Europe and South America Used Car Market Analysis and Size

The industry encompasses the buying and selling of pre-owned vehicles across various countries within these regions. This market includes the trading of used cars through dealerships, online platforms, auctions, and private sales, involving vehicles that have been previously owned and driven. It involves various segments, including passenger cars, SUVs, trucks, and commercial vehicles, and encompasses both individual consumers and businesses involved in the buying and selling processes. Factors influencing this market include supply and demand dynamics, economic conditions, regulatory policies, technological advancements, and consumer preferences.

Data Bridge Market Research analyses that the Europe used car market is expected to reach a value of USD 639,011.39 million by 2030, at a CAGR of 6.4% during the forecast period. South America used car market is expected to reach a value of USD 99,146.78 million by 2030, at a CAGR of 4.1% during the forecast period. The Europe and South America used car market report also comprehensively covers pricing analysis, patent analysis, and technological advancements.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021(Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

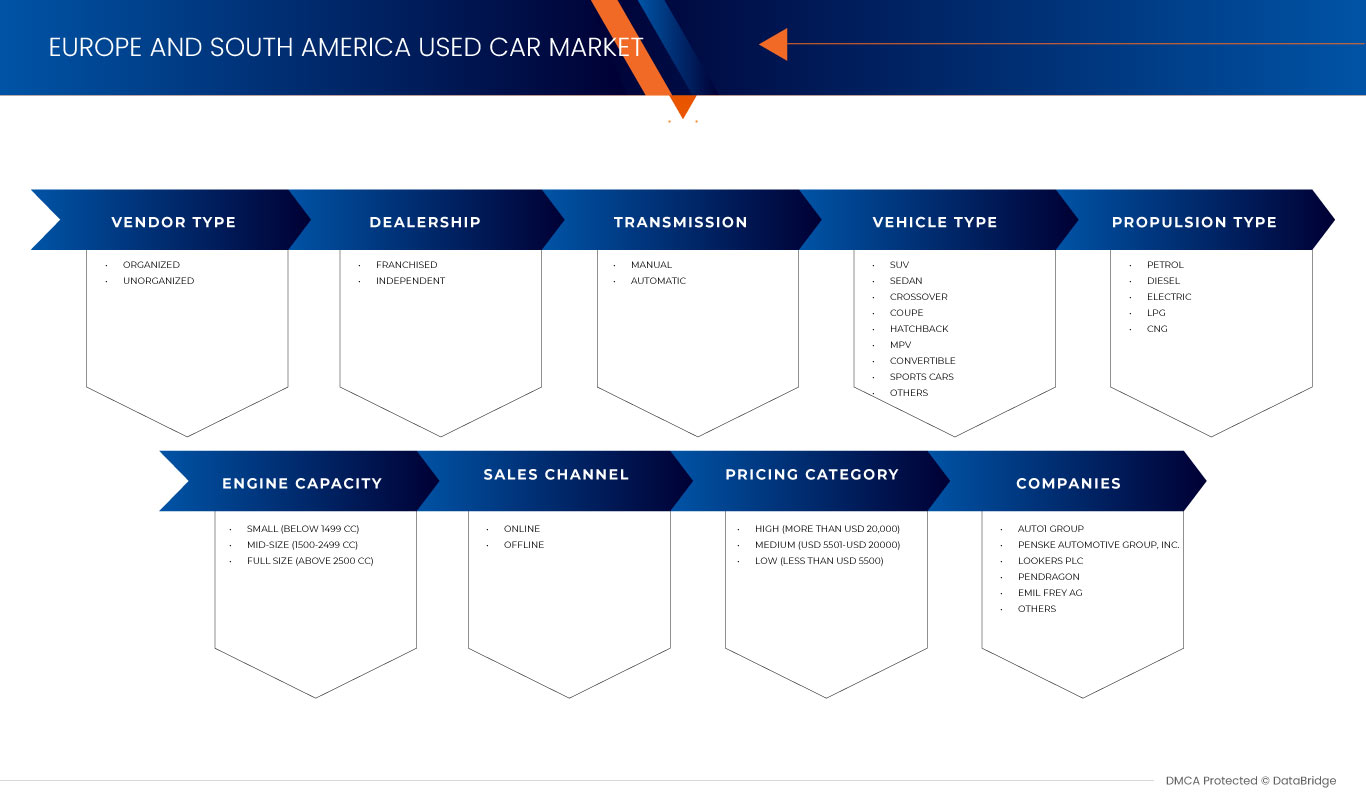

Vendor Type (Organized, Unorganized), Propulsion Type (Petrol, Diesel, Electric, LPG, and CNG), Engine Capacity (Small (Below 1499 CC), Mid-Size (1500-2499 CC), and Full Size (Above 2500 CC)), Dealership (Franchised, Independent), Transmission (Manual, Automatic), Vehicle Type (SUV, Sedan, Crossover, Coupe, Hatchback, MPV, Convertible, Sports Cars, and Others), Pricing Category (High (More than USD 20,000), Medium (USD 5501-USD 20000), and Low (Less than USD 5500), Sales Channel (Offline, Online) |

|

Countries Covered |

Germany, U.K., France, Italy, Spain, Russia, Poland, Netherlands, Belgium, Switzerland, Denmark, Finland, Sweden, Norway, Turkey and Rest of Europe, Brazil, Argentina and Rest of South America |

|

Market Players Covered |

AUTO1 Group, Penske Automotive Group, Inc., Lookers PLC, PENDRAGON, Emil Frey AG, Group1 Automotive, Inc., Arnold Clark Automobiles Limited, Gottfried Schultz Automobile Trading SE, Alibaba Group Holding Limited, OLX GROUP, Auto Trader Group plc., KAVAK, HELLMAN & FRIEDMAN LLC, leboncoin, mobile.de GmbH, Gumtree.com Limited, Webmotors SA, AUTONIZA, Seminuevos.com, SALFA, Unidas, Grupo Sinal among others |

Market Definition

The used car market is a dynamic sector involving the trade of previously owned vehicles across multiple countries within these regions. It encompasses a wide range of vehicle types, such as passenger cars, SUVs, trucks, and commercial vehicles, which have been previously owned by individuals or companies. This market operates through various channels including dealership networks, online platforms, auctions, and direct person-to-person transactions.

Key elements of this market include the evaluation and pricing of used vehicles, vehicle history checks, financing options, maintenance and refurbishment services, and the overall customer experience. Economic conditions, consumer purchasing power, cultural preferences, environmental regulations, and advancements in technology play a significant role in shaping the market dynamics. The growth of online platforms has also transformed the way used cars are bought and sold, providing consumers with easier access to information and a wider selection of options.

