Mercado de gestão da força de trabalho da América do Norte, por oferta (soluções e serviços), dimensão da organização (grandes empresas e pequenas e médias empresas), sistemas operativos (Windows, Android, iOS, LINUX e outros), modelo de implementação (cloud e local) , Utilizador final ( banca, serviços financeiros e seguros , automóvel, telecomunicações e TI, manufatura, saúde, defesa e governo, transportes e logística, bens de consumo e retalho, soluções de energia e serviços públicos e outros) - tendências e previsões do sector até 2030 .

Análise e dimensão do mercado de gestão da força de trabalho na América do Norte

A gestão da força de trabalho refere-se aos processos e ferramentas utilizados pelas organizações para otimizar a produtividade e a eficiência dos seus colaboradores. O mercado de gestão da força de trabalho está a crescer rapidamente, impulsionado pela crescente adoção de soluções baseadas na cloud e pela necessidade das empresas melhorarem a sua eficiência operacional. No entanto, este mercado também enfrenta diversas restrições, como a escassez de mão-de-obra qualificada e a crescente complexidade das leis e regulamentos laborais. Neste contexto, é importante compreender as tendências e os fatores atuais que moldam o mercado de gestão da força de trabalho e os desafios que as organizações enfrentam neste campo.

A Data Bridge Market Research analisa que o mercado de gestão de força de trabalho na América do Norte deverá atingir os 3.574.810,79 mil dólares até 2030, com um CAGR de 10,1% durante o período previsto. O relatório do mercado de gestão da força de trabalho na América do Norte também abrange de forma abrangente a análise de preços, a análise de patentes e os avanços tecnológicos.

|

Métrica de Reporte |

Detalhes |

|

Período de previsão |

2023 a 2030 |

|

Ano base |

2022 |

|

Anos históricos |

2021 (Personalizável para 2020-2016) |

|

Unidades quantitativas |

Receita em USD mil |

|

Segmentos abrangidos |

Oferta (Soluções e Serviços), Dimensão da Organização (Grande Empresa e Pequenas e Médias Empresas), Sistemas Operativos (Windows, Android, iOS, LINUX e Outros), Modelo de Implantação (Nuvem e Local), Utilizador Final (Bancos, Serviços financeiros e seguros, automóvel, telecomunicações e TI, manufatura, saúde, defesa e governo, transportes e logística, bens de consumo e retalho, soluções de energia e serviços públicos e outros) |

|

Países abrangidos |

EUA, Canadá e México. |

|

Atores do mercado abrangidos |

UKG Inc., Reflexis Systems, Inc., SAP, Verint Systems Inc., ADP, ATOSS Software AG, NICE, Workday, Inc., Visier, Inc., Ceridian HCM, Inc., Paylocity., Paycom Payroll LLC., Sumtotal Systems, LLC, Infor, Cegid Meta4, Ramco Systems, Replicon, IBM, INFORM Software, InVision AG, Oracle |

Definição de Mercado

A gestão da força de trabalho otimiza a produtividade dos colaboradores, garantindo que todos os recursos funcionam no momento e no local certos. A gestão da força de trabalho compreende normalmente a previsão, a programação, a gestão de competências, a gestão intradiária, o controlo de ponto e assiduidade. O software de gestão da força de trabalho é geralmente incorporado em aplicações de RH de empresas externas e tecnologias importantes de RH que atuam como repositórios importantes para informações sobre emprego. Isto ajuda os RH a gerir os colaboradores de forma eficiente para aumentar a produtividade da organização. A gestão da força de trabalho (WFM) cumpre eficazmente os requisitos de trabalho e estabelece e gere os horários dos colaboradores para executar uma tarefa específica diariamente e de hora a hora. A gestão da força de trabalho introduz tecnologias de IoT e IA para oferecer soluções melhoradas para a gestão de recursos humanos. O segmento da cloud está a crescer no mercado de gestão de força de trabalho da Ásia-Pacífico devido a vantagens como escalabilidade ilimitada, controlo e várias aplicações.

Dinâmica do mercado de gestão da força de trabalho na América do Norte

Esta secção trata da compreensão dos impulsionadores, vantagens, oportunidades, restrições e desafios do mercado. Tudo isto é discutido em detalhe abaixo:

MOTORISTAS

- Adoção crescente de soluções de gestão de força de trabalho baseadas na cloud e na Internet das Coisas (IoT)

A internet das coisas é uma das tecnologias potenciais que pode fornecer soluções modernas para locais de trabalho modernos para impulsionar a cultura de trabalho e otimizar a utilização dos recursos. A utilização da IoT e da tecnologia baseada na cloud na gestão da força de trabalho permite uma melhor conectividade, competências de tomada de decisão e interoperabilidade perfeita, além de desenvolver uma cultura de trabalho inteligente.

