Asia-Pacific and SEA X-ray Inspection System Market, By Component (Product, Software, and Services), Type (Microfocus CT and High Energy CT), Resolution (2D and 3D), Product Type (Benchtop, Portable, and Stationary), Source (Upto 200 KV, 200 KV – 400 KV, and More Than 400 KV), Weight (Less than 500 KG, 500 KG – 1000 KG, 1000 KG - 3000 KG, 3000 KG -5000 KG, More Than 5000 KG), Application (Flaw Detection, Structural, And Assembly Analysis, Failure Analysis, Image-Based Finite Element Analysis, Quality Control, Metrology Dimensioning, and Tolerancing Analysis, Porosity, and Composite Analysis, Reverse Engineering, and Others), End User (Automotive, Aerospace, Electronics, Manufacturing, Oil and Gas, Food, Medical, and Others), Distribution Channel (Direct Channel and Indirect Channel) - Industry Trends and Forecast to 2030.

Asia-Pacific and SEA X-ray Inspection System Market Analysis and Size

An X-ray inspection system is an advanced technology used for non-destructive testing and inspection of objects and materials. It utilizes X-ray radiation to generate detailed images of the internal structures of various objects, enabling the detection of defects, contaminants, or threats without the need for physical contact or disassembly. X-ray inspection systems consist of an X-ray source, a detector, a conveyor system, a control unit, and image processing software. They find applications in manufacturing, quality control, security, and customs and border protection, providing high-resolution imaging and precise analysis for efficient and reliable inspections. The growing emphasis on product quality and safety across industries drives the demand for X-ray inspection systems. These systems enable thorough inspections, helping businesses ensure compliance with quality standards, detect defects, and prevent product recalls, safeguarding their reputation and customer trust.

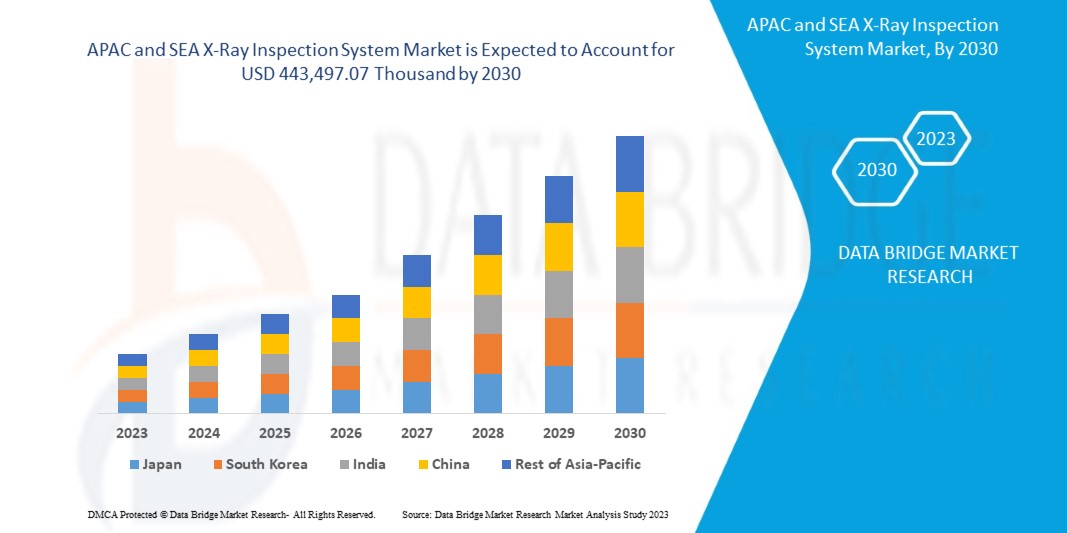

Data Bridge Market Research analyses that the APAC & SEA X-ray inspection system market is expected to reach a value of USD 443,497.07 thousand by 2030, at a CAGR of 8.2% during the forecast period. The APAC & SEA X-ray inspection system market report also comprehensively covers pricing analysis, patent analysis, and technological advancements.

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015 - 2020)

|

|

Quantitative Units

|

Revenue in USD Thousand

|

|

Segments Covered

|

Component (Product, Software, and Services), Type (Microfocus CT and High Energy CT), Resolution (2D and 3D), Product Type (Benchtop, Portable, and Stationary), Source (Upto 200 KV, 200 KV – 400 KV, and More Than 400 KV), Weight (Less than 500 KG, 500 KG – 1000 KG, 1000 KG - 3000 KG, 3000 KG -5000 KG, More Than 5000 KG), Application (Flaw Detection, Stru ctural, And Assembly Analysis, Failure Analysis, Image-Based Finite Element Analysis, Quality Control, Metrology Dimensioning, and Tolerancing Analysis, Porosity, and Composite Analysis, Reverse Engineering, and Others), End User (Automotive, Aerospace, Electronics, Manufacturing, Oil and Gas, Food, Medical, and Others), Distribution Channel (Direct Channel and Indirect Channel)

