Asia-Pacific Alkyd Resin Market Analysis and Size

Asia-Pacific alkyd resin market is being driven by the growing consumption in the paint and coating industry is an important driver for the Global alkyd resin market. Moreover, High-quality properties and compatibility of alkyd resin with a wide range of polymers is expected to boost the market growth. However, fluctuating prices of raw materials lead to change in the manufacturing cost of alkyd resins is expected to pose a challenge to market growth which may restrain the market growth.

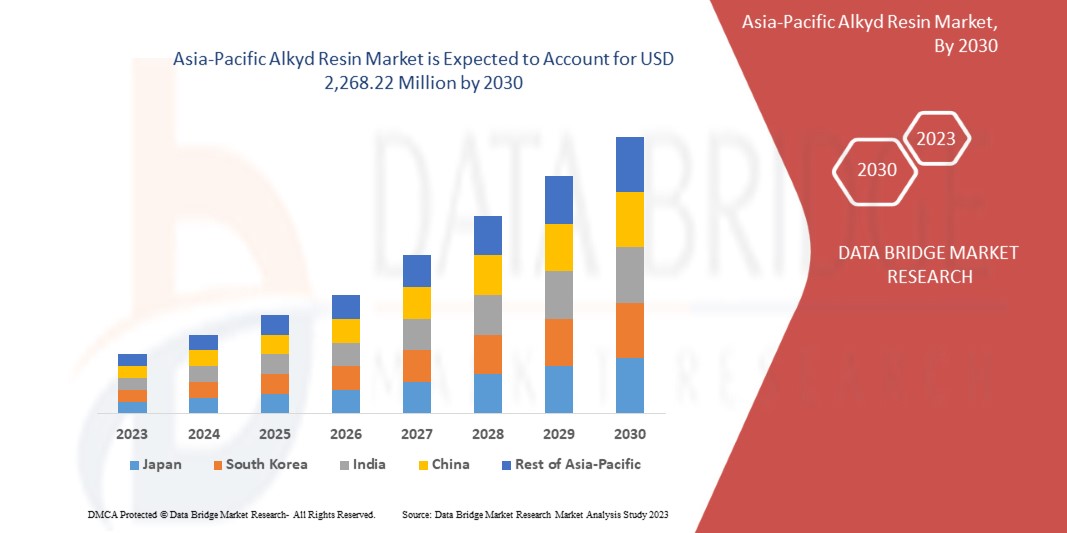

Data Bridge Market Research analyses that the Asia-Pacific alkyd resin market is expected to reach the value of USD 2,268.22 million by 2030, at a CAGR of 4.4% during the forecast period.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

Resin Type (Non-Drying Alkyd Resin, Drying Alkyd Resin, and Semi-Drying Alkyd Resin), Process Type (Fatty Acid Process and Glyceride Process), Class (Long Alkyd Resin, Medium Alkyd Resin, and Short Alkyd Resin), Formulation Type (Modifying Alkyds, Waterborne Alkyds, Solvent Borne Coatings, High-Solids Alkyds, Powder Coatings, and Others), Application (Building & Construction, Automotive OEM Coatings, Electrical Equipment, Furniture & Decor, Metal Coatings, Automotive Refinish Coatings, Coil Coatings, and Packaging), End Use Industry (Construction & Architecture Industry, Automotive Industry, Electronics Industry, Aerospace Industry, Marine Industry, and Others) |

|

Countries Covered |

Asia-Pacific (Japan, China, South Korea, India, Australia, Singapore, Thailand, Taiwan, Hong kong, New Zealand, Malaysia, Indonesia, Philippines, and Rest of Asia Pacific) |

|

Market Players Covered |

OPC polymers, Covestro AG, Uniform Synthetics, Synthopol, Arkema, BASF SE, Allnex GMBH, D.S.V Chemcials Pvt Ltd, Ratnaka Resins Pvt. Ltd., Hempel A/S, Neo-Pack Plast, POLYNT SPA, Krishna Resins & Pigments Pvt. Ltd., Arakawa Chemical Industries, Ltd., MACRO POLYMERS, Nord Composites Italia SRL, Girdhari Chemicals & Resins, Eternal Materials Co., Ltd., US Polymers-Accurez, LLC, Spolek pro chemickou a hutní výrobu, akciová společnost, and Mancuso Chemicals Limited among others |

Market Definition

Alkyd resin is a synthetic resin made by a condensation reaction between a polyhydric alcohol and dibasic acid. Alkyd resins are thermoplastic polyester resins which are polyhydric alcohols heated with polybasic acids or their anhydrides to create alkyd resins. Due to their adaptability and affordability, they are utilized to create weather-resistant protective coatings and are crucial components in many synthetic paints.

Asia-Pacific Alkyd Resin Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers

- Rising Demand in the Paint and Coating Industry

The paint and coating industry is currently seeing a significant increase in demand for alkyd resin. This increased attention can be associated with alkyd resin's notable characteristics, versatility, and the most abundant category of synthetic resins, which makes it a preferred choice for various industrial applications. Alkyd resin is an oil-modified polyester, which is used as a film-forming agent in certain paints and clear coatings These resins exhibit compatibility with a broad range of other resins used in the paint industry, including amino resin, phenolic, rosin, resin, and polyurethanes, facilitating convenient modifications to achieve desired properties. Furthermore, modified alkyd resin-based varnishes and enamels find utility in painting cars, airplanes, railroads, and agricultural machinery, while the composition of alkyd resins blended with urea-formaldehyde and melamine-formaldehyde. Resins produce enamels that are suitable for painting automobiles, bicycles, and various equipment. Due to high application, continued research and development carried out by researchers and manufacturers is expected to boost the market growth

- Growing Disposable Income and Lifestyle of Consumers

As consumer lifestyles improve, there is a growing emphasis on quality and durability. Alkyd resin-based coatings are known for their excellent adhesion, durability, and resistance to wear and tear. Consumers with higher disposable income are more likely to choose for a long-lasting coating that requires less frequent maintenance. The demand for alkyd resin-based coating increased as consumers seek products that align with their desired lifestyle. With higher disposable income, consumers are more likely to invest in premium and specialty coatings for specific applications. Alkyd resins can be formulated to meet specific requirements such as heat resistance, chemical resistance, and low VOC content. Consumers who prioritize specialized properties are willing to pay a premium for coatings that offer enhanced performance and contribute to the demand for alkyd resin-based specialty coatings.

