Global Alcohol Prep Pads Market

Market Size in USD Million

CAGR :

%

USD

343.71 Million

USD

906.65 Million

2024

2032

USD

343.71 Million

USD

906.65 Million

2024

2032

| 2025 –2032 | |

| USD 343.71 Million | |

| USD 906.65 Million | |

|

|

|

|

Alcohol Prep Pads Market Size

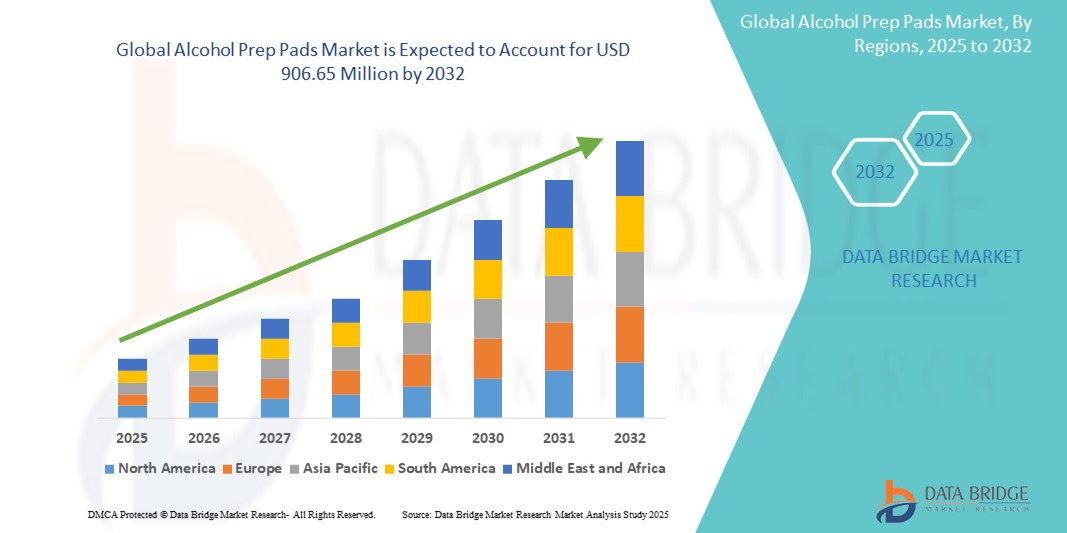

- The global alcohol prep pads market size was valued at USD 343.71 million in 2024 and is expected to reach USD 906.65 million by 2032, at a CAGR of 12.89% during the forecast period

- The market expansion is primarily driven by the rising focus on hygiene and infection prevention in healthcare settings, personal care, and home use, fostering widespread adoption across diverse end-use industries

- In addition, increasing surgical procedures, growing demand for first-aid products, and heightened awareness of sterilization practices are positioning alcohol prep pads as essential components in infection control. These drivers are propelling consistent growth in the market, establishing strong momentum for the industry moving forward

Alcohol Prep Pads Market Analysis

- Alcohol prep pads, consisting of pre-saturated, single-use wipes with isopropyl alcohol, play a crucial role in disinfecting skin prior to injections or minor procedures and are increasingly used across hospitals, clinics, and home care settings due to their convenience and sterility

- The rising demand for alcohol prep pads is driven by growing emphasis on infection prevention, a surge in chronic disease management requiring frequent injections and heightened awareness regarding hygiene in both clinical and personal environments

- North America dominated the alcohol prep pads market with the largest revenue share of 39.2% in 2024, attributed to the high volume of outpatient procedures, established healthcare infrastructure, and stringent regulatory focus on infection control, particularly in the U.S., where usage is prevalent across hospitals, vaccination centers, and home healthcare

- Asia-Pacific is anticipated to witness the fastest growth in the alcohol prep pads market during the forecast period, fueled by expanding healthcare access, rising healthcare expenditures, and increased public awareness of hygiene standards in countries such as China and India

- Alcohol Cotton Balls segment dominated the alcohol prep pads market with a market share of 53.2% in 2024, driven by its ease of use, affordability, and widespread application in wound cleaning and pre-injection skin disinfection

Report Scope and Alcohol Prep Pads Market Segmentation

|

Attributes |

Alcohol Prep Pads Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Alcohol Prep Pads Market Trends

