Asia-Pacific Anti-Nuclear Antibody Test Market Segmentation, By Antibody Type (Extractable Nuclear Antigens (ENA), Anti-DSDNA & Histones, Anti-DFS70 Antibodies, Anti-PM-SCL, Anti-Centromere Antibodies, Anti-SP100, and Others), Product (Instruments, Consumables and Reagents, and Services), Technique (ELISA, Indirect ImmunoFluorescence (IIF), Blotting Test, Antigen Microarray, Gel Based Techniques, Multiplex Assay, Flow Cytometry, Passive Haemagglutination (PHA), and Others), Application (Autoimmune Diseases and Infectious Diseases), By End User (Hospitals, Laboratories, Diagnostic Centers, Research Institutes and Others), Distribution Channel (Direct Tender, Retail Sales, and Third Party Distributor and Others) – Industry Trends and Forecast to 2031

Anti-Nuclear Antibody Test Market Analysis

The Asia-Pacific anti-nuclear antibody test market is experiencing steady growth, driven by the rising prevalence of autoimmune disorders like systemic lupus erythematosus, rheumatoid arthritis, and Sjogren’s syndrome, which necessitate accurate and timely diagnosis. ANA tests, which detect the presence of autoantibodies targeting the nuclei of cells, are critical for diagnosing and monitoring autoimmune conditions. The market encompasses various testing technologies, including enzyme-linked immunosorbent assays (ELISA), indirect immunofluorescence assays (IFA), and multiplex assays, all aimed at enhancing the sensitivity and specificity of the diagnostic process. Technological advancements in automation and the development of more efficient and faster diagnostic platforms are key trends shaping the market, alongside the rising awareness of autoimmune diseases and the importance of early diagnosis.

