Australia And New Zealand Non Stick Cookware Market

Market Size in USD Million

CAGR :

%

USD

254.62 Million

USD

356.78 Million

2024

2032

USD

254.62 Million

USD

356.78 Million

2024

2032

| 2025 –2032 | |

| USD 254.62 Million | |

| USD 356.78 Million | |

|

|

|

Australia and New Zealand Non-Stick Cookware Market Analysis

Non-stick cookware market has an increased demand for quick, easy-to-clean cookware due to busy work schedule, as consumers are increasingly seek rising interest in personalized cookware while ensuring healthy cooking methods, again advancements and innovations in non-stick coatings, materials and designs helps consumers to choose the products according to the various cooking needs thereby driving market growth globally.

Australia and New Zealand Non-Stick Cookware Market Size

Australia and New Zealand non-stick cookware market is expected to reach USD 356.78 million by 2032 from USD 254.62 million in 2024, growing with a substantial CAGR of 4.41% in the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Australia and New Zealand Non-Stick Cookware Market Trends

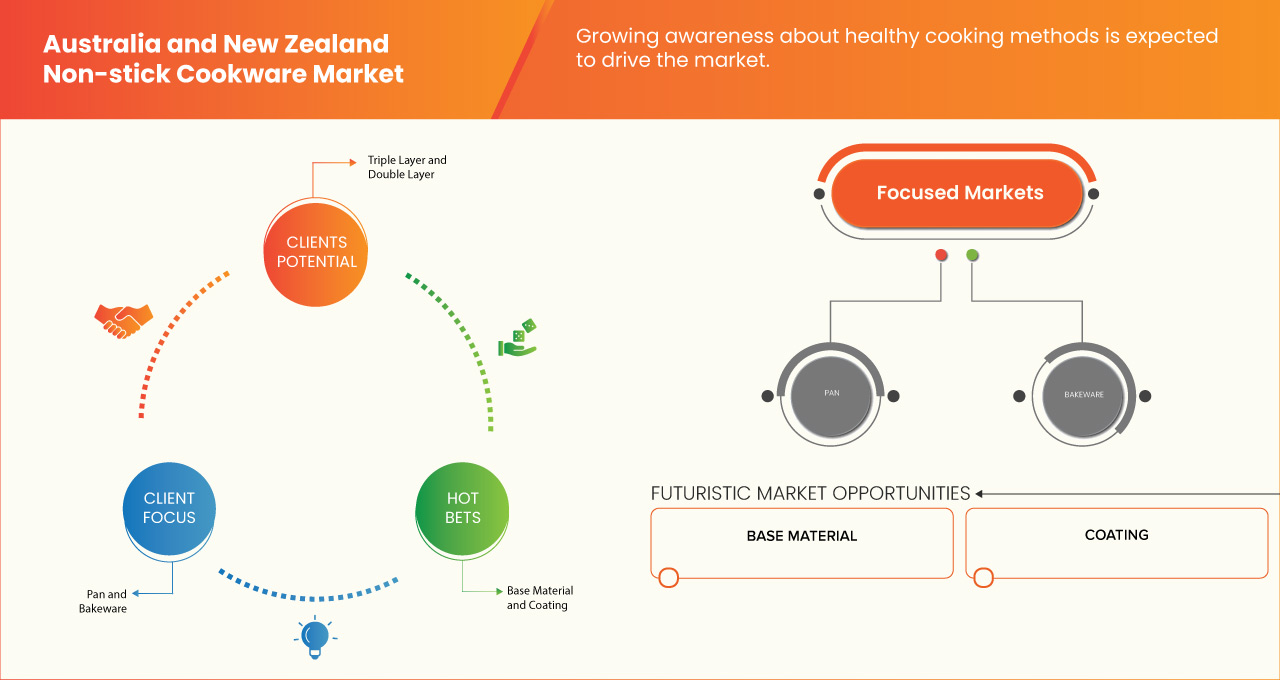

“Growing Awareness about Healthy Cooking Methods ”

The increasing consumer emphasis on health-conscious lifestyles is significantly propelling the demand for non-stick cookware in the Australia and New Zealand markets. With rising awareness of the health risks associated with excessive oil consumption, modern consumers are seeking cookware solutions that enable low-fat cooking. Non-stick cookware, with its ability to reduce or eliminate the need for cooking oils or butter, aligns seamlessly with this growing trend, positioning itself as a preferred choice among health-conscious households.

