Asia-Pacific Ultra-Low-Power Microcontroller Market, By Peripheral Type (Analog Devices and Digital Devices), Type (General Purpose Sensing and Measurement MCUs, Capacitive Touch Sensing MCUs and Ultrasonic Sensing MCUs), Component (Hardware, Software and Services), Packaging Type (8 Bit Packaging, 16 Bit Packaging and 32 Bit Packaging), Network Connectivity (Wireless and Wired), RAM Capacity (Less Than 96 kb, 96 kb-512 kb and More Than 512 kb), retention power mode (1.6 μW- 2.4 μW, 2.4 μW- 3.5 μW and More Than 3.5 μW), Application (General Test & Measurement, Sensing, Flow Measurement and Others), End-User (Healthcare, Industrial, Manufacturing, It & Telecom, Military & Defence, Aerospace, Media & Entertainment, Automotive, Servers & Data Centers, Consumer Electronics and Others) Industry Trends and Forecast to 2029

Asia-Pacific Ultra-Low-Power Microcontroller Market Analysis and Size

Ultra-low-power microcontroller is the type of semiconductor manufactured to have computing power with the lowest energy consumption for applications such as smart devices, autonomous vehicles, robots, industrial processes, edge AI devices, and others.

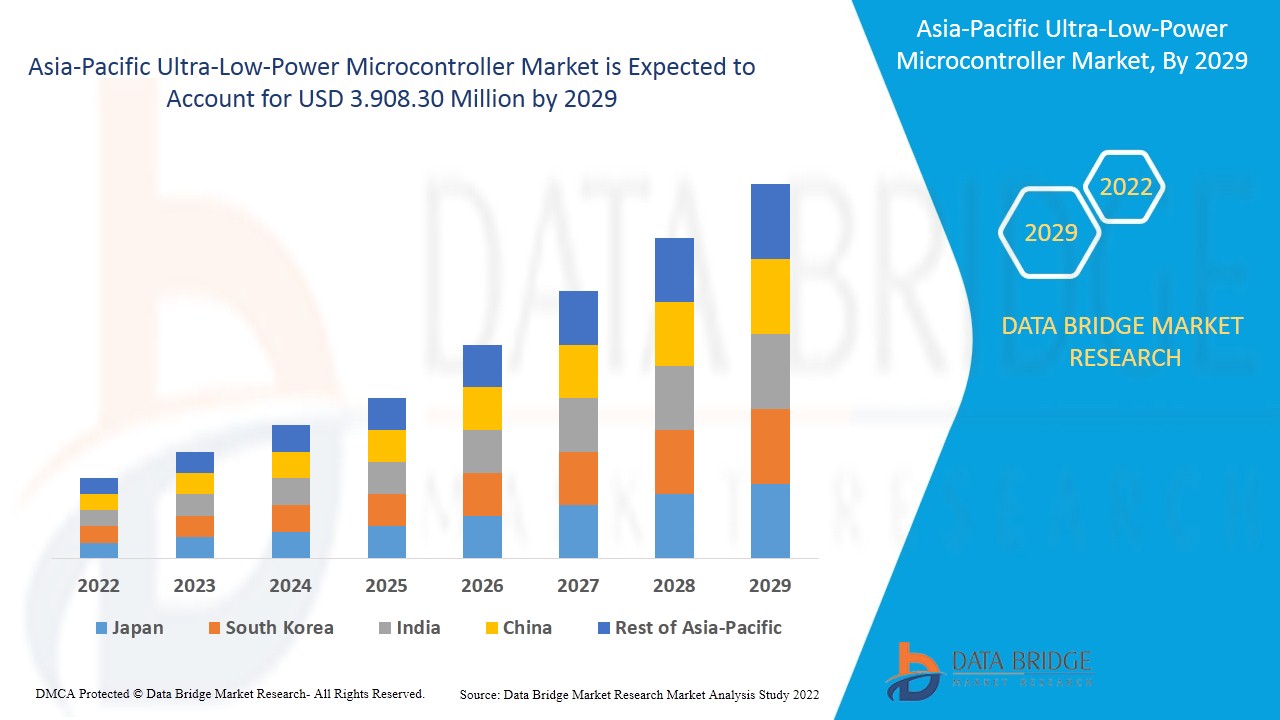

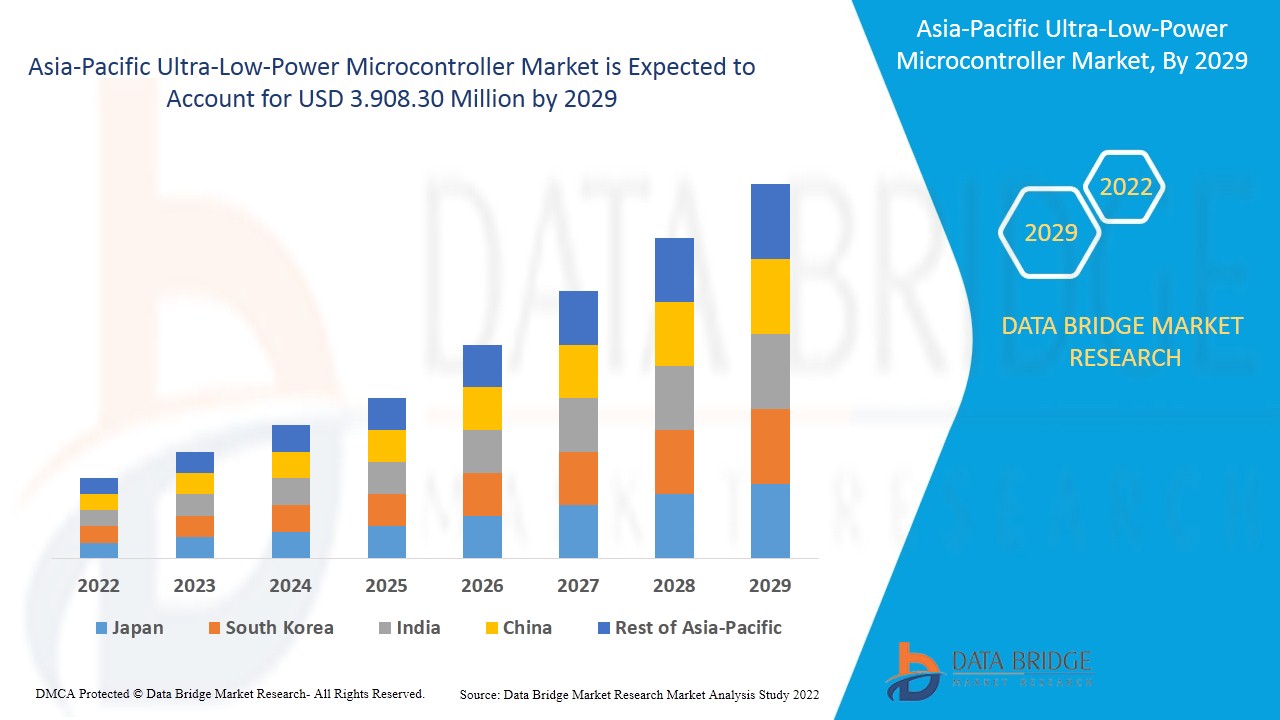

With increasing digitalization, the demand for power electronics worldwide is increasing, thus driving the demand for these ultra-low-power microcontrollers. Data Bridge Market Research analyses that the Asia-Pacific ultra-low-power microcontroller market is expected to reach the value of USD 3.908.30 million by the year 2029, at a CAGR of 11.5% during the forecast period. MCUs have wide applications and are utilized in almost all the industrial, commercial or residential sectors. Growing emphasis on energy conservation in electronic devices is driving the world towards using more efficient and power-conserving equipment, this has been driving the demand of ultra-low-power microcontrollers in the market.