Anti-Nuclear Antibody Test Market Size

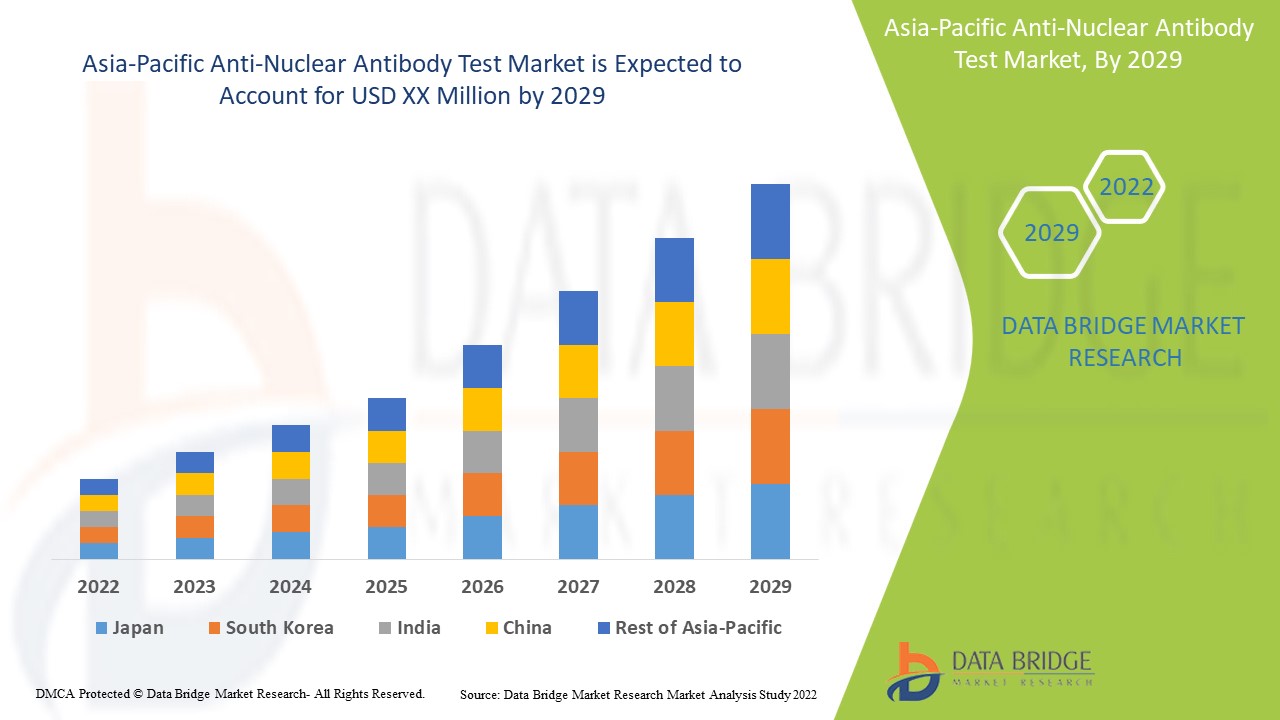

Asia-Pacific anti-nuclear antibody test market size was valued at USD 488.44 million in 2023 and is projected to reach USD 1,433.16 million by 2031, growing with a CAGR of 14.4% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production Asia-Pacific overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Anti-Nuclear Antibody Test Market Trends

“Growing Research Efforts Focused On Autoimmune Diseases”

Growing research efforts focused on autoimmune diseases are significantly driving the Asia-Pacific anti-nuclear antibody test market. Increased funding and resources are being dedicated to exploring the complex mechanisms behind these disorders, including genetic, environmental, and immunological factors. This intensified focus is leading to the identification of new biomarkers and potential therapeutic targets, which enhance the development of more accurate diagnostic tools. As researchers uncover novel insights, they contribute to improved methodologies for ANA testing, enabling earlier diagnosis and better patient management. Additionally, as awareness of these conditions continues to grow, the emphasis on research not only enriches scientific knowledge but also supports the advancement of diagnostic capabilities in the field of autoimmune medicine. This ongoing commitment to understanding autoimmune diseases directly correlates with an increased demand for ANA tests in clinical practice.

Growing research initiatives focused on autoimmune diseases are significantly influencing the Asia-Pacific anti-nuclear antibody test market. Enhanced funding and resources are being allocated to investigate the intricate mechanisms underlying these conditions, including genetic, environmental, and immunological aspects. This intensified research effort is leading to the discovery of new biomarkers and potential treatment targets, facilitating the development of more precise diagnostic tools. As new insights emerge, they improve ANA testing methodologies, allowing for earlier detection and better patient care. With increasing awareness of autoimmune disorders, this research focus not only deepens scientific understanding but also drives greater demand for ANA testing in clinical settings.

Report Scope and Anti-Nuclear Antibody Test Market Segmentation

|

Attributes

|

Anti-Nuclear Antibody Test Key Market Insights

|

|

Segments Covered

|

|

|

Countries Covered

|

China, India, Japan, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, and rest of Asia-Pacific

|

|

Key Market Players

|

Thermo Fisher Scientific Inc. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Abbott Laboratories. (U.S.), Euroimmun Medizinische Labordiagnostika AG (Germany), Revvity Inc. (U.S.), Trinity Biotech (Ireland), LIFESPAN BIOSCIENCES, INC (U.S.), ORIGENE TECHNOLOGIES, INC. U.S.), Abnova Corporation (Taiwan), CUSABIO TECHNOLOGY LLC (U.S.), Biorbyt Ltd. (England)

|

|

Market Opportunities

|

|

|

Value Added Data Infosets

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production Asia-Pacific overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

Anti-Nuclear Antibody Test Market Definition

The Asia-Pacific anti-nuclear antibody test market refers to the market for diagnostic tests used to detect the presence of anti-nuclear antibodies in the blood, which are commonly associated with autoimmune disorders such as systemic lupus erythematosus, rheumatoid arthritis, and Sjogren’s syndrome. These tests play a crucial role in diagnosing, monitoring, and managing autoimmune diseases by identifying autoantibodies that target the body's own cell nuclei. The market encompasses a range of diagnostic technologies, including immunoassays, enzyme-linked immunosorbent assays (ELISA), and indirect immunofluorescence assays (IFA), used in clinical laboratories and hospitals. The demand for ANA tests is driven by the rising prevalence of autoimmune diseases, increasing awareness of early diagnosis, advancements in diagnostic technologies, and supportive healthcare policies worldwide. The market includes a variety of stakeholders, such as diagnostic test manufacturers, healthcare providers, and research institutions, with continuous innovation and development aiming to improve test accuracy, speed, and accessibility for patients across different regions.

