Europe Tomatoes Market Analysis and Size

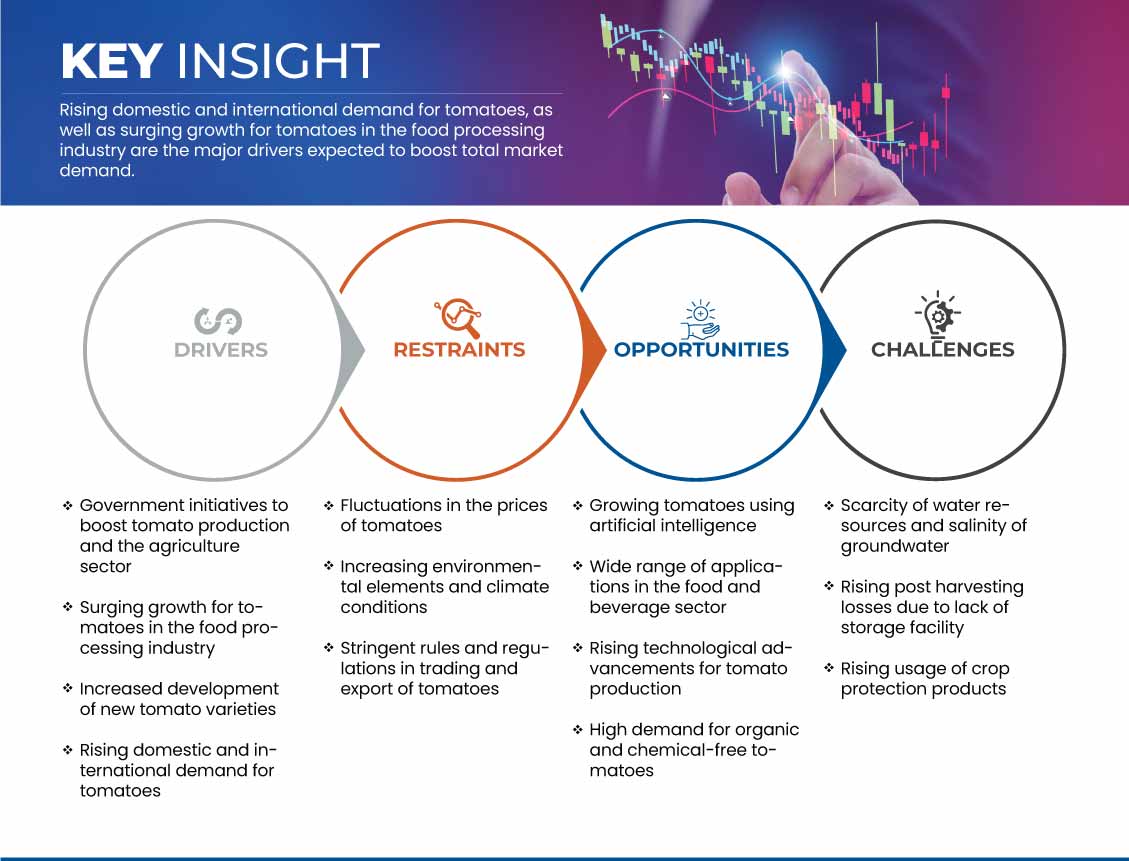

The Europe tomatoes market is being driven by the numerous benefits it offers to both companies and employees. The market for tomatoes is also being driven by an increase in demand for tomatoes in the food processing industry. The B2B market needs tomatoes since they are utilized as a raw material to make other processed tomato products. Tomatoes are used in various forms, including juice, paste, puree, diced/peeled tomatoes, Tomato ketchup, pickles, sauces, and ready-to-eat curries, which ultimately act as a driver for market growth. The growing number of working groups and the millennial population’s demand for tomatoes and their various forms has increased massively. Rising technological advancements in tomato production are an opportunity to enter this expanding market. However, fluctuations in the prices of tomatoes are one of the main restraining factors limiting market growth.

