Global Aerospace Parts Manufacturing Market

Market Size in USD Million

CAGR :

%

USD

971.99 Million

USD

1,381.84 Million

2024

2032

USD

971.99 Million

USD

1,381.84 Million

2024

2032

| 2025 –2032 | |

| USD 971.99 Million | |

| USD 1,381.84 Million | |

|

|

|

|

What is the Global Aerospace Parts Manufacturing Market Size and Growth Rate?

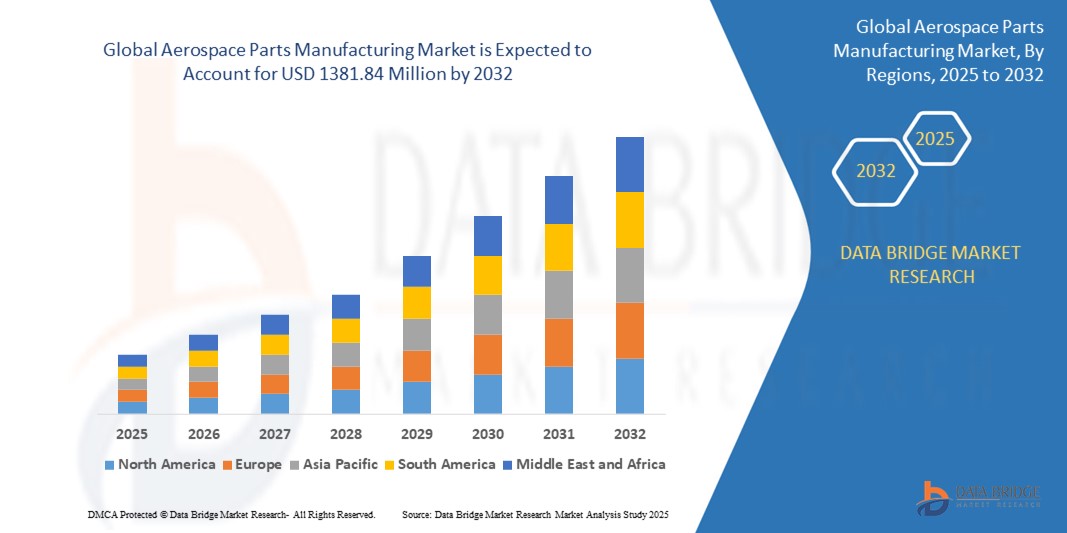

- The global aerospace parts manufacturing market size was valued at USD 971.69 million in 2024 and is expected to reach USD 1381.84 million by 2032, at a CAGR of 4.50% during the forecast period

- The global aerospace parts manufacturing market is robust, driven by demand from both commercial plane manufacturers and space rocket companies. The steady growth of the commercial aviation sector, marked by increasing air travel demand, drives the market for aircraft components

- Likewise, the surge in space exploration and satellite deployment amplifies the demand for rocket parts. For instance, companies such as Boeing and SpaceX continuously expand their fleets, contributing to the upward trajectory of the aerospace parts manufacturing market

What are the Major Takeaways of Aerospace Parts Manufacturing Market?

- Innovations such as lightweight composite materials, additive manufacturing techniques, and advanced propulsion systems continuously reshape the aerospace parts manufacturing market. These technological breakthroughs enable the production of more efficient, durable, and high-performance aerospace components

- They facilitate the development of next-generation aircraft and spacecraft, meeting evolving customer demands for fuel efficiency, safety, and sustainability

- North America dominated the global aerospace parts manufacturing market, accounting for the largest revenue share of 51.2% in 2024, driven by strong defense spending, a robust commercial aviation sector, and the presence of leading aerospace manufacturers and suppliers

- Asia-Pacific aerospace parts manufacturing market is anticipated to grow at the fastest CAGR of 17.3% from 2025 to 2032, driven by increasing air travel demand, rising defense budgets, and rapid expansion of domestic aircraft manufacturing programs across countries such as China, India, and Japan

- The Engines segment dominated the aerospace parts manufacturing market with the largest market revenue share of 36.4% in 2024, driven by the increasing global demand for fuel-efficient, lightweight, and high-performance aircraft engines

Report Scope and Aerospace Parts Manufacturing Market Segmentation

|

Attributes |

Aerospace Parts Manufacturing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Aerospace Parts Manufacturing Market?

