Asia-Pacific Antibody Drug Conjugates (ADC) Market Segmentation, By Product (Enhertu, Kadcyla, Trodelvy, Polivy, Adcetris, Padcev, Besponsa, Elahere, Zylonta, Mylotarg, Tivdak, and Others), Antigen Component (HER2 Receptor, Trop-2, CD79B, CD30, Nectin 4, CD22, CD19, CD33, Tissue Factors, and Others), Antibody Component (Third Generation ADCs, Second Generation ADCs, Fourth Generation ADCs, and First Generation ADCs), Linkers Component (Cleavable Linkers and Non Cleavable Linkers), Cytotoxic Payloads or Warheads Component (DNA Damaging Agents and Microtubule Disrupting Agents), Linker Technology (Peptide Linkers, Thioether Linkers, Hydrazone Linkers, and Disulfide Linkers), Conjugation Technology (Site-Specific Conjugation and Chemical Conjugation), Indication (Breast Cancer, Blood Cancer (Leukemia, Lymphoma), Lung Cancer, Gynecological Cancer, Gastrointestinal Cancer, Genitourinary Cancer, and Others), End User (Hospitals, Specialty Center, Clinics, Ambulatory Centers, Home Healthcare, and Others), Distribution Channel (Direct Tenders, Retail Sales, and Others) - Industry Trends and Forecast to 2031

Antibody Drug Conjugates (ADC) Market Analysis

In May 2024, according to the data published by National Cancer Institute, in 2024, the U.S. is projected to see 2 million new cancer cases and 611,720 deaths. Leading cancers include breast, prostate, lung, colorectal, and melanoma. Prostate, lung, and colorectal cancers will comprise 48% of male cases, while breast, lung, and colorectal will make up 51% for women. The annual incidence rate is 440.5 per 100,000 people, with a mortality rate of 146.0 per 100,000. Among children and adolescents (0-19), 14,910 are expected to be diagnosed, with 1,590 deaths. The rising number of FDA approvals for ADCs and growing clinical trials highlight the market's potential. However, challenges such as high manufacturing costs and complex production processes may impact growth. Overall, the North American ADC market is poised for substantial development, supported by technological advancements and increasing adoption in oncology treatments.

