Global Air Pressure Sensors Market

Market Size in USD Billion

CAGR :

%

USD

20.30 Billion

USD

33.30 Billion

2024

2032

USD

20.30 Billion

USD

33.30 Billion

2024

2032

| 2025 –2032 | |

| USD 20.30 Billion | |

| USD 33.30 Billion | |

|

|

|

|

Air Pressure Sensors Market Size

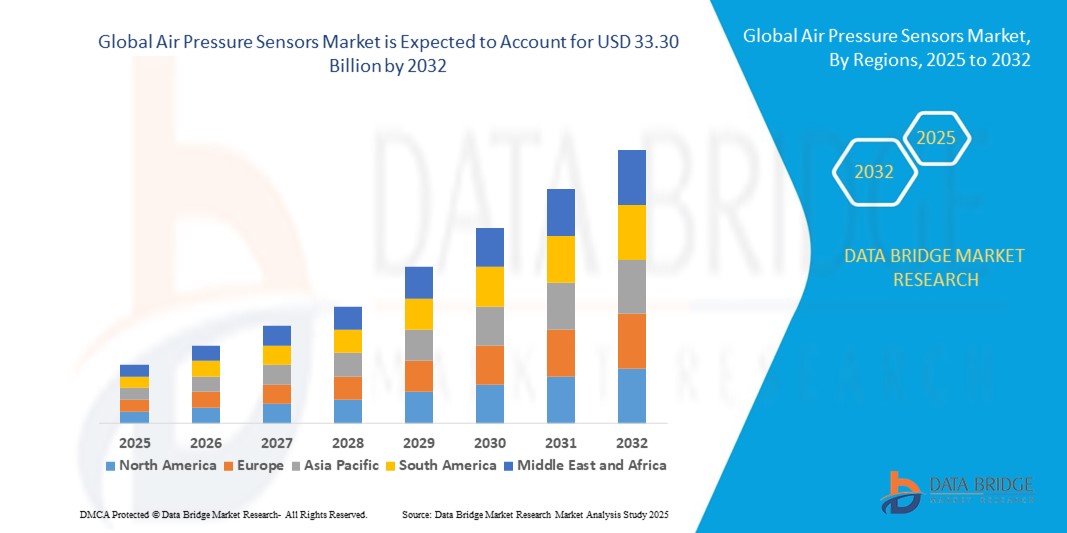

- The global air pressure sensors market size was valued at USD 20.30 billion in 2024 and is expected to reach USD 33.30 billion by 2032, at a CAGR of 6.38% during the forecast period

- The market growth is largely fueled by the increasing adoption of industrial automation, IoT integration, and connected devices across automotive, aerospace, healthcare, and consumer electronics sectors, leading to greater demand for precise and reliable air pressure measurement

- Furthermore, rising requirements for real-time monitoring, energy efficiency, and safety in industrial and commercial applications are driving the adoption of advanced air pressure sensors. These converging factors are accelerating deployment across multiple industries, thereby significantly boosting the market’s expansion

Air Pressure Sensors Market Analysis

- Air pressure sensors are devices that measure the pressure of gases or liquids and convert the information into readable electrical signals. They are widely used in automotive systems, HVAC, medical devices, industrial equipment, and environmental monitoring applications, providing accurate, real-time pressure data for performance optimization and safety

- The escalating demand for air pressure sensors is primarily fueled by the growth of smart and connected infrastructure, stricter regulatory standards for safety and emissions, and the increasing need for miniaturized, high-precision sensor solutions in automotive, medical, and industrial markets

- Asia-Pacific dominated the air pressure sensors market with a share of 39.5% in 2024, due to the rapid expansion of the automotive and industrial sectors, increasing adoption of sensor-based monitoring systems, and strong demand from consumer electronics manufacturing hubs

- North America is expected to be the fastest growing region in the air pressure sensors market during the forecast period due to increasing adoption of sensors in autonomous vehicles, smart infrastructure, and industrial IoT applications

- Wired sensors segment dominated the market with a market share of 63.9% in 2024, due to their established reliability, consistent power supply, and suitability for critical industrial and aerospace applications where uninterrupted data transmission is essential. Wired connections minimize signal interference, ensuring accurate readings in high-stakes environments such as aircraft cabins, manufacturing facilities, and medical devices

Report Scope and Air Pressure Sensors Market Segmentation

|

Attributes |

Air Pressure Sensors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Air Pressure Sensors Market Trends

