Europe Immunoassay Reagents And Devices Market

Market Size in USD Billion

CAGR :

%

USD

5.73 Billion

USD

8.09 Billion

2024

2032

USD

5.73 Billion

USD

8.09 Billion

2024

2032

| 2025 –2032 | |

| USD 5.73 Billion | |

| USD 8.09 Billion | |

|

|

|

|

Europe Immunoassay Reagent and Device Market Size

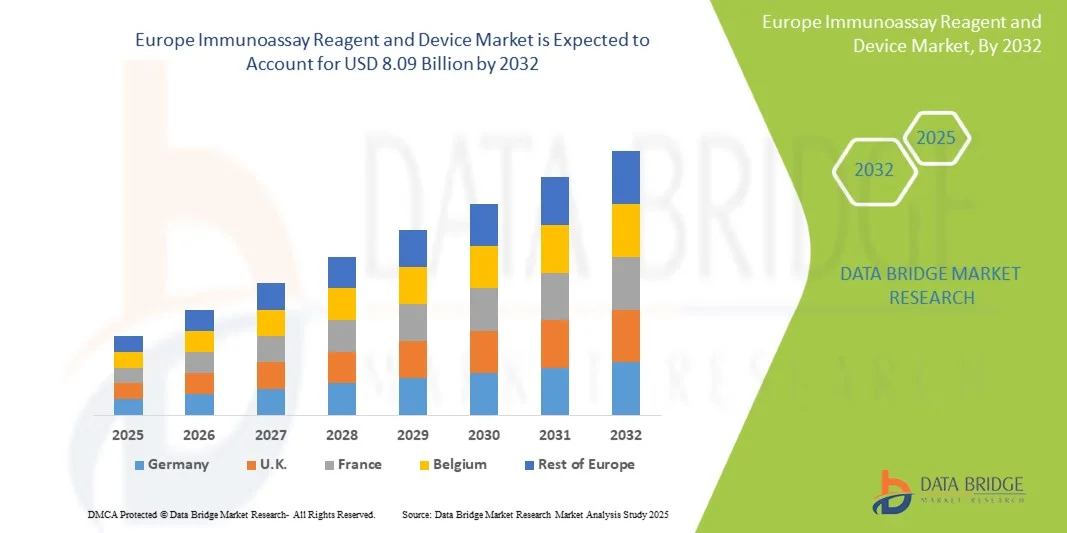

- The Europe immunoassay reagent and device market size was valued at USD 5.73 billion in 2024 and is expected to reach USD 8.09 billion by 2032, at a CAGR of 4.40% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced diagnostic technologies and continuous technological progress in immunoassay platforms, enabling faster, more accurate, and high-throughput testing across clinical, research, and pharmaceutical settings

- Furthermore, rising demand for reliable, cost-effective, and user-friendly immunoassay solutions is driving the adoption of reagent kits and analyzers across hospitals, laboratories, and research institutes. These converging factors are accelerating the uptake of immunoassay reagent and device solutions, thereby significantly boosting the industry's growth

Europe Immunoassay Reagent and Device Market Analysis

- Immunoassay reagents and devices are increasingly vital in European healthcare due to their critical role in accurate disease diagnosis, early detection of chronic and infectious diseases, and support for personalized medicine. Continuous advancements in automation, assay sensitivity, and high-throughput testing are driving adoption across hospitals, reference laboratories, and research centers

- The escalating demand for immunoassay solutions is primarily fueled by increasing healthcare expenditure, growing awareness of early disease detection, and rising investments in laboratory infrastructure across Europe. These factors are establishing immunoassays as a preferred diagnostic approach in clinical and research applications

- Germany dominated the Europe immunoassay reagent and device market with the largest revenue share of 28.7% in 2024, characterized by a strong healthcare infrastructure, high adoption of advanced diagnostic platforms, and the presence of key industry players such as Roche Diagnostics, DiaSorin, and Siemens Healthineers. Germany continues to lead due to significant investments in hospital laboratories and research institutions

- France is expected to be the fastest-growing country in the Europe immunoassay reagent and device market during the forecast period, driven by rising healthcare awareness, expanding diagnostic laboratory networks, and increasing adoption of high-throughput immunoassay platforms for infectious diseases, oncology, and cardiology diagnostics

