Asia Pacific Medical Imaging Market

Market Size in USD Billion

CAGR :

%

USD

23.60 Billion

USD

36.22 Billion

2024

2032

USD

23.60 Billion

USD

36.22 Billion

2024

2032

| 2025 –2032 | |

| USD 23.60 Billion | |

| USD 36.22 Billion | |

|

|

|

Medical Imaging Market Analysis

Medical imaging refers to the techniques and processes used to make images of the human body (or parts of it) for a variety of clinical applications, including medical operations and diagnosis, as well as medical science, which includes the study of normal anatomy and function. It is a subset of biological imaging that includes radiography, endoscopy, thermography, medical photography, and microscopy in a broader sense. Measurement and recording techniques such as electroencephalography (EEG) and magnetoencephalography (MEG) are examples of medical imaging since they create data that can be represented as maps rather than images.

Medical Imaging Market Size

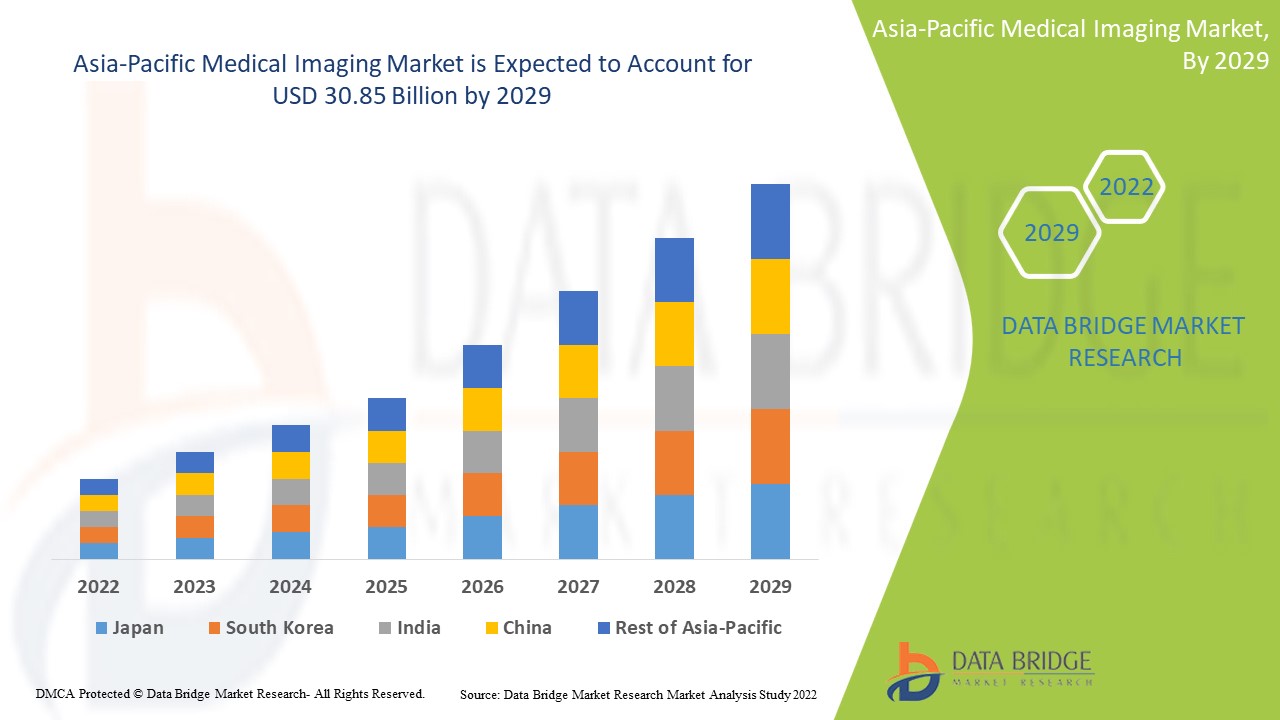

Asia-Pacific medical imaging market size was valued at USD 23.60 billion in 2024 and is projected to reach USD 36.22 billion by 2032, with a CAGR of 5.50% during the forecast period of 2025 to 2032.

Report Scope and Market Segmentation

|

Attributes |

Medical Imaging Key Market Insights |

|

Segmentation |

|

|

Countries Covered |

China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC) |

|

Key Market Players |

Koninklijke Philips N.V. (Netherlands), RamSoft, Inc.(Canada), InHealth Group (U.K), Radiology Reports online (U.S), Siemens (Germany), Sonic Healthcare Limited ( Australia), RadNet, Inc. (U.S), General Electric (U.S), Akumin Inc. (U.S), Hologic Inc. (U.S), Shimadzu Corporation (Japan), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China), CANON MEDICAL SYSTEMS CORPORATION (Japan), Carl Zeiss Ag (Germany), FUJIFILM Corporation (Japan), Hitachi, Ltd. (Japan), MEDNAX Services, Inc. (U.S), Carestream Health (U.S), Teleradiology Solutions (U.S), UNILABS (Switzerland), ONRAD, Inc. (U.S) |

|

Market Opportunities |

|

Medical Imaging Market Definition

Medical imaging is a technique for generating diverse inside images of the body for disease diagnosis and therapy. This technique is mostly important in improving people's health around the world since it can aid in the early detection of certain inside ailments and the proper treatment of those disorders. It's also possible to look into what has already been diagnosed and treated.