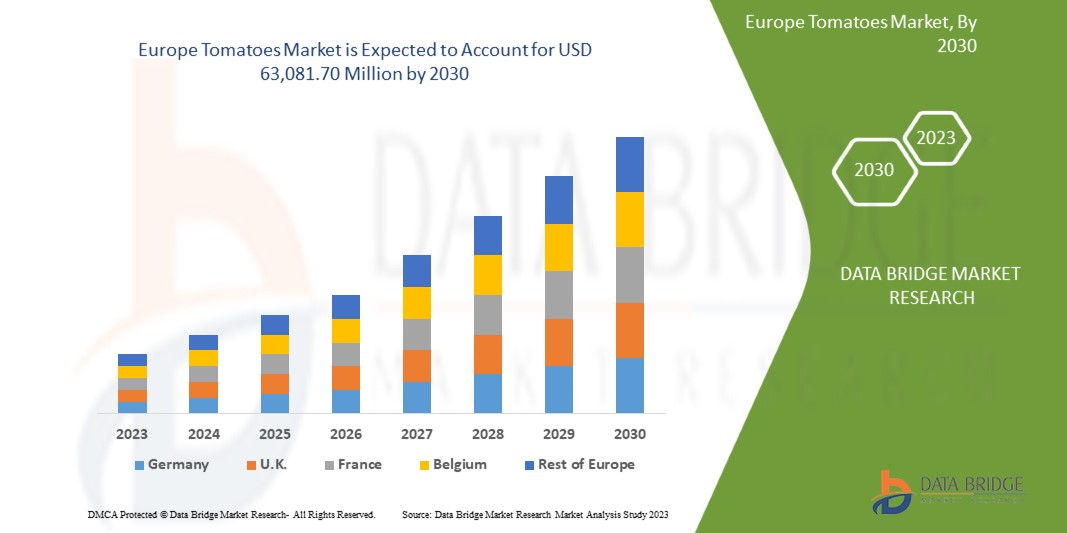

Data Bridge Market Research analyzes that the Europe tomatoes market is expected to reach the value of USD 63,081.70 million by 2030, at a CAGR of 3.4% during the forecast period of 2023 to 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Year |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in Million, Pricing in USD, Volume in Units |

|

Segments Covered |

Type (Cherry Tomatoes, Grape Tomatoes, Roma Tomatoes, Tomatoes On The Vine, Beefsteak Tomatoes, Heirloom Tomatoes, Green Tomatoes, and Others), Product Type (Fresh, Frozen, and Dried), Category (Conventional and Organic), End User (Food Service Industry and Household/ Retail Industry), Distribution Channel (Direct and Indirect) |

|

Countries Covered |

Turkey, Russia, Spain, Italy, France, Germany, Poland, U.K., Belgium, Netherlands, Sweden, Switzerland, Finland, Denmark, Norway, and the rest of Europe |

|

Market Players Covered |

CASALASCO - SOCIETÀ AGRICOLA S.p.A (Cremona, Italy), Duijvestijn Tomatoes (Pijnacker, Netherlands), R&L Holt Ltd. (Evesham, Europe), REDSTAR Sales BV (De Lier, Netherlands), and MASTRONARDI PRODUCE LTD (Ontario, Canada) among others |

Market Definition

Tomatoes are basically round-shaped vegetables that can be eaten cooked or uncooked. They are edible, pulpy berries of the herb Solanum lycoperscium. They are of many colors such as red, yellow, orange, and many more. They are of many varieties having different tastes and applications.

Tomatoes have a wide application in the food and beverages industry. They are used in the production of soups, sauces, purees, juices, and ketchup among others. They are also used as raw vegetables in burgers, sandwiches, salads, pizza, and many more.

Tomatoes are an essential source in food processing industries having wide applications, and also contain essential components useful for the human body. They help in maintaining blood pressure and healthy skin and also have anti-inflammatory action.

Europe Tomatoes Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Government Initiatives to Boost Tomato Production and the Agricultural Sector

With the increasing population and higher demand for fruits and fresh vegetables, the government has put several efforts into increasing the production and processing of the crops. Through much R&D in science and technology, the government has come up with many initiatives to increase tomato production to fulfill the demand for tomatoes and other agricultural products. The government funds research institutions such as the California Tomato Research Institute, Agriculture Research Service (ARS), and ICAR-IIHR in India to develop new varieties such as Pusa Ruby, Pusa Gaurav, and Chhuhara. These high-yielding varieties give more yield and are also more disease and pest-resistant, which is very important for higher production and makes them less prone to natural disasters.