- The reagents & kits segment dominated the Europe immunoassay reagent and device market with a share of 62.5% in 2024, driven by its critical role in diagnostic testing across infectious diseases, oncology, endocrinology, and autoimmune disorders

Report Scope and Immunoassay Reagent and Device Market Segmentation

|

Attributes |

Europe Immunoassay Reagent and Device Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Immunoassay Reagent and Device Market Trends

Enhanced Diagnostic Efficiency and Automation Integration

- The increasing prevalence of chronic and infectious diseases across Europe, coupled with the accelerating adoption of advanced diagnostic platforms, is a significant driver for the heightened demand for immunoassay reagents and devices. Hospitals, reference laboratories, and research institutions are increasingly relying on these solutions for rapid, accurate, and high-throughput testing

- For instance, in April 2024, DiaSorin S.p.A. expanded its in vitro diagnostics reagent kits in Europe, enhancing capabilities for immunodiagnostics and molecular diagnostics. Such strategic product developments by key companies are expected to drive the Immunoassay Reagent and Device industry growth during the forecast period

- As healthcare providers aim to improve early disease detection and patient care, immunoassay systems offer advanced features such as high-throughput testing, multiplex assay capabilities, and automated data management, providing significant improvements over traditional diagnostic methods

- Furthermore, the growing emphasis on personalized medicine, biomarker-based screening, and routine health monitoring is making immunoassays an integral component of modern laboratory workflows. These solutions enable seamless integration with laboratory information management systems (LIMS) and electronic health records (EHR), supporting more efficient and coordinated testing processes

- The convenience of automated sample handling, rapid result generation, and scalable testing for large patient volumes are key factors propelling the adoption of immunoassay reagents and devices in both clinical and research applications. Increasing investments in hospital infrastructure, laboratory modernization, and user-friendly automated systems further contribute to market growth

Europe Immunoassay Reagent and Device Market Dynamics

Driver

Concerns Regarding High Initial Costs and Technical Complexity

- The increasing concerns regarding the high initial costs and technical complexity of advanced immunoassay platforms are key factors influencing the Europe Immunoassay Reagent and Device Market. These concerns can slow adoption among smaller laboratories and healthcare facilities with limited budgets

- For instance, in April 2024, Roche Diagnostics announced the launch of a new user-friendly, automated immunoassay analyzer designed for European clinical laboratories, aimed at reducing operational complexity and training requirements. Such strategies are expected to support steady growth in the Europe Immunoassay Reagent and Device industry over the forecast period

- The technical complexity of operating automated analyzers and advanced platforms can pose challenges for laboratory staff, requiring training and workflow adjustments. These factors make some institutions cautious about investing in cutting-edge systems despite their diagnostic advantages

- Moreover, the integration of immunoassay devices with laboratory information systems (LIS) and electronic health records (EHR) demands technical expertise, which may be perceived as a barrier by smaller or decentralized laboratories

- The high upfront investment for instruments, coupled with recurring costs for reagents and consumables, can limit adoption, particularly in budget-conscious healthcare facilities. However, hospitals and larger reference laboratories continue to invest due to the long-term benefits of automation, high throughput, and accurate diagnostic results

- Addressing these challenges through enhanced training, simplified instrument interfaces, scalable solutions, and cost-effective reagent kits is critical to boosting adoption across Europe. Improved support services and financing options are also helping laboratories overcome these barriers

Restraint/Challenge

Concerns Regarding Cybersecurity and High Initial Costs

- The relatively high initial cost of advanced immunoassay reagent kits and automated diagnostic platforms can be a barrier to adoption, particularly for smaller laboratories or budget-conscious healthcare providers. While basic immunoassay kits are more affordable, premium systems with automated workflows, multiplexing, and integrated data analysis often come with higher price tags

- In addition, the technical complexity of certain high-throughput immunoassay analyzers and the need for skilled personnel can limit broader market penetration. Laboratories must invest in staff training, equipment calibration, and maintenance to ensure accurate and reliable results

