China Automotive Testing, Inspection and Certification (TIC) Market Analysis and Size

The market for automotive vehicles is growing rapidly in China, especially for passenger vehicles. China's auto market seems to be the world's biggest, with intelligent functions like internet connectivity and autonomous driving. This is expected to drive sales to increase by 30% by 2025. Although with the growing automotive sales in the country, there is an increase in traffic incidents. The main reason for traffic incidents in China are actions against traffic regulations, including over freight and speed, fatigue driving, and vehicle malfunctions. In recent years, the government has been strengthening large-scale inspections of safety measures during long-distance passenger transportation rush periods, thus containing frequent heavy traffic accidents and effectively controlling the rise in the death toll claimed by traffic accidents. However, in another aspect, with the increase in vehicle population, the death toll caused by accidents or vehicle collisions has increased.

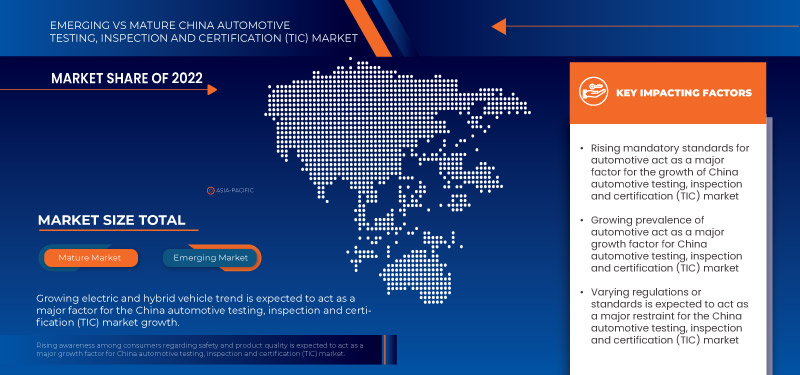

Data Bridge Market Research analyses that the China automotive testing, inspection and certification (TIC) market is expected to grow at a CAGR of 4.8% from 2023 to 2030. Government to implement strict and mandatory safety standards to be followed by vehicle manufacturers, which has been increasing over the years.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable 2015-2020) |

|

Quantitative Units |

Revenue in Million, Pricing in USD |

|

Segments Covered |

By Application (Chassis and Body Controller, Cockpit Controller, and Functional Safety), Supply Chain (Design, Production, Distribution, Selling, and Operation), Sourcing Type (In-House and Outsourced), Type (Electrical Systems and Components, Electric Vehicles, Hybrid Electric Vehicles, and Battery Systems, Telematics, Fuels, Fluids and Lubricant, Interior and Exterior Materials and Components, Vehicle Inspection Services, Homologation Testing, Others) |

|

Countries Covered |

China |

|

Market Players Covered |

Nemko, DEKRA, RINA S.p.A., NSF, Applus+, Asia Quality Focus, DNV GL, TÜV SÜD, TÜV NORD GROUP, Intertek Group Plc, MISTRAS Group, SGS Société Générale de Surveillance SA, TÜV Rheinland, Element Materials Technology, The British Standards Institution, Veritell Inspection Certification Co., Ltd, China Certification and Inspection (Group) Co., Ltd., Eurofins Scientific, and HQTS Group Ltd. among others |

Market Definition

The automotive testing, inspection, and certification (TIC) market is a specialized sector within the automotive industry that provides essential services to ensure the safety, quality, and compliance of vehicles and automotive components. This market encompasses a range of activities, including testing, inspection, and certification services that play a crucial role in enhancing product reliability, mitigating risks, and meeting regulatory requirements.

In the TIC market, testing services involve comprehensive evaluations of automotive products, systems, and materials to assess their performance, durability, and adherence to industry standards. This includes inspections of manufacturing plants, supply chain audits, quality control checks, and pre-shipment inspections. Additionally, certification services involve the issuance of official certifications and approvals that validate the compliance of automotive products and processes with relevant regulations and standards.

