Europe and U.S. Lubricants Market Analysis and Size

The market is expected to grow significantly in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the Europe and U.S. lubricants market is growing with a CAGR of 2.8% in the forecast period of 2023 to 2030 and is expected to reach USD 54,663.48 million by 2030. The growing use of lubricants in various industries has been the major driver for the market.

The Europe and U.S. lubricants market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an analyst brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volume in Kilo Tons |

|

Segments Covered |

Product (Engine Oils, Hydraulic Oils, Circulation Fluids, Gear Oil, Grease, Metalworking Fluids, Wind Turbine Oils, Compressor Oils, Gas Turbine Oils, Heat Transfer Oils, Rust Preventive Oils, and Others), Base Oil (Mineral Oil, Synthetic Oil, Semi-Synthetic Oil, and Bio-Based Oil), Sales Channel (B2B and B2C), End Use (Automotive, General Manufacturing, Electrical/Utility, Building & Construction, Marine, Agriculture, Mining, Aviation/Aerospace, and Food & Beverages) |

|

Countries Covered |

U.S., Germany, U.K., France, Poland, and Rest of Europe |

|

Market Players Covered |

Exxon Mobil Corporation, Shell, TotalEnergies, Chevron Corporation, BP p.l.c., FUCHS, Repsol, Eni S.p.A., Quaker Chemical Corporation d/b/a Quaker Houghton, Valvoline Inc., BASF SE, and LANXESS, among others |

Europe and U.S. Lubricants Market Definition

Lubricants are organic compounds employed to minimize friction and heat generation between interacting surfaces. They may also possess properties for conveying forces and particles or regulating temperature, with the expectation of maintaining their effectiveness at elevated temperatures.

Europe and U.S. Lubricants Market Dynamics

This section deals with understanding the market drivers, opportunities, challenges, and restraints. All of this is discussed in detail below:

Drivers

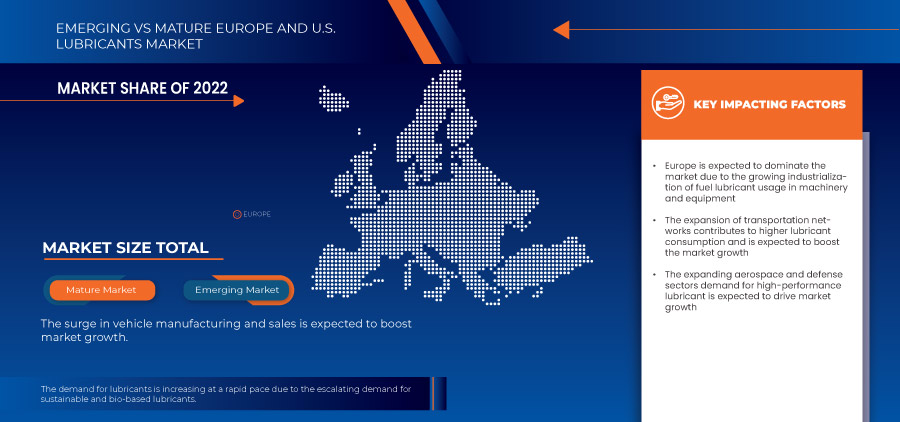

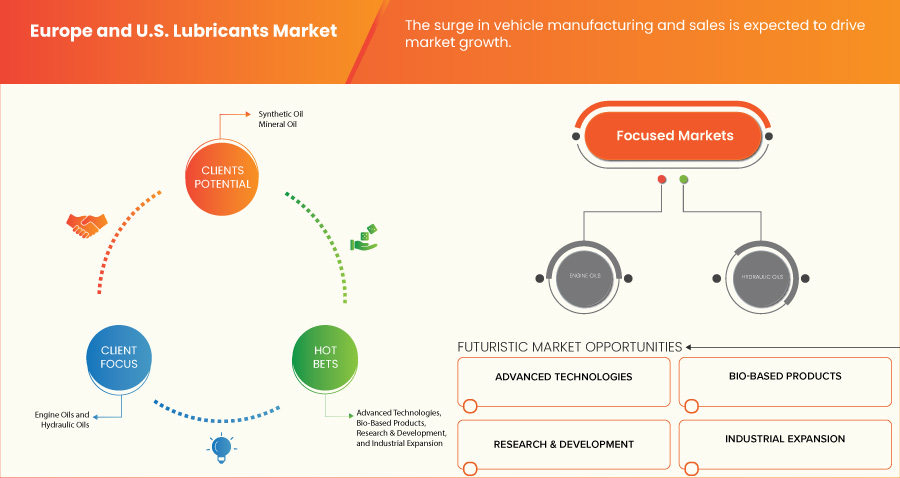

- The Surge in Vehicle Manufacturing and Sales

The surge in vehicle manufacturing and sales has emerged as a significant driver for the market. This surge has several interrelated factors that contribute to its impact on the lubricants industry.