- Overcoming these challenges through cost optimization, simplified user interfaces, robust technical support, and training programs will be crucial for enabling wider adoption across hospitals, research labs, and academic institutions

- Companies such as Roche Diagnostics, Siemens Healthineers, and DiaSorin are emphasizing affordable, scalable, and user-friendly solutions to address these constraints

- While prices are gradually becoming more competitive, the perceived premium for advanced immunoassay systems can still hinder adoption in smaller or resource-constrained laboratories

- Ensuring that these technologies remain accessible and easy to use will be vital for sustained growth in the European market

Europe Immunoassay Reagent and Device Market Scope

The market is segmented on the basis of product, platform, technique, specimen type, application, and end users.

• By Product

On the basis of product, the Europe immunoassay reagent and device market is segmented into reagents & kits and analyzers. The reagents & kits segment dominated the Europe market with a share of 62.5% in 2024, driven by its critical role in diagnostic testing across infectious diseases, oncology, endocrinology, and autoimmune disorders. Reagents are required for every assay, ensuring continuous utilization in hospitals, clinical laboratories, and research facilities. Their high reliability, sensitivity, and reproducibility make them indispensable for accurate test results. Major players such as Roche Diagnostics, DiaSorin, and Siemens Healthineers continuously innovate high-sensitivity reagents, enhancing assay performance and consolidating the segment’s dominance. Strong demand is also driven by frequent replenishment cycles, wide applicability across multiple disease areas, and the growing emphasis on standardized laboratory testing in Europe.

The analyzers segment is expected to witness the fastest CAGR of 9.8% from 2025 to 2032, fueled by growing adoption of automated and high-throughput immunoassay platforms. Hospitals and laboratories are increasingly investing in analyzers to improve workflow efficiency, reduce human error, and ensure faster turnaround times. Technological advancements such as multiplexing, integration with laboratory information systems, and connectivity for remote monitoring further enhance their appeal. Portable and compact analyzers for point-of-care testing are gaining traction in decentralized laboratories, supporting adoption across diverse European healthcare facilities.

• By Platform

On the basis of platform, the Europe immunoassay reagent and device market is segmented into chemiluminescence immunoassays (CLIA), fluorescence immunoassays (FIA), enzyme immunoassays (EIA), radioimmunoassays (RIA), and others. The enzyme immunoassays (EIA) segment dominated with a share of 45.3% in 2024, owing to its wide clinical applications, cost-effectiveness, and established reliability. EIA is extensively used for infectious disease detection, endocrine disorder evaluation, and autoimmune testing across European hospitals and reference laboratories. Its robustness, ability to process large sample volumes efficiently, and adaptability to multiple analytes contribute to its strong market presence. Leading companies continue to enhance EIA platforms with improved sensitivity and high throughput capabilities, further solidifying dominance. The long-standing acceptance of EIA in routine diagnostics and research studies also reinforces its market leadership.

The chemiluminescence immunoassays (CLIA) segment is expected to grow the fastest at a CAGR of 8.7% from 2025 to 2032, driven by its superior sensitivity and ability to detect low-abundance biomarkers. CLIA is increasingly adopted in oncology and cardiology diagnostics due to its rapid processing and high signal-to-noise ratio. Investments in automated, high-throughput CLIA platforms by key players such as Abbott and Siemens are further boosting adoption. European laboratories are increasingly deploying CLIA to improve diagnostic accuracy, reduce turnaround times, and handle growing patient volumes efficiently.

• By Technique

On the basis of technique, the Europe immunoassay reagent and device market is segmented into enzyme-linked immunosorbent assays (ELISA), rapid tests, enzyme-linked immunospot (ELISPOT), western blotting, immuno-PCR, and other techniques. The ELISA segment dominated with a market share of 48.1% in 2024, due to its reliability, reproducibility, and versatility in testing multiple analytes. ELISA is widely used for infectious disease screening, oncology, and endocrine evaluations in hospitals and reference laboratories. Its well-established protocols, accuracy, and compatibility with high-throughput analyzers make it a preferred choice. Leading companies continue to enhance ELISA kits with higher sensitivity and faster processing times. The long-standing adoption in clinical laboratories and strong regulatory support further reinforce dominance.