- High-Quality Properties And Compatibility of the Alkyd Resin With A Wide Range of Polymers

Alkyd resins are highly versatile and cost-effective components used in the manufacturing of synthetic paints. One of the key advantages of alkyd resins is their compatibility with other coating polymers. They can be combined with vinyl resins, such as copolymers of vinyl chloride and vinyl acetate, containing hydroxyl groups, to improve application properties and adhesion, particularly in marine top-coat paints. Alkyd resins can be blended with acrylic resins, epoxy resins, polyurethane resins, and other coating polymers to achieve desired characteristics and meet specific application requirements. By combining alkyd resins with these polymers, manufacturers can modify the properties of the finished coatings, including gloss, hardness, chemical resistance, weather ability, and drying time.

- Growing Urbanization in the Developing Countries

Growing urbanization and industrialization has led to the growth of the economies. Urbanization frequently results in an increase in construction activity, including the development of residential properties, commercial and industrial buildings, and infrastructure projects. These projects require paints and varnishes that use alkyd resin as their binder. The building and construction sector relies on specialty resins to meet stringent quality standards in applications such as adhesives, sealants, and coatings (architectural, decorative, and protective). These resins exhibit exceptional characteristics, including high-temperature resistance and excellent chemical resistance. As a result, a significant volume of these resins is expected to use in upcoming infrastructure projects and the construction of residential and non-residential buildings.

Restraints

- Growing Awareness of the Harmful Impact of Alkyd Resins

Alkyd resins have been used as binders for paints since the 1930s. Their compatibility with many polymers and the extremely wide formulating latitude made them suitable for the production of a broad range of coating materials. The primary concern with the organic solvents used to formulate the product, various solvents are used in alkyd coatings including mineral spirits, toluene, xylene, and petroleum distillates. The evaporation of these solvents in both alkyd resin production and end use drying processes introduced significant environmental concerns. Conventional solvent based alkyd coatings have gone out of favor due to concerns over volatile organic compound (VOCs). The emission of potentially harmful VOCs has increased the number of health problems such as asthma, allergies, and other breathing problems and the environmental concerns associated with the global warming.

- Availability of Substitutes

The availability of alternatives to alkyd resins can hamper the growth of the global alkyd resin market. Moreover, the instability price of the raw materials will also negatively impact the market growth as consumers move towards the use of other resins in various applications such as paints, insulating enamels, and automotive among others.

Challenges

- The Fluctuating Price of Raw Material Leads to Changes in the Manufacturing Cost of Alkyd Resins

Volatile and unstable prices of raw materials have widespread implications for manufacturing organizations. From the rising energy costs to unexpected fluctuations in raw material costs, obstacles are destabilizing supply chains making it difficult for manufacturers to either absorb additional costs, or find new ways to mitigate the expenses. The Russia’s Invasion of Ukraine has disrupted oil industry which led to skyrocketing oil prices. Russia is one of the biggest producers of oil and natural gas. The price of crude oil was also inflated even before the war due to higher demand for fuel by the recovery of the global economies from the COVID-19 pandemic and low investment in the oil and gas industry. The high fluctuating raw material costs and ineffective price management can damage the company’s profitability factor. Such fluctuations in crude oil prices can negatively impact alkyd resin prices and their applications, moreover, the fluctuation in crude oil prices leads to variations in the manufacturing costs of alkyd resin to significantly impact prices for end-users.

Opportunities

- Growing Demand for Sustainable Coating in the Market

Consumers are becoming more conscious about products that impact the environment. They favor environmentally friendly products that reduce environmental damage and support sustainable lifestyles. As a result, there is a demand for coatings and paints developed with environmentally friendly alkyd resins. Sustainability is becoming a core principle that many businesses are adopting and incorporating into their business strategies. Through all of their supply chains, they strive to minimize the environmental effect, promote sustainable sourcing, and reduce carbon footprint. As sustainability becomes a more prominent factor in purchasing decisions, businesses are recognizing the market demand for eco-friendly products. Offering sustainable alkyd resin-based coatings and paints products provides a competitive advantage by meeting customer expectations.

