Asia-Pacific Stem Cell Therapy Market, By Product Type (Bone Marrow Derived Mesenchymal Cells, Placental or Umbilical Stem Cell, Adipose Tissue Derived Mesenchymal Stem Cells, and Others), Type (Allogenic Stem Cell Therapy and Autologous Stem Cell Therapy), Application (Musculoskeletal Disorders, Acute Graft-Versus-Host Disease (AGVHD), Wounds and Injuries, Cardiovascular Diseases, Surgeries, Gastrointestinal Diseases, and Others), End User (Hospitals and Surgical Centers, Therapeutic Companies, Services Companies, and Others), Distribution Channel (Direct Tender, Third Party Distributors) Industry Trends and Forecast to 2029

Market Analysis and Size

Chronic diseases-including cancer, musculoskeletal disorders, neurology disorders, chronic injuries, cardiovascular and gastrointestinal - can lead to hospitalization, long-term disability, reduced quality of life, and death.

The mesenchymal stem cells penetrate and integrate into multiple organs, repair cardiovascular, lung, and spinal cord injuries, and improve the state of autoimmune diseases, liver, and bone and cartilage diseases. Stems cells are a potent tool for the treatment of infections caused by inflammation, immune system failure, and, or tissue degeneration.

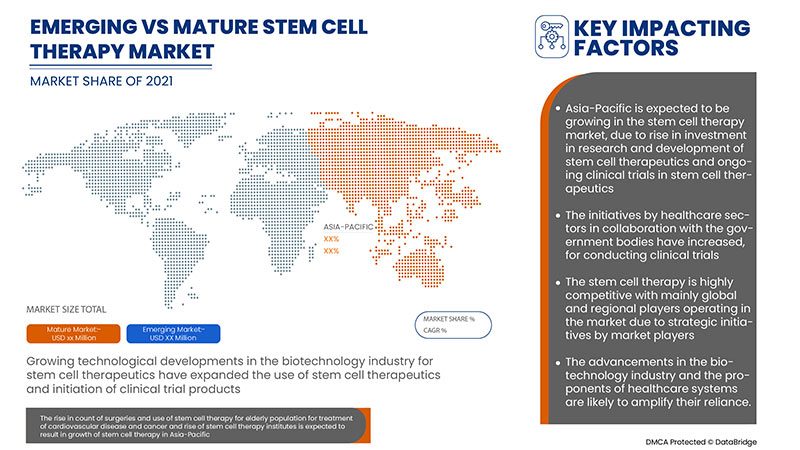

The drivers responsible for the growth of the Asia-Pacific stem cell therapy market are the increased incidence of chronic diseases, rise in GMP-certification approvals for cell therapy production facilities, growing biotechnology sector and rise in clinical trials for stem-cell-based therapies. However, factors that are expected to restrain the market growth are the rise in the cost of stem cell-based research, and the risks faced while undergoing stem cell therapy, and the availability of alternatives.

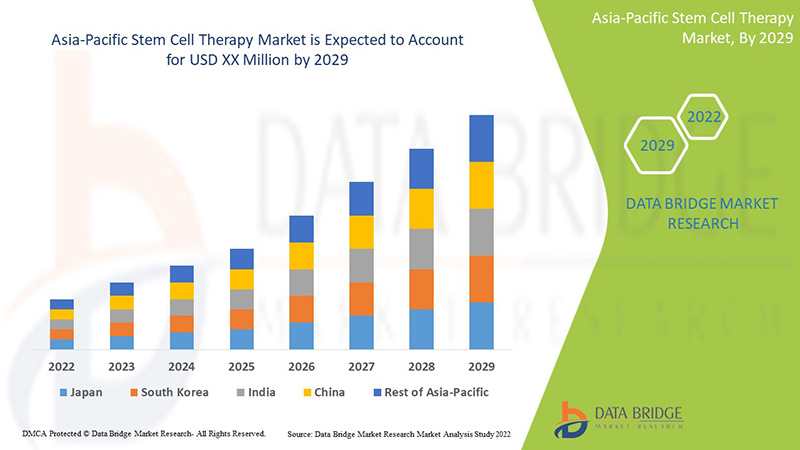

The Asia-Pacific stem cell therapy is supportive and aims to reduce the severity of the symptoms. Data Bridge Market Research analyses that the Asia-Pacific stem cell therapy market is expected to reach the value of USD 191.12 million by 2029, at a CAGR of 10.8% during the forecast period of 2022 to 2029.