The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2019 - 2014)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Type (Analog Devices and Digital Devices), Type (General Purpose Sensing and Measurement MCUs, Capacitive Touch Sensing MCUs and Ultrasonic Sensing MCUs), Component (Hardware, Software and Services), Packaging Type (8 Bit Packaging, 16 Bit Packaging and 32 Bit Packaging), Network Connectivity (Wireless and Wired), RAM Capacity (Less Than 96 kb, 96 kb-512 kb and More Than 512 kb), retention power mode (1.6 μW- 2.4 μW, 2.4 μW- 3.5 μW and More Than 3.5 μW), Application (General Test & Measurement, Sensing, Flow Measurement and Others), End-User (Healthcare, Industrial, Manufacturing, It & Telecom, Military & Defence, Aerospace, Media & Entertainment, Automotive, Servers & Data Centers, Consumer Electronics and Others),

|

|

Countries Covered

|

China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC)

|

|

Market Players Covered

|

Texas Instruments Incorporated, STMicroelectronics, Analog Devices, Inc., Infineon Technologies AG, Microchip Technology Inc., Ambiq Micro, Inc., Broadcom, EM Microelectronics, ESPRESSIF SYSTEMS (SHANGHAI) CO., LTD., Holtek Semiconductor Inc., LAPIS Semiconductor, Co., Ltd., Nuvoton Technology Corporation, NXP Semiconductors, Renesas Electonics Corporation, Seiko Epson Corporation, Semiconductor Components Industries, LLC, Silicon Laboratories, TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION, Zilog, Inc.