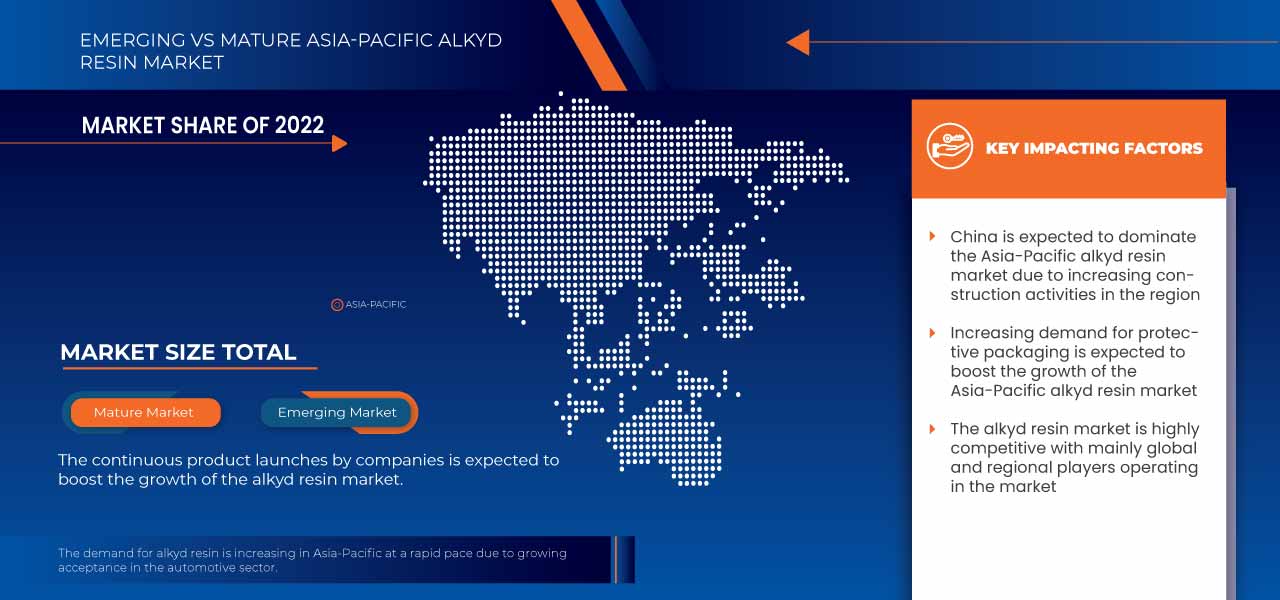

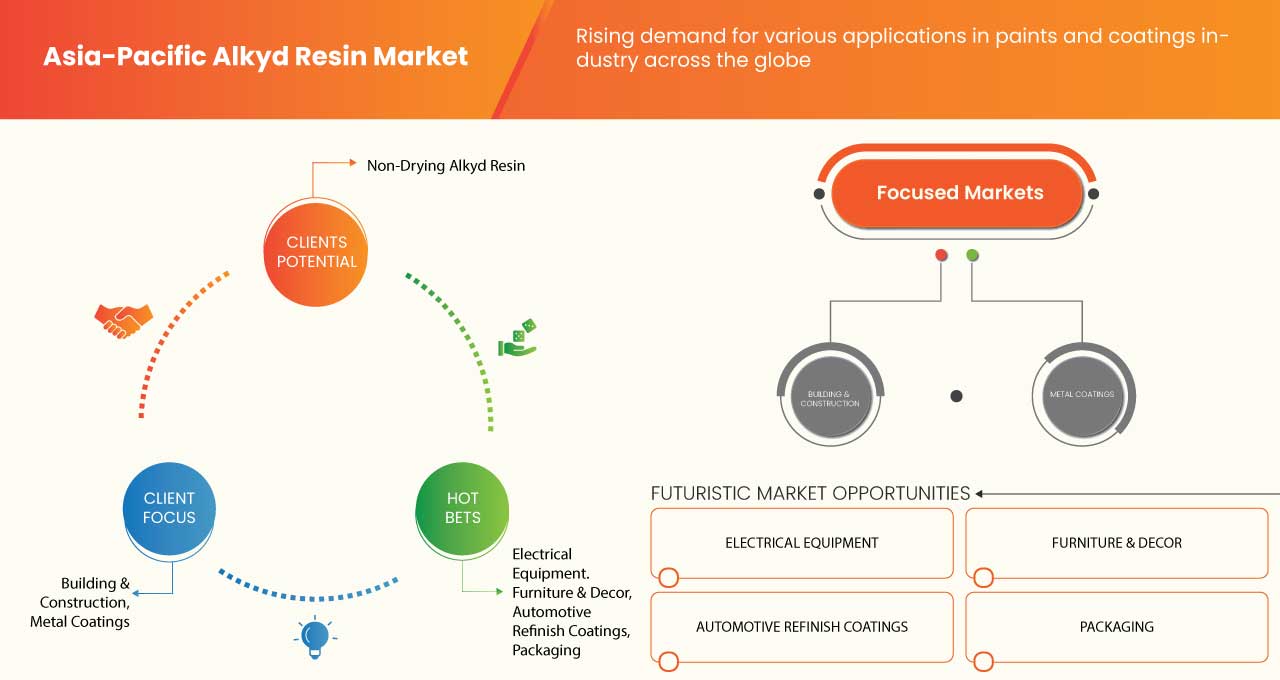

- The Continuous Product Launches By Companies Boost Market Growth

A product launch strategy involves research, testing, and actions from different departments to ensure that the customers buy a product. The market players in alkyd resin manufacturing are constantly working towards new product launches in the market. The launch of new alkyd resin products helps to satisfy the preference of different consumers in the market. Launch strategies help in product launches, market understanding, trends analysis, and many more beneficial accepts which help the industry experts to expand. An important part of the launch plan is validating the product and its benefit quickly. Manufacturers consistently create new product launches which helps the company to grow, continuous collaborations between companies, strategic alliances, funding, and company expansion boost the company's growth globally which will ultimately boost the market growth.

Recent Developments

- In May, 2023 Polynt Group announced the expansion of resin production capacity to serve the North American Coatings Market and to meet the growing needs of the paints and coatings industry. This investment will help the company to expand its capacity in conventional alkyds, oil modified urethanes, and water based technologies.

- In May, 2023 Hempel A/S was recognized as a supplier engagement leader by CDP for environmental action across its supply chain. Hempel is recognized with an A score in CDP’s 2022 Supplier Engagement Rating (SER). This will help the company to improve its brand recognition and meet its sustainability goals in the market.