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Year

|

2020 (Customizable to 2019 - 2014)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

By Product Type (Bone Marrow Derived Mesenchymal Cells, Placental or Umbilical Stem Cell, Adipose Tissue Derived Mesenchymal Stem Cells, and Others), Type (Allogenic Stem Cell Therapy and Autologous Stem Cell Therapy), Application (Musculoskeletal Disorders, Acute Graft-Versus-Host Disease (AGVHD), Wounds and Injuries, Cardiovascular Diseases, Surgeries, Gastrointestinal Diseases, and Others), End User (Hospitals and Surgical Centers, Therapeutic Companies, Services Companies, and Others), Distribution Channel (Direct Tender, Third Party Distributors)

|

|

Countries Covered

|

South Korea, Japan, and India

|

|

Market Players Covered

|

JCR Pharmaceuticals Co., Ltd, MEDIPOST, Takeda Pharmaceutical Company Limited, CORESTEM, Inc., PHARMICELL Co., Ltd., STEMPEUTICS RESEARCH PVT LTD, ANTEROGEN.CO., LTD, U.S. Stem Cell, Inc., Mesoblast Ltd, Orthofic Medical Inc., among others

|

Market Definition

Stem cells are the body's initial materials from which all other cells with specialized functions are generated. Under the right conditions in the body or a laboratory, stem cells divide to form more cells called daughter cells. The daughter cells become new stem cells or specialized cells (differentiation) with a more specific function, such as blood cells, brain cells, heart muscle cells, or bone cells. Much interest in stem cells has brought interest among the research scientists. Understanding how a disease develops and occurs by using stem cells, generating healthy cells to replace cells, and testing novel drug safety and efficacy are the scientific reasons why stem cell therapeutics are used.

Stem cell therapy promotes dysfunctional or injured tissue repair response using stem cells or derivatives. It is the next chapter in organ transplantation and uses cells instead of donor organs, which are limited in supply. The adult stem cells, such as adipose tissue-derived mesenchymal stem cells, bone marrow-derived mesenchymal stem cells, and placental or umbilical stem cells, are found in small numbers in most tissues. The embryonic stem cells originate from embryos, which are three to five days old. Emerging indications indicate that adult stem cells may be able to create various types of cells.

Asia-Pacific Stem Cell Therapy Market Dynamics

Drivers

- Rise in clinical trials for stem-cell-based therapies

Clinical trials with stem cells have taken the field in many new directions. While numerous teams continue to refine and expand the role of bone marrow and cord blood stem cells for their vanguard uses in blood and immune disorders, many others are looking to expand the uses of the various types of stem cells found in the bone marrow and cord blood, in particular mesenchymal stem cells, to services beyond those that could be corrected by replacing cells in their lineage.

For instance,

- In September 2020, MEDIPOST initiated the phase 2 clinical trial of CARTISTEM, an allogenic stem cell therapy product for knee osteoarthritis, in Japan.

- Rise in GMP certification approvals for cell therapy production facilities.

GMP ensures that products are consistently produced and controlled to state-of-the-art quality standards appropriate to their intended use. Thus, GMP principles significantly contribute to providing consumers and patients with products with consistent quality and high safety levels.

- Growing biotechnology sector

People are getting more aware of their health, and also there is alertness for preventive healthcare. Emphasis on healthcare is gaining popularity. Awareness of disease and symptoms is essential for screening and early detection of infections due to advanced technology available in the healthcare system, such as stem cell technology which is helping the healthcare providers lead to higher survival rates. Many biotechnology companies focusing on the development of stem cell-based therapies are expected to drive the market's growth.

For instance,

- In 2022, according to InvestIndia, India will be among the top 12 destinations for biotechnology globally and 3rd largest biotechnology destination in the Asia Pacific region. In 2020, the Biotech industry reached a market size of USD 70,200 million, raising 12.3%.