The rapid tests segment is expected to witness the fastest CAGR of 10.2% from 2025 to 2032, driven by demand for quick, point-of-care diagnostics. Rapid tests offer convenience, minimal equipment requirements, and timely results, making them ideal for outpatient and decentralized testing. Adoption is increasing in infectious disease screening, emergency care, and public health initiatives. European healthcare providers are focusing on rapid diagnostics to improve patient outcomes and expand testing accessibility, which further accelerates segment growth. In addition, ongoing innovations in test sensitivity and specificity are enhancing the reliability of rapid tests, encouraging broader adoption across hospitals, clinics, and community health programs.

• By Specimen Type

On the basis of specimen type, the Europe immunoassay reagent and device market is segmented into saliva, urine, blood, and others. The blood segment dominated with a share of 54.6% in 2024, owing to its widespread use in clinical diagnostics, high reliability, and compatibility with most immunoassay platforms. Blood-based immunoassays are essential for infectious disease detection, oncology monitoring, and autoimmune disorder assessment. Hospitals and reference laboratories extensively rely on blood specimens due to standardized protocols and strong regulatory acceptance. The segment benefits from established collection methods and wide adoption in routine and specialized testing, reinforcing dominance in the European market.

The saliva segment is expected to grow the fastest at a CAGR of 9.5% from 2025 to 2032, driven by its non-invasive nature and convenience for patients. Saliva-based immunoassays are increasingly adopted for point-of-care testing, large-scale screening, and hormone testing. Their ease of collection improves patient compliance and allows frequent testing without discomfort. Growth is further supported by expanding research on saliva biomarkers and rising adoption in decentralized and outpatient testing centers across Europe. Moreover, advancements in assay sensitivity and accuracy are making saliva a reliable alternative to blood-based testing, further boosting its acceptance across clinical and research applications.

• By Application

On the basis of application, the Europe immunoassay reagent and device market is segmented into infectious diseases, oncology & endocrinology, bone & mineral disorders, cardiology, hematology & blood screening, autoimmune disorders, toxicology, neonatal screening, and others. The infectious diseases segment dominated with a share of 39.8% in 2024, driven by high demand for serological assays in HIV, hepatitis, influenza, and emerging pathogens. COVID-19 emphasized the importance of immunoassays in pandemic preparedness. European hospitals and laboratories continue to invest in advanced immunoassay platforms to enhance disease detection, monitor outbreaks, and support vaccination programs. Public health initiatives and widespread testing requirements reinforce the dominance of this segment.

The oncology & endocrinology segment is expected to witness the fastest CAGR of 9.7% from 2025 to 2032, driven by the rising incidence of cancer and endocrine disorders. Immunoassay tests are increasingly used for biomarker-based early detection, monitoring treatment efficacy, and personalized medicine approaches. Integration with molecular diagnostic platforms and automation in laboratories is accelerating adoption. Increased research, government funding, and growing awareness of early detection benefits contribute to rapid growth across Europe. Furthermore, the development of high-sensitivity immunoassays enables detection of low-abundance tumor markers, supporting early intervention strategies. Continuous innovations in assay multiplexing also allow simultaneous testing for multiple biomarkers, enhancing diagnostic efficiency and patient care

• By End Users

On the basis of end users, the Europe immunoassay reagent and device market is segmented into hospitals, clinical laboratories, pharmaceutical & biotechnology companies, blood banks, research & academic laboratories, and others. The hospitals segment dominated with a market share of 41.5% in 2024, due to high patient testing volumes, advanced diagnostic infrastructure, and integration of immunoassay systems with electronic health records (EHR). Hospitals serve as primary testing centers for routine and critical diagnostics. Adoption is further reinforced by government funding and investment in advanced laboratory platforms. Major hospitals in Germany, France, and the U.K. contribute heavily to segment revenue, consolidating dominance.

