Europe Gas Barrier Membrane Market Analysis and Insights

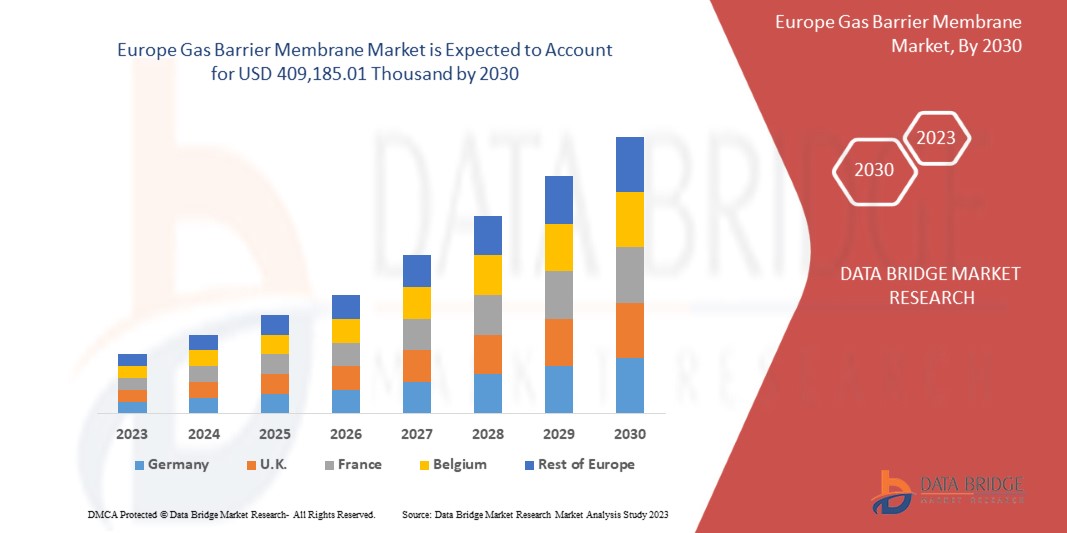

The Europe gas barrier membrane market is expected to gain significant growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyzes that the market is growing with a CAGR of 4.3% in the forecast period of 2023 to 2030 and is expected to reach USD 409,185.01 thousand by 2030. The major factors driving the market growth are an increase in the construction industry across European countries and a rise in government investments in new infrastructure projects.

