Asia-Pacific Hydroxyl-Terminated Polybutadiene (HTPB) Market, By Product (Conventional Hydroxyl Terminated Polybutadienes and Low Molecular Weight Hydroxyl Terminated Polybutadienes), Application (Rocket Fuel, Rubber Material, Paint, Polyurethane and Others), End Use (Building & Construction, Aerospace & Defense, Automotive, Electrical & Electronics, Construction, Packaging, and Others), Industry Trends and Forecast to 2029.

Market Analysis and Size

Hydroxyl Terminated Polybutadiene (HTPB) is the most commonly used polyol in recent times. Due to its excellent physical properties, such as high tensile and tear strength and good chemical resistance possessed by this chemical, it acts as a fuel binder for PU propellant. The chemical HTPB contains hydrogen and carbon as its main constituents during combustion. It becomes chemically and physically compatible with conventional oxidizers and other ingredients.

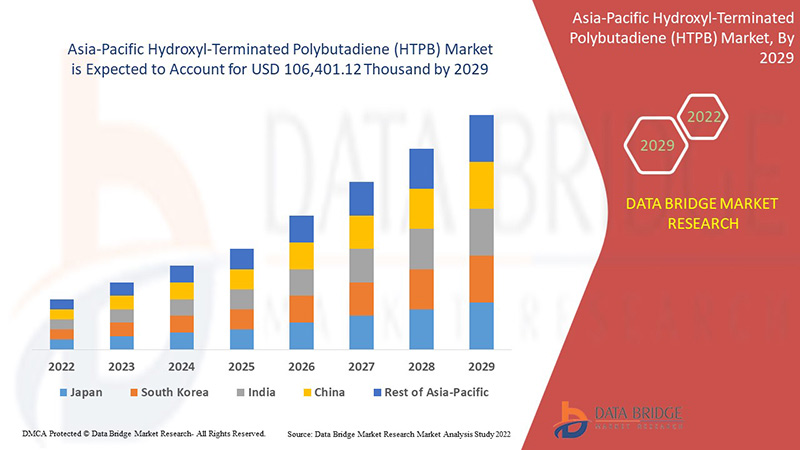

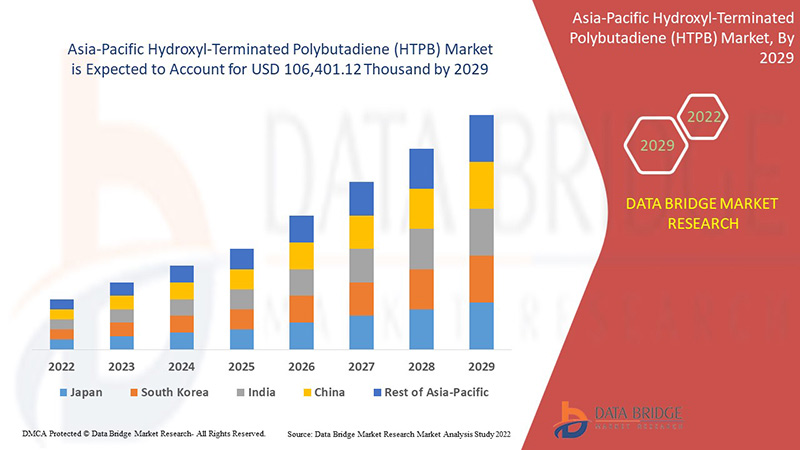

The growing demand for innovative aerospace components significantly impacts the expansion of the market for hydroxyl-terminated polybutadiene (HTPB). In line with this, the gaining popularity of hydroxyl-terminated polybutadiene (HTPB) in the automotive industry, and increasing demand for consumer electronic goods, are key determinants favoring the growth of the hydroxyl-terminated polybutadiene (HTPB) market during the forecast period. Data Bridge Market Research analyses that the hydroxyl-terminated polybutadiene (HTPB) market is expected to reach USD 106,401.12 thousand by the year 2029, at a CAGR of 7.2% during the forecast period. "Aerospace & defense" accounts for the most prominent end-use segment in the respective market owing to the demand for HTPB adhesives and binders in various industries such as automotive, construction, and other industries. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2019 - 2014)

|

|

Quantitative Units

|

Revenue in USD Thousand, Volume in Kilo Tons, Pricing in USD

|

|

Segments Covered

|

By Product (Conventional Hydroxyl Terminated Polybutadienes and Low Molecular Weight Hydroxyl Terminated Polybutadienes), Application (Rocket Fuel, Rubber Material, Paint, Polyurethane, and Others), End Use (Building & Construction, Aerospace & Defense, Automotive, Electrical & Electronics, Construction, Packaging, and Others)

