Global External Cloud Automotive Cyber Security Services Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

3.40 Billion

USD

12.02 Billion

2024

2032

USD

3.40 Billion

USD

12.02 Billion

2024

2032

| 2025 –2032 | |

| USD 3.40 Billion | |

| USD 12.02 Billion | |

|

|

|

|

Segmentação do mercado global de serviços de segurança cibernética automotiva em nuvem externa, por segurança (segurança de endpoint, segurança de aplicativo e segurança de rede sem fio), aplicação (sistema telemático, sistema de infoentretenimento, sistema de transmissão, sistema de controle e conforto da carroceria, sistema de comunicação e ADAS e sistema de segurança), veículo (carro de passeio e veículo comercial), veículo elétrico (veículo elétrico a bateria, veículo elétrico híbrido e veículo elétrico híbrido plug-in) - Tendências do setor e previsões até 2032

Tamanho do mercado de serviços de segurança cibernética automotiva em nuvem externa

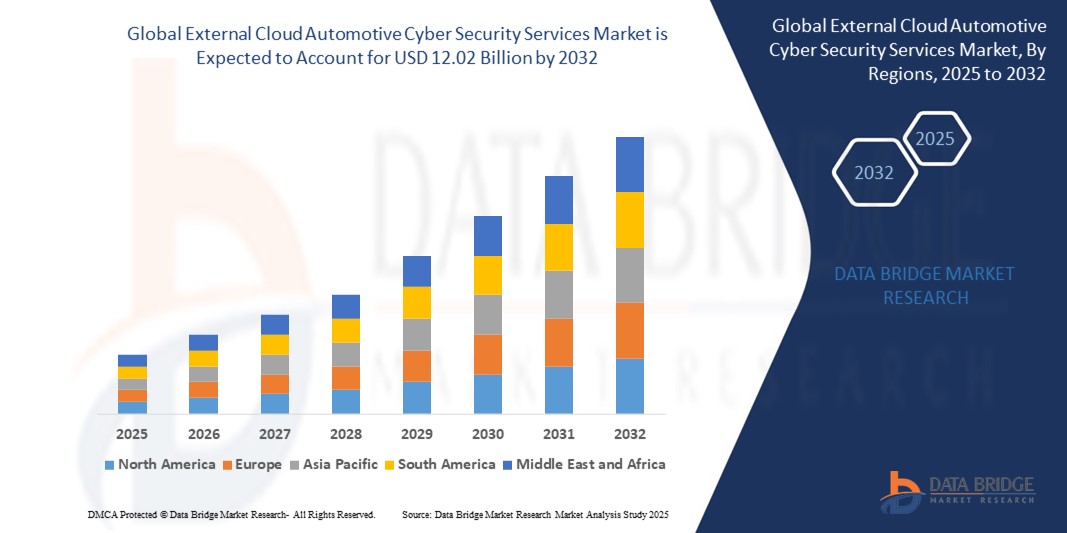

- O tamanho do mercado global de serviços de segurança cibernética automotiva em nuvem externa foi avaliado em US$ 3,4 bilhões em 2024 e deve atingir US$ 12,02 bilhões até 2032 , com um CAGR de 17,1% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela rápida adoção de tecnologias de veículos conectados e autônomos, pela crescente dependência de serviços automotivos baseados em nuvem e pelo aumento das ameaças à segurança cibernética direcionadas aos sistemas de comunicação e controle de veículos.

- Além disso, os rigorosos requisitos regulatórios para a proteção de dados automotivos, as crescentes preocupações dos consumidores com privacidade e segurança e a expansão da infraestrutura V2X (veículo para tudo) estão levando fabricantes de equipamentos originais (OEMs) e operadores de frotas a implementar soluções robustas de segurança cibernética em nuvem externa. Essas dinâmicas combinadas estão acelerando o crescimento do mercado e reforçando a necessidade de estruturas de segurança cibernética automotiva escaláveis e nativas da nuvem.

Análise de mercado de serviços de segurança cibernética automotiva em nuvem externa

- Os serviços externos de segurança cibernética automotiva em nuvem abrangem uma gama de soluções e protocolos de segurança projetados para proteger os sistemas eletrônicos, redes de comunicação, algoritmos e dados de usuários de veículos conectados contra ataques maliciosos ou acesso não autorizado, com foco especial em sistemas e serviços baseados em nuvem. Esses serviços visam proteger a crescente conectividade e os sistemas de software dos veículos contra ameaças cibernéticas, aprimorando assim a segurança geral, a integridade dos dados e a confiabilidade das tecnologias automotivas modernas.