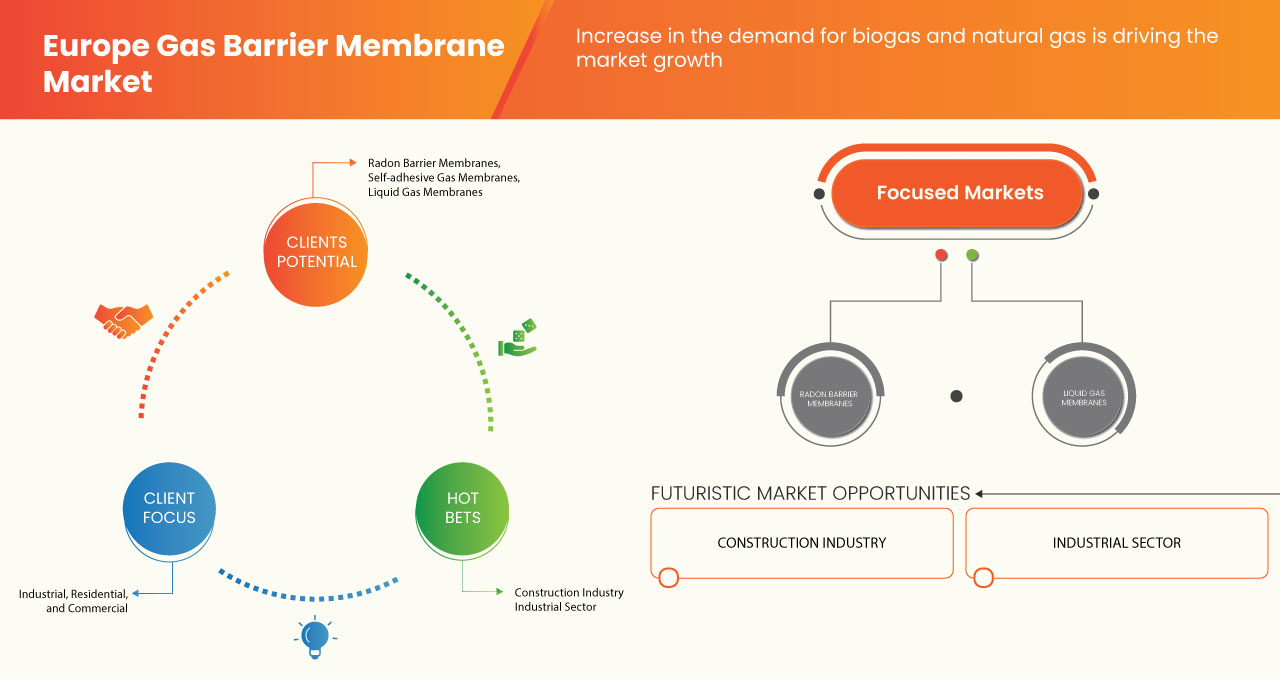

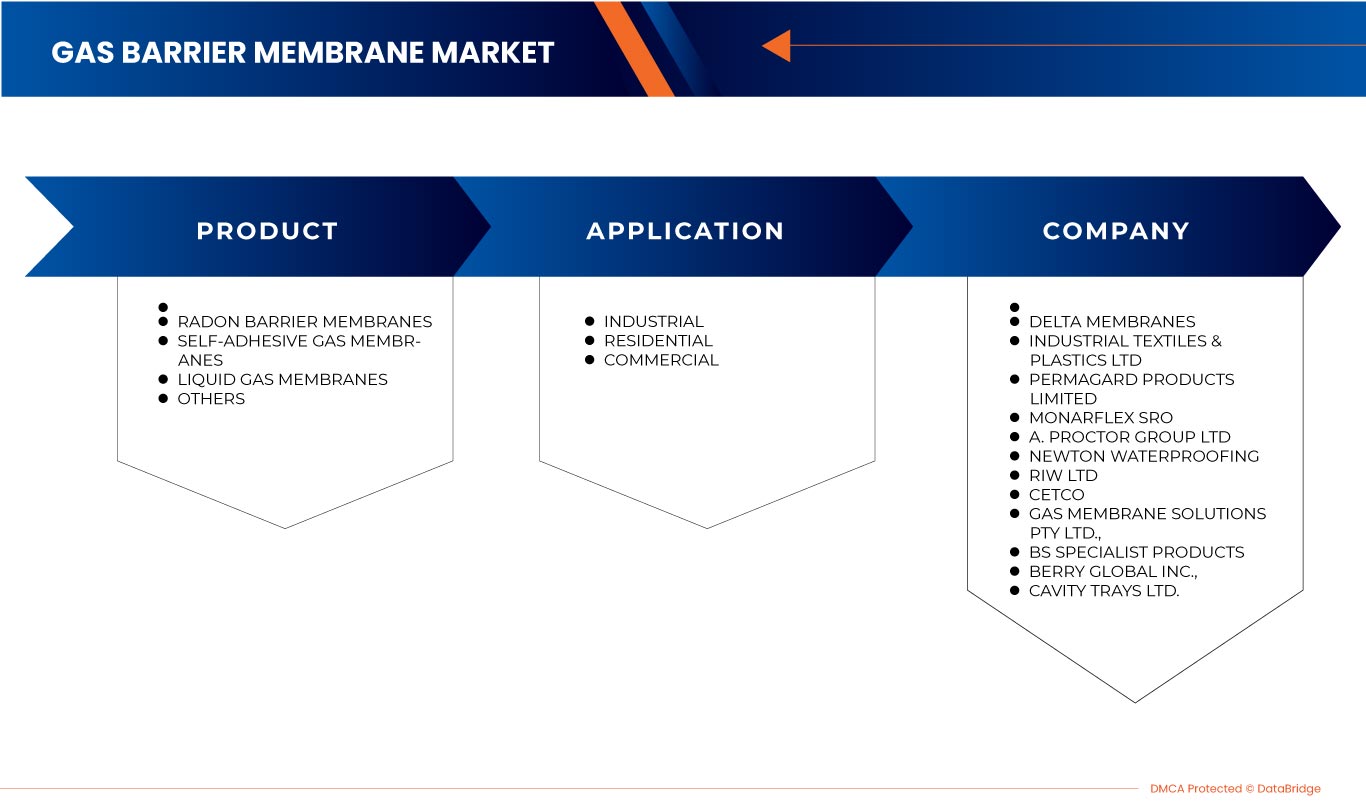

A gas barrier membrane is used in the construction of floors and in maintaining and conserving the properties of harmful ground gases such as radon, carbon-di-oxide, and methane. These are also used for gas separations in the oil and gas industry. In addition to this, they are also used in industries such as food and beverage, pharmaceutical, mining, and chemical processing. Gas barrier membranes are developed as a barrier against harmful gases emitted by contaminated land. Based on the mode of application, there are different varieties of gas barrier membranes such as radon gas barrier membranes, self-adhesive gas membranes, and liquid gas membranes. Among these, the radon gas barrier membrane is the widely used membrane.

The Europe gas barrier membrane market report provides details of market share, new developments, and the impact of domestic and localized market players, analyzes opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Year |

2021 (Customizable to 2020-2016) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

By Product (Radon Barrier Membranes, Self-Adhesive Gas Membranes, Liquid Gas Membranes, and Others), Application (Industrial, Residential, and Commercial) |

|

Countries Covered |

Germany, U.K., France, Italy, Spain, Russia, Turkey, Belgium, Netherlands, Switzerland, and Rest of Europe. |

|

Market Players Covered |

Delta Membranes, Industrial Textiles & Plastics Ltd, Permagard Products Limited, Monarflex sro, A. Proctor Group Ltd, Newton Waterproofing, RIW Ltd, CETCO, Gas Membrane Solutions Pty Ltd., BS SPECIALIST PRODUCTS, Berry Global Inc., and Cavity Trays Ltd. |

Market Definition

A gas barrier membrane is a type of membrane technology developed as a barrier against harmful ground gases such as radon, carbon dioxide, and methane. These are widely used in floor construction and the protection of commercial and residential buildings. They are made up of polymers such as polyamide and cellulose acetate. Gas barriers provide multilayer protection and help to sustain the buildings from harmful gases emitted by the contaminated land. There are different types of gas barrier membranes used for different applications such as industrial, commercial, and residential. Gas barrier membranes have become a part of modern construction regulations and are used widely for floor construction and property protection.