The surge in health-focused cooking practices is further amplified by the influence of social media, rising trend of health-focused cooking shows, and online content promoting nutritious recipes. These platforms frequently highlight the advantages of non-stick cookware in preparing meals that retain their nutritional value while reducing calorie intake. As a result, this segment of cookware is witnessing robust adoption across diverse demographic groups, from young professionals to families prioritizing healthier eating habits. Additionally, the expansion of wellness-oriented product portfolios by leading cookware brands in these regions is fueling market growth. Manufacturers are innovating with eco-friendly, toxin-free, non-stick coatings, such as ceramic or PFOA-free options, which resonate with environmentally conscious consumers. This commitment to safety and sustainability not only enhances consumer trust but also aligns with the region's growing emphasis on green and ethical consumption.

Report Scope and Market Segmentation

|

Attributes |

Australia and New Zealand Non-Stick Cookware Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Australia and New Zealand |

|

Key Market Players |

Cuisinart - Conair Australia (Australia), Scanpan Australia (Denmark), Tefal (France), SOLIDTEKNICS PTY LTD. (Australia), Made In (U.S.), GreenPan Australia (Australia), and Biome (Australia) among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Australia and New Zealand Non-Stick Cookware Market Definition

Non-stick cookware refers to cooking vessels, such as pans, pots, and baking trays, designed with a surface that prevents food from adhering during cooking. This feature is achieved through the application of a non-stick coating, commonly made of Polytetrafluoroethylene (PTFE), like Teflon, or ceramic-based materials. Non-stick cookware offers significant advantages, including the need for minimal oil or butter, promoting healthier cooking, and ease of cleaning. The surface ensures that delicate foods like eggs, pancakes, or fish can be prepared without tearing or sticking. Modern non-stick cookware often includes coatings free of harmful chemicals like PFOA (perfluorooctanoic acid), making them safer for long-term use. However, these items require specific care, such as avoiding metal utensils and high heat, to maintain their coating’s integrity. Non-stick cookware is widely used in home and professional kitchens for its convenience, efficiency, and suitability for low-fat cooking.

Australia and New Zealand Non-Stick Cookware Market Dynamics

Drivers

- Increased Demand for Quick, Easy-to-Clean Cookware Due to Busy Work Schedule

The growing prevalence of fast-paced lifestyles and demanding work schedules is fueling the demand for non-stick cookware in Australia and New Zealand. With a large segment of the population juggling work, family responsibilities, and personal commitments, consumers are increasingly prioritizing kitchen products that streamline meal preparation and cleanup. Non-stick cookware, designed for easy food release and minimal cleaning effort, is emerging as a go-to solution for time-pressed households.

As dual-income families and working professionals in urban areas seek to optimize their time, the convenience offered by non-stick cookware has become a significant purchase motivator. Its ability to reduce food residue and prevent sticking eliminates the hassle of scrubbing and soaking, making it particularly attractive to consumers who view efficiency as a priority. The product’s compatibility with quick-cooking techniques, such as stir-frying and sautéing, further enhances its appeal to busy individuals seeking to prepare meals with minimal effort.

The rise of compact, multi-functional cookware sets targeting small households and apartment living is another trend supporting this growth. Leading brands like Tefal, Scanpan, and Circulon have responded to this demand by offering space-saving. These versatile non-stick cookware collections meet the needs of modern kitchens while providing ease of maintenance. Retailers in Australia and New Zealand, such as Kmart and Target, and online platforms like Catch and Mighty Ape, have also capitalized on this demand by promoting affordable, durable, non-stick cookware.

For instance

- In January, according to an article published on NCBI in Australia and New Zealand, the rise of dual-income households, increasing from 56% in 2001 to 66% in 2017, reflects shifting gender roles and shared decision-making. With busy lifestyles, dual-earner couples prioritize convenience, driving demand for non-stick cookware that supports quick, healthy meals, aligning with their need for efficient, time-saving cooking solutions.

