Asia Pacific Artificial Blood Substitutes Market

Market Size in USD Billion

CAGR :

%

USD

13.18 Billion

USD

75.10 Billion

2025

2033

USD

13.18 Billion

USD

75.10 Billion

2025

2033

| 2026 –2033 | |

| USD 13.18 Billion | |

| USD 75.10 Billion | |

|

|

|

|

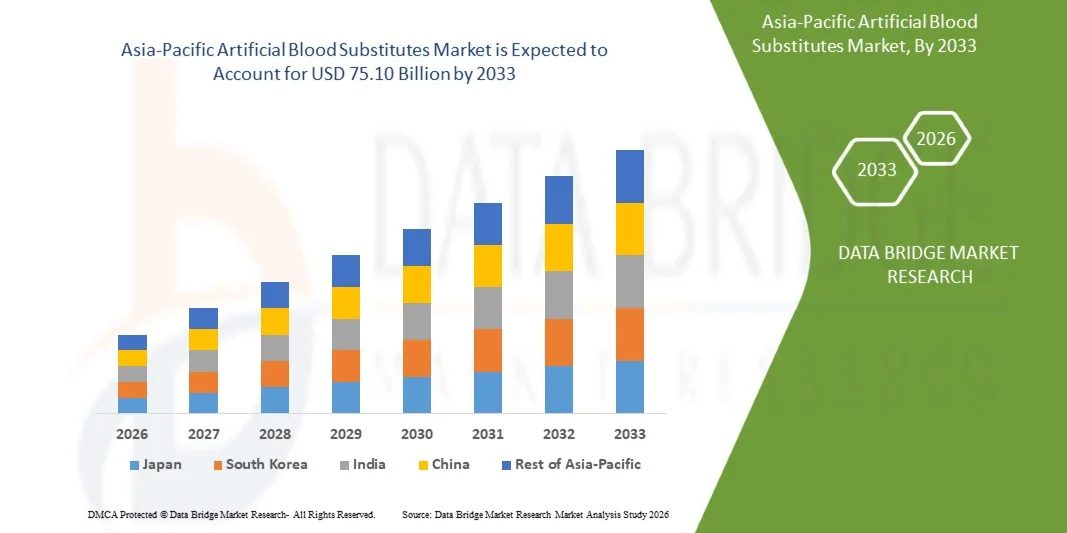

Asia-Pacific Artificial Blood Substitutes Market Size

- The Asia-Pacific Artificial Blood Substitutes Market size was valued at USD 13.18 billion in 2025 and is expected to reach USD 75.10 billion by 2033, at a CAGR of 24.30% during the forecast period

- The market growth is largely fueled by the increasing demand for blood transfusion alternatives, driven by the rising prevalence of chronic diseases, trauma cases, and surgical procedures, which is pushing healthcare providers to seek safer and more readily available substitutes

- Furthermore, advancements in biotechnology and synthetic medicine, along with growing research in oxygen therapeutics and hemoglobin-based substitutes, are accelerating product innovation and clinical adoption, thereby significantly boosting the uptake of Artificial Blood Substitutes solutions and expanding the overall market growth

Asia-Pacific Artificial Blood Substitutes Market Analysis

- Artificial blood substitutes, also known as oxygen therapeutics, are emerging as crucial alternatives to traditional blood transfusions, particularly in emergency medicine, military trauma care, and regions facing blood shortages. These substitutes help overcome limitations of donor blood, such as compatibility issues, short shelf life, and risk of infections

- The market demand is rising due to increasing trauma cases, surgical procedures, and chronic conditions requiring frequent blood transfusions, coupled with a global shortage of donated blood. Technological advancements in hemoglobin-based oxygen carriers (HBOCs) and perfluorocarbon-based oxygen carriers (PFCs) are driving product innovation and clinical adoption

- China dominated the Asia-Pacific Artificial Blood Substitutes Market with the largest revenue share of approximately 36.8% in 2025, supported by strong government funding for medical research, rising investments in biotech, expanding healthcare infrastructure, and rapid adoption of innovative medical therapies

- India is expected to be the fastest-growing region in the Asia-Pacific Artificial Blood Substitutes Market during the forecast period, with a projected CAGR of approximately 11.2%, driven by increasing healthcare expenditure, rising surgical procedures, growing trauma cases, and expanding clinical research and manufacturing capabilities

- The Hemoglobin-Based Oxygen Carriers (HBOCs) segment dominated the market with approximately 58.4% revenue share in 2025

Report Scope and Asia-Pacific Artificial Blood Substitutes Market Segmentation

|

Attributes |

Asia-Pacific Artificial Blood Substitutes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Asia-Pacific Artificial Blood Substitutes Market Trends