Asia-Pacific Alkyd Resin Market Scope

Asia-Pacific alkyd resin market is categorized into six notable segment, by resin type, process type, class, formulation type, application, and end use industry. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Resin Type

- Non-drying alkyd resin

- Drying alkyd resin

- Semi-drying alkyd resin

On the basis of resin type, the Asia-Pacific alkyd resin market is segmented into non-drying alkyd resin, drying alkyd resin, and semi-drying alkyd resin.

Process Type

- Fatty Acid Process

- Glyceride Process

On the basis of Process type, the Asia-Pacific alkyd resin market is segmented into fatty acid process and glyceride process.

Class

- Long Alkyd Resin

- Medium Alkyd Resin

- Short Alkyd Resin

On the basis of class, the Asia-Pacific alkyd resin market is segmented into long alkyd resin, medium alkyd resin, and short alkyd resin.

Formulation Type

- High-Solid Alkyds

- Waterborne Alkyds

- Modifying Alkyds

- Solvent Borne Coatings

- Powder Coatings

- Others

On the basis of formulation type, the Asia-Pacific alkyd resin market is segmented into high-solid alkyd, waterborne alkyds, modifying alkyds, solvent borne coatings, powder coatings, and others.

Application

- Building & Construction

- Automotive 0em Coatings

- Electrical Equipment

- Furniture & Decor

- Metal Coatings

- Automotive Refinish Coatings

- Coil Coatings

- Packaging

On the basis of application, the Asia-Pacific alkyd resin market is segmented into building & construction, automotive 0em coatings, electrical equipment, furniture & décor, metal coatings, automotive refinish coatings, coil coatings, and packaging.

End Use Industry

- Construction & Architecture Industry

- Automotive Industry

- Electronics Industry

- Aerospace Industry

- Marine Industry

- Others

On the basis of end use industry, the Asia-Pacific alkyd resin market is segmented into construction & architecture industry, automotive industry, electronics industry, aerospace industry, marine industry, and others.

Asia-Pacific Alkyd Resin Market Regional Analysis/Insights

Asia-Pacific alkyd resin market is categorized into six notable segment, by resin type, process type, class, formulation type, application, and end use industry.

The countries covered in the Asia-Pacific alkyd resin market report are Asia-Pacific (Japan, China, South Korea, India, Australia, Singapore, Thailand, Taiwan, Hong kong, New Zealand, Malaysia, Indonesia, Philippines, and Rest of Asia Pacific).

China is expected to dominate the Asia-Pacific alkyd resin market due to large production, easy availability of products, and increase in customer base.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Alkyd Resin Market Share Analysis

The Asia-Pacific Alkyd Resin Market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies focus on the Global alkyd resin market.

Some of the major players operating in the Asia-Pacific alkyd resin market are OPC polymers, Covestro AG, Uniform Synthetics, Synthopol, Arkema, BASF SE, Allnex GMBH, D.S.V Chemcials Pvt Ltd, Ratnaka Resins Pvt. Ltd., Hempel A/S, Neo-Pack Plast, POLYNT SPA, Krishna Resins & Pigments Pvt. Ltd., Arakawa Chemical Industries, Ltd., MACRO POLYMERS, Nord Composites Italia SRL, Girdhari Chemicals & Resins, Eternal Materials Co., Ltd., US Polymers-Accurez, LLC, Spolek pro chemickou a hutní výrobu, akciová společnost, and Mancuso Chemicals Limited among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA-PACIFIC ALKYD RESIN MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 MULTIVARIATE MODELLING

2.9 CATEGORY LIFELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 CUSTOMER BARGAINING POWER

4.2.4 SUPPLIER BARGAINING POWER

4.2.5 INTERNAL COMPETITION (RIVALRY)

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT’S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 IMPORT-EXPORT ANALYSIS

4.5 SUPPLY CHAIN ANALYSIS

4.5.1 OVERVIEW

4.5.2 LOGISTIC COST SCENARIO

4.5.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.6 TECHNOLOGICAL INNOVATION

4.7 VENDOR SELECTION CRITERIA

4.8 PRICE ANALYSIS

4.9 PRODUCTION CAPACITY OUTLOOK

4.1 PRODUCTION CONSUMPTION ANALYSIS

4.11 RAW MATERIAL COVERAGE

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND IN THE PAINT AND COATING INDUSTRY