Rapid expansion of the automotive industry: The Europe and U.S. automotive industry has witnessed remarkable growth, driven by rising consumer demand, expanding middle-class populations in emerging economies, and increasing urbanization. There has been a surge in vehicle manufacturing to meet this demand, as more people aspire to own vehicles. This, in turn, leads to higher lubricant consumption, as vehicles require lubricants for engine performance and maintenance.

- Growing Industrialization Fuels Lubricant Usage in Machinery and Equipment

Growing industrialization is a pivotal driver for the market, significantly impacting lubricant consumption and the overall industry landscape. This driver encompasses a wide range of factors that underscore the symbiotic relationship between industrialization and lubricants.

Industrial Expansion - Industrialization with economic growth and the establishment of manufacturing facilities across various sectors, including automotive, machinery, aerospace, and energy. The demand for lubricants in machinery and equipment also grows, as industries expand.

Energy Sector - The energy sector, comprising oil and gas exploration, power generation, and renewable energy installations, relies heavily on lubricants for critical applications. Lubricants are essential in maintaining the integrity of equipment used in drilling, refining, and power generation processes.

Opportunities

- Escalating Demand for Sustainable and Bio-Based Lubricants

Escalating demand for sustainable and bio-based lubricants presents a significant opportunity for the market. Industries and consumers are actively seeking lubricant solutions that are not only effective but also environmentally friendly, as environmental concerns continue to gain momentum. This shift in demand has opened up several avenues for growth and innovation within the lubricants industry.

One of the key opportunities lies in the development and production of bio-based lubricants. These lubricants are derived from renewable resources such as plant oils, animal fats, and even microbial sources. Different from traditional mineral oil-based lubricants, bio-based lubricants have the advantage of being biodegradable and less harmful to the environment. They also offer improved biodegradability and reduced toxicity, making them a preferred choice in applications where environmental impact is a concern.

- Continued Industrial Expansion Offers a Substantial Market Growth Opportunity

Continued industrial expansion presents a substantial growth opportunity for the market. The demand for lubricants across various sectors is expected to surge, as economies evolve and industrialization remains a driving force. This opportunity arises from the indispensable role lubricants play in maintaining the efficiency, performance, and longevity of industrial machinery and equipment.

The rapid urbanization and infrastructure development witnessed in emerging economies. The need for heavy machinery and equipment increases significantly, as these countries invest in building and upgrading infrastructure, such as roads, bridges, airports, and manufacturing facilities. Lubricants are critical for ensuring the smooth operation of these machines, reducing friction, and preventing wear and tear. Moreover, the expansion of construction and infrastructure projects often requires specialized lubricants designed to withstand extreme conditions, further driving demand.

Restraints/Challenges

- Fluctuations in Crude Oil Prices Affect the Cost of Lubricant Production

Fluctuations in crude oil prices act as a significant restraint for the market. Crude oil serves as the primary raw material for lubricant production, and its price volatility can have profound implications for the industry. Several factors contribute to the restraint posed by crude oil price fluctuations.

For instance, Oil prices rose by USD 1 after Russia announced a ban on most fuel exports. Morgan Stanley increased its Brent forecast due to Saudi-Russia production cuts but cautioned that USD 100 per barrel was a "stretched" target.

Firstly, these fluctuations introduce variability in input costs. The cost of crude oil directly affects the manufacturing costs of base oils, additives, and other raw materials used in lubricant formulations. Such cost fluctuations can be sudden and unpredictable, challenging manufacturers to manage production expenses effectively. The uncertainty in crude oil prices creates pricing challenges. The lubricants market operates in a competitive environment, and rapid price changes in crude oil can disrupt pricing strategies. Manufacturers may find it challenging to pass on increased costs to customers promptly, potentially eroding profit margins during periods of rising crude oil prices.

- Highly Competitive Lubricant Industry Manufacturers Requires Constant Innovation and Differentiation

The market faces a formidable challenge driven by the highly competitive nature of the industry. Lubricant manufacturers operate in a dynamic environment where innovation and differentiation are essential for survival and success. This challenge is multi-faceted and demands continuous efforts to stay ahead in the fiercely competitive landscape.

The primary challenge in the market is the need for constant innovation. Lubricants play a critical role in machinery and equipment maintenance, and their performance directly impacts the efficiency, reliability, and lifespan of these assets. Lubricant manufacturers must continually innovate to develop formulations that address specific challenges and requirements, as industries and applications become more demanding and diverse.

