Market Analysis and Insights

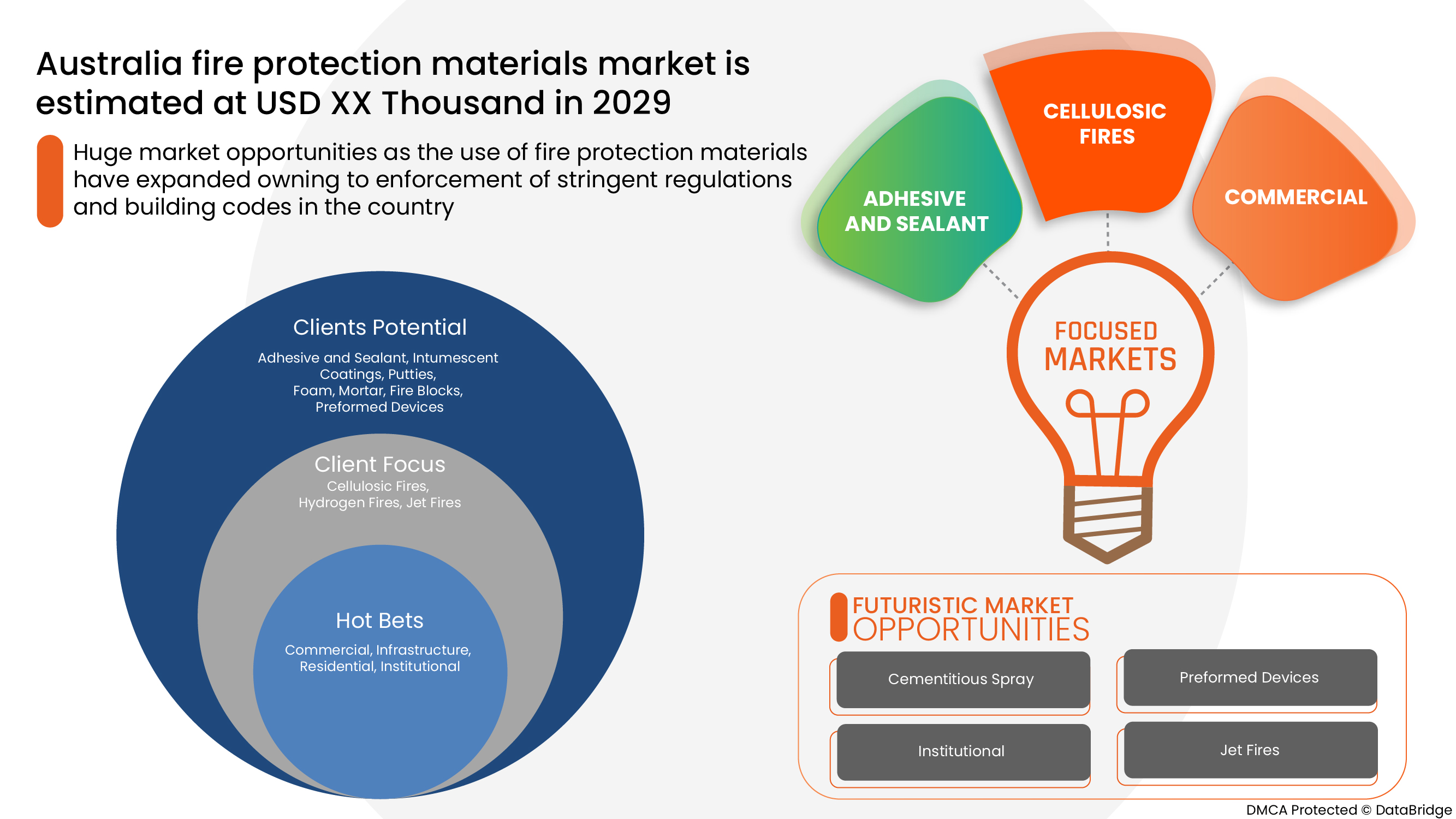

Australia fire protection materials market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 5.2% in the forecast period of 2022 to 2029 and is expected to reach USD 165,601.87 thousand by 2029.

