Global Active Insulation Market

Market Size in USD Million

CAGR :

%

USD

339.78 Million

USD

539.52 Million

2024

2032

USD

339.78 Million

USD

539.52 Million

2024

2032

| 2025 –2032 | |

| USD 339.78 Million | |

| USD 539.52 Million | |

|

|

|

|

Active Insulation Market Size

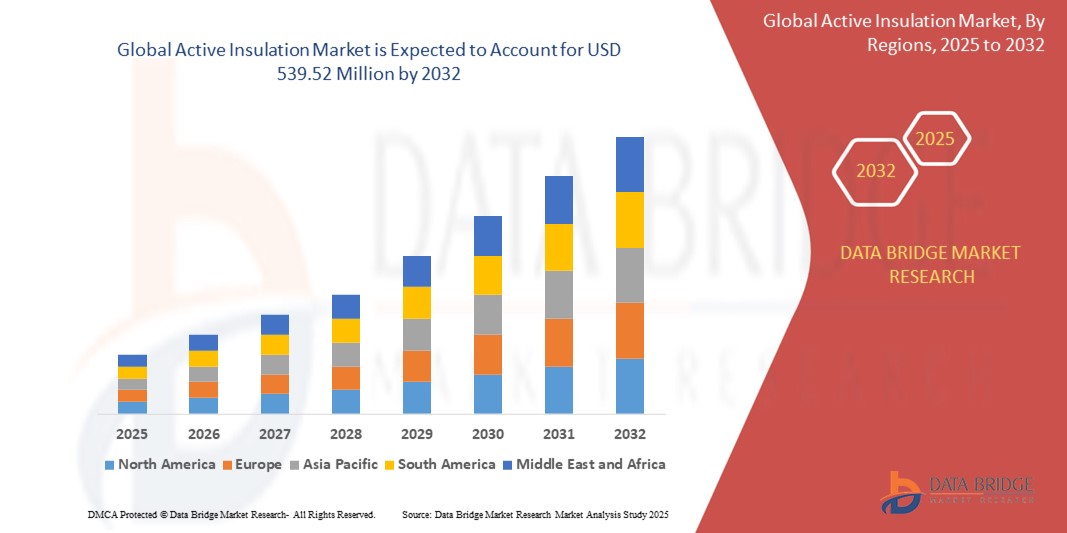

- The global active insulation market size was valued at USD 339.78 million in 2024 and is expected to reach USD 539.52 million by 2032, at a CAGR of 5.95% during the forecast period

- The market growth is primarily driven by increasing demand for energy-efficient building solutions and sustainable textile products, fueled by advancements in material science and growing environmental consciousness

- Rising consumer preference for eco-friendly and high-performance insulation solutions in residential, commercial, and industrial applications is positioning active insulation as a key component in modern construction and textile industries

Active Insulation Market Analysis

- Active insulation materials, designed to dynamically regulate heat and moisture, are becoming essential in energy-efficient building designs and high-performance textiles due to their ability to adapt to environmental conditions, enhancing comfort and reducing energy consumption

- The surge in demand is driven by global trends toward sustainable construction, stringent energy efficiency regulations, and growing adoption of smart textiles in sportswear and outdoor apparel

- Europe dominated the active insulation market with the largest revenue share of 42.5% in 2024, attributed to stringent environmental regulations, widespread adoption of green building standards, and a strong presence of key manufacturers. Countries such as Germany, France, and the U.K. are leading due to innovations in sustainable materials and government incentives for energy-efficient construction

- North America is expected to be the fastest-growing region during the forecast period, driven by increasing construction activities, rising awareness of energy conservation, and growing demand for advanced textiles in the U.S. and Canada

- The polyester segment dominated the largest market revenue share of 42.9% in 2024, driven by its versatility, durability, and quick-drying properties, making it ideal for textile applications such as activewear and sportswear, as well as building insulation due to its efficient moisture handling and cost-effectiveness

Report Scope and Active Insulation Market Segmentation

|

Attributes |

Active Insulation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Active Insulation Market Trends

“Integration of Advanced Materials and Smart Technologies”

- The global active insulation market is experiencing a notable trend toward the integration of advanced materials, such as phase change materials (PCMs) and smart textiles, to enhance thermal regulation and energy efficiency

- These materials dynamically respond to environmental changes, such as temperature and moisture, providing superior insulation in both textile and building applications

- Smart insulation technologies, including IoT-enabled systems, allow real-time monitoring and control of insulation performance, optimizing energy use in buildings and improving comfort in activewear

- For instances, companies are developing PCM-based textiles that adapt to body temperature for sportswear and smart insulation panels for buildings that adjust to external weather conditions

- This trend is increasing the appeal of active insulation for eco-conscious consumers and industries aiming to meet sustainability goals

