Egypt Artificial Intelligence Market, By Component (Hardware, Software, Services), Type (General/Strong AI, Narrow/Weak AI), Organization Size (Large Enterprises, Small and Medium-Sized Enterprises), Technology (Machine Learning, Deep Learning, Computer Vision, Natural Language Processing (NLP), Speech Recognition, Image Processing, Context-Aware Computing), Application (Virtual Assistants/Chatbots, Forecasts and Modeling, Text Analytics, Speech Analytics, Predictive Maintenance and Others), End User (Manufacturing, Retail, Healthcare, Security, Automotive, Aerospace, Marketing, Construction, Telecommunication, Defense, Oil and Gas, Banking and Finance, Law, Building Automation, Media and Entertainment, Human Resources, Supply Chain, Food and Beverage, Gaming, Agriculture, Consumer Products, Education, Entertainment and others) - Industry Trends and Forecast to 2029.

Egypt Artificial Intelligence Market Analysis and Size

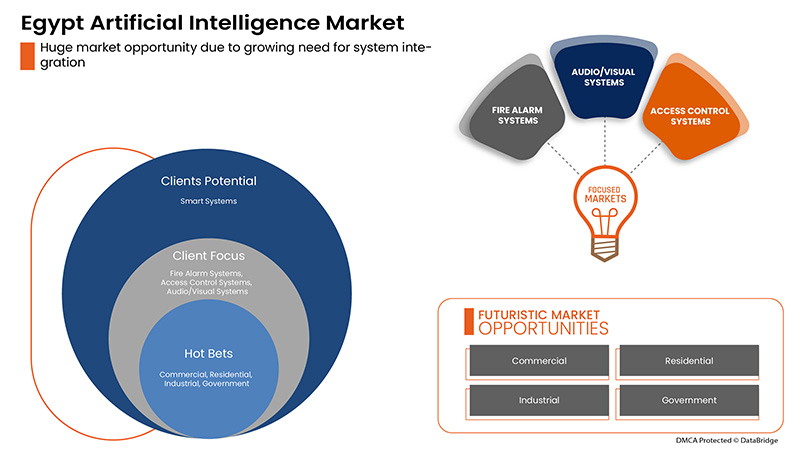

Artificial intelligence is used for data management, smooth flow and security by ensuring that all resources are working correctly and in the correct location. Forecasting, scheduling, skills management, resource management, processing and computing and classifying the data are all common aspects of artificial intelligence. With the advancement in artificial intelligence technology and the gradual shift toward smart systems, the Egypt artificial intelligence market will boom in the future. Growing investments in artificial intelligence systems primarily drive the Egypt artificial intelligence market. In addition, the rise in demand for intelligent systems is fueling the market to grow at a rapid rate. However, the high implementation cost of artificial intelligence (AI) solutions is the major restraining factor affecting the market's growth. Further, increasing industry 4.0 trends provide lucrative opportunities for the Egypt artificial intelligence market.

Data Bridge Market Research analyses that the Egypt artificial intelligence market is expected to reach the value of USD 2,961.37 million by 2029, at a CAGR of 13.4% during the forecast period. "Hardware" accounts for the largest components segment in the Egypt artificial intelligence market and provides basic facilities and a wide range of features with different platforms.

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customisable to 2019-2014)

|

|

Quantitative Units

|

Revenue in USD Million, Pricing in USD

|

|

Segments Covered

|

Component (Hardware, Software, Services), Type (General/Strong AI, Narrow/Weak AI), Organization Size (Large Enterprises, Small and Medium-Sized Enterprises), Technology (Machine Learning, Deep Learning, Computer Vision, Natural Language Processing (NLP), Speech Recognition, Image Processing, Context-Aware Computing), Application (Virtual Assistants/Chatbots, Forecasts and Modeling, Text Analytics, Speech Analytics, Predictive Maintenance and Others), End User (Manufacturing, Retail, Healthcare, Security, Automotive, Aerospace, Marketing, Construction, Telecommunication, Defense, Oil and Gas, Banking and Finance, Law, Building Automation, Media and Entertainment, Human Resources, Supply Chain, Food and Beverage, Gaming, Agriculture, Consumer Products, Education, Entertainment and others)

