Market Analysis and Insights : Asia-Pacific Cryptocurrency Mining Market

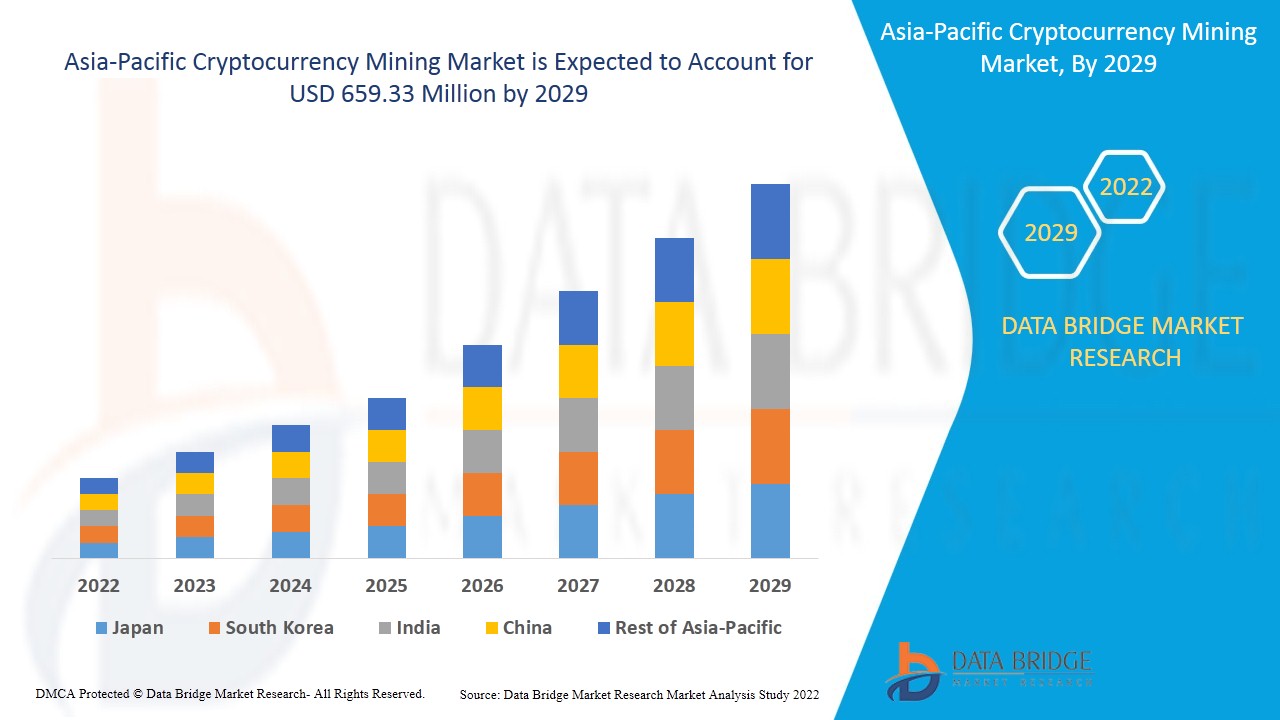

The cryptocurrency market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with the CAGR of 6.7% in the forecast period of 2022 to 2029 and expected to reach USD 659.33 million by 2029.

Cryptocurrency mining is a mechanism by which Bitcoin and several other cryptocurrencies generate new coins and validate new transactions. It entails the use of huge, decentralized networks of computers all over the world to verify and safeguard blockchains, which are virtual ledgers that record bitcoin transactions. Computers in the network are rewarded with new coins in exchange for contributing their processing power. It is a virtuous circle where miners secure and maintain the blockchain. In return, the blockchain rewards coins, and the coins provide an incentive for the miners to maintain the blockchain.

Cryptocurrency mining is the process of creating new bitcoin by solving puzzles. Miners have become very sophisticated over the past several years, using complex machinery to speed up mining operations. Because of this, the companies are coming up with advanced mining machines for their customers. In addition, some companies are collaborating with other companies to provide different services to the customers. Thus as the demand for a mining pool is increasing in the market, the demand for advanced mining machines is also increasing. However, the high transaction fees related to it may hamper the growth of the market.

The cryptocurrency mining market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the Cryptocurrency mining market scenario contact Data Bridge Market Research for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

Cryptocurrency Mining Market Scope and Market Size

The cryptocurrency mining market is segmented into four notable segments which are based on the mining enterprise, revenue source, mining type and hardware. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- Based on the mining enterprise, the cryptocurrency mining market is segmented into large miners and small miners. In 2022, the large miners’ segment is expected to dominate the global cryptocurrency mining market, as it is good for cryptocurrency because they have inspired further innovation. In addition, it reduces centralization and market cornering.