Advancements and Innovations in Non-Stick Coatings, Materials and Designs

Technological advancements and innovations in non-stick coatings, materials, and designs are significantly driving the growth of the non-stick cookware market in Australia and New Zealand. With increasing consumer demand for high-performance, safe, and durable cookware, manufacturers are continuously evolving their product offerings to meet these expectations.

One of the most notable developments has been the shift toward safer, more environmentally friendly, non-stick coatings. Traditional coatings, such as those based on PTFE (Teflon), have evolved to include PFOA-free and ceramic-based alternatives, which have gained significant traction in Australia and New Zealand due to their safety benefits and environmentally conscious appeal. Brands like GreenPan and Scanpan have pioneered the introduction of these innovative, non-toxic, and heat-resistant coatings, which cater to the growing consumer preference for healthier cooking options without sacrificing performance. Additionally, advancements in the durability and scratch-resistance of non-stick materials have further enhanced the appeal of non-stick cookware. Newer non-stick surfaces, designed to withstand higher temperatures and more aggressive use, offer consumers longer-lasting products. For example, non-stick cookware with reinforced ceramic or diamond-infused coatings provides superior longevity and greater resistance to wear and tear, which addresses previous concerns over the lifespan of non-stick pans. This innovation has encouraged both retail and online purchases as consumers are increasingly willing to invest in high-quality cookware.

Furthermore, the evolution in cookware design has enhanced the functionality of non-stick products. Modern designs, including ergonomic handles, heat-efficient bases, and even non-stick cookware that can be used on induction stoves, meet the diverse needs of today's busy households. Retailers in Australia and New Zealand, including Kmart, Target, and online platforms like Catch, have expanded their portfolios to feature these technologically advanced products, driving sales and market penetration.

For instance

- GreenPan has become a leading brand in Australia and New Zealand by introducing ceramic-based non-stick cookware. Their "Thermolon" coating is free from toxic chemicals like PTFE and PFOA, catering to the growing demand for healthier, environmentally friendly cooking solutions. This innovation has boosted GreenPan’s popularity, particularly in health-conscious markets, and has significantly influenced consumer purchasing decisions

Opportunities

- Rising Interest in Personalized Cookware

The growing consumer interest in personalized cookware presents a significant opportunity for the non-stick cookware market in Australia and New Zealand. As consumers increasingly seek products that reflect their individual cooking preferences, lifestyles, and aesthetics, manufacturers and retailers can leverage this trend to introduce customizable offerings and expand their market share.

Personalized cookware includes options such as customizable sizes, colors, patterns, and materials that cater to specific consumer needs. For instance, urban professionals may prefer compact, multi-functional cookware suited for smaller kitchens, while avid home chefs may seek specialized non-stick pans tailored for specific cuisines or recipes. Offering customizable features allows manufacturers to target niche market segments effectively and build stronger brand loyalty. Moreover, personalized cookware aligns with the rising demand for unique and thoughtful gifting options. Customized non-stick pans or cookware sets engraved with names or special messages are gaining popularity as premium gifts for weddings, anniversaries, and housewarming events.

The rise of e-commerce platforms further supports this opportunity. Brands can implement user-friendly configurators on their websites, enabling customers to select their preferred handle designs, coating types, or colors. Companies like Le Creuset have already started offering limited customization options in global markets, paving the way for local brands to replicate similar initiatives in Australia and New Zealand.

For instance,

- In January 2024, according to an article published by International Trade Administration E-commerce in Australia grew modestly in 2022, accounting for 18% of retail spending (USD 45 billion), with 82% of households shopping online and strong growth from rural areas. This shift supports the non-stick cookware market, as consumers increasingly rely on online platforms to access premium and convenient cooking solutions, regardless of location

Rapidly Growing Culinary Culture Such as Cooking Shows, Influencers, and Home Cooking

The rapidly growing culinary culture in Australia and New Zealand, fueled by cooking shows, social media influencers, and the increasing popularity of home cooking, presents a significant opportunity for the non-stick cookware market. As more consumers embrace cooking as a hobby and a way to connect with family and friends, the demand for high-quality, user-friendly cookware is intensifying, particularly in the non-stick segment.