- Advanced materials such as polyester and glass wool are being engineered to offer improved durability, lightweight properties, and recyclability, further driving market growth

Active Insulation Market Dynamics

Driver

“Growing Demand for Energy-Efficient and Sustainable Solutions”

- Rising consumer and regulatory demand for energy-efficient buildings and sustainable textiles is a key driver for the global active insulation market

- Active insulation materials, such as glass wool, mineral wool, and EPS, reduce energy consumption by minimizing heating and cooling needs in buildings, aligning with global sustainability initiatives

- Government regulations, particularly in Europe (the dominating region), such as the EU’s Energy Performance of Buildings Directive, are mandating the use of advanced insulation to achieve carbon neutrality

- The increasing popularity of outdoor activities, such as hiking, cycling, and sports, is boosting demand for high-performance activewear made from materials such as polyester, cotton, wool, and nylon

- The proliferation of smart building technologies and the expansion of construction activities in emerging markets are further enhancing the adoption of active insulation solutions

- In North America, the fastest-growing region, rapid urbanization and infrastructure development are driving demand for energy-efficient insulation in both residential and commercial applications

Restraint/Challenge

“High Costs and Regulatory Complexities”

- The high initial costs of advanced active insulation materials, such as PCMs and smart textiles, and their installation can be a significant barrier, particularly in cost-sensitive markets

- Retrofitting existing buildings with active insulation systems is complex and expensive, limiting adoption in older infrastructure

- Data privacy and regulatory compliance pose challenges for IoT-enabled insulation systems, as they collect and process environmental and usage data, raising concerns about security and misuse

- The fragmented regulatory landscape across regions, with varying standards for energy efficiency and material safety, complicates operations for manufacturers and service providers

- These factors can deter adoption, particularly in regions with low awareness of active insulation benefits or where budget constraints are prevalent

Active Insulation market Scope

The market is segmented on the basis of material and application.

- By Material

On the basis of material, the global active insulation market is segmented into polyester, cotton, wool, glass wool, mineral wool, nylon, EPS, and others. The polyester segment dominated the largest market revenue share of 42.9% in 2024, driven by its versatility, durability, and quick-drying properties, making it ideal for textile applications such as activewear and sportswear, as well as building insulation due to its efficient moisture handling and cost-effectiveness.

The EPS (expanded polystyrene) segment is expected to witness the fastest growth rate of 6.7% from 2025 to 2032, attributed to its lightweight nature, high thermal insulation capabilities, and ease of installation in building and construction applications. Its widespread use in energy-efficient construction projects further supports its growth.

- By Application

On the basis of application, the global active insulation market is segmented into textile and building and construction. The building and construction segment dominated the market with a revenue share of 60.7% in 2024, driven by the increasing demand for energy-efficient solutions to maintain indoor temperatures and reduce heating and cooling costs. Stringent regulations promoting green building practices and the need for sustainable construction further fuel this segment's growth.

The textile segment is anticipated to experience the fastest growth rate of 8.4% from 2025 to 2032, propelled by rising consumer interest in performance clothing, particularly activewear and sportswear. Innovations in moisture-wicking and temperature-regulating fabrics, coupled with growing health and fitness trends, enhance the adoption of active insulation in textiles.

Active Insulation Market Regional Analysis

- Europe dominated the active insulation market with the largest revenue share of 42.5% in 2024, attributed to stringent environmental regulations, widespread adoption of green building standards, and a strong presence of key manufacturers. Countries such as Germany, France, and the U.K. are leading due to innovations in sustainable materials and government incentives for energy-efficient construction

- The U.K. market for active insulation is expected to witness significant growth, driven by increasing demand for energy-efficient building materials and thermally efficient textiles. Consumers seek materials that enhance comfort and reduce energy costs in urban and suburban settings

- Germany is expected to witness robust growth in the active insulation market, attributed to its advanced construction sector and high consumer focus on energy efficiency and thermal comfort

North America Active Insulation Market Insight

North America is the fastest-growing region in the global active insulation market, driven by robust expansion in the construction sector, rising disposable incomes, and increased industrial output. Consumers are increasingly adopting active insulation materials for their energy efficiency and thermal regulation benefits in both textile and building applications. The U.S. leads the region with strong demand in both OEM and aftermarket segments, fueled by growing awareness of sustainability and energy conservation. Advancements in material technologies, such as phase change materials (PCMs) and synthetic fibers, further accelerate market growth.

U.S. Active Insulation Market Insight

The U.S. dominates the North America active insulation market with the highest revenue share in 2024, propelled by strong demand in the building and construction sector and growing consumer preference for energy-efficient solutions. The trend toward sustainable construction and retrofitting under-insulated homes to reduce energy consumption boosts market expansion. In addition, the increasing popularity of activewear and sportswear, driven by outdoor activities, supports the textile segment, with polyester leading due to its durability and quick-drying properties.