- Based on revenue source, the cryptocurrency mining market is segmented into transaction fees and block rewards. In 2022, the block rewards segment is anticipated to dominate the global cryptocurrency mining market, as it is a reward given to the miner to compensate them for their efforts in mining the block.

- Based on mining type, the cryptocurrency mining market is segmented into self-mining, cloud mining services, and remote hosting services. In 2022, the remote hosting services segment is anticipated to dominate the market as several miners combine their effort and resources over a network and mine cryptocurrency with much more computational power.

- Based on hardware, the cryptocurrency mining market is segmented into ASIC, GPU, CPU, and others. In 2022, ASIC is anticipated to dominate the market, as it is the most energy-efficient of all other miners. In addition, it provides high hash rates and enhances the earning prospects of investors, which is expected to raise its demand in the market.

Cryptocurrency Mining Market Country Level Analysis

The cryptocurrency mining market is analyzed and market size information is provided by the country, mining enterprise, revenue source, mining type and hardware as referenced above.

The countries covered in the cryptocurrency mining market report are the Japan, China, South Korea, India, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines, and Rest of Asia-Pacific.

China dominates the Asia-Pacific region due to presence of major key players such as Canaan Inc. and Shenzhen Microbt Electronics Technology Co. Ltd.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Increasing penetration of internet and smartphones has risen the demand for cryptocurrency in the market

The cryptocurrency mining market also provides you with detailed market analysis for every country growth in particular market. Additionally, it provides the detail information regarding the market players’ strategy and their geographical presence. The data is available for historic period 2012-2020.

Competitive Landscape and Cryptocurrency Mining Market Share Analysis

Cryptocurrency mining market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to cryptocurrency mining market.

Some of the major players operating in the cryptocurrency mining market are Canaan Inc., Argo Blockchain, HIVE Blockchain Technologies Ltd., Bit Digital, Inc., Riot Blockchain, Inc., ViaBTC, Braiins Systems s.r.o., F2Pool, Genesis Mining Ltd., BITMAIN Technologies Holding Company, Hut 8 Mining Corp., Miningstore.com, MININGSKY (a subsidiary of Skychain Technologies Inc.), iMining Technologies Inc., MinerGate, ASICminer Company, INNOSILICON Technology Ltd., Shenzhen MicroBT Electronics Technology Co., Ltd, GMO Internet, Core Scientific, among others.

Many contracts and agreements are also initiated by the companies’ worldwide which are also accelerating the cryptocurrency mining market.

For instances,

- In January 2022, Hut 8 Mining Corp. announced that they had acquired the cloud and co-location data center business of TeraGo Inc. The acquisition comprises five data centers in Canada, which include a complete selection of scalable cloud services. Thus this will help the company to expand its business and customer base in the market

- In August 2021, iMining Technologies Inc. announced that they had acquired the three validators securing the Ethereum Proof-of-Stake blockchain. These three Eth2.0 validators are cloud-based and are operational. Thus, the acquisition will help the company to save fees and weeks of staking rewards, helping in companies growth

Customization Available: Asia-Pacific Cryptocurrency Mining Market

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC CRYPTOCURRENCY MINING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 THE MARKET CHALLENGE MATRIX

2.9 MULTIVARIATE MODELING

2.1 MINING ENTERPRISE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CRYPTOCURRENCY MINING ANALYSIS

4.2 BITMAIN ANTMINER S9

4.3 IN THE U.S., THE AVERAGE ELECTRICITY COST IS AROUND USD 0.11 CENTS PER KILOWATT-HOUR.

5 REGIONAL SUMMARY

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN THE POPULARITY OF MINING POOLS