Anti-Nuclear Antibody Test Market Dynamics

Drivers

- Increasing Prevalence of Autoimmune Diseases Across The Globe

The rising prevalence of autoimmune diseases is a critical driver for the Asia-Pacific anti-nuclear antibody (ANA) Test Market. Autoimmune disorders such as lupus, rheumatoid arthritis, and multiple sclerosis are becoming increasingly common due to a combination of genetic, environmental, and lifestyle factors. This surge in prevalence is prompting healthcare providers to prioritize early and accurate diagnosis to improve patient outcomes. As awareness of these diseases grows, both patients and healthcare professionals are more likely to recognize symptoms and seek diagnostic testing. The ANA test serves as a fundamental tool in identifying these conditions, facilitating timely intervention and treatment. The importance of early detection is underscored by studies linking prompt diagnosis to better disease management and improved quality of life for patients. Additionally, the increasing prevalence of autoimmune diseases has led to a greater focus on research and development in this field, with pharmaceutical companies and research institutions investing heavily in discovering new diagnostic methods and treatments. Consequently, the market for ANA tests is expected to expand significantly to meet the rising demand from both clinical and research settings. Furthermore, the growing prevalence of autoimmune diseases is influencing healthcare policies and insurance coverage, making diagnostic testing more accessible to a larger population, which encourages more individuals to undergo testing and drives market growth.

For instance,

- In March 2024, according to the article published by National Health Council, the worrisome increase in autoimmunity, with studies suggesting an annual increase of 3-12%, is reaching epidemic proportions. This trend underscores the urgent need for effective diagnostic solutions, such as the Asia-Pacific Anti-Nuclear Antibody Test. As the prevalence of autoimmune diseases escalates, it acts as a significant driver for the expansion of this market

- In June 2023, according to the article published by NCBI, Autoimmune diseases affect approximately one in ten individuals, and their burden continues to increase over time at varying rates across different conditions. This rising prevalence underscores the urgent need for effective diagnostic tools, such as the Anti-Nuclear Antibody (ANA) test, which acts as a significant driver for the market

- In February 2023, according to the article published by Science Direct, the rising prevalence of autoimmune diseases worldwide, driven by shifting environmental exposures, is significantly impacting healthcare. This increase highlights the growing need for effective diagnostic tools, such as the Asia-Pacific Anti-Nuclear Antibody Test. Consequently, the surge in autoimmune conditions serves as a key driver for the expansion of the market for these diagnostic tests

The rising prevalence of autoimmune diseases significantly drives the Asia-Pacific Anti-Nuclear Antibody (ANA) Test Market. Conditions like lupus and rheumatoid arthritis are increasingly common due to genetic and environmental factors. This trend prompts healthcare providers to emphasize early and accurate diagnoses. Growing awareness among patients and professionals leads to higher demand for ANA testing, which is crucial for timely intervention. Moreover, increased investment in research and development enhances diagnostic methods, while evolving healthcare policies improve access to testing, encouraging more individuals to seek diagnoses and further boosting market growth.

- Expansion of Diagnostic Centers and Laboratories

The expansion of diagnostic centers and laboratories worldwide is significantly driving the growth of the Asia-Pacific anti-nuclear antibody test market. As healthcare systems evolve and the demand for accurate and timely diagnostics increases, more facilities are being established to cater to this need. These centers play a critical role in enhancing access to diagnostic testing, making it easier for patients to obtain necessary evaluations for autoimmune disorders. With advancements in technology and improved laboratory capabilities, these facilities can now offer a broader range of tests, including anti-nuclear antibody tests, which are vital for the diagnosis of various autoimmune conditions. Additionally, the proliferation of specialized laboratories allows for faster turnaround times and more precise results, thereby boosting clinician confidence in diagnosis and treatment planning. This trend is further supported by an increasing focus on early detection and preventive healthcare, which emphasizes the importance of comprehensive testing. As more diagnostic centers and laboratories emerge, they contribute significantly to the overall growth of the anti-nuclear antibody test market.

For instance,

- In October 2024, according to the article published on Business Standard Private Ltd., Reliance Retail Ventures is set to expand its business in the USD 150 billion diagnostic healthcare sector, increasing access to essential testing services. This growth in diagnostic facilities acts as a significant driver for the ANA test market, enabling timely diagnoses and improved patient care

- In April 2024, according to the article published by Living Media India Limited., Apollo Health & Lifestyle, a subsidiary of Apollo Hospitals Enterprise Limited, aims to broaden its presence in India while maintaining its leadership in diagnostic and preventive care. This growth in diagnostic facilities will significantly enhance access to ANA testing, driving market expansion

