Europe Orthopedic Prosthetics Market

Market Size in USD Million

CAGR :

%

USD

2.35 Million

USD

4.85 Million

2024

2032

USD

2.35 Million

USD

4.85 Million

2024

2032

| 2025 –2032 | |

| USD 2.35 Million | |

| USD 4.85 Million | |

|

|

|

|

Europe Orthopedic Prosthetics Market Size

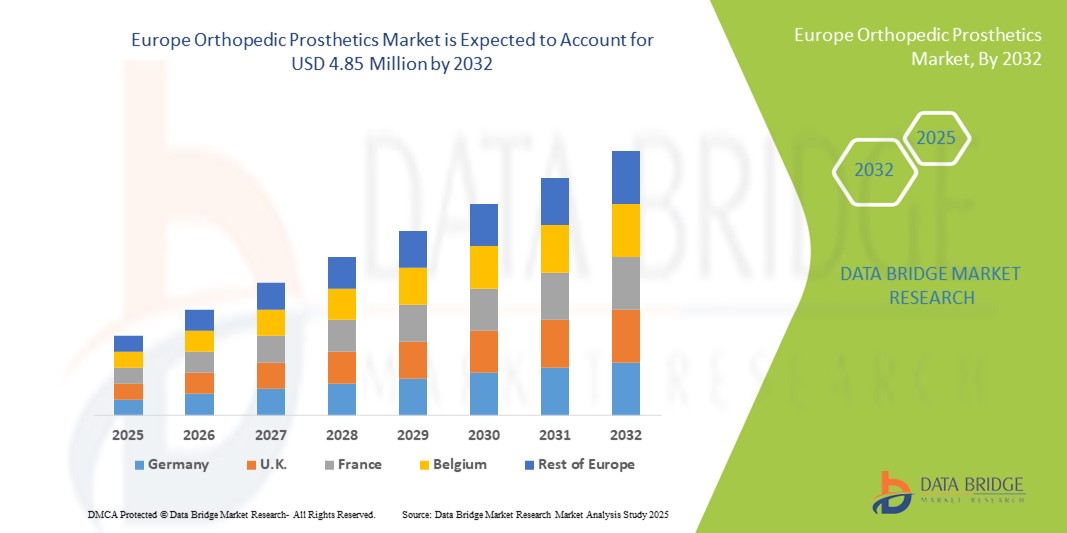

- The Europe orthopedic prosthetics market size was valued at USD 2.35 million in 2024 and is expected to reach USD 4.85 million by 2032, at a CAGR of 9.50% during the forecast period

- The market growth is largely fueled by increasing prevalence of musculoskeletal disorders, rising geriatric population, and advancements in biomedical materials, leading to enhanced adoption of orthopedic prosthetics in both hospitals and rehabilitation centers

- Furthermore, growing awareness among patients and healthcare providers regarding improved mobility, pain reduction, and quality of life is driving demand for advanced prosthetic solutions. These converging factors are accelerating the uptake of Orthopedic Prosthetics solutions, thereby significantly boosting the industry's growth

Europe Orthopedic Prosthetics Market Analysis

- Orthopedic prosthetics, including advanced joint replacements, limb prosthetics, and related supportive devices, are increasingly vital components of modern healthcare, offering enhanced mobility, functionality, and quality of life for patients with orthopedic conditions

- The escalating demand for orthopedic prosthetics is primarily fueled by the rising prevalence of musculoskeletal disorders, aging populations, increasing adoption of advanced surgical procedures, and growing awareness about rehabilitation and mobility solutions

- Germany dominated the Europe orthopedic prosthetics market with the largest revenue share of 36.5% in 2024, supported by its advanced healthcare infrastructure, strong adoption of high-precision prosthetic devices, and presence of leading medical device manufacturers. The country’s emphasis on orthopedic research, rehabilitation centers, and collaborations with key prosthetics innovators strengthens its leadership in the regional market

- France is expected to be the fastest-growing country in the Europe orthopedic prosthetics market during the forecast period, registering the highest CAGR due to increasing investments in healthcare modernization, expanding access to advanced prosthetic procedures, and rising adoption of patient-specific and 3D-printed prosthetic solutions. Awareness programs and government support for rehabilitation further accelerate growth

- Disabled adults dominated the Europe orthopedic prosthetics market with the largest revenue share of 62.8% in 2024, as the majority of prosthetic users in Europe fall within this demographic