|

|

Countries Covered

|

China, Japan, South Korea, India, Taiwan, Australia & New Zealand, SEA, Singapore, Thailand, Malaysia, Indonesia, Philippines, Vietnam, Myanmar, Laos, and Rest of SEA

|

|

Market Players Covered

|

Shimadzu Corporation, Nikon Metrology Inc. (A Subsidiary of Nikon Corporation), Thermo Fisher Scientific Inc., ZEISS, TOSHIBA IT & CONTROL SYSTEMS CORPORATION (a subsidiary of TOSHIBA CORPORATION), Dandong Aolong Radiative Instrument Group Co., Ltd, Hitachi, Ltd., OMRON Corporation, Rigaku Corporation, Comet Group, Baker Hughes Company, North Star Imaging Inc., Jinan Horizon Imp.& Exp.Co., Ltd., Royma Tech(Suzhou) Precision Co., Ltd., Werth Inc

|

Market Definition

APAC (Asia-Pacific) and SEA (Southeast Asia) X-ray inspection system market refer to the industry and market landscape related to the production, distribution, and utilization of X-ray inspection systems within the Asia-Pacific and Southeast Asian regions. X-ray inspection systems are advanced technological devices used for non-destructive testing and inspection of various materials and products. These systems employ X-ray technology to generate images or scans that help identify defects, inconsistencies, or contaminants in objects, ensuring quality control and compliance with safety regulations.

The APAC and SEA X-ray inspection systems market encompasses the demand and supply dynamics of X-ray inspection systems across industries such as automotive, electronics, pharmaceuticals, food and beverages, aerospace, and more. The market includes manufacturers, suppliers, distributors, and service providers involved in the design, development, manufacturing, installation, and maintenance of X-ray inspection systems. The market is influenced by various stakeholders, including government bodies, regulatory agencies, research institutions, and industry associations that set standards, provide certifications, and promote technological advancements in X-ray inspection systems. Overall, the market represents the ecosystems of companies, organizations, and industries involved in the development, production, and application of X-ray inspection systems in the Asia-Pacific and Southeast Asian regions.

Asia-Pacific and SEA X-ray Inspection System Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Increased Demand for Non-Destructive Testing

Increased demand for non-destructive testing (NDT) serves as a significant driver for the X-ray inspection system market in the Asia-Pacific (APAC) and Southeast Asia (SEA) regions. The growing emphasis on quality control, safety, and compliance across industries has increased the need for accurate and efficient inspection methods. X-ray inspection systems offer advanced NDT capabilities, enabling thorough inspections without causing damage to the tested objects. This demand for NDT solutions in APAC and SEA presents a favourable market opportunity for X-ray inspection systems, allowing businesses to meet industry standards, enhance product quality, and ensure customer satisfaction.

- Growth in Safety Regulations and Quality Standards

The increasing emphasis on safety regulations and quality standards drives the X-ray inspection system market in the Asia-Pacific (APAC) and Southeast Asia (SEA) regions. Industries across APAC and SEA are experiencing stricter regulatory requirements and a heightened focus on product safety and quality. X-ray inspection systems offer reliable and accurate inspection capabilities, enabling businesses to comply with these regulations, detect defects, and ensure product integrity. The need to meet stringent safety and quality standards is fuelling the demand for X-ray inspection systems in APAC and SEA, presenting a favourable market opportunity for businesses in these regions.

Opportunity

- Rising Adoption in the Food and Beverages Sector

The rising adoption of X-ray inspection systems in the food and beverages sectors is a significant driver for the X-ray inspection system market in the Asia-Pacific (APAC) and Southeast Asia (SEA) regions. The food and beverages industry faces stringent safety and quality regulations, and ensuring product integrity is paramount. X-ray inspection systems effectively detect contaminants, foreign objects, and product defects, enhancing food safety and quality control measures. The increasing awareness of food safety and the need for reliable inspection solutions in the APAC and SEA regions are fuelling the demand for X-ray inspection systems, creating a favourable market opportunity for businesses in this sector.

Restraint/Challenge

- High Cost Associated With the X-Ray Inspection System

The high cost of X-ray inspection systems represents a significant restraint for the market. The initial investment required to purchase and install these systems and the ongoing maintenance and operation costs can be substantial. This poses a challenge for businesses with limited budgets or cost-sensitive industries that may struggle to justify the expense. The high cost is a barrier to entry for some potential buyers and may impact the widespread adoption of X-ray inspection systems in specific sectors.

