Global Anti Money Laundering Software Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

2.92 Billion

USD

9.84 Billion

2024

2032

USD

2.92 Billion

USD

9.84 Billion

2024

2032

| 2025 –2032 | |

| USD 2.92 Billion | |

| USD 9.84 Billion | |

|

|

|

|

Segmentação do mercado global de software antilavagem de dinheiro, por tipo de produto (software de monitoramento de transações, software de gerenciamento de identidade do cliente, software de gerenciamento de conformidade, software de relatórios de transações monetárias, software de triagem de sanções, software de detecção de fraudes, outros), componente (software, serviços, serviços gerenciados), aplicativo (serviços bancários e financeiros, seguros, jogos e apostas, governo, saúde, corretoras de criptomoedas, varejo e comércio eletrônico, outros), modelo de implantação (local, baseado em nuvem, híbrido), usuário final (grandes empresas, pequenas e médias empresas) – tendências do setor e previsão para 2032

Tamanho do mercado de software antilavagem de dinheiro

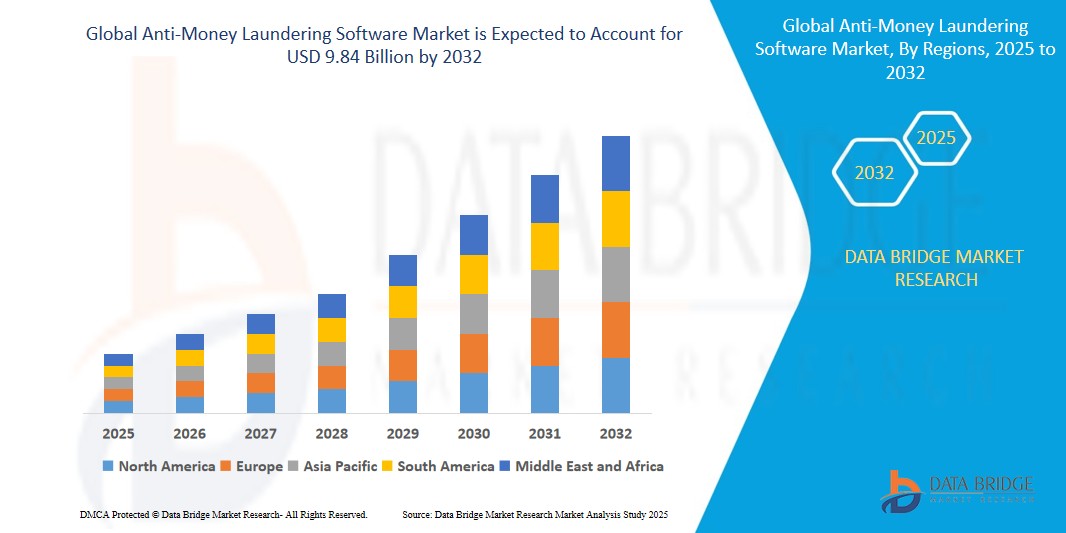

- O tamanho do mercado global de software anti-lavagem de dinheiro foi avaliado em US$ 2,92 bilhões em 2024 e deve atingir US$ 9,84 bilhões até 2032 , com um CAGR de 16,40% durante o período previsto.

- A expansão significativa do mercado é atribuída principalmente à ampla adoção de software AML em diversos setores, juntamente com rápidos avanços em inteligência artificial (IA), aprendizado de máquina (ML) e tecnologias de blockchain que aumentam a precisão e a eficiência da detecção e prevenção de crimes financeiros, como lavagem de dinheiro e financiamento do terrorismo.

- Além disso, a crescente demanda por monitoramento de transações em tempo real, os rigorosos requisitos de conformidade regulatória global e a crescente prevalência de transações digitais em setores como bancos, comércio eletrônico e criptomoedas estão estabelecendo o software AML como uma ferramenta essencial para garantir a integridade financeira e a adesão aos padrões regulatórios.

Análise de Mercado de Software Anti-Lavagem de Dinheiro

- O software de combate à lavagem de dinheiro abrange um conjunto de soluções tecnológicas avançadas projetadas para detectar, monitorar e prevenir atividades financeiras ilícitas, incluindo lavagem de dinheiro, financiamento do terrorismo e fraudes, em instituições financeiras e outros setores regulamentados. Essas soluções utilizam IA, ML, análise de big data e blockchain para analisar grandes volumes de dados transacionais, identificar padrões suspeitos e garantir a conformidade com marcos regulatórios globais, como as recomendações do Grupo de Ação Financeira Internacional (GAFI).

