North America Wax Emulsion Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

714.04 Million

USD

869.99 Million

2024

2032

USD

714.04 Million

USD

869.99 Million

2024

2032

| 2025 –2032 | |

| USD 714.04 Million | |

| USD 869.99 Million | |

|

|

|

|

Segmentação do mercado de emulsões de cera na América do Norte, por base de material (emulsão de cera de base sintética e emulsão de cera de base natural), emulsificante (surfactantes não iônicos, surfactantes aniônicos e surfactantes catiônicos), setor de usuários finais (tintas e revestimentos, têxteis, cosméticos, adesivos e selantes, construção e marcenaria, indústria alimentícia e outros) - Tendências do setor e previsões até 2032

Tamanho do mercado de emulsões de cera na América do Norte

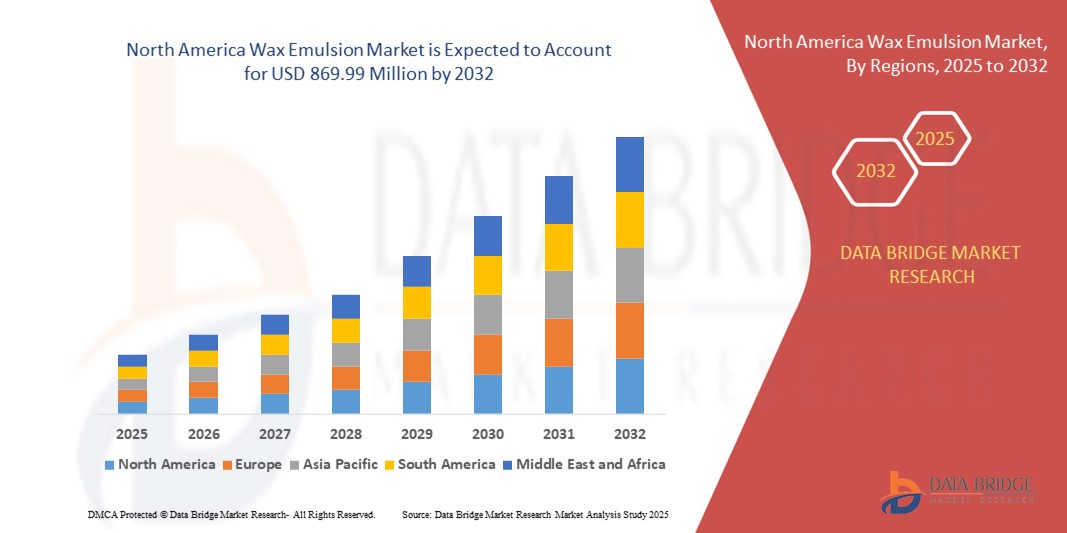

- O tamanho do mercado de emulsões de cera da América do Norte foi avaliado em US$ 714,04 milhões em 2024 e deve atingir US$ 869,99 milhões até 2032 , com um CAGR de 2,50% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente demanda por revestimentos e formulações sustentáveis à base de água em setores como tintas, embalagens, têxteis e adesivos, à medida que os fabricantes migram para alternativas ecológicas em vez de sistemas à base de solventes.

- O uso crescente de emulsões de cera em produtos químicos de construção, juntamente com os avanços na tecnologia de emulsões que oferecem maior durabilidade, brilho e resistência à água, está impulsionando ainda mais a adoção de produtos em vários setores de uso final.

Análise do mercado de emulsões de cera na América do Norte

- O mercado de emulsões de cera da América do Norte está testemunhando um crescimento constante impulsionado pelo aumento de aplicações em revestimentos industriais, acabamento de madeira e embalagens de papel, à medida que as indústrias priorizam cada vez mais a eficiência de desempenho e a sustentabilidade

- Investimentos contínuos em P&D e avanços tecnológicos em processos de polimerização em emulsão estão permitindo o desenvolvimento de produtos de emulsão de cera personalizados, adaptados a requisitos industriais específicos, aumentando a competitividade do mercado e o desempenho do produto.