- A crescente necessidade por esses serviços é impulsionada principalmente pela crescente adoção de veículos conectados e autônomos, o que, inerentemente, expande o cenário de potenciais vulnerabilidades cibernéticas. Além disso, a crescente frequência e sofisticação dos ataques cibernéticos direcionados à indústria automotiva, aliadas a regulamentações governamentais rigorosas e à crescente conscientização do consumidor sobre privacidade de dados e segurança veicular, estão criando uma demanda significativa por serviços robustos de segurança cibernética externa baseados em nuvem para garantir proteção abrangente e mitigação de ameaças.

- A América do Norte dominou o mercado externo de serviços de segurança cibernética automotiva em nuvem com uma participação de 42,6% em 2024 devido à crescente demanda por soluções automotivas inteligentes na região

- Espera-se que a Ásia-Pacífico seja a região de crescimento mais rápido no mercado de serviços de segurança cibernética automotiva em nuvem externa, com uma participação de 100% durante o período previsto, devido à rápida transformação digital do setor automotivo na China, Japão, Coreia do Sul e Índia.

- O segmento de segurança de redes sem fio dominou o mercado, com uma participação de mercado de 43,0% em 2024, devido à expansão das comunicações V2X e à conectividade veicular baseada em 5G. À medida que os veículos dependem cada vez mais de canais sem fio para atualizações, diagnósticos e navegação, proteger essas vias de comunicação tornou-se vital, especialmente contra interceptação e falsificação de dados.

Escopo do Relatório e Segmentação do Mercado de Serviços de Segurança Cibernética Automotiva em Nuvem Externa

|

Atributos |

Principais insights de mercado sobre serviços de segurança cibernética automotiva em nuvem externa |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Europa

Ásia-Pacífico

Oriente Médio e África

Ámérica do Sul

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além de insights de mercado, como valor de mercado, taxa de crescimento, segmentos de mercado, cobertura geográfica, participantes do mercado e cenário de mercado, o relatório de mercado selecionado pela equipe de pesquisa de mercado da Data Bridge inclui análise aprofundada de especialistas, análise de importação/exportação, análise de preços, análise de consumo de produção e análise pilão. |

Tendências do mercado de serviços de segurança cibernética automotiva em nuvem externa

“Aumento da conectividade e digitalização dos veículos”

- Uma tendência significativa e crescente no mercado global de serviços de segurança cibernética automotiva em nuvem externa é a crescente conectividade e digitalização dos veículos, refletindo a mudança mais ampla em direção a veículos definidos por software, atualizações remotas e plataformas de nuvem integradas. À medida que os veículos se tornam mais dependentes de trocas externas de dados para infoentretenimento, diagnóstico e funcionalidade autônoma, a necessidade de soluções avançadas de segurança cibernética baseadas em nuvem torna-se primordial.

- Por exemplo, grandes empresas como a Continental AG e a Harman International (subsidiária da Samsung) estão desenvolvendo ativamente sistemas de defesa cibernética integrados à nuvem para proteger as comunicações e os dados dos veículos. A plataforma Automotive Edge da Continental integra funções de segurança cibernética para sistemas de veículos conectados, enquanto o Shield Auto Cybersecurity da Harman oferece monitoramento em nuvem e detecção de ameaças em tempo real. Da mesma forma, a plataforma QNX da Blackberry, amplamente utilizada em sistemas veiculares, está cada vez mais associada aos serviços de segurança cibernética em nuvem da Cylance, baseados em IA, para lidar com ameaças em evolução.

- A crescente pegada digital dos veículos modernos os expõe a novas vulnerabilidades, como execução remota de código, violações de dados e manipulação de sistemas. Recursos como diagnóstico remoto, sincronização do veículo com a nuvem e funções de direção autônoma dependem fortemente de conexões seguras na nuvem, tornando as soluções de segurança baseadas na nuvem um requisito crítico. As crescentes expectativas dos consumidores por serviços digitais integrados e a proliferação de modelos de veículos conectados estão acelerando o ritmo dessa transformação.