Increasing Adoption of IoT Technology

- Integration of air pressure sensors with IoT ecosystems is expanding rapidly, enabling real-time monitoring, predictive maintenance, and connected control in industries such as automotive, industrial automation, aerospace, and healthcare

- For instance, companies such as Bosch Sensortec, Honeywell International, and STMicroelectronics are developing IoT-enabled MEMS air pressure sensors with wireless data transfer and cloud connectivity for applications in connected vehicles, smart buildings, and wearable devices

- Deployment in smart city networks, environmental monitoring systems, and building automation projects supports improved energy efficiency, safety, and operational decision-making through continuous atmospheric data collection and analysis

- Technological upgrades including AI-based calibration, self-diagnostics, and firmware optimization enhance sensor accuracy, reliability, and service life in both consumer and industrial applications

- Growth of sensor fusion—integrating air pressure sensors with temperature, humidity, and position sensing—delivers more comprehensive analytics for weather prediction, aviation navigation, and autonomous transport systems

- Rising demand from consumer electronics such as smartphones, fitness bands, and GPS devices accelerates adoption of miniaturized, energy-efficient sensors for altitude detection, indoor navigation, and health tracking

Air Pressure Sensors Market Dynamics

Driver

Growing Automotive Sector

- Expansion of the global automotive industry, coupled with advancements in safety regulations and vehicle performance requirements, continues to drive demand for air pressure sensors in applications such as tire pressure monitoring, braking control, and engine management

- For instance, automotive manufacturers such as Toyota, Volkswagen, and General Motors are integrating precision air pressure sensors in both conventional and electric vehicle platforms to enhance fuel efficiency, ensure passenger safety, and meet emission standards

- Growth of autonomous driving technology and advanced driver assistance systems (ADAS) increases the need for accurate real-time pressure monitoring across multiple vehicle systems

- Rising production and adoption of electric and hybrid vehicles boosts demand for sensors in battery management, thermal regulation, and adaptive suspension systems

- Connected car features and fleet telematics further expand use cases for air pressure sensors by enabling predictive maintenance, automated alerts, and performance optimization

Restraint/Challenge

High Initial Investment

- High costs associated with manufacturing, integrating, and deploying advanced air pressure sensors—particularly IoT and AI-enabled versions—remain a barrier for small and mid-sized enterprises

- For instance, manufacturers upgrading to state-of-the-art sensor systems with advanced calibration, wireless communication, and cloud compatibility may encounter budgetary constraints, especially in cost-sensitive markets

- Complex customization requirements for different industries increase research, development, and compliance costs, extending time-to-market for new sensor solutions

- Integration with existing platforms in multi-vendor environments adds interoperability and infrastructure upgrade expenses, impacting short-term ROI

- Price volatility for high-grade electronic components and raw materials can raise production costs and limit affordability for large-scale adoption. Scaling production of miniaturized, high-accuracy sensors while maintaining quality standards demands significant capital investment in advanced manufacturing technologies

Air Pressure Sensors Market Scope

The market is segmented on the basis of product type, sensor type, technology, and end-user.

- By Product Type

On the basis of product type, the air pressure sensors market is segmented into absolute pressure sensors, differential pressure sensors, and gauge pressure sensors. The absolute pressure sensors segment dominated the largest market revenue share in 2024, driven by their wide use in automotive engine control systems, weather monitoring, and industrial vacuum measurement. These sensors measure pressure relative to a perfect vacuum, making them essential in applications where atmospheric variations can impact system performance. Their high accuracy, stability under varying environmental conditions, and compatibility with diverse measurement systems have established them as a preferred choice across multiple industries.

The differential pressure sensors segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by their increasing use in HVAC systems, cleanroom monitoring, and industrial process control. These sensors measure the difference between two pressure points, making them ideal for applications that require precise airflow and filter monitoring. The surge in demand for energy-efficient building systems, along with stricter regulations on environmental control, is accelerating adoption. In addition, advancements in miniaturization and wireless data transmission are enhancing their versatility in both industrial and IoT-integrated applications.

- By Sensor Type

On the basis of sensor type, the air pressure sensors market is segmented into wired sensors and wireless sensors. The wired sensors segment held the largest market revenue share of 63.9% in 2024 due to their established reliability, consistent power supply, and suitability for critical industrial and aerospace applications where uninterrupted data transmission is essential. Wired connections minimize signal interference, ensuring accurate readings in high-stakes environments such as aircraft cabins, manufacturing facilities, and medical devices.