Report Scope and Orthopedic Prosthetics Market Segmentation

|

Attributes |

Orthopedic Prosthetics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Orthopedic Prosthetics Market Trends

Enhanced Functionality and Patient-Centric Innovations

- A significant and accelerating trend in the Europe orthopedic prosthetics market is the growing adoption of patient-specific, digitally assisted, and sensor-integrated prosthetic solutions. These innovations are significantly enhancing user comfort, mobility, and overall quality of life for patients

- For instance, advanced 3D-printed prosthetic limbs and joint implants are enabling customized fits that improve alignment, reduce discomfort, and enhance rehabilitation outcomes. Similarly, modular and adjustable prosthetic systems allow patients to gradually adapt to new devices during recovery

- Innovations in prosthetic materials and design are improving durability, reducing weight, and providing more natural movement patterns. For instance, certain lower-limb prosthetics utilize lightweight alloys and advanced polymers to optimize energy efficiency and gait performance. Furthermore, embedded sensors and microprocessor-controlled joints in high-end prosthetic devices are improving functionality for patients with complex mobility requirements

- The integration of these advanced prosthetic systems with digital rehabilitation platforms allows healthcare providers to monitor patient progress remotely, adjust device settings as needed, and provide personalized care plans. This facilitates better recovery outcomes and greater independence for patients

- This trend towards more intelligent, ergonomic, and patient-focused prosthetic solutions is fundamentally reshaping expectations for orthopedic care. Consequently, companies such as Ottobock and Össur are developing next-generation prosthetics with modular designs, enhanced motion capabilities, and adaptive features tailored to individual patient needs

- The demand for advanced prosthetic solutions that improve functionality, comfort, and long-term patient outcomes is growing rapidly across hospitals, rehabilitation centers, and specialized orthopedic clinics, as healthcare providers increasingly prioritize patient-centric care and innovative rehabilitation technologies

Europe Orthopedic Prosthetics Market Dynamics

Driver

Growing Need Due to Rising Awareness and Technological Advancements

- The increasing prevalence of mobility impairments and physical disabilities among children and adults, coupled with rapid advancements in prosthetic technologies, is a significant driver for the heightened demand for orthopedic prosthetics

- For instance, in March 2024, Ottobock introduced a next-generation myoelectric prosthetic limb with enhanced control and comfort, aimed at improving mobility and independence for users. Such strategies by key companies are expected to drive the Orthopedic Prosthetics industry growth in the forecast period

- As patients become more aware of the benefits of advanced prosthetic solutions, including personalized and lightweight devices, there is a growing demand for prosthetics that provide better functionality, comfort, and aesthetics compared to conventional options

- Furthermore, the integration of digital technologies, such as 3D printing, sensors, and AI-based motion control, is making prosthetic devices more adaptive and user-friendly, allowing seamless customization for individual needs

- The convenience of modular components, easy adjustment, and improved biomechanical performance are key factors propelling the adoption of orthopedic prosthetics in hospitals, rehabilitation centers, and home care settings. The trend towards patient-centric care and the increasing availability of affordable yet advanced prosthetic options further contribute to market growth

Restraint/Challenge

High Costs and Limited Awareness in Certain Regions

- The relatively high cost of advanced orthopedic prosthetics compared to conventional devices is a significant barrier to adoption, particularly in developing countries and among price-sensitive patients. Premium features such as myoelectric control, 3D-printed customization, and sensor integration often come with higher price tags, limiting accessibility

- In addition, limited awareness among patients and caregivers about the benefits of modern prosthetic solutions, coupled with a shortage of trained healthcare professionals in some regions, restricts widespread adoption. Many patients continue to rely on conventional or less advanced devices due to lack of information or guidance

- To overcome these challenges, companies and stakeholders need to focus on cost-effective production methods, expand insurance coverage, and implement educational programs that increase awareness of advanced prosthetic technologies

- Promoting training for healthcare professionals and rehabilitation specialists is also essential to ensure proper fitting, usage, and maintenance of prosthetic devices, thereby boosting confidence and adoption among end users

- Addressing these factors is critical for the sustainable growth and broader penetration of the Orthopedic Prosthetics market in both developed and emerging regions

Europe Orthopedic Prosthetics Market Scope

The orthopedic prosthetics market is segmented on the basis of product type, technology, application, and end user.