|

|

Countries Covered

|

China, Japan, India, South Korea, Singapore, Malaysia, Australia & New Zealand, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC)

|

|

Market Players Covered

|

Evonik Industries AG (North Rhine-Westphalia, Germany), Idemitsu Kosan Co.,Ltd. (Tokyo, Japan), Cray Valley (A Subsidiary of TotalEnergies) (Pennsylvania, U.S.), Polymer Source. Inc. (Quebec, Canada), NIPPON SODA CO., LTD. (Tokyo, Japan), and Island Pyrochemical Industries (IPI) (New York, U.S.), among others.

|

Market Definition

Hydroxyl-terminated polybutadiene (HTPB) is an oligomer of the chemical compound butadiene with hydroxyl functional groups completed at the individual end. Polyurethane polymers are produced with the reaction of hydroxyl-terminated polybutadiene with isocyanates. It is a liquid that is translucent and has a color alike to that of wax paper and viscosity texture as that of corn syrup. The major application area for the HTPB compounds is solid rocket propellant. Due to the properties such as excellent hydrophobicity, low glass transition temperatures, and low volatiles content, these polybutadienes are used majorly in aerospace and defense industries.

Regulatory Framework

Environmental Protection Agency (EPA): All components of HTPB are listed or excluded from listing on the United States Environmental Protection Agency Toxic Substances Control Act (TSCA) inventory. This product contains no toxic chemicals in excess of the applicable de minimis concentration subject to the reporting requirements of Section 313 of Title III of the Superfund Amendments and Reauthorization Act of 1986 and 40 CFR Part 372.

The Market Dynamics of the Asia-Pacific Hydroxyl-Terminated Polybutadiene (HTPB) Market Include:

Drivers/Opportunities in the Asia-Pacific Hydroxyl-Terminated Polybutadiene (HTPB) Market

- Growing demand for innovative aerospace components

Aerospace components are usually made from advanced materials, including hydroxyl-terminated polybutadiene, titanium alloys, nickel-based super alloys, and other ceramics. Aircraft manufacturers have benefited greatly due to advancements in material science. Therefore, the efficiency of the hydroxyl-terminated polybutadiene in aerospace technology improves airplane wings and makes aircraft more lightweight and fuel-efficient.

- Gaining popularity of hydroxyl-terminated polybutadiene (HTPB) in the automotive industry

With the increase in disposable incomes across major economies of the world. The demand for automobiles has flourished. This increase in automobile production can also be attributed to the easy availability of loans and continued preference for personal mobility, especially after the pandemic. The demand for commercial vehicles has also increased due to trade activities.

- The use of hydroxyl-terminated polybutadiene (HTPB) in solid rocket propellant

Growing active participation and interest by governments in strengthening their space capabilities. Rise in efforts and initiatives by space agencies, research centers, and even private companies in some parts of the globe to launch unmanned space vehicles. Growing satellite launches for communication purposes. These are the key drivers behind the demand for rocket propulsion systems growth. This growth in the Asia-Pacific aerospace industry directly impacts the hydroxyl terminated polybutadiene market growth.

- Positive outlook towards consumer electronic goods

Consumer or home electronics are electric devices designed for everyday use, generally in private homes. Consumer electronics encompass a variety of gadgets used for entertainment, communication, and recreation, including mobile phones, TVs, and circuit boards. The electronic manufacturing services (EMS) market remains a very active market, driven primarily by the consumer electronics and communications industries. In response to increasingly fierce competition in the industry, EMS providers are increasingly embracing innovative and strategic business models along with an increased demand for hydroxyl-terminated polybutadiene (HTPB).

Restraints/Challenges faced by the Asia-Pacific Hydroxyl-Terminated Polybutadiene (HTPB) Market

- High strain rate and shock properties of hydroxyl-terminated polybutadiene (HTPB)

Hydroxyl-terminated polybutadiene (HTPB) is a polymeric binder used in polymer-bonded explosives (PBXs) and solid rocket propellants. Even though used in small fractions, the elastomeric binder absorbs much of the impact energy. It, therefore, requires careful modeling of its mechanical behavior to accurately simulate the response of PBXs when they are subjected to large strains and strain rates.