China Automotive Testing, Inspection and Certification (TIC) Market Dynamics

This section deals with understanding the drivers, restraints, challenges, and weaknesses. All of this is discussed in detail below:

Drivers

- Increasing focus of the government on imposing mandatory safety standards for automotive

The market for automotive vehicles is growing rapidly in China, especially for passenger vehicles. China's auto market seems to be the world's biggest, with intelligent functions such as internet connectivity and autonomous driving. This is expected to drive sales to increase by 30% by 2025.

Although with the growing automotive sales in the country, there is an increase in traffic incidents. The main reason for traffic incidents in China are actions against traffic regulations, including over freight and speed, fatigue driving, and vehicle malfunctions. In recent years, the government has been strengthening large-scale inspections of safety measures. This was during rush periods of long-distance passenger transportation. Thus, having contained frequent heavy traffic accidents and effectively controlled the rise in death toll claimed by traffic accidents. However, in another aspect, the death toll caused by accidents or vehicle collisions has increased with the increase in vehicle population.

- Growing prevalence of automotive

The production and consumption of automobiles are mainly centered on the passenger segment automobiles in China. This has been a major driving factor for the increase in the automobile industry since the 21st century. The growth of the Chinese economy, the vehicle population, especially passenger vehicles with private cars as the mainstay, has been increasing rapidly.

China continues to be the world's largest vehicle market by annual sales and manufacturing output, with domestic production expected to reach 35 million vehicles by 2025. Based on data from the Ministry of Industry and Information Technology, over 26 million vehicles were sold in 2021, including 21.48 million passenger vehicles, an increase of 7.1% from 2020. Commercial vehicle sales reached 4.79 million units, down 6.6% from 2020.

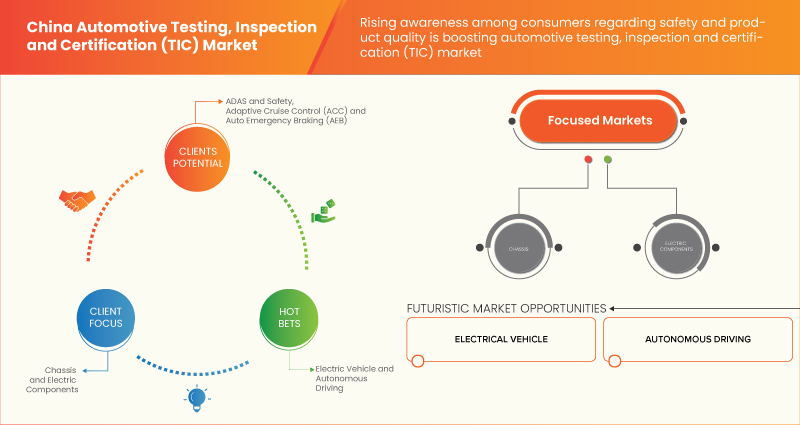

Moreover, there is a growing importance for electric vehicles across the globe. Electric vehicles (EVs) are designed to be a promising technology to achieve sustainable transportation with zero carbon emissions, low noise, and high efficiency. Electric vehicles are highly embedded with automotive software and have various benefits concentrated by various countries. This has resulted in formulation regulation, policies, testing, inspection, and certification process to boost electric vehicle quality as it helps control carbon emissions and avoid China warming.

Opportunity

- Growing trend of electric and ADAS vehicles

Electric vehicles (EVs) are designed to be a promising technology for sustainable transportation with zero carbon emissions, low noise, and high efficiency. Moreover, electric vehicles evolved in the 19th century, but due to a lack of technological advancement, internal combustion engines had a huge demand compared to electric vehicles. During the 20th century, technological advancement was boosted yearly, resulting in developments and innovations that helped reshape electric vehicles.

Moreover, electric vehicles are the key technology to decarbonize road transport. Recent years have seen exponential growth in the sale of electric vehicles with improved range, wider model availability, and increased performance. Passenger electric cars are surging in popularity. In addition, the government of China is supporting the usage of electric vehicles. Governments are providing various policies and formulating rules to promote electric vehicle usage.

Restraint/Challenge

- Varying standards across different regions/countries

Automotive emissions are one of the leading contributors to air pollution. The various exhaust gases from an automobile tailpipe, such as NOx, CO2, and CO, are the primary reasons for polluting the atmosphere and environment, which further leads to cause respiratory and skin diseases in humans. This has made many countries formulate stringent rules and regulations to reduce emissions.

