Europe CBCT Dental Imaging Market, By Type (Systems, Detectors, and Softwares), Field of View (Large, Medium, and Small), Device Type (Patient Position) (Standing, Seated, and Supine), Application (Dental Implants, Endodontics, General Dentistry, Oral and Maxillofacial Surgery, Orthodontics, Temporomandibular Joint (TMJ) Disorders, Periodontics, Forensic Dentistry, and Others), End User (Hospitals & Dental Clinics, Academics and Research Institutes, and Others) - Industry Trends and Forecast to 2030.

Europe CBCT Dental Imaging Market Analysis and Insights

The growing prevalence of dental infection and disorders in the region and the rise in the population of all age groups is enhancing the demand for the market. The rising healthcare expenditure for better healthcare services is also attributed to market growth. The major market players are highly focusing on product launches during this crucial period. In addition, the government and regulatory bodies are supporting market players with product approval due to surging emergence. The market is growing in the forecast year due to the rise in market players and the availability of imaging consumables products. The market is supportive and aims to reduce the progression of dental disorders.

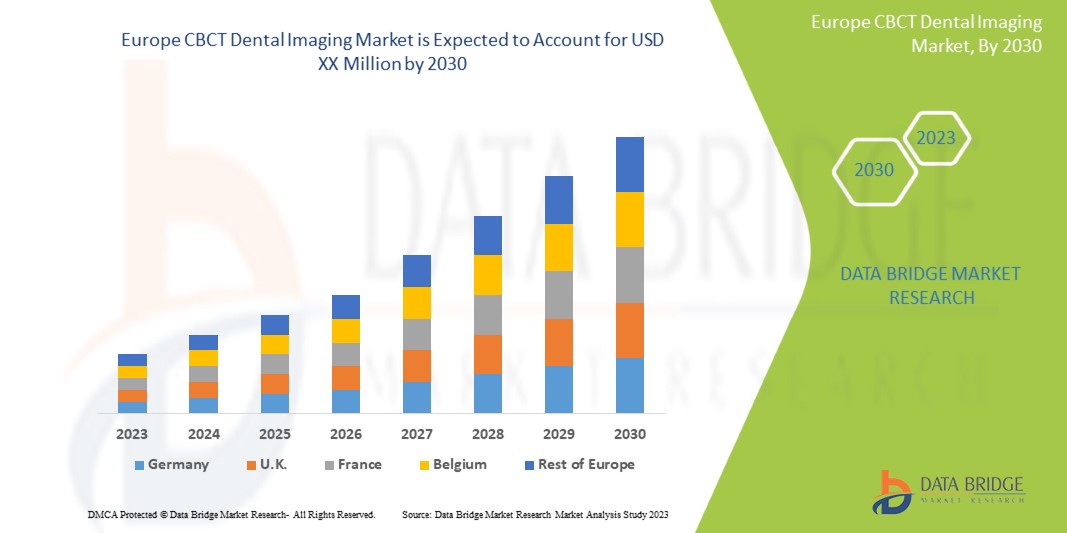

Data Bridge Market Research analyzes that the Europe CBCT dental imaging market is expected to grow at a CAGR of 9.8% during the forecast period of 2023 to 2030.

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Year

|

2021 (Customizable to 2015 - 2020)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

Type (Systems, Detectors, and Softwares), Field of View (Large, Medium, and Small), Device Type (Patient Position) (Standing, Seated, and Supine), Application (Dental Implants, Endodontics, General Dentistry, Oral and Maxillofacial Surgery, Orthodontics, Temporomandibular Joint (TMJ) Disorders, Periodontics, Forensic Dentistry, and Others), End User (Hospitals & Dental Clinics, Academics and Research Institutes, and Others)

|

|

Countries Covered

|

Germany, France, U.K, Italy, Spain, Netherlands, Russia, Belgium, Switzerland, Turkey, and Rest of Europe

|

|

Market Players Covered

|

Carestream Health., Cefla s.c., Midmark Corporation, Dentsply Sirona, PLANMECA OY, Carestream Dental LLC., KaVo Dental, GENORAY CO., LTD., J. MORITA TOKYO MFG. CORP., acteon, Air Techniques, (Subsidiary Dental Imaging Technologies Corporation, VATECH, DÜRR DENTAL SE, TAKARA BELMONT Corp., PreXion, FONA srl, ASAHIROENTGEN IND.CO.,LTD., Owandy Radiology, and PINGSENG Healthcare among others

|

Market Definition

Cone beam computed tomography (CBCT) in dental imaging is referred to as a special type of X-ray machine used in situations where regular dental X-rays are not sufficient. It is not commonly used because the radiation exposure from this scanner is significantly more than from regular dental X-rays. It uses a special type of technology to generate three-dimensional (3-D) images of dental structures, soft tissues, and nerve paths in a single scan.

