Asia Pacific Departmental Pacs Market

Market Size in USD Billion

CAGR :

%

USD

3.39 Billion

USD

5.52 Billion

2024

2032

USD

3.39 Billion

USD

5.52 Billion

2024

2032

| 2025 –2032 | |

| USD 3.39 Billion | |

| USD 5.52 Billion | |

|

|

|

|

APAC Departmental PACS Market Size

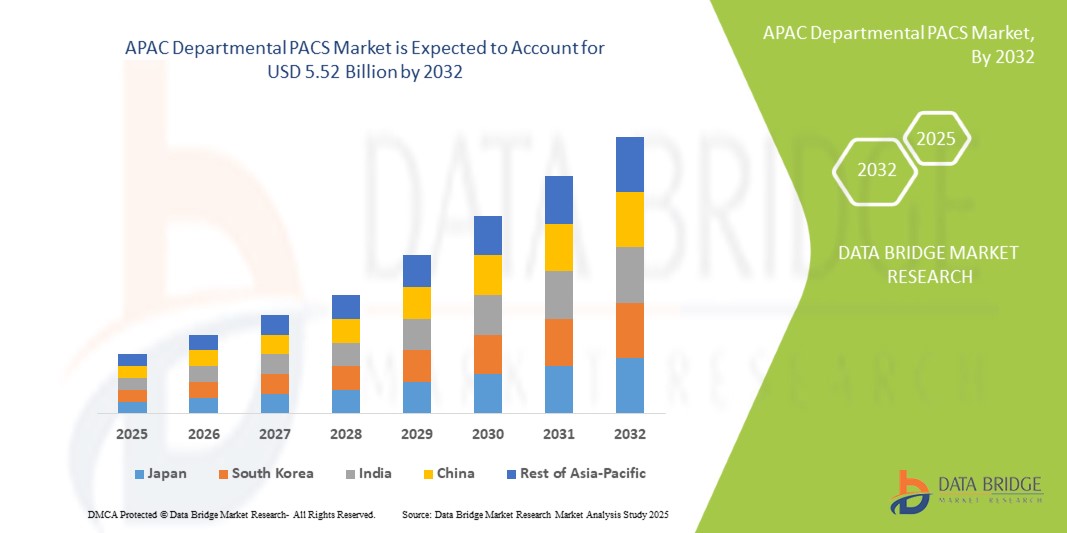

- The APAC departmental PACS market size was valued at USD 3.39 billion in 2024 and is expected to reach USD 5.52 billion by 2032, at a CAGR of 6.30 % during the forecast period

- This growth is driven by factors such as the increasing healthcare digitization, rising chronic disease prevalence, technological advancements, government initiatives, improved infrastructure, and adoption in emerging economies

APAC Departmental PACS Market Analysis

- The market for departmental PACS is experiencing a steady expansion, driven by the rising adoption of advanced healthcare technologies across medical institutions. Hospitals and diagnostic centers are increasingly integrating these systems to enhance workflow and improve patient care

- The demand for departmental PACS solutions is also influenced by the growing need for efficient data storage and retrieval systems in medical imaging. These systems provide centralized access to patient images, improving diagnostic accuracy and reducing operational costs

- China is expected to dominate the APAC Departmental PACS market due to its advanced healthcare infrastructure, high adoption of digital imaging technologies, and strong presence of leading PACS vendors

- India expected to be the fastest growing region in the APAC Departmental PACS market during the forecast period due to rapid healthcare digitization, rising investments in medical imaging, and increasing demand for efficient diagnostic solutions

- The Specialty PACS segment is expected to dominate the market with a market share of 28% in 2025 due to its tailored functionalities for specific medical specialties, enhancing diagnostic accuracy and workflow efficiency

Report Scope and APAC Departmental PACS Market Segmentation

|

Attributes |

APAC Departmental PACS Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

APAC Departmental PACS Market Trends

“Increasing Integration of Artificial Intelligence into Imaging Systems”

- AI is revolutionizing industries, improving efficiency, accuracy, and functionality in imaging systems

- For instance, Google's DeepMind has developed an AI system that outperforms human experts in diagnosing eye diseases from retinal scans

- In healthcare, AI algorithms analyze medical images (X-rays, MRIs, CT scans, ultrasounds) with high precision

- For instance, Aidoc’s AI software assists radiologists by quickly identifying critical cases in CT scans, reducing response time in emergency care

- AI helps detect conditions such as cancer, cardiovascular diseases, and neurological disorders earlier and more accurately

- For instance, PathAI’s deep learning models assist pathologists in diagnosing cancerous tissues with greater precision, reducing diagnostic errors

- AI can identify patterns in images that human experts might miss, leading to faster, more reliable diagnoses

- For instance, The AI system developed by Enlitic has shown that it can spot subtle fractures in X-rays that are often overlooked by radiologists

- In security, AI-driven imaging systems are used for facial recognition and surveillance to monitor activities and identify individuals

APAC Departmental PACS Market Dynamics

Driver

“Rising Demand for Early Disease Detection”

- The increasing demand for early disease detection is driving the APAC Departmental PACS market

- Healthcare providers are focusing on preventive care, which requires advanced imaging technologies for early disease identification

- PACS systems enable efficient storage, retrieval, and sharing of medical images, leading to timely and accurate diagnoses

- Early detection of conditions such as cancer, cardiovascular diseases, and neurological disorders results in better patient outcomes