|

Market Definition

Ultra-low-power (ULP) microcontroller allows edge nodes to intelligently process localized data with the smallest amount of system power. This allows customers to extend battery life and the time between charges allowing longer use. Smaller battery sizes and longer time between in-field product replacements provide cost-saving for end users. Ultra-low-power consumption is a very important requirement to operate with small energy sources (to reduce size) and not generate local heating issues.

The Market Dynamics of the Ultra-Low-Power Microcontroller Market Include:

- Surge in need of energy efficient power electronic components

Developments in embedded technology led to the developments in high efficiency MCUs. The power requirements for these MCUs increased proportionally with their features and capabilities. Therefore, to design energy-efficient and compact applications using embedded systems, the power consumption of microcontrollers has to be reduced. Low power consumption also aids in making the device compact by reducing the required power supply. An ultra-low-power device can work for a long period, even on a smaller battery. This has encouraged many companies to produce ultra-low-power and energy-efficient MCUs without compromising their performance, thus expected to drive the market's growth.

- Growing popularity of low-battery-powered IoT devices

There is a growing demand for ultra-low-power MCUs in IoT applications for increasing energy conservation and making the device more compact. This is expected to drive the growth in the Asia-Pacific ultra-low-power microcontroller market.

- Increasing demand for low power consuming MCU in smart devices

The market for personal wellness and medical wearable applications is growing fast. New technological advancements and changing lifestyle has led to the increase of adoption of smart devices throughout the globe, this is increasing the demand for ultra-low-power microcontrollers in the market.

- Rising demand for microcontrollers in edge AI

The demand for ultra-low-power microcontrollers for performing ML at the edge has become a very hot area of development. Manufacturers are working to develop ultra-low-power microcontrollers that would allow inferencing, and ultimately training, to be executed on small, resource-constrained low-power devices, especially microcontrollers.

- Increasing demand for smart home and building management applications

With the developments and adoption in the smart home market, the demand for appliances to become sleeker and slim with a smaller form factor and more energy efficient is increasing. This has increased the demand for ultra-low-power microcontrollers.

Restraints/Challenges faced by the Ultra-Low-Power Microcontroller Market

- Huge carbon footprint issue in the semiconductor manufacturing sector

Chip manufacturers are major contributors to the climate crisis. It requires huge amounts of energy and water. Thus the resource intensive manufacturing process for a ULP microcontroller may restrain the growth of the market.

- Chip supply shortages

The leaders and executives at multinational corporations in Asia-Pacific are worried about the scarcity of semiconductors, which has hit manufacturing and sales in numerous countries, and no early solution is in sight. This poses as a significant challenge to the growth of the market.

This ultra-low-power microcontroller market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the ultra-low-power microcontroller market contact Data Bridge Market Research for an Analyst Brief. Our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In June 2021, Texas Instruments Incorporated announced the plans to acquire Micron Technology's 300-mm semiconductor factory (or "fab") in Lehi, Utah, for USD 900 million. With this, the company aimed at strengthening its competitive advantage in manufacturing and technology. This enabled the company to extend greater control over its supply chain..

- In February 2021, STMicroelectronics announced the launch of a new generation of extreme power-saving microcontrollers (MCUs). The extremely low power STM32U5 series of MCUs were designed to meet smart applications' most demanding power/performance requirements, including wearables, personal medical devices, home automation, and industrial sensors. The new STM32U5 series teamed the efficient Arm Cortex-M33 core with ST's innovative proprietary power-saving features and on-chip IP cutting down energy demand while pumping up performance.

Asia-Pacific Ultra-Low-Power Microcontroller Market Scope

The ultra-low-power microcontroller market is segmented on the basis of peripheral type, type, component, packaging type, network connectivity, RAM capacity, retention power mode, application, and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Peripheral Type

- Analog Devices

- Digital Devices

On the basis of peripheral type, the ultra-low-power microcontroller market is segmented into analog devices and digital devices.

Type

- General Purpose Sensing And Measurement MCUs

- Capacitive Touch Sensing MCUs

- Ultrasonic Sensing MCUS

On the basis of type, the ultra-low-power microcontroller market is segmented into general purpose sensing and measurement MCUS, capacitive touch sensing MCUS and ultrasonic sensing MCUS.