Antibody Drug Conjugates (ADC) Market Size

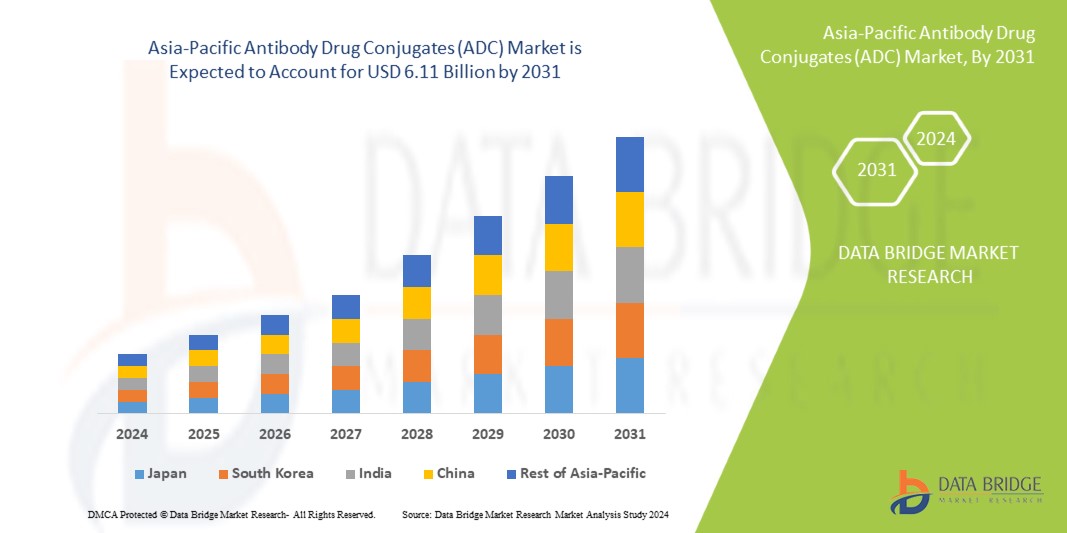

Asia-Pacific Antibody Drug Conjugates (ADC) market size was valued at USD 1.77 billion in 2023 and is projected to reach USD 6.11 billion by 2031, with a CAGR of 16.7% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Antibody Drug Conjugates (ADC) Market Trends

“Advances in Antibody-Drug Conjugate (ADC) Technology”

Advances in antibody-drug conjugate (ADC) technology are driving growth in the Asia-Pacific ADC market by enhancing both treatment effectiveness and safety in cancer care. Key innovations trends include improved linkers for stable, precise drug delivery that targets cancer cells while sparing healthy tissue. Next-generation ADCs with optimized payloads and biomarker-driven patient selection ensure that therapies reach those who will benefit most, minimizing side effects. In addition, improved manufacturing processes are lowering production costs, increasing access, and encouraging greater investment in ADC development, all contributing to a robust pipeline and expanding market interest.

Report Scope and Antibody Drug Conjugates (ADC) Market Segmentation

|

Attributes

|

Antibody Drug Conjugates (ADC) Key Market Insights

|

|

Segments Covered

|

|

|

Countries Covered

|

Japan, China, India, Australia, Singapore, and Rest of Asia-Pacific

|

|

Key Market Players

|

DAIICHI SANKYO COMPANY, LIMITED (Japan), F. Hoffmann-La Roche Ltd (Switzerland), Gilead Sciences, Inc. (U.S.), Astellas Pharma Inc. (Japan), Takeda (Japan), Pfizer Inc. (U.S.), Abbvie (U.S.), ADC Therapeutics (Switzerland), Amgen, Inc. (California), AstraZeneca (England), Bayer (Germany), Byondis (Netherlands), EISAI INC (Japan), GSK plc (UK), Johnson & Johnson Services, Inc. (U.S.), Oxford BioTherapeutics (England), Remegen (China), Sanofi (France), and Sutra Biopharma, Inc. (U.S.)

|

|

Market Opportunities

|

|

|

Value Added Data Infosets

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

Antibody Drug Conjugates (ADC) Market Definition

Antibody-Drug Conjugates (ADCs) are targeted cancer therapies that combine an antibody with a potent anti-cancer drug. The antibody specifically binds to cancer cell markers, delivering the drug directly to cancer cells while minimizing impact on healthy cells. This precision reduces side effects and increases the drug’s effectiveness in treating cancer.

Antibody Drug Conjugates (ADC) Market Dynamics

Drivers

- Increasing Prevalence of Cancer

The rising prevalence of cancer significantly drives the North America Antibody-Drug Conjugates (ADC) market, increasing demand for targeted, effective treatments. ADCs offer precise cancer cell targeting with reduced harm to healthy tissues by combining monoclonal antibodies with potent cytotoxic drugs. As cancer rates climb, pharmaceutical companies are investing heavily in ADC technology to meet the need for more personalized treatments, especially for challenging cancer types. This growth in the cancer patient population accelerates ADC clinical trials, regulatory approvals, and commercial launches, further advancing the ADC market.

For instance,

In February 2024, according to an article published by WHO, in 2022, there were an estimated 20 million new cancer cases and 9.7 million deaths, with 53.5 million people alive within five years of diagnosis. Lung cancer was the most common (2.5 million cases, 12.4%), followed by breast (2.3 million, 11.6%), colorectal (1.9 million, 9.6%), prostate (1.5 million, 7.3%), and stomach cancers (970,000, 4.9%). One in five people will develop cancer, with predictions of over 35 million new cases by 2050—a 77% increase. This rising incidence drives market growth for targeted cancer therapies.