Cooking shows, including popular programs like MasterChef Australia and My Kitchen Rules, have played a pivotal role in shaping consumer attitudes towards cooking. These platforms not only showcase new culinary techniques but also highlight the importance of using the right cookware, driving awareness of non-stick pans' convenience and versatility. Viewers are increasingly inspired to recreate professional-level dishes at home, often seeking out non-stick cookware for its ease of use and minimal need for oil. Furthermore, social media influencers and food bloggers are shaping trends by showcasing their cooking experiences using non-stick cookware. Platforms like Instagram, YouTube, and TikTok are flooded with influencers sharing recipes and reviews of cookware, with non-stick products frequently featured for their practical and aesthetic appeal. As influencers promote kitchen tools that make cooking simpler, more stylish, and healthier, consumers are more inclined to invest in non-stick cookware for their homes.

The rise in home cooking, particularly in response to the pandemic, has shifted the mindset of many consumers who now view their kitchens as spaces for creativity and personal expression. Non-stick cookware is seen as a must-have for both novice cooks and seasoned chefs due to its ease of cleaning, versatility, and ability to produce healthier meals with less oil. This growing culinary culture is generating demand for premium non-stick cookware, with opportunities for manufacturers to introduce innovative products, such as specialized non-stick frying pans or cookware designed for specific cooking styles or cuisines.

For instance

- The rapidly growing culinary culture, driven by cooking shows, influencers, and home cooking trends, has elevated cookware like Scanpan’s Pro IQ range. With its high-performance features, including a stainless steel riveted handle and squeeze-cast induction aluminum body, it has become a preferred choice for culinary enthusiasts, including those featured on shows like MasterChef Australia. This growing interest in cooking culture drives demand for premium kitchenware, which blends functionality with aesthetic appeal

Restraints/Challenges

- Strict Regulations Regarding Food Safety Standards and the Use of Chemicals in Non-Stick Coatings

The stringent regulations regarding food safety standards and the use of chemicals in non-stick coatings present significant challenges for the non-stick cookware market in Australia and New Zealand. As consumers become increasingly concerned about health and safety, cookware manufacturers must comply with evolving legal frameworks, which often require costly adjustments to production processes and materials.

Both Australia and New Zealand have rigorous standards for consumer products, particularly those that come into direct contact with food. Non-stick cookware is subject to regulations regarding the chemicals used in coatings, such as Perfluorooctanoic Acid (PFOA) and Perfluorooctyl Sulfonate (PFOS), which are banned or restricted in many markets due to concerns about their environmental and health impact. Manufacturers must ensure their products meet local and international standards, such as the Australian Competition and Consumer Commission (ACCC) and Food Standards Australia New Zealand (FSANZ) guidelines, which may require costly certifications and testing. For instance, cookware brands have to ensure their non-stick coatings are free from harmful substances, such as PFOA, a chemical previously common in non-stick products. In response to increasing consumer concerns, many manufacturers have shifted to using alternative coatings, which may be more expensive and less readily available, further raising production costs. This shift may challenge small and mid-sized manufacturers that lack the resources to meet new material requirements. Furthermore, compliance with these safety standards often requires ongoing testing and verification, adding complexity to the production process. Any failure to meet these regulations can lead to legal issues, product recalls, or damage to brand reputation, which can severely affect market stability.

For instance

- Food Standards Australia New Zealand (FSANZ) and the Australian Competition and Consumer Commission (ACCC) impose stringent requirements on the safety of materials in direct contact with food. These regulations ensure that the non-stick coatings used in cookware do not leach harmful chemicals when exposed to high heat. This requires manufacturers to invest in extensive

High Prices of Non-Stick Cookware

The relatively high prices of non-stick cookware, particularly premium and innovative products, are a significant restraint in the Australia and New Zealand market. As consumers in these regions increasingly prioritize affordability due to rising living costs, the price sensitivity in cookware purchasing decisions has intensified. This dynamic limit the adoption of high-quality non-stick cookware among middle- and lower-income households.