“AI-Driven Automation and Additive Manufacturing Reshaping Aerospace Production”

- A prominent and accelerating trend in the global aerospace parts manufacturing market is the widespread adoption of AI-driven automation and additive manufacturing (3D printing), revolutionizing the production of complex aircraft components with improved precision, reduced costs, and shorter lead times

- For instance, aerospace leaders such as Boeing and Airbus are increasingly deploying AI-enabled robots and additive manufacturing technologies to produce lightweight structural parts, engine components, and interior fittings, significantly enhancing operational efficiency and product performance

- AI-powered predictive maintenance and smart quality control systems are also transforming manufacturing processes by minimizing defects, optimizing material usage, and ensuring compliance with stringent aerospace standards

- Moreover, the combination of digital twins, AI simulation, and advanced manufacturing allows companies to design, test, and produce components virtually, reducing development cycles and enabling rapid prototyping for next-generation aircraft

- This trend toward automated, intelligent, and digitally connected manufacturing ecosystems is reshaping the competitive landscape, pushing aerospace suppliers to integrate smart factories and data-driven production models to remain relevant

- As global demand for fuel-efficient, lightweight, and sustainable aircraft rises, AI and advanced manufacturing technologies are becoming central to innovation, driving efficiency, cost-effectiveness, and customization across the aerospace parts manufacturing sector

What are the Key Drivers of Aerospace Parts Manufacturing Market?

- The growing global demand for fuel-efficient, lightweight, and high-performance aircraft, coupled with advancements in materials science, AI, and production technologies, is a major driver propelling the aerospace parts manufacturing market forward

- For instance, in March 2024, Airbus unveiled new 3D-printed titanium components for its commercial aircraft, reducing part weight and improving fuel efficiency, demonstrating the industry's shift toward innovative manufacturing solutions

- The rise in air travel, booming defense spending, and rapid urbanization in emerging economies are fueling demand for commercial jets, defense aircraft, and helicopters, creating significant growth opportunities for aerospace component suppliers

- In addition, the shift toward electric and hybrid-electric aircraft, supported by stringent emission regulations, is accelerating the need for advanced materials, precision-engineered parts, and efficient production techniques

- Increased investments in smart factories, robotics, and data analytics are enhancing production capabilities, improving quality control, and enabling scalable, cost-efficient part manufacturing

- The growing emphasis on supply chain resilience and local production is further boosting demand for advanced aerospace parts manufacturing solutions, ensuring operational continuity and reducing dependency on global supply disruptions

Which Factor is challenging the Growth of the Aerospace Parts Manufacturing Market?

- The high capital investment, technological complexity, and stringent regulatory requirements associated with aerospace parts manufacturing remain significant barriers to market growth, particularly for small and mid-sized suppliers

- For instance, the aerospace industry faces intense scrutiny regarding part quality, safety, and compliance with standards such as AS9100, making it challenging for manufacturers to adopt new technologies without significant certification processes and testing

- Moreover, the supply chain disruptions caused by geopolitical tensions, raw material shortages, and pandemic-related constraints have exposed vulnerabilities, delaying production schedules and increasing operational risks

- The integration of AI, automation, and advanced materials requires significant workforce upskilling, infrastructure upgrades, and cybersecurity investments, posing challenges for traditional manufacturers with limited technical expertise

- Furthermore, the high costs of additive manufacturing materials, complex design validation processes, and limited large-scale 3D printing capabilities can hinder widespread adoption, especially for critical structural components

- Overcoming these challenges will necessitate collaboration between aerospace OEMs, technology providers, and regulators, coupled with sustained R&D investments to lower costs, streamline certification, and enhance the scalability of advanced manufacturing solutions, ensuring long-term market growth

How is the Aerospace Parts Manufacturing Market Segmented?

The market is segmented on the basis of product and application.