Europe and South America Used Car Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Emergence of Different E-Commerce Platform in Europe and South America Regions

E-commerce platforms have fundamentally changed the automotive retailing market to a larger extent. The increasing penetration of the internet has also facilitated an online marketplace around the world. With that, consumers have several choices including unlimited varieties, style, price, and model comparison features in the online portals. Most dealerships list new and used car details online so that customers can find information along with pictures on almost any vehicle of interest. Furthermore, if pricing and incentive information is not available, the user can just call and approach many dealers available online and get the required information about the car model. In addition, various online used car sales websites offer free or discounted after-sales service packages that cover various types of maintenance costs associated with the vehicle after purchase.

- Increase in Transparency and Symmetry of Information Between Dealers and Customers

Online shopping is influencing the way consumers think about purchasing used cars. Consumers want the choice of configuring a vehicle to their requirements rather than accepting what’s on the lot as the only option out there. So, trust between consumers and dealers is necessary for their decision-making process to avoid any conflicts or disagreements. As with new car sales, the relationship between dealer and customer will need to be based on respect, and ease of purchase. Such an asymmetrical relationship will presume that buyers and sellers possess the same information to determine a product’s quality. In addition, the Internet is increasingly becoming the information source of choice for used vehicle buyers. With that, nowadays customers are increasingly knowledgeable about cars, their quality, residual value, prices applied, finance charges, availability, and more frequently the exact profit margin that the dealer makes in closing a deal. Technology is also allowing dealers to find new ways to source inventory and unload wholesale units more quickly. Improvements such as these in the used car sector are further helping dealers to run their sales process more efficiently while also improving inventory flow control.

Opportunity

- Rise in Strategic Partnership and Acquisitions Between Two Companies

Coordinating and integrating various technologies is essential for achieving sustained improvements in the automobile sector. For this reason, the government is also striving through partnerships and acquisitions to accelerate the appropriate use of existing technologies in the used car market. This not only helps to make awareness and profit of the organization but also creates scope for a new invention. Also through partnerships, the company can provide all facilities including online promotions and good offers to attract buyers in the marketplace. Furthermore, this helps both companies to get recognized in the premium market. So, the increase in mergers and acquisitions in the automobile sector is creating a lot of opportunities for the used car market to grow extensively.