Recent Development

- In June 2023, Shell Lubricants (Shell) and Ducati Corse cooperated to develop a new high-performance motorcycle oil particularly intended for the new Ducati Panigale V4 R with dry clutch – the closest production model to a racing motorcycle ever manufactured. It employs Shell's unique PurePlus technology to power and safeguard Ducati engines by minimizing friction to enhance power, preventing the engine from wear, and maintaining gearbox performance

- In September 2023, Lubmarine was at IMPA London 2023, a global gathering of maritime procurement experts. Visit Booth 15 to explore lubrication strategies supporting the industry's low-carbon transition beyond 2030

- In February 2023, CASTROL LIMITED announced a redesigned brand with a new appearance and feel. The brand makeover is intended to better represent the company's distinctive market positioning and the potential it sees in satisfying consumers' shifting requirements. Their dedication to investing in the future and providing new prospects for development and success is reflected in their refreshed brand identity

- In August 2022, Exxon Mobil Corporation established a strategic agreement with THINK Gas Distribution Pvt Ltd., a company specializing in the distribution of clean fuel to customers, to sell its line of Compressed Natural Gas (CNG) lubricants for passenger and commercial vehicles. This collaboration will make Mobil's specialty gas engine oil supplies available at THINK Gas-owned and managed outlets across India Regional Analysis

Europe and U.S. Lubricants Market Scope

The Europe and U.S. Lubricants market is categorized based on product, base oil, sales channel, and end-use. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product

- Engine Oils

- Hydraulic Oils

- Circulation Fluids

- Gear Oil

- Grease

- Metalworking Fluids

- Wind Turbine Oils

- Compressor Oils

- Gas Turbine Oils

- Heat Transfer Oils

- Rust Preventive Oils

- Others

On the basis of product, the market is segmented engine oil, hydraulic oil, circulation fluids, gear oil, grease, metalworking fluids, wind turbine oils, compressor oils, gas turbine oils, heat transfer oils, rust preventive oils, and others.

Base Oil

- Mineral Oil

- Synthetic Oil

- Semi-Synthetic Oil

- Bio-Based Oil

On the basis of base oil, the market is segmented into mineral oil, synthetic oil, semi-synthetic oil, and bio-based oil.

Sales Channel

- B2B

- B2C

On the basis of sales channel, the market is segmented into B2B and B2C.

End-Use

- Automotive

- General Manufacturing

- Electrical/Utility

- Building & Construction

- Marine

- Agriculture

- Mining

- Aviation/Aerospace

- Food & Beverage

On the basis of end-use, the market is segmented into automotive, general manufacturing, electrical/utility, building & construction, marine, agriculture, mining, aviation/aerospace, and food & beverage.

Europe and U.S. Lubricants Market Regional Analysis/Insights

The Europe and U.S. lubricants market is segmented on the basis of product, base oil, sales channel, and end-use.

The countries covered in the Europe and U.S. lubricants market are U.S., Germany, U.K., France, Poland, and Rest of Europe.

Germany is expected to dominate the market due to the increasing demand in the automotive industry.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of regional brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe and U.S. Lubricants Market Share Analysis

The Europe and U.S. lubricants market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the market.

Some of the major market players operating in the market are Exxon Mobil Corporation, Shell, TotalEnergies, Chevron Corporation, BP p.l.c., FUCHS, Repsol, Eni S.p.A., Quaker Chemical Corporation d/b/a Quaker Houghton, Valvoline Inc., BASF SE, and LANXESS, among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE AND U.S. LUBRICANTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USE COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 THE SURGE IN VEHICLE MANUFACTURING AND SALES

