Asia-Pacific Freight Transportation Management Market, By Transportation Mode (Roadways, Railways, Marine and Airways), Offering (Solutions and Services), Deployment Mode (Cloud or Hosted and On Premise), Organization Size (Large Enterprises and SME'S), Industry (Manufacturing, Retail & E-Commerce, Transportation, Fast Moving Consumer Goods (FMCG), Healthcare, Food & Beverages, Oil & Gas, Energy & Utility, Electronics, Automotive, IT & Telecom and Others) – Industry Trends and Forecast to 2029.

Asia-Pacific Freight Transportation Management Market Analysis and Size

Freight transport management incorporates forming various strategies for increasing the efficiency of freight and commercial transport efficiency. Freight transport management focuses on reducing the shipper costs while considering social costs such as congestion or pollution impacts. The high benefits offered by freight transportation management, is making the rise in the demand for freight transportation management solutions in the market. Global freight transportation management market is growing rapidly due to increasing globalization leading to high freight transportation. The companies are even launching new products to gain a larger market share.

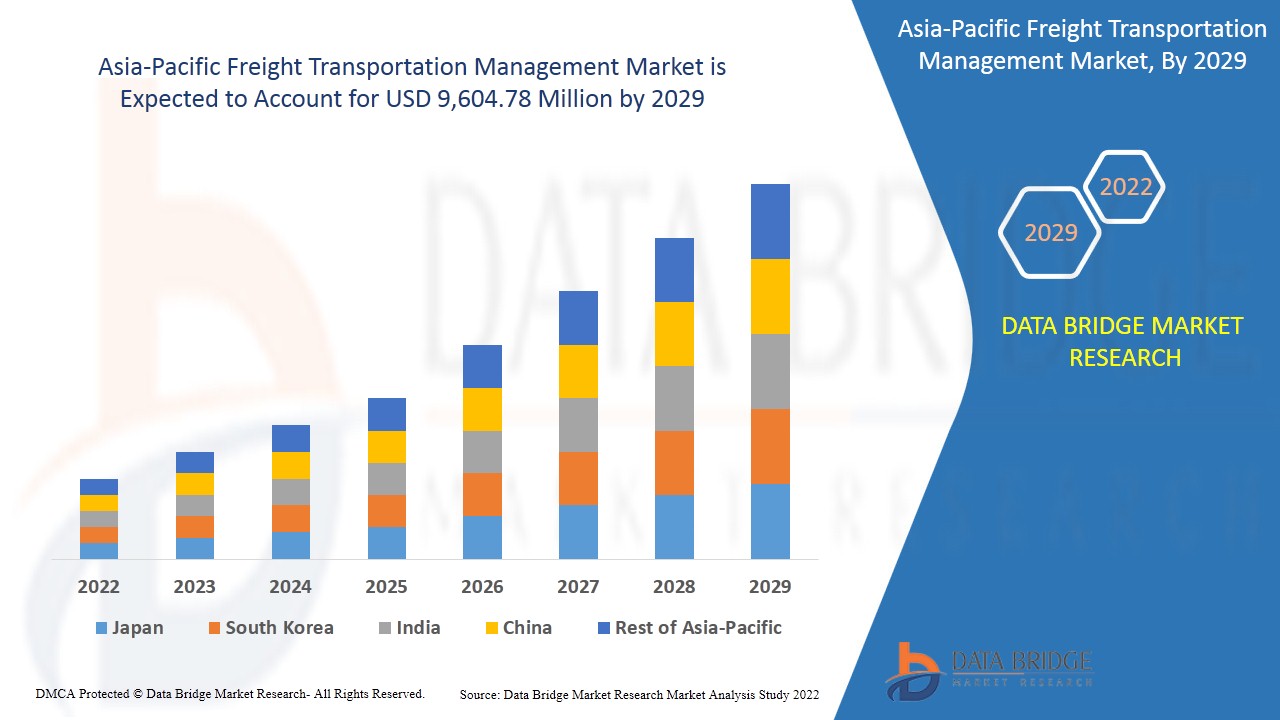

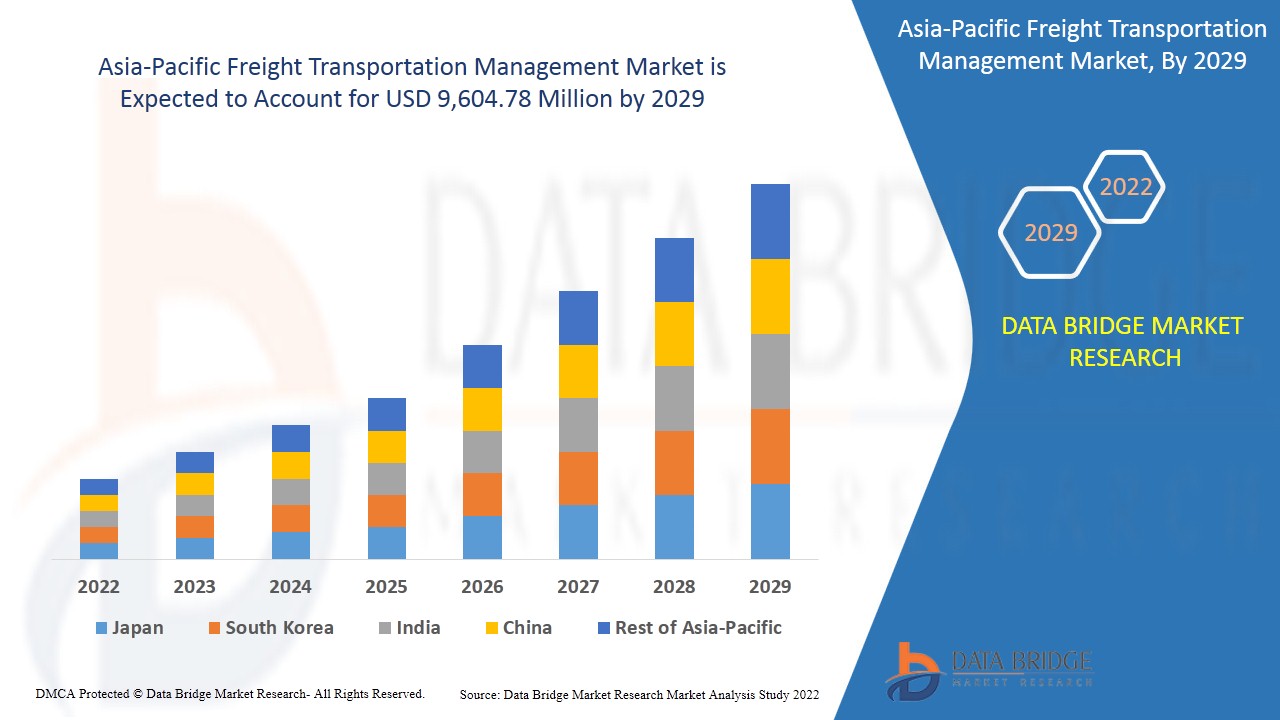

Data Bridge Market Research analyses that the freight transportation management market is expected to reach the value of USD 9,604.78 million by 2029, at a CAGR of 7.7% during the forecast period. "Roadways" accounts for the most prominent transportation mode segment as they require less capital investment and can provide door-to-door fragmented management. Freight transportation management market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020

|

|

Quantitative Units

|

USD Million

|

|

Segments Covered

|

By Transportation Mode (Roadways, Railways, Marine and Airways), Offering (Solutions and Services), Deployment Mode (Cloud or Hosted and On Premise), Organization Size (Large Enterprises and SME'S), Industry (Manufacturing, Retail & E-Commerce, Transportation, Fast Moving Consumer Goods (FMCG), Healthcare, Food & Beverages, Oil & Gas, Energy & Utility, Electronics, Automotive, IT & Telecom and Others)

|

|

Countries Covered

|

China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, and Rest of Asia-Pacific (APAC)