- In June 2022, according to the article published on The Times of India, Suraksha Diagnostics Pvt. Ltd (SDPL) a diagnostic chain plans to invest USD 140.8 Million to establish more units across India by 2025, enhancing accessibility to essential testing services. This increased availability of ANA testing facilities is a crucial driver for market growth, facilitating early diagnosis and treatment

The rapid expansion of diagnostic centers and laboratories around the globe is a key factor propelling the growth of the Asia-Pacific anti-nuclear antibody test market. As healthcare systems advance, there is a greater demand for accurate and accessible diagnostic services, leading to the establishment of more facilities. These centers enhance patient access to essential testing for autoimmune disorders, ensuring timely evaluations. With improved technology and capabilities, they can now provide a wider array of tests, including anti-nuclear antibody tests, crucial for diagnosing various autoimmune conditions. The growth of specialized laboratories also results in quicker turnaround times and more reliable outcomes, increasing clinician trust in their diagnostic processes. Additionally, the emphasis on early detection and preventive care further fuels the need for comprehensive testing. This ongoing expansion of diagnostic centers and laboratories significantly supports the rise of the anti-nuclear antibody test market.

Opportunities

- Integration of Digital Health Solutions

The integration of digital health solutions offers a number of opportunities for the Asia-Pacific Anti-Nuclear Antibody (ANA) Test Market, in turn, transforming access and utilization of testing. One of the most significant benefits is the enhancement of patient access to diagnostic services. Telemedicine platforms have become increasingly popular, allowing patients to consult healthcare professionals remotely and receive recommendations for ANA testing without the barriers of geographical distance or the need for in-person visits. This convenience can lead to higher testing rates, as patients are more likely to seek testing when it is easily accessible.

For instance,

- In June 2020, according to a news article published by the American College of Rheumatology, telemedicine is a tool with the potential to increase access and improve care for patients with rheumatic diseases. These enable to communicate more quickly with their healthcare providers regarding medication adjustments, side effects, or new symptoms, potentially leading to timely interventions

In addition to improved access, digital health solutions enable more effective patient engagement and education. Online platforms and mobile applications provide valuable information about autoimmune diseases, symptoms, and the importance of ANA testing. This increased awareness encourages individuals to actively participate in their health management and also empowers healthcare providers to engage proactively with patients about the necessity of testing.

Data management and analytics represent another area where digital health technologies can bolster the ANA Test Market. The integration with electronic health records (EHRs) allows for seamless tracking of test results and patient histories, facilitating better monitoring of autoimmune diseases over time. This comprehensive data capture aids healthcare providers in identifying trends, recognizing patterns, and personalizing treatment plans effectively. Furthermore, the ability to analyze large volumes of anonymized data can support research efforts in understanding autoimmune conditions better and enhancing diagnostic methodologies.

For Instance,

- In April 2023, according to an article published in the Nature Communications, a machine learning model was identified to help the patients in need of autoimmune disease testing using electronic health records that may systematize and accelerate autoimmune testing. It helped to identify more individuals for autoantibody testing compared with current clinical standards

Real-time PCR allows rapid and precise amplification of nucleic acids, enabling healthcare providers to detect specific antibodies related to autoimmune disorders with greater sensitivity and specificity compared to traditional testing methods. This advanced technology facilitates quicker diagnosis, which is critical in managing conditions characterized by ANA positivity, ultimately leading to timely treatment interventions.

For Instance,

- In September 2023, NeoDx Biotech Labs launched real-time PCR-technology-based in vitro diagnostic (IVD) kit for detecting autoimmune disorders. This was performed in the aim to improve their testing capabilities and strengthening the throughput and automation capabilities

Moreover, the advent of wearable health devices has the potential to monitor own health of patients in relation to autoimmune disorders. By capturing real-time health data—such as biometrics, activity levels, and symptoms—these devices can alert both patients and healthcare providers to potential issues that may warrant ANA testing.

- Improvement in Healthcare Infrastructure

Improvements in healthcare infrastructure present a significant opportunity for the Asia-Pacific Anti-Nuclear Antibody (ANA) test market by facilitating access to advanced diagnostic services. Enhanced healthcare facilities, including modern laboratories and well-equipped hospitals, enable the implementation of more sophisticated testing methodologies and technologies for ANA testing. As healthcare systems upgrade their capabilities, they become better positioned to offer an array of diagnostic tests, including those for autoimmune disorders, thereby increasing the demand for ANAs. Improved infrastructure can support larger patient volumes, ultimately leading to greater throughput and efficiency in laboratory settings.