6.1.2 GROWING DISPOSABLE INCOME AND LIFESTYLE OF CONSUMERS

6.1.3 HIGH-QUALITY PROPERTIES AND COMPATIBILITY OF THE ALKYD RESIN WITH A WIDE RANGE OF POLYMERS

6.1.4 GROWING URBANIZATION IN THE DEVELOPING COUNTRIES

6.2 RESTRAINTS

6.2.1 GROWING AWARENESS OF THE HARMFUL IMPACT OF ALKYD RESINS

6.2.2 AVAILABILITY OF SUBSTITUTES

6.3 OPPORTUNITIES

6.3.1 GROWING DEMAND FOR SUSTAINABLE COATING IN THE MARKET

6.3.2 THE CONTINUOUS PRODUCT LAUNCHES BY COMPANIES BOOST THE MARKET GROWTH

6.4 CHALLENGE

6.4.1 THE FLUCTUATING PRICE OF RAW MATERIALS LEADS TO CHANGES IN THE MANUFACTURING COST OF ALKYD RESINS

7 ASIA-PACIFIC ALKYD RESIN MARKET, BY REGION

7.1 ASIA-PACIFIC

7.1.1 CHINA

7.1.2 INDIA

7.1.3 JAPAN

7.1.4 SOUTH KOREA

7.1.5 AUSTRALIA

7.1.6 INDONESIA

7.1.7 SINGAPORE

7.1.8 MALAYSIA

7.1.9 PHILIPPINES

7.1.10 NEW ZEALAND

7.1.11 THAILAND

7.1.12 HONG KONG

7.1.13 TAIWAN

7.1.14 REST OF ASIA-PACIFIC

8 ASIA-PACIFIC ALKYD RESIN MARKET, COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

8.2 ACQUISITION

8.3 NEW LAUNCHES

8.4 RECOGNITION

8.5 NEW PLANT

9 COMPANY PROFILES

9.1 ARKEMA

9.1.1 COMPANY SNAPSHOT

9.1.2 REVENUE ANALYSIS

9.1.3 COMPANY SHARE ANALYSIS

9.1.4 PRODUCT PORTFOLIO

9.1.5 SWOT

9.1.6 RECENT DEVELOPMENTS

9.2 BASF SE (2022)

9.2.1 COMPANY SNAPSHOT

9.2.2 REVENUE ANALYSIS

9.2.3 COMPANY SHARE ANALYSIS

9.2.4 PRODUCT PORTFOLIO

9.2.5 SWOT

9.2.6 RECENT DEVELOPMENTS

9.3 ALLNEX GMBH

9.3.1 COMPANY SNAPSHOT

9.3.2 COMPANY SHARE ANALYSIS

9.3.3 PRODUCT PORTFOLIO

9.3.4 SWOT

9.3.5 RECENT DEVELOPMENTS

9.4 ETERNAL MATERIALS CO.,LTD. (2022)

9.4.1 COMPANY SNAPSHOT

9.4.2 REVENUE ANALYSIS

9.4.3 COMPANY SHARE ANALYSIS

9.4.4 PRODUCT PORTFOLIO

9.4.5 SWOT

9.4.6 RECENT DEVELOPMENT

9.5 OPC POLYMERS

9.5.1 COMPANY SNAPSHOT

9.5.2 COMPANY SHARE ANALYSIS

9.5.3 PRODUCT PORTFOLIO

9.5.4 SWOT ANALYSIS

9.5.5 RECENT DEVELOPMENTS

9.6 ARAKAWA CHEMICAL INDUSTRIES,LTD. (2022)

9.6.1 COMPANY SNAPSHOT

9.6.2 REVENUE ANALYSIS

9.6.3 PRODUCT PORTFOLIO

9.6.4 SWOT

9.6.5 RECENT DEVELOPMENTS

9.7 COVESTRO AG

9.7.1 COMPANY SNAPSHOT

9.7.2 REVENUE ANALYSIS

9.7.3 COMPANY SHARE ANALYSIS

9.7.4 PRODUCT PORTFOLIO

9.7.5 SWOT ANALYSIS

9.7.6 RECENT DEVELOPMENT

9.8 D.S.V CHEMCIALS PVT LTD

9.8.1 COMPANY SNAPSHOT

9.8.2 PRODUCT PORTFOLIO

9.8.3 SWOT

9.8.4 RECENT DEVELOPMENTS

9.9 GIRDHARI CHEMICALS & RESINS PVT.LTD.

9.9.1 COMPANY SNAPSHOT

9.9.2 PRODUCT PORTFOLIO

9.9.3 SWOT

9.9.4 RECENT DEVELOPMENTS

9.1 HEMPEL A/S

9.10.1 COMPANY SNAPSHOT

9.10.2 PRODUCT PORTFOLIO

9.10.3 SWOT ANALYSIS

9.10.4 RECENT DEVELOPMENT

9.11 KRISHNA RESINS & PIGMENTS PVT. LTD.

9.11.1 COMPANY SNAPSHOT

9.11.2 PRODUCT PORTFOLIO

9.11.3 SWOT

9.11.4 RECENT DEVELOPMENTS

9.12 MACRO POLYMERS

9.12.1 COMPANY SNAPSHOT

9.12.2 PRODUCT PORTFOLIO

9.12.3 SWOT

9.12.4 RECENT DEVELOPMENTS

9.13 MANCUSO CHEMICALS LIMITED

9.13.1 COMPANY SNAPSHOT

9.13.2 PRODUCT PORTFOLIO

9.13.3 SWOT

9.13.4 RECENT DEVELOPMENT

9.14 NEO-PACK PLAST

9.14.1 COMPANY SNAPSHOT

9.14.2 PRODUCT PORTFOLIO

9.14.3 SWOT ANALYSIS

9.14.4 RECENT DEVELOPMENTS

9.15 NORD COMPOSITES ITALIA SRL

9.15.1 COMPANY SNAPSHOT

9.15.2 PRODUCT PORTFOLIO

9.15.3 SWOT

9.15.4 RECENT DEVELOPMENTS

9.16 POLYNT SPA

9.16.1 COMPANY SNAPSHOT

9.16.2 PRODUCT PORTFOLIO

9.16.3 SWOT ANALYSIS

9.16.4 RECENT DEVELOPMENT

9.17 RATNAKA RESINS PVT.LTD.

9.17.1 COMPANY SNAPSHOT

9.17.2 PRODUCT PORTFOLIO

9.17.3 SWOT ANALYSIS

9.17.4 RECENT DEVELOPMENTS

9.18 SPOLEK PRO CHEMICKOU A HUTNÍ VÝROBU, AKCIOVÁ SPOLEČNOST

9.18.1 COMPANY SNAPSHOT

9.18.2 PRODUCT PORTFOLIO

9.18.3 SWOT

9.18.4 RECENT DEVELOPMENTT

9.19 SYNTHOPOL

9.19.1 COMPANY SNAPSHOT

9.19.2 PRODUCT PORTFOLIO

9.19.3 SWOT ANALYSIS

9.19.4 RECENT DEVELOPMENT

9.2 UNIFORM SYNTHETICS

9.20.1 COMPANY SNAPSHOT

9.20.2 PRODUCT PORTFOLIO

9.20.3 SWOT ANALYSIS

9.20.4 RECENT DEVELOPMENTS

9.21 US POLYMERS-ACCUREZ, LLC

9.21.1 COMPANY SNAPSHOT

9.21.2 PRODUCT PORTFOLIO

9.21.3 SWOT

9.21.4 RECENT DEVELOPMENT

10 QUESTIONNAIRE

11 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF "ALKYD RESINS, IN PRIMARY FORMS"; HS CODE OF PRODUCT: 390750

TABLE 2 IMPORT DATA OF " ALKYD RESINS, IN PRIMARY FORMS"; HS CODE OF PRODUCT: 390750

TABLE 3 EXPORT DATA OF "ALKYD RESINS, IN PRIMARY FORMS"; HS CODE OF PRODUCT: 390750

TABLE 4 EXPORT DATA OF "ALKYD RESINS, IN PRIMARY FORMS"; HS CODE OF PRODUCT: 390750

TABLE 5 TOP FIVE COMPANIES - PRODUCTION CAPACITY ANALYSIS

TABLE 6 REGULATORY COVERAGE

TABLE 7 ASIA-PACIFIC ALKYD RESIN MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 8 ASIA-PACIFIC ALKYD RESIN MARKET, BY COUNTRY, 2021-2030 (KILO TONS)

TABLE 9 ASIA-PACIFIC ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 10 ASIA-PACIFIC ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (KILO TONS)

TABLE 11 ASIA-PACIFIC ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (ASP)