The growing prevalence of dental disorders and increasing demand for dental care services and advancements in CBCT dental imaging technologies and software are the key factors driving the market growth. In addition, government initiatives to promote oral health awareness and dental care services are driving the market growth.

Europe CBCT Dental Imaging Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

DRIVERS

- Growing Prevalence of Dental Disorders and Increasing Demand for Dental Care Services

In recent years, the prevalence of dental diseases has increased, which has increased the demand for dental services. Several factors are driving this trend, such as an aging population, poor oral hygiene, diet, lifestyle, increased awareness, and advances in technology and innovation.

As people age, they are more prone to dental problems such as tooth decay, gum disease, and tooth loss. This is caused by several factors, including changes in hormone levels, decreased saliva production, and a weakened immune system. The aging population has increased the demand for dental services, especially restorative and cosmetic procedures.

Poor oral hygiene is another important factor affecting the prevalence of dental diseases. Despite advances in oral health, many people neglect their oral health. Failure to brush and floss regularly can lead to plaque buildup, which can lead to cavities, gum disease, and bad breath.

- Advancements in CBCT Dental Imaging Technologies and Software

One of the most important advances in CBCT imaging technology is the increased resolution of the images. Higher resolution images allow more accurate and precise diagnosis of diseases related to teeth and jaws. This is particularly useful in implant dentistry because it allows better visualization of bone structure and tooth position, which can help determine the optimal placement of dental implants.

Another improvement is the increased firing rate. With newer CBCT machines, images are obtained in 5-10 seconds, reducing the patient's exposure to radiation and improving the dental office's efficiency. This is particularly useful for patients who have difficulty sitting still for long periods or who require multiple scans.

In addition, new software developments have made CBCT images easier to process and analyze. 3D imaging software enables better visualization of images, and measuring devices can accurately measure image structures and distances. This makes it easier for dentists to diagnose and plan treatment for various diseases.

OPPORTUNITY

- Growing Adoption of Digital Dentistry

Digital dentistry means the use of digital technologies in dental practice, from diagnosis and treatment planning to the manufacture of dental fillings. With the advancement of technology, digital dentistry has become more common in recent years.

Some of the advantages of the adoption of digital dentistry are:

- Improved Accuracy: Digital technologies such as intraoral scanners, 3D imaging, and Computer-Aided Design (CAD) software provide dentists with highly accurate and precise measurements of a patient's teeth and gums. This helps improve the quality of treatment planning and the preparation of dental fillings.

- Better Patient Experience: Digital dentistry reduces the need for traditional dental impressions, which can be uncomfortable and confusing for patients. Intraoral scanners enable fast and convenient digital reproduction, making the experience more pleasant for patients.

Thus, the growing adoption of digital dentistry is expected to act as an opportunity for market growth.

RESTRAINT/CHALLENGE

- Lack of Skilled Professionals to Operate CBCT Dental Imaging Systems

The shortage of skills is already impacting the nation, with an increasing number of people being forced to wait more than six months for their dental treatments. There is a shortage of skilled professionals in the field of CBCT dental imaging in emerging or developing countries due to technical advancements, basic infrastructure, and several other factors.

The lack of skilled professionals is partly due to the rigorous education and training required to become a dental professional as well as the competitive job market. Moreover, skilled dentists need more formally-trained, licensed dental assistants to help maintain and increase access to oral healthcare to operate and execute advanced technological systems such as CBCT dental imaging systems.

The emerging countries lack skilled professionals who cannot operate the new technologies effectively. This might create a challenge in the market for new technologies to emerge as these countries are delaying the onset of technologically driven advancements in the market.