The government also frames export and import policies that focus on the import and export of agricultural products, which will help the farmers and the supplier to catch up with the international demand for tomatoes and other products expected to drive the market growth. Thus, various initiatives taken by government bodies to promote the production and processing of tomatoes will accelerate market growth.

- Surging Growth for Tomatoes in the Food Processing Industry

The B2B market needs tomatoes since they are utilized as a raw material to make other processed tomato products. Tomatoes are used in various forms, including juice, paste, puree, diced/peeled tomatoes, ketchup, pickles, sauces, and ready-to-eat curries. There are numerous uses for processed tomato products in the food sector, such as in snacks, culinary, hotels, restaurants, and fast food retail chains. They can be eaten both cooked and uncooked and have a high demand in the Europe market. Because of rapid urbanization, consumers in emerging and developed countries are enticed to eat readymade foods and tomato-processed products. To meet the growing demand, processed food manufacturers and tomato paste processors focus on ready-to-eat products.

Additionally, the range of tomato processed foods is expanding with the introduction of various tomato products, including powder-based products. Tomato paste and tomato puree are the primary processed tomato products. Secondary processed products for tomatoes are made possible by processing primary products. The main market for tomato paste and puree is the ketchup and sauce sector. The beverage and food industry is the second largest user of tomato paste and puree.

With the growing number of working groups and millennial populations, the demand for tomatoes and their various forms has increased massively in the fast food sector, resulting and café, university dining halls, hotels, inns, catering, and food processing industries, which ultimately contribute towards the market growth.

Restraint

- Fluctuations in the Prices of Tomatoes

Volatile and unpredictable Europe marketplaces have far-reaching consequences for industrial companies. Unanticipated barriers such as rising energy costs and unexpected variations in raw material pricing are disrupting supply chains and making it harder for businesses to stay profitable. Variations in the prices of raw materials for making sauces, dressings, and condiments hot fill bottle packaging put up additional costs on the price of the finished product. A bumper crop or crop disaster in a major production region can change tomato prices quickly.

The prices of tomatoes are volatile as it depends on various factors such as seasonality in production, unseasonal rains, and prolonged drought. It also depends on location, preferences, consumers' age, and consumer buying power. Due to its seasonality, prices increase when the product is out of season and decreases when it is in season.

In India, around 70% of tomato is produced and harvested between December and June, that is, when the prices decrease and the supply increases. Between July and November, only 30% of the total production is harvested, where the prices rise due to limited supply.

Farmers, suppliers, and companies dealing in the tomato market find it difficult to correctly judge the risk of large fluctuations in tomato costs. Highly fluctuating costs and ineffective price management can seriously jeopardize the success of companies. The growers utilize many greenhouse facilities to grow tomatoes to lessen the impact of weather on tomato growing and increase the yield per acre. Tomatoes grown in greenhouses require different seeds than those grown in their natural environment. As a result, the cost of seeds used to grow tomatoes in greenhouses is higher than those used to grow tomatoes in natural conditions.

For instance,

- In July 2022, according to an article published in The Economic Times, every year from July to November, seasonal factors tend to push tomato prices up, with the pressure being highest in July. However, in March, the seasonal component exerts the most downward pressure on pricing. Given that around 70% of tomatoes are produced during the Rabi season. This seasonality in prices results from the seasonal pattern of tomato production

Moreover, increased Europe trade, urbanization, transportation needs, and energy demands put further pressure on the cost of the intermediaries required for the tomato market. Therefore, changes in the costs of tomatoes affect the demand for the product and are, thus, expected to hinder market growth.

Challenge

- Rising Post Harvesting Losses Due to Lack of Storage Facility

Despite the driving factors and the opportunities available in the market for tomato demand Europe, there is a certain challenge faced by the farmer and the supplier that would affect the supply of tomatoes. The challenge is post-harvest losses because of the perishable nature of tomatoes and the lack of storage facilities after harvesting and during transportation. Post-harvest losses are primarily caused by rotting, mechanical damage, poor handling, inappropriate temperature, relative humidity management, and hygiene issues during handling. Post-harvest losses cause the product's quality to decline, eventually lowering its price and negatively influencing market expansion.