• By Product

On the basis of product, the aerospace parts manufacturing market is segmented into Engines, Aircraft Manufacturing, Cabin Interiors, Avionics, Insulation Components and Equipment, and System and Support. The Engines segment dominated the aerospace parts manufacturing market with the largest market revenue share of 36.4% in 2024, driven by the increasing global demand for fuel-efficient, lightweight, and high-performance aircraft engines. Continuous advancements in engine design, materials, and manufacturing processes are enhancing fuel efficiency, reducing emissions, and improving reliability, making engines a critical focus area for aerospace manufacturers.

The Avionics segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by the rising need for advanced navigation, communication, and flight control systems. The integration of cutting-edge avionics technologies, including AI-enabled flight management and autonomous capabilities, is transforming aircraft operations, driving strong growth in this segment.

• By Application

On the basis of application, the aerospace parts manufacturing market is segmented into Commercial Aircraft, Business Aircraft, Military Aircraft, and Others. The Commercial Aircraft segment held the largest market revenue share in 2024, driven by the surge in air travel demand, fleet modernization initiatives, and a global push for more fuel-efficient, lightweight aircraft. Aerospace Parts Manufacturing companies are focusing on delivering innovative, high-performance components to meet the evolving requirements of commercial aviation, contributing to the segment's dominance.

The Military Aircraft segment is projected to witness the fastest CAGR during the forecast period, fueled by increased defense spending, modernization programs, and the demand for advanced, mission-critical aerospace components. The growing emphasis on stealth technology, lightweight materials, and next-generation military aircraft is driving robust growth in this application segment.

Which Region Holds the Largest Share of the Aerospace Parts Manufacturing Market?

- North America dominated the global aerospace parts manufacturing market, accounting for the largest revenue share of 51.2% in 2024, driven by strong defense spending, a robust commercial aviation sector, and the presence of leading aerospace manufacturers and suppliers

- The region benefits from advanced R&D capabilities, widespread adoption of next-generation materials, and significant investment in aircraft modernization programs, fostering continuous demand for aerospace components

- This regional leadership is further supported by partnerships between OEMs such as Boeing, technology innovators, and government initiatives to enhance domestic aerospace production, positioning North America as the global hub for aerospace innovation and component manufacturing

U.S. Aerospace Parts Manufacturing Market Insight

U.S. aerospace parts manufacturing market captured the largest revenue share within North America in 2024, fueled by the country's thriving defense and commercial aviation sectors. The U.S. hosts some of the world’s largest aerospace manufacturers, including Boeing, Lockheed Martin, and Textron, driving consistent demand for aircraft engines, structural components, and avionics. The nation’s emphasis on military modernization, alongside high demand for fuel-efficient commercial aircraft, continues to accelerate aerospace parts production. In addition, technological advancements in additive manufacturing and AI-driven automation are strengthening the competitiveness of U.S.-based aerospace suppliers.

Europe Aerospace Parts Manufacturing Market Insight

Europe aerospace parts manufacturing market is expected to witness steady growth throughout the forecast period, supported by the presence of major aircraft OEMs such as Airbus, and strong initiatives for sustainability and innovation. European aerospace companies are focusing on lightweight materials, fuel efficiency, and green aviation technologies, driving demand for advanced parts and components. The region's expertise in precision engineering, along with increased investments in space exploration and defense projects, is further contributing to the expansion of the aerospace parts manufacturing industry across Europe.

U.K. Aerospace Parts Manufacturing Market Insight

U.K. aerospace parts manufacturing market is projected to expand at a notable CAGR during the forecast period, driven by its established position as a leading supplier of aircraft engines, advanced materials, and defense components. The U.K.'s aerospace industry, supported by companies such as Rolls-Royce, plays a vital role in the global supply chain, focusing on engine manufacturing, avionics, and cutting-edge composite materials. The government's investment in aerospace innovation and sustainability initiatives, along with access to European and global markets, positions the U.K. as a key player in aerospace component production.

Germany Aerospace Parts Manufacturing Market Insight

Germany aerospace parts manufacturing market is expected to grow steadily, driven by the country's technological expertise, precision engineering capabilities, and strong emphasis on quality and innovation. Germany is a crucial part of the Airbus supply chain and is investing in lightweight materials, advanced cabin interiors, and next-generation avionics. Collaborations between German aerospace firms, research institutions, and global OEMs are further enhancing the country’s role in producing high-performance aerospace components, especially in commercial aviation and defense sectors.