|

|

Country Covered

|

Egypt

|

|

Market Players Covered

|

NVIDIA Corporation, Intel Corporation, IBM Corporation, Cisco Systems, Inc., Amazon Web Services, Inc. (Subsidiary of Amazon.com, Inc.), Google (a subsidiary of Alphabet Inc.), QlikTech International AB, MICROSTRATEGY INCORPORATED, Twerlo, CBOT, WideBot, Inc, DilenyTech, Siemens, SAMSUNG ELECTRONICS CO., LTD., Meta, Oracle, SAP SE, Salesforce, Inc., SAS Institute Inc., Baidu, Inc., Hyperlink InfoSystem, CSP Solution, DECE Software Inc., Rockwell Automation, Inc., Yesil Science Teknoloji Ltd. Sti., Microsoft, Huawei Technologies Co., Ltd., among others

|

Market Definition

Artificial intelligence is a field that combines computer science and robust datasets to enable problem-solving. It also encompasses sub-fields of machine learning and deep learning, which are frequently mentioned in conjunction with artificial intelligence. These disciplines are comprised of AI algorithms that seek to create expert systems that make predictions or classifications based on input data.

Artificial Intelligence can be categorized into weak and strong AI. Weak AI, also called Narrow AI or Artificial Narrow Intelligence (ANI), is AI trained and focused on performing specific tasks. Weak AI drives most of the AI that surrounds us today. 'Narrow' might be a more accurate descriptor for this type of AI as it is anything but weak; it enables some very robust applications, such as Apple's Siri, Amazon's Alexa, IBM Watson and autonomous vehicles. Strong AI is made up of Artificial General Intelligence (AGI) and Artificial Super Intelligence (ASI). Artificial general intelligence (AGI), or general AI, is a theoretical form of AI where a machine would have an intelligence equivalent to humans; it would have a self-aware consciousness that can solve problems, learn and plan for the future.

Egypt Artificial Intelligence Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail below:

Drivers

- Growing Investments In Artificial Intelligence Systems

Governments and businesses across the Middle East are beginning to realize the shift towards AI and advanced technologies. AI has the potential to fundamentally disrupt markets in the Middle East through the creation of innovative new services and entirely new business models. Businesses across the Middle East have started to shift their focus toward emerging and in-demand technologies such as artificial intelligence

- Majority of Applications of Artificial Intelligence Across Different Sectors Such as Healthcare, BFSI, E-commerce and Retail

Artificial intelligence has become crucial for automating various corporate and industrial tasks. Artificial intelligence can improve the efficiency of a manufacturing unit. At the same time, it can make human resource management, financial analysis and other business decision-making processes accurate. Implementation of this technology also automates various business tasks. Without human involvement, businesses can manage many tasks through artificial intelligence or machine learning.

- Rise in Demand for Intelligent Systems

Intelligent systems are technologically advanced machines that perceive and respond to the world around them. Intelligent systems refer to different software tools that enable decision-makers to draw on experts' knowledge and decision processes in making decisions. Manufacturers use AI technology to make systems intelligent. Machine intelligence proves more efficient than human intelligence in a few cases. Therefore, a business can increase productivity by integrating AI with its systems.

- Rising Adoption of Cloud Technology

Nowadays cloud has become a new paradigm for delivering computing as a utility. Organizations were adapting and reshaping themselves to meet consumers growing and changing demands with technology, innovation and digitization. Cloud services are revolutionizing business operations through managed services. Businesses are adopting cloud technologies to manage and process data for real-time insights effectively. Using AI in the cloud can improve performance and efficiency while driving enterprise digital transformation. AI capabilities in the cloud computing environment are crucial to making business operations more efficient, strategic and insight-driven while also providing additional flexibility, agility and cost savings.

Restraints

- High Implementation Cost of Artificial Intelligence (AI) Solutions

Artificial intelligence (AI) encompasses everything from chatbots to data analysis systems, helping businesses around the globe to create personalized, sales-driving experiences for consumers and business buyers. High cost and time are required to implement and install an AI system effectively. The true cost of AI can be a lot more complicated based on the features needed and business line; sometimes, the budget may exceed the decided ones.

- Lack of Technical Expertise

Increasing technological advances, innovations and digitization of business processes are making it difficult for workers, employees and staff to match their skill set with the needs of the growing and technologically updated operations. This creates a skill gap between the staff and the business. There is a shortage of technical skilled expertise with relevant qualifications and knowledge as technology upgrades daily.

