Asia-Pacific Chromatography Food Testing Market, By Chromatography Testing Type (Liquid Chromatography, Gas Chromatography, Column Chromatography, Paper Chromatography, and Thin Layer Chromatography), Type of Tests (Food Safety Testing, Food Authenticity Testing, Food Shelf Life Testing, and Others), Site (Inhouse/Internal Lab, and Commercial Service Laboratory), Application Product Phase (Testing for Product in Running Production Phase, Testing For Final Product, and Testing For Product in Research & Development Phase), Application (Food and Beverages) Industry Trends and Forecast to 2029

Asia-Pacific Chromatography Food Testing Market Analysis and Insights

Chromatography food testing can be used at various stages of the food chain, from determining the quality of food to detecting additives, pesticides, pathogens, and other harmful contaminants which can affect human health. A rise in pandemics such as COVID-19 across the regions has boosted the growth of food testing, including chromatography food testing.

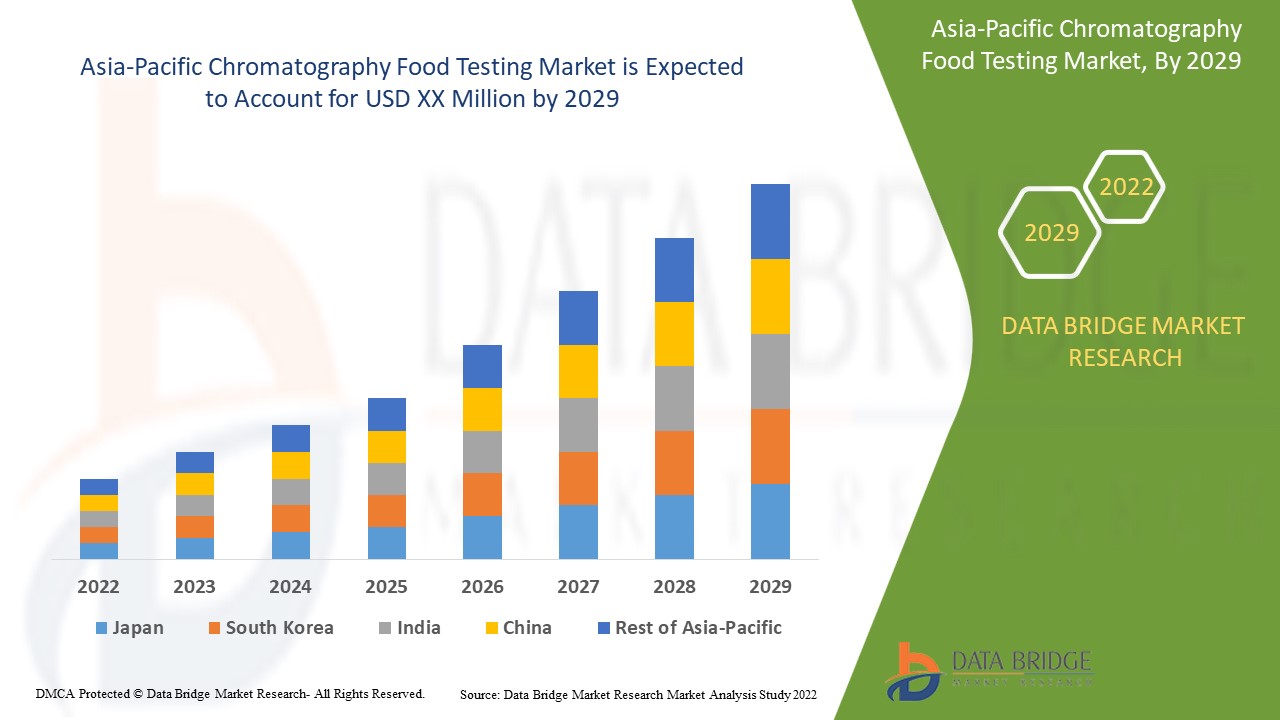

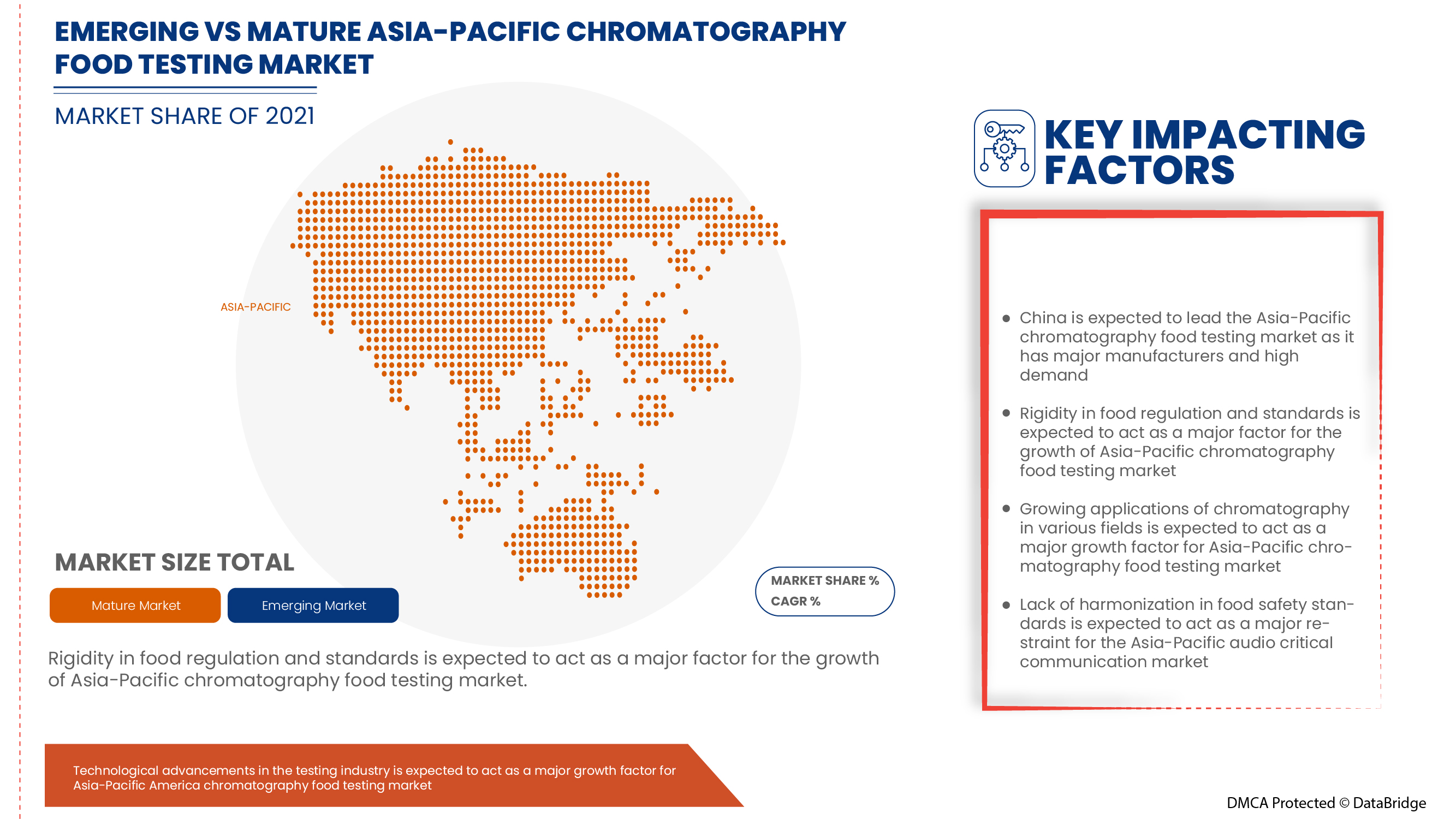

The rising number of foodborne illnesses, technological advancements in the testing industry, rigidity in food regulation and standards, and increasing investment in food safety testing services are some factors driving the market. However, the high cost of chromatography equipment and the presence of alternative food testing technologies may hinder the market's growth. Data Bridge Market Research analyses that the chromatography food testing market is expected to grow at a CAGR of 7.3% during the forecast period of 2022 to 2029.

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2019 - 2014)

|

|

Quantitative Units

|

Revenue in USD thousand, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