The wireless sensors segment is projected to register the fastest CAGR from 2025 to 2032, driven by the growing integration of IoT in industrial automation, smart infrastructure, and portable medical devices. Wireless air pressure sensors enable remote monitoring, reduce installation complexity, and support flexible placement in challenging environments. Increasing demand for real-time analytics, coupled with advancements in low-power wireless protocols, is further boosting their adoption in both commercial and consumer markets.

- By Technology

On the basis of technology, the air pressure sensors market is segmented into piezoresistive, capacitive, electromagnetic, resonant solid-state, optical, and others. The piezoresistive segment dominated the largest revenue share in 2024, owing to its cost-effectiveness, robust performance under harsh conditions, and extensive use in automotive, medical, and industrial equipment. Piezoresistive sensors are known for their high sensitivity and simple design, making them ideal for high-volume manufacturing and integration into compact devices.

The optical segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its superior precision, immunity to electromagnetic interference, and suitability for extreme environmental conditions. Optical air pressure sensors are gaining traction in aerospace, defense, and subsea applications, where traditional sensors may fail due to high temperatures or corrosive conditions. Ongoing research in fiber-optic sensing technology is further enhancing their range, accuracy, and adaptability in specialized industries.

- By End-User

On the basis of end-user, the air pressure sensors market is segmented into automotive, aerospace and defense, industrial, medical, and others. The automotive segment dominated the market share in 2024, supported by the extensive use of air pressure sensors in tire pressure monitoring systems (TPMS), engine control, and airbag deployment mechanisms. Increasing vehicle safety regulations and the growing trend toward electric and connected vehicles have strengthened demand for high-precision sensors to enhance efficiency and safety.

The medical segment is forecast to grow at the fastest CAGR from 2025 to 2032, fueled by the rising use of air pressure sensors in respiratory monitoring devices, ventilators, and non-invasive diagnostic equipment. The global emphasis on healthcare innovation, combined with advancements in compact and high-sensitivity medical sensors, is driving adoption. The expansion of telehealth and remote patient monitoring solutions is further increasing demand for air pressure sensors that can deliver reliable and real-time performance in portable medical devices.

Air Pressure Sensors Market Regional Analysis

- Asia-Pacific dominated the air pressure sensors market with the largest revenue share of 39.5% in 2024, driven by the rapid expansion of the automotive and industrial sectors, increasing adoption of sensor-based monitoring systems, and strong demand from consumer electronics manufacturing hubs

- The region’s competitive manufacturing costs, rising investments in industrial automation, and the growing use of pressure sensors in environmental monitoring and healthcare devices are accelerating market growth

- Availability of skilled engineers, supportive government initiatives for semiconductor and sensor production, and fast-paced urbanization in developing economies are contributing to the increasing deployment of air pressure sensors across multiple industries

China Air Pressure Sensors Market Insight

China held the largest share in the Asia-Pacific air pressure sensors market in 2024, supported by its strong automotive manufacturing base, leadership in electronics production, and rapid adoption of IoT-enabled devices. The country’s robust industrial infrastructure, large-scale production capabilities, and government-backed programs for smart manufacturing are boosting demand. In addition, increasing use of air pressure sensors in electric vehicles, home appliances, and weather monitoring systems is driving further market expansion.

India Air Pressure Sensors Market Insight

India is expected to record the fastest growth in the Asia-Pacific region, fueled by rising automotive production, expanding aerospace manufacturing, and growing penetration of wearable and healthcare devices. Government programs such as “Make in India” and increased investments in domestic electronics and sensor manufacturing are creating favorable growth conditions. The rising demand for low-cost yet high-precision sensors in industrial automation and environmental monitoring is further supporting market growth.

Europe Air Pressure Sensors Market Insight

The Europe air pressure sensors market is witnessing steady growth, driven by strict automotive emission regulations, strong demand from aerospace and defense sectors, and increasing focus on energy-efficient industrial processes. The region’s emphasis on high-quality production, compliance with environmental standards, and advancements in MEMS (microelectromechanical systems) technology are supporting adoption. The growing integration of sensors into smart home systems and wearable devices is also boosting demand.

Germany Air Pressure Sensors Market Insight

Germany’s market growth is supported by its leadership in advanced automotive engineering, well-established industrial automation systems, and strong aerospace manufacturing base. The country’s focus on precision engineering and innovation in sensor technology is fueling demand across sectors. In addition, collaborations between research institutions and manufacturers are enhancing the development of high-accuracy pressure measurement solutions for automotive, industrial, and environmental applications.