Europe Gas Barrier Membrane Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

DRIVERS

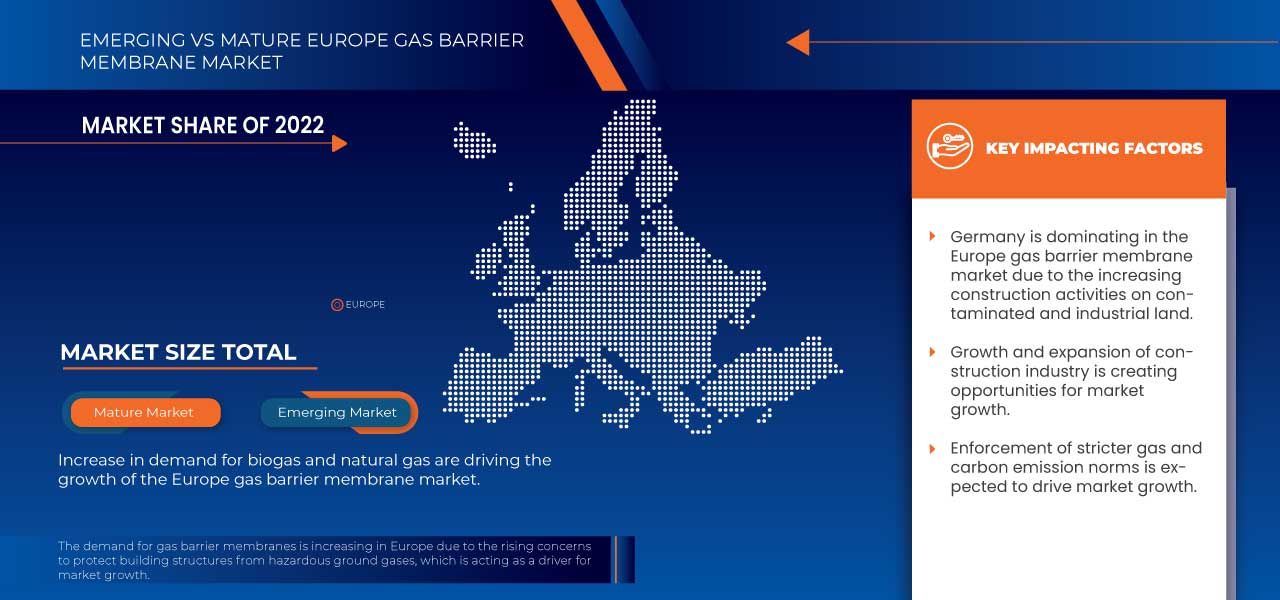

- Rising Concerns to Protect Building Structures from Hazardous Ground Gases

The Europe gas barrier membrane market is expected to grow at a significant rate in the near future owing to rising concerns to protect building structures from hazardous ground gases. Prevention of invisible and harmful gases to enter into residential and commercial structures is expected to increase the demand for these membranes that prevent gas penetration. Contaminated land emits radon and carbon dioxide gases among others from ground surfaces that can negatively impact human health, therefore, modern houses need barrier protection to prevent these. This is anticipated to help in the increased demand for gas barrier protection in these structures.

- Increasing Construction Activities on Contaminated and Industrial Land

Across the European region, the urban population is growing steadily and the demand for land is rapidly increasing. Revitalizing and remediating industrial sites and contaminated land presents an opportunity for sustainable urban development and construction of new residential and commercial buildings and reduces pressure on undisturbed land resources. Redevelopment of contaminated sites has various challenges and may cause continued environmental and health consequences if contamination risks are not properly managed or remediated. Urban areas stimulate migration from the countryside by providing employment opportunities, prospects for higher living standards, and vibrant city life. The growing urban population and associated urban sprawl pose several challenges to urban planners and local authorities.

- Increase in Demand for Biogas and Natural Gas

One of the most important applications of gas barrier membranes is the separation of carbon dioxide from gas streams. It is employed in gas sweetening, improved oil recovery, and biogas purification. The most common application for gas barrier membranes is the removal of carbon dioxide from natural gas, followed by improved oil recovery. Carbon dioxide is an acid gas that is found in high concentrations in natural gas. When it integrates with water, it becomes extremely corrosive, corroding pipelines and equipment. It also affects natural gas’s heating value and pipeline capacity. Therefore, carbon dioxide must be eliminated from Liquefied Natural Gas (LNG) plants to avoid low-temperature chillers from freezing. Carbon dioxide removal becomes a crucial separation procedure for better natural gas transmission and processing.

OPPORTUNITIES

- Growth and Expansion of Construction Industry

The rise in demand for gas barrier membranes in the building and construction sector is increasing the growth rate of the European market. Construction on contaminated land spaces gives rise to the emission of harmful gases such as methane, carbon dioxide, radon, and carbon monoxide. So, the gas barrier membranes are used as gas barrier protection as they help to protect human health and the environment from harmful gases. Thus, growth in the construction industry across European countries is likely to create immense opportunities for market growth in the near future.

- Advancements in Technologies for the Production of Gas Membranes

Manufacturers in the gas barrier membranes market are focusing on the introduction of gas membranes with multi-function capabilities such as protection from hazardous gases and waterproofing at the same time among other technological advancements. Technological developments in the product have introduced barrier membranes with reinforced polymers and integral aluminum foil and enhanced strength to sustain in heavy-weighing flooring applications.

Furthermore, the market is expected to rise due to an increase in the number of R&D efforts aimed at improving the efficacy of gas separation membranes.

- Enforcement of Stricter Gas and Carbon Emission Norms

Gas barrier membranes when installed with relevant codes of practices, provide safe solutions for the protection of buildings against various gases and chemicals that occur naturally and through contaminated land. The products’ multilayer structure, high strength, and easy installation have propelled their popularity in the European market. These barrier membranes are installed in the flooring foundation of newly built properties.

The early structural planning of the construction site complying with building standards and regulations and the use of barrier membranes can prevent harmful gases and chemicals from entering the interior of the property. Thus, builders nowadays are focusing on the installation of gas barriers for residential and commercial construction specifically for precast concrete slabs, suspended beam-and-block concrete floors, and reinforced cast-in-situ concrete floors.