Furthermore, different countries and regions have implemented norms and have set different standards. Several large state-owned automobile enterprises, such as Beijing Automotive Industry Corp, Brilliance China Automotive Holdings, and many others in China, tried to partner with foreign auto manufacturers. These joint ventures are formed to increase their capacity and enhance their technical capabilities.

However, companies from other countries have different vehicle standards and norms than China. This will create variations in the features of the automobile along with the pricing. Moreover, the government of China is changing the norms and standards frequently.

Recent Developments

- In November 2022, Nemko acquired the remaining shares of Nemko Norlab, making them the company's sole owner. This acquisition aims to enhance collaboration and meet customer needs more effectively, leveraging the market synergies and opportunities observed since the initial share acquisition in June.

- In October 2023, Nemko Germany obtained accreditation from DAkkS in Functional Safety. This development has enabled them to test and assess equipment/systems' functional safety in compliance with international standards and regulations, ensuring the control of hazards and minimizing risks for the safety of individuals, facilities, and the environment. Such recognition helps the company to gain customer attention Chinaly.

China Automotive Testing, Inspection and Certification (TIC) Market Scope

China automotive testing, inspection and certification (TIC) market is segmented into four notable segments based on application, supply chain, sourcing type, and type. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and insights to help them make strategic decisions for identifying core market applications.

Application

- Chassis and Body Controller

- Cockpit Controller

- Functional Safety

On the basis of application, the China automotive testing, inspection and certification (TIC) market is segmented into chassis and body controller, cockpit controller and functional safety.

Supply Chain

- Design

- Production

- Distribution

- Selling

- Operation

On the basis of supply chain, the China automotive testing, inspection and certification (TIC) market is segmented into design, production, distribution, selling and operation.

Sourcing Type

- In-House

- Outsourced

On the basis of sourcing type, the China automotive testing, inspection and certification (TIC) market is segmented into in-house and outsourced.

Type

- Electrical Systems and Components

- Electric Vehicles, Hybrid Electric Vehicles, and Battery Systems

- Telematics

- Fuels, Fluids and Lubricant

- Interior and Exterior Materials and Components

- Vehicle Inspection Services

- Homologation Testing

- Others

On the basis of type, the China automotive testing, inspection and certification (TIC) market is segmented into electrical systems and components, electric vehicles, hybrid electric vehicles, and battery systems, telematics, fuels, fluids and lubricant, interior and exterior materials and components, vehicle inspection services, homologation testing, and others.

Competitive Landscape and China Automotive Testing, Inspection and Certification (TIC) Market Share Analysis

The China automotive testing, inspection and certification (TIC) market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points only relate to the companies focusing on the market.

Some of the major players operating in the China automotive testing, inspection and certification (TIC) market are Nemko, DEKRA, RINA S.p.A., NSF, Applus+, Asia Quality Focus, DNV GL, TÜV SÜD, TÜV NORD GROUP, Intertek Group Plc, MISTRAS Group, SGS Société Générale de Surveillance SA, TÜV Rheinland, Element Materials Technology, The British Standards Institution, Veritell Inspection Certification Co., Ltd, China Certification and Inspection (Group) Co., Ltd., Eurofins Scientific, and HQTS Group Ltd. among others among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 APPLICATION CURVE

2.8 MARKET END-USER COVERAGE GRID

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET POSITION GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING FOCUS OF THE GOVERNMENT ON IMPOSING MANDATORY SAFETY STANDARDS FOR AUTOMOTIVE