|

|

Market Players Covered

|

CTSI-GLOBAL, GEODIS, THE DESCARTES SYSTEMS GROUP INC, Manhattan Associates, Transplace, Softeon, GlobalTranz, Oracle, SAP SE, Accenture, Blue Yonder Group, Inc., E2open, LLC., Trimble Inc., DSV, Werner Enterprises, Supply Chain Solutions, C.H. Robinson Worldwide, Inc., TRANSPOREON GmbH, MercuryGate, among others

|

Market Definition

Freight transport management incorporates forming various strategies for increasing the efficiency of freight and commercial transport efficiency. Freight transport management focuses on reducing the shipper costs while considering social costs such as congestion or pollution impacts. It helps the shippers to use the right mode of transportation. For instance, rail and water transport are highly efficient for long distances as compared to the use of trucks for the same. It helps in improving the routing and scheduling in order to increase load factors and reduce freight vehicle mileage. It helps implement fleet management programs that help use optimally sized vehicles for each trip, reduce vehicle mileage, and ensure that fleet vehicles are operated and maintained in ways that reduce external costs.

Freight transport management is used for various modes of transportation such as roadways, railways, marine, and airways. The freight movement done through the path of roads is termed under the segment. It is the most common type of transportation mode as it requires a single customs document process. Railway mode of transportation is highly fuel-efficient and can be termed as a 'green' mode of transportation. Marine shipments are used for the movement of bulk commodities such as coal, agri-products, iron ore, and wet bulk products such as crude oil and gas. Airways are the fastest mode of transportation and are highly used to achieve 'just-in-time' (JIT) inventory replenishment.

Freight Transportation Management Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

- High Benefits Offered By Freight Transportation Management

Over the years, it has become extremely necessary to have a highly efficient supply chain. This requirement is fulfilled by freight transportation management. Freight transportation management system helps the enterprises in moving the products from one destination to another in a cost-effective, reliable, and efficient manner. The system provides higher visibility and better analysis of data, thus increasing the growth of the global freight transportation management market.

- Increasing Demand for Rail Freight Transports

Rail freight transport utilizes railways for the transportation of cargo on land. It is used for transporting various cargo such as chemicals, raw construction material, agriculture, automotive, energy (coal, oil, and wind turbines), and forest productions. The railways can transport heavy cargo quickly through the railroads. Railways are one of the most highly used forms of transportation and have a huge built-up infrastructure around the world. The increasing use of railways for transportation increases the growth of freight transportation management for managing rail freight transportation.

- High Use of Freight Transportation Management in Roadways

Increasing digitalization has seen the transformation in various industries and has given birth to e-commerce. The growth in e-commerce has made it necessary for the companies to make their supply chain highly efficient, reduce the transit time and provide the products to the customers without any delay. This has increased the flow of domestic transportation through roadways, and a large number of trucks are being used for the same. The increasing growth in roadways technology is augmenting the growth of the global freight transportation management market.

- Congestion Associated With Trade Routes

As traffic volumes and congestion grow on roadways and waterways, freight and transport service operators grow to be increasingly challenged to keep reliable schedules. This affects supply chains and truck-dependent businesses, each of which is of growing significance for both public coverage and private region operators. Moreover, several accidents on roads or oil spills at sea can act as an unexpected challenge for the transportation systems, which makes it difficult for the system to manage. Recent COVID-19 has also halted several logistics operations causing severe damage to entire supply chain operations. These parameters act as a major restraint for the growth of the global freight transportation management market.

- Government Restrictions and Regulations on Trade

International trade has seen several restrictions and changing regulations due to the U.S. and China trade war and COVID-19 pandemic. Cross-border transportation gets limited, and the cost increases, which are not able to foresee by the transportation management system and leads to inefficiency in supply chain and inventory thus acting as a major restraint for the global freight transportation management market.