- Os EUA conquistaram a maior fatia da receita em 2024 na América do Norte, impulsionados pela rápida adoção de materiais sustentáveis em aplicações de embalagem, construção e marcenaria

- Espera-se que o Canadá testemunhe a maior taxa de crescimento anual composta (CAGR) no mercado de emulsões de cera da América do Norte devido à crescente demanda por soluções de embalagens ecológicas e de qualidade alimentar, ao aumento dos investimentos nos setores de construção e automotivo e à crescente adoção de emulsões de cera sustentáveis em cosméticos, revestimentos e aplicações industriais.

- O segmento de Emulsão de Cera de Base Sintética foi responsável pela maior fatia de mercado em 2024, impulsionado por sua relação custo-benefício, qualidade consistente e ampla aplicação em tintas, revestimentos e materiais de embalagem. Sua durabilidade e propriedades repelentes à água o tornam a escolha preferencial para produção em escala industrial.

Escopo do relatório e segmentação do mercado de emulsões de cera na América do Norte

|

Atributos |

Principais insights de mercado sobre emulsões de cera na América do Norte |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de consumo de produção, análise de tendência de preço, cenário de mudança climática, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matéria-prima/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de emulsões de cera na América do Norte

Mudança para formulações sustentáveis e ecologicamente corretas

- A crescente demanda por revestimentos ecológicos e à base de água está impulsionando a adoção de emulsões de cera de base biológica em todos os setores, especialmente em embalagens e têxteis. Os fabricantes estão substituindo sistemas à base de solventes por alternativas sustentáveis e com baixo teor de COV para atender às rigorosas regulamentações ambientais e à crescente preferência dos consumidores por produtos ecologicamente corretos.

- A crescente conscientização sobre sustentabilidade entre os usuários finais acelerou o uso de emulsões de cera em papéis e embalagens para aplicações de grau alimentício. Esses revestimentos ecológicos aprimoram as propriedades de barreira, prolongam a vida útil e se alinham aos esforços globais para minimizar o uso de plástico, ao mesmo tempo em que apoiam iniciativas de reciclabilidade e compostabilidade em toda a cadeia de valor.

- A crescente mudança em direção às práticas da química verde levou os fabricantes a investirem pesadamente em P&D para emulsões de cera à base de ésteres sintéticos e derivados de plantas. Isso permite melhor desempenho do revestimento, redução da pegada de carbono e compatibilidade com os processos de fabricação existentes, sem comprometer a eficiência de custos ou a qualidade do produto.

- Por exemplo, em 2023, diversas empresas de embalagens na América do Norte lançaram copos de papel compostáveis revestidos com emulsões de cera de origem biológica. Essas soluções ofereceram resistência à umidade, maior biodegradabilidade e conformidade com os padrões de segurança alimentar, proporcionando uma vantagem competitiva nos mercados de embalagens sustentáveis.

- Embora a sustentabilidade seja um fator-chave no crescimento, os fabricantes precisam equilibrar custo-benefício, escalabilidade e otimização de desempenho para garantir a adoção em larga escala. Os participantes do setor estão explorando o fornecimento regional de matérias-primas e a automação de processos para manter a lucratividade no cenário de manufatura verde em evolução.

Dinâmica do mercado de emulsões de cera na América do Norte

Motorista

Aumento da demanda nas indústrias de construção e embalagens

- A expansão das atividades de construção na América do Norte está impulsionando a demanda por emulsões de cera na cura de concreto, revestimentos de madeira e adesivos. Essas emulsões melhoram a proteção da superfície, a resistência à água e o apelo estético dos materiais de construção, aumentando assim a durabilidade e reduzindo os custos de manutenção para os usuários finais.

- O setor de embalagens está testemunhando um crescimento significativo devido à expansão do comércio eletrônico e à crescente demanda por soluções de embalagem para alimentos. Emulsões de cera são cada vez mais preferidas por fornecer revestimentos de barreira, resistência à gordura e melhor capacidade de impressão em embalagens de papel, garantindo funcionalidade sem comprometer o meio ambiente.

- A pressão regulatória por materiais de embalagem sustentáveis incentivou ainda mais os fabricantes a desenvolver revestimentos de emulsão de cera biodegradáveis e seguros para alimentos. A conformidade com as diretrizes da FDA e da EPA está permitindo aplicações mais amplas no setor alimentício, ao mesmo tempo em que atende às metas de sustentabilidade corporativa em toda a cadeia de suprimentos.