5.1.2 GROWING PREVALENCE OF AUTOMOTIVE

5.2 RESTRAINTS

5.2.1 VARYING STANDARDS ACROSS DIFFERENT REGIONS/COUNTRIES

5.2.2 LENGTHY PROCESS AND LEAD TIME FOR QUALIFICATION TESTS

5.3 OPPORTUNITIES

5.3.1 GROWING TREND OF ELECTRIC AND ADAS VEHICLES

5.3.2 INCREASE IN THE USAGE OF ELECTRONIC SYSTEMS IN VEHICLES

5.3.3 RISING AWARENESS REGARDING SAFETY AND PRODUCT QUALITY AMONG CONSUMERS

5.4 CHALLENGES

5.4.1 RISK AVERSION AND NEW TECHNOLOGY RELUCTANCE

5.4.2 LACK OF SKILLED PROFESSIONALS

6 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY APPLICATION

6.1 OVERVIEW

6.2 CHASSIS AND BODY CONTROLLER

6.3 FUNCTIONAL SAFETY

6.3.1 ADAS AND SAFETY

6.3.2 ADAPTIVE CRUISE CONTROL (ACC)

6.3.3 AUTO EMERGENCY BRAKING (AEB)

6.3.4 LANE DEPARTURE WARNING SYSTEM (LDWS)

6.3.5 TIRE PRESSURE MONITORING SYSTEM (TPMS)

6.3.6 AUTOMATIC PARKING

6.3.7 PEDESTRIAN WARNING/PROTECTION SYSTEM

6.3.8 AUTOMOTIVE NIGHT VISION

6.3.9 TRAFFIC SIGN RECOGNITION

6.3.10 DRIVER DROWSINESS DETECTION

6.3.11 BLIND SPOT DETECTION

6.3.12 OTHER ADAS AND SAFETY CONTROLLERS

6.4 COCKPIT CONTROLLER

6.4.1 HUMAN-MACHINE INTERFACE (HMI)

6.4.2 HEADS-UP DISPLAY (HUD)

6.4.3 OTHER

7 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SUPPLY CHAIN

7.1 OVERVIEW

7.2 DESIGN

7.3 PRODUCTION

7.4 DISTRIBUTION

7.5 OPERATION

7.6 SELLING

8 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE

8.1 OVERVIEW

8.2 IN-HOUSE

8.3 OUTSOURCED

9 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY TYPE

9.1 OVERVIEW

9.2 ELECTRICAL SYSTEMS AND COMPONENTS

9.2.1 IN-HOUSE

9.2.2 OUTSOURCED

9.3 ELECTRIC VEHICLES, HYBRID ELECTRIC VEHICLES, AND BATTERY SYSTEMS

9.3.1 IN-HOUSE

9.3.2 OUTSOURCED

9.4 TELEMATICS

9.4.1 IN-HOUSE

9.4.2 OUTSOURCED

9.5 FUELS, FLUIDS AND LUBRICANT

9.5.1 IN-HOUSE

9.5.2 OUTSOURCED

9.6 INTERIOR AND EXTERIOR MATERIALS AND COMPONENTS

9.6.1 IN-HOUSE

9.6.2 OUTSOURCED

9.7 VEHICLE INSPECTION SERVICES

9.7.1 IN-HOUSE

9.7.2 OUTSOURCED

9.8 HOMOLOGATION TESTING

9.8.1 IN-HOUSE

9.8.2 OUTSOURCED

9.9 OTHERS

10 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 DEKRA

12.1.1 COMPANY SNAPSHOT

12.1.2 SERVICE PORTFOLIO

12.1.3 RECENT DEVELOPMENTS

12.2 TÜV SÜD

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 SERVICE PORTFOLIO

12.2.4 RECENT DEVELOPMENTS

12.3 DNV GL

12.3.1 COMPANY SNAPSHOT

12.3.2 SERVICE PORTFOLIO

12.3.3 RECENT DEVELOPMENTS

12.4 APPLUS+

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 SERVICE PORTFOLIO

12.4.4 RECENT DEVELOPMENTS

12.5 TÜV RHEINLAND

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 SERVICE PORTFOLIO

12.5.4 RECENT DEVELOPMENTS

12.6 ASIA QUALITY FOCUS

12.6.1 COMPANY SNAPSHOT

12.6.2 SERVICE PORTFOLIO

12.6.3 RECENT DEVELOPMENTS

12.7 CHINA CERTIFICATION AND INSPECTION (GROUP) CO., LTD.

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENTS

12.8 ELEMENT MATERIALS TECHNOLOGY

12.8.1 COMPANY SNAPSHOT

12.8.2 SERVICE PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 EUROFINS SCIENTIFIC

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 SERVICE PORTFOLIO

12.9.4 RECENT DEVELOPMENTS

12.1 HQTS GROUP LTD

12.10.1 COMPANY SNAPSHOT

12.10.2 SERVICE PORTFOLIO

12.10.3 RECENT DEVELOPMENTS

12.11 INTERTEK GROUP PLC

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 SERVICE PORTFOLIO

12.11.4 RECENT DEVELOPMENTS

12.12 MISTRAS GROUP

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 SERVICE PORTFOLIO

12.12.4 RECENT DEVELOPMENT

12.13 NEMKO

12.13.1 COMPANY SNAPSHOT

12.13.2 SERVICE PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

