Europe Warehouse Management System Market, By Component (Hardware, Software, Services), Deployment (Cloud-Based, On-Premise), Type of Tier (Advanced, Intermediate, Basic), Function (Labour Management System, Analytics and Optimization, Billing and Yard Management, Systems Integration and Maintenance, Consulting Services), Distribution Channel (Online, Offline), End-User (Food and Beverage, E-Commerce, Automotive, Third-Party Logistics, Healthcare, Electrical and Electronics, Metals and Machinery, Chemicals, Others) – Industry Trends and Forecast to 2029

Europe Warehouse Management System Market Analysis and Size

There has been a huge growth of the e-commerce business, owing to which the demand for WMS is expanding. Moreover, the introduction of modern technology such as cloud computing and software-as-a-service (SaaS), among other things, has prompted supply chain operators to embrace warehouse management systems, which provide an end-to-end operation with greater efficiency and transparency. These determinants will largely aid the market in gaining traction over the forecasted period.

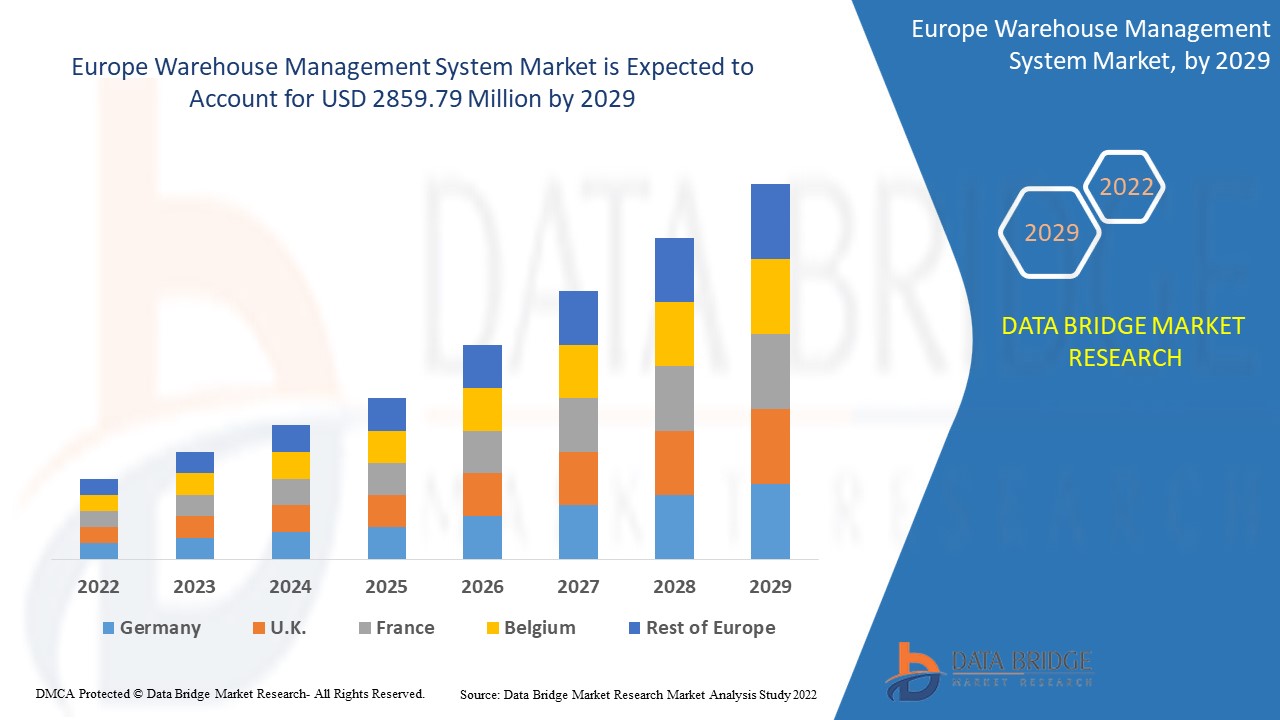

Europe warehouse management system market was valued at USD 854.47 million in 2021 and is expected to reach USD 2859.79 million by 2029, registering a CAGR of 16.30% during the forecast period of 2022-2029. The “software” accounts for the largest component segment in the warehouse management system market within the forecasted period owing to the increasing awareness about WMS software among small and mid-sized enterprises (SMEs) and the growing share of cloud-based WMS software solutions. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Market Definition

Warehouse management system is a system that functions for the simplification of the network, along with its administration by moving into a network that can be well-handled by any commodity server that is under the network operator’s control. The network's operation is adaptable, which can result in several advantages for the target audience who adopts its new services. The use of the v-CPE on a broad scale by network providers can result in simplification and acceleration in service delivery and setup and device management from remote locations.