Post-COVID-19 Impact on the Europe CBCT Dental Imaging Market

The high burden of COVID-19 on healthcare systems around the world has raised concerns among medical oncologists about the impact of COVID-19 on CBCT dental imaging. We investigated the impact of COVID-19 on CBCT dental imaging before and after the COVID-19 era in this retrospective cohort study. During the pandemic, CBCT dental imaging decreased with slightly more advanced stages of the dental disorders, and there was a significant increase in dental surgery and imaging as the first definitive treatment and a decrease in both systemic treatment and surgery compared to the pre-COVID-19 era. When compared to pre-COVID-19 times, there was no significant delay in starting dental imaging and treatment during the pandemic.

During the pandemic, however, we observed a delay in dental surgery. COVID-19 appears to have had a significant impact on CBCT dental imaging diagnoses and treatment patterns. Many dental practitioners are concerned that the number of newly diagnosed dental disorder patients will rise in the coming year. This research is still ongoing, and more information will be gathered and analyzed to better understand the overall impact of the COVID-19 pandemic on the CBCT dental imaging patient population.

Recent Developments

- In October 2022, Carestream Dental LLC. announced its partnership with Overjet, the industry leader in dental Artificial Intelligence (AI). The partnership gives Carestream Dental LLC.’s customers access to Overjet’s AI-powered X-ray analysis tool that detects decay, quantifies bone loss, and highlights other areas of concern. This partnership increased the product portfolio and helped to increase the revenue of the company.

- In March 2021, Air Techniques announced its partnership with SICAT which includes a software partnership for ProVecta 3D Prime CBCT users and FlowStar Nitrous Oxide Nasal Hoods/FlowStar Scavenging Circuits. The company believes that this would help to bring a true digital hybrid solution for the all-new SensorX Intraoral Sensor and ScanX Duo Touch Scanners.

Europe CBCT Dental Imaging Market Segmentation

The Europe CBCT dental imaging market is segmented into five notable segments based on type, field of view, device type (patient position), application, and end user. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

Type

- Systems

- Detectors

- Softwares

On the basis of type, the market is segmented into systems, detectors, and softwares.

Field of View

- Small

- Medium

- Large

On the basis of field of view, the market is segmented into large, medium, and small.

Device Type (Patient Position)

- Standing

- Seated

- Supine

On the basis of device type (patient position), the market is segmented into standing, seated, and supine.

Application

- Dental Implants

- Orthodontics

- Endodontics

- Oral and Maxillofacial Surgery

- General Dentistry

- Temporomandibular Joint (TMJ) Disorders

- Periodontics

- Forensic Dentistry

- Others

On the basis of application, the market is segmented into dental implants, endodontics, general dentistry, oral and maxillofacial surgery, orthodontics, temporomandibular Joint (TMJ) disorders, periodontics, forensic dentistry, and others.

End User

- Hospitals & Dental Clinics

- Academics and Research Institutes

- Others

On the basis of end user, the market is segmented into hospitals & dental clinics, academics and research institutes, and others.

Europe CBCT Dental Imaging Market Regional Analysis/Insights

The Europe CBCT dental imaging market is analyzed, and market size insights and trends are provided based on type, field of view, device type (patient position), application, and end user.

The countries covered in this market report are Germany, France, U.K, Italy, Spain, Netherlands, Russia, Switzerland, Turkey, Belgium, and Rest of Europe.

Germany is expected to dominate the Europe CBCT dental imaging market due to the increasing technology and reliability of healthcare services, which are also delivering infotainment services. The demand in this region is projected to be driven by a rise in dental diseases with the growing integration of healthcare data with portable devices.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as downstream and upstream value chain analysis, technical trends, Porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of regional brands and their challenges faced due to large or scarce competition from local and domestic brands and the impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe CBCT Dental Imaging Market Share Analysis

The Europe CBCT dental imaging market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, regional presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on the market.

Some of the major market players operating in the market are Carestream Health., Cefla s.c., Midmark Corporation, Dentsply Sirona, PLANMECA OY, Carestream Dental LLC., KaVo Dental, GENORAY CO., LTD., J. MORITA TOKYO MFG. CORP., acteon, Air Techniques, (Subsidiary Dental Imaging Technologies Corporation, VATECH, DÜRR DENTAL SE, TAKARA BELMONT Corp., PreXion, FONA srl, ASAHIROENTGEN IND.CO., LTD., Owandy Radiology, and PINGSENG Healthcare among others.

SKU-