- A crescente demanda por softwares AML é impulsionada principalmente por sua capacidade de fornecer monitoramento de transações em tempo real, auditoria rigorosa de clientes e relatórios automatizados de conformidade, além das crescentes pressões regulatórias globais e da crescente incidência de crimes financeiros. Segundo as Nações Unidas, estima-se que 2 a 5% do PIB global, o equivalente a US$ 800 bilhões a US$ 2 trilhões, seja lavado anualmente, o que reforça a necessidade urgente de soluções AML eficazes.

- A América do Norte dominou o mercado global de software AML, com uma participação de receita de 33,92% em 2024, impulsionada por uma infraestrutura financeira bem estabelecida, estruturas regulatórias rigorosas, como o USA PATRIOT Act, e altas taxas de adoção em serviços bancários e financeiros. Os Estados Unidos, em particular, emergiram como líderes devido à presença de grandes provedores de soluções AML e órgãos reguladores proativos, como a Autoridade Reguladora do Setor Financeiro (FINRA).

- Espera-se que a região da Ásia-Pacífico experimente a maior taxa de crescimento durante o período previsto, impulsionada pela rápida digitalização, aumento de transações internacionais e iniciativas lideradas pelo governo para combater crimes financeiros em países como China, Índia e Cingapura.

- Entre os tipos de produtos, o segmento de software de monitoramento de transações detinha a maior fatia de mercado, de mais de 52,44% em 2024, atribuída ao seu papel fundamental na análise em tempo real de transações financeiras e na detecção de atividades suspeitas, o que é essencial para a conformidade com as regulamentações de combate à lavagem de dinheiro.

Escopo do Relatório e Segmentação do Mercado de Software Anti-Lavagem de Dinheiro

|

Atributos |

Principais insights de mercado sobre software antilavagem de dinheiro |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Europa

Ásia-Pacífico

Oriente Médio e África

Ámérica do Sul

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de software antilavagem de dinheiro

“ Avanços em Inteligência Artificial e Tecnologias Blockchain ”

- Uma tendência proeminente e transformadora no mercado global de software de combate à lavagem de dinheiro é a integração cada vez mais profunda das tecnologias de inteligência artificial (IA), aprendizado de máquina (ML) e blockchain, que aumentam significativamente a precisão, a automação e a transparência das soluções de combate à lavagem de dinheiro no combate a crimes financeiros.

- Por exemplo, em abril de 2023, a NICE Actimize lançou o SAM-10, uma solução de monitoramento de transações baseada em IA com análises multicamadas para melhorar a detecção de atividades suspeitas e minimizar falsos positivos, simplificando assim os processos de conformidade para instituições financeiras.

- O software AML com tecnologia de IA permite a análise em tempo real de vastos conjuntos de dados transacionais, identifica padrões complexos de atividades ilícitas e automatiza o gerenciamento de alertas, tornando-o altamente eficaz para aplicações em bancos, seguros e corretoras de criptomoedas. Por exemplo, a solução de IA da WorkFusion, Isaac, lançada em outubro de 2023, automatiza as revisões de alertas de primeiro nível, escalando casos de alto risco e encerrando alertas não suspeitos com documentação de suporte abrangente.

- A tecnologia blockchain, avaliada em US$ 1,43 bilhão em 2023, é cada vez mais adotada por sua capacidade de fornecer registros imutáveis e transparentes de transações financeiras, reduzindo o risco de atividades de lavagem de dinheiro não detectadas e melhorando a rastreabilidade em redes financeiras globais.

- Essa tendência em direção a sistemas AML mais inteligentes, automatizados e transparentes está remodelando fundamentalmente o cenário da tecnologia financeira, com empresas como a LexisNexis Risk Solutions desenvolvendo capacidades analíticas avançadas para otimizar os processos de Conheça Seu Cliente (KYC) e reforçar a conformidade regulatória.