Premium non-stick cookware brands, such as Scanpan, Tefal, and Circulon, are often associated with advanced features like PFOA-free coatings, improved durability, and heat efficiency. However, these attributes come with higher production costs, which translate into elevated retail prices. For example, a single high-quality non-stick frying pan can cost upwards of AUD 150 (NZD 160), making it inaccessible for budget-conscious consumers. As a result, many buyers opt for cheaper alternatives like standard stainless steel or cast iron cookware, which are perceived as more cost-effective in the long run.

Additionally, the durability of non-stick coatings can raise further cost concerns. Even high-end products may require replacement after a few years of frequent use, which deters cost-conscious buyers who seek longer-lasting cookware solutions. This short lifecycle, combined with a high upfront cost, reduces repeat purchases, impacting overall market growth.

For instance,

- The Scanpan Classic Frypan is listed at around AUD 180 to AUD 380 in major Australian retailers like Myer and David Jones. These high prices may deter price-sensitive consumers, leading them to opt for cheaper cookware alternatives

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Australia and New Zealand Non-Stick Cookware Market Scope

The market is segmented on the basis of product, raw material, coating layer, distribution channel, and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Pan

- Pot

- Bakeware

- Pressure Cooker

- Skillet

- Square Grill

- Oven Tray

- Dutch Oven

- Loaf Tin

- Sandwich Toaster

- Wok

- Egg Poacher

- Others

Raw Material

- Base Material

- Base Material, By Type

- Cast Iron

- Aluminium

- Copper

- Stainless Steel

- Carbon Steel

- Clay and Stoneware

- Others

- Base Material, By Type

- Coating

- Coating, By Type

- Teflon Coated

- Fluoropolymer

- Ceramic Coating

- Anodized Aluminum Coated

- Enameled Iron Coated

- Silicones/Siloxanes

- Silicon Polyesters

- Hybrids

- Superhydrophobic

- Others

- Coating, By Type

Coating Layer

- Triple Layer

- Double Layer

- Single Layer

Distribution Channel

- Supermarkets/Hypermarkets

- E-Commerce

- Utensil Store

- Others

End-User

- Residential

- Commercial

Australia and New Zealand Non-Stick Cookware Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, country presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Australia and New Zealand Non-Stick Cookware Market Leaders Operating in the Market Are:

- Conair Australia (Australia)

- Scanpan Australia (Denmark)

- Tefal (France)

- SOLIDTEKNICS PTY LTD. (Australia)

- Made In (U.S.)

- GreenPan Australia (Australia)

- Biome (Australia)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END-USER COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING AWARENESS OF HEALTHY COOKING METHODS

5.1.2 INCREASED DEMAND FOR QUICK, EASY-TO-CLEAN COOKWARE DUE TO BUSY WORK SCHEDULE

5.1.3 ADVANCEMENTS AND INNOVATIONS IN NON-STICK COATINGS, MATERIALS AND DESIGNS

5.2 RESTRAINTS

5.2.1 CONCERNS ABOUT POTENTIAL HEALTH RISKS ASSOCIATED WITH SOME NON-STICK COATING

5.2.2 HIGH PRICES OF NON-STICK COOKWARE

5.3 OPPORTUNITIES

5.3.1 RISING INTEREST IN PERSONALIZED COOKWARE

5.3.2 RAPIDLY GROWING CULINARY CULTURE, SUCH AS COOKING SHOWS, INFLUENCERS, AND HOME COOKING

5.4 CHALLENGES

5.4.1 STRICT REGULATIONS REGARDING FOOD SAFETY STANDARDS AND THE USE OF CHEMICALS IN NON-STICK COATINGS

5.4.2 HIGH COMPETITION FROM ALTERNATIVE COOKWARE

6 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 PAN

6.3 POT

6.4 BAKEWARE

6.5 PRESSURE COOKER

6.6 SKILLET

6.7 SQUARE GRILL

6.8 OVEN TRAY

6.9 DUTCH OVEN

6.1 LOAF TIN

6.11 SANDWICH TOASTER

6.12 WOK

6.13 EGG POACHER

6.14 OTHERS

7 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET, BY RAW MATERIAL

7.1 OVERVIEW

7.2 BASE MATERIAL

7.3 COATING

8 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET, BY COATING LAYER

8.1 OVERVIEW

8.2 TRIPLE LAYER

8.3 DOUBLE LAYER

8.4 SINGLE LAYER

9 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET, BY END-USER

9.1 OVERVIEW

9.2 RESIDENTIAL

9.3 COMMERCIAL

10 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 SUPERMARKETS/HYPERMARKETS

10.3 E-COMMERCE

10.4 UTENSIL STORE

10.5 OTHERS

11 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET…………..