TABLE 12 ASIA-PACIFIC ALKYD RESIN MARKET, BY PROCESS TYPE, 2021-2030 (USD MILLION)

TABLE 13 ASIA-PACIFIC ALKYD RESIN MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 14 ASIA-PACIFIC ALKYD RESIN MARKET, BY FORMULATION TYPE, 2021-2030 (USD MILLION)

TABLE 15 ASIA-PACIFIC ALKYD RESIN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 16 ASIA-PACIFIC ALKYD RESIN MARKET, BY END USE INDUSTRY, 2021-2030 (USD MILLION)

TABLE 17 ASIA-PACIFIC CONSTRUCTION & ARCHITECTURE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 18 ASIA-PACIFIC AUTOMOTIVE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 19 ASIA-PACIFIC ELECTRONICS INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 20 ASIA-PACIFIC AEROSPACE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 21 ASIA-PACIFIC MARINE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 22 ASIA-PACIFIC OTHERS IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 23 CHINA ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 24 CHINA ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (KILO TONS)

TABLE 25 CHINA ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (ASP)

TABLE 26 CHINA ALKYD RESIN MARKET, BY PROCESS TYPE, 2021-2030 (USD MILLION)

TABLE 27 CHINA ALKYD RESIN MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 28 CHINA ALKYD RESIN MARKET, BY FORMULATION TYPE, 2021-2030 (USD MILLION)

TABLE 29 CHINA ALKYD RESIN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 30 CHINA ALKYD RESIN MARKET, BY END USE INDUSTRY, 2021-2030 (USD MILLION)

TABLE 31 CHINA CONSTRUCTION & ARCHITECTURE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 32 CHINA AUTOMOTIVE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 33 CHINA ELECTRONICS INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 34 CHINA AEROSPACE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 35 CHINA MARINE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 36 CHINA OTHERS IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 37 INDIA ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 38 INDIA ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (KILO TONS)

TABLE 39 INDIA ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (ASP)

TABLE 40 INDIA ALKYD RESIN MARKET, BY PROCESS TYPE, 2021-2030 (USD MILLION)

TABLE 41 INDIA ALKYD RESIN MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 42 INDIA ALKYD RESIN MARKET, BY FORMULATION TYPE, 2021-2030 (USD MILLION)

TABLE 43 INDIA ALKYD RESIN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 44 INDIA ALKYD RESIN MARKET, BY END USE INDUSTRY, 2021-2030 (USD MILLION)

TABLE 45 INDIA CONSTRUCTION & ARCHITECTURE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 46 INDIA AUTOMOTIVE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 47 INDIA ELECTRONICS INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 48 INDIA AEROSPACE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 49 INDIA MARINE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 50 INDIA OTHERS IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 51 JAPAN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 52 JAPAN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (KILO TONS)

TABLE 53 JAPAN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (ASP)

TABLE 54 JAPAN ALKYD RESIN MARKET, BY PROCESS TYPE, 2021-2030 (USD MILLION)

TABLE 55 JAPAN ALKYD RESIN MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 56 JAPAN ALKYD RESIN MARKET, BY FORMULATION TYPE, 2021-2030 (USD MILLION)

TABLE 57 JAPAN ALKYD RESIN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 58 JAPAN ALKYD RESIN MARKET, BY END USE INDUSTRY, 2021-2030 (USD MILLION)

TABLE 59 JAPAN CONSTRUCTION & ARCHITECTURE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 60 JAPAN AUTOMOTIVE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 61 JAPAN ELECTRONICS INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 62 JAPAN AEROSPACE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 63 JAPAN MARINE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 64 JAPAN OTHERS IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 65 SOUTH KOREA ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 66 SOUTH KOREA ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (KILO TONS)

TABLE 67 SOUTH KOREA ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (ASP)

TABLE 68 SOUTH KOREA ALKYD RESIN MARKET, BY PROCESS TYPE, 2021-2030 (USD MILLION)

TABLE 69 SOUTH KOREA ALKYD RESIN MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 70 SOUTH KOREA ALKYD RESIN MARKET, BY FORMULATION TYPE, 2021-2030 (USD MILLION)

TABLE 71 SOUTH KOREA ALKYD RESIN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 72 SOUTH KOREA ALKYD RESIN MARKET, BY END USE INDUSTRY, 2021-2030 (USD MILLION)