Restraint/Challenge

- Lack of Post-Sale Services for Used Car

There is no doubt that customer satisfaction is one of the essential objectives of any business not for its survival alone but its sustenance. Unfortunately, this is not easy to achieve in reality due to intense competition and customer complexity. Customer satisfaction without quality enhancement features that are valued by the customers cannot be achieved. Quality appreciation from the customers via service encounters and post-purchase evaluations if not satisfied will decline the demand for the used car eventually. Although, service quality has become a crucial aspect of every service provider's product in the market, and the automobile business is no different, with customers seeking better after-sales services for greater value for money. Undoubtedly after-sales services have become a significant aspect of automotive firms marketing strategies due to the benefits and rewards they provide in the short and long term.

Recent Developments

- In April 2023, AUTO1 Group introduced the Auto1 Group Price Index, the first European used car price index based on wholesale transaction data, revealing a record-high 25.7% year-on-year surge in used car prices in July 2022, attributed to pandemic disruptions, semiconductor shortages, and geopolitical tensions. Amid fluctuating trends, the index rebounded by 1.2% in March 2023 but declined by 5.9% year-on-year. This comprehensive index offers valuable insights into pricing dynamics within the European wholesale used car market.

- In March 2023, Emil Frey AG collaborated with iptiQ, the digital insurance subsidiary of Swiss Re, to introduce a groundbreaking digital insurance solution named "Emil Frey Protect." This strategic partnership harnesses Emil Frey's customer-centric approach in the automotive sector and iptiQ's expertise in seamlessly integrating digital insurance into consumer brands' value chains. Available to Swiss customers during car purchases and servicing, Emil Frey Protect is fully integrated into Emil Frey's digital sales and mobility platform, offering a 100% paperless experience. This innovative insurance solution enhances Emil Frey's service offerings, providing comprehensive and personalized car insurance to customers with ease, strengthening the company's position in the European and South American used car markets.