12.14 NSF

12.14.1 COMPANY SNAPSHOT

12.14.2 SERVICE PORTFOLIO

12.14.3 RECENT DEVELOPMENTS

12.15 RINA S.P.A.

12.15.1 COMPANY SNAPSHOT

12.15.2 SERVICE PORTFOLIO

12.15.3 RECENT DEVELOPMENTS

12.16 SGS SOCIÉTÉ GÉNÉRALE DE SURVEILLANCE SA

12.16.1 COMPANY SNAPSHOT

12.16.2 REVENUE ANALYSIS

12.16.3 SERVICE PORTFOLIO

12.16.4 RECENT DEVELOPMENTS

12.17 THE BRITISH STANDARDS INSTITUTION

12.17.1 COMPANY SNAPSHOT

12.17.2 SERVICE PORTFOLIO

12.17.3 RECENT DEVELOPMENTS

12.18 TÜV NORD GROUP

12.18.1 COMPANY SNAPSHOT

12.18.2 REVENUE ANALYSIS

12.18.3 SERVICE PORTFOLIO

12.18.4 RECENT DEVELOPMENTS

12.19 VERITELL INSPECTION CERTIFICATION CO., LTD

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCT PORTFOLIO

12.19.3 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 2 CHINA FUNCTIONAL SAFETY IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 3 CHINA COCKPIT CONTROLLER IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SUPPLY CHAIN, 2021-2030 (USD MILLION)

TABLE 5 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

TABLE 6 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 CHINA ELECTRICAL SYSTEMS AND COMPONENTS IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

TABLE 8 CHINA ELECTRIC VEHICLES, HYBRID ELECTRIC VEHICLES, AND BATTERY SYSTEMS IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

TABLE 9 CHINA TELEMATICS IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

TABLE 10 CHINA FUELS, FLUIDS AND LUBRICANT IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

TABLE 11 CHINA INTERIOR AND EXTERIOR MATERIALS AND COMPONENTS IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

TABLE 12 CHINA VEHICLE INSPECTION SERVICES IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

TABLE 13 CHINA HOMOLOGATION TESTING IN AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET, BY SOURCING TYPE, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: SEGMENTATION

FIGURE 2 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: DATA TRIANGULATION

FIGURE 3 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: DROC ANALYSIS

FIGURE 4 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: MULTIVARIATE MODELLING

FIGURE 7 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: MARKET: APPLICATION CURVE

FIGURE 8 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: MARKET END-USER COVERAGE GRID

FIGURE 9 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: DBMR MARKET POSITION GRID

FIGURE 11 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: SEGMENTATION

FIGURE 12 UPSURGE OF ADOPTION OF ADVANCED FEATURES FOR VEHICLES IS EXPECTED TO DRIVE CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET IN THE FORECAST PERIOD

FIGURE 13 CHASSIS AND BODY CONTROLLER IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET FROM 2023 & 2030

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF GLOBAL SYNCHRONOUS CONDENSER MARKET

FIGURE 15 GROWTH RATE OF ADOPTION OF ELECTRONIC SYSTEMS IN VARIOUS APPLICATIONS (CAGR)

FIGURE 16 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: BY APPLICATION, 2022

FIGURE 17 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: BY SUPPLY CHAIN, 2022

FIGURE 18 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: BY SOURCING TYPE, 2022

FIGURE 19 CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: BY TYPE, 2022

FIGURE 20 THE CHINA AUTOMOTIVE TESTING, INSPECTION AND CERTIFICATION (TIC) MARKET: COMPANY SHARE 2022(%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.