For instance,

- In July 2024, according to an article published in American Medical Association, health spending in the U.S. increased by 4.1% in 2022 to USD 4.5 trillion or USD 13,493 per capita. These spending included categories such as hospital care, physician services, clinical services, prescription drugs, nursing care facilities, home health care and diagnostics. This helped the government to implement more advanced and modern facilities, more sophisticated testing measures in healthcare

Moreover, as healthcare infrastructure advances, there is a stronger focus on integrating diagnostic testing into primary care settings. This integration allows for earlier detection and diagnosis of autoimmune diseases, which are often characterized by prolonged symptoms that can be misattributed to other conditions. With improved infrastructure, primary care physicians can more routinely order ANA tests as part of comprehensive health evaluations. This proactive approach to diagnostics not only enhances patient outcomes through timely treatment but also helps raise awareness of autoimmune conditions within the population, expanding the overall market for ANA testing.

Additionally, the investment in digital health systems, such as electronic health records (EHR) and laboratory information management systems (LIMS), complements the improvements in healthcare infrastructure. These systems enhance data management, allowing for seamless tracking of ANA test results, analysis of patient histories, and more coordinated care among healthcare providers. Enhanced data access leads to more informed clinical decision-making and fosters stronger patient engagement, as individuals become more aware of their test results and treatment options. This dynamic promotes a culture of preventive care, further expanding the relevance and demand for ANA testing in the market.

For instance,

- In August 2021, according to an article ‘Digital health, big data and smart technologies for the care of patients with systemic autoimmune diseases: Where do we stand?’, digital health technologies, including telemedicine and big data analysis, offer enormous potential for improving the care of autoimmune diseases. Moreover, smart technologies are used to provide remote expertise, real-world evidence, real-life drug utilization and advanced efficacy and safety data for rare diseases

Finally, as healthcare infrastructure improves, there is also a growing emphasis on research and development in the field of autoimmune diseases. Enhanced facilities often attract investment for clinical studies and trials that can lead to the identification of new biomarkers and refined diagnostic criteria for ANA testing. This increased focus on research can result in the development of novel testing methodologies, expanding the overall capabilities of the ANA test market and encouraging innovation in diagnostic approaches. As the awareness and understanding of autoimmune diseases continue to grow within the healthcare community, fueled by a robust infrastructure, the demand for accurate and efficient ANA testing is likely to rise, creating substantial opportunities for market growth.

Restraints/Challenges

- Lack of Standardization for Testing Protocols

The lack of standardization for testing protocols in the Asia-Pacific Anti-Nuclear Antibody (ANA) Test Market acts as a significant restraint because it leads to inconsistencies in how the tests are conducted and interpreted across different laboratories and regions. Varying methodologies, reagents, and result interpretation guidelines create discrepancies in the sensitivity and specificity of ANA tests, making it difficult for healthcare providers to rely on consistent outcomes. This inconsistency expected to undermine the clinical utility of ANA tests, as physicians may struggle to make accurate diagnoses based on conflicting or unclear results. Moreover, without standardized testing protocols, it becomes challenging for manufacturers to develop universally accepted test kits, limiting Asia-Pacific adoption. This lack of uniformity also complicates regulatory approval processes, as agencies requires region-specific validation, increasing time and cost for test developers. Ultimately, the absence of standardization reduces trust in the test's reliability and hinders its widespread clinical use, particularly in regions with limited healthcare infrastructure or expertise.

For instance,

- In April 2021, according to the article published by NCBI, this article highlights the lack of standardization in ANA testing protocols as a key issue. It points out that variations in testing methods, including differences in assay types, interpretation of results, and cutoff values, contribute to inconsistent results across laboratories. The absence of uniform guidelines leads to discrepancies in test sensitivity and specificity, which complicates diagnostic accuracy and clinical decision-making. This article also emphasizes the need for standardized procedures to ensure reliable and comparable ANA test results across different settings

- In April 2019, according to the article published by BMJ Journals, there is a significant barrier that remains in clinical practice. One major issue is the variability in screening dilution, where recent SLE criteria recommend 1:80 dilution compared to the commonly used 1:40, affecting test sensitivity. Additionally, factors like conjugate strength, washing steps, and microscope optics further contribute to inconsistencies. Differences in the sensitivity of slides from various manufacturers, influenced by cell preparation methods, also lead to variability. Subjectivity in interpreting results adds to the challenge, highlighting the need for automated interpretation systems to reduce variability and enhance consistency, especially in Asia-Pacific clinical trials. These variations underscore the lack of standardization in ANA testing protocols across different laboratories and manufacturers

The absence of standardized testing protocols in the Asia-Pacific Anti-Nuclear Antibody (ANA) Test Market hampers consistent test results, making it difficult for healthcare professionals to trust and utilize the test reliably. This inconsistency not only complicates diagnoses but also slows down regulatory approvals and Asia-Pacific adoption, limiting the test's overall effectiveness in clinical practice.