Which Region is the Fastest Growing Region in the Aerospace Parts Manufacturing Market?

Asia-Pacific aerospace parts manufacturing market is anticipated to grow at the fastest CAGR of 17.3% from 2025 to 2032, driven by increasing air travel demand, rising defense budgets, and rapid expansion of domestic aircraft manufacturing programs across countries such as China, India, and Japan. The region's growing middle class, fleet modernization, and government-backed aerospace initiatives are creating significant opportunities for aerospace parts suppliers, particularly for lightweight structures, engine components, and avionics. In addition, rising investments in MRO (maintenance, repair, and overhaul) facilities and defense aviation are boosting regional market growth.

Japan Aerospace Parts Manufacturing Market Insight

Japan aerospace parts manufacturing market is experiencing steady expansion, supported by the country’s reputation for advanced technology, material innovation, and precision manufacturing. Japanese aerospace companies are key suppliers of components for both commercial aircraft and defense programs, with a strong focus on high-performance materials and avionics. The government's emphasis on strengthening domestic aerospace capabilities and international partnerships, particularly in the Mitsubishi SpaceJet and defense sectors, is enhancing Japan's role in the global aerospace parts supply chain.

China Aerospace Parts Manufacturing Market Insight

China aerospace parts manufacturing market accounted for the largest revenue share within the Asia-Pacific region in 2024, fueled by significant investments in domestic aircraft programs such as the COMAC C919, expanding MRO facilities, and a growing focus on aerospace self-sufficiency. China’s rapidly developing aerospace sector, supported by favorable government policies and partnerships with global OEMs, is driving strong demand for aircraft structures, interiors, and engine components. The nation’s increasing participation in international aerospace supply chains and focus on advanced manufacturing technologies are accelerating the market’s growth across commercial and defense aviation.

Which are the Top Companies in Aerospace Parts Manufacturing Market?

The aerospace parts manufacturing industry is primarily led by well-established companies, including:

- Eaton (Ireland)

- NTN BEARING CORPORATION OF AMERICA (U.S.)

- Amphenol Aerospace (U.S.)

- Berkshire Hathaway Inc. (U.S.)

- Arconic (U.S.)

- R.B.C. Bearings Incorporated (U.S.)

- Stanley Black & Decker, Inc. (U.S.)

- TriMas (U.S.)

- National Aerospace Fasteners Corporation (Taiwan)

- LISI AEROSPACE (France)

- Triumph Group (U.S.)

- Safran (France)

- S.K.F. (Sweden)

- TE Connectivity (Switzerland)

- Satcom Direct, Inc. (U.S.)

- Boeing (U.S.)

- Airbus S.A.S (France)

- Embraer (Brazil)

- A.T.R. (France)

- Lockheed Martin Corporation (U.S.)

- Textron Aviation Inc. (U.S.)

What are the Recent Developments in Global Aerospace Parts Manufacturing Market?

- In August 2022, Safran Data Systems, a Safran Electronics & Defense division, has just purchased Captronic Systems, a local Indian firm. Safran Data Systems is expanding its product portfolio and strengthening its international operations in this strategic country as a leading player in the space industry, supplying instrumentation for testing, telemetry, and communications with satellites, and launch vehicles. This enhances India's capabilities, attracting investments, stimulating innovation, and driving overall market advancement

- In May 2022, JAMCO Corporation announced the signing of a Supporter Agreement with SkyDrive Inc., a company that is developing flying cars. JAMCO will begin the collaboration by lending SkyDrive its Aircraft Interiors development professionals. This collaboration enhances SkyDrive's capabilities, accelerates product development, and strengthens its position in the market

- In December 2021, Intrex Aerospace partnered with Eaton and UTC Aerospace, developing a new business strategy to withhold the aerospace parts market. This collaboration leverages combined expertise and resources to drive innovation, expand product offerings, and capture new market opportunities, fostering overall industry growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.