Medical Imaging Market Dynamics

Drivers

- Increasing demand for innovative imaging modalities

The industry is being driven by the integration of surgical suits with imaging technology. However, the number of new hospitals in Asia Pacific developing countries has increased dramatically. The entry of global healthcare service providers is to blame for this. Private players dominate the healthcare sector in these countries. Imaging modalities are usually given specific space in new hospitals. In the future years, rising competition and increased demand for world-class healthcare services are likely to drive segment expansion.

- Increase in cases of chronic diseases

The Asia-Pacific medical imaging reagents market is driven by factors such as cancer and cardiovascular illnesses, technical developments, medical imaging reagent development, and high unmet medical and diagnostic imaging procedure demands. Cardiovascular disorders, for example, are one of the main causes of death worldwide. Furthermore, because elderly people are more likely to develop chronic diseases, the increasing growth of the geriatric population is predicted to raise demand for medical imaging reagents.

- Development in demand for medical imaging reagents

The rising number of cancer patients who require advanced diagnostic imaging techniques such as photoacoustic imaging and imaging reagents for better diagnosis also adds to market expansion. Furthermore, the growing elderly population, rising healthcare spending, and rising demand for effective procedures and safe drugs are likely to drive the medical imaging reagents market forward.

Opportunities

Technological advancements, when combined with government investments and money, are anticipated to contribute to market expansion, particularly in developing countries like India and China. In January 2020, Allengers, for example, unveiled India's first locally built 32 slice CT scanner. Canon Medical Systems assisted in the creation of the system.

Teaching, hospitals and universities are predicted to increase their need for state-of-the-art imaging modalities in order to provide advanced technology training, which will have a substantial impact on market growth in the future years. This trend, which was previously limited to rich countries, is increasingly spreading to developing countries. For example, the sole certified 7T Magnetic Resonance Imaging (MRI) equipment, Siemens Healthineers' MAGNETOM Terra, has only been installed in the United States.

Restraints/Challenges

However, the market's expansion is likely to be hampered by a shortage of experienced medical personnel, expensive equipment costs, a lack of imaging reagent providers, and rigorous government regulations.

This medical imaging market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the medical imaging market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Medical Imaging Market Scope

The medical imaging market is segmented on the basis of type, modality, procedure, technology, patient age, application and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Services

- Product

Modality

- Stationary

- Portable

Procedure

- Computed Tomography (CT) Scan

- X-Ray Imaging

- Magnetic Resonance Imaging (MRI)

- Ultrasound, Nuclear Imaging (SPECT/PET)

- Others

Technology

- Direct Digital Radiology

- Computed Radiology

Patient Age

- Adults

- Pediatric

Application

- Cardiology

- Pelvic And Abdominal

- Oncology

- Mammography

- Gynecology

- Neurology

- Urology

- Musculoskeletal

- Dental

- Others

End Users

- Hospitals

- Diagnostic Centers

- Imaging Centers

- Specialty Clinics

- Ambulatory Surgical Centers

- Academic and Research Institutes

- Others

Medical Imaging Market Regional Analysis

The medical imaging market is analyzed and market size insights and trends are provided by country, type, modality, procedure, technology, patient age, application and end-user as referenced above.

The countries covered in the medical imaging market report are China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC).

Asia-Pacific is growing with the highest growth rate, due to the increasing number of geriatrics and increased health care spending. Because of the country's advanced healthcare infrastructure, the Japan medical imaging industry is dominating. Medical imaging services are in high demand in Japan due to the country's ageing population and chronic diseases.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Medical Imaging Market Share

The medical imaging market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to medical imaging market.

Medical Imaging Market Leaders Operating in the Market Are:

- Koninklijke Philips N.V. (Netherlands)

- RamSoft, Inc.(Canada)

- InHealth Group (U.K)

- Radiology Reports online (U.S)

- Siemens (Germany)

- Sonic Healthcare Limited (Australia)

- RadNet, Inc. (U.S)

- General Electric (U.S)

- Akumin Inc. (U.S)

- Hologic Inc. (U.S)

- Shimadzu Corporation (Japan)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Carl Zeiss Ag (Germany)

- FUJIFILM Corporation (Japan)

- Hitachi, Ltd. (Japan)

- MEDNAX Services, Inc. (U.S),

- Carestream Health (U.S)

- Teleradiology Solutions (U.S)

- UNILABS (Switzerland)

- ONRAD, Inc. (U.S)

Latest Developments in Medical Imaging Market

- In March 2021, Vscan AirTM is a cutting-edge, wireless pocket-sized ultrasound from GE Healthcare that provides doctors with crystal clear image quality, whole-body scanning capabilities, and intuitive software

- In Jan 2021, In Canada, Esaote North America has released the MyLab X8 Ultrasound System. MyLab X8 is a fully featured premium imaging system that integrates the newest technologies and delivers greater image quality without compromising workflow or efficiency. It was previously authorised by the FDA in the U.S.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.