RESTRAINTS/CHALLENGES

- Lack of Awareness Regarding Gas Barrier Membranes

Installation of gas barrier membranes additionally adds up to the construction costs of a building or any other space. Moreover, there is a lack of awareness regarding the installation of gas barrier membranes among end-users and consumers as not all constructors are aware of the application of gas barrier membranes as well as are not skilled in their installation. Moreover, there are several other technologies for the removal of gases such as the amine guard process, cryogenic process, pressure swing adsorption, thermal swing adsorption, and many others, which add up to the challenge to the market growth. Further, these barrier membrane techniques are widely employed in the chemical, petrochemical, and other manufacturing industries for the separation of gases. Therefore, there is awareness regarding these membranes among end-users from the residential sector. This lack of awareness regarding the benefits of gas barrier membranes is expected to act as a major challenge to the growth and development of the market.

- Upscaling and Commercializing New Membranes

Most of the gas barrier and separation membranes are created and developed in the laboratory under controlled conditions. Upscaling of new membrane technology will ensure reliability and durability. Upscaling also ensures the safe design and operation of the membrane in real operating conditions. However, testing these newly developed gas barrier membranes in the pilot plant and analyzing their performance is highly time-consuming and needs high installation and construction costs. Therefore, most of the membranes developed in recent times or years are not fully tested and are yet to be tested under real conditions, which leads to delays in their commercialization and incur huge loss to the manufacturers. The high costs and time consumption associated with the upscaling and commercializing of new gas barrier membrane products in the market pose a major challenge for the market players operating in the market.

- Lack of Skilled Workforce Required to Install These Membranes

The installation of gas barrier membranes requires a skilled workforce and detailing to achieve effective sealing across the space. Moreover, the lack of awareness about the product and its benefits along with the lack of a skilled workforce is likely to hamper its demand for gas barrier membranes.

Moreover, these membranes are available in different forms such as radon barrier membranes, self-adhesive gas membranes, liquid gas membranes, and others. Specialized membrane products are available for protection against CO2, methane, and hydrocarbons. Further, the installation of these membranes requires special components including joint tapes, top hat units, detailing tapes, drainage & venting map, heavy-duty protection board, and other equipment, which add to the cost of installation and complete gas barrier membrane set-up.

Recent Development

- In June, A. Proctor Group was awarded BBA certification for Radon 400 high-performance radon barrier membrane. In the year 2020, Newton Waterproofing was awarded National Building and Construction award. This award increased morale and improved the reputation of the organization by highlighting its achievements.

Europe Gas Barrier Membrane Market Scope

The Europe gas barrier membrane market is segmented into two notable segments based on product and application. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product

- Radon Barrier Membranes

- Self-Adhesive Gas Membranes

- Liquid Gas Membranes

- Others

Based on product, the market is segmented into radon barrier membranes, self-adhesive gas membranes, liquid gas membranes, and others.

Application

- Industrial

- Residential

- Commercial

Based on application, the market is segmented into industrial, residential, and commercial.

Europe Gas Barrier Membrane Market Regional Analysis/Insights

The Europe gas barrier membrane market is analyzed and market size information is provided based on country, product, and application.

The countries covered in this market report are Germany, U.K., France, Italy, Spain, Russia, Turkey, Belgium, Netherlands, Switzerland, and rest of Europe.

Germany is expected to dominate the Europe gas barrier membrane market due to the high number of market players present in the country and the increased consumption rate of gas barrier membranes for construction and industrial purposes.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points, downstream and upstream value chain analysis, technical test and porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of the Europe brands and the challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing a forecast analysis of the country’s data.

Competitive Landscape and Europe Gas Barrier Membrane Market Share Analysis

The Europe gas barrier membrane market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, and technology lifeline curve. The above data points provided are only related to the companies’ focus related to the market.

Some of the prominent participants operating in the Europe gas barrier membrane market are Delta Membranes, Industrial Textiles & Plastics Ltd, Permagard Products Limited, Monarflex sro, A. Proctor Group Ltd, Newton Waterproofing, RIW Ltd, CETCO, Gas Membrane Solutions Pty Ltd., BS SPECIALIST PRODUCTS, Berry Global Inc., and Cavity Trays Ltd among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 RAW MATERIAL LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 BARGAINING POWER OF SUPPLIERS

4.2.5 INTERNAL COMPETITION

4.3 PRICING INDEX

4.4 PRODUCTION CAPACITY OVERVIEW

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 RAW MATERIAL COVERAGE

4.7 SUPPLY CHAIN ANALYSIS

4.8 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.9 VENDOR SELECTION CRITERIA