By Chromatography Testing Type (Liquid Chromatography, Gas Chromatography, Column Chromatography, Paper Chromatography, and Thin Layer Chromatography), Type of Tests (Food Safety Testing, Food Authenticity Testing, Food Shelf Life Testing, and Others), Site (Inhouse/Internal Lab, and Commercial Service Laboratory), Application Product Phase (Testing for Product in Running Production Phase, Testing For Final Product, and Testing For Product in Research & Development Phase), Application (Food and Beverages)

|

|

Countries Covered

|

China, Japan, Australia, India, South Korea, Malaysia, Singapore, Vietnam, Indonesia, Thailand, Philippines, New Zealand, Rest of the Asia-Pacific

|

|

Market Players Covered

|

SGS SA, Bureau Veritas, Eurofins Scientific, TÜV SÜD, ALS, Intertek Group plc, Symbio Laboratories, BVAQ, QIMA, Pacific Labs, Merck KGaA, Cotecna, Mérieux NutriSciences Corporation, Food Safety Net Services, AsureQuality, Element Materials Technology (formerly AVOMEEN), Spectro Analytical Labs Pvt. Limited, NSF, R J Hill Laboratories Limited, Neogen Corporation, Waters Corporation, Thermo Fisher Scientific Inc., and Shimadzu Corporation among others

|

Market Definition

Foodborne illness is caused by consuming spoiled or contaminated food with additives, pesticides, pathogenic bacteria, viruses, parasites, and others, leading to infection. Foodborne illnesses can be spread through various factors such as improper food handling, lack of awareness, and many more. These disease-causing factors must be tested before the consumption of the food. Chromatography can be used at various stages of the food chain, from determining the quality of food to detecting additives, pesticides, and other harmful contaminants.