- Competition From Alternative Diagnostic Methods

Emerging technologies, particularly molecular diagnostics and biosensors, are transforming the landscape of autoimmune disease diagnostics, posing a significant challenge to the traditional Anti-Nuclear Antibody (ANA) test market. Molecular techniques such as polymerase chain reaction (PCR), next-generation sequencing (NGS), and microarrays offer higher sensitivity, specificity, and faster results. These technologies allow for simultaneous detection of multiple biomarkers, providing deeper insights into autoimmune conditions. Furthermore, artificial intelligence (AI)-driven solutions are enhancing diagnostic precision by predicting disease progression, guiding targeted therapies, and reducing diagnostic errors.

Biosensors have emerged as an innovative tool in the diagnosis of autoimmune diseases, offering real-time, point-of-care testing with improved accuracy and ease of use. These devices integrate biological components, such as antibodies, with electronic systems to detect specific biomarkers linked to autoimmune diseases, including autoantibodies. Recent advances in nanotechnology have led to the development of highly sensitive biosensors that can detect even trace levels of biomarkers, potentially replacing traditional ANA tests. Portable biosensors are being integrated into telemedicine platforms, improving access to diagnostic tools in remote areas.

For instance,

- In February 2024, according to an article published by MDPI, in France traditional methods like ELISA, indirect immunofluorescence (IIF), and Western blotting are widely used for diagnosing autoimmune diseases (ADs), but they are less sensitive, costly, and time-consuming. In response, biosensors have emerged as promising alternatives, offering faster, more accurate, and cost-effective diagnostics with real-time detection. With the rising prevalence of ADs and the need for reliable tools, biosensors provide a competitive edge over complex methods, posing a challenge for the Asia-Pacific Anti-Nuclear Antibody (ANA) Test Market by potentially reducing the reliance on ANA tests and shifting demand toward these advanced, efficient platforms

- In July 2021, according to an article published by NCBI, Molecular diagnosis plays a crucial role in treatment, prognosis, and genetic counseling, with next-generation sequencing (NGS) technologies revolutionizing clinical diagnostics across all age groups. A recent analysis by Boegel et al. highlighted that rheumatoid arthritis, systemic lupus erythematosus, and osteoarthritis are the most studied rheumatic diseases, with whole exome sequencing (WES) and targeted panels accounting for approximately 24% of high-throughput sequencing applications in rheumatology. WES, in particular, demonstrates significant diagnostic potential

This underscores the challenge of "competition from alternative diagnostic techniques," as the growing use of NGS and WES in diagnosing complex autoimmune conditions can divert attention and resources away from traditional ANA testing, hindering its market growth

The growing adoption of molecular diagnostics and advancements in biosensors presents significant challenges to the Asia-Pacific ANA test market by offering faster, more accurate, and patient-friendly solutions aligned with precision healthcare. As personalized medicine gains priority, demand for advanced diagnostic tools providing deeper insights is increasing, reducing reliance on traditional ANA tests. Without innovation or integration with these technologies, the ANA test market risks losing relevance in a competitive landscape dominated by more versatile methods. Consequently, these emerging diagnostics are likely to limit the ANA market’s growth by capturing the same patient base and shifting healthcare preferences.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Anti-Nuclear Antibody Test Market Scope

The market is segmented on the basis of antibody type, product, technique, application, end user, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Antibody Type

- Extractable Nuclear Antigens (ENA)