Opportunities

- The emergence of induced pluripotent stem cells (IPSCS)

Induced pluripotent stem (iPS) cells are a type of pluripotent stem cell-derived from adult somatic cells that have been genetically reprogrammed to an embryonic stem (E.S.) cell-like state through the forced expression of genes and factors. The induced pluripotent stem cells are better since the IPSCs are less prone to immune rejection since they can be patient-derived. The production of iPS cell lines avoids the ethical controversy of embryo destruction associated with E.S. cell generation. The market players have also developed induced pluripotent stem cells, keeping in mind the safety and convenience of the patients.

For instance,

- In April 2018, ViaCyte, Inc. announced the issuance of more than 200 patents for pluripotent stem cells. The newly issued patents had further strengthened the ViaCyte's already strong position in pluripotent cell-derived and implantable cell replacement therapies for insulin-requiring diabetes and other potential indications.

- Strategic initiative by market players

The demand for stem cell therapy has increased the demand in Asia-Pacific due to the timely treatment of chronic conditions. These favorable factors enhance the need for medications, and to achieve the market demand, minor and major market players are utilizing various strategies.

The major players are also trying to devise specific strategies, such as product launches, acquisitions, approvals, expansions, and partnerships, to ensure the smooth running of the business, avoid risks, and increase the long-term growth in the sales of the market.

These strategic initiatives by the market players, including acquisition, conferences, and focused segment product launches, are helping the companies grow and improve the company's product portfolios, ultimately leading to more revenue generation. Hence, these strategic initiatives by the market players provide an opportunity that is helping them to drive market growth.

Restraints/Challenges

- Availability of alternatives

The availability of alternate treatment is a term that describes medical treatments that are used instead of traditional (mainstream) therapies. Some people also refer to it as "integrative" or "complementary" medicine. The alternatives of stem cell therapy are used since some adult stem cells may not be able to be manipulated to produce all cell types. The other options instead of stem cell therapy are exosomes and somatic cell nuclear transfer.

The availability of alternative treatments would result in a decline in stem cell therapeutics in poor economy countries. Hence, alternate therapies are expected to restrain the market growth.

- Stringent regulations in Asia-Pacific

The regulatory guidelines for stem cell therapeutics are strict compared to older ones. The manufacturers have to make specific product changes before approval, which is expected to cause delays.

The companies have to carefully review the product specifications and certifications before categorizing their product according to the Food and Drug Administration (FDA) and the European Union (E.U.). Every country has its regulatory authority responsible for enforcing rules and regulations for drug development, licensing, registration, manufacturing, marketing, and labeling of pharmaceutical products.

FDA's Center for Biologics Evaluation & Research (CBER) regulates human tissues, cells, and tissue-based products intended for transplantation, including hematopoietic stem cells. The FDA has published comprehensive requirements such as donor screening, donor testing requirements, and current good tissue practices to prevent the introduction, transmission, and spread of infectious diseases.

For instance,

- In India, the regulatory laws for stem cell therapy are governed by the Stem Cells, and Cell-Based products (SCCPs) are regulated as Drug. for Stem Cell Research and have been published by ICMR as National Guideline for Stem Cell Research (NGSCR) 2017, which elaborates on restricted, prohibited and permitted research along with the minimal, substantial and major manipulation. Further, the indications that require prior approval are given in Annexure III of the guidelines.

- The regulatory framework in Japan holds regulatory laws similar to the U.S. and the European Union. Japan's Act on the Safety of Regenerative Medicine (ASRM) created an innovative regulatory framework intended to safely promote the clinical development of stem cell-based interventions (SCBIs) while subjecting commercialized, unproven SCBIs to greater scrutiny and accountability. The Act on the Safety of Regenerative Medicine (ASRM) specifies the regulations that doctors, review committees, and cell culture/processing facilities must adhere to when providing regenerative medicine in medical care, not only in clinical research but also in private practice.

The Asia-Pacific stem cell therapy market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on Asia-Pacific stem cell therapy market, contact Data Bridge Market Research for an Analyst Brief; our team will help you make an informed market decision to achieve market growth.