“Growing Focus on Synthetic Oxygen Carriers and Hemoglobin-Based Therapeutics”

- A major trend in the global Asia-Pacific Artificial Blood Substitutes Market is the increasing development and clinical adoption of synthetic oxygen carriers, including hemoglobin-based oxygen carriers (HBOCs) and perfluorocarbon-based solutions, aimed at addressing the shortage of donor blood and improving emergency care outcomes

- For instance, in 2023, Japan’s Nipro Corporation expanded its research and development efforts in hemoglobin-based blood substitutes, exploring advanced formulations designed for trauma and surgical blood loss management, reflecting a broader regional focus on next-generation blood alternatives

- The trend is also supported by rising investments in clinical trials, regulatory pathways for innovative blood substitutes, and increased collaboration between academic institutions and biotech companies across China, Japan, India, and South Korea

- Growing demand for emergency medicine, trauma care, and battlefield applications is driving interest in artificial blood products that can provide rapid oxygen delivery without the need for cross-matching

- In addition, the rising prevalence of chronic diseases and surgical procedures in the region is increasing demand for blood transfusion alternatives that can reduce infection risks and improve supply stability

Asia-Pacific Artificial Blood Substitutes Market Dynamics

Driver

“Blood Shortages and Rising Demand for Emergency & Surgical Care”

- The primary driver for the Asia-Pacific Artificial Blood Substitutes Market is the ongoing shortage of donor blood, particularly in rural and developing regions where blood donation infrastructure is limited

- For instance, during the COVID-19 pandemic (2021–2022), several APAC countries reported severe blood supply shortages, prompting healthcare systems to seek alternative solutions such as artificial blood substitutes for emergency care and surgical procedures

- Increased healthcare spending, expansion of trauma centers, and rising surgical volumes are further fueling demand for artificial blood substitutes as a reliable and safe alternative to traditional blood transfusion

- Moreover, the growth of medical tourism in countries like India, Thailand, and Singapore is driving adoption of advanced medical therapies, including blood substitute technologies

- Government initiatives to strengthen emergency response systems and promote innovation in healthcare also support market growth in the region

Restraint/Challenge

“Regulatory Hurdles and Clinical Safety Concerns”

- A major restraint in the Asia-Pacific Artificial Blood Substitutes Market is the stringent regulatory approval process, which requires extensive clinical trials and long-term safety data before commercialization

- For instance, several hemoglobin-based oxygen carrier products have faced delays in clinical approval due to concerns related to cardiovascular risks and side effects, leading to cautious regulatory oversight and limited market entry

- High development costs, lengthy clinical trial timelines, and uncertainty regarding long-term safety outcomes can hinder investment and slow product launches in the region

- In addition, limited awareness among clinicians and preference for traditional blood transfusion continue to restrict adoption in many countries

- Overcoming these challenges will require improved clinical evidence, streamlined regulatory frameworks, and increased collaboration between industry and regulatory agencies to ensure safe and effective market access

Asia-Pacific Artificial Blood Substitutes Market Scope

The market is segmented on the basis of type, source, application, and end user.

• By Product Type

On the basis of product type, the Asia-Pacific Artificial Blood Substitutes Market is segmented into Perfluorocarbon (PFCs) and Hemoglobin-Based Oxygen Carries (HBOCs). The Hemoglobin-Based Oxygen Carriers (HBOCs) segment dominated the market with approximately 58.4% revenue share in 2025. HBOCs closely mimic the oxygen-carrying function of human hemoglobin and can rapidly transport oxygen to tissues. Their superior oxygen delivery performance makes them highly preferred in emergency trauma care and surgical settings. The segment benefits from ongoing research in hemoglobin modification to reduce toxicity. HBOCs are favored in regions facing blood shortages due to compatibility and longer shelf-life. Regulatory approvals for newer HBOC formulations are strengthening adoption. Increasing demand for blood substitutes in military and disaster medicine supports growth. Hospitals and trauma centers are major consumers of HBOCs. Continuous innovation and improved safety profiles further reinforce dominance.

The Perfluorocarbon (PFCs) segment is expected to grow at the fastest CAGR of 13.2% from 2026 to 2033. PFCs are synthetic compounds capable of dissolving large volumes of oxygen and delivering it efficiently to hypoxic tissues. Their rapid oxygenation properties make them suitable for critical care and perioperative applications. PFCs also support use in organ preservation and tumor hypoxia management. Advancements in PFC formulation are reducing side effects and improving biocompatibility. Rising demand for safe oxygen therapeutics in remote or resource-limited areas drives growth. PFCs are increasingly used as temporary oxygen carriers during surgeries. Growing clinical trials and research investments are accelerating market expansion. Improved manufacturing scalability and regulatory support also contribute to high CAGR.