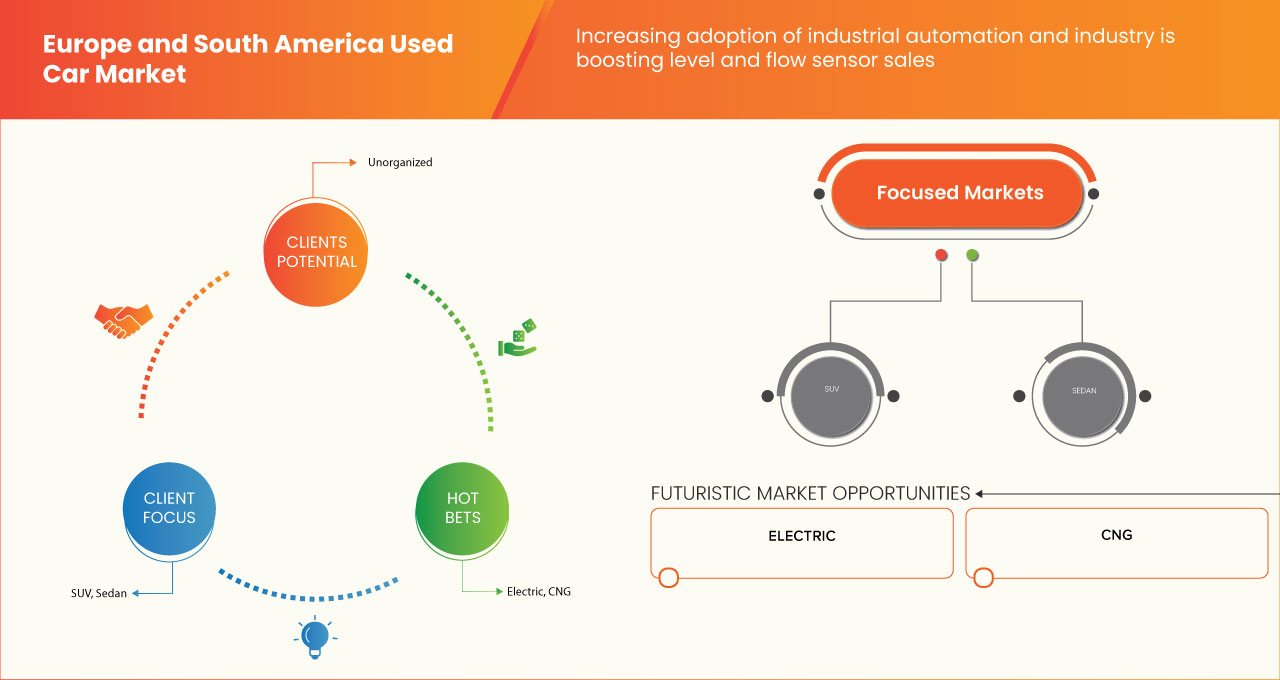

Europe and South America Used Car Market Scope

Europe and South America used car market is segmented on the basis of vendor type, propulsion type, engine capacity, vehicle type, dealership, transmission, pricing category, and sales channel. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Vendor Type

- Organized

- Unorganized

On the basis of vendor type, the Europe and South America used car market is segmented into organized, and unorganized.

Propulsion Type

- Petrol

- Diesel

- CNG

- LPG

- Electric

On the basis of propulsion type, the Europe and South America used car market is segmented into petrol, diesel, cng, lpg, and electric.

Engine Capacity

- Full Size (Above 2500 Cc)

- Mid-Size (Between 1500-2499 Cc)

- Small (Below 1499 Cc)

On the basis of engine capacity, the Europe and South America used car market is segmented into full size (above 2500 Cc), mid-size (between 1500-2499 Cc), and small (below 1499 Cc).

Dealership

- Franchised

- Independent

On the basis of dealership, the Europe and South America used car market is segmented into franchised, and independent.

Transmission

- Automatic

- Manual

On the basis of transmission, the Europe and South America used car market is segmented into automatic and manual.

Pricing Category

- High (More Than USD 20,000)

- Medium (USD 5,501 – USD 20,000)

- Low (Less Than USD 5,500)

On the basis of pricing category, the Europe and South America used car market is segmented into high (more than USD 20,000), medium (USD 5,501 – USD 20,000), and low (less than USD 5,500).

Sales Channel

- Online

- Offline

On the basis of sales channel, the Europe and South America used car market is segmented into online and offline.

Vehicle Type

- SUV

- Sedan

- Hatchback

- Convertible

- Crossover

- MPV

- Coupe

- Sports Car

- Others

On the basis of vehicle type, the Europe and South America used car market is segmented into SUV, Sedan, hatchback, convertible, crossover, MPV, coupe, sports car, and others.

Europe and South America Used Car Market Country Analysis/Insights

Europe and South America used car market is segmented on the basis of vendor type, propulsion type, engine capacity, vehicle type, dealership, transmission, pricing category, and sales channel.

The countries covered in the Europe and South America used car market report are Germany, U.K., France, Italy, Spain, Russia, Poland, Netherlands, Belgium, Switzerland, Denmark, Finland, Sweden, Norway, Turkey and Rest of Europe, Brazil, Argentina and Rest of South America.

U.K. dominates in the Europe region due to the UK having one of the largest economies and populations in Europe, which naturally translates into a larger automotive market, including the used car segment. Brazil dominates in the South America region because many people prefer purchasing used cars due to the cost savings compared to buying new vehicles.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, and Porter’s five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe and South America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe and South America Used Car Market Share Analysis

Europe and South America used car market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe and South America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to Europe and South America used car Market.

Some of the major players operating in the Europe and South America used car market are: AUTO1 Group, Penske Automotive Group, Inc., Lookers PLC, PENDRAGON, Emil Frey AG, Group1 Automotive, Inc., Arnold Clark Automobiles Limited, Gottfried Schultz Automobile Trading SE, Alibaba Group Holding Limited, OLX GROUP, Auto Trader Group plc., KAVAK, HELLMAN & FRIEDMAN LLC, leboncoin, mobile.de GmbH, Gumtree.com Limited, Webmotors SA, AUTONIZA, Seminuevos.com, SALFA, Unidas, Grupo Sinal among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE AND SOUTH AMERICA USED CAR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 VENDOR TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 EMERGENCE OF DIFFERENT E-COMMERCE PLATFORM IN EUROPE AND SOUTH AMERICA REGIONS