“Rising Demand for Single-Use, Sterile, and Convenient Disinfection Solutions”

- A notable and strengthening trend in the global alcohol prep pads market is the rising demand for single-use, sterile disinfection solutions driven by infection prevention protocols in both clinical and non-clinical settings. Alcohol prep pads offer a hygienic, easy-to-use solution for pre-injection skin cleansing, wound treatment, and general antiseptic use

- For instance, brands such as BD and Dynarex have expanded their alcohol prep pad lines to cater to increased usage in home healthcare and point-of-care testing environments, especially with the rise in self-administered therapies for chronic conditions such as diabetes

- Healthcare providers are increasingly adopting sterile, individually wrapped alcohol prep pads to ensure compliance with infection control standards and minimize cross-contamination. This shift is particularly significant in outpatient facilities, emergency services, and home-based care where quick and hygienic access is critical

- Additionally, the convenience of compact, ready-to-use packaging has expanded alcohol prep pad usage beyond medical settings into personal care, travel kits, and everyday hygiene routines, supported by growing consumer awareness

- As consumers prioritize sanitation in light of global health concerns, companies such as Medline and GAMA Healthcare are innovating with thicker, two-ply pads and improved saturation levels to enhance efficacy

- This ongoing trend toward compact, sterile, and disposable disinfection tools is reshaping consumer and professional preferences, making alcohol prep pads a staple in first-aid and clinical care kits across the globe

Alcohol Prep Pads Market Dynamics

Driver

“Increasing Need for Infection Prevention and Chronic Disease Management”

- The growing global focus on infection prevention in medical and home settings is a key driver of the alcohol prep pads market, supported by increasing awareness of hygiene standards and sterilization practices

- For instance, with the rise in chronic diseases such as diabetes, which require routine self-injections, the demand for alcohol prep pads for safe skin disinfection continues to grow, especially in home healthcare and ambulatory care segments

- Hospitals, clinics, and pharmacies rely on these products to prevent infections during routine procedures, vaccinations, and sample collection. The COVID-19 pandemic further reinforced the importance of single-use disinfectants in maintaining sanitary conditions

- Additionally, the expansion of immunization programs, particularly in developing regions, and the growth of mobile health services are increasing the routine use of alcohol prep pads

- The affordability, portability, and ease of use of these pads make them a preferred choice for both healthcare professionals and consumers, ensuring widespread adoption across various medical and non-medical applications

Restraint/Challenge

“Skin Irritation Concerns and Regulatory Compliance Barriers”

- Despite their widespread use, alcohol prep pads may cause skin irritation or allergic reactions in sensitive individuals, especially with frequent or prolonged use, potentially limiting usage in certain patient populations

- For instance, reports of dermatitis or dryness due to repeated exposure to isopropyl alcohol have led some consumers and healthcare providers to seek alternatives or limit pad use in specific cases

- Additionally, manufacturers face challenges in maintaining strict compliance with evolving healthcare regulations and sterilization standards. Regulatory scrutiny from bodies such as the FDA and EMA requires rigorous quality control and documentation, especially regarding pad saturation levels and packaging sterility

- Non-compliance or product recalls due to contamination concerns can negatively impact consumer confidence and brand reputation, as seen in past incidents involving improperly sealed or under-saturated pads

- Furthermore, fluctuations in the availability and cost of medical-grade alcohol or non-woven materials may affect production and pricing. Overcoming these issues through hypoallergenic formulations, sustainable sourcing, and adherence to international standards will be crucial for sustained market performance

Alcohol Prep Pads Market Scope

The market is segmented on the basis of type, product, and end user.

- By Type

On the basis of type, the alcohol prep pads market is segmented into skim and non-skim. The Non-Skim segment dominated the market with the largest market revenue share of 63.4% in 2024, attributed to its superior absorbency, strength, and effectiveness in clinical disinfection. Non-skim pads are preferred in healthcare settings for their ability to retain more alcohol and provide thorough sterilization with fewer applications. Their robust texture ensures reliable performance, especially in high-volume medical environments where efficiency and sterility are critical.