Post COVID-19 Impact on Artificial Intelligence

COVID-19 created a major impact on artificial intelligence as almost every country opted for the shutdown of every production facility except the ones dealing in producing essential goods. The government has taken strict actions such as shutting down the production and sale of non-essential goods, blocking international trade and many more to prevent the spread of COVID-19. The only businesses dealing with this pandemic were the essential services allowed to open and run the processes.

The limited investment costs and lack of employees hampered data center sales and production. However, government and market key players adopted new safety measures for developing the practices. Technological advancements escalated the growth rate of Artificial Intelligence as it targeted the right audience. The data center construction market is expected to regain its pace during the post-pandemic scenario due to the easing of the restrictions.

Recent Developments

- In December 2020, Twerlo announced the launch of its WhatsApp API-based customer support solution. The products enhance customer experience by building solutions that ease customer journey. Twerlo has the vision of transforming the ways businesses communicate with their customers. Twerlo has already started gaining attention from the business giants in Saudi Arabia. This enhanced the company's offerings in the region

- In March 2022, SAP SE announced the opening of SAP Labs Singapore, a digital innovation hub that will promote local digital talent, advance ecosystem and community involvement and drive product leadership. To advance a revolutionary digital supply chain, intelligent business network and sustainability solutions, this will be the first of its kind for SAP in the South East Asia (SEA) region. Deep technologies such as artificial intelligence (AI) and machine learning will also be catalyzed. This development will enhance the presence of SAP in the region

Egypt Artificial Intelligence Market Scope

Egypt artificial intelligence market is segmented into component, type, organization size, technology, application and end user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Hardware

- Software

- Services

On the basis of component, the Egypt artificial intelligence market is segmented into hardware, software and services.

Type

- General/Strong AI,

- Narrow/Weak AI

On the basis of type, the Egypt artificial intelligence market is segmented into general/strong AI, narrow/weak AI.

Organization Size

- Large Enterprises

- Small Enterprises

- Medium-Sized Enterprises

On the basis of organization size, the Egypt artificial intelligence market is segmented into large enterprises, small and medium-sized enterprises.

Technology

- Machine Learning

- Deep Learning

- Computer Vision

- Natural Language Processing (NLP)

- Speech Recognition

- Image Processing

- Context-Aware Computing

On the basis of technology, the Egypt artificial intelligence market is segmented into machine learning, deep learning, computer vision, natural language processing (NLP), speech recognition, image processing, context-aware computing.

Application

- Virtual Assistants/Chatbots

- Forecasts and Modeling

- Text Analytics

- Speech Analytics

- Predictive Maintenance

- Others

On the basis of application, the Egypt artificial intelligence market is segmented into virtual assistants/chatbots, forecasts and modeling, text analytics, speech analytics, predictive maintenance and others.

End User

- Manufacturing

- Retail

- Healthcare

- Security

- Automotive

- Aerospace

- Marketing

- Construction

- Telecommunication

- Defense

- Oil and Gas

- Banking and Finance

- Law

- Building Automation

- Media and Entertainment

- Human Resources

- Supply Chain

- Food and Beverage

- Gaming

- Agriculture

- Consumer Products

- Education

- Entertainment

- Others

On the basis of end user, the Egypt artificial intelligence market is segmented into manufacturing, retail, healthcare, security, automotive, aerospace, marketing, construction, telecommunication, defense, oil and gas, banking and finance, law, building automation, media and entertainment, human resources, supply chain, food and beverage, gaming, agriculture, consumer products, education, entertainment and others.

Competitive Landscape and Egypt Artificial Intelligence Market Share Analysis

The Egypt artificial intelligence market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, region presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the Egypt artificial intelligence market.

Some of the major players operating in the Egypt artificial intelligence market are NVIDIA Corporation, Intel Corporation, IBM Corporation, Cisco Systems, Inc., Amazon Web Services, Inc. (Subsidiary of Amazon.com, Inc.), Google (a subsidiary of Alphabet Inc.), QlikTech International AB, MICROSTRATEGY INCORPORATED, Twerlo, CBOT, WideBot, Inc, DilenyTech, Siemens, SAMSUNG ELECTRONICS CO., LTD., Meta, Oracle, SAP SE, Salesforce, Inc., SAS Institute Inc., Baidu, Inc., Hyperlink InfoSystem, CSP Solution, DECE Software Inc., Rockwell Automation, Inc., Yesil Science Teknoloji Ltd. Sti., Microsoft, Huawei Technologies Co., Ltd., among others.

SKU-