Recent Development

- In February 2023, Shimadzu launched a range of microfocus X-ray inspection systems for high-resolution inspection of electronic assemblies, components, and PCBs. Their lineup includes the Xslicer SMX-1010/1020, with improved image quality and workflow, and the Xslicer SMX-6010, providing high-accuracy images with a wide dynamic range for detailed observation of internal structures and defects. These systems cater to industries such as electronics, automotive, semiconductors, and aerospace, enabling non-destructive testing and 3D analysis of materials. The launch of these advanced X-ray inspection systems could potentially attract new customers and expand Shimadzu's market reach. With this product, Shimadzu expanded its product portfolio in industries that require precise inspection and quality control, such as manufacturing, electronics, and automotive, which can benefit from the improved capabilities of these systems.

- In January 2021, Yxlon launched Cheetah and Cougar EVO microfocus X-ray families. This event towards automation displayed new options that boosted the efficiency in the X-ray inspection of electronic components were offered. The launch of the new X-ray inspection system helped the company by providing a cutting-edge product that meets the regulatory requirements and industry standards, enhancing the company's reputation and competitiveness in the market. Additionally, the system's advanced features and capabilities improved the efficiency and accuracy of product inspection, leading to increased customer satisfaction and potentially attracting new clients.

Asia-Pacific and SEA X-ray Inspection System Market Scope

The market is segmented on the basis of component, type, source, product type, weight, resolution, application, end user, and distribution channel. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Product

- Software

- Services

On the basis of component, the market is segmented into product, services, and software.

Type

- Microfocus CT

- High Energy CT

On the basis of type, the market is segmented into microfocus CT and high energy CT.

Resolution

- 2D

- 3D

On the basis of resolution, the market is segmented into 2D and 3D.

Product Type

- Benchtop

- Portable

- Stationary

On the basis of product type, the market is segmented into benchtop, portable, and stationary.

Source

- UPTO 200 KV

- 200 KV – 400 KV

- MORE THAN 400 KV

On the basis of source, the market is segmented into up to 200 KV, 200 KV – 400 KV, and more than 400 KV.

Weight

- Less Than 500 Kg

- 500 Kg – 1000 Kg

- 1000 Kg - 3000 Kg

- 3000 Kg -5000 Kg

- More Than 5000 Kg

On the basis of weight, the market is segmented into less than 500 Kg, 500 Kg – 1000 Kg, 1000 Kg - 3000 Kg, 3000 Kg -5000 Kg, and more than 5000 Kg.

Application

- Flaw Detection

- Structural and Assembly Analysis

- Failure Analysis

- Image Based Finite Element Analysis

- Quality Control

- Metrology /Dimensioning and Tolerancing Analysis

- Porosity and Composite Analysis

- Reverse Engineering

- Others

On the basis of application, the market is segmented into flaw detection, structural and assembly, metrology /dimensioning and tolerancing analysis, failure analysis, image based finite element analysis, quality control, porosity and composite analysis, reverse engineering and others.

End User

- Food

- Automotive

- Oil and Gas

- Electronics

- Aerospace

- Manufacturing

- Medical

- Others

On the basis of end user, the market is segmented into food, automotive, oil and gas, electronics, aerospace, manufacturing, medical, and others.

Distribution Channel

- Direct Channel

- Indirect Channel

On the basis of distribution channel, the market is segmented into direct channel and indirect channel.

Asia-Pacific and SEA X-ray Inspection System Market Country Analysis/Insights

The market is analysed, and market size insights and trends are provided by country, component, type, source, product type, weight, resolution, application, end user, and distribution channel.

The countries covered in this market report are China, Japan, South Korea, India, Taiwan, Australia & New Zealand, SEA, Singapore, Thailand, Malaysia, Indonesia, Philippines, Vietnam, Myanmar, Laos, and Rest of SEA. China dominates in the APAC & SEA region due to the high demand for X-ray inspection systems in the region. In addition, China has a large and growing domestic market for X-ray inspection systems, driven by the country's rapid economic growth and increasing demand for quality control in manufacturing.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, and Porter’s five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of APAC & SEA brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific and SEA X-ray Inspection System Market Share Analysis

APAC & SEA X-ray inspection system market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, APAC & SEA presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to APAC & SEA X-ray inspection system Market.

Some of the major players operating in the market are Shimadzu Corporation, Nikon Metrology Inc. (A Subsidiary of Nikon Corporation), Thermo Fisher Scientific Inc., ZEISS, TOSHIBA IT & CONTROL SYSTEMS CORPORATION (a subsidiary of TOSHIBA CORPORATION), Dandong Aolong Radiative Instrument Group Co., Ltd, Hitachi, Ltd., OMRON Corporation, Rigaku Corporation, Comet Group, Baker Hughes Company, North Star Imaging Inc., Jinan Horizon Imp.& Exp.Co., Ltd., Royma Tech(Suzhou) Precision Co., Ltd., Werth Inc.

SKU-