++

++

Escalating the application scope of fire protection materials in various industries is expected to be an important driver for the Australia fire protection materials market. The imposition of favorable government guidelines and fire safety standards may accelerate market growth. Growing building & construction activities due to rapid growth in population are expected to further lead to the Australia fire protection materials market growth.

The major restraints that may negatively impact the Australia fire protection materials market could be the fluctuations in the price of raw materials and the integration of user interfaces with fire protection solutions.

Rapid technological advancements in fire protection systems and products and increasing utilization of safety codes in buildings for occupants and users are expected to provide the Australia fire protection materials market with opportunities. However, the low adoption rate among the potential end-users due to lack of awareness and high installation and maintenance costs are projected to challenge the Australia fire protection materials market growth.

Australia fire protection materials market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief; our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

By Product (Adhesive and Sealant, Intumescent Coatings, Sheets & Boards, Foam, Putties, Mortar, Fire Blocks, Cementitious Spray, Preformed Devices, Fire Safe Pipe Penetrations, Others), Types of Fire (Cellulosic Fires, Hydrogen Fires, Jet Fires), Application (Pipe, Duct, Structural Steel Fireproofing, Cable & Wire Tray Fireproofing, Doors, Windows, Glasses, Others), End-Use (Residential, Commercial, Institutional, Infrastructure) |

|

Country Covered |

Australia |

|

Market Players Covered |

3M, BASF SE, PPG Industries, Inc., The Sherwin-Williams Company, Morgan Advanced Materials and its affiliates, Hilti Group, Tremco Incorporated, Unifrax, Tenmat, Sika Australia Pty Ltd, among others |

Market Definition

Fire protection materials are those materials that are used to ensure the safety of buildings from hazards related to fire. This involves using passive fire protection materials such as fire-resistant boards, sealants, and fire-resistant materials, such as mineral wool and fireproof coatings, or may include active fire protection materials such as fire extinguishing foams, chemicals, water, and sprays. When choosing a material that protects from fire, multiple factors are considered, such as its load-bearing capabilities, thermal conductivity, and tendency towards decay.

There is a growing demand for fire protection materials owing to stringent building codes & fire safety policies and various official standards established to overlook and ensure product effectiveness in the Australian region. This is expected to drive the fire protection materials over forecasted years. Moreover, the increasing awareness regarding protection from fire-related accidents among consumers is also expected to drive the growth of fire protection materials.

Australia Fire Protection Materials Market Dynamics

Drivers

- Escalating application scope of fire protection materials in various industries

Advanced fire protection materials are used in this vertical to avoid fire accidents. Highly efficient fire detection and prevention systems are required in this sector to prevent accidents. Clean agent fire suppression systems, dry chemical fire suppression materials, and water and foam sprinklers are extensively used in the mining sector.

Gas-based suppression systems containing CO2, Novec, and Inert gases and sprinkler systems are also used in the oil & gas sector. Additionally, rising applications of fire protection materials in mining vehicles to suppress fire by enhancing firefighting operation is also helping in the market growth.

- Imposition of favorable government guidelines and fire safety standards

Commercial construction is one of the growing application segments in the fire protection materials market, and the government has implemented strict safety regulations and strict building codes in the construction of offices, shopping centers, malls, hospitals, colleges, schools, universities, and hotels due to a large number of people in these buildings. Therefore, enforcement of these fire regulations and legislations will significantly increase awareness among the consumers, which may help to boost the demand for fire protection materials in the Australia fire protection materials market.

- Growing building and construction activities due to rapid growth in population

The engineering of a safety-proof structure is needed to ensure the stability of the structure and make fire and explosion risks manageable. Furthermore, the increase in the number of fire accidents, leading to the loss of life and valuable assets, has made various construction companies more vigilant, compelling them to employ fire protection measures for safety. This, in turn, is expected to boost the Australian fire protection materials market.

Opportunities

- Rapid technological advancements in fire protection systems and products

The advances that have occurred in improving the fire retardancy of specific materials have occurred, ranging from developments in phosphorus and halogen-free flame retardants to the use of nanocomposites as novel flame retardant systems. Thus, rapid technological advances in materials and fire protection systems may provide lucrative opportunities for the growth and development of the Australian fire protection materials market.