- Aumento da penetração de soluções analíticas e aplicações de dispositivos conectados

A análise da força de trabalho combina software e metodologia, o que aplica modelos estatísticos a dados relacionados com o trabalho e permite às organizações otimizar os recursos humanos. Estas tecnologias e análises têm crescido ao longo dos anos e evoluem diariamente com o aumento da procura no mercado.

- Necessidade de redução de despesas relacionadas com recursos humanos

Nos negócios de hoje, as empresas estão a trabalhar arduamente para aumentar os lucros e expandir os negócios neste mercado hipercompetitivo, o que gera uma pressão constante para reduzir custos e melhorar a rentabilidade. A compressão dos custos relacionados com os recursos humanos desempenha um papel importante no aumento da rentabilidade das empresas.

OPORTUNIDADE

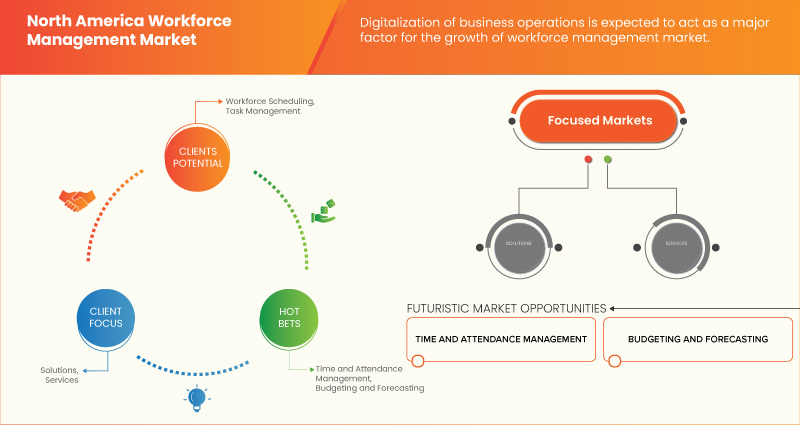

- Digitalização das operações comerciais

Os avanços tecnológicos estão a impulsionar a revolução industrial com a potencial transformação das indústrias da América do Norte e um impacto social, económico e ambiental significativo, representando um enorme potencial de crescimento. A maior oportunidade é a transformação de todas as indústrias e empresas através da melhoria dos processos de produção e de negócio, o que potencia o investimento na região.

RESTRIÇÕES/DESAFIOS

- Falta de sensibilização sobre as ferramentas de gestão da força de trabalho

O mundo está a evoluir em torno da tecnologia digital, e vários setores estão a adotar avanços tecnológicos para o seu desenvolvimento e transformação. O avanço tecnológico em qualquer setor tornou as operações comerciais mais simples. Da mesma forma, a incorporação de software e tecnologias avançadas em todos os setores influenciou a sua produtividade e eficiência .

- Elevado custo associado à compra e implementação de soluções de gestão de força de trabalho

A gestão da força de trabalho é um termo abrangente para vários instrumentos e arranjos utilizados pelas organizações para lidar com a sua força de trabalho, desde a construção das suas listas, criação de horários de trabalho e movimentos para organizações baseadas em turnos até ao acompanhamento do horário de trabalho e a obtenção de prova de trabalho para trabalho remoto ou trabalhadores de campo. Esta classificação de programação consolida frequentemente as finanças, a contabilidade e outras respostas de RH para garantir uma gestão de colaboradores mais eficaz. Existem muitos elementos e dispositivos num arranjo de força de trabalho que frequentemente se cruzam com a programação de RH.

Impacto pós-COVID-19 no mercado de gestão da força de trabalho da América do Norte

A pandemia da COVID-19 impactou significativamente o mercado de gestão da força de trabalho, acelerando diversas tendências existentes e criando novos desafios para as organizações. Com a mudança repentina para o trabalho remoto e a necessidade de manter a continuidade do negócio, as empresas adaptaram rapidamente as suas estratégias e ferramentas de gestão da força de trabalho. Isto levou a uma procura crescente por soluções baseadas na cloud que permitam o trabalho remoto e por tecnologias como a videoconferência, ferramentas de colaboração e plataformas de formação virtual. Ao mesmo tempo, a pandemia também destacou a importância da gestão da força de trabalho para manter a produtividade e garantir o envolvimento dos colaboradores em tempos de crise. À medida que o mundo avança para uma era pós-pandemia, espera-se que o mercado de gestão da força de trabalho continue a evoluir, impulsionado pela necessidade de maior agilidade e flexibilidade face à incerteza.

