alloy market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific , Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa, Brazil, Argentina and Rest of South America

Asia Pacific dominates the global aluminum alloy market due to robust manufacturing, automotive, and construction industries, as well as high demand for lightweight materials in sectors such as aerospace.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and up-stream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Global Aluminum Alloy Industry Growth and New Technology Penetration

The global aluminum alloy market also provides you with detailed market analysis for every country growth in aluminum alloy, installed new production plant, impact of technology using life line curves and changes in global aluminum alloy regulatory scenarios and their impact on the global aluminum alloy market. The data is available for historic period 2015 to 2020.

Competitive Landscape and Global Aluminum Alloy Market Share Analysis

The global aluminum alloy market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the company’s focus related to global aluminum alloy market.

Some of the major players operating in the global aluminum alloy market are:

- Alcoa (U.S.)

- Rio Tinto (Australia)

- Norsk Hydro (Norway)

- Rusal (Russia)

- Novelis (Canada)

- China Hongqiao Group (China)

- Emirates Global Aluminium (U.A.E.)

- South32 (Australia)

- Constellium (Netherlands)

- Vedanta Limited (India)

SKU-