• By Source

On the basis of source, the market is segmented into Human Blood, Animal Blood, Microorganism Based Recombinant HB, Synthetic Polymers, and Stem Cells. The microorganism-based recombinant hemoglobin segment dominated with 37.5% revenue share in 2025, driven by scalability and lower contamination risk. Recombinant hemoglobin is produced using engineered microorganisms, ensuring consistent quality and reduced dependence on donor blood. It offers improved safety compared to animal-derived sources. The segment is preferred in biotechnology and pharmaceutical settings due to easier regulatory compliance. It supports mass production and rapid availability. Increasing research funding in recombinant therapeutics is fueling demand. High adoption in developed markets due to advanced biotech infrastructure supports dominance. Enhanced oxygen affinity and reduced immunogenicity further strengthen preference. Continued innovation in recombinant expression systems boosts segment growth.

The synthetic polymers segment is expected to grow at a CAGR of 14.1% from 2026 to 2033, driven by strong research in polymer-based oxygen carriers. Synthetic polymers can be engineered to improve circulation time and reduce toxicity. Their flexibility allows design for targeted oxygen delivery and controlled release. Synthetic polymer carriers also offer longer shelf life and lower storage constraints. Rising demand for safer, standardized blood substitutes supports growth. Ongoing clinical trials and polymer innovation attract significant investment. Growth is also fueled by increasing focus on trauma and emergency medicine. Emerging economies are adopting synthetic polymer substitutes due to cost-effectiveness. Strong collaborations between research institutes and manufacturers enhance market expansion.

• By Application

On the basis of application, the market is segmented into Cardiovascular Diseases, Malignant Neoplasma, Injuries, Neonatal Conditions, Organ Transplant, and Maternal Conditions. The injuries segment dominated with 42.1% revenue share in 2025, due to rising trauma cases and emergency surgeries. Artificial blood substitutes are vital for rapid oxygen delivery in hemorrhagic shock and trauma. Their ability to stabilize patients before transfusion makes them essential in emergency medicine. Military and disaster response demand drives the segment strongly. Growing road accidents and surgical complications increase need for blood substitutes. Hospitals prioritize substitutes for trauma protocols and intensive care. Artificial blood reduces dependency on donor blood during mass casualty events. Rising global trauma incidence supports continuous adoption. High demand in pre-hospital care and ambulatory settings further strengthens dominance.

The organ transplant segment is expected to grow fastest at CAGR of 12.6% from 2026 to 2033. Artificial blood substitutes improve organ preservation and reduce ischemia-related damage. During transplant procedures, substitutes help maintain oxygenation without relying on donor blood. Increasing organ transplant surgeries globally drive demand. Advanced substitutes support better patient outcomes and reduce rejection risks. Growth is supported by rising chronic organ failure cases. Research in oxygen therapeutics for organ storage and transport is expanding. Regulatory support for transplant innovations further boosts adoption. Hospital transplant centers are increasingly integrating substitutes into protocols.

• By End User

On the basis of end user, the market is segmented into Hospital & Clinics, Blood Banks, and Others. The hospital & clinics segment dominated with 56.7% revenue share in 2025, driven by high demand for emergency and surgical applications. Hospitals rely on substitutes for trauma, surgery, and critical care where blood supply is limited. High procedural volumes and advanced healthcare infrastructure support adoption. Hospitals also conduct clinical trials and research for new blood substitutes. Emergency response units and trauma centers are major consumers. The ability to store substitutes longer than donor blood strengthens preference. Increasing focus on patient safety and reduced transfusion risks drives demand. Growing number of surgeries and chronic disease cases supports segment dominance. Hospitals in developed markets lead in adoption due to higher budgets.

The blood banks segment is expected to grow at the fastest CAGR of 11.8% from 2026 to 2033. Blood banks are adopting substitutes to manage shortages and reduce dependency on donor supply. Growing demand for backup oxygen therapeutics during emergencies increases adoption. Blood banks are also supporting research and trials for newer substitutes. Improved storage and distribution capabilities help expand availability. Increased focus on maintaining blood supply during pandemics and disasters boosts growth. Blood banks in emerging markets are investing in substitutes to meet rising healthcare needs. Collaborations with biotech companies strengthen access to new products. Regulatory frameworks for safe blood substitutes also accelerate growth.