- By Product Type

On the basis of product type, the orthopedic prosthetics market is segmented into spinal orthotics, sockets, modular components, liners, braces, lower extremity prosthetics, and upper extremity prosthetics. The lower extremity prosthetics segment dominated the European market in 2024, capturing the largest revenue share of 41.5%. The dominance is attributed to the high prevalence of lower limb amputations caused by trauma, diabetes, and vascular diseases in the region. Advanced prosthetic designs with lightweight materials and improved gait mechanics have further fueled demand. Hospitals and specialized clinics prefer lower extremity devices due to their critical role in restoring mobility and independence for adult patients. In addition, increasing adoption of modular systems and customizable socket designs is enhancing patient comfort and rehabilitation outcomes. The availability of supportive rehabilitation programs and insurance coverage in countries such as Germany and France also supports widespread adoption of lower extremity prosthetics.

The modular components segment is expected to witness the fastest CAGR of 9.4% from 2025 to 2032. Growth is driven by the increasing demand for highly customizable prosthetic solutions that can be adapted as patients’ needs evolve. Modular systems allow clinicians to interchange parts such as pylons, connectors, and feet, offering flexibility and reducing replacement costs. Advancements in lightweight materials, including carbon fiber and high-strength alloys, are making modular prosthetics more efficient and comfortable. Patient-centric rehabilitation approaches also encourage modular solutions, as they facilitate incremental improvements during recovery. The trend toward combining modular components with advanced liners and sockets for enhanced biomechanical performance is further accelerating market adoption.

- By Technology

On the basis of technology, the orthopedic prosthetics market is segmented into manual prosthetics, hybrid orthopedic prosthetics, electric powered, and conventional. Manual prosthetics accounted for the largest market revenue share of 47.2% in 2024, owing to their simplicity, affordability, and reliability for daily use. These devices remain highly preferred in rehabilitation centers and clinics where durability and ease of maintenance are critical. Manual prosthetics provide essential mobility support while requiring minimal technical expertise for operation, making them suitable for both children and adults. Their cost-effectiveness also ensures accessibility in both public and private healthcare settings across Europe. Continuous improvements in lightweight materials and ergonomic design have enhanced patient compliance and comfort. Moreover, well-established distribution networks in key markets such as Germany and the U.K. further bolster adoption of manual prosthetics.

Electric powered prosthetics are expected to register the fastest CAGR of 10.1% from 2025 to 2032. Increasing patient preference for high-performance prosthetics that mimic natural movement is driving growth. Integration with sensor-based systems allows real-time control and adaptability, enhancing mobility and quality of life. Rising investment in research and development by leading European prosthetic manufacturers is improving energy efficiency, battery life, and joint articulation. Growing awareness among patients and healthcare professionals about the benefits of powered prosthetics, particularly for upper limb applications, is accelerating adoption. Supportive reimbursement frameworks in Western Europe are also enabling more widespread access to electric powered devices.

- By Application

On the basis of application, the orthopedic prosthetics market is segmented into disabled children and disabled adults. Disabled adults accounted for the largest revenue share of 62.8% in 2024, as the majority of prosthetic users in Europe fall within this demographic. Causes such as trauma, vascular diseases, diabetes-related amputations, and age-related conditions significantly contribute to market demand. Adult patients generally require durable, functional, and high-performance prosthetic solutions, which drives adoption of both modular and electric prosthetics. Rehabilitation centers and orthopedic clinics focus heavily on adult prosthetics due to the critical need for restoring mobility and independence. Customization of liners, sockets, and modular components is widely implemented to ensure proper fit and long-term comfort. Patient education and physiotherapy programs also support improved outcomes, reinforcing the dominant position of this segment.

The disabled children segment is expected to witness the fastest CAGR of 8.9% from 2025 to 2032, driven by rising awareness of early intervention and pediatric rehabilitation. Technological advancements in adjustable and growth-accommodating prosthetics allow children to use devices for longer periods as they grow. Pediatric prosthetics are increasingly incorporating lightweight materials and ergonomically designed sockets to enhance comfort and mobility. The rising focus on inclusive education and sports participation for children with disabilities is boosting demand for functional and adaptive devices. Government initiatives and NGO programs in Europe to support children with disabilities are also facilitating market expansion.