The clinical laboratories segment is expected to grow the fastest at a CAGR of 10.1% from 2025 to 2032, fueled by increasing outsourcing of diagnostic services, rise of specialized reference labs, and growing demand for high-throughput testing. Collaborations with pharmaceutical companies for clinical trials and biomarker studies further support adoption. Countries such as Germany, the U.K., and France are witnessing rapid expansion of diagnostic laboratories, driving segment growth across Europe. Moreover, advancements in automated immunoassay platforms and integration with digital reporting systems are enhancing efficiency and accuracy, further strengthening the segment’s growth trajectory.

Europe Immunoassay Reagent and Device Market Regional Analysis

- The Europe immunoassay reagent and device market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing adoption of advanced diagnostic technologies, rising prevalence of chronic and infectious diseases, and growing demand for rapid, accurate, and high-throughput testing across hospitals, laboratories, and research institutions

- Germany dominated the Europe immunoassay reagent and device market with the largest revenue share of 28.7% in 2024, characterized by a strong healthcare infrastructure, high adoption of advanced diagnostic platforms, and the presence of key industry players such as Roche Diagnostics, DiaSorin, and Siemens Healthineers. Germany continues to lead due to significant investments in hospital laboratories and research institutions

- France is expected to be the fastest-growing country in the Europe immunoassay reagent and device market during the forecast period, driven by rising healthcare awareness, expanding diagnostic laboratory networks, and increasing adoption of high-throughput immunoassay platforms for infectious diseases, oncology, and cardiology diagnostics

Germany Immunoassay Reagent and Device Market Insight

The Germany immunoassay reagent and device market dominated the Europe market in 2024 with the largest revenue share of 28.7%, owing to its strong healthcare infrastructure, high adoption of advanced diagnostic platforms, and the presence of key industry players such as Roche Diagnostics, DiaSorin, and Siemens Healthineers. The country continues to lead the market due to significant investments in hospital laboratories and research institutions, as well as a well-established ecosystem supporting precision diagnostics and innovation in immunoassay technologies.

France Immunoassay Reagent and Device Market Insight

The France immunoassay reagent and device market is expected to be the fastest-growing country in the Europe immunoassay reagent and device market during the forecast period, driven by rising healthcare awareness, expanding diagnostic laboratory networks, and increasing adoption of high-throughput immunoassay platforms for applications in infectious diseases, oncology, and cardiology diagnostics. Government initiatives promoting early disease detection, combined with strong R&D efforts and the modernization of clinical laboratories, are supporting rapid market growth in the country.

Europe Immunoassay Reagent and Device Market Share

The immunoassay reagent and device industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Siemens Healthineers AG (Germany)

- Bio-Rad Laboratories, Inc. (U.S.)

- Danaher Corporation (U.S.)

- Thermo Fisher Scientific, Inc. (U.S.)

- Sysmex Corporation (Japan)

- BIOMÉRIEUX (France)

- QuidelOrtho Corporation (U.S.)

- PerkinElmer (U.S.)

- BD (U.S.)

- DiaSorin S.p.A. (Italy)

- Agilent Technologies, Inc. (U.S.)

- Luminex Corporation (U.S.)

Latest Developments in Europe Immunoassay Reagent and Device Market

- In June 2021, Thermo Fisher Scientific introduced the TaqMan SARS-CoV-2 Mutation Panel for research use only. This scalable solution enables the detection of relevant COVID-19 mutations using real-time PCR technology, allowing researchers to identify currently relevant SARS-CoV-2 mutations and adapt quickly as additional mutations and variants emerge

- In February 2021, bioMérieux received Emergency Use Authorization (EUA) from the U.S. FDA for its VIDAS SARS-CoV-2 IgG automated assay. This assay uses the ELFA (Enzyme Linked Fluorescent Assay) technique for the qualitative detection of IgG antibodies to SARS-CoV-2 in human serum or plasma, aiding in identifying individuals with previous exposure to the virus

- In July 2023, Siemens Healthineers launched the Atellica CI Analyzer for immunoassay and clinical chemistry testing. This analyzer received FDA clearance and is now available in many of the world's major markets, offering improved turnaround time predictability and advanced reporting functionality

- In March 2025, Beckman Coulter requested the U.S. FDA to revoke the Emergency Use Authorization (EUA) for its Access SARS-CoV-2 IgG II assay. The FDA determined that revocation was appropriate to protect public health or safety

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.