Desenvolvimentos recentes

- Em março de 2022, a Ceridian HCM Inc. anunciou que a Center Parcs UK & Ireland tinha selecionado a Dayforce para otimizar a sua força de trabalho, impulsionar o envolvimento dos colaboradores e reforçar a conformidade regulamentar. Esta colaboração ajudará a empresa a reforçar a sua posição de mercado em seis localizações no Reino Unido e na Irlanda.

- Em novembro de 2021, a Visier, Inc. anunciou o desenvolvimento de uma nova Plataforma como Serviço (PaaS) Alpine Visier. Estes novos serviços ajudam a empresa a diversificar as ofertas para os clientes e fornecem uma solução robusta que atrai novos clientes para acelerar o crescimento das receitas.

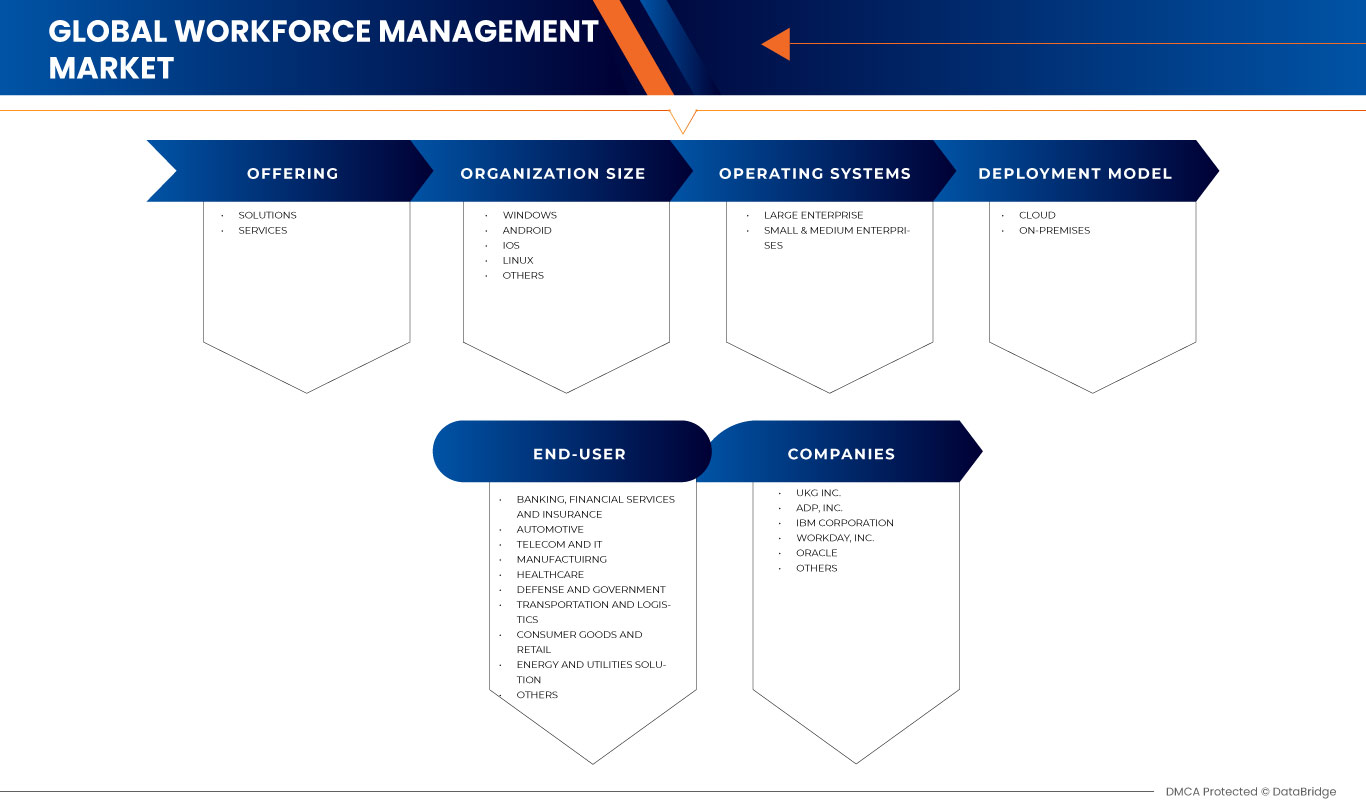

Âmbito do mercado de gestão da força de trabalho na América do Norte

O mercado de gestão da força de trabalho da América do Norte é segmentado com base na oferta, tamanho da organização, sistemas operacionais, modelo de implementação e utilizador final. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de crescimento escassos nos setores e fornecerá aos utilizadores uma visão geral valiosa do mercado e insights para os ajudar a tomar decisões estratégicas para identificar as principais aplicações de mercado.

