Europe Active Medical Implantable Devices Market, By Product (Cardiac Resynchronization Therapy Devices (CRT-D), Implantable Cardioverter Defibrillators, Implantable Cardiac Pacemakers, Eye Implants, Neurostimulators, Active Implantable Hearing Devices, Ventricular Assist Devices, Implantable Heart Monitors/Insertable Loop recorders, Brachytheraphy, Implantable Glucose Monitors, Dropped Foot Implants, Shoulder Implants, Implantable Infusion Pumps, and Implantable Accessories), Surgery Type (Traditional Surgical Methods and Minimally Invasive Surgery), Procedure (Neurovascular, Cardiovascular, Hearing, and Others), End User (Hospitals, Specialty Clinics, Ambulatory Surgical Centers, Clinics), Country (Germany, U.K., France, Italy, Spain, Netherlands, Russia, Switzerland, Rest of Europe) Industry Trends and Forecast to 2028

Market Analysis and Insights: Europe Active Medical Implantable Devices Market

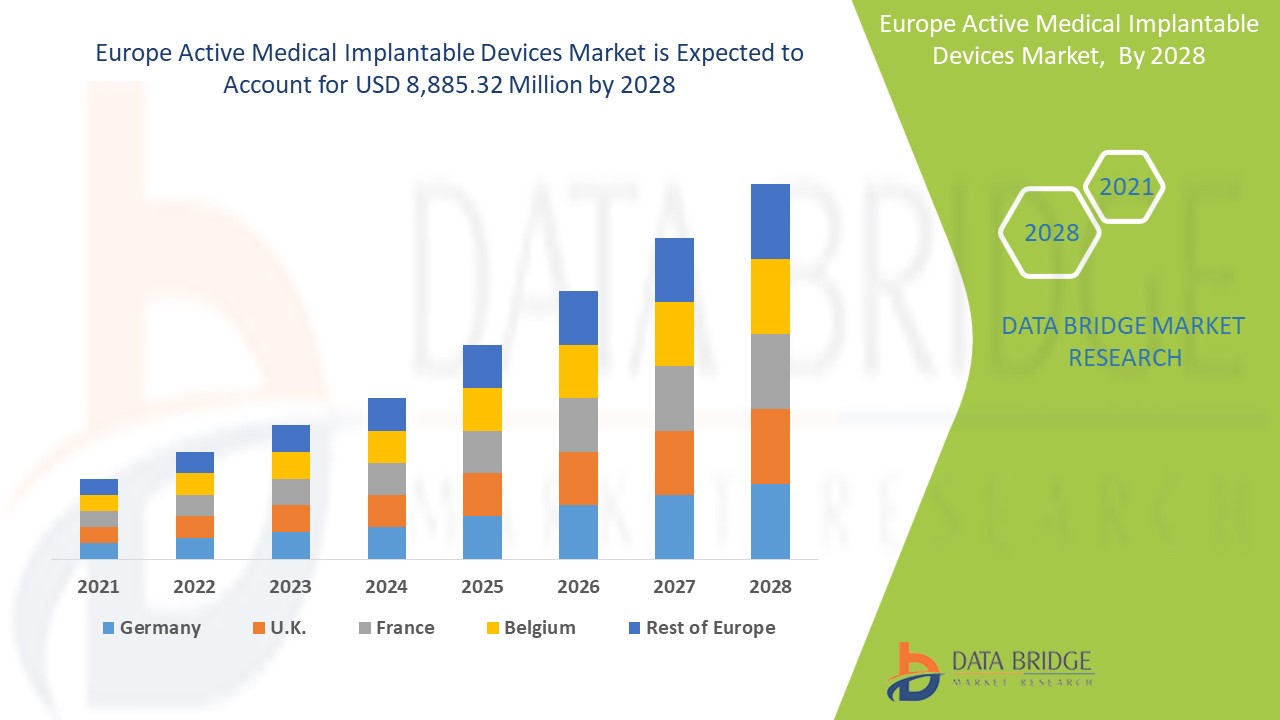

Europe active medical implantable devices market is expected to gain significant growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyzes that the market is growing with a CAGR of 9.2% in the forecast period of 2021 to 2028 and is expected to reach USD 8,885.32 million by 2028. Increase in products development and rising demand for treatment are the major drivers, boosting the growth of the market in the forecast period. The rise of healthcare infrastructure and R& D activities is a major opportunity for the market. However, lack of skilled professionals is challenging the market growth.