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING CONCERNS TO PROTECT BUILDING STRUCTURES FROM HAZARDOUS GROUND GASES

6.1.2 INCREASING CONSTRUCTION ACTIVITIES ON CONTAMINATED AND INDUSTRIAL LAND

6.1.3 INCREASE IN DEMAND FOR BIOGAS AND NATURAL GAS

6.2 RESTRAINTS

6.2.1 FLUCTUATIONS AND INSTABILITY IN THE CONSTRUCTION INDUSTRY

6.2.2 LACK OF SKILLED WORKFORCE REQUIRED TO INSTALL THESE MEMBRANES

6.3 OPPORTUNITIES

6.3.1 GROWTH AND EXPANSION OF THE CONSTRUCTION INDUSTRY

6.3.2 ADVANCEMENTS IN TECHNOLOGIES FOR THE PRODUCTION OF GAS MEMBRANES

6.3.3 ENFORCEMENT OF STRICTER GAS AND CARBON EMISSION NORMS

6.4 CHALLENGES

6.4.1 LACK OF AWARENESS REGARDING GAS BARRIER MEMBRANES

6.4.2 UPSCALING AND COMMERCIALIZING NEW MEMBRANES

7 EUROPE GAS BARRIER MEMBRANE MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 RADON BARRIER MEMBRANES

7.3 SELF-ADHESIVE GAS MEMBRANES

7.4 LIQUID GAS MEMBRANES

7.5 OTHERS

8 EUROPE GAS BARRIER MEMBRANE MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 INDUSTRIAL

8.2.1 OIL AND GAS

8.2.2 MINING

8.2.3 FOOD AND BEVERAGES

8.2.4 PHARMACEUTICALS

8.2.5 CHEMICAL PROCESSING

8.2.6 OTHERS

8.2.6.1 RADON BARRIER MEMBRANES

8.2.6.2 SELF-ADHESIVE GAS MEMBRANES

8.2.6.3 LIQUID GAS MEMBRANES

8.2.6.4 OTHERS

8.3 RESIDENTIAL

8.3.1 RADON BARRIER MEMBRANES

8.3.2 SELF-ADHESIVE GAS MEMBRANES

8.3.3 LIQUID GAS MEMBRANES

8.3.4 OTHERS

8.4 COMMERCIAL

8.4.1 RADON BARRIER MEMBRANES

8.4.2 SELF-ADHESIVE GAS MEMBRANES

8.4.3 LIQUID GAS MEMBRANES

8.4.4 OTHERS

9 EUROPE GAS BARRIER MEMBRANE MARKET, BY COUNTRY

9.1 GERMANY

9.2 U.K.

9.3 FRANCE

9.4 ITALY

9.5 RUSSIA

9.6 SPAIN

9.7 SWITZERLAND

9.8 TURKEY

9.9 BELGIUM

9.1 NETHERLANDS

9.11 REST OF EUROPE

10 COMPANY SHARE ANALYSIS: EUROPE

10.1 AWARD

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 CETCO

12.1.1 COMPANY SNAPSHOT

12.1.2 SWOT ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT UPDATES

12.2 GAS MEMBRANE SOLUTIONS PTY LTD

12.2.1 COMPANY SNAPSHOT

12.2.2 SWOT ANALYSIS

12.3 RIWA LTD

12.3.1 COMPANY SNAPSHOT

12.3.2 SWOT ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT UPDATES

12.4 BERRY GLOBAL INC.

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 SWOT ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT UPDATES