However, post-harvest losses and other issues represent a serious market expansion challenge. In most nations, the tomato business is steadily disintegrating due to post-harvest issues, both on and off the farm. Most emerging nations cannot produce enough tomatoes on their own, as evidenced by the importation of completed tomato products. Even while there is always an oversupply on the market, this is only temporary because unprocessed tomatoes are difficult to preserve and highly perishable. Because of the inefficiencies in the post-harvest processing of tomatoes, there is a demand gap being supplied by imported processed goods. These post-harvest losses lower the market value of the product and act as a barrier to market expansion.

Post-harvest loss covers food lost along the entire food supply chain, from when a crop is harvested until it is consumed. The losses fall into several categories: weight loss from rotting, quality loss, nutritional loss, seed viability loss, and commercial loss. A shortage of storage facilities mostly causes these post-harvest losses on and off farms, which will be a key challenge to the market expansion.

Opportunities

- Growing Tomatoes Using Artificial Intelligence

Artificial intelligence (AI) is a wide-ranging branch of computer science engaged in building smart machines capable of performing tasks that typically require human intelligence. AI is a growing part of everyday life and is used in the agricultural sector. AI technology is focused on solving various problems to increase and optimize production and operation processes.

Advanced computational approaches are used in artificial intelligence to solve many real-world issues. These methods can be used in the agricultural industry to conduct original research that will enhance the kind, speed, new variety, and protection. AI can automatically check crop quality, yield, pH value, nutrient proportion, and amount of needed water, humidity, and oxygen components. Many nations use mini-bots to assess crop quality and ripeness in the agricultural industry. Mini-bots harvest ripe fruit and vegetables without damaging tomatoes' delicate skin.

AI-powered solutions help farmers to improve efficiencies, quantity, and quality and ensure faster go-to-market for crops. AI is used for crop yield prediction and price forecasting to gain maximum profits. AI sensors can help in intelligent spraying techniques by detecting weeds affected areas and spraying herbicides. Predictive insights can lighten the right time to sow the seeds for maximum productivity in different weather conditions. Agricultural robots help to harvest huge volumes of crops at a faster pace. With the help of AI/ML, crop health can be monitored, and soil deficiencies can be detected. Plant disease can be diagnosed through proper strategies to help farmers.

Thus, growing tomatoes using artificial intelligence is expected to offer opportunities for the growth of the European tomatoes market due to getting high quality and high quantity yield per unit area.

Recent Developments

- In April 2022, CASALASCO - SOCIETÀ AGRICOLA S.p.A announced its partnership with the rosella brand of Australia. This partnership has led to the development of different types of new products, like tomato roasted bell pepper soup, delicious carrot & potato soup, and creamy pumpkin soup, which will definitely help in the growth of the market and company.

- In December 2021, CASALASCO - SOCIETÀ AGRICOLA S.p.A obtained a certification named G.R.A.S.P that focuses on the agricultural activity and cultivation practice standards of the company. This helped in providing trust in the consumers for the company for providing safe and healthy products and helped in the growth of the company.