TABLE 73 SOUTH KOREA CONSTRUCTION & ARCHITECTURE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 74 SOUTH KOREA AUTOMOTIVE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 75 SOUTH KOREA ELECTRONICS INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 76 SOUTH KOREA AEROSPACE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 77 SOUTH KOREA MARINE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 78 SOUTH KOREA OTHERS IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 79 AUSTRALIA ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 80 AUSTRALIA ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (KILO TONS)

TABLE 81 AUSTRALIA ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (ASP)

TABLE 82 AUSTRALIA ALKYD RESIN MARKET, BY PROCESS TYPE, 2021-2030 (USD MILLION)

TABLE 83 AUSTRALIA ALKYD RESIN MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 84 AUSTRALIA ALKYD RESIN MARKET, BY FORMULATION TYPE, 2021-2030 (USD MILLION)

TABLE 85 AUSTRALIA ALKYD RESIN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 86 AUSTRALIA ALKYD RESIN MARKET, BY END USE INDUSTRY, 2021-2030 (USD MILLION)

TABLE 87 AUSTRALIA CONSTRUCTION & ARCHITECTURE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 88 AUSTRALIA AUTOMOTIVE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 89 AUSTRALIA ELECTRONICS INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 90 AUSTRALIA AEROSPACE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 91 AUSTRALIA MARINE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 92 AUSTRALIA OTHERS IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 93 INDONESIA ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 94 INDONESIA ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (KILO TONS)

TABLE 95 INDONESIA ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (ASP)

TABLE 96 INDONESIA ALKYD RESIN MARKET, BY PROCESS TYPE, 2021-2030 (USD MILLION)

TABLE 97 INDONESIA ALKYD RESIN MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 98 INDONESIA ALKYD RESIN MARKET, BY FORMULATION TYPE, 2021-2030 (USD MILLION)

TABLE 99 INDONESIA ALKYD RESIN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 100 INDONESIA ALKYD RESIN MARKET, BY END USE INDUSTRY, 2021-2030 (USD MILLION)

TABLE 101 INDONESIA CONSTRUCTION & ARCHITECTURE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 102 INDONESIA AUTOMOTIVE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 103 INDONESIA ELECTRONICS INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 104 INDONESIA AEROSPACE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 105 INDONESIA MARINE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 106 INDONESIA OTHERS IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 107 SINGAPORE ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 108 SINGAPORE ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (KILO TONS)

TABLE 109 SINGAPORE ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (ASP)

TABLE 110 SINGAPORE ALKYD RESIN MARKET, BY PROCESS TYPE, 2021-2030 (USD MILLION)

TABLE 111 SINGAPORE ALKYD RESIN MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 112 SINGAPORE ALKYD RESIN MARKET, BY FORMULATION TYPE, 2021-2030 (USD MILLION)

TABLE 113 SINGAPORE ALKYD RESIN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 114 SINGAPORE ALKYD RESIN MARKET, BY END USE INDUSTRY, 2021-2030 (USD MILLION)

TABLE 115 SINGAPORE CONSTRUCTION & ARCHITECTURE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 116 SINGAPORE AUTOMOTIVE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 117 SINGAPORE ELECTRONICS INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 118 SINGAPORE AEROSPACE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 119 SINGAPORE MARINE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 120 SINGAPORE OTHERS IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 121 MALAYSIA ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 122 MALAYSIA ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (KILO TONS)

TABLE 123 MALAYSIA ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (ASP)

TABLE 124 MALAYSIA ALKYD RESIN MARKET, BY PROCESS TYPE, 2021-2030 (USD MILLION)

TABLE 125 MALAYSIA ALKYD RESIN MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 126 MALAYSIA ALKYD RESIN MARKET, BY FORMULATION TYPE, 2021-2030 (USD MILLION)

TABLE 127 MALAYSIA ALKYD RESIN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 128 MALAYSIA ALKYD RESIN MARKET, BY END USE INDUSTRY, 2021-2030 (USD MILLION)

TABLE 129 MALAYSIA CONSTRUCTION & ARCHITECTURE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 130 MALAYSIA AUTOMOTIVE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 131 MALAYSIA ELECTRONICS INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 132 MALAYSIA AEROSPACE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 133 MALAYSIA MARINE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 134 MALAYSIA OTHERS IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 135 PHILIPPINES ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 136 PHILIPPINES ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (KILO TONS)

TABLE 137 PHILIPPINES ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (ASP)

TABLE 138 PHILIPPINES ALKYD RESIN MARKET, BY PROCESS TYPE, 2021-2030 (USD MILLION)

TABLE 139 PHILIPPINES ALKYD RESIN MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 140 PHILIPPINES ALKYD RESIN MARKET, BY FORMULATION TYPE, 2021-2030 (USD MILLION)

TABLE 141 PHILIPPINES ALKYD RESIN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 142 PHILIPPINES ALKYD RESIN MARKET, BY END USE INDUSTRY, 2021-2030 (USD MILLION)

TABLE 143 PHILIPPINES CONSTRUCTION & ARCHITECTURE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 144 PHILIPPINES AUTOMOTIVE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 145 PHILIPPINES ELECTRONICS INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 146 PHILIPPINES AEROSPACE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 147 PHILIPPINES MARINE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 148 PHILIPPINES OTHERS IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 149 NEW ZEALAND ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 150 NEW ZEALAND ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (KILO TONS)

TABLE 151 NEW ZEALAND ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (ASP)

TABLE 152 NEW ZEALAND ALKYD RESIN MARKET, BY PROCESS TYPE, 2021-2030 (USD MILLION)

TABLE 153 NEW ZEALAND ALKYD RESIN MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 154 NEW ZEALAND ALKYD RESIN MARKET, BY FORMULATION TYPE, 2021-2030 (USD MILLION)

