Asia-Pacific Bio Surgical Agents Market, By Product (Bone-Graft Substitutes, Soft-Tissue Attachments, Hemostatic Agent, Surgical Sealants & Adhesives, Adhesion Barriers, Staple-Line Reinforcement Agents, Others), Application (General Surgery, Cardiovascular Surgery, Orthopaedic Surgery, Neurological Surgery, Reconstructive Surgery, Gynecological Surgery, Thoracic Surgery, Urological Surgery, Others), Source (Biological, Synthetic), End-Users (Hospitals, Specialty Clinics, Ambulatory Surgical Centres, Homecare, Others), Distribution Channel (Retails Sales, Online Sales, Others) – Industry Trends and Forecast to 2031.

Asia-Pacific Bio Surgical Agents Market Analysis and Size

The rising prevalence of chronic diseases is anticipated to fuel the bio-surgical agents market. Risks associated with bio-surgical agents act as restraints for the growth of the bio-surgical agents market. Strategic initiatives done by the key market players to expand its market presence, among others, are acting as an opportunity for its growth in the bio-surgical agents market. Stringent regulation acts as a challenge to the growth of the bio-surgical agents market.

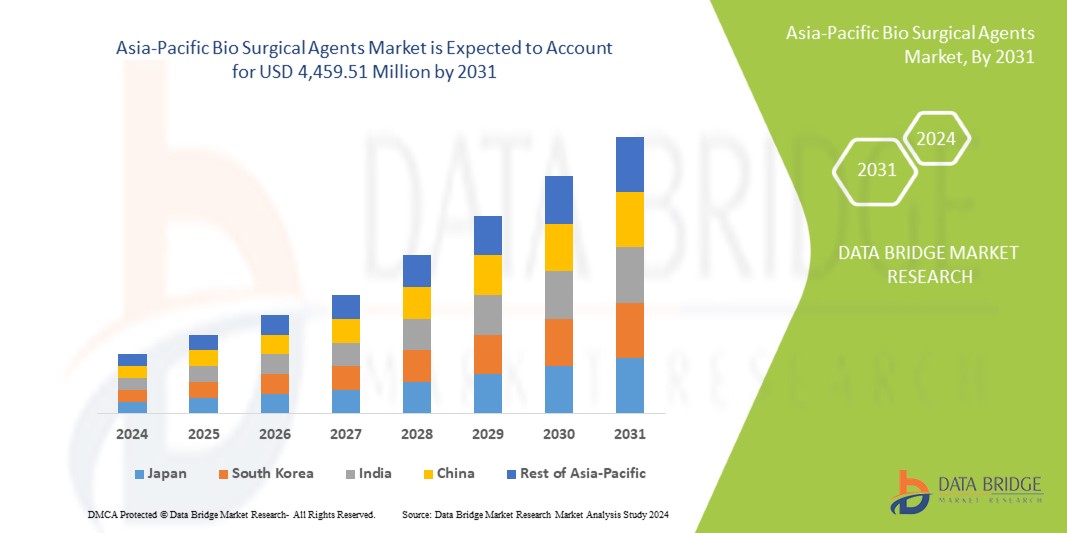

Data Bridge Market Research analyzes that the Asia-Pacific bio-surgical agents market, which was USD 2,391.38 million in 2023, is likely to reach USD 4,459.51 million by 2031 and is expected to undergo a CAGR of 7.7% during the forecast period. The “bone-graft substitutes” dominate the product segment of the market due to the growing number of accidental and sports-related injuries. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

By Product (Bone-Graft Substitutes, Soft-Tissue Attachments, Hemostatic Agent, Surgical Sealants & Adhesives, Adhesion Barriers, Staple-Line Reinforcement Agents, Others), Application (General Surgery, Cardiovascular Surgery, Orthopaedic Surgery, Neurological Surgery, Reconstructive Surgery, Gynecological Surgery, Thoracic Surgery, Urological Surgery, Others), Source (Biological, Synthetic), End-Users (Hospitals, Specialty Clinics, Ambulatory Surgical Centres, Homecare, Others), Distribution Channel (Retails Sales, Online Sales, Others)

|

|

Countries Covered

|

China, Japan, South Korea, India, Australia, Vietnam, Singapore, Thailand, Malaysia, Indonesia, Philippines, Rest of Asia-Pacific

|

|

Market Players Covered

|

Integra LifeSciences Corporation (U.S.), B. Braun Melsungen AG (Germany), Sanofi (France), Zimmer Biomet (U.S.), NuVasive, Inc. (U.S.), Pfizer Inc. (U.S.), Wright Medical Group N.V. (Netherlands), Anika Therapeutics, Inc. (U.S.), Adhezion Biomedical (U.S.), CryoLife, Inc. (U.S.), AROA BIOSURGERY LIMITED (New Zealand), Exactech, Inc. (U.S.), Getinge AB (Sweden), Smith & Nephew (U.K.), Teleflex Incorporated (U.S.), BD (U.S.), Baxter (U.S.), Johnson & Johnson Services, Inc. (U.S.), Medtronic (Ireland), Stryker (U.S.)

|

|

Market Opportunities

|

|

Market Definition

Bio surgical agents are the agents being utilized in surgical fields to achieve hemostasis and to optimize wound healing. Furthermore, bio surgical agents play an essential role in regulating blood loss and closing surgical sites during different types of surgeries. The bio surgical agents include bone graft substitute, soft tissue attachment, hemostatic agent, surgical sealants and adhesives, adhesion barriers, staple-line reinforcement agents and others.