Component

- Hardware

- Software

- Services

On the basis of component, the ultra-low-power microcontroller market is segmented into hardware, software and services.

Packaging Type

- 8 Bit Packaging

- 16 Bit Packaging

- 32 Bit Packaging

On the basis of packaging type, the ultra-low-power microcontroller market is segmented into 8 bit packaging, 16 bit packaging and 32 bit packaging.

Network Connectivity

- Wired

- Wireless

On the basis of network connectivity, the ultra-low-power microcontroller market is segmented into wireless and wired.

RAM Capacity

- Less Than 96 kb,

- 96 kb-512 kb

- More Than 512 kb

On the basis of RAM capacity, the ultra-low-power microcontroller market is segmented into less than 96 kb, 96 kb-512 kb and more than 512 kb.

Retention Power Mode

- 1.6 μW- 2.4 μW,

- 2.4 μW- 3.5 μW

- More Than 3.5 μW

On the basis of retention power mode, the ultra-low-power microcontroller market is segmented into 1.6 μW- 2.4 μW, 2.4 μW- 3.5 μW and more than 3.5 μW.

Application

- General Test & Measurement

- Sensing

- Flow Measurement

- Others

On the basis of application, the ultra-low-power microcontroller market is segmented into general test & measurement, sensing, flow measurement and others.

End-User

- Healthcare

- Industrial

- Manufacturing

- It & Telecom

- Military & Defense

- Aerospace

- Media & Entertainment

- Automotive

- Servers & Data Centers

- Consumer Electronics

- Others

On the basis of end-user, the ultra-low-power microcontroller market is segmented into healthcare, industrial, manufacturing, IT & telecom, military & defense, aerospace, media & entertainment, automotive, servers & data centers, consumer electronics and others.

Ultra-Low-Power Microcontroller Market Regional Analysis/Insights

The ultra-low-power microcontroller market is analyzed and market size insights and trends are provided by country, peripheral type, type, component, packaging type, network connectivity, RAM capacity, retention power mode, application, and end-user as referenced above.

The countries covered in the ultra-low-power microcontroller market report are the China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, and rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC).

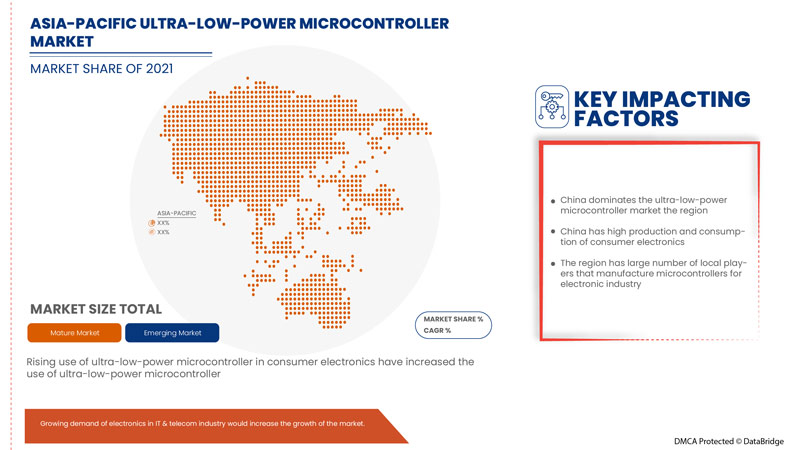

China dominates the ultra-low-power microcontroller market because of the presence of a large number of manufacturers and fabrication foundries in the region. The domestic MCU industry of China is also seeking to advance into the global market via supplying Chinese automakers and proceed into supplying joint ventures between domestic and international automakers.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Ultra-Low-Power Microcontroller Market Share Analysis

The ultra-low-power microcontroller market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to ultra-low-power microcontroller market.

Some of the major players operating in the ultra-low-power microcontroller market are Texas Instruments Incorporated, STMicroelectronics, Analog Devices, Inc., Infineon Technologies AG, Microchip Technology Inc., Ambiq Micro, Inc., Broadcom, EM Microelectronics, ESPRESSIF SYSTEMS (SHANGHAI) CO., LTD., Holtek Semiconductor Inc., LAPIS Semiconductor, Co., Ltd., Nuvoton Technology Corporation, NXP Semiconductors, Renesas Electonics Corporation, Seiko Epson Corporation, Semiconductor Components Industries, LLC, Silicon Laboratories, TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION, Zilog, Inc among others.

SKU-