Post COVID-19 Impact on Freight Transportation Management Market

COVID-19 created a major impact on the freight transportation management market as almost every country has opted for the shutdown for every production facility except the ones dealing in producing the essential goods. The government has taken some strict actions such as the shutdown of production and sale of non-essential goods, blocked international trade, and many more to prevent the spread of COVID-19. The only business which is dealing in this pandemic situation is the essential services that are allowed to open and run the processes.

The growth of the freight transportation management market is rising due to the government policies to boost international trade post covid. Also the benefits offered by freight transportation management for optimizing costs and routs is rising the demand for freight transportation management in the market. However, factors such as congestion associated with trade routes and trade restrictions between some nations are restraining the market growth. The shutdown of production facilities during the pandemic situation has had a significant impact on the market.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology involved in the freight transportation management. With this, the companies will bring advanced and accurate solutions to the market. In addition, the government initiatives to boost international trade has led to the market's growth.

Recent Development

- In March 2021, SAP SE announced its partnership with Sedna Systems. Under this partnership, the companies will be integrating SAP TMS with Sedna Systems' team collaboration and e-mail management solution, which can help the customers to gain a whole control over transportation management-related data. Thus with this, the company will be able to solidify its position in the market.

- In February 2022, Oracle announced the introduction of new logistics management capabilities within Oracle Fusion Cloud Supply Chain & Manufacturing (SCM). The company has updated its Oracle Fusion Cloud Transportation Management which can help organizations to reduce costs and risk, improve the customer experience, and become more adaptable to business disruptions. Thus with this, the company will be able to attract more customers in the market.

Asia-Pacific Freight Transportation Management Market Scope

The Freight Transportation Management market is segmented on the basis of transportation mode, by offering, by deployment mode, by organization size and by industry. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Transportation Mode

- Roadways

- Railways

- Marine

- Airways

On the basis of transportation mode, the global freight transportation management market is segmented into Roadways, Railways, Marine and Airways.

By Offering

- Solutions

- Services

On the basis of by offering, the global freight transportation management market has been segmented into solutions and services.

By Deployment Mode

- Cloud or Hosted

- On Premise

On the basis of deployment mode, the global freight transportation management market has been segmented into cloud or hosted and on premise.

By Organization Size

- Large Enterprises

- SMES

On the basis of organization size, the global freight transportation management market has been segmented into large enterprises and SMES.

By Industry

- Manufacturing

- Retail & E-Commerce

- Transportation

- Fast Moving Consumer Goods (FMCG)

- Healthcare

- Food & Beverages

- Oil & Gas

- Energy & Utility

- Electronics

- Automotive

- It & Telecom

- Others

On the basis of industry, the global freight transportation management market has been segmented into manufacturing, retail & e-commerce, transportation, fast moving consumer goods (FMCG), healthcare, food & beverages, oil & gas, energy & utility, electronics, automotive, IT & telecom and others.

Freight Transportation Management Market Regional Analysis/Insights

The freight transportation management market is analysed and market size insights and trends are provided by country, transportation mode, offering, deployment mode, organization size and industry as referenced above.

The countries covered in the freight transportation management market report are China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, and Rest of Asia-Pacific (APAC).

China dominates the Asia-Pacific freight transportation management market. China is likely to be the fastest-growing Asia-Pacific Freight Transportation Management market. The rising infrastructure, commercial, and industrial developments in emerging countries such as China, Japan, India, and South Korea are credited with the market's dominance. China dominates the Asia-Pacific region due to the high manufacturing and outsourced manufacturing capacities of major companies leading to exports from the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Freight Transportation Management Market Share Analysis

Freight transportation management market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to freight transportation management market.

Some of the major players operating in the Freight Transportation Management market are: CTSI-GLOBAL, GEODIS, THE DESCARTES SYSTEMS GROUP INC, Manhattan Associates, Transplace, Softeon, GlobalTranz, Oracle, SAP SE, Accenture, Blue Yonder Group, Inc., E2open, LLC, Trimble Inc., DSV, Werner Enterprises, Supply Chain Solutions, C.H. Robinson Worldwide, Inc., TRANSPOREON GmbH, MercuryGate.

SKU-