TABLE 155 NEW ZEALAND ALKYD RESIN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 156 NEW ZEALAND ALKYD RESIN MARKET, BY END USE INDUSTRY, 2021-2030 (USD MILLION)

TABLE 157 NEW ZEALAND CONSTRUCTION & ARCHITECTURE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 158 NEW ZEALAND AUTOMOTIVE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 159 NEW ZEALAND ELECTRONICS INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 160 NEW ZEALAND AEROSPACE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 161 NEW ZEALAND MARINE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 162 NEW ZEALAND OTHERS IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 163 THAILAND ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 164 THAILAND ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (KILO TONS)

TABLE 165 THAILAND ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (ASP)

TABLE 166 THAILAND ALKYD RESIN MARKET, BY PROCESS TYPE, 2021-2030 (USD MILLION)

TABLE 167 THAILAND ALKYD RESIN MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 168 THAILAND ALKYD RESIN MARKET, BY FORMULATION TYPE, 2021-2030 (USD MILLION)

TABLE 169 THAILAND ALKYD RESIN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 170 THAILAND ALKYD RESIN MARKET, BY END USE INDUSTRY, 2021-2030 (USD MILLION)

TABLE 171 THAILAND CONSTRUCTION & ARCHITECTURE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 172 THAILAND AUTOMOTIVE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 173 THAILAND ELECTRONICS INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 174 THAILAND AEROSPACE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 175 THAILAND MARINE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 176 THAILAND OTHERS IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 177 HONG KONG ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 178 HONG KONG ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (KILO TONS)

TABLE 179 HONG KONG ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (ASP)

TABLE 180 HONG KONG ALKYD RESIN MARKET, BY PROCESS TYPE, 2021-2030 (USD MILLION)

TABLE 181 HONG KONG ALKYD RESIN MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 182 HONG KONG ALKYD RESIN MARKET, BY FORMULATION TYPE, 2021-2030 (USD MILLION)

TABLE 183 HONG KONG ALKYD RESIN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 184 HONG KONG ALKYD RESIN MARKET, BY END USE INDUSTRY, 2021-2030 (USD MILLION)

TABLE 185 HONG KONG CONSTRUCTION & ARCHITECTURE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 186 HONG KONG AUTOMOTIVE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 187 HONG KONG ELECTRONICS INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 188 HONG KONG AEROSPACE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 189 HONG KONG MARINE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 190 HONG KONG OTHERS IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 191 TAIWAN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 192 TAIWAN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (KILO TONS)

TABLE 193 TAIWAN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (ASP)

TABLE 194 TAIWAN ALKYD RESIN MARKET, BY PROCESS TYPE, 2021-2030 (USD MILLION)

TABLE 195 TAIWAN ALKYD RESIN MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 196 TAIWAN ALKYD RESIN MARKET, BY FORMULATION TYPE, 2021-2030 (USD MILLION)

TABLE 197 TAIWAN ALKYD RESIN MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 198 TAIWAN ALKYD RESIN MARKET, BY END USE INDUSTRY, 2021-2030 (USD MILLION)

TABLE 199 TAIWAN CONSTRUCTION & ARCHITECTURE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 200 TAIWAN AUTOMOTIVE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 201 TAIWAN ELECTRONICS INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 202 TAIWAN AEROSPACE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 203 TAIWAN MARINE INDUSTRY IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 204 TAIWAN OTHERS IN ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 205 REST OF ASIA-PACIFIC ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (USD MILLION)

TABLE 206 REST OF ASIA-PACIFIC ALKYD RESIN MARKET, BY RESIN TYPE, 2021-2030 (KILO TONS)

List of Figure

FIGURE 1 ASIA-PACIFIC ALKYD RESIN MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC ALKYD RESIN MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC ALKYD RESIN MARKET : DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC ALKYD RESIN MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC ALKYD RESIN MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 THE ASIA-PACIFIC ALKYD RESIN MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 THE ASIA-PACIFIC ALKYD RESIN MARKET: DBMR MARKET POSITION GRID

FIGURE 8 THE ASIA-PACIFIC ALKYD RESIN MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 ASIA-PACIFIC ALKYD RESIN MARKET VENDOR SHARE ANALYSIS

FIGURE 10 THE ASIA-PACIFIC ALKYD RESIN MARKET: SEGMENTATION

FIGURE 11 GROWING CONSUMPTION IN THE PAINT AND COATING INDUSTRY IS EXPECTED TO DRIVE THE GROWTH OF THE ASIA-PACIFIC ALKYD RESIN MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 NON-DRYING ALKYD RESIN SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC ALKYD RESIN MARKET IN 2023 AND 2030

FIGURE 13 VENDOR SELECTION CRITERIA

FIGURE 14 PRICE ANALYSIS FOR ASIA-PACIFIC ALKYD RESIN MARKET (USD/KG)

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE ASIA-PACIFIC ALKYD RESIN MARKET

FIGURE 16 ASIA-PACIFIC ALKYD RESIN MARKET: SNAPSHOT (2022)

FIGURE 17 ASIA-PACIFIC ALKYD RESIN MARKET: BY COUNTRY (2022)

FIGURE 18 ASIA-PACIFIC ALKYD RESIN MARKET: BY COUNTRY (2023 & 2030)

FIGURE 19 ASIA-PACIFIC ALKYD RESIN MARKET: BY COUNTRY (2022 & 2030)

FIGURE 20 ASIA-PACIFIC ALKYD RESIN MARKET: BY RESIN TYPE (2023-2030)

FIGURE 21 ASIA-PACIFIC ALKYD RESIN MARKET: COMPANY SHARE 2022 (%)

Asia Pacific Alkyd Resin Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Alkyd Resin Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Alkyd Resin Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.