Oferta

- Soluções

- Serviços

Com base na oferta, o mercado de gestão de força de trabalho da América do Norte está segmentado em soluções e serviços.

Modelo de Implantação

- Nuvem

- No local

Com base no modelo de implementação, o mercado de gestão de força de trabalho da América do Norte está segmentado em local e na nuvem.

Tamanho da organização

- Grande empresa

- Pequenas e Médias Empresas

Com base no tamanho da organização, o mercado de gestão da força de trabalho da América do Norte está segmentado em grandes empresas e pequenas e médias empresas.

Sistemas Operacionais

- Windows

- Andróide

- iOS

- Linux - O Linux é um sistema operativo Windows que permite executar aplicações em qualquer lugar, desde que esteja ligado a um computador.

- Outros

Com base nos sistemas operativos, o mercado de gestão de força de trabalho da América do Norte está segmentado em Windows, Android, iOS, Linux e outros.

Utilizador final

- Bancos, Serviços Financeiros e Seguros

- Automotivo

- Telecomunicações e Informática

- Fabricação

- Assistência médica

- Defesa e Governo

- Transporte e Logística

- Bens de consumo e retalho

- Soluções de Energia e Utilidades

- Outros

Com base no utilizador final, o mercado de gestão da força de trabalho da América do Norte está segmentado em banca, serviços financeiros e seguros, automóvel, telecomunicações e TI, manufatura, saúde, defesa e governo, transporte e logística, bens de consumo e retalho, energia e serviços públicos.

Análise/Insights Regionais do Mercado de Gestão da Força de Trabalho da América do Norte

O mercado de gestão da força de trabalho da América do Norte é analisado, e são fornecidos insights e tendências sobre o tamanho do mercado por região, oferta, tamanho da organização, sistemas operacionais, modelo de implementação e utilizador final, conforme referenciado acima.

Os países abrangidos pelo relatório de mercado de gestão da força de trabalho da América do Norte são os EUA, o Canadá e o México.

Espera-se que os EUA dominem a região da América do Norte, uma vez que têm a maior economia do mundo, com uma força de trabalho altamente diversificada que inclui trabalhadores de uma vasta gama de setores. Isto criou uma procura significativa por soluções de gestão da força de trabalho, à medida que as empresas procuram gerir os seus colaboradores de forma mais eficaz e eficiente.

A secção regional do relatório também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a montante e a jusante, tendências técnicas, análise das cinco forças de Porter e estudos de caso são alguns indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e disponibilidade de marcas da América do Norte e os seus desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, o impacto das tarifas domésticas e das rotas comerciais são considerados ao fornecer uma análise de previsão dos dados da região .

Análise do cenário competitivo e da quota de mercado na gestão da força de trabalho na América do Norte

O panorama competitivo do mercado de gestão da força de trabalho na América do Norte fornece detalhes dos concorrentes. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença na América do Norte, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento do produto, amplitude e abrangência do produto, e domínio da aplicação. Os pontos de dados acima referidos referem-se apenas às empresas focadas no mercado de gestão da força de trabalho na América do Norte.

Alguns dos principais participantes que operam no mercado norte-americano de gestão da força de trabalho são a UKG Inc., a Reflexis Systems, Inc., a SAP, a Verint Systems Inc., a ADP, a ATOSS Software AG, a NICE, a Workday, Inc., a Visier , Inc., Ceridian HCM, Inc., Paylocity., Paycom Payroll LLC., Sumtotal Systems, LLC, Infor, Cegid Meta4, Ramco Systems, Replicon, IBM, INFORM Software, InVision AG e Oracle.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA WORKFORCE MANAGEMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 OFFERING TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S ANALYSIS