The rising prevalence of cancer significantly boosts the North America ADC market by increasing the demand for targeted, effective therapies. ADCs, with their ability to deliver potent treatments directly to cancer cells while sparing healthy tissue, have gained attention as a promising solution. This growing cancer burden drives research, development, and investment in ADC technology, pushing forward new advancements and expanding the market

- Advances in Antibody-Drug Conjugate (ADC) Technology

Advances in antibody-drug conjugate (ADC) technology are driving growth in the global ADC market by enhancing both treatment effectiveness and safety in cancer care. Key innovations include improved linkers for stable, precise drug delivery that targets cancer cells while sparing healthy tissue. Next-generation ADCs with optimized payloads and biomarker-driven patient selection ensure that therapies reach those who will benefit most, minimizing side effects. Additionally, improved manufacturing processes are lowering production costs, increasing access, and encouraging greater investment in ADC development, all contributing to a robust pipeline and expanding market interest.

For instance,

In October 2023, according to the article published in Acta Pharmaceutica Sinica B, recent progress in ADC research focuses on developing safer, more potent payloads. Key advancements include stronger cytotoxic drugs, stable linkers for precise delivery, and novel payloads like DNA-damaging and immune-modulating agents. These innovations expand the therapeutic window, reducing off-target toxicity and improving effectiveness against resistant tumors, shaping next-gen ADCs.

Innovations such as enhanced linker systems and effective drug payloads improve the precision and safety of cancer treatments. Biomarker-guided strategies enhance patient targeting for optimal efficacy. Improved manufacturing techniques have made ADCs more accessible and cost-effective, attracting investment and expanding therapy options. Overall, these advancements boost ADC effectiveness and stimulate market growth and interest from the pharmaceutical industry

Opportunities

Growing Oncology Pipeline for Antibody Drug Conjugates (ADCS)

The oncology pipeline for Antibody Drug Conjugates (ADCs) is rapidly expanding, offering significant market potential. Numerous ADC candidates are in various stages of development, driven by advancements in tumor biology and the need for targeted therapies.

Pharmaceutical and biotech companies are heavily investing in new ADCs to enhance efficacy and safety for a range of cancers, including solid tumors and hematological malignancies. Innovations in linker technology, payloads, and antibody engineering are resulting in more effective and less toxic ADCs, broadening treatment options and attracting investor interest.

For instance,

In August 2024, according to the article published by Johnson & Johnson Innovation LLC, Johnson & Johnson's growing pipeline of antibody-drug conjugate (ADC) therapeutics and active collaborations demonstrate a strong commitment to the ADC sector. Their emphasis on innovative, safe, and effective cancer treatments showcases the transformative potential of ADCs. These initiatives foster industry partnerships, enhancing development and accessibility, and creating substantial growth opportunities in the North America ADC market.

- Increasing Investment in Cancer Research

Increasing investment in cancer research presents a significant opportunity for the growth of the global antibody-drug conjugate (ADC) market. As governments, private organizations, and philanthropic entities prioritize effective cancer treatments, this funding becomes essential for advancing innovative ADC therapies.

These investments allow researchers to deepen their understanding of tumor biology and the mechanisms of drug action, which is critical for developing more targeted and effective ADCs. Additionally, enhanced funding facilitates larger and more diverse clinical trials, improving insights into patient responses and accelerating the evaluation and approval processes for promising ADC candidates.

For Instance,

In October 2024, according to the article published in UKRI, Innovate UK and OLS are investing USD 5.19 million in six projects under the advancing precision medicines competition, part of the Life Sciences Vision Cancer Mission. This significant funding underscores the growing commitment to cancer research and development. Such investments pave the way for innovative therapies, including antibody-drug conjugates (ADCs), creating a valuable opportunity for growth in the global ADC market.