- Essa tendência não se limita a marcas de luxo ou premium; montadoras de veículos de massa também estão investindo em segurança cibernética em nuvem externa, à medida que a conectividade padrão se torna mais difundida. Recursos de detecção de ameaças em nuvem, prevenção de intrusão e atualizações seguras via rádio estão sendo adotados em uma gama crescente de categorias de veículos, com o suporte de soluções de monitoramento e conformidade em tempo real de fornecedores especializados em segurança.

- Consequentemente, empresas como Tesla, Ford e BMW estão alavancando parcerias com provedores de segurança cibernética para reforçar suas plataformas de carros conectados. As atualizações frequentes de software da Tesla dependem de uma infraestrutura de nuvem segura, enquanto os serviços BlueCruise da Ford e ConnectedDrive da BMW incorporam mecanismos de segurança em nuvem multicamadas para proteger a integridade do veículo e os dados do usuário em redes distribuídas.

- A demanda por serviços externos de segurança cibernética em nuvem está se expandindo rapidamente entre OEMs, fornecedores de nível 1 e provedores de serviços de mobilidade, à medida que os veículos operam cada vez mais como plataformas digitais conectadas. Essa tendência está remodelando fundamentalmente o cenário da segurança cibernética automotiva, impulsionando a inovação e obrigando o setor a priorizar arquiteturas de segurança nativas da nuvem para proteger o futuro da mobilidade.

Dinâmica do mercado de serviços de segurança cibernética automotiva em nuvem externa

Motorista

“Crescentes preocupações com a segurança cibernética”

- As crescentes preocupações com a segurança cibernética na indústria automotiva são um fator significativo para a crescente demanda por serviços externos de segurança cibernética automotiva em nuvem, à medida que os veículos modernos se tornam mais conectados e suscetíveis a ameaças digitais que visam dados do usuário e sistemas de controle do veículo.

- Por exemplo, grandes empresas de segurança cibernética, como a Upstream Security, fornecem soluções de inteligência e monitoramento de ameaças baseadas em nuvem, especialmente adaptadas para veículos conectados, detectando anomalias em tempo real e protegendo frotas de ataques cibernéticos em larga escala. Da mesma forma, a GuardKnox e a AUTOCRYPT oferecem plataformas especializadas de segurança cibernética automotiva integradas à nuvem, projetadas para proteger veículos definidos por software contra intrusão, manipulação e acesso não autorizado.

- À medida que as montadoras integram cada vez mais recursos como diagnóstico remoto, streaming de infoentretenimento, recursos de direção autônoma e atualizações over-the-air (OTA), elas enfrentam maior exposição a ameaças potenciais, como ransomware, adulteração de firmware e violações de dados. Esse cenário crescente de ameaças está levando os fabricantes de equipamentos originais (OEMs) a adotar defesas cibernéticas externas baseadas em nuvem, que podem ser escalonadas para diferentes modelos de veículos e regiões.

- Além disso, o aumento no número de incidentes relatados de ataques cibernéticos e vulnerabilidades relacionadas a veículos está levando os órgãos reguladores a introduzir padrões de conformidade de segurança cibernética mais rigorosos, como o UNECE WP.29, que exige a gestão de riscos ao longo do ciclo de vida do veículo. Essas estruturas estão acelerando a necessidade de uma infraestrutura de segurança robusta baseada em nuvem.

- A demanda por serviços de segurança cibernética em nuvem confiáveis, escaláveis e adaptáveis está crescendo constantemente, à medida que as partes interessadas em toda a cadeia de valor automotiva buscam mitigar os riscos crescentes da conectividade veicular. Essa tendência está impulsionando o setor a investir proativamente em tecnologias de segurança nativas da nuvem, remodelando o cenário da proteção de veículos conectados.

Restrição/Desafio

“Sistemas Legados Desafiam a Integração da Cibersegurança”

- Sistemas veiculares legados e arquiteturas de unidades de controle eletrônico (ECU) obsoletas representam um desafio significativo para a integração perfeita de serviços externos de segurança cibernética automotiva em nuvem, potencialmente limitando sua eficácia na proteção de modelos de veículos mais antigos. A falta de uniformidade entre as plataformas de veículos dificulta a implementação de soluções de segurança modernas e baseadas em nuvem em escala.