4.2 REGULATORY FRAMEWORK

4.3 TECHNOLOGICAL TRENDS

4.4 PATENT ANALYSIS

4.5 CASE STUDY

4.6 VALUE CHAIN ANALYSIS

4.7 COMPANY COMPARATIVE ANALYSIS

4.7.1 UKG INC.:

4.7.2 SAP SE:

4.7.3 WORKDAY, INC.:

4.7.4 ADP, INC.:

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING ADOPTION OF THE INTERNET OF THINGS (IOT) AND CLOUD-BASED WORKFORCE MANAGEMENT SOLUTIONS

5.1.2 INCREASING PENETRATION OF ANALYTICAL SOLUTIONS AND CONNECTED DEVICES APPLICATIONS

5.1.3 NEED FOR REDUCTION OF EXPENSES RELATED TO HUMAN RESOURCE

5.2 RESTRAINTS

5.2.1 LACK OF AWARENESS ABOUT WORKFORCE MANAGEMENT TOOLS

5.2.2 COMPLEXITIES IN THE INTEGRATION OF DIFFERENT WORKFORCE MANAGEMENT TOOLS

5.3 OPPORTUNITIES

5.3.1 DIGITALIZATION OF BUSINESS OPERATIONS

5.3.2 INCREASE IN DEMAND FOR FLEXIBLE MANAGEMENT RESOURCES

5.3.3 UPSURGE IN THE ADOPTION OF ARTIFICIAL INTELLIGENCE IN BUSINESS OPERATIONS

5.4 CHALLENGES

5.4.1 HIGH COST ASSOCIATED WITH THE PURCHASE AND DEPLOYMENT OF WORKFORCE MANAGEMENT SOLUTIONS

5.4.2 RISING NEED FOR REGULAR DATA MONITORING AND DATA INPUT SYSTEMS IN THE WORKFORCE

6 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOLUTIONS

6.2.1 TIME AND ATTENDANCE MANAGEMENT

6.2.2 LEAVE AND ABSENCE MANAGEMENT

6.2.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

6.2.4 WORKFORCE SCHEDULING

6.2.5 WORKFORCE ANALYTICS

6.2.6 BUDGETING AND FORECASTING

6.2.7 TASK MANAGEMENT

6.2.8 FATIGUE MANAGEMENT

6.2.9 OTHERS

6.3 SERVICES

6.3.1 CONSULTING

6.3.2 IMPLEMENTATION

6.3.3 TRAINING, SUPPORT AND MAINTENANCE

7 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY ORGANIZATION SIZE

7.1 OVERVIEW

7.2 LARGE ENTERPRISE

7.3 SMALL & MEDIUM ENTERPRISES

8 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY OPERATING SYSTEMS

8.1 OVERVIEW

8.2 WINDOWS

8.3 ANDROID

8.4 IOS

8.5 LINUX

8.6 OTHERS

9 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY DEPLOYMENT MODEL

9.1 OVERVIEW

9.2 CLOUD

9.3 ON-PREMISES

10 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY END-USER

10.1 OVERVIEW

10.2 BANKING, FINANCIAL SERVICES AND INSURANCE

10.2.1 SOLUTIONS

10.2.1.1 TIME AND ATTENDANCE MANAGEMENT

10.2.1.2 LEAVE AND ABSENCE MANAGEMENT

10.2.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.2.1.4 WORKFORCE SCHEDULING

10.2.1.5 WORKFORCE ANALYTICS

10.2.1.6 BUDGETING AND FORECASTING

10.2.1.7 TASK MANAGEMENT

10.2.1.8 FATIGUE MANAGEMENT

10.2.1.9 OTHERS

10.2.2 SERVICES

10.2.2.1 CONSULTING

10.2.2.2 IMPLEMENTATION

10.2.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.3 AUTOMOTIVE

10.3.1 SOLUTIONS

10.3.1.1 TIME AND ATTENDANCE MANAGEMENT

10.3.1.2 LEAVE AND ABSENCE MANAGEMENT

10.3.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.3.1.4 WORKFORCE SCHEDULING

10.3.1.5 WORKFORCE ANALYTICS

10.3.1.6 BUDGETING AND FORECASTING

10.3.1.7 TASK MANAGEMENT

10.3.1.8 FATIGUE MANAGEMENT

10.3.1.9 OTHERS

10.3.2 SERVICES

10.3.2.1 CONSULTING

10.3.2.2 IMPLEMENTATION

10.3.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.4 TELECOM AND IT

10.4.1 SOLUTIONS

10.4.1.1 TIME AND ATTENDANCE MANAGEMENT

10.4.1.2 LEAVE AND ABSENCE MANAGEMENT

10.4.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.4.1.4 WORKFORCE SCHEDULING