Europe Tomatoes Market Scope

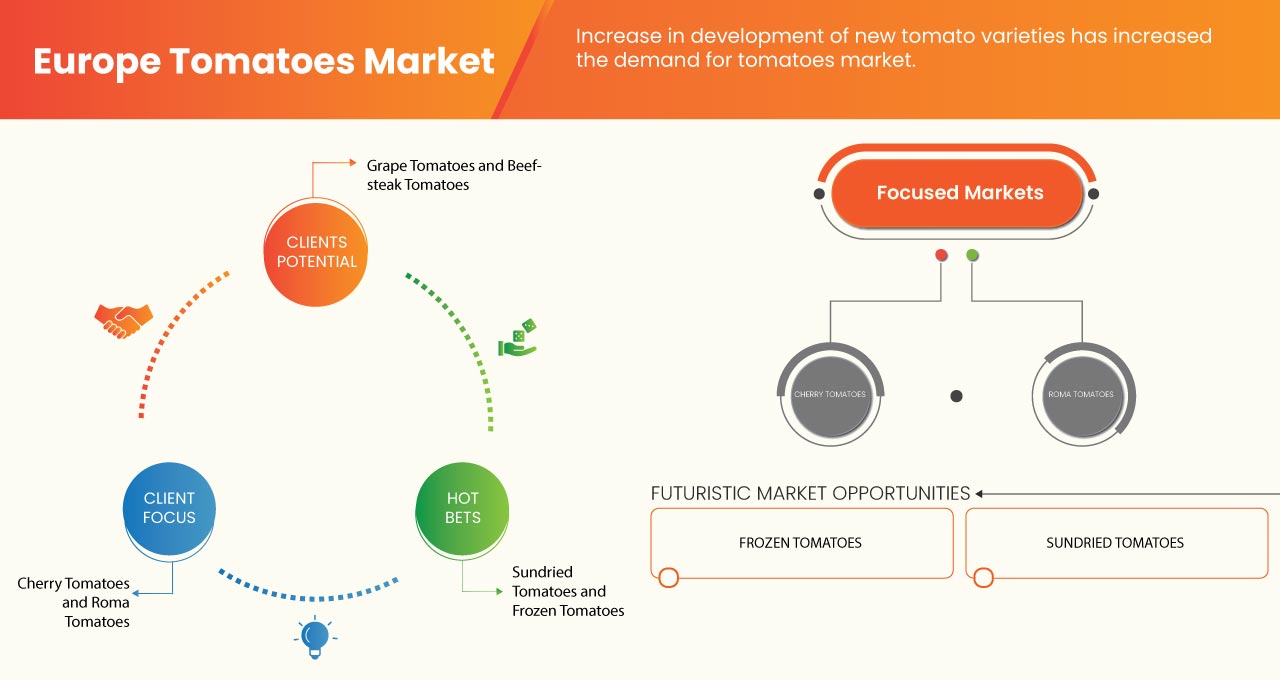

Europe tomatoes market is segmented into five notable segments based on type, product type, category, end user, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Cherry Tomatoes

- Grape Tomatoes

- Roma Tomatoes

- Tomatoes on the Vine

- Beefsteak Tomatoes

- Heirloom Tomatoes

- Green Tomatoes

- Others

Based on type, the market is segmented into cherry tomatoes, grape tomatoes, roma tomatoes, tomatoes on the vine, beefsteak tomatoes, heirloom tomatoes, green tomatoes, and others.

Product Type

- Fresh

- Frozen

- Dried

Based on product type, the market is segmented into fresh, frozen, and dried.

Category

- Conventional

- Organic

Based on category, the market is segmented into conventional and organic.

End User

- Food Service Industry

- Household/Retail Industry

Based on end user, the market is segmented into the food service industry and household/retail industry.

Distribution channel

- Direct

- Indirect

Based on distribution channel, the market is segmented into direct and indirect.

Europe Tomatoes Market Regional Analysis/Insights

The Europe tomatoes market is analyzed, and market size insights and trends are provided by country, type, product type, category, end user, and distribution channel, as referenced above.

The countries covered in this report are Turkey, Russia, Spain, Italy, France, Germany, Poland, U.K., Belgium, Netherlands, Sweden, Switzerland, Finland, Denmark, Norway, and the rest of Europe.

Turkey is dominating the Europe tomatoes market. The increasingly high demand from the processing industry for tomato processed products worldwide is the major reason for the market growth in Turkey. However, high cost of excellent raw materials is likely to restrict the market growth.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Tomatoes Market Share Analysis

The Europe tomatoes market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on the market.

Some of the major players operating in the Europe tomatoes market are CASALASCO - SOCIETÀ AGRICOLA S.p.A , Duijvestijn Tomatoes, R&L Holt Ltd., REDSTAR Sales BV, and MASTRONARDI PRODUCE LTD among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE TOMATOES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 MARKET END USER COVERAGE GRID

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET POSITION GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TOP 5 EXPORTER OF EUROPE TOMATOES MARKET

4.2 TOP 5 IMPORTER OF EUROPE TOMATOES MARKET

4.3 NEW PRODUCT LAUNCH STRATEGIES

4.3.1 PROMOTING LAUNCH BY PACKAGING STRATEGIES

4.3.2 LAUNCHING ORGANIC PRODUCTS

4.3.3 CONCLUSION

5 REGULATION COVERAGES

6 SUPPLY CHAIN OF THE EUROPE TOMATOES MARKET

6.1 RAW MATERIAL PROCUREMENT

6.2 PROCESSING

6.3 MARKETING AND DISTRIBUTION

6.4 END USERS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GOVERNMENT INITIATIVES TO BOOST TOMATO PRODUCTION AND THE AGRICULTURAL SECTOR