- By End User

On the basis of end user, the orthopedic prosthetics market is segmented into trauma centers, rehabilitation centers, prosthetic clinics, outpatient centers, orthopedic clinics, hospitals, and other end users. Hospitals captured the largest market share of 38.9% in 2024, driven by their comprehensive capabilities to provide surgical, rehabilitation, and long-term prosthetic care. Hospitals offer integrated services including surgical interventions, post-operative rehabilitation, and device fitting, which ensures high-quality outcomes. They are preferred for both adult and pediatric patients due to the availability of specialized staff and multidisciplinary care teams. Advanced prosthetics and modular components are increasingly deployed in hospital settings to optimize mobility and patient comfort. Hospital networks in Germany, France, and the U.K. also benefit from robust insurance coverage and reimbursement policies, supporting widespread adoption.

Prosthetic clinics are expected to witness the fastest CAGR of 9.7% from 2025 to 2032. These clinics specialize in providing customized prosthetic solutions, enabling personalized fittings, regular adjustments, and follow-up care. The increasing trend of outpatient rehabilitation and patient-centric care models is driving growth in this segment. Clinics often offer advanced technologies such as modular systems, electric powered devices, and specialized liners tailored to patient requirements. Partnerships with manufacturers for direct distribution of prosthetic components enhance efficiency and reduce costs. Focused attention on patient satisfaction and functional outcomes positions prosthetic clinics as a rapidly expanding end-user segment in Europe.

Europe Orthopedic Prosthetics Market Regional Analysis

- The Europe orthopedic prosthetics market is projected to expand at a substantial CAGR throughout the forecast period

- Driven by increasing prevalence of mobility impairments, rising adoption of advanced prosthetic technologies, and growing demand for patient-specific solutions

- The region is witnessing significant growth across hospitals, rehabilitation centers, and outpatient care settings, with modern prosthetic devices being increasingly integrated into treatment plans

Germany Orthopedic Prosthetics Market Insight

The Germany orthopedic prosthetics market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s advanced healthcare infrastructure, strong adoption of high-precision prosthetic devices, and presence of leading medical device manufacturers. Germany dominated the Europe orthopedic prosthetics market with the largest revenue share of 36.5% in 2024, supported by its advanced healthcare infrastructure, strong adoption of high-precision prosthetic devices, and presence of leading medical device manufacturers. The country’s emphasis on orthopedic research, rehabilitation centers, and collaborations with key prosthetics innovators strengthens its leadership in the regional market. High adoption of digital technologies such as 3D printing, myoelectric controls, and modular prosthetic components, combined with well-established rehabilitation centers, further strengthens Germany’s position as the regional leader in orthopedic prosthetics.

France Orthopedic Prosthetics Market Insight

The France orthopedic prosthetics market is expected to be the fastest-growing country in the Europe orthopedic prosthetics market during the forecast period, registering the highest CAGR. France is projected to achieve rapid growth due to increasing investments in healthcare modernization, expanding access to advanced prosthetic procedures, and rising adoption of patient-specific and 3D-printed prosthetic solutions. Awareness programs and government support for rehabilitation further accelerate growth. The market is further driven by rising patient demand for personalized prosthetic solutions, technological innovation, and improved access to orthopedic care across both urban and rural areas.

Europe Orthopedic Prosthetics Market Share

The orthopedic prosthetics industry is primarily led by well-established companies, including:

- Ottobock (Germany)

- Johnsons and Johnsons and its affiliates (U.S.)

- Smith + Nephew (U.K.)

- Stryker (U.S.)

- Zimmer Biomet (U.S.)

- Össur (Iceland)

- UNYQ (U.S.)

- Blatchford Limited (U.K.)

- Proteor (France)

- Streifeneder (Germany)

- WillowWood Global LLC (U.S.)

Latest Developments in Europe Orthopedic Prosthetics Market

- In August 2025, Ottobock, a leading German prosthetics manufacturer, announced plans for an initial public offering (IPO) on the German stock exchange, targeting a valuation exceeding EUR 6 billion. The company aims to raise funds to repay a EUR 1.1 billion loan and support future growth in advanced prosthetic technologies

- In June 2025, it was reported that Ottobock is planning to sell its mobility unit as part of preparations for its upcoming IPO. Goldman Sachs is advising on the process, and the unit recorded EBITDA of €8 million to EUR 10 million for 2024. The divestment is expected to be completed before the IPO, allowing Ottobock to focus on its core prosthetics business

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.