Patient Epidemiology Analysis

The Asia-Pacific stem cell therapy market also provides you with detailed market analyses for patient analysis, prognosis, and cures. Prevalence, incidence, mortality, and adherence rates are some of the data variables available in the report. Direct or indirect impact analyses of epidemiology to the market growth are analyzed to create a more robust and cohort multivariate statistical model for forecasting the market during the growth period.

Impact of COVID-19 on the Asia-Pacific Stem Cell Therapy Market

During the pandemic, stem cell therapy had a remarkable effect on reducing mortality and morbidity of patients with COVID-19. Further large-scale studies are needed to approve these results. A protocol for stem cell therapy in COVID-19 infection should be defined to achieve the best possible clinical outcomes. Clinical trials were conducted during COVID-19.

Recent Development

- In March 2020, during the pandemic, MEDIPOST received approval in Malaysia for its knee osteoarthritis drug CARTISTEM. The approval received would result in boosting the product's commercialization.

Asia-Pacific Stem Cell Therapy Market Scope

The Asia-Pacific stem cell therapy market is segmented into five segments based on product type, type, application, end user, and distribution channel. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Bone Marrow Derived Mesenchymal Stem Cells

- Placental or Umbilical Stem Cell

- Adipose Tissue Derived Mesenchymal Stem Cells

- Others

On the basis of product type, the Asia-Pacific stem cell therapy market is segmented into bone marrow derived mesenchymal stem cells, placental or umbilical stem cell, adipose tissue derived mesenchymal stem cells, and others.

Type

- Allogeneic Stem Cell Therapy

- Autologous Stem Cell Therapy

On the basis of type, the Asia-Pacific stem cell therapy market is segmented into allogenic stem cell therapy, and autologous stem cell therapy.

Application

- Musculoskeletal Disorders

- Wounds and Injuries

- Acute Graft-Versus-Host Disease (AGVHD)

- Surgeries

- Gastrointestinal Diseases

- Cardiovascular Diseases

- Others

On the basis of application, the Asia-Pacific stem cell therapy market is segmented into musculoskeletal disorders, wounds and injuries, acute graft-versus-host disease (AGVHD), surgeries, gastrointestinal diseases, cardiovascular diseases, and others.

End User

- Hospitals and Surgical Centers

- Therapeutic Companies

- Services Companies

- Others

On the basis of end user, the Asia-Pacific stem cell therapy market is segmented into hospitals and surgical centers, therapeutic companies, services companies, and others.

Distribution Channel

- Direct Tenders

- Third Party Distributors

On the basis of distribution channel, the Asia-Pacific stem cell therapy market is segmented into direct tender, and third party distributors.

Asia-Pacific Stem Cell Therapy Market Regional Analysis/Insights

The Asia-Pacific stem cell therapy market is analyzed, and market size insights and trends are provided by country, product type, type, application, end user, and distribution channel, as referenced above.

Some of the countries covered in the Asia-Pacific stem cell therapy market report are South Korea, Japan, and India. South Korea is expected to dominate the market due to growth in biopharmaceutical industries in stem cell therapy and the rise in the number of academic institutes and stem cell banks for extensive research and development in stem cell therapy and tissue engineering.

The country section of the report also provides individual market impacting factors and changes in regulations in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, disease epidemiology, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands impact on sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Stem Cell Therapy Market Share Analysis

The Asia-Pacific stem cell therapy market competitive landscape provides details on the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, the Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, and product width and breadth, application dominance. The above data points are only related to the companies' focus on the Asia-Pacific stem cell therapy market.

Some of the major players operating in the Asia-Pacific stem cell therapy market are JCR Pharmaceuticals Co., Ltd, MEDIPOST, Takeda Pharmaceutical Company Limited, CORESTEM, Inc., PHARMICELL Co., Ltd., STEMPEUTICS RESEARCH PVT LTD, ANTEROGEN.CO., LTD, U.S. Stem Cell, Inc., Mesoblast Ltd, Orthofic Medical Inc., among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or can drop down your inquiry. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Asia-Pacific versus Regional, and Vendor Share Analysis. To know more about the research methodology, drop an inquiry to speak to our industry experts.

SKU-