5.1.2 GROWING INDUSTRIALIZATION FUELS LUBRICANT USAGE IN MACHINERY AND EQUIPMENT

5.1.3 THE EXPANSION OF TRANSPORTATION NETWORKS CONTRIBUTES TO HIGHER LUBRICANT CONSUMPTION

5.1.4 THE EXPANDING AEROSPACE AND DEFENSE SECTORS DEMAND HIGH-PERFORMANCE LUBRICANT

5.2 RESTRAINTS

5.2.1 FLUCTUATIONS IN CRUDE OIL PRICES AFFECT THE COST OF LUBRICANT PRODUCTION

5.2.2 INCREASING ENVIRONMENTAL CONSCIOUSNESS

5.3 OPPORTUNITIES

5.3.1 ESCALATING DEMAND FOR SUSTAINABLE AND BIO-BASED LUBRICANTS

5.3.2 CONTINUED INDUSTRIAL EXPANSION OFFERS A SUBSTANTIAL MARKET GROWTH OPPORTUNITY

5.3.3 THE CONTINUOUS EVOLUTION OF LUBRICANT TECHNOLOGY

5.4 CHALLENGES

5.4.1 HIGHLY COMPETITIVE LUBRICANT INDUSTRY MANUFACTURERS REQUIRES CONSTANT INNOVATION AND DIFFERENTIATION

5.4.2 RESISTANCE TO SWITCHING FROM CONVENTIONAL LUBRICANTS TO MORE EXPENSIVE ALTERNATIVES

6 EUROPE LUBRICANTS MARKET: BY SNAPSHOT (2022)

7 COMPANY LANDSCAPE

7.1 COMPANY SHARE ANALYSIS: EUROPE

7.2 COMPANY SHARE ANALYSIS: U.S.

7.3 EVENT

7.4 INVESTMENT

7.5 BRAND REFRESH

7.6 NEW PLANT

7.7 PARTNERSHIP

7.8 COLLABORATION

7.9 EXPANSION

7.1 ACQUISITION

7.11 CERTIFICATION

7.12 PRODUCT LAUNCH

8 SWOT ANALYSIS

9 COMPANY PROFILES

9.1 SHELL

9.1.1 COMPANY SNAPSHOT

9.1.2 REVENUE ANALYSIS

9.1.3 PRODUCT PORTFOLIO

9.1.4 RECENT DEVELOPMENTS

9.2 CHEVRON CORPORATION

9.2.1 COMPANY SNAPSHOT

9.2.2 REVENUE ANALYSIS

9.2.3 PRODUCT PORTFOLIO

9.2.4 RECENT DEVELOPMENT

9.3 REPSOL

9.3.1 COMPANY SNAPSHOT

9.3.2 REVENUE ANALYSIS

9.3.3 PRODUCT PORTFOLIO

9.3.4 RECENT DEVELOPMENT

9.4 ENI S.P.A.

9.4.1 COMPANY SNAPSHOT

9.4.2 REVENUE ANALYSIS

9.4.3 PRODUCT PORTFOLIO

9.4.4 RECENT DEVELOPMENT

9.5 FUCHS

9.5.1 COMPANY SNAPSHOT

9.5.2 REVENUE ANALYSIS

9.5.3 PRODUCT PORTFOLIO

9.5.4 RECENT DEVELOPMENTS

9.6 BP P.L.C.

9.6.1 COMPANY SNAPSHOT

9.6.2 REVENUE ANALYSIS

9.6.3 PRODUCT PORTFOLIO

9.6.4 RECENT DEVELOPMENTS

9.7 VALVOLINE INC.

9.7.1 COMPANY SNAPSHOT

9.7.2 REVENUE ANALYSIS

9.7.3 PRODUCT PORTFOLIO

9.7.4 RECENT DEVELOPMENTS

10 QUESTIONNAIRE

11 RELATED REPORTS

List of Figure

FIGURE 1 EUROPE AND U.S. LUBRICANTS MARKET: SEGMENTATION

FIGURE 2 EUROPE AND U.S. LUBRICANTS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE AND U.S. LUBRICANTS MARKET: DROC ANALYSIS

FIGURE 4 U.S. LUBRICANTS MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE LUBRICANTS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 6 U.S. AND EUROPE LUBRICANTS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 7 EUROPE AND U.S. LUBRICANTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE LUBRICANTS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 U.S. LUBRICANTS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE LUBRICANTS MARKET: MARKET END USE COVERAGE GRID

FIGURE 11 U.S LUBRICANTS MARKET: MARKET END USE COVERAGE GRID

FIGURE 12 EUROPE AND U.S. LUBRICANTS MARKET: SEGMENTATION

FIGURE 13 GROWING INDUSTRIALIZATION FUELS LUBRICANTS USAGE IN MACHINERY AND EQUIPMENT IS EXPECTED TO DRIVE THE GROWTH OF THE EUROPE LUBRICANTS MARKET IN THE FORECAST PERIOD FROM 2023 TO 2030

FIGURE 14 THE SURGE IN VEHICLE MANUFACTURING AND SALES IS EXPECTED TO DRIVE THE GROWTH OF THE U.S. LUBRICANTS MARKET IN THE FORECAST PERIOD FROM 2023 TO 2030

FIGURE 15 THE ENGINE OILS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE LUBRICANTS MARKET IN 2023 AND 2030

FIGURE 16 THE ENGINE OILS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. LUBRICANTS MARKET IN 2023 AND 2030

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE AND U.S. LUBRICANTS MARKET

FIGURE 18 EUROPE LUBRICANTS MARKET: COMPANY SHARE 2022 (%)

FIGURE 19 U.S. LUBRICANTS MARKET: COMPANY SHARE 2022 (%)

Europe And Us Lubricants Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe And Us Lubricants Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe And Us Lubricants Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.