Asia-Pacific Artificial Blood Substitutes Market Regional Analysis

- The Asia-Pacific Artificial Blood Substitutes Market is poised to grow at the fastest CAGR of 11.2% during the forecast period of 2026 to 2033, driven by increasing healthcare expenditure, expanding hospital infrastructure, and rising surgical procedures across emerging economies. The region is witnessing a growing number of trauma cases and emergency surgeries, which is boosting demand for blood substitutes due to limited blood supply and donor dependency

- Governments in APAC are promoting healthcare modernization and supporting research in advanced therapeutics. Increasing investments in biotechnology and clinical trials further support market expansion. Countries such as China and India are focusing on developing local manufacturing capabilities, reducing product costs and improving accessibility. Rising awareness about patient safety and infection risks associated with transfusions is also driving adoption

- The growing number of private and public healthcare facilities enhances market penetration. In addition, the increasing prevalence of chronic diseases and accidents increases the need for blood replacement solutions. The overall growth is fueled by strategic collaborations between manufacturers and healthcare providers across the region

China Asia-Pacific Artificial Blood Substitutes Market Insight

The China Asia-Pacific Artificial Blood Substitutes Market dominated the global market with the largest revenue share of approximately 36.8% in 2025, supported by strong government funding for medical research and rising investments in biotechnology. The country’s expanding healthcare infrastructure and rapid adoption of innovative medical therapies are key factors driving demand. China has a high volume of surgical procedures and trauma cases, which increases the need for reliable blood substitutes. Strong domestic manufacturing capabilities and continuous product innovation help in offering cost-effective solutions. The presence of major biotechnology companies and advanced research institutions accelerates market growth. China’s emphasis on improving emergency care and trauma management supports increased adoption. Ongoing clinical trials and collaborations with global manufacturers strengthen the market. Rising awareness about transfusion-related risks and the need for safer alternatives further boosts demand. The country’s large patient population and growing healthcare spending make it a dominant market in APAC.

India Asia-Pacific Artificial Blood Substitutes Market Insight

The India Asia-Pacific Artificial Blood Substitutes Market is expected to be the fastest-growing region with a projected CAGR of approximately 11.2% during the forecast period of 2026 to 2033, driven by rising healthcare expenditure and increasing surgical procedures. The country is witnessing growing trauma and accident cases, which is increasing the need for blood substitutes to manage emergencies and reduce donor dependency. India’s expanding clinical research ecosystem and improving regulatory framework support adoption. Growing investments in biotechnology manufacturing and local production of blood substitutes are improving affordability and availability. The rising number of hospitals, trauma centers, and critical care facilities is boosting demand. In addition, increasing awareness about the benefits of artificial blood substitutes and improved patient safety is driving market growth. Collaborations between Indian biotech firms and global companies are supporting technology transfer and innovation. Overall, India’s growing healthcare infrastructure and high unmet medical needs make it a key growth market in APAC.

Asia-Pacific Artificial Blood Substitutes Market Share

The Artificial Blood Substitutes industry is primarily led by well-established companies, including:

- Baxter International Inc. (U.S.)

- Grifols, S.A. (Spain)

- Northfield Laboratories (U.S.)

- Hemarina (France)

- Pioneer Biomedical (U.S.)

- Pharmaceuticals & Medical Devices Agency (Japan)

- OPKO Health (U.S.)

- Serum Institute of India (India)

- Mitsubishi Tanabe Pharma Corporation (Japan)

- NexGen Medical Systems (U.S.)

- Kamada Ltd. (Israel)

- CytomX Therapeutics (U.S.)

- Inotek Pharmaceuticals (U.S.)

- Novo Nordisk (Denmark)

- Baxalta (U.S.)

Latest Developments in Asia-Pacific Artificial Blood Substitutes Market

- In March 2021, a Technavio industry report projected that the global Asia-Pacific Artificial Blood Substitutes Market was expected to grow by approximately USD 7.38 billion with a ~23 % CAGR during 2021–2025, driven by increasing research funding, clinical development, and interest in hemoglobin-based and perfluorocarbon oxygen carrier technologies. This forecast underscored rising investor and academic focus on artificial blood alternatives

- In July 2024, Nara Medical University (Japan) announced plans for a first-of-its-kind clinical trial of artificial red blood cells — generated by extracting hemoglobin and encapsulating it in lipid vesicles for long-term storage and universal compatibility — with a goal of initiating testing before March 2025 to support emergency transfusion applications

- In March 2025, scientists from Nara Medical University began human trials of a universal artificial blood product (haemoglobin vesicles) designed to be compatible with all blood types and stored for up to two years without refrigeration, addressing chronic shortages and transfusion logistics challenges worldwide

- In May 2025, Japanese researchers developed and publicized a universal artificial blood substitute capable of oxygen transport regardless of blood type, long shelf life, and virus-free formulation — a breakthrough targeting emergency medicine, trauma care, and global transfusion systems

- In July 2025, industry analysis noted continued advancements in artificial blood cell technologies, including hybrid oxygen carriers, nano-encapsulated hemoglobin formulations with improved stability, and portable battlefield blood solutions in preclinical evaluation stages

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.