- Increasing utilization of safety codes in buildings for occupants and users

In addition, the Australian NCC also promotes low-combustible building materials and safe exit routes for occupants in well-designed fire compartments within buildings. All these specifications help set up the Fire resistance Level (FRL) of the buildings, ensuring structural adequacy, integrity, and proper insulation on the premises.

Thus, the increasing utilization and adoption of safety codes and protocols in various residential and commercial buildings for occupants and users are expected to offer growth opportunities to investors and players operating in the Australia fire protection materials market.

Restraints/Challenges

- Fluctuations in the price of raw materials

Higher raw material prices increase production costs at the company level. This, in turn, affects the consumers as the finished products cost more to the consumers, therefore, limiting their demand as consumers either stop the consumption of such costly products and materials or start looking for alternatives available in the market.

In addition, the increase in the price of various raw materials such as steel, concrete, and glass has directly and negatively affected the realty market, which may hinder the growth of the Australia fire protection materials market. Therefore, fast fluctuating and increasing raw material prices are expected to hinder the market's growth.

- Integration of user interfaces with fire protection solutions

Proper coordination between the mechanical, electrical, fire protection, and installing contractors is a must for the proper functioning of the fire control systems. In addition, with the integration of all security and fire systems in one place, the user interface becomes too confusing and complex to use.

The first time many operators interact with the control panel of this user interface is in times of uncertainty or an emergency. The more complex the user interface is, the more difficult its operation. Complex menu systems can easily lead to confusion, inciting fear and paralyzing the user due to a lack of guidance or panel intuition. Therefore, integration of the user interface with the fire protection system and materials is not an easy task and may hinder the growth of the Australia fire protection materials market.

- Low adoption rate among the potential end-users due to lack of awareness

However, the Australian population lacks in the basic areas of fire safety awareness, including the nature of fire, the causes of fire, the behavior of fire, and fire safety management. With the low awareness among the users of fire protection materials, people usually prefer cheap materials that do not provide protection from fire or are not suitable to contain the fire in case of any accidents. This is anticipated to be a challenging problem for the growth of the Australia fire protection market.

- High installation and maintenance cost

In addition, installing various fire protection systems adds up to the cost of the overall budget of a building. For example, installing an automatic water sprinkler system requires additional equipment, pipework, valve sets, booster pumps, and water storage, which are not pocket-friendly for all occupants or users. Moreover, the use of more heavy fire protection materials in a building also increases the load on the beam of the building, which negatively affects the building's load-bearing capacity, making it less stable over a longer time. Therefore, the disadvantage of the high costs of installation and maintenance of fire protection materials, products, and systems in a building will act as a challenge to the growth of the Australia fire protection market.

Recent Development

- In March 2022, PPG Industries, Inc. launched their new PPG AMERLOCK 600 multipurpose epoxy coating for applications requiring maximum versatility. This newly launched range of coatings are highly built, polyamide-cured coating that combines a broad application thickness range with fast dry times and a one-year recoat window.

Australia Fire Protection Materials Market Scope

Australia fire protection materials market is categorized based on product, types of fire, application, and end-use. The growth amongst these segments will help you analyze major industry growth segments and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product

- Adhesive & Sealant

- Intumescent Coatings

- Sheets & Boards

- Putties

- Mortar

- Foam

- Fire Blocks

- Fire Safe Pipe Penetrations

- Preformed Devices

- Cementitious Spray

- Others

On the basis of product, Australia fire protection materials market is segmented into adhesive and sealant, intumescent coatings, sheets & boards, foam, putties, mortar, fire blocks, cementitious spray, preformed devices, fire safe pipe penetrations, others.

Types of Fires

- Cellulosic Fires

- Hydrogen Fires

- Jet Fires

On the basis of types of fires, Australia fire protection materials market is segmented into cellulosic fires, hydrogen fires, and jet fires.

Application

- Pipe

- Duct

- Structural Steel Fireproofing

- Cable & Wire Tray Fireproofing

- Doors

- Windows

- Glasses

- Others

On the basis of application, Australia fire protection materials market is segmented into pipe, duct, structural steel fireproofing, cable & wire tray fireproofing, doors, windows, glasses, others.

End-Use

- Commercial

- Infrastructure

- Institutional

- Residential

On the basis of end-use, the Australia fire protection materials market is segmented into residential, commercial, institutional, and infrastructure.