Active medical implantable devices are the one which are inserted into the human body and require outer power source and energy to remain there for the following procedure and treatment. These devices are used for various application such as hearing Aid, neurological and cardiovascular.

Europe Active medical implantable devices market is expected to grow with the increase in cardiovascular diseases and increasing healthcare expenditure, increasing the demand for treatment and product by manufactures into the market and increasing investment in research and development. However, limitation associated with the lack of skilled professionals and workers is expected to restrain the market growth in the forecast period.

The active medical implantable devices market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an analyst brief, our team will help you create a revenue impact solution to achieve your desired goal.

Europe Active Medical Implantable Devices Market Scope and Market Size

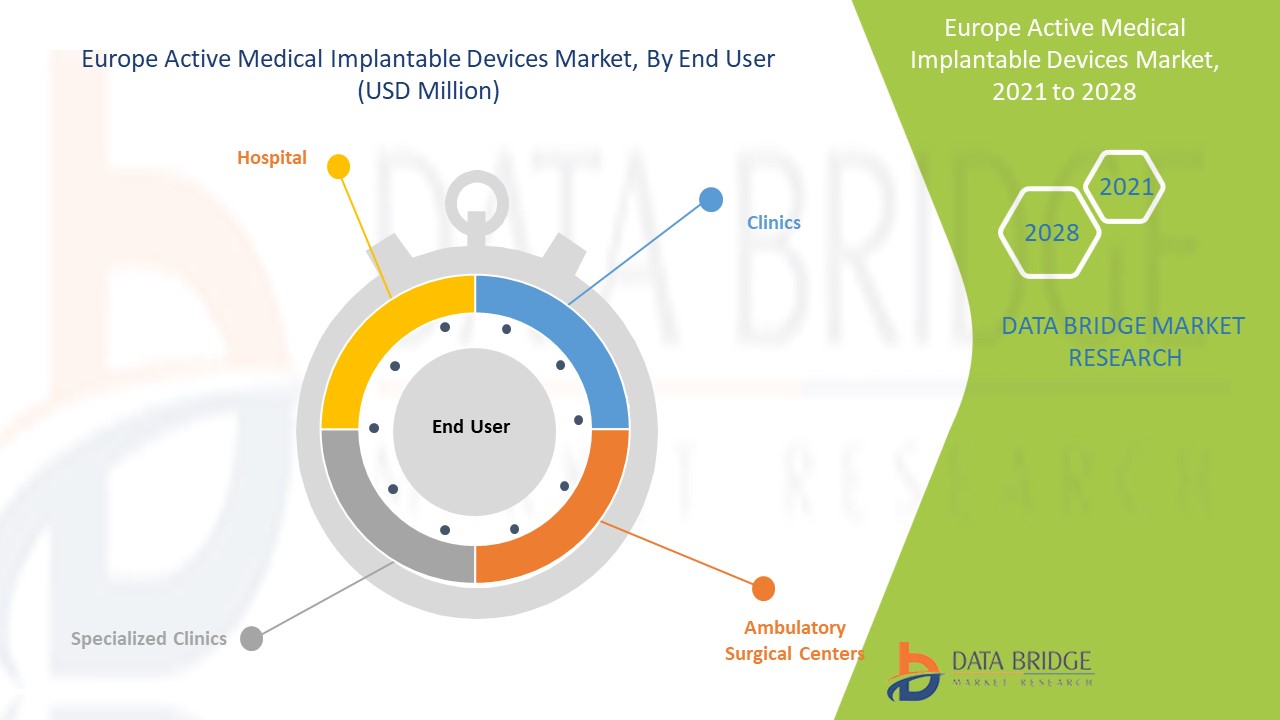

Active medical implantable devices market is segmented based on product, surgery type, procedure, and end users. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of product, the Europe active medical implantable devices market is segmented into Cardiac Resynchronization Therapy Devices (CRT-D), implantable cardioverter defibrillators, implantable cardiac pacemakers, eye implants, neurostimulators, active implantable hearing devices, ventricular assist devices, implantable heart monitors/ insertable loop recorders, brachytheraphy, implantable glucose monitors, dropped foot implants, shoulder implants, implantable infusion pumps and implantable accessories. In 2021, Cardiac Resynchronization Therapy Devices (CRT-D) segment is expected to dominate the market with the increase in prevalence of cardiovascular diseases in the region.

- On the basis of surgery type, the Europe active medical implantable devices market is segmented into traditional surgical methods, and minimally invasive surgery. In 2021, traditional surgical methods segment is expected to dominate the market as it has reasonable cost and expense of the treatment.

- On the basis of procedure, the Europe active medical implantable devices market is segmented into neurovascular, cardiovascular, hearing, and others. In 2021, cardiovascular segment is expected to dominate the market with the increase in cardiovascular disease.

- On the basis of end-users, the Europe active medical implantable devices market is segmented into hospitals, specialty clinics, ambulatory surgical centers, and clinics. In 2021, hospital segment is expected to dominate the market with the increase in demand for implantable products.

Active Medical Implantable Devices Market Country Level Analysis