10.4.1.5 WORKFORCE ANALYTICS

10.4.1.6 BUDGETING AND FORECASTING

10.4.1.7 TASK MANAGEMENT

10.4.1.8 FATIGUE MANAGEMENT

10.4.1.9 OTHERS

10.4.2 SERVICES

10.4.2.1 CONSULTING

10.4.2.2 IMPLEMENTATION

10.4.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.5 MANUFACTURING

10.5.1 SOLUTIONS

10.5.1.1 TIME AND ATTENDANCE MANAGEMENT

10.5.1.2 LEAVE AND ABSENCE MANAGEMENT

10.5.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.5.1.4 WORKFORCE SCHEDULING

10.5.1.5 WORKFORCE ANALYTICS

10.5.1.6 BUDGETING AND FORECASTING

10.5.1.7 TASK MANAGEMENT

10.5.1.8 FATIGUE MANAGEMENT

10.5.1.9 OTHERS

10.5.2 SERVICES

10.5.2.1 CONSULTING

10.5.2.2 IMPLEMENTATION

10.5.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.6 HEALTHCARE

10.6.1 SOLUTIONS

10.6.1.1 TIME AND ATTENDANCE MANAGEMENT

10.6.1.2 LEAVE AND ABSENCE MANAGEMENT

10.6.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.6.1.4 WORKFORCE SCHEDULING

10.6.1.5 WORKFORCE ANALYTICS

10.6.1.6 BUDGETING AND FORECASTING

10.6.1.7 TASK MANAGEMENT

10.6.1.8 FATIGUE MANAGEMENT

10.6.1.9 OTHERS

10.6.2 SERVICES

10.6.2.1 CONSULTING

10.6.2.2 IMPLEMENTATION

10.6.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.7 DEFENSE AND GOVERNMENT

10.7.1 SOLUTIONS

10.7.1.1 TIME AND ATTENDANCE MANAGEMENT

10.7.1.2 LEAVE AND ABSENCE MANAGEMENT

10.7.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.7.1.4 WORKFORCE SCHEDULING

10.7.1.5 WORKFORCE ANALYTICS

10.7.1.6 BUDGETING AND FORECASTING

10.7.1.7 TASK MANAGEMENT

10.7.1.8 FATIGUE MANAGEMENT

10.7.1.9 OTHERS

10.7.2 SERVICES

10.7.2.1 CONSULTING

10.7.2.2 IMPLEMENTATION

10.7.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.8 TRANSPORTATION AND LOGISTICS

10.8.1 SOLUTIONS

10.8.1.1 TIME AND ATTENDANCE MANAGEMENT

10.8.1.2 LEAVE AND ABSENCE MANAGEMENT

10.8.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.8.1.4 WORKFORCE SCHEDULING

10.8.1.5 WORKFORCE ANALYTICS

10.8.1.6 BUDGETING AND FORECASTING

10.8.1.7 TASK MANAGEMENT

10.8.1.8 FATIGUE MANAGEMENT

10.8.1.9 OTHERS

10.8.2 SERVICES

10.8.2.1 CONSULTING

10.8.2.2 IMPLEMENTATION

10.8.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.9 CONSUMER GOODS AND RETAIL

10.9.1 SOLUTIONS

10.9.1.1 TIME AND ATTENDANCE MANAGEMENT

10.9.1.2 LEAVE AND ABSENCE MANAGEMENT

10.9.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.9.1.4 WORKFORCE SCHEDULING

10.9.1.5 WORKFORCE ANALYTICS

10.9.1.6 BUDGETING AND FORECASTING

10.9.1.7 TASK MANAGEMENT

10.9.1.8 FATIGUE MANAGEMENT

10.9.1.9 OTHERS

10.9.2 SERVICES

10.9.2.1 CONSULTING

10.9.2.2 IMPLEMENTATION

10.9.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.1 ENERGY AND UTILITIES SOLUTIONS

10.10.1 SOLUTIONS

10.10.1.1 TIME AND ATTENDANCE MANAGEMENT

10.10.1.2 LEAVE AND ABSENCE MANAGEMENT

10.10.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.10.1.4 WORKFORCE SCHEDULING

10.10.1.5 WORKFORCE ANALYTICS

10.10.1.6 BUDGETING AND FORECASTING

10.10.1.7 TASK MANAGEMENT

10.10.1.8 FATIGUE MANAGEMENT

10.10.1.9 OTHERS

10.10.2 SERVICES

10.10.2.1 CONSULTING

10.10.2.2 IMPLEMENTATION

10.10.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.11 OTHERS

11 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 UKG INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 SOLUTION PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 ADP, INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 IBM CORPORATION