Dinâmica do mercado de software antilavagem de dinheiro

Motorista

“Aumento da conformidade regulatória e escalada dos crimes financeiros”

- A crescente necessidade de conformidade regulatória rigorosa, impulsionada por regulamentações globais como as recomendações do Grupo de Ação Financeira Internacional (GAFI), o USA PATRIOT Act e a Quinta Diretiva Antilavagem de Dinheiro da UE, é um importante impulsionador do crescimento do mercado de software AML. Essas regulamentações exigem sistemas robustos de monitoramento, relatórios e due diligence do cliente para combater eficazmente a lavagem de dinheiro e o financiamento do terrorismo.

- Por exemplo, em janeiro de 2024, a FICO lançou uma solução AML aprimorada com algoritmos avançados de aprendizado de máquina projetados para melhorar a detecção de anomalias, abordando a crescente complexidade de crimes financeiros em um cenário financeiro cada vez mais digital.

- O software AML fornece soluções econômicas, escaláveis e automatizadas para monitoramento de transações em tempo real, verificação de identidade do cliente e relatórios de conformidade, reduzindo significativamente o risco de penalidades regulatórias, que atingiram US$ 7,7 bilhões globalmente de janeiro a abril de 2022, de acordo com relatórios do setor.

- O aumento nos pagamentos digitais, serviços bancários on-line e transações com criptomoedas aumentou exponencialmente o volume e a complexidade das transações financeiras, exigindo soluções AML sofisticadas para monitorar atividades internacionais, detectar padrões suspeitos e garantir a conformidade com os padrões internacionais.

Restrição/Desafio

“ Altos custos de implementação e escassez de profissionais qualificados ”

- Os altos custos de implementação e manutenção associados a softwares avançados de combate à lavagem de dinheiro, especialmente aqueles que incorporam tecnologias de IA, aprendizado de máquina e blockchain, representam desafios significativos à adoção, especialmente para pequenas e médias empresas (PMEs) que operam com orçamentos limitados. Por exemplo, algumas licenças de software de combate à lavagem de dinheiro começam em € 259 mensais, com custos adicionais para atualizações do sistema, integração com sistemas legados e manutenção contínua.

- A escassez de especialistas qualificados em AML, capazes de utilizar com eficácia insights avançados de software e navegar por cenários regulatórios complexos, é um grande obstáculo, especialmente em regiões com ecossistemas de tecnologia financeira subdesenvolvidos. Essa falta de profissionais qualificados limita a capacidade das organizações de aproveitar ao máximo os recursos das soluções AML.

- Complexidades regulatórias, como diferentes requisitos de conformidade em diferentes jurisdições, podem prejudicar o crescimento do mercado ao aumentar o tempo e o custo de implantação de soluções AML padronizadas, especialmente para organizações multinacionais que operam em várias regiões.

- Enfrentar esses desafios por meio do desenvolvimento de soluções AML baseadas em nuvem e com boa relação custo-benefício, estruturas regulatórias globais padronizadas e investimentos em programas de treinamento da força de trabalho é essencial para promover a confiança do consumidor e garantir o crescimento sustentado do mercado.

Escopo de mercado de software antilavagem de dinheiro

O mercado global de software antilavagem de dinheiro é segmentado com base no tipo de produto, componente, aplicação, modelo de implantação e usuário final.

- Por tipo de produto

Com base no tipo de produto, o mercado de software AML é segmentado em software de monitoramento de transações, software de gerenciamento de identidade de clientes, software de gerenciamento de conformidade, software de relatórios de transações cambiais, software de triagem de sanções, software de detecção de fraudes, entre outros. O segmento de software de monitoramento de transações dominou o mercado, com uma participação de receita de mais de 52,44% em 2024, impulsionado por seu papel essencial na análise em tempo real de transações financeiras e na detecção de atividades suspeitas, como grandes depósitos repentinos ou pequenas transações frequentes, projetadas para escapar do escrutínio regulatório.

Espera-se que o segmento de software de triagem de sanções testemunhe o CAGR mais rápido de 18,1% entre 2025 e 2032, impulsionado pelo aumento dos regimes de sanções globais e pela necessidade de instituições financeiras rastrearem transações e clientes em listas de sanções internacionais para garantir a conformidade e evitar penalidades.

- Por componente

Com base nos componentes, o mercado de software AML é segmentado em software, serviços e serviços gerenciados. O segmento de software deteve a maior participação de mercado na receita, com 63,41% em 2024, impulsionado pela ampla adoção de software AML baseado em IA e em nuvem para monitoramento de transações em tempo real, conformidade com KYC e relatórios automatizados.

Espera-se que o segmento de serviços gerenciados testemunhe o CAGR mais rápido de 2025 a 2032, impulsionado pela crescente demanda por soluções terceirizadas de AML que forneçam monitoramento especializado, suporte de conformidade e manutenção de sistemas, especialmente para organizações sem experiência interna.

- Por aplicação

Com base na aplicação, o mercado de software AML é segmentado em serviços bancários e financeiros, seguros, jogos e apostas, governo, saúde, corretoras de criptomoedas, varejo e e-commerce, entre outros. O segmento de serviços bancários e financeiros representou a maior fatia da receita de mercado, com mais de 46,71% em 2024, impulsionado pela alta exposição do setor a crimes financeiros e pelos rigorosos requisitos regulatórios para monitoramento de transações e due diligence do cliente.

Espera-se que o segmento de exchanges de criptomoedas testemunhe o CAGR mais rápido de 2025 a 2032, impulsionado pelo rápido crescimento das moedas digitais, pelo aumento do escrutínio regulatório das transações de criptomoedas e pela necessidade de prevenir a lavagem de dinheiro em sistemas financeiros descentralizados.

- Por modelo de implantação

Com base no modelo de implantação, o mercado de software AML é segmentado em on-premises, baseado em nuvem e híbrido. O segmento baseado em nuvem deteve a maior participação de mercado na receita em 2024, impulsionado por sua escalabilidade, custo-benefício e facilidade de integração com sistemas financeiros existentes, tornando-o a escolha preferencial para instituições em transformação digital.

Espera-se que o segmento híbrido testemunhe o CAGR mais rápido de 2025 a 2032, à medida que as organizações buscam equilibrar a segurança dos sistemas locais com a flexibilidade das soluções baseadas em nuvem, especialmente em setores altamente regulamentados, como bancos e governo.

- Por usuário final

Com base no usuário final, o mercado de software AML é segmentado em grandes empresas e pequenas e médias empresas (PMEs). O segmento de grandes empresas dominou o mercado com uma participação significativa em 2024, impulsionado por suas complexas necessidades operacionais, altos volumes de transações e orçamentos substanciais para soluções avançadas de AML.

Espera-se que o segmento de PMEs cresça na CAGR mais rápida de 2025 a 2032, impulsionado pelas crescentes pressões regulatórias sobre organizações menores e pela disponibilidade de soluções AML acessíveis e baseadas em nuvem, adaptadas às suas necessidades.

Análise regional do mercado de software antilavagem de dinheiro

América do Norte

A América do Norte dominou o mercado global de software AML, com uma participação de receita de 33,04% em 2024, impulsionada pela infraestrutura financeira avançada da região, por marcos regulatórios rigorosos, como o USA PATRIOT Act e o Bank Secrecy Act, e pela ampla adoção nos setores bancário, de serviços financeiros e de seguros. As instituições financeiras na América do Norte valorizam muito a eficiência, a escalabilidade e os recursos de monitoramento em tempo real oferecidos pelo software AML, que se integra perfeitamente a tecnologias avançadas como IA, ML e blockchain para garantir a conformidade e combater crimes financeiros. A ampla adoção é ainda apoiada por uma forte fiscalização regulatória, altas taxas de crimes financeiros e pela presença de provedores líderes de soluções AML, como a LexisNexis Risk Solutions e a NICE Actimizet.

Visão do mercado de software antilavagem de dinheiro dos EUA

O mercado de software AML dos EUA capturou a maior fatia da receita, de 82,51%, na América do Norte em 2024, impulsionado pela rápida adoção de tecnologias financeiras avançadas e um foco crescente no combate a crimes financeiros em um ecossistema financeiro altamente digitalizado. As instituições financeiras estão priorizando o monitoramento de transações em tempo real, processos KYC aprimorados e triagem de sanções para atender aos rigorosos requisitos regulatórios de órgãos como a Autoridade Reguladora do Setor Financeiro (FINRA) e a Comissão de Valores Mobiliários (SEC). A crescente preferência por soluções AML baseadas em IA e em nuvem, combinada com a forte demanda por integração com plataformas bancárias digitais e criptomoedas, impulsiona ainda mais o mercado. Regulamentações favoráveis e a presença de empresas líderes como SAS Institute e Fiserv estão contribuindo significativamente para a expansão do mercado.

Visão do mercado de software antilavagem de dinheiro na Europa

O mercado europeu de software AML deverá crescer a uma CAGR substancial ao longo do período previsto, impulsionado principalmente por padrões regulatórios rigorosos, como a Quinta e a Sexta Diretivas Antilavagem de Dinheiro da UE, e pela crescente necessidade de soluções robustas de conformidade nos setores bancário, de seguros e emergentes, como as corretoras de criptomoedas. O aumento das transações internacionais, aliado à demanda por análises avançadas para detectar crimes financeiros sofisticados, está fomentando a adoção de software AML nos setores financeiro e não financeiro. As instituições financeiras europeias também são atraídas pelos benefícios de eficiência e transparência oferecidos por soluções baseadas em IA e blockchain, com crescimento significativo observado em importantes centros financeiros como Reino Unido, Alemanha e Suíça.

Visão geral do mercado de software antilavagem de dinheiro no Reino Unido

Prevê-se que o mercado de software AML do Reino Unido cresça a um CAGR considerável durante o período previsto, impulsionado pela crescente tendência dos bancos digitais, pelo rápido crescimento das startups de fintech e pela necessidade de maior conformidade para combater crimes financeiros. Preocupações com penalidades regulatórias, que podem chegar a milhões de libras, e riscos à reputação estão incentivando instituições financeiras e entidades regulamentadas a adotar soluções avançadas de AML para monitoramento de transações, conformidade com KYC e análise de sanções. Espera-se que o robusto setor de serviços financeiros do Reino Unido, juntamente com sua sólida estrutura regulatória sob a Autoridade de Conduta Financeira (FCA), continue estimulando o crescimento do mercado.

Visão do mercado de software antilavagem de dinheiro na Alemanha

Espera-se que o mercado de software AML na Alemanha cresça a um CAGR considerável durante o período previsto, impulsionado pela crescente conscientização sobre os riscos de crimes financeiros, pela demanda por soluções de conformidade tecnologicamente avançadas e pela posição da Alemanha como um centro financeiro líder na Europa. O setor financeiro bem desenvolvido da Alemanha, combinado com sua ênfase em conformidade regulatória e segurança de dados sob a Autoridade Federal de Supervisão Financeira (BaFin), promove a adoção de software AML, especialmente em bancos, seguros e corretoras de criptomoedas. A integração de soluções AML com análises orientadas por IA e plataformas baseadas em nuvem está se tornando cada vez mais prevalente, alinhando-se às prioridades locais para operações financeiras eficientes, seguras e em conformidade.

Visão do mercado de software antilavagem de dinheiro na Ásia-Pacífico

O mercado de software AML da região Ásia-Pacífico deverá crescer à taxa composta de crescimento anual (CAGR) mais rápida, de 18,2%, durante o período previsto de 2025 a 2032, impulsionado pela rápida digitalização, pelo aumento das transações internacionais e por iniciativas governamentais proativas para combater crimes financeiros em países como China, Índia e Cingapura. A crescente adoção de plataformas de pagamento digitais na região, apoiada por iniciativas governamentais como o programa Digital India da Índia e a iniciativa Smart Nation de Cingapura, está impulsionando a demanda por software AML para monitorar transações de alto risco e garantir a conformidade regulatória. Além disso, à medida que a região Ásia-Pacífico emerge como um polo de inovação em tecnologia financeira e adoção de criptomoedas, a acessibilidade e a escalabilidade das soluções AML baseadas em nuvem estão se expandindo para uma gama mais ampla de instituições, incluindo PMEs e startups de fintech.

Visão do mercado de software antilavagem de dinheiro no Japão

O mercado japonês de software AML está ganhando impulso devido ao avançado setor de tecnologia financeira do país, ao rápido crescimento dos pagamentos digitais e à crescente demanda por soluções robustas de conformidade para lidar com os riscos de crimes financeiros. O mercado japonês dá grande ênfase à precisão, confiabilidade e aderência regulatória, e a adoção de software AML é impulsionada pelo crescente volume de transações bancárias digitais, e-commerce e criptomoedas. A integração de soluções AML com tecnologias de IA, aprendizado de máquina e blockchain está impulsionando o crescimento, permitindo que instituições financeiras detectem esquemas sofisticados de lavagem de dinheiro. Além disso, o rigoroso ambiente regulatório do Japão sob a Agência de Serviços Financeiros (FSA) e a Lei de Prevenção à Transferência de Recursos Criminais provavelmente estimulará a demanda por sistemas AML avançados em bancos, serviços financeiros e setores emergentes, como corretoras de criptomoedas.

Visão do mercado de software antilavagem de dinheiro da China

O mercado chinês de software AML foi responsável pela maior fatia da receita de mercado na região Ásia-Pacífico em 2024, devido à rápida expansão da economia digital do país, ao crescimento significativo dos serviços bancários online e do comércio eletrônico e aos altos índices de fiscalização regulatória da Comissão Reguladora de Bancos e Seguros da China (CBIRC) e do Banco Popular da China (PBoC). A China se destaca como um dos maiores mercados para software AML, com amplo uso em bancos, fintechs e corretoras de criptomoedas para monitorar transações de alto risco e garantir a conformidade com as regulamentações de combate à lavagem de dinheiro. O impulso para sistemas financeiros digitais, a crescente adoção de criptomoedas e a disponibilidade de soluções AML escaláveis, juntamente com fortes provedores nacionais, são fatores-chave que impulsionam o mercado na China.

Participação de mercado de software antilavagem de dinheiro

- O setor de software antilavagem de dinheiro é liderado principalmente por empresas bem estabelecidas, incluindo:

- LexisNexis Risk Solutions (Estados Unidos)

- NICE Actimize (Estados Unidos)

- SAS Institute Inc. (Estados Unidos)

- Fiserv Inc. (Estados Unidos)

- Oracle Corporation (Estados Unidos)

- BAE Systems PLC (Reino Unido)

- Thomson Reuters Corporation (Canadá)

- Accenture PLC (Irlanda)

- FICO (Fair Isaac Corporation) (Estados Unidos)

- ComplyAdvantage Ltd. (Reino Unido)

- Refinitiv (Reino Unido)

- ACI Worldwide Inc. (Estados Unidos)

- TransUnion Holding Company Inc. (Estados Unidos)

- Feedzai Inc. (Portugal)

- CaseWare RCM Inc. (Canadá)

- Temenos AG (Suíça)

- WorkFusion (Estados Unidos)

- Eastnets Holding Ltd. (Emirados Árabes Unidos)

- Dow Jones Risk & Compliance (Estados Unidos)

- Quantexa Ltd. (Reino Unido)

- Alessa da Tier1 Financial Solutions (Canadá)

- Verafin Inc. (Canadá)

Últimos desenvolvimentos no mercado global de software antilavagem de dinheiro

- Em abril de 2023, a NICE Actimize lançou o SAM-10, uma solução de monitoramento de transações baseada em IA com análises multicamadas para aprimorar a detecção de atividades suspeitas e reduzir falsos positivos, melhorando a eficiência de conformidade para instituições financeiras em todo o mundo.

- Em janeiro de 2024, a FICO introduziu uma solução AML aprimorada com algoritmos avançados de aprendizado de máquina projetados para melhorar a detecção de anomalias, abordando a crescente complexidade de crimes financeiros em transações bancárias digitais e criptomoedas.

- Em fevereiro de 2023, a NICE Actimize anunciou uma parceria estratégica com a Microsoft para integrar suas soluções AML com o Microsoft Azure, fornecendo às instituições financeiras um ambiente robusto baseado em nuvem para maior conformidade, escalabilidade e gerenciamento de riscos.

- Em outubro de 2023, a WorkFusion lançou o Isaac, uma solução orientada por IA projetada para automatizar revisões de alertas de primeiro nível para monitoramento de transações de AML, escalando casos de alto risco e fechando alertas não suspeitos com documentação de suporte abrangente, reduzindo cargas de trabalho manuais.

- Em maio de 2025, a Azentio Software revelou o Amlock, uma plataforma AML de última geração com recursos avançados de IA para combater crimes financeiros no setor bancário, de serviços financeiros e de seguros (BFSI), aprimorando o monitoramento em tempo real, os processos KYC e a triagem de sanções.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.