Europe Warehouse Management System Market Scope and Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014 - 2019)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Component (Hardware, Software, Services), Deployment (Cloud-Based, On-Premise), Type of Tier (Advanced, Intermediate, Basic), Function (Labour Management System, Analytics and Optimization, Billing and Yard Management, Systems Integration and Maintenance, Consulting Services), Distribution Channel (Online, Offline), End-User (Food and Beverage, E-Commerce, Automotive, Third-Party Logistics, Healthcare, Electrical and Electronics, Metals and Machinery, Chemicals, Others)

|

|

Countries Covered

|

Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe

|

|

Market Players Covered

|

Manhattan Associates, (U.S.), Blue Yonder Group, Inc. (U.S.), HighJump (U.S.), Oracle (U.S.), IBM (U.S.), SAP SE (Germany), ACL Digital (U.S.), VMWare Inc. (U.S.), Ericsson Inc (Sweden), Hewlett Packard Enterprise Development LP (U.S.), Softeon (U.S.), Telco Systems (U.S.), NEC Corporation (Japan), Juniper Networks Inc.(U.S.), Infor (U.S.), Versa Networks Inc., (U.S.) and Cisco Systems Inc. (U.S.)

|

|

Market Opportunities

|

|

Warehouse Management System Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Digitization And The Usage Across E-Commerce

The market for warehouse management systems is rising due to the rapid rise of digitization and the wider consumer use of it across the e-commerce sectors in their everyday activities, as well as the requirements of omni-channel fulfilment. This factor is projected to be the most significant factor driving the growth for this market.

The need for versatile software in tackling the barcodes, smart scales and moment of goods from one place to another with equal skill, and working in collaboration is also estimated to bolster the market's overall growth. Furthermore, the WMS add-on module sales, labor efficiency and cost ownership advantages also fuels the market growth. The emergence of the varying traffic demands also cushions the market’s growth within the forecasted period. The availability of a variety of flavors also acts as a market driver.

Opportunities

- Digitization and Demand for Virtual Solutions

The digitization of the supply chain aids in building a completely integrated ecosystem are estimated to generate lucrative opportunities for the market, which will further expand the warehouse management system market's growth rate in the future. Additionally, the increased quantum of demand for virtual solutions and services, in the area of network will also offer numerous growth opportunities within the market.

Restraints/Challenges

- Lesser Awareness

The lack of awareness about WMS in small and medium sized enterprises, is expected to obstruct market growth.

- High Costs

On-premises WMS has a significant disadvantage in hardware updates and maintenance costs, as the significant-end on-premises WMS solutions have a high implementation cost, preventing SMEs from adopting them. Furthermore, a warehousing system necessitates a large initial investment that can withstand market growth, which is projected to be a challenge for the warehouse management system market over the forecast period.

This warehouse management system market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the warehouse management system market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Covid-19 Impact on Warehouse Management System Market

COVID-19, a global epidemic, infected 215 countries and impacted a wide range of industries. The warehouse management system market was immensely impacted by the outbreak of COVID-19 as consumers are fast migrating to internet platforms. Online demand for food and beverages, essentials, and prescriptions, all of which are provided utilizing unique contactless methods, has increased. Raised online demand for various products has also increased the requirement for warehousing. Several major firms are opening new warehouses in several countries to accommodate the rising demand. As a result, warehouse management systems are becoming more popular in e-commerce and third-party logistics companies. E-commerce behemoths like Amazon, Alibaba, and eBay are projected to continue driving up demand for the warehouse management system as they establish new facilities throughout the world.

Additionally, the situation is improving owing to decline in COVID cases worldwide and the market is picking up speed and will expand throughout the projection period. Therefore, the market is estimated to grow at a substantial pace post COVID-19.

Recent Developments

- In May 2020, Manhattan Associates Inc., a leading warehouse management software provider, unveiled the Manhattan Active Warehouse Management solution, the world's first cloud-native enterprise-class warehouse management system (WMS) that combines all aspects of distribution and never requires upgrades. Manhattan Active WM, made entirely of microservices and extremely elastic, brings in a new level of speed, adaptability, and ease of use in distribution management.

Europe Warehouse Management System Market Scope

The warehouse management system market is segmented on the basis of component, deployment, type of tier, function, distribution channel and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Hardware

- Software

- Services

Deployment

- Cloud-Based

- On-Premise

Type of Tier

- Advanced

- Intermediate

- Basic

Function

- Labour Management System

- Analytics and Optimization

- Billing and Yard Management

- Systems Integration and Maintenance

- Consulting Services

Distribution Channel

- Online

- Offline

End-User

- Food and Beverage

- E-Commerce

- Automotive

- Third-Party Logistics

- Healthcare

- Electrical and Electronics

- Metals and Machinery

- Chemicals

- Others

Warehouse Management System Market Regional Analysis/Insights

The warehouse management system market is analyzed and market size insights and trends are provided by country, component, deployment, type of tier, function, distribution channel and end-user as referenced above.

The countries covered in the warehouse management system market report are Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe.

Germany is leading the warehouse management system market thanks to the growing usage of multi-channel warehouse management systems, which raise demand by providing real-time data on inventory through barcoding, serial numbers, and RFID tagging. Also, due to the growth in the e-commerce business, the U.K. is dominating. The multi-channel warehouse management system is more widely used, which is why France dominates.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Warehouse Management System Market Share Analysis

The warehouse management system market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to warehouse management system market.

Some of the major players operating in the warehouse management system market are

- Manhattan Associates, (U.S.)

- Blue Yonder Group, Inc. (U.S.)

- HighJump (U.S.)

- Oracle (U.S.)

- IBM (U.S.)

- SAP SE (Germany)

- ACL Digital (U.S.)

- VMWare Inc. (U.S.)

- Ericsson Inc., (Sweden)

- Hewlett Packard Enterprise Development LP (U.S.)

- Softeon (U.S.)

- Telco Systems (U.S.)

- NEC Corporation (Japan)

- Juniper Networks Inc., (U.S.)

- Infor (U.S.)

- Versa Networks Inc., (U.S.)

- Cisco Systems Inc. (U.S.)

SKU-