- Anti-RO/SS-A and Anti-LA/SS-B

- Anti-SCL-70/Anti-Topoisomerase I

- Anti-NRNP/Anti-U1-RNP

- Anti-SM

- Anti-JO-1

- Anti-DSDNA & Histones

- Anti-DFS70 Antibodies

- Anti-PM-SCL

- Anti-Centromere Antibodies

- Anti-SP100

- Others

Product

- Instruments

- Analyzers

- Automatic Analyzers

- Semi-Automatic Analyzers

- Microscopes

- Incubators

- Analyzers

- Consumables and Reagents

- Reagents

- Reactive Reagents

- Positive control

- Negative control

- Color Reagent

- Titrable Control Serum

- Enzyme Antibody Reagent

- Others

- Non-Reactive Reagents

- PBS Buffer Powder

- Semi-Permeating Mounting Medium

- Solutions

- Others

- Reactive Reagents

- Accessories

- Cuvette Cube

- Caps

- Pippettes

- Vials

- Perforated Containers

- Others

- Reagents

- Services

Technique

- ELISA

- Generic Assay Technique

- Antigen Specific Assay Technique

- Indirect ImmunoFluorescence (IIF)

- HEP-2 Substrate

- Crithidia Luciliae Substrate

- Blotting Test

- Dot Blot

- Western Blot

- Antigen Microarray

- Gel Based Techniques

- Counter Current Immunoelectrophoresis (CIE)

- Double Immunodiffusion (DID)

- Multiplex Assay

- Flow Cytometry

- Passive Haemagglutination (PHA)

- Others

Application

- Autoimmune Diseases

- Rheumatoid Arthritis

- Systemic Lupus Erythematosus

- Sjogren Syndrome

- Scleroderma

- Polymyositis

- Thyroiditis

- Mixed Connective Tissue Disease (MCTD)

- Autoimmune Hepatitis

- Lymphomas

- Others

- Infectious Diseases

- Hepatitis C

- HIV

- EB Virus

- Parvovirus

- Others

End User

- Hospitals

- Laboratories

- Diagnostic Centers

- Research Institutes

- Others

Distribution Channel

- Direct Tender

- Retail Sales

- Third Party Distributor

- Others

Anti-Nuclear Antibody Test Market Regional Analysis

The market is segmented on the basis of antibody type, product, technique, application, end user, and distribution channel.

The countries covered in the market are China, India, Japan, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, and rest of Asia-Pacific

China is expected to dominate the market due to the region's advanced healthcare infrastructure, high prevalence of autoimmune diseases, and increasing adoption of early diagnostic tools.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Anti-Nuclear Antibody Test Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production Asia-Pacific, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Anti-Nuclear Antibody Test Market Leaders Operating in the Market Are:

- Thermo Fisher Scientific Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Abbott Laboratories. (U.S.)

- Euroimmun Medizinische Labordiagnostika AG (Germany)

Latest Developments in Anti-Nuclear Antibody Test Market

- In January 2023, Revvity’s EUROIMMUN has launched an automated indirect immunofluorescence test (IIFT) system to enhance diagnostic accuracy and efficiency in detecting autoantibodies. This innovation streamlines laboratory workflows, reduces manual errors, and positions EUROIMMUN to meet growing demand, ultimately driving revenue growth and reinforcing Revvity’s commitment to transformative healthcare solutions

- In January 2023, Quantum-Si announced a collaboration with Aviva Systems Biology to develop protein enrichment kits for enhanced protein sequencing. The kits will include immunoprecipitation tools to streamline workflows and enable in-depth analysis of protein variants, facilitating research into biological processes and diseases

- In November 2022, Bio-Rad has expanded its range of quality controls specifically for Abbott's clinical diagnostics platforms, enhancing laboratory performance and reliability. This initiative not only improves diagnostic accuracy and patient care but also strengthens Bio-Rad's competitive position in the healthcare market. By providing innovative quality control solutions, Bio-Rad aims to meet the growing demands of laboratories, ultimately driving revenue growth and reinforcing its commitment to advancing diagnostic excellence

- In May 2021, EUROIMMUN’s Anti-SARS-CoV-2 S1 Curve ELISA has received FDA Emergency Use Authorization, allowing for rapid and accurate detection of SARS-CoV-2 antibodies. This authorization enhances EUROIMMUN’s market position, expands its customer base, and supports Revvity’s mission to provide cutting-edge diagnostic solutions in response to public health needs

- In January 2021, Abnova announced the launch of its innovative high-throughput antibody production platform, which significantly accelerates the development of monoclonal antibodies. This advancement enhances the company’s capability to deliver customized antibodies more efficiently, positioning Abnova to better meet market demand and strengthen its competitive edge in the biopharmaceutical industry

SKU-