U.K. Air Pressure Sensors Market Insight

The U.K. market benefits from a mature aerospace industry, growing adoption of renewable energy projects, and increasing investments in medical device manufacturing. Post-Brexit emphasis on domestic manufacturing and supply chain resilience is boosting local production. Research-driven innovation, particularly in MEMS-based sensors for portable medical devices and environmental monitoring, is further contributing to market expansion.

North America Air Pressure Sensors Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, supported by increasing adoption of sensors in autonomous vehicles, smart infrastructure, and industrial IoT applications. The region’s strong R&D ecosystem, advancements in wireless sensor technology, and growing use in healthcare monitoring devices are driving demand. Rising reshoring of manufacturing and the expansion of semiconductor production facilities are also key growth enablers.

U.S. Air Pressure Sensors Market Insight

The U.S. accounted for the largest share in the North America market in 2024, attributed to its strong automotive sector, leadership in aerospace innovation, and significant investments in healthcare technology. Widespread adoption of IoT-based monitoring systems, presence of leading sensor manufacturers, and a mature supply chain infrastructure are bolstering the market. The country’s regulatory focus on workplace safety, environmental monitoring, and fuel efficiency is further encouraging adoption.

Air Pressure Sensors Market Share

The air pressure sensors industry is primarily led by well-established companies, including:

- ABB (Switzerland)

- General Electric (U.S.)

- Emerson Electric (U.S.)

- Honeywell International Inc. (U.S.)

- NXP Semiconductors (Netherlands)

- Infineon Technologies (Germany)

- Siemens (Germany)

- STMicroelectronics (Switzerland)

- Continental (Germany)

- SSI Technologies (U.S.)

- Delphi (U.S.)

- Robert Bosch (Germany)

- Endress+Hauser Management AG (Switzerland)

- Sensata Technology Inc. (U.S.)

- BD (Germany)

- ChampionX Corporation (U.S.)

- Texas Instruments (U.S.)

- MRON Corporation (Japan)

- Denso Corporation (Japan)

- Analog Devices, Inc. (U.S.)

- Freescale Semiconductor (U.S.)

Latest Developments in Global Air Pressure Sensors Market

- In 2025, TE expanded its product portfolio by launching lightweight digital barometric pressure sensors targeting meteorology and UAV applications. These sensors enable precise atmospheric monitoring and improve drone navigation, supporting early warning systems and climate resilience programs. This move positions TE to capture emerging opportunities in environmental sensing and unmanned aerial vehicle markets, expanding its reach beyond traditional industrial and consumer applications

- In 2025, Sensata introduced sealed gauge pressure sensors designed for HVAC systems and portable medical devices, providing high stability under dynamic and mobile conditions. This innovation addresses the growing demand for durable and reliable sensors in rugged environments, driving adoption across mobile, healthcare, and industrial applications. Sensata’s focus on resilient sensor platforms strengthens its competitive position in markets requiring high performance under challenging conditions

- In 2025, Honeywell launched smart HVAC pressure sensors equipped with IoT integration and fault detection capabilities to optimize energy management in commercial buildings. These advanced sensors enhance operational efficiency, regulatory compliance, and system reliability, reinforcing Honeywell’s leadership in mission-critical infrastructure applications. The development also accelerates the adoption of connected building solutions and energy-efficient technologies

- In 2025, Bosch integrated AI-ready functionality into its environmental sensor suite, enabling context-aware sensing for smartphones, smartwatches, and AR devices. This advancement aligns with the global trend toward miniaturized, multifunctional sensing platforms, expanding Bosch’s presence in consumer electronics and IoT ecosystems. The AI integration enhances user experience through smarter, more responsive devices, driving growth in portable and wearable sensor markets

- In June 2023, Infineon Technologies AG has unveiled two new XENSIV barometric air pressure (BAP) sensors: the KP464 and KP466, tailored for automotive applications. The KP464 is engineered for engine control management, while the KP466 is geared towards seat comfort functions. By measuring atmospheric pressure, these sensors enable precise air density calculations, optimizing fuel efficiency and reducing emissions. This advancement marks a significant step towards minimizing energy losses and lowering CO2 emissions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Air Pressure Sensors Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Air Pressure Sensors Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Air Pressure Sensors Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.