- Por exemplo, grandes provedores de segurança cibernética, como AUTOCRYPT e Karamba Security, frequentemente enfrentam obstáculos ao implementar proteção avançada baseada em nuvem em modelos de veículos mais antigos, sem o poder computacional ou os protocolos de conectividade necessários para suportar estruturas de segurança modernas. Da mesma forma, a Upstream Security destacou as lacunas de integração impostas por ecossistemas de software automotivo fragmentados, especialmente em frotas com gerações mistas de hardware.

- Para enfrentar esses desafios, as montadoras e os fornecedores de segurança cibernética precisam modernizar os sistemas legados com gateways intermediários ou patches de software que permitam compatibilidade parcial com os serviços em nuvem. No entanto, essa modernização pode ser custosa, complexa e pode não oferecer proteção completa contra ameaças, deixando alguns sistemas vulneráveis.

- Para complicar ainda mais a questão, há o ciclo de vida prolongado de muitos veículos, especialmente em mercados emergentes, onde modelos mais antigos continuam operando por anos sem a infraestrutura necessária para atualizações contínuas de segurança ou diagnósticos remotos. Isso aumenta os riscos de segurança cibernética a longo prazo e complica a conformidade regulatória.

- O desafio de proteger sistemas legados ressalta a importância do desenvolvimento de arquiteturas de segurança cibernética flexíveis e compatíveis com versões anteriores. Para que o mercado de serviços externos de segurança cibernética automotiva em nuvem alcance ampla adoção, os provedores precisam inovar maneiras de proteger plataformas de veículos antigos, mantendo a interoperabilidade com sistemas de próxima geração.

Escopo de mercado de serviços de segurança cibernética automotiva em nuvem externa

O mercado é segmentado com base em segurança, aplicação, veículo e veículo elétrico.

- Por Segurança

Com base na segurança, o mercado é segmentado em segurança de endpoints, segurança de aplicações e segurança de redes sem fio. O segmento de segurança de redes sem fio representou a maior fatia da receita de mercado, 43,0% em 2024, impulsionado pela expansão das comunicações V2X e da conectividade veicular baseada em 5G. À medida que os veículos dependem cada vez mais de canais sem fio para atualizações, diagnósticos e navegação, proteger essas vias de comunicação tornou-se vital, especialmente contra interceptação e falsificação de dados.

Espera-se que o segmento de segurança de endpoints apresente o CAGR mais rápido entre 2025 e 2032, impulsionado pela crescente necessidade de proteger endpoints de veículos, como ECUs e unidades telemáticas, contra ataques cibernéticos. À medida que os veículos modernos integram mais recursos conectados à nuvem, o risco de acesso não autorizado aumenta, tornando a segurança de endpoints uma camada crítica. As montadoras estão priorizando cada vez mais a proteção de endpoints como parte de suas estratégias mais amplas de segurança cibernética.

- Por aplicação

Com base na aplicação, o mercado é segmentado em sistemas telemáticos, sistemas de infoentretenimento, sistemas de propulsão, sistemas de controle e conforto da carroceria, sistemas de comunicação e sistemas ADAS e de segurança. O segmento de sistemas de infoentretenimento deteve a maior participação de mercado, com 36,57% de receita em 2024, impulsionado pela ampla integração de recursos conectados, como navegação, assistentes de voz, atualizações de trânsito em tempo real e serviços de streaming em veículos modernos. Esses sistemas frequentemente interagem com redes externas e plataformas em nuvem, aumentando sua vulnerabilidade a ameaças cibernéticas e impulsionando a demanda por serviços avançados de segurança cibernética.

O segmento de ADAS e sistemas de segurança deverá apresentar o crescimento mais rápido, com uma taxa composta de crescimento anual (CAGR) de 22,6% entre 2025 e 2032, devido à crescente implantação de recursos de direção autônoma e à necessidade crítica de garantir a troca de dados em tempo real entre sensores e unidades de controle. A integridade das funções ADAS, incluindo prevenção de colisões e assistência de faixa, é essencial para a segurança dos passageiros, o que motiva investimentos em serviços externos robustos de segurança cibernética.

- Por veículo

Com base no veículo, o mercado é segmentado em automóveis de passeio e veículos comerciais. O segmento de automóveis de passeio conquistou a maior fatia de mercado em 2024, devido à rápida adoção de tecnologias conectadas e à crescente demanda dos consumidores por acesso à internet a bordo e integração de aplicativos móveis. Os principais fabricantes de equipamentos originais (OEMs) estão integrando soluções externas de segurança cibernética em nuvem para aprimorar a segurança dos passageiros e a reputação da marca.