Asia-Pacific Active Insulation Market Insight

The Asia-Pacific region is expected to witness significant growth, driven by expanding construction activities and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of energy efficiency, sustainability, and thermal regulation boosts demand for active insulation in both textile and building applications. Government initiatives promoting green building practices and energy-efficient materials further encourage the adoption of advanced insulation solutions such as polyester and mineral wool.

Japan Active Insulation Market Insight

Japan’s active insulation market is expected to witness strong growth due to consumer preference for high-quality, technologically advanced materials that enhance thermal regulation and sustainability. The presence of major construction and textile manufacturers accelerates market penetration, with active insulation materials integrated into both OEM and aftermarket applications. Rising interest in eco-friendly textiles and energy-efficient building solutions also contributes to market expansion.

China Active Insulation Market Insight

China holds the largest share of the Asia-Pacific active insulation market, propelled by rapid urbanization, rising construction activities, and increasing demand for energy-efficient solutions. The country’s growing middle class and focus on sustainable building practices support the adoption of advanced materials such as EPS and polyester. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility, driving growth in both textile and building applications.

Active Insulation Market Share

The active insulation industry is primarily led by well-established companies, including:

- Armacell (Luxembourg)

- Knauf Digital GmbH (Germany)

- Neo Thermal Insulation (India)

- Owens Corning (U.S.)

- Polybond (India)

- PrimaLoft, Inc. (U.S.)

- Remmers GmbH (U.K.)

- Rockwool A/S (Denmark)

- Saint-Gobain Group (France)

- Imerys (France)

- W. L. Gore & Associates, Inc. (U.S.)

- Huntsman Corporation (U.S.)

- Kingspan Group (Ireland)

- Mitsubishi Chemical Corporation (Japan)

- Recticel NV/SA (Belgium)

- Aspen Aerogels (U.S.)

What are the Recent Developments in Global Active Insulation Market?

- In October 2024, Aerogel Systems launched its next-generation aerogel panels featuring enhanced fire resistance, specifically engineered for aerospace and marine applications. These advanced panels offer improved thermal insulation and structural integrity under extreme conditions. Simultaneously, the company began testing its Nanogel products in sustainable building projects across Asia, aiming to boost energy efficiency and reduce carbon footprints in urban infrastructure. Aerogel Systems also initiated investments in recyclable aerogel materials, aligning with circular economy principles. This includes research into closed-loop manufacturing and eco-friendly disposal methods, reinforcing the company’s commitment to sustainability and innovation in high-performance insulation technologies

- In August 2024, American Aerogel Corporation rolled out acoustic aerogel insulation designed to reduce noise in automotive and industrial settings, offering superior sound absorption with minimal weight. The company also began collaborations with HVAC manufacturers to incorporate aerogel into energy-efficient systems, enhancing thermal performance and reducing energy consumption. In addition, they introduced low-dust aerogel formulations to improve safety in construction environments, minimizing airborne particles during installation. These initiatives reflect American Aerogel’s commitment to expanding aerogel applications across industries, focusing on performance, sustainability, and workplace safety

- In January 2024, Active Aerogels has actively advanced the development of flexible aerogel blankets tailored for industrial and building insulation. These efforts reflect the company’s strategic push to expand its product portfolio and meet rising demand for energy-efficient, lightweight, and fire-resistant insulation materials. The aerogel blankets offer superior thermal performance and durability, making them ideal for applications in construction, oil & gas, aerospace, and transportation. This sustained innovation underscores Active Aerogels’ commitment to driving growth in the aerogel segment and supporting sustainable infrastructure solutions

- In November 2023, Whirlpool Corporation introduced SlimTech™ insulation in North America, featuring Vacuum Insulated Structure (VIS) technology for refrigerators. This breakthrough reduces wall thickness by up to 66%, enabling up to 25% more internal storage capacity without increasing external dimensions. SlimTech™ not only enhances space efficiency but also improves thermal insulation, contributing to better energy performance. The launch reflects Whirlpool’s commitment to sustainable innovation in home appliances, offering consumers smarter, more spacious, and energy-efficient refrigeration solutions

- In January 2023, International Builders’ Show (IBS), Owens Corning debuted an expanded insulation portfolio aimed at improving indoor air quality and simplifying installation. The lineup featured Ultra-Pure® low VOC spray foam insulation with Odor Scavenger™ technology, designed to meet stringent energy codes while enhancing air purity. Also showcased was PINK Next Gen™ Fiberglas™, engineered with advanced fiber technology for a soft texture and faster, more precise installation. These innovations reflect Owens Corning’s commitment to sustainable, high-performance building solutions that prioritize comfort, safety, and efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Active Insulation Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Active Insulation Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Active Insulation Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.