- Por exemplo, em 2023, os principais produtores de embalagens nos EUA adotaram emulsões de cera aprovadas pela FDA para revestimentos de papel de grau alimentício. Esse desenvolvimento aumentou a segurança do produto, reforçou a reputação da marca e fortaleceu a competitividade no mercado de materiais de embalagem ecológicos.

- Embora a construção e a embalagem continuem sendo os principais impulsionadores do crescimento, a crescente adoção de emulsões de cera nas indústrias têxtil, automotiva e cosmética aumenta ainda mais o potencial de mercado. Os fabricantes estão alavancando essa tendência com o lançamento de emulsões de cera de grau especial, adaptadas para aplicações de nicho e alto desempenho.

Restrição/Desafio

Volatilidade dos preços das matérias-primas e conhecimento limitado nas PMEs

- A flutuação dos preços de matérias-primas como parafina, polietileno e ceras naturais gera incertezas de custo para os fabricantes, afetando o planejamento da produção, o controle de estoque e as estratégias de preços de longo prazo. Essas flutuações frequentemente afetam as margens de lucro e atrasam os planos de expansão de capacidade em todo o setor.

- Pequenas e médias empresas (PMEs) frequentemente carecem de conhecimento técnico sobre emulsões de cera avançadas, o que limita a adoção em aplicações de nicho, como revestimentos especiais e lubrificantes industriais. Essa lacuna de conhecimento reduz as oportunidades para as PMEs transitarem para linhas de produtos de alto valor agregado e ecologicamente corretas.

- A disponibilidade de alternativas sintéticas de baixo custo também dificulta o crescimento de emulsões de cera de base biológica premium em mercados sensíveis ao preço. Clientes com restrições orçamentárias frequentemente priorizam substitutos mais baratos, apesar dos benefícios de desempenho e sustentabilidade oferecidos por formulações avançadas.

- Por exemplo, em 2023, diversas PMEs no México relataram atrasos na transição para emulsões de cera sustentáveis devido aos custos mais elevados em comparação com os revestimentos tradicionais. Essa tendência destaca a necessidade de incentivos financeiros e programas de treinamento técnico para empresas menores do setor.

- Os participantes do mercado devem se concentrar na diversificação de matérias-primas, na otimização de custos e em programas de conscientização para superar essas barreiras e garantir um crescimento constante. Iniciativas colaborativas entre fornecedores, fabricantes e formuladores de políticas são cruciais para promover a adoção de tecnologias verdes acessíveis em mercados emergentes.

Escopo do mercado de emulsões de cera na América do Norte

O mercado é segmentado com base no material base, no emulsificante e no setor de uso final.

- Por Base Material

Com base no material base, o mercado de emulsões de cera na América do Norte é segmentado em Emulsão de Cera de Base Sintética e Emulsão de Cera de Base Natural. O segmento de Emulsão de Cera de Base Sintética foi responsável pela maior fatia de mercado em 2024, impulsionado por sua relação custo-benefício, qualidade consistente e ampla aplicação em tintas, revestimentos e materiais de embalagem. Sua durabilidade e propriedades repelentes à água o tornam a escolha preferencial para produção em escala industrial.

Espera-se que o segmento de Emulsões de Cera de Base Natural apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente demanda por produtos de base biológica e ecologicamente corretos em todos os setores. As crescentes regulamentações de sustentabilidade e a preferência do consumidor por materiais verdes estão impulsionando a adoção de emulsões de cera natural em embalagens de alimentos e aplicações cosméticas.

- Por Emulsificante

Com base no emulsificante, o mercado é segmentado em surfactantes não iônicos, surfactantes aniônicos e surfactantes catiônicos. O segmento de surfactantes não iônicos dominou a participação de mercado na receita em 2024, apoiado por sua excelente estabilidade, compatibilidade com diversas formulações e capacidade de fornecer propriedades de revestimento uniformes em diversos setores de usuários finais.

Espera-se que o segmento de surfactantes catiônicos apresente a maior taxa de crescimento entre 2025 e 2032, devido às suas propriedades de adesão superiores e ao uso crescente em aplicações de construção e marcenaria. Esses emulsificantes aumentam a resistência à água e a