Asia-pacific Chromatography Food Testing Market Dynamics

Drivers

- Rise in number of foodborne illnesses

Foodborne diseases are caused by consuming contaminated food or drink. There are more than 250 known foodborne diseases. The majority of the infections are caused by bacteria, viruses, and parasites, and some are caused by chemicals and toxins. Escherichia coli are the major bacteria species that live in human intestines.

- Increasing adoption of chromatography testing techniques

Chromatography is an important biophysical technique that enables the separation, identification, and purification of the components of a mixture for qualitative and quantitative analysis. Today, chromatography allows the food industry to provide accurate information about the nutrients in particular food and much more.

- An increase in the amount of food recalls and food adulterations

A food recall is an action taken in order to remove from sale, distribution, and consumption of a particular food that may pose a safety risk to consumers. A food recall may be initiated as a result of a report or complaint from a variety of sources, such as manufacturers, wholesalers, retailers, government agencies, and consumers.

Opportunities

-

Technological advancements in the testing industry

The technological trends in chromatography food testing which is driving the market growth in recent times are Artificial intelligence (AI), digitalization, connectivity technologies, and smart automated technologies fuelled by data & machine learning. In pre-pandemic times, interest in the benefits of smart and automated technologies was high.

Restraints/Challenges

- High cost associated with chromatography testing & presence of alternative food testing technologies

However, at present, there are different types of chromatography testing, such as paper chromatography, thin-layer chromatography, gas chromatography, membrane chromatography, and dye-ligand chromatography. These chromatography testing are widely used in the food, biopharmaceutical, nutraceutical, and in bioprocessing industries among others. Chromatography testing is used in various industries for the accurate result obtained post-testing, but chromatography testing is costly and takes much time in the testing. The other factor that may impede chromatography testing used in the food industry is the cost associated with it.

COVID-19 Impact on Asia-Pacific Chromatography Food Testing Market

COVID-19 had a positive effect on the market as food testing services boomed. As chromatography food testing systems and services were in high demand among consumers due to COVID-19, the need to detect contamination and pathogens was a mandate for the food industry to follow. This boosted the growth of various types of food testing services, including chromatography food testing.

Recent Development

- In June 2022, PerkinElmer, Inc. launched next generation, automated gas chromatography platform solution. The key features of this solution were its automated gas chromatography (GC), headspace sampler, and GC/mass spectrometry (GC/MS) solution

Asia-Pacific Chromatography Food Testing Market Scope

The chromatography food testing market is segmented on the basis of chromatography testing type, type of tests, site, application product phase, and application. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Chromatography Testing Type

- Liquid chromatography

- Gas chromatography

- Column chromatography

- Paper chromatography

- Thin layer chromatography

On the basis of chromatography testing type, the chromatography food testing market is segmented into liquid chromatography, gas chromatography, column chromatography, paper chromatography, and thin layer chromatography.

Type of Tests

- Food safety testing

- Food authenticity testing

- Food shelf life testing

- Others

On the basis of the type of tests, the chromatography food testing market is segmented into food safety testing, food authenticity testing, food shelf life testing, and others.

Site

- In-house/Internal lab

- Commercial service laboratory

On the basis of site, the chromatography food testing market is segmented into in-house/internal lab and commercial service laboratory.

Application Product Phase

- Testing for product in running production phase

- Testing for final product

- Testing for product in research & development phase

On the basis of the application product phase, the chromatography food testing market is segmented into testing for product in running production phase, testing for final product, and testing for product in research & development phase.

Application

- Food

- Beverages

On the basis of application, the chromatography food testing market is segmented into food and beverages.

Asia-Pacific Chromatography Food Testing Market Regional Analysis/Insights

The Asia-Pacific chromatography food testing market is analyzed, and market size insights and trends are provided by country, chromatography testing type, type of tests, site, application product phase, and application, as referenced above.

In 2022, China is expected to dominate the Asia-Pacific chromatography food testing market due to the increasing adoption of chromatography testing techniques due to the widespread pandemic emphasizing food safety in the region.

The country section of the report also provides individual market impacting factors and changes in regulations in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, disease epidemiology, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Chromatography Food Testing Market Share Analysis

The Asia-Pacific chromatography food testing market competitive landscape provides details by a competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, solution launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the Asia-Pacific chromatography food testing market.

Some of the major players operating in the Asia-Pacific chromatography food testing market are SGS SA, Bureau Veritas, Eurofins Scientific, TÜV SÜD, ALS, Intertek Group plc, Symbio Laboratories, BVAQ, QIMA, Pacific Labs, Merck KGaA, Cotecna, Mérieux NutriSciences Corporation, Food Safety Net Services, AsureQuality, Element Materials Technology (formerly AVOMEEN), Spectro Analytical Labs Pvt. Limited, NSF, R J Hill Laboratories Limited, Neogen Corporation, Waters Corporation, Thermo Fisher Scientific Inc., and Shimadzu Corporation among others.

SKU-