6.1.2 INCREASING ADOPTION OF CRYPTOCURRENCY IN THE FINANCIAL MARKET

6.1.3 INCREASING DEMAND FOR CRYPTOCURRENCY-SPECIFIC HARDWARE

6.1.4 INCREASING PENETRATION OF THE INTERNET AND SMARTPHONES

6.2 RESTRAINTS

6.2.1 HIGH TRANSACTION FEES

6.2.2 BAN OF CRYPTOCURRENCY MINING

6.3 OPPORTUNITIES

6.3.1 INCREASE IN VARIOUS STRATEGIC DECISIONS SUCH AS PARTNERSHIP AND ACQUISITION

6.3.2 DEVELOPMENTS IN THE HARDWARE AND SOFTWARE

6.4 CHALLENGES

6.4.1 ENVIRONMENTAL IMPACT OF CRYPTOCURRENCY MINING

6.4.2 MISUSE OF VIRTUAL CURRENCY AND SECURITY ATTACK

7 IMPACT ANALYSIS OF COVID-19 ON ASIA PACIFIC CRYPTOCURRENCY MINING MARKET

7.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

7.2 STRATEGIC DECISION BY MANUFACTURERS AFTER COVID-19

7.3 IMPACT ON DEMAND

7.4 IMPACT ON PRICE

7.5 IMPACT ON SUPPLY CHAIN

7.6 CONCLUSION

8 ASIA PACIFIC CRYPTOCURRENCY MINING MARKET, BY MINING ENTERPRISE

8.1 OVERVIEW

8.2 LARGE MINERS

8.3 SMALL MINERS

9 ASIA PACIFIC CRYPTOCURRENCY MINING MARKET, BY REVENUE SOURCE

9.1 OVERVIEW

9.2 BLOCK REWARDS

9.3 TRANSACTION FEES

10 ASIA PACIFIC CRYPTOCURRENCY MINING MARKET, BY MINING TYPE

10.1 OVERVIEW

10.2 REMOTE HOSTING SERVICES

10.3 CLOUD MINING SERVICES

10.4 SELF-MINING

11 ASIA PACIFIC CRYPTOCURRENCY MINING MARKET, BY HARDWARE

11.1 OVERVIEW

11.2 ASIC

11.3 GPU

11.4 CPU

11.5 OTHER

12 ASIA PACIFIC CRYPTOCURRENCY MINING MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 AUSTRALIA

12.1.3 JAPAN

12.1.4 SOUTH KOREA

12.1.5 SINGAPORE

12.1.6 INDIA

12.1.7 THAILAND

12.1.8 MALAYSIA

12.1.9 PHILIPPINES

12.1.10 INDONESIA

12.1.11 REST OF ASIA-PACIFIC

13 ASIA PACIFIC CRYPTOCURRENCY MINING MARKET:COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 CANAAN INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 ARGO BLOCKCHAIN

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 HIVE BLOCKCHAIN TECHNOLOGIES LTD.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 BIT DIGITAL, INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 RIOT BLOCKCHAIN, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 SERVICE PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ASICMINER COMPANY

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 BRAIINS SYSTEMS S.R.O.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 BITMAIN TECHNOLOGIES HOLDING COMPANY

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 CORE SCIENTIFIC, INC., INC., INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 F2POOL

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 GENESIS MINING LTD

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 GMO INTERNET, INC., INC., INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 SERVICE PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 HUT 8 MINING CORP.

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 SERVICE PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 IMINING TECHNOLOGIES INC.

15.14.1 COMPANY SNAPSHOT

15.14.2 SERVICE PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 INNOSILICON TECHNOLOGY LTD.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 MINERGATE

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 MININGSKY (A SUBSIDIARY OF SKYCHAIN TECHNOLOGIES INC.)

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 MININGSTORE.COM

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 SHENZHEN MICROBT ELECTRONICS TECHNOLOGY CO., LTD

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 VIABTC

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 CRYPTOCURRENCY MINING ANALYSIS

TABLE 2 ASIA PACIFIC CRYPTOCURRENCY MINING MARKET, BY MINING ENTERPRISE, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC LARGE MINERS IN CRYPTOCURRENCY MINING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC SMALL MINERS IN CRYPTOCURRENCY MINING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC CRYPTOCURRENCY MINING MARKET, BY REVENUE SOURCE, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC BLOCK REWARDS IN CRYPTOCURRENCY MINING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC TRANSACTION FEES IN CRYPTOCURRENCY MINING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC CRYPTOCURRENCY MINING MARKET, BY MINING TYPE, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC REMOTE HOSTING SERVICES IN CRYPTOCURRENCY MINING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC CLOUD MINING SERVICES IN CRYPTOCURRENCY MINING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC SELF-MINING IN CRYPTOCURRENCY MINING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC CRYPTOCURRENCY MINING MARKET, BY HARDWARE, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC ASIC IN CRYPTOCURRENCY MINING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC GPU IN CRYPTOCURRENCY MINING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC CPU IN CRYPTOCURRENCY MINING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC OTHER IN CRYPTOCURRENCY MINING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA-PACIFIC CRYPTOCURRENCY MINING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 18 ASIA-PACIFIC CRYPTOCURRENCY MINING MARKET, BY MINING ENTERPRISES, 2020-2029 (USD MILLION)