The Skim segment is expected to witness the fastest CAGR from 2025 to 2032, particularly in cost-sensitive markets and home-use applications. Skim pads are lightweight, more economical, and sufficient for routine cleaning and personal hygiene purposes. Their affordability and compact packaging make them an attractive option in travel kits and non-intensive care settings.

- By Product

On the basis of product, the alcohol prep pads market is segmented into alcohol cotton balls and alcohol cotton sheets. The Alcohol Cotton Balls segment leads the market with a dominant share of 53.2% in 2024, driven by its ease of use, cost-efficiency, and wide-ranging utility in wound cleaning, pre-injection disinfection, and personal hygiene applications. Their rounded form and consistent alcohol saturation offer convenient, single-use antiseptic solutions for both medical professionals and at-home users.

The Alcohol Cotton Sheets segment is expected to witness the fastest CAGR from 2025 to 2032due to their broader surface coverage, making them ideal for use in surgical prep and large-area disinfection. Their flat design and higher alcohol retention enhance efficiency in high-volume clinical tasks, especially in operating rooms and diagnostic labs.

- By End User

On the basis of end user, the alcohol prep pads market is segmented into hospitals, clinics, pharmacies, ambulatory surgical centers (ASCs), and others. The Hospital segment dominated the market with the largest revenue share of 41.9% in 2024, owing to the consistent need for sterile and disposable disinfectants across a wide range of medical procedures. Hospitals utilize alcohol prep pads extensively for injections, IV placements, wound cleaning, and general infection control protocols, making them the largest consumers globally.

The Ambulatory Surgical Centers (ASCs) segment is anticipated to grow at the fastest CAGR from 2025 to 2032, supported by the increasing number of outpatient surgeries and minimally invasive procedures. ASCs require compact, sterile, and disposable products that streamline patient care, and alcohol prep pads fit seamlessly into their cost-efficient and high-throughput operational models

Alcohol Prep Pads Market Regional Analysis

- North America dominated the alcohol prep pads market with the largest revenue share of 39.2% in 2024, attributed to the high volume of outpatient procedures, established healthcare infrastructure, and stringent regulatory focus on infection control

- Consumers and healthcare providers in the region prioritize sterile, single-use solutions for disinfection, supporting consistent demand across hospitals, clinics, pharmacies, and home care environments

- This strong adoption is further fueled by a well-established healthcare infrastructure, high healthcare spending, and a growing population managing chronic conditions such as diabetes, positioning alcohol prep pads as an essential component of routine medical and personal hygiene practices

U.S. Alcohol Prep Pads Market Insight

The U.S. alcohol prep pads market captured the largest revenue share of 79.2% in 2024 within North America, driven by a high volume of outpatient procedures, extensive immunization programs, and rising self-administration of medications such as insulin. The demand is further supported by a strong emphasis on infection prevention, strict hygiene protocols, and the wide availability of medical-grade disposable products. The growing preference for home healthcare and the increasing prevalence of chronic conditions are further bolstering market growth across clinical and personal care settings.

Europe Alcohol Prep Pads Market Insight

The Europe alcohol prep pads market is projected to grow at a substantial CAGR during the forecast period, supported by stringent health and sanitation regulations and a robust healthcare infrastructure. Rising awareness about infection control in both hospital and home care environments is fostering demand across the region. The surge in surgical procedures, coupled with a focus on minimizing hospital-acquired infections (HAIs), continues to drive product adoption. Countries such as Germany and France are investing heavily in disposable hygiene products for both institutional and consumer use.

U.K. Alcohol Prep Pads Market Insight

The U.K. alcohol prep pads market is expected to expand at a notable CAGR, driven by increasing demand for sterile, single-use disinfection products in hospitals, pharmacies, and home settings. Public health initiatives emphasizing cleanliness, combined with the rising trend of home-based care and self-administered treatments, are contributing to strong market performance. The country's National Health Service (NHS) protocols further reinforce the widespread use of disposable antiseptic solutions, particularly in ambulatory and emergency care.

Germany Alcohol Prep Pads Market Insight

The Germany alcohol prep pads market is anticipated to grow steadily due to a high standard of medical care, rigorous infection control practices, and growing demand for eco-friendly, reliable disinfection tools. With a strong focus on clinical hygiene, German healthcare institutions are prioritizing single-use antiseptics to minimize infection risks. The market is also supported by a mature pharmaceutical sector and consumer preference for convenient, effective hygiene products, especially in elderly care and chronic disease management.