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 WORKDAY, INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 ORACLE

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 SOLUTION PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ATOSS SOFTWARE AG

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 SERVICES PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 CEGID META4

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 CERIDIAN HCM, INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 SOLUTION PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 INFOR

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 INFORM SOFTWARE

14.10.1 COMPANY SNAPSHOT

14.10.2 SERVICE PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 INVISION AG

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 NICE

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 SOLUTION PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 PAYCOM PAYROLL LLC

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 SOLUTION PORTFOLIO

14.13.4 RECENT DEVELOPMENTS

14.14 PAYLOCITY

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 SOLUTION PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 QUINYX AB

14.15.1 COMPANY SNAPSHOT

14.15.2 SOLUTION PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 RAMCO SYSTEMS

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 REFLEXIS SYSTEMS, INC.

14.17.1 COMPANY SNAPSHOT

14.17.2 SERVICE PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 REPLICON

14.18.1 COMPANY SNAPSHOT

14.18.2 SERVICE PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 SAP SE

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 COMPANY SHARE ANALYSIS

14.19.4 PRODUCT PORTFOLIO

14.19.5 RECENT DEVELOPMENTS

14.2 SUMTOTAL SYSTEMS, LLC

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENTS

14.21 VERINT SYSTEMS INC.

14.21.1 COMPANY SNAPSHOT

14.21.2 REVENUE ANALYSIS

14.21.3 PRODUCT PORTFOLIO

14.21.4 RECENT DEVELOPMENTS

14.22 VISIER, INC.

14.22.1 COMPANY SNAPSHOT

14.22.2 SOLUTION PORTFOLIO

14.22.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tabela

TABLE 1 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 2 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 3 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA LARGE ENTERPRISE IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA SMALL & MEDIUM ENTERPRISES IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY OPERATING SYSTEMS, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA WINDOWS IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA ANDROID IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA IOS IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA LINUX IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA OTHERS IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA CLOUD IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA ON-PREMISES IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA AUTOMOTIVE IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA AUTOMOTIVE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA TELECOM AND IT IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA TELECOM AND IT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA MANUFACTURING IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA MANUFACTURING IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA HEALTHCARE IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA HEALTHCARE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 37 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 39 NORTH AMERICA DEFENSE AND GOVERNMENT IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA DEFENSE AND GOVERNMENT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 41 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 43 NORTH AMERICA TRANSPORTATION AND LOGISTICS IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA TRANSPORTATION AND LOGISTICS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 45 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 46 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 47 NORTH AMERICA CONSUMER GOODS AND RETAIL IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 48 NORTH AMERICA CONSUMER GOODS AND RETAIL IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 49 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 50 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 51 NORTH AMERICA ENERGY AND UTILITIES SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 52 NORTH AMERICA ENERGY AND UTILITIES SOLUTION IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 53 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 54 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 55 NORTH AMERICA OTHERS IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 56 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 57 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 58 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 59 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 60 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD THOUSAND)

TABLE 61 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY OPERATING SYSTEMS, 2021-2030 (USD THOUSAND)

TABLE 62 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 63 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 64 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 65 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 66 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 67 NORTH AMERICA AUTOMOTIVE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 68 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 69 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 70 NORTH AMERICA TELECOM AND IT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 71 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 72 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 73 NORTH AMERICA MANUFACTURING IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 74 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 75 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 76 NORTH AMERICA HEALTHCARE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 77 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 78 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 79 NORTH AMERICA DEFENSE AND GOVERNMENT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 80 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 81 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 82 NORTH AMERICA TRANSPORTATION AND LOGISTICS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 83 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 84 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 85 NORTH AMERICA CONSUMER GOODS AND RETAIL IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 86 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 87 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 88 NORTH AMERICA ENERGY AND UTILITIES SOLUTION IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 89 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 90 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 91 U.S. WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 92 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 93 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 94 U.S. WORKFORCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD THOUSAND)

TABLE 95 U.S. WORKFORCE MANAGEMENT MARKET, BY OPERATING SYSTEMS, 2021-2030 (USD THOUSAND)