Competitive Landscape and Australia Fire Protection Materials Market Share Analysis

Australia fire protection materials market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points are only related to the companies' focus on the Australia fire protection materials market.

Some of the prominent players operating in the Australia fire protection materials market are 3M, BASF SE, PPG Industries, Inc., The Sherwin-Williams Company, Morgan Advanced Materials and its affiliates, Hilti Group, Tremco Incorporated, Unifrax, Tenmat, Sika Australia Pty Ltd, among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Australia Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF AUSTRALIA FIRE PROTECTION MATERIALS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 TECHNOLOGY ADVANCEMENTS

4.4 VENDOR SELECTION CRITERIA

4.5 RAW MATERIAL PRODUCTION COVERAGE

4.6 REGULATION OVERVIEW

5 COUNTRY ANALYSIS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 ESCALATING APPLICATION SCOPE OF FIRE PROTECTION MATERIALS IN VARIOUS INDUSTRIES

6.1.2 IMPOSITION OF FAVOURABLE GOVERNMENT GUIDELINES AND FIRE SAFETY STANDARDS

6.1.3 GROWING BUILDING AND CONSTRUCTION ACTIVITIES DUE TO RAPID GROWTH IN POPULATION

6.2 RESTRAINTS

6.2.1 FLUCTUATIONS IN THE PRICE OF RAW MATERIALS

6.2.2 INTEGRATION OF USER INTERFACES WITH FIRE PROTECTION SOLUTIONS

6.3 OPPORTUNITIES

6.3.1 RAPID TECHNOLOGICAL ADVANCEMENTS IN FIRE PROTECTION SYSTEMS AND PRODUCTS

6.3.2 INCREASING UTILIZATION OF SAFETY CODES IN BUILDINGS FOR OCCUPANTS AND USERS

6.4 CHALLENGES

6.4.1 LOW ADOPTION RATE AMONG THE POTENTIAL END-USERS DUE TO LACK OF AWARENESS

6.4.2 HIGH INSTALLATION AND MAINTENANCE COST

7 AUSTRALIA FIRE PROTECTION MATERIALS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 ADHESIVE & SEALANT

7.2.1 SILICONE

7.2.2 ACRYLIC

7.2.3 OTHERS

7.3 INTUMESCENT COATINGS

7.3.1 STYRENE ACRYLICS

7.3.2 VINYL TOULENE ACRYLICS

7.3.3 SILICONE ACRYLICS

7.3.4 FLUOROPOLYMER

7.3.5 EPOXIES

7.3.6 URETHANES

7.3.7 CHLORINATED RUBBER

7.3.8 OTHERS

7.4 SHEETS & BOARDS

7.4.1 GYPSUM BOARDS

7.4.2 PERLITE BOARDS

7.4.3 PROPLEX SHEETS

7.4.4 CALCIUM SILICATE

7.4.5 SODIUM SILICATE

7.4.6 POTASSIUM SILICATE

7.4.7 OTHERS

7.5 PUTTIES

7.6 MORTAR

7.7 FOAM

7.8 FIRE BLOCKS

7.9 FIRE SAFE PIPE PENETRATIONS

7.9.1 FIRE SAFE PIPE PENETRATIONS, BY PRODUCT

7.9.1.1 OUTER INSULATION PRODUCT

7.9.1.1.1 TAPE

7.9.1.1.2 BANDAGE

7.9.1.1.3 OTHERS

7.9.1.2 BASE INSULATION PRODUCT

7.9.1.2.1 STONE WOOL

7.9.1.2.2 GLASS WOOL

7.9.1.2.3 OTHERS

7.9.2 FIRE SAFE PIPE PENETRATIONS, BY RESISTANCE CLASS

7.9.2.1 EI 120

7.9.2.2 EI 90

7.9.2.3 OTHERS

7.9.3 FIRE SAFE PIPE PENETRATIONS, BY SOLUTION

7.9.3.1 CONTINUOUS SUSTAINED (CS)

7.9.3.2 LOCAL SUSTAINED (LS)

7.9.3.3 OTHERS

7.1 PREFORMED DEVICES

7.10.1 WRAP STRIPS

7.10.2 COLLARS

7.10.3 PILLOW

7.10.4 PU-BRICK

7.10.5 CAST-IN DEVICE

7.11 CEMENTITIOUS SPRAY

7.12 OTHERS

8 AUSTRALIA FIRE PROTECTION MATERIALS MARKET, BY TYPE OF FIRE

8.1 OVERVIEW