TABLE 19 ASIA-PACIFIC CRYPTOCURRENCY MINING MARKET, BY REVENUE SOURCE, 2020-2029 (USD MILLION)

TABLE 20 ASIA-PACIFIC CRYPTOCURRENCY MINING MARKET, BY MINING TYPE, 2020-2029 (USD MILLION)

TABLE 21 ASIA-PACIFIC CRYPTOCURRENCY MINING MARKET, BY HARDWARE, 2020-2029 (USD MILLION)

TABLE 22 CHINA CRYPTOCURRENCY MINING MARKET, BY MINING ENTERPRISES, 2020-2029 (USD MILLION)

TABLE 23 CHINA CRYPTOCURRENCY MINING MARKET, BY REVENUE SOURCE, 2020-2029 (USD MILLION)

TABLE 24 CHINA CRYPTOCURRENCY MINING MARKET, BY MINING TYPE, 2020-2029 (USD MILLION)

TABLE 25 CHINA CRYPTOCURRENCY MINING MARKET, BY HARDWARE, 2020-2029 (USD MILLION)

TABLE 26 AUSTRALIA CRYPTOCURRENCY MINING MARKET, BY MINING ENTERPRISES, 2020-2029 (USD MILLION)

TABLE 27 AUSTRALIA CRYPTOCURRENCY MINING MARKET, BY REVENUE SOURCE, 2020-2029 (USD MILLION)

TABLE 28 AUSTRALIA CRYPTOCURRENCY MINING MARKET, BY MINING TYPE, 2020-2029 (USD MILLION)

TABLE 29 AUSTRALIA CRYPTOCURRENCY MINING MARKET, BY HARDWARE, 2020-2029 (USD MILLION)

TABLE 30 JAPAN CRYPTOCURRENCY MINING MARKET, BY MINING ENTERPRISES, 2020-2029 (USD MILLION)

TABLE 31 JAPAN CRYPTOCURRENCY MINING MARKET, BY REVENUE SOURCE, 2020-2029 (USD MILLION)

TABLE 32 JAPAN CRYPTOCURRENCY MINING MARKET, BY MINING TYPE, 2020-2029 (USD MILLION)

TABLE 33 JAPAN CRYPTOCURRENCY MINING MARKET, BY HARDWARE, 2020-2029 (USD MILLION)

TABLE 34 SOUTH KOREA CRYPTOCURRENCY MINING MARKET, BY MINING ENTERPRISES, 2020-2029 (USD MILLION)

TABLE 35 SOUTH KOREA CRYPTOCURRENCY MINING MARKET, BY REVENUE SOURCE, 2020-2029 (USD MILLION)

TABLE 36 SOUTH KOREA CRYPTOCURRENCY MINING MARKET, BY MINING TYPE, 2020-2029 (USD MILLION)

TABLE 37 SOUTH KOREA CRYPTOCURRENCY MINING MARKET, BY HARDWARE, 2020-2029 (USD MILLION)

TABLE 38 SINGAPORE CRYPTOCURRENCY MINING MARKET, BY MINING ENTERPRISES, 2020-2029 (USD MILLION)

TABLE 39 SINGAPORE CRYPTOCURRENCY MINING MARKET, BY REVENUE SOURCE, 2020-2029 (USD MILLION)

TABLE 40 SINGAPORE CRYPTOCURRENCY MINING MARKET, BY MINING TYPE, 2020-2029 (USD MILLION)

TABLE 41 SINGAPORE CRYPTOCURRENCY MINING MARKET, BY HARDWARE, 2020-2029 (USD MILLION)

TABLE 42 INDIA CRYPTOCURRENCY MINING MARKET, BY MINING ENTERPRISES, 2020-2029 (USD MILLION)

TABLE 43 INDIA CRYPTOCURRENCY MINING MARKET, BY REVENUE SOURCE, 2020-2029 (USD MILLION)

TABLE 44 INDIA CRYPTOCURRENCY MINING MARKET, BY MINING TYPE, 2020-2029 (USD MILLION)

TABLE 45 INDIA CRYPTOCURRENCY MINING MARKET, BY HARDWARE, 2020-2029 (USD MILLION)

TABLE 46 THAILAND CRYPTOCURRENCY MINING MARKET, BY MINING ENTERPRISES, 2020-2029 (USD MILLION)

TABLE 47 THAILAND CRYPTOCURRENCY MINING MARKET, BY REVENUE SOURCE, 2020-2029 (USD MILLION)