TABLE 96 U.S. WORKFORCE MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 97 U.S. WORKFORCE MANAGEMENT MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 98 U.S. BANKING, FINANCIAL SERVICES AND INSURANCE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 99 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 100 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 101 U.S. AUTOMOTIVE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 102 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 103 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 104 U.S. TELECOM AND IT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 105 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 106 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 107 U.S. MANUFACTURING IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 108 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 109 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 110 U.S. HEALTHCARE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 111 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 112 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 113 U.S. DEFENSE AND GOVERNMENT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 114 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 115 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 116 U.S. TRANSPORTATION AND LOGISTICS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 117 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 118 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 119 U.S. CONSUMER GOODS AND RETAIL IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 120 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 121 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 122 U.S. ENERGY AND UTILITIES SOLUTION IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 123 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 124 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 125 CANADA WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 126 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 127 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 128 CANADA WORKFORCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD THOUSAND)

TABLE 129 CANADA WORKFORCE MANAGEMENT MARKET, BY OPERATING SYSTEMS, 2021-2030 (USD THOUSAND)

TABLE 130 CANADA WORKFORCE MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 131 CANADA WORKFORCE MANAGEMENT MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 132 CANADA BANKING, FINANCIAL SERVICES AND INSURANCE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 133 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 134 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 135 CANADA AUTOMOTIVE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 136 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 137 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 138 CANADA TELECOM AND IT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 139 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 140 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 141 CANADA MANUFACTURING IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 142 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 143 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 144 CANADA HEALTHCARE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 145 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 146 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 147 CANADA DEFENSE AND GOVERNMENT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 148 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 149 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 150 CANADA TRANSPORTATION AND LOGISTICS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 151 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 152 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 153 CANADA CONSUMER GOODS AND RETAIL IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 154 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 155 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 156 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 157 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 158 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 159 MEXICO WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 160 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 161 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 162 MEXICO WORKFORCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD THOUSAND)

TABLE 163 MEXICO WORKFORCE MANAGEMENT MARKET, BY OPERATING SYSTEMS, 2021-2030 (USD THOUSAND)

TABLE 164 MEXICO WORKFORCE MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 165 MEXICO WORKFORCE MANAGEMENT MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 166 MEXICO BANKING, FINANCIAL SERVICES AND INSURANCE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 167 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 168 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 169 MEXICO AUTOMOTIVE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 170 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 171 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 172 MEXICO TELECOM AND IT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 173 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 174 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 175 MEXICO MANUFACTURING IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 176 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 177 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 178 MEXICO HEALTHCARE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 179 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 180 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 181 MEXICO DEFENSE AND GOVERNMENT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 182 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 183 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 184 MEXICO TRANSPORTATION AND LOGISTICS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 185 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 186 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 187 MEXICO CONSUMER GOODS AND RETAIL IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 188 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 189 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 190 MEXICO ENERGY AND UTILITIES SOLUTION IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 191 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 192 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

Lista de Figura

FIGURE 1 NORTH AMERICA WORKFORCE MANAGEMENT MARKET : SEGMENTATION

FIGURE 2 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: MULTIVARIATE MODELLING

FIGURE 11 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: OFFERING TIMELINE CURVE

FIGURE 12 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: SEGMENTATION

FIGURE 13 INCREASING PENETRATION OF ANALYTICAL SOLUTIONS AND CONNECTED DEVICES APPLICATIONSARE EXPECTED TO BE KEY DRIVERS FOR THE NORTH AMERICA WORKFORCE MANAGEMENT MARKET IN THE FORECAST PERIOD 2023 TO 2030

FIGURE 14 THE SOLUTIONS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA WORKFORCE MANAGEMENT MARKET FROM 2023 TO 2030

FIGURE 15 VALUE CHAIN ANALYSIS FRAMEWORK

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF NORTH AMERICA WORKFORCE MANAGEMENT MARKET

FIGURE 17 ENTERPRISES USING IOT, 2021

FIGURE 18 EMPLOYMENT FOR THE AGE 20 TO 64

FIGURE 19 AI ADOPTION RATE AROUND THE WORLD

FIGURE 20 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY OFFERING, 2022

FIGURE 21 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY ORGANIZATION SIZE, 2022

FIGURE 22 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY OPERATING SYSTEMS, 2022

FIGURE 23 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY DEPLOYMENT MODEL, 2022

FIGURE 24 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY END-USER, 2022

FIGURE 25 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: SNAPSHOT (2022)

FIGURE 26 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY COUNTRY (2022)

FIGURE 27 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY COUNTRY (2023-2030)

FIGURE 28 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY COUNTRY (2022-2030)

FIGURE 29 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY OFFERING (2023-2030)

FIGURE 30 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: COMPANY SHARE 2022 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.