8.2 CELLULOSIC FIRES

8.3 HYDROGEN FIRES

8.4 JET FIRES

9 AUSTRALIA FIRE PROTECTION MATERIALS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 PIPE

9.2.1 STAINLESS STEEL PIPE

9.2.2 STEEL PIPE

9.2.3 COPPER PIPE

9.2.4 IRON PIPE

9.2.5 COMPOSITE PIPE

9.2.6 PLASTIC PIPE

9.3 DUCT

9.4 STRUCTURAL STEEL FIREPROOFING

9.5 CABLE & WIRE TRAY FIREPROOFING

9.6 DOORS

9.7 WINDOWS

9.8 GLASSES

9.9 OTHERS

10 AUSTRALIA FIRE PROTECTION MATERIALS MARKET, BY END USE

10.1 OVERVIEW

10.2 COMMERCIAL

10.2.1 ADHESIVE & SEALANT

10.2.2 INTUMESCENT COATINGS

10.2.3 SHEETS & BOARDS

10.2.4 PUTTIES

10.2.5 MORTAR

10.2.6 FOAM

10.2.7 FIRE BLOCKS

10.2.8 FIRE SAFE PIPE PENETRATION

10.2.9 PREFORMED DEVICES

10.2.10 CEMENTITIOUS SPRAY

10.2.11 OTHERS

10.3 INFRASTRUTURE

10.3.1 ADHESIVE & SEALANT

10.3.2 INTUMESCENT COATINGS

10.3.3 SHEETS & BOARDS

10.3.4 PUTTIES

10.3.5 MORTAR

10.3.6 FOAM

10.3.7 FIRE BLOCKS

10.3.8 FIRE SAFE PIPE PENETRATION

10.3.9 PREFORMED DEVICES

10.3.10 CEMENTITIOUS SPRAY

10.3.11 OTHERS

10.4 INSTITUTIONAL

10.4.1 ADHESIVE & SEALANT

10.4.2 INTUMESCENT COATINGS

10.4.3 SHEETS & BOARDS

10.4.4 PUTTIES

10.4.5 MORTAR

10.4.6 FOAM

10.4.7 FIRE BLOCKS

10.4.8 FIRE SAFE PIPE PENETRATION

10.4.9 PREFORMED DEVICES

10.4.10 CEMENTITIOUS SPRAY

10.4.11 OTHERS

10.5 RESIDENTIAL

10.5.1 ADHESIVE & SEALANT

10.5.2 INTUMESCENT COATINGS

10.5.3 SHEETS & BOARDS

10.5.4 PUTTIES

10.5.5 MORTAR

10.5.6 FOAM

10.5.7 FIRE BLOCKS

10.5.8 FIRE SAFE PIPE PENETRATION

10.5.9 PREFORMED DEVICES

10.5.10 CEMENTITIOUS SPRAY

10.5.11 OTHERS

10.6 RESIDENTIAL, BY SEGMENT

10.6.1 APARTMENTS

10.6.2 MULTI FAMILY HOME

10.6.3 SINGLE FAMILY HOME

10.6.4 OTHERS

11 AUSTRALIA FIRE PROTECTION MATERIALS MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: AUSTRALIA

11.2 COLLABORATION

11.3 PRODUCT LAUNCHES

11.4 FACILITY EXPANSION

11.5 ACQUISITION

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 3M

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT UPDATES

13.2 PPG INDUSTRIES, INC

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT UPDATES

13.3 SIKA AUSTRALIA PTY LTD

13.3.1 COMPANY SNAPSHOT

13.3.2 PRODUCT PORTFOLIO

13.3.3 RECENT UPDATE

13.4 HILTI GROUP

13.4.1 COMPANY SNAPSHOT

13.4.2 PRODUCT PORTFOLIO

13.4.3 RECENT UPDATES

13.5 BASF SE

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT UPDATE

13.6 TREMCO INCORPORATED

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT UPDATES

13.7 MORGAN ADVANCED MATERIALS AND ITS AFFILIATES

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT UPDATES

13.8 TENMAT

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT UPDATE

13.9 THE SHERWIN-WILLIAMS COMPANY

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT UPDATES

13.1 UNIFRAX

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT UPDATE

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF PARTS OF FIRE EXTINGUISHERS, SPRAY GUNS AND SIMILAR APPLIANCES, STEAM OR SAND BLASTING; HS CODE - 842490 (USD THOUSAND)