5.1.1.1 GERMANY

5.1.1.1.1 AUTOSCOUT24

5.1.1.1.2 MOBILE.DE

5.1.1.2 U.K.

5.1.1.2.1 MOTORS. CO.UK.

5.1.1.2.2 AUTOTRADER

5.1.1.3 FRANCE

5.1.1.3.1 LEBONCOIN

5.1.1.4 BRAZIL

5.1.1.4.1 VOLANTY

5.1.2 INCREASE IN TRANSPARENCY AND SYMMETRY OF INFORMATION BETWEEN DEALERS AND CUSTOMERS

5.1.3 RISE IN DEMAND FOR OFF-LEASE CARS & SUBSCRIPTION SERVICE BY THE FRANCHISE

5.1.4 RISE IN DEMAND FOR THE PERSONAL TRANSPORT MOBILITY

5.1.5 UPSURGE DEMAND FOR THE VEHICLE WITH GREATER VALUE AT LOWER COST

5.2 RESTRAINTS

5.2.1 EVER INCREASE IN COST OF OWNERSHIP

5.2.2 STRINGENT GOVERNMENT REGULATIONS FOR CAR DEALERS

5.2.3 HIGHER MAINTENANCE AND SERVICE COST

5.3 OPPORTUNITIES

5.3.1 RISE IN STRATEGIC PARTNERSHIP AND ACQUISITIONS BETWEEN TWO COMPANIES

5.3.2 ORIGINAL EQUIPMENT MANUFACTURERS (OEMS) INVOLVEMENT IN CERTIFICATION AND MARKETING PROGRAMS

5.3.3 RISE IN THE INVESTMENT BY THE GOVERNMENT IN THE AUTOMOBILE SECTOR

5.3.4 AVAILABILITY OF THE REIMBURSED POLICY FOR THE USED CAR

5.4 CHALLENGES

5.4.1 LACK OF POST-SALE SERVICES FOR USED CAR

5.4.2 INCLINATION OF OEMS (ORIGINAL EQUIPMENT MANUFACTURERS) IN SALE OF ONLY NEW CAR

6 EUROPE & SOUTH AMERICA USED CAR MARKET, BY VENDOR TYPE

6.1 OVERVIEW

6.2 ORGANIZED

6.3 UNORGANIZED

7 EUROPE & SOUTH AMERICA USED CAR MARKET, BY PROPULSION TYPE

7.1 OVERVIEW

7.2 PETROL

7.3 DIESEL

7.4 ELECTRIC

7.4.1 BATTERY OPERATED VEHICLES (BEV)

7.4.2 PLUGIN VEHICLES (PEV)

7.4.3 HYBRID VEHICLES (HEVS)

7.5 LPG

7.6 CNG

8 EUROPE & SOUTH AMERICA USED CAR MARKET, BY ENGINE CAPACITY

8.1 OVERVIEW

8.2 SMALL (BELOW 1499 CC)

8.3 MID-SIZE (BETWEEN 1500-2499 CC)

8.4 FULL SIZE (ABOVE 2500 CC)

9 EUROPE & SOUTH AMERICA USED CAR MARKET, BY DEALERSHIP

9.1 OVERVIEW

9.2 FRANCHIASED

9.3 INDEPENDENT

10 EUROPE & SOUTH AMERICA USED CAR MARKET, BY TRANSMISSION

10.1 OVERVIEW

10.2 MANUAL

10.3 AUTOMATIC

11 EUROPE & SOUTH AMERICA USED CAR MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 SUV

11.3 SEDAN

11.4 CROSSOVER

11.5 COUPE

11.6 HATCHBACK

11.7 MPV

11.8 CONVERTIBLE

11.9 SPORTS CARS

11.1 OTHERS

12 EUROPE & SOUTH AMERICA USED CAR MARKET, BY PRICING CATEGORY

12.1 OVERVIEW

12.2 HIGH (MORE THAN USD 20,000)

12.3 MEDIUM (USD 5501-USD 20000)

12.4 LOW (LESS THAN USD 5500)

13 EUROPE & SOUTH AMERICA USED CAR MARKET, BY SALES CHANNEL

13.1 OVERVIEW

13.2 OFFLINE

13.3 ONLINE

14 EUROPE AND SOUTH AMERICA USED CAR MARKET BY REGION

14.1 EUROPE

14.1.1 U.K.

14.1.2 GERMANY

14.1.3 FRANCE

14.1.4 ITALY

14.1.5 RUSSIA

14.1.6 SPAIN

14.1.7 TURKEY

14.1.8 NETHERLANDS

14.1.9 BELGIUM

14.1.10 SWITZERLAND

14.1.11 DENMARK

14.1.12 SWEDEN

14.1.13 POLAND

14.1.14 NORWAY

14.1.15 FINLAND

14.1.16 REST OF EUROPE

14.2 SOUTH AMERICA

14.2.1 BRAZIL

14.2.2 ARGENTINA

14.2.3 REST OF SOUTH AMERICA

15 EUROPE AND SOUTH AMERICA USED CAR MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

15.2 COMPANY SHARE ANALYSIS: SOUTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 AUTO1 GROUP

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 BRAND PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 PENSKE AUTOMOTIVE GROUP, INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENTS

17.3 LOOKERS PLC

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 PENDRAGON

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENTS

17.5 EMIL FREY AG

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENTS

17.6 ALIBABA GROUP HOLDING LIMITED

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 ARNOLD CLARK AUTOMOBILES LIMITED

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 AUTO TRADER GROUP PLC

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 AUTONIZA

17.9.1 COMPANY SNAPSHOT

17.9.2 BRAND PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 GOTTFRIED SCHULTZ AUTOMOBILE TRADING SE

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 GROUP1 AUTOMOTIVE, INC.

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 GRUPO SINAL

17.12.1 COMPANY SNAPSHOT

17.12.2 SOLUTION PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 GUMTREE.COM LIMITED

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 HELLMAN & FRIEDMAN LLC

17.14.1 COMPANY SNAPSHOT

17.14.2 BRAND PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 KAVAK

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 LEBONCOIN

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 MOBILE.DE GMBH

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 OLX GROUP

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 SALFA

17.19.1 COMPANY SNAPSHOT

17.19.2 BRAND PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 SEMINUEVOS.COM

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 UNIDAS

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 WEBMOTORS SA

17.22.1 COMPANY SNAPSHOT

17.22.2 SOLUTION PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 SCALE OF USED VEHICLE EXPORTS IN THE YEAR 2017 (USD MILLION)

TABLE 2 COMPARISON OF THE BRAND AND ESTIMATED MAINTENANCE COST OVER 10 YEARS (APPROX.)

TABLE 3 ROUTINE AND BASIC MAINTENANCE COST OF USED CARS (APPROX. IN USD)

TABLE 4 EUROPE USED CAR MARKET, BY VENDOR TYPE, 2021-2030 (UD MILLION)

TABLE 5 SOUTH AMERICA USED CAR MARKET, BY VENDOR TYPE, 2021-2030 (UD MILLION)

TABLE 6 EUROPE USED CAR MARKET, BY PROPULSION TYPE, 2021-2030 (UD MILLION)

TABLE 7 SOUTH AMERICA USED CAR MARKET, BY PROPULSION TYPE, 2021-2030 (UD MILLION)

TABLE 8 EUROPE ELECTRIC IN USED CAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 SOUTH AMERICA ELECTRIC IN USED CAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 EUROPE USED CAR MARKET, BY ENGINE CAPACITY, 2021-2030 (USD MILLION)

TABLE 11 SOUTH AMERICA USED CAR MARKET, BY ENGINE CAPACITY, 2021-2030 (USD MILLION)

TABLE 12 EUROPE USED CAR MARKET, BY DEALERSHIP, 2021-2030 (USD MILLION)

TABLE 13 SOUTH AMERICA USED CAR MARKET, BY DEALERSHIP, 2021-2030 (USD MILLION)

TABLE 14 EUROPE USED CAR MARKET, BY TRANSMISSION, 2021-2030 (USD MILLION)

TABLE 15 SOUTH AMERICA USED CAR MARKET, BY TRANSMISSION, 2021-2030 (USD MILLION)

TABLE 16 EUROPE USED CAR MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 17 SOUTH AMERICA USED CAR MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 18 EUROPE USED CAR MARKET, BY PRICING CATEGORY, 2021-2030 (USD MILLION)

TABLE 19 SOUTH AMERICA USED CAR MARKET, BY PRICING CATEGORY, 2021-2030 (USD MILLION)

TABLE 20 EUROPE USED CAR MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 21 SOUTH AMERICA USED CAR MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 EUROPE AND SOUTH AMERICA USED CAR MARKET SEGMENTATION