- The integration of AI and machine learning with PACS enhances diagnostic precision and workflow efficiency, boosting market growth

For instances,

- Aidoc’s AI-driven PACS solution assists radiologists in identifying critical cases in CT scans more quickly, improving the speed of diagnosis in emergency settings

- Google’s DeepMind AI has shown the ability to outperform human experts in diagnosing eye diseases from retinal scans, illustrating the power of AI integration into PACS for early disease detection

Opportunity

“Growing Demand for Cloud-Based PACS Solutions”

- The growing demand for cloud-based PACS solutions presents a significant opportunity in the APAC Departmental PACS market

- Healthcare organizations are increasingly looking to reduce infrastructure costs and improve scalability

- Cloud-based PACS offer flexibility, lower initial capital investment, and simplified maintenance compared to traditional on-premise systems

- These systems allow healthcare providers to store and access medical imaging data remotely, which is especially beneficial in regions with limited physical infrastructure or for healthcare facilities operating across multiple locations

- The cloud's scalability helps manage the growing volume of medical imaging data without the need for constant hardware upgrades

For instance,

- Ambra Health offers cloud-based PACS solutions that enable healthcare providers to access and share imaging data remotely, reducing infrastructure costs and improving operational flexibility

- Everlight Radiology uses cloud-based PACS to provide real-time radiology reporting, enabling access to expert opinions in underserved areas, improving patient care and diagnostic efficiency

Restraint/Challenge

“High Costs Associated with Implementation”

- High costs associated with the implementation of medical imaging management systems, such as PACS, act as a significant restraint for the APAC Departmental PACS market

- The costs include not only the initial investment in hardware and software but also ongoing expenses related to system maintenance, upgrades, and staff training

- Smaller healthcare facilities and those in developing regions often face budget constraints, making it difficult to allocate funds for advanced imaging solutions

- The financial burden of integrating PACS with existing hospital information systems, ensuring data security, and complying with healthcare regulations further increases costs

- These economic challenges can deter healthcare providers from adopting PACS technology despite its benefits in improving diagnostic accuracy and operational efficiency

For instance,

- In many rural hospitals in India, the high costs of implementing PACS systems have delayed the adoption of these technologies, limiting access to advanced diagnostic tools

- A study from the World Health Organization (WHO) highlighted that small clinics in Southeast Asia struggle with the costs of both setting up and maintaining PACS systems, which hinders their ability to provide high-quality imaging services

APAC Departmental PACS Market Scope

The market is segmented on the basis of product type, component, application, integration level, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Component |

|

|

By Application |

|

|

By Integration Level |

|

|

By End User |

|

|

By Distribution Channel |

|

In 2025, specialty PACS Solutions the is projected to dominate the market with a largest share in product type segment

The specialty PACS segment is expected to dominate the APAC departmental PACS market with the largest share of 28% in 2025 due to its tailored solutions that cater to specific medical specialties such as oncology, cardiology, orthopedics, and ophthalmology. These systems are designed to handle complex imaging data, improving diagnostic accuracy and workflow efficiency.

The MRI is expected to account for the largest share during the forecast period in technology market

In 2025, the MRI segment is expected to dominate the market with the largest market share of 30% to 35% due to its critical role in non-invasive diagnostics and its ability to provide high-resolution imaging of soft tissues. MRI is widely used for diagnosing neurological disorders, musculoskeletal issues, cancers, and other complex conditions.

APAC Departmental PACS Market Regional Analysis

“China Holds the Largest Share in the APAC Departmental PACS Market”

- China is anticipated to hold the largest market share due to its robust healthcare infrastructure and widespread adoption of advanced imaging technologies

- The country's substantial investments in healthcare digitalization and hospital network expansions contribute to its leading position in the PACS market

- With the medical device industry growing, China is well-positioned to maintain its dominance in the PACS sector

- Government initiatives supporting digital health tools further strengthen the integration of PACS systems across healthcare facilities in China

“India is Projected to Register the Highest CAGR in the APAC Departmental PACS Market”

- India is set to experience the highest compound annual growth rate (CAGR) in the APAC PACS market, driven by its expanding healthcare sector

- The growing demand for advanced imaging solutions in India’s rapidly developing medical device and hospital industries fuels the market’s fast growth

- India’s healthcare industry is a key driver, accounting for a significant share of the overall medical sector, boosting PACS adoption

- The increasing number of hospitals and diagnostic centers in India highlights the need for efficient imaging systems, accelerating the growth of PACS in the region

APAC Departmental PACS Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- FUJIFILM Corporation (Japan)

- Mach 7 Technologies Limited (Australia)

- Reyence (Japan)

- SinoVision (China)

- TeleRAD Reporting Services Private Limited (India)

- Canon Medical Systems Corporation (Japan)

- Konica Minolta, Inc. (Japan)

- INFINITT Healthcare (South Korea)

- Samsung Medison (South Korea)

Latest Developments in APAC Departmental PACS Market

- In January 2024, FUJIFILM Diosynth Biotechnologies (U.S.) and SHL Medical (Switzerland) entered a strategic partnership to meet the increasing market demand for autoinjector medicines. The collaboration will enhance FUJIFILM's production capacity in Denmark, reaching up to 30 million units annually by early 2025. By integrating SHL's Molly autoinjector platform, the partnership aims to streamline production processes and reduce supply chain risks. This development will benefit pharmaceutical and biotech companies by providing quicker timelines to market and improving patient access to self-injection medications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.