7.1.2 SURGING GROWTH FOR TOMATOES IN THE FOOD PROCESSING INDUSTRY

7.1.3 INCREASED DEVELOPMENT OF NEW TOMATO VARIETIES

7.1.4 RISING DOMESTIC AND INTERNATIONAL DEMAND FOR TOMATOES

7.2 RESTRAINTS

7.2.1 FLUCTUATIONS IN THE PRICES OF TOMATOES

7.2.2 INCREASING ENVIRONMENTAL ELEMENTS AND CLIMATE CONDITIONS

7.2.3 STRINGENT RULES AND REGULATIONS IN TRADING AND EXPORT OF TOMATOES

7.3 OPPORTUNITY

7.3.1 GROWING TOMATOES USING ARTIFICIAL INTELLIGENCE

7.3.2 WIDE RANGE OF APPLICATIONS IN THE FOOD AND BEVERAGE SECTOR

7.3.3 RISING TECHNOLOGICAL ADVANCEMENTS FOR TOMATO PRODUCTION

7.3.4 HIGH DEMAND FOR ORGANIC AND CHEMICAL-FREE TOMATOES

7.4 CHALLENGES

7.4.1 SCARCITY OF WATER RESOURCES AND SALINITY OF GROUNDWATER

7.4.2 RISING POST HARVESTING LOSSES DUE TO LACK OF STORAGE FACILITY

7.4.3 RISING USAGE OF CROP PROTECTION PRODUCTS

8 EUROPE TOMATOES MARKET, BY TYPE

8.1 OVERVIEW

8.2 CHERRY TOMATOES

8.3 GRAPE TOMATOES

8.4 ROMA TOMATOES

8.5 TOMATOES ON THE VINE

8.6 BEEFSTEAK TOMATOES

8.7 HEIRLOOM TOMATOES

8.8 GREEN TOMATOES

8.9 OTHERS

9 EUROPE TOMATOES MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 FRESH

9.3 FROZEN

9.4 DRIED

10 EUROPE TOMATOES MARKET, BY CATEGORY

10.1 OVERVIEW

10.2 CONVENTIONAL

10.3 ORGANIC

11 EUROPE TOMATOES MARKET, BY END USER

11.1 OVERVIEW

11.2 FOOD SERVICE INDUSTRY

11.2.1 FOOD SERVICE INDUSTRY, BY TYPE

11.2.1.1 HOTELS

11.2.1.2 RESTAURANTS

11.2.1.3 CAFES

11.2.1.4 OTHERS

11.3 HOUSEHOLD/RETAIL INDUSTRY

12 EUROPE TOMATOES MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT

12.3 INDIRECT

13 EUROPE TOMATOES MARKET : BY COUNTRIES

13.1 TURKEY

13.2 RUSSIA

13.3 SPAIN

13.4 ITALY

13.5 FRANCE

13.6 GERMANY

13.7 POLAND

13.8 U.K.

13.9 BELGIUM

13.1 NETHERLANDS

13.11 SWEDEN

13.12 SWITZERLAND

13.13 FINLAND

13.14 DENMARK

13.15 NORWAY

13.16 REST OF EUROPE

14 EUROPE TOMATOES MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 CASALASCO - SOCIETÀ AGRICOLA S.P.A.

16.1.1 COMPANY SNAPSHOT

16.1.2 PRODUCT PORTFOLIO

16.1.3 RECENT DEVELOPMENTS

16.2 MASTRONARDI PRODUCE LTD.

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 RECENT DEVELOPMENTS

16.3 REDSTAR SALES BV

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT DEVELOPMENT

16.4 DUIJVESTIJN TOMATEN

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT DEVELOPMENT

16.5 R&L HOLT LTD.

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 TOP 5 EXPORTER OF FRESH AND CHILLED TOMATOES, HS CODE: 0702 2017-2021, VOLUME IN TONS

TABLE 2 TOP 5 IMPORTER OF FRESH AND CHILLED TOMATOES, HS CODE: 0702 2017-2021, VOLUME IN TONS

TABLE 3 IN CASE SIZE CODES ARE APPLIED, THE CODES AND RANGES IN THE FOLLOWING TABLE HAVE TO BE RESPECTED:

TABLE 4 EUROPE TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 5 EUROPE TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 6 EUROPE TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 7 EUROPE TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 8 EUROPE FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 EUROPE TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 10 EUROPE TOMATOES MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 11 TURKEY TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 12 TURKEY TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 13 TURKEY TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 14 TURKEY TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 15 TURKEY FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 16 TURKEY TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 17 RUSSIA TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 18 RUSSIA TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 19 RUSSIA TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 20 RUSSIA TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 21 RUSSIA FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 22 RUSSIA TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 23 SPAIN TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 24 SPAIN TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 25 SPAIN TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 26 SPAIN TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 27 SPAIN FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 SPAIN TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 29 ITALY TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 30 ITALY TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 31 ITALY TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 32 ITALY TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 33 ITALY FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 ITALY TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 35 FRANCE TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 36 FRANCE TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 37 FRANCE TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 38 FRANCE TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 39 FRANCE FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 FRANCE TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 41 GERMANY TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 42 GERMANY TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 43 GERMANY TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 44 GERMANY TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 45 GERMANY FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 GERMANY TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 47 POLAND TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 48 POLAND TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 49 POLAND TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 50 POLAND TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 51 POLAND FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 POLAND TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 53 U.K. TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 54 U.K. TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 55 U.K. TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 56 U.K. TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 57 U.K. FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 U.K. TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 59 BELGIUM TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 60 BELGIUM TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 61 BELGIUM TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 62 BELGIUM TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 63 BELGIUM FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 BELGIUM TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 65 NETHERLANDS TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 66 NETHERLANDS TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 67 NETHERLANDS TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 68 NETHERLANDS TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 69 NETHERLANDS FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 NETHERLANDS TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 71 SWEDEN TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 72 SWEDEN TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 73 SWEDEN TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 74 SWEDEN TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 75 SWEDEN FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 SWEDEN TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 77 SWITZERLAND TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 78 SWITZERLAND TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 79 SWITZERLAND TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 80 SWITZERLAND TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 81 SWITZERLAND FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 SWITZERLAND TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 83 FINLAND TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 84 FINLAND TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 85 FINLAND TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 86 FINLAND TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 87 FINLAND FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 88 FINLAND TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 89 DENMARK TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 90 DENMARK TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 91 DENMARK TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 92 DENMARK TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 93 DENMARK FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 94 DENMARK TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 95 NORWAY TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 96 NORWAY TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 97 NORWAY TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 98 NORWAY TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 99 NORWAY FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 NORWAY TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 101 REST OF EUROPE TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 EUROPE TOMATOES MARKET: SEGMENTATION

FIGURE 2 EUROPE TOMATOES MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE TOMATOES MARKET: DROC ANALYSIS

FIGURE 4 EUROPE TOMATOES MARKET: GLOBAL VS REGIONAL ANALYSIS

FIGURE 5 EUROPE TOMATOES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 THE EUROPE TOMATOES MARKET: MARKET END USER COVERAGE GRID

FIGURE 7 EUROPE TOMATOES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE TOMATOES MARKET: DBMR POSITION GRID

FIGURE 9 EUROPE TOMATOES MARKET: SEGMENTATION

FIGURE 10 SURGING GROWTH FOR TOMATOES IN THE FOOD PROCESSING INDUSTRY IS EXPECTED TO DRIVE THE EUROPE TOMATOES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 THE CHERRY TOMATO SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE TOMATOES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 SUPPLY CHAIN OF THE EUROPE TOMATOES MARKET

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE TOMATOES MARKET

FIGURE 14 EUROPE TOMATOES MARKET: BY TYPE, 2022

FIGURE 15 EUROPE TOMATOES MARKET: BY PRODUCT TYPE, 2022

FIGURE 16 EUROPE TOMATOES MARKET: BY CATEGORY, 2022

FIGURE 17 EUROPE TOMATOES MARKET: BY END USER, 2022

FIGURE 18 EUROPE TOMATOES MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 19 EUROPE TOMATOES MARKET: SNAPSHOT (2022)

FIGURE 20 EUROPE TOMATOES MARKET: BY COUNTRY (2022)

FIGURE 21 EUROPE TOMATOES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 22 EUROPE TOMATOES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 23 EUROPE TOMATOES MARKET: BY TYPE (2023 - 2030)

FIGURE 24 EUROPE TOMATOES MARKET: COMPANY SHARE 2022 (%)

Europe Tomatoes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Tomatoes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Tomatoes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.