The active medical implantable devices market is analyzed and market size information is provided on the basis of product, surgery type, procedure, and end users.

The countries covered in the Europe active medical implantable devices market report are the Germany, U.K., France, Italy, Spain, Belgium, Turkey, Netherlands, Russia, Switzerland, Rest of Europe.

Active medical implantable devices segment in the Europe region is expected to grow with the highest growth rate in the forecast period of 2021 to 2028 due to rising demand for active medical implantable devices. Germany is leading the growth of the Europe active medical implantable devices market and hospital segment is dominating in this country due to growth of R & D in healthcare industry.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Rising healthcare expenditure are boosting the growth of active medical implantable devices

Active medical implantable devices market also provides you with detailed market analysis for every country growth in Active medical implantable devices industry with Active medical implantable devices drugs sales, impact of advancement in the Active medical implantable devices technology and changes in regulatory scenarios with their support for the market. The data is available for historic period 2010 to 2018.

Competitive Landscape and Active Medical Implantable Devices Market Share Analysis

Active medical implantable devices market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, and technology lifeline curve. The above data points provided are only related to the company’s focus related to Active medical implantable devices market.

The major companies which are dealing in the Europe active medical implantable devices market are NeuroPace, Inc., Axonics, Inc., Stimwave LLC, NEVRO CORP, Second Sight, BIOTRONIK, ABIOMED, Boston Scientific Corporation, Medtronic, Abbott, Eckert & Ziegler., Sonova, Zhejiang Nurotron Biotechnology Co., Ltd, Demant A/S, Cochlear Ltd, Microson, Oticon Medical, Nano Retina, GluSense, MED-EL Medical Electronics among others.

Several product launches and agreements are also initiated by the companies worldwide, which are also accelerating the growth of the active medical implantable devices market.

For instance,

- In December 2020, Abbott received approval by Health Canada for its product FreeStyle Libre 2 for adults and children with diabetes which measure glucose data every minute with customizable and optional real time alarms. This will help the company to diversify its market and grow in coming years.

- In January 2021, Boston Scientific announced that it has received FDA approval for Vercise Deep Brain Stimulation System. The portfolio consists of implantable pulse generator designed to provide optimal symptom relief. This will help the company to expand its business in coming years

SKU-