- Hydroxyl-terminated polybutadiene (HTPB) grain cannot be reshaped, reused, or recycled

The most commonly used hybrid rocket fuel, hydroxyl-terminated polybutadiene (HTPB), is a legacy thermosetting polymer material frequently used as a binder for solid-rocket propellant grains. The hydroxyl-terminated polybutadiene (HTPB) remains the primary polymer for hybrid fuel grain material due to its industry familiarity with its chemical and structural properties.

COVID-19 had a Minimal Impact on Asia-Pacific Hydroxyl-Terminated Polybutadiene (HTPB) Market

COVID-19 impacted various manufacturing and service-providing industries in the year 2020-2021 as it led to the closure of workplaces, disruption of supply chains, and restrictions on transportation. Though, the imbalance between demand and supply and its impact on pricing is considered short-term and expected to recover as this pandemic ends. Due to the outbreak of Covid-19 throughout the globe, the demand for hydroxyl-terminated polybutadiene (HTPB) was decreased. Thus, the automotive, electrical and electronics, building, and construction industries suffered a lot during Covid-19 outbreak. The hydroxyl-terminated polybutadiene (HTPB) industry will hopefully grow with the removed restrictions in varied countries.

Recent Developments

- In July 2019, Entegris announced that it had acquired MPD Chemicals, the parent company of Monomer-Polymer & Dajac Labs. This acquisition helped to grow and diversify Entegris' engineered materials portfolio.

- In November 2014, Evonik Industries AG opened a new plant for hydroxyl-terminated polybutadiene (HTPB) in Marl. Evonik marketed HTPB under the brand name POLYVEST HT, and along with it, the company had extended its polybutadienes product portfolio by a further functionalized grade. This development helped the company to create goodwill for the company.

Asia-Pacific Hydroxyl-Terminated Polybutadiene (HTPB) Market Scope

The Asia-Pacific hydroxyl-terminated polybutadiene (HTPB) market is segmented on the basis of product, application, and end use. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Low Molecular Weight Hydroxyl Terminated Polybutadienes

- Conventional Hydroxyl Terminated Polybutadienes

On the basis of product, the Asia-Pacific hydroxyl-terminated polybutadiene (HTPB) market is segmented into conventional hydroxyl-terminated polybutadienes and low molecular weight hydroxyl-terminated polybutadienes.

Application

- Rocket Fuel

- Polyurethane

- Paint

- Rubber Material

- Others

On the basis of application, the Asia-Pacific hydroxyl-terminated polybutadiene (HTPB) market is segmented into rocket fuel, rubber material, paint, polyurethane, and others.

End Use

- Aerospace & Defense

- Automotive

- Building And Construction

- Electrical & Electronics

- Packaging

- Others

On the basis of end use, the Asia-Pacific hydroxyl-terminated polybutadiene (HTPB) market is segmented into building & construction, aerospace & defense, automotive, electrical & electronics, construction, packaging, and others.

Asia-Pacific Hydroxyl-Terminated Polybutadiene (HTPB) Market Regional Analysis/Insights

The Asia-Pacific hydroxyl-terminated polybutadiene (HTPB) market is analyzed, and market size insights and trends are provided by country, product, application, and end use, as referenced above.

The countries covered in the hydroxyl-terminated polybutadiene (HTPB) market report are China, Japan, India, South Korea, Singapore, Malaysia, Australia & New Zealand, Thailand, Indonesia, Philippines, and Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC).

China dominates the hydroxyl-terminated polybutadiene (HTPB) market because of the increased demand for HTPB in the automotive industry. China is followed by India and is expected to witness significant growth during the forecast period of 2022 to 2029 due to the growing demand for hydroxyl-terminated polybutadiene (HTPB) from the aerospace and defense industry in the region. India is followed by Japan and is expected to grow significantly owing to the rising application of HTPB in various industrial applications such as paint, rocket fuel, and adhesives.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Hydroxyl-Terminated Polybutadiene (HTPB) Market Share Analysis

The hydroxyl-terminated polybutadiene (HTPB) market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, application dominance. The above data points provided are only related to the companies' focus on the hydroxyl-terminated polybutadiene (HTPB) market.

Some of the major market players engaged in the Asia-Pacific hydroxyl-terminated polybutadiene (HTPB) market are Evonik Industries AG, Idemitsu Kosan Co., Ltd., Cray Valley (A Subsidiary of TotalEnergies), Polymer Source. Inc., NIPPON SODA CO., LTD., Island Pyrochemical Industries (IPI), among others.

SKU-