Bio Surgical Agents Market Dynamics

Drivers

- Growing aging population

The Asia-Pacific region is experiencing a significant increase in its aging population. As people age, there is often an increased need for various surgical interventions and treatments, which can drive the demand for bio surgical agents.

- Rising incidence of chronic diseases

The prevalence of chronic diseases, such as cardiovascular diseases, orthopedic disorders, and cancer, is on the rise in the Asia-Pacific region. Bio surgical agents, including products used in soft tissue repair and regeneration, may be increasingly utilized in surgeries related to these conditions.

- Technological advancements in surgical procedures

Advances in surgical techniques and technologies, including the use of bio surgical agents, can enhance the efficacy of surgical procedures. Surgeons and healthcare providers in the Asia-Pacific region may adopt these technologies to improve patient outcomes, contributing to market growth.

- Growing investment for healthcare facilities

Surging focus towards improving the condition of healthcare facilities and improving the overall healthcare infrastructure another important factor fostering the growth of the market. Rising number of partnerships and strategic collaborations between the public and private players pertaining to funding and application of new and improved technology is further creating lucrative market opportunities.

Opportunities

- Increasing awareness and adoption of regenerative medicine

There is a growing awareness and acceptance of regenerative medicine approaches in the Asia-Pacific region. Bio surgical agents that promote tissue regeneration and repair align with the principles of regenerative medicine, presenting opportunities for market growth.

- Expanding applications in orthopedic surgeries

Bio surgical agents are commonly used in orthopedic surgeries for soft tissue repair and bone regeneration. The Asia-Pacific region is experiencing an increase in orthopedic procedures due to factors such as sports injuries, fractures, and degenerative joint diseases, providing opportunities for the market.

Restraints

- Stringent regulatory approval processes

The regulatory approval process for bio surgical agents can be time-consuming and expensive. Stringent regulations in the Asia-Pacific region may pose a challenge for market players in terms of product development timelines and costs.

- Limited reimbursement policies

Limited or inconsistent reimbursement policies for bio surgical agents in certain Asia-Pacific countries may impact their adoption. Healthcare providers and patients may face challenges in accessing these products due to reimbursement constraints.

Challenges

- Limited healthcare infrastructure in some regions

Certain regions within the Asia-Pacific may face challenges related to limited healthcare infrastructure. Insufficient facilities and resources in some areas can hinder the adoption and accessibility of advanced bio surgical agents.

- Ethical and cultural considerations

Ethical considerations related to the use of bio surgical agents, especially those derived from animal or human sources, may vary across different cultures. Understanding and navigating these ethical considerations can pose challenges for market penetration.

This bio surgical agents market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the bio surgical agents market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In March 2022, Molecular Matrix, Inc. (MMI) launched Osteo-P Synthetic Bone Graft Substitute (BGS) for use in the musculoskeletal system

- In February 2022, Gunze Limited received medical device approval to manufacture and sell TENALEAF, the first sheet-type absorbable adhesion barrier made in Japan

Asia-Pacific Bio Surgical Agents Market Scope

The bio surgical agents market is segmented on the basis of product, application, source, end-users, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Bone-Graft Substitutes

- Soft-Tissue Attachments

- Hemostatic Agent

- Surgical Sealants & Adhesives

- Adhesion Barriers

- Staple-Line Reinforcement Agents

- Others

Surgical Agents

- General Surgery

- Cardiovascular Surgery

- Orthopaedic Surgery

- Neurological Surgery

- Reconstructive Surgery

- Gynecological Surgery

- Thoracic Surgery

- Urological Surgery

- Others

Source

- Synthetic

- Biological

End User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centres

- Homecare

- Others

Distribution Channel

- Retails Sales

- Online Sales

- Others

Bio Surgical Agents Market Regional Analysis/Insights

The bio surgical agents market is analyzed and market size insights and trends are provided by country, product, application, source, end-users, and distribution channel as referenced above.

The countries covered in the market report are China, Japan, South Korea, India, Australia, Vietnam, Singapore, Thailand, Malaysia, Indonesia, Philippines and rest of Asia-Pacific.

China is expected to dominate the market and grow with the highest growth rate in the forecast period due to growing prevalence of chronic diseases.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure growth Installed base and New Technology Penetration

The bio surgical agents market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for bio surgical agents market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the bio surgical agents market. The data is available for historic period 2010-2020.

Competitive Landscape and Bio Surgical Agents Market Share Analysis

The bio surgical agents’ market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Regional presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to bio surgical agents market.

Some of the major players operating in the bio surgical agents market are:

- Integra LifeSciences Corporation (U.S.)

- B. Braun Melsungen AG (Germany)

- Sanofi (France)

- Zimmer Biomet (U.S.)

- NuVasive, Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Wright Medical Group N.V. (Netherlands)

- Anika Therapeutics, Inc. (U.S.)

- Adhezion Biomedical (U.S.)

- CryoLife, Inc. (U.S.)

- AROA BIOSURGERY LIMITED (New Zealand)

- Exactech, Inc. (U.S.)

- Getinge AB (Sweden)

- Smith & Nephew (U.K.)

- Teleflex Incorporated (U.S.)

- BD (U.S.)

- Baxter (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Medtronic (Ireland)

- Stryker (U.S.)

SKU-