TABLE 2 EXPORT IMPORT DATA OF PARTS OF FIRE EXTINGUISHERS, SPRAY GUNS AND SIMILAR APPLIANCES, STEAM OR SAND BLASTING; HS CODE - 842490 (USD THOUSAND

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 AUSTRALIA FIRE PROTECTION MATERIALS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 5 AUSTRALIA ADHESIVE & SEALANT IN FIRE PROTECTION MATERIALS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 6 AUSTRALIA INTUMESCENT COATINGS IN FIRE PROTECTION MATERIALS MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 7 AUSTRALIA SHEETS & BOARDS IN FIRE PROTECTION MATERIALS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 8 AUSTRALIA FIRE SAFE PIPE PENETRATIONS IN FIRE PROTECTION MATERIALS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 9 AUSTRALIA OUTER INSULATION PRODUCT IN FIRE PROTECTION MATERIALS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 10 AUSTRALIA BASE INSULATION PRODUCT IN FIRE PROTECTION MATERIALS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 AUSTRALIA FIRE SAFE PIPE PENETRATIONS IN FIRE PROTECTION MATERIALS MARKET, BY RESISTANCE CLASS, 2020-2029 (USD THOUSAND)

TABLE 12 AUSTRALIA FIRE SAFE PIPE PENETRATIONS IN FIRE PROTECTION MATERIALS MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 13 AUSTRALIA PERFORMED DEVICES IN FIRE PROTECTION MATERIALS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 14 AUSTRALIA FIRE PROTECTION MATERIALS MARKET, BY TYPE OF FIRE, 2020-2029 (USD THOUSAND)

TABLE 15 AUSTRALIA FIRE PROTECTION MATERIALS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 16 AUSTRALIA PIPE IN FIRE PROTECTION MATERIALS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 17 AUSTRALIA FIRE PROTECTION MATERIALS MARKET, BY END USE, 2020-2029 (USD THOUSAND)

TABLE 18 AUSTRALIA COMMERCIAL IN FIRE PROTECTION MATERIALS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 19 AUSTRALIA INFRASTRUCTURE IN FIRE PROTECTION MATERIALS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 20 AUSTRALIA INSTITUTIONAL IN FIRE PROTECTION MATERIALS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 21 AUSTRALIA RESIDENTIAL IN FIRE PROTECTION MATERIALS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 22 AUSTRALIA RESIDENTIAL IN FIRE PROTECTION MATERIALS MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

List of Figure

FIGURE 1 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: SEGMENTATION

FIGURE 2 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: DATA TRIANGULATION

FIGURE 3 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: DROC ANALYSIS

FIGURE 4 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: PRODUCT LIFE LINE CURVE

FIGURE 7 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: MULTIVARIATE MODELLING

FIGURE 8 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: APPLICATION COVERAGE GRID

FIGURE 11 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: SEGMENTATION

FIGURE 13 ESCALATING APPLICATION SCOPE OF FIRE PROTECTION MATERIALS IN VARIOUS INDUSTRIES IS EXPECTED TO DRIVE AUSTRALIA FIRE PROTECTION MATERIALS MARKET IN THE FORECAST PERIOD

FIGURE 14 ADHESIVE & SEALANT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE AUSTRALIA FIRE PROTECTION MATERIALS MARKET IN 2022 & 2029

FIGURE 15 VENDOR SELECTION CRITERIA

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF AUSTRALIA FIRE PROTECTION MATERIALS MARKET

FIGURE 17 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: BY PRODUCT, 2021

FIGURE 18 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: BY TYPE OF FIRE, 2021

FIGURE 19 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: BY APPLICATION, 2021

FIGURE 20 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: BY END USE, 2021

FIGURE 21 AUSTRALIA FIRE PROTECTION MATERIALS MARKET: COMPANY SHARE 2021 (%)

Australia Fire Protection Materials Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Australia Fire Protection Materials Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Australia Fire Protection Materials Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.