Asia-Pacific Alcohol Prep Pads Market Insight

The Asia-Pacific alcohol prep pads market is poised to grow at the fastest CAGR of 22.6% during 2025 to 2032, driven by increasing healthcare access, rising health awareness, and rapid urbanization in countries such as China, India, and Japan. Expanding immunization programs, increased hospital admissions, and growth in outpatient care are fostering high demand for sterile disinfection solutions. Additionally, the growth of domestic manufacturing and low-cost production is enhancing affordability and availability of alcohol prep pads across the region.

Japan Alcohol Prep Pads Market Insight

The Japan alcohol prep pads market is gaining traction due to the country’s aging population, strong healthcare infrastructure, and high demand for sterile, user-friendly medical supplies. The widespread use of injectable treatments and home-based care is fueling the adoption of alcohol prep pads for routine disinfection. Japan's focus on hygiene and advanced product innovation supports a consistent rise in demand, especially for compact, high-saturation, individually packaged antiseptic wipes.

India Alcohol Prep Pads Market Insight

The India alcohol prep pads market accounted for the largest market revenue share in Asia Pacific in 2024, driven by the increasing burden of chronic diseases, expanding healthcare access, and government initiatives promoting hygiene. India’s large population and rising middle class are fueling strong demand in both institutional and household segments. The push for improved sanitation under national programs and the growing popularity of home-based medical care are further accelerating market adoption, supported by domestic manufacturing and expanding distribution channels.

Alcohol Prep Pads Market Share

The alcohol prep pads industry is primarily led by well-established companies, including:

- Avantor Inc. (U.S.)

- B. Braun SE (Germany)

- Baxter (U.S.)

- Dynarex Corporation (U.S.)

- McKesson Corporation (U.S.)

- Medline Industries Inc., LP (U.S.)

- Medtronic (Ireland)

- Nipro Europe Group Companies (Japan)

- PDI, Inc. (U.S.)

- Control D (India)

- Reynard Health Supplies (U.K.)

- Thermo Fisher Scientific Inc. (U.S.)

- Narang Medical Limited (India)

- GLOBAL SURGIMED INDUSTRIES (India)

- Rapid Diagnostics Group of Companies (India)

- SARAHEALTH CARE (India)

- Medline Industries, Inc., LP (U.S.)

- Nipro Europe Group Companies (Japan)

- Global Surgimed Industries (India)

What are the Recent Developments in Global Alcohol Prep Pads Market?

- In March 2024, BD (Becton, Dickinson and Company) launched an enhanced line of alcohol prep pads with improved packaging and increased alcohol saturation, aimed at boosting disinfection efficiency in clinical and home settings. This development reflects BD’s commitment to improving patient safety and infection control protocols, offering healthcare providers more effective and user-friendly antiseptic products that meet rising hygiene expectations across various applications

- In February 2024, Medline Industries LP announced the expansion of its alcohol prep pad manufacturing capabilities in North America to address rising demand from hospitals, clinics, and home healthcare providers. This strategic move aims to enhance supply chain resilience, reduce lead times, and support the company's commitment to maintaining high-quality, sterile disinfection products across the healthcare continuum

- In January 2024, Dynarex Corporation introduced a new two-ply alcohol prep pad featuring higher durability and increased absorbency, designed to meet the evolving needs of emergency care providers and outpatient facilities. The launch supports Dynarex's focus on innovation in infection prevention and expands its product line catering to high-throughput healthcare environments

- In December 2023, GAMA Healthcare Ltd unveiled a line of eco-friendly alcohol prep pads made with biodegradable materials, targeting both clinical use and environmentally conscious consumers. This launch aligns with global sustainability goals and reflects GAMA’s leadership in developing products that balance high disinfection standards with reduced environmental impact

- In November 2023, Winner Medical Co., Ltd. entered into a supply agreement with a network of Asian public health institutions to provide alcohol prep pads for vaccination and emergency response programs. This collaboration underscores the increasing role of alcohol prep pads in national health campaigns and highlights Winner Medical's growing influence in the global disposable hygiene product market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.