Restraints/Challenges

- High Development Cost & Manufacturing Complexities

The extensive investment needed for research—including innovative linker design, selecting cytotoxic agents, and optimizing conjugation techniques—substantially increases costs. The intricate manufacturing process requires precise drug-antibody attachment and rigorous quality control, further driving up expenses. In addition, specialized facilities and equipment needed for safe and efficient production add financial burdens, making it difficult for smaller biotech firms to pursue ADC development and limiting larger companies to a few projects at a time. As a result, while ADCs offer promising targeted cancer therapies, these issues restrict market growth and the introduction of new treatments.

For instance,

In July 2024, according to the article published by Journal of Antibody Drug Conjugates, Bristol Myers Squibb (BMS) made an upfront payment of USD 800 million to license Systimmune's EGFR x HER3 bispecific ADC, BL-B01D1 (Zalontamab brengitecan), currently in Phase 1 in the US and Phase 3 in China. While BL-B01D1 shows promising safety and efficacy in heavily pretreated metastatic solid tumors, the high investment costs are a concern. In addition, developing bispecific ADCs presents challenges, such as selecting the appropriate antibody format, which often requires creating two stable cell lines. This complexity increases manufacturing costs and complicates assay development

High development costs and manufacturing complexities significantly hinder the growth of the North America antibody-drug conjugates (ADC) market. The substantial financial investment required for research and the intricate manufacturing processes contribute to elevated production expenses. This complexity not only necessitates rigorous quality control measures but also demands specialized facilities and equipment, further straining resources. As a result, smaller biotech companies may be discouraged from entering the market, while even larger firms may limit their ADC initiatives.

- Safety and Toxicity Issues of Antibody Drug Conjugates

Safety and toxicity concerns are major restraints on the growth of the global Antibody Drug Conjugates (ADC) market. Despite their design to target cancer cells, ADCs can adversely affect healthy tissues due to their potent cytotoxic payloads, leading to systemic toxicity and side effects such as neutropenia and organ-specific toxicities. Additionally, unpredictable immune responses may cause allergic reactions or immunogenicity, limiting their use in certain patient populations. The risk of off-target effects, where ADCs impact non-cancerous cells with similar antigens, further complicates treatment.

For instance,

In June 2021, according to the news release published by Elsevier, off-target toxicities are a major cause of dose-limiting side effects in antibody-drug conjugates (ADCs), primarily due to linker-drug instability and premature payload release. This narrow therapeutic index necessitates thorough safety assessments during preclinical and clinical stages. Improving testing methods and understanding safety profiles are crucial for optimizing ADCs' therapeutic potential.

Safety and toxicity concerns present major challenges for the global ADC market, as potent cytotoxic agents can lead to severe side effects, including blood disorders and organ-specific toxicities. The risk of immune reactions and off-target effects complicates their safe use, necessitating rigorous clinical testing and regulatory oversight.

Antibody Drug Conjugates (ADC) Market Scope

The market is segmented on the basis of product, antigen component, antibody component, linkers component, cytotoxic payloads or warheads component, linker technology, conjugation technology, indication, end user, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Enhertu

- Kadcyla

- Podelvy

- Adcetris

- Padcev

- Besponsa

- Elahere

- Zylonta

- Mylotarg

- Tivdak

- Others

Antigen Component

- HER2 Receptor

- Trop-2

- Cd79b

- Cd30

- Nectin 4

- Cd22

- Cd19

- Cd33

- Tissue Factors

- Others

Antibody Component

- Third Generation ADCs

- Second Generation ADCs

- Fourth Generation ADCs

- First Generation ADCs

Linkers Component

- Cleavable Linkers

- Peptide Based

- Acid Sensitive or Acid Labile

- Glutathione Sensitive Disulfide

- Non Cleavable Linkers

Cytotoxic Payloads or Warheads Component

- DNA Damaging Agents

- Camptothecin

- Calicheamicin

- Pyrrolobenzodiazepines

- Microtubule Disrupting Agents

- Auristatin

- Maytansinoids

Linker Technology

- Peptide Linkers

- Thioether Linkers

- Hydrazone Linkers

- Disulfide Linkers

Conjugation Technology

- Site-Specific Conjugation

- Chemical Conjugation

Indication

- Breast Cancer

- Blood Cancer (Leukemia, Lymphoma)