11.1 AUSTRALIA NON-STICK COOKWARE MARKET

11.2 NEW ZEALAND NON-STICK COOKWARE MARKET

12 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: AUSTRALIA AND NEW ZEALAND

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 CUISINART - CONAIR AUSTRALIA

14.1.1 COMPANY SNAPSHOT

14.1.2 PRODUCT PORTFOLIO

14.1.3 RECENT UPDATES

14.2 SCANPAN AUSTRALIA

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 RECENT UPDATES

14.3 TEFAL

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT UPDATES

14.4 SOLIDTEKNICS PTY LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT UPDATES

14.5 MADE IN

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT UPDATES

14.6 BIOME

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATES

14.7 GREENPAN AUSTRALIA

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 2 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET, BY PRODUCT, 2018-2032 (THOUSAND UNITS)

TABLE 3 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET, BY RAW MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 4 AUSTRALIA AND NEW ZEALAND BASE MATERIAL IN NON-STICK COOKWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 AUSTRALIA AND NEW ZEALAND COATING IN NON-STICK COOKWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET, BY COATING LAYER, 2018-2032 (USD THOUSAND)

TABLE 7 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 8 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 9 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 10 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET, BY COUNTRY, 2018-2032 (THOUSAND UNITS)

TABLE 11 AUSTRALIA NON-STICK COOKWARE MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 12 AUSTRALIA NON-STICK COOKWARE MARKET, BY PRODUCT, 2018-2032 (THOUSAND UNITS)

TABLE 13 AUSTRALIA NON-STICK COOKWARE MARKET, BY RAW MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 14 AUSTRALIA BASE MATERIAL IN NON-STICK COOKWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 AUSTRALIA COATING IN NON-STICK COOKWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 AUSTRALIA NON-STICK COOKWARE MARKET, BY COATING LAYER, 2018-2032 (USD THOUSAND)

TABLE 17 AUSTRALIA NON-STICK COOKWARE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 18 AUSTRALIA NON-STICK COOKWARE MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 19 NEW ZEALAND NON-STICK COOKWARE MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 20 NEW ZEALAND NON-STICK COOKWARE MARKET, BY PRODUCT, 2018-2032 (THOUSAND UNITS)

TABLE 21 NEW ZEALAND NON-STICK COOKWARE MARKET, BY RAW MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 22 NEW ZEALAND BASE MATERIAL IN NON-STICK COOKWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 NEW ZEALAND COATING IN NON-STICK COOKWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 NEW ZEALAND NON-STICK COOKWARE MARKET, BY COATING LAYER, 2018-2032 (USD THOUSAND)

TABLE 25 NEW ZEALAND NON-STICK COOKWARE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 26 NEW ZEALAND NON-STICK COOKWARE MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET

FIGURE 2 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: DATA TRIANGULATION

FIGURE 3 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: DROC ANALYSIS

FIGURE 4 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: AUSTRALIA AND NEW ZEALAND VS REGIONS MARKET ANALYSIS

FIGURE 5 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: MULTIVARIATE MODELLING

FIGURE 7 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: END-USER COVERAGE GRID

FIGURE 10 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: SEGMENTATION

FIGURE 11 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: BY PRODUCT

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 GROWING AWARENESS ABOUT HEALTHY COOKING METHODS IS EXPECTED TO DRIVE THE AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET

FIGURE 14 THE PAN SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET IN 2025 AND 2032

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET

FIGURE 16 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: BY PRODUCT, 2024

FIGURE 17 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: BY RAW MATERIAL, 2024

FIGURE 18 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: BY COATING LAYER, 2024

FIGURE 19 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: BY END-USER, 2024

FIGURE 20 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 21 AUSTRALIA AND NEW ZEALAND NON-STICK COOKWARE MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.