12.5 INDUSTRIAL TEXTILES & PLASTICS LTD

12.5.1 COMPANY SNAPSHOT

12.5.2 SWOT ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT UPDATES

12.6 A. PROCTOR GROUP LTD.

12.6.1 COMPANY SNAPSHOT

12.6.2 SWOT ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT UPDATE

12.7 BS SPECIALIST PRODUCTS

12.7.1 COMPANY SNAPSHOT

12.7.2 SWOT ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT UPDATES

12.8 CAVITY TRAYS LTD.

12.8.1 COMPANY SNAPSHOT

12.8.2 SWOT ANALYSIS

12.8.3 PRODUCT PORTFOLIO

12.8.4 RECENT UPDATES

12.9 DELTA MEMBRANES

12.9.1 COMPANY SNAPSHOT

12.9.2 SWOT ANALYSIS

12.9.3 PRODUCT PORTFOLIO

12.9.4 RECENT UPDATES

12.1 MONARFLEX SRO

12.10.1 COMPANY SNAPSHOT

12.10.2 SWOT ANALYSIS

12.10.3 PRODUCT PORTFOLIO

12.10.4 RECENT UPDATES

12.11 NEWTON WATERPROOFING

12.11.1 COMPANY SNAPSHOT

12.11.2 SWOT ANALYSIS

12.11.3 PRODUCT PORTFOLIO

12.11.4 RECENT UPDATES

12.11.5 PRODUCT PORTFOLIO

12.11.6 RECENT UPDATES

12.12 PERMAGARD PRODUCTS LIMITED

12.12.1 COMPANY SNAPSHOT

12.12.2 SWOT ANALYSIS

12.12.3 PRODUCT PORTFOLIO

12.12.4 RECENT UPDATES

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF SELF-ADHESIVE PLATES, SHEETS, FILM, FOIL, TAPE, STRIP, AND OTHER FLAT SHAPES, OF PLASTICS ...; HS CODE – 391990 (USD THOUSAND)

TABLE 2 EXPORT DATA OF SELF-ADHESIVE PLATES, SHEETS, FILM, FOIL, TAPE, STRIP AND OTHER FLAT SHAPES, OF PLASTICS; HS CODE – 391990 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 EUROPE GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 5 EUROPE GAS BARRIER MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 6 EUROPE INDUSTRIAL IN GAS BARRIER MEMBRANE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 7 EUROPE INDUSTRIAL IN GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 8 EUROPE RESIDENTIAL IN GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 9 EUROPE COMMERCIAL IN GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 10 EUROPE GAS BARRIER MEMBRANE MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 11 GERMANY GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 12 GERMANY GAS BARRIER MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 13 GERMANY INDUSTRIAL IN GAS BARRIER MEMBRANE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 14 GERMANY INDUSTRIAL IN GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 15 GERMANY RESIDENTIAL GAS BARRIER MEMBRANE MARKET, BY PRODUCT , 2021-2030 (USD THOUSAND)

TABLE 16 GERMANY COMMERCIAL GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 17 U.K. GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 18 U.K. GAS BARRIER MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 19 U.K. INDUSTRIAL IN GAS BARRIER MEMBRANE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 20 U.K. INDUSTRIAL IN GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 21 U.K. RESIDENTIAL GAS BARRIER MEMBRANE MARKET, BY PRODUCT , 2021-2030 (USD THOUSAND)

TABLE 22 U.K. COMMERCIAL GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 23 FRANCE GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 24 FRANCE GAS BARRIER MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 25 FRANCE INDUSTRIAL IN GAS BARRIER MEMBRANE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 26 FRANCE INDUSTRIAL IN GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 27 FRANCE RESIDENTIAL GAS BARRIER MEMBRANE MARKET, BY PRODUCT , 2021-2030 (USD THOUSAND)

TABLE 28 FRANCE COMMERCIAL GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 29 ITALY GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 30 ITALY GAS BARRIER MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 31 ITALY INDUSTRIAL IN GAS BARRIER MEMBRANE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 32 ITALY INDUSTRIAL IN GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 33 ITALY RESIDENTIAL GAS BARRIER MEMBRANE MARKET, BY PRODUCT , 2021-2030 (USD THOUSAND)

TABLE 34 ITALY COMMERCIAL GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 35 RUSSIA GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 36 RUSSIA GAS BARRIER MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 37 RUSSIA INDUSTRIAL IN GAS BARRIER MEMBRANE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 38 RUSSIA INDUSTRIAL IN GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 39 RUSSIA RESIDENTIAL GAS BARRIER MEMBRANE MARKET, BY PRODUCT , 2021-2030 (USD THOUSAND)

TABLE 40 RUSSIA COMMERCIAL GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 41 SPAIN GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 42 SPAIN GAS BARRIER MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 43 SPAIN INDUSTRIAL IN GAS BARRIER MEMBRANE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 44 SPAIN INDUSTRIAL IN GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 45 SPAIN RESIDENTIAL GAS BARRIER MEMBRANE MARKET, BY PRODUCT , 2021-2030 (USD THOUSAND)