- Lung Cancer

- Gynecological Cancer

- Gastrointestinal Cancer

- Genitourinary Cancer

- Others

End User

- Hospitals

- Specialty center

- Clinics

- Ambulatory centers

- Home healthcare

- Others

Distribution Channel

- Direct tenders

- Retail sales

- Hospital pharmacy

- Retail pharmacy

- Online pharmacy

- Others

Antibody Drug Conjugates (ADC) Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, product, antigen component, antibody component, linkers component, cytotoxic payloads or warheads component, linker technology, conjugation technology, indication, end user, and distribution channel as referenced above.

The countries covered in the market are Japan, China, India, Australia, Singapore, and Rest of Asia-Pacific.

Japan is expected to dominate the market due to its advanced healthcare infrastructure, high demand for innovative medical devices, and a strong focus on quality and patient care.

Japan is expected to be the fastest growing due to increasing adoption of advanced healthcare technologies, rising chronic disease prevalence, and a growing emphasis on cost-effective long-term vascular access solutions.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Antibody Drug Conjugates (ADC) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Antibody Drug Conjugates (ADC) Market Leaders Operating in the Market Are:

- Daiichi Sankyo Company, Limited (Japan)

- F. Hoffmann-La Roche Ltd (Genentech) (Switzerland)

- Gilead Sciences, Inc. (U.S.)

- Astellas Pharma Inc. (Japan)

- Takeda (Japan)

- Pfizer Inc. (U.S.)

- Abbvie (U.S.)

- ADC Therapeutics (Switzerland)

- Amgen, Inc. (U.S.)

- AstraZeneca (U.K.)

- Bayer (Germany)

- Byondis (Netherlands)

- EISAI INC (Japan)

- GSK plc (U.K.)

- Johnson & Johnson Services, Inc. (U.S.)

- Oxford Big Therapeutics (U.K.)

- Remegen (China)

- Sanofi (France)

- Sutra Biopharma (U.S.)

Latest Developments in Antibody Drug Conjugates (ADC) Market

- In October 2024, Daiichi Sankyo and AstraZeneca's ENHERTU has received conditional approval in China as the first HER2-directed therapy for adult patients with HER2 mutant metastatic non-small cell lung cancer (NSCLC). This approval, based on positive results from the DESTINY-Lung02 and DESTINY-Lung05 studies, highlights ENHERTU's efficacy in previously treated patients. This marks the fourth indication for ENHERTU in China across various tumor types, enhancing the companies' oncology portfolio and addressing a significant unmet need in lung cancer treatment

- In August 2024, Bayer and NextRNA Therapeutics have announced a collaboration and license agreement to develop small molecule therapeutics targeting long non-coding RNAs (lncRNAs) in oncology, offering a novel approach to disrupt lncRNA-RBP interactions in disease treatment

- In March 2023, Roche announced its collaboration with Eli Lilly to develop the Elecsys Amyloid Plasma Panel. This innovative blood test aimed to facilitate earlier Alzheimer’s diagnosis, addressing significant barriers and improving access to timely treatments for patients

- In January 2022, Roche launched the cobas pulse system, an innovative handheld blood glucose management device. It combined advanced digital capabilities with user-friendly design, simplifying workflows for healthcare professionals and enhancing patient care in various settings

- In June 2024, Takeda has expanded its partnership with Partners In Health (PIH) to improve health equity in Massachusetts. This initiative will establish Health Equity Communities of Practice, empower local health departments, and create more opportunities for community health workers

SKU-