FIGURE 2 EUROPE AND SOUTH AMERICA USED CAR MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE AND SOUTH AMERICA USED CAR MARKET: DROC ANALYSIS

FIGURE 4 EUROPE USED CAR MARKET: REGION VS COUNTRY MARKET ANALYSIS

FIGURE 5 SOUTH AMERICA USED CAR MARKET: REGION VS COUNTRY MARKET ANALYSIS

FIGURE 6 EUROPE AND SOUTH AMERICA USED CAR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 7 EUROPE AND SOUTH AMERICA USED CAR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE USED CAR MARKET: DBMR MARKET POSITION GRID

FIGURE 9 SOUTH AMERICA USED CAR MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE AND SOUTH AMERICA USED CAR MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 EUROPE AND SOUTH AMERICA USED CAR MARKET: MULTIVARIATE MODELING

FIGURE 12 EUROPE USED CAR MARKET: VENDOR TYPE TIMELINE CURVE

FIGURE 13 SOUTH AMERICA USED CAR MARKET: VENDOR TYPE TIMELINE CURVE

FIGURE 14 EUROPE AND SOUTH AMERICA USED CAR MARKET SEGMENTATION

FIGURE 15 EMERGENCE OF DIFFERENT ECOMMERCE PLATFORMS IS EXPECTED TO DRIVE THE EUROPE USED CAR MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 16 RISE IN DEMAND FOR OFF-LEASE CARS & AND SUBSCRIPTION SERVICE BY THE FRANCHISE IS EXPECTED TO DRIVE THE SOUTH AMERICA USED CAR MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 17 ORGANIZED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE USED CAR MARKET IN 2023 & 2030

FIGURE 18 ORGANIZED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF SOUTH AMERICA USED CAR MARKET IN 2023 & 2030

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR EUROPE AND SOUTH AMERICA USED CAR MARKET

FIGURE 20 MONTHLY PASSENGER CAR SALES IN EUROPE BETWEEN AUGUST 2020 AND JUNE 2021 (1,000 UNITS)

FIGURE 21 CAR RENTAL PRICES FOR POPULAR CITIES IN SOUTH AMERICA

FIGURE 22 VARIOUS GOVERNMENT INITIATIVES

FIGURE 23 EUROPE USED CAR MARKET: BY VENDOR TYPE, 2022

FIGURE 24 SOUTH AMERICA USED CAR MARKET: BY VENDOR TYPE, 2022

FIGURE 25 EUROPE USED CAR MARKET: BY PROPULSION TYPE, 2022

FIGURE 26 SOUTH AMERICA USED CAR MARKET: BY PROPULSION TYPE, 2022

FIGURE 27 EUROPE USED CAR MARKET: BY ENGINE CAPACITY, 2022

FIGURE 28 SOUTH AMERICA USED CAR MARKET: BY ENGINE CAPACITY, 2022

FIGURE 29 EUROPE USED CAR MARKET: BY DEALERSHIP, 2022

FIGURE 30 SOUTH AMERICA USED CAR MARKET: BY DEALERSHIP, 2022

FIGURE 31 EUROPE USED CAR MARKET: BY TRANSMISSION, 2022

FIGURE 32 SOUTH AMERICA USED CAR MARKET: BY TRANSMISSION, 2022

FIGURE 33 EUROPE USED CAR MARKET: BY VEHCLE TYPE, 2022

FIGURE 34 SOUTH AMERICA USED CAR MARKET: BY VEHCLE TYPE, 2022

FIGURE 35 EUROPE USED CAR MARKET: BY PRICING CATEGORY, 2022

FIGURE 36 SOUTH AMERICA USED CAR MARKET: BY PRICING CATEGORY, 2022

FIGURE 37 EUROPE USED CAR MARKET: BY SALES CHANNEL, 2022

FIGURE 38 SOUTH AMERICA USED CAR MARKET: BY SALES CHANNEL, 2022

FIGURE 39 EUROPE USED CAR MARKET: SNAPSHOT (2022)

FIGURE 40 SOUTH AMERICA USED CAR MARKET: SNAPSHOT (2022)

FIGURE 41 EUROPE USED CAR MARKET: COMPANY SHARE 2022 (%)

FIGURE 42 SOUTH AMERICA USED CAR MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.