TABLE 46 SPAIN COMMERCIAL GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 47 SWITZERLAND GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 48 SWITZERLAND GAS BARRIER MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 49 SWITZERLAND INDUSTRIAL IN GAS BARRIER MEMBRANE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 50 SWITZERLAND INDUSTRIAL IN GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 51 SWITZERLAND RESIDENTIAL GAS BARRIER MEMBRANE MARKET, BY PRODUCT , 2021-2030 (USD THOUSAND)

TABLE 52 SWITZERLAND COMMERCIAL GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 53 TURKEY GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 54 TURKEY GAS BARRIER MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 55 TURKEY INDUSTRIAL IN GAS BARRIER MEMBRANE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 56 TURKEY INDUSTRIAL IN GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 57 TURKEY RESIDENTIAL GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 58 TURKEY COMMERCIAL GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 59 BELGIUM GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 60 BELGIUM GAS BARRIER MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 61 BELGIUM INDUSTRIAL IN GAS BARRIER MEMBRANE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 62 BELGIUM INDUSTRIAL IN GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 63 BELGIUM RESIDENTIAL GAS BARRIER MEMBRANE MARKET, BY PRODUCT , 2021-2030 (USD THOUSAND)

TABLE 64 BELGIUM COMMERCIAL GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 65 NETHERLANDS GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 66 NETHERLANDS GAS BARRIER MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 67 NETHERLANDS INDUSTRIAL IN GAS BARRIER MEMBRANE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 68 NETHERLANDS INDUSTRIAL IN GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 69 NETHERLANDS RESIDENTIAL GAS BARRIER MEMBRANE MARKET, BY PRODUCT , 2021-2030 (USD THOUSAND)

TABLE 70 NETHERLANDS COMMERCIAL GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 71 REST OF EUROPE GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

List of Figure

FIGURE 1 EUROPE GAS BARRIER MEMBRANE MARKET

FIGURE 2 EUROPE GAS BARRIER MEMBRANE MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE GAS BARRIER MEMBRANE MARKET: DROC ANALYSIS

FIGURE 4 EUROPE GAS BARRIER MEMBRANE MARKET: EUROPE MARKET ANALYSIS

FIGURE 5 EUROPE GAS BARRIER MEMBRANE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE GAS BARRIER MEMBRANE MARKET: THE RAW MATERIAL LIFELINE CURVE

FIGURE 7 EUROPE GAS BARRIER MEMBRANE MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE GAS BARRIER MEMBRANE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE GAS BARRIER MEMBRANE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE GAS BARRIER MEMBRANE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 EUROPE GAS BARRIER MEMBRANE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE GAS BARRIER MEMBRANE MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE GAS BARRIER MEMBRANE MARKET: SEGMENTATION

FIGURE 14 RISING CONCERNS TO PROTECT THE BUILDING STRUCTURES FROM HAZARDOUS GROUND GASES ARE EXPECTED TO DRIVE EUROPE GAS BARRIER MEMBRANE MARKET IN THE FORECAST PERIOD

FIGURE 15 RADON BARRIER MEMBRANES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE GAS BARRIER MEMBRANE MARKET IN 2023 AND 2030

FIGURE 16 PRICE ANALYSIS FOR EUROPE GAS BARRIER MEMBRANE MARKET (USD/METER)

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE GAS BARRIER MEMBRANE MARKET

FIGURE 18 EUROPE GAS BARRIER MEMBRANE MARKET, BY PRODUCT, 2022

FIGURE 19 EUROPE GAS BARRIER MEMBRANE MARKET, BY APPLICATION, 2022

FIGURE 20 EUROPE GAS BARRIER MEMBRANE MARKET: SNAPSHOT (2022)

FIGURE 21 EUROPE GAS BARRIER MEMBRANE MARKET: BY COUNTRY (2022)

FIGURE 22 EUROPE GAS BARRIER MEMBRANE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 EUROPE GAS BARRIER MEMBRANE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 EUROPE GAS BARRIER MEMBRANE MARKET: BY PRODUCT (2023-2030)

FIGURE 25 EUROPE GAS BARRIER MEMBRANE MARKET: COMPANY SHARE 2022 (%)

Europe Gas Barrier Membrane Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Gas Barrier Membrane Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Gas Barrier Membrane Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.