TABLE 48 THAILAND CRYPTOCURRENCY MINING MARKET, BY MINING TYPE, 2020-2029 (USD MILLION)

TABLE 49 THAILAND CRYPTOCURRENCY MINING MARKET, BY HARDWARE, 2020-2029 (USD MILLION)

TABLE 50 MALAYSIA CRYPTOCURRENCY MINING MARKET, BY MINING ENTERPRISES, 2020-2029 (USD MILLION)

TABLE 51 MALAYSIA CRYPTOCURRENCY MINING MARKET, BY REVENUE SOURCE, 2020-2029 (USD MILLION)

TABLE 52 MALAYSIA CRYPTOCURRENCY MINING MARKET, BY MINING TYPE, 2020-2029 (USD MILLION)

TABLE 53 MALAYSIA CRYPTOCURRENCY MINING MARKET, BY HARDWARE, 2020-2029 (USD MILLION)

TABLE 54 PHILIPPINES CRYPTOCURRENCY MINING MARKET, BY MINING ENTERPRISES, 2020-2029 (USD MILLION)

TABLE 55 PHILIPPINES CRYPTOCURRENCY MINING MARKET, BY REVENUE SOURCE, 2020-2029 (USD MILLION)

TABLE 56 PHILIPPINES CRYPTOCURRENCY MINING MARKET, BY MINING TYPE, 2020-2029 (USD MILLION)

TABLE 57 PHILIPPINES CRYPTOCURRENCY MINING MARKET, BY HARDWARE, 2020-2029 (USD MILLION)

TABLE 58 INDONESIA CRYPTOCURRENCY MINING MARKET, BY MINING ENTERPRISES, 2020-2029 (USD MILLION)

TABLE 59 INDONESIA CRYPTOCURRENCY MINING MARKET, BY REVENUE SOURCE, 2020-2029 (USD MILLION)

TABLE 60 INDONESIA CRYPTOCURRENCY MINING MARKET, BY MINING TYPE, 2020-2029 (USD MILLION)

TABLE 61 INDONESIA CRYPTOCURRENCY MINING MARKET, BY HARDWARE, 2020-2029 (USD MILLION)

TABLE 62 REST OF ASIA-PACIFIC CRYPTOCURRENCY MINING MARKET, BY MINING ENTERPRISES, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 ASIA PACIFIC CRYPTOCURRENCY MINING MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC CRYPTOCURRENCY MINING MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC CRYPTOCURRENCY MINING MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC CRYPTOCURRENCY MINING MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC CRYPTOCURRENCY MINING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC CRYPTOCURRENCY MINING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC CRYPTOCURRENCY MINING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC CRYPTOCURRENCY MINING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC CRYPTOCURRENCY MINING MARKET: SEGMENTATION

FIGURE 10 RISE IN THE POPULARITY OF MINING POOLS IS EXPECTED TO DRIVE THE ASIA PACIFIC CRYPTOCURRENCY MINING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 MINING ENTERPRISE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC CRYPTOCURRENCY MINING MARKET IN 2022 & 2029

FIGURE 12 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE ASIA PACIFIC CRYPTOCURRENCY MINING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC CRYPTOCURRENCY MINING MARKET

FIGURE 14 ASIA PACIFIC CRYPTOCURRENCY MINING MARKET: BY MINING ENTERPRISE, 2021

FIGURE 15 ASIA PACIFIC CRYPTOCURRENCY MINING MARKET: BY REVENUE SOURCE, 2021

FIGURE 16 ASIA PACIFIC CRYPTOCURRENCY MINING MARKET: BY MINING TYPE, 2021

FIGURE 17 ASIA PACIFIC CRYPTOCURRENCY MINING MARKET: BY HARDWARE, 2021

FIGURE 18 ASIA-PACIFIC CRYPTOCURRENCY MINING MARKET: SNAPSHOT (2021)

FIGURE 19 ASIA-PACIFIC CRYPTOCURRENCY MINING MARKET: BY COUNTRY (2021)

FIGURE 20 ASIA-PACIFIC CRYPTOCURRENCY MINING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 21 ASIA-PACIFIC CRYPTOCURRENCY MINING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 22 ASIA-PACIFIC CRYPTOCURRENCY MINING MARKET: BY MINING ENTERPRISES (2022-2029)

FIGURE 23 ASIA PACIFIC CRYPTOCURRENCY MINING MARKET: COMPANY SHARE 2021 (%)

Asia Pacific Cryptocurrency Mining Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Cryptocurrency Mining Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Cryptocurrency Mining Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.