Espera-se que o segmento de veículos comerciais cresça com a CAGR mais rápida entre 2025 e 2032, impulsionado pelo crescimento das frotas de logística conectadas e pela necessidade de prevenir sequestros remotos ou roubo de dados. Serviços seguros baseados em nuvem são cada vez mais utilizados por operadores de frotas para proteger dados operacionais e de comunicação, garantir a conformidade e reduzir o tempo de inatividade relacionado à segurança cibernética.

- Por veículo elétrico

Com base nos veículos elétricos, o mercado é segmentado em veículos elétricos a bateria (BEV), veículos elétricos híbridos (HEV) e veículos elétricos híbridos plug-in (PHEV). O segmento de veículos elétricos a bateria dominou a maior fatia da receita em 2024, visto que os BEVs são normalmente construídos com sistemas digitais altamente integrados, aumentando a exposição a ameaças baseadas na nuvem. As montadoras estão equipando os BEVs com estruturas avançadas de cibersegurança para garantir atualizações OTA seguras e interfaces digitais.

O segmento de veículos elétricos híbridos plug-in deverá registrar o CAGR mais rápido entre 2025 e 2032, impulsionado pela convergência do gerenciamento duplo do trem de força e do monitoramento remoto de energia. Os PHEVs exigem camadas sofisticadas de segurança cibernética para proteger tanto os diagnósticos baseados em nuvem quanto os dados do usuário, à medida que os serviços digitais se tornam mais integrados à operação do veículo.

Análise regional do mercado de serviços de segurança cibernética automotiva em nuvem externa

- A América do Norte dominou o mercado externo de serviços de segurança cibernética automotiva em nuvem com a maior participação na receita de 42,6% em 2024, impulsionada pela crescente demanda por soluções automotivas inteligentes na região

- Além disso, o aumento do apoio governamental e do investimento para combater ataques cibernéticos na indústria automotiva também são fatores significativos que impulsionam o crescimento do mercado na América do Norte

Visão do mercado de serviços de segurança cibernética automotiva em nuvem externa dos EUA

O mercado dos EUA conquistou a maior fatia da receita em 2024 na América do Norte, impulsionado pela ampla implantação de tecnologias de veículos conectados e pelo rápido crescimento dos serviços automotivos baseados em nuvem. Fabricantes de equipamentos originais (OEMs) e operadores de frotas estão investindo cada vez mais em soluções externas de segurança cibernética em nuvem para proteger sistemas críticos, como infoentretenimento, telemática e ADAS. A forte presença de fornecedores de segurança cibernética, aliada a rigorosos requisitos regulatórios para proteção de dados automotivos, continua a impulsionar a expansão do mercado no país.

Visão do mercado de serviços de segurança cibernética automotiva em nuvem externa na Europa

O mercado europeu deverá crescer a uma CAGR robusta durante o período previsto, impulsionado pelo crescente escrutínio regulatório e pela ênfase na segurança da infraestrutura de veículos conectados e autônomos. A crescente adoção da comunicação V2X, aliada aos rigorosos requisitos de conformidade com o GDPR, está incentivando os fabricantes automotivos a implementar serviços avançados de segurança cibernética baseados em nuvem. O mercado também está se beneficiando dos esforços colaborativos entre montadoras e empresas de tecnologia para lidar com as crescentes ameaças cibernéticas nos ecossistemas digitais dos veículos.

Visão do mercado de serviços de segurança cibernética automotiva em nuvem externa do Reino Unido

Espera-se que o mercado do Reino Unido testemunhe um crescimento constante, apoiado pelo foco estratégico do país em mobilidade inteligente e segurança cibernética. Iniciativas apoiadas pelo governo para proteger plataformas de veículos conectados estão incentivando fabricantes de equipamentos originais (OEMs) a adotar estruturas robustas de segurança em nuvem externa. Além disso, a crescente penetração de veículos elétricos e serviços de carros conectados está aumentando a demanda por soluções de segurança cibernética escaláveis e integradas à nuvem em todo o setor automotivo.

Visão do mercado de serviços de segurança cibernética automotiva em nuvem externa na Alemanha

Prevê-se que o mercado alemão se expanda significativamente, impulsionado por seu status como um polo de inovação automotiva e um forte defensor da privacidade de dados. À medida que as montadoras alemãs aceleram sua transição para veículos definidos por software, a necessidade de proteger serviços de nuvem externos integrados a infoentretenimento, telemática e ADAS se intensifica. Os rigorosos padrões de segurança cibernética do país e o investimento em infraestrutura de mobilidade inteligente reforçam ainda mais sua liderança em soluções de defesa cibernética automotiva.

Visão do mercado de serviços de segurança cibernética automotiva em nuvem externa na Ásia-Pacífico

O mercado da Ásia-Pacífico deverá registrar o CAGR mais rápido entre 2025 e 2032, impulsionado pela rápida transformação digital do setor automotivo na China, Japão, Coreia do Sul e Índia. O aumento da produção e da adoção de veículos conectados e elétricos, juntamente com iniciativas de mobilidade inteligente lideradas por governos, estão impulsionando a demanda por serviços avançados de segurança cibernética em nuvem externa. A robusta base de fabricação automotiva da região e a crescente ênfase na proteção de dados são fatores-chave para a aceleração do mercado.

Visão do mercado de serviços de segurança cibernética automotiva em nuvem externa do Japão

O mercado japonês está ganhando força à medida que as tecnologias de veículos conectados e autônomos se tornam mais prevalentes. O cenário automotivo de alta tecnologia do país e a ênfase regulatória na prontidão para a segurança cibernética estão levando as montadoras a aprimorarem suas camadas de proteção baseadas em nuvem. Além disso, o foco do Japão em mobilidade contínua e sua crescente população idosa estão contribuindo para a adoção de sistemas veiculares seguros e gerenciados em nuvem.

Visão do mercado de serviços de segurança cibernética automotiva em nuvem externa da China

A China foi responsável pela maior fatia de mercado na região Ásia-Pacífico em 2024, impulsionada por sua capacidade dominante de fabricação automotiva, rápida implementação do 5G e expansão agressiva de iniciativas de cidades inteligentes. O crescente número de veículos conectados e elétricos está aumentando a exposição a riscos cibernéticos, impulsionando a demanda por serviços de segurança cibernética baseados em nuvem. Montadoras e gigantes da tecnologia nacionais estão investindo pesadamente em infraestrutura em nuvem para fornecer serviços seguros e escaláveis a bordo dos veículos, reforçando a liderança da China no mercado.

Participação no mercado de serviços de segurança cibernética automotiva em nuvem externa

O setor de serviços externos de segurança cibernética automotiva em nuvem é liderado principalmente por empresas bem estabelecidas, incluindo:

Os principais líderes de mercado que operam no mercado são:

- HARMAN International (EUA)

- Continental AG (Alemanha)

- DENSO CORPORATION (Japão)

- Aptiv (Irlanda)

- NXP Semiconductors (Holanda)

- Honeywell International Inc. (EUA)

- Trillium Secure, Inc. (EUA)

- ETAS (Alemanha)

- Vector Informatik GmbH (Alemanha)

- Karamba Security (Israel)

- GUARDKNOX (Israel)

- Upstream Security Ltda. (Israel)

- Lear (EUA)

- Capricode Oy (Finlândia)

- Fujitsu (Japão)

- Telefonaktiebolaget LM Ericsson (Suécia)

Últimos desenvolvimentos no mercado global de serviços de segurança cibernética automotiva em nuvem externa

- Em abril de 2024, a Argus Cyber Security, líder global em segurança cibernética automotiva, realizou com sucesso testes de penetração em nível de veículo no novo caminhão pesado F-MAX da Ford Trucks. Esses testes, que atenderam à regulamentação de segurança cibernética UNR 155, representaram um marco significativo para a Ford Trucks na obtenção da certificação de homologação para o modelo F-MAX.

- Em abril de 2023, a Upstream Security, startup israelense especializada em cibersegurança automotiva, garantiu um investimento não divulgado da Cisco Investments. Este investimento ocorre em um momento em que a demanda por veículos e outros dispositivos conectados à internet continua a crescer. A Cisco Investments, braço de capital de risco corporativo da Cisco Systems, fez este investimento estratégico na Upstream Security para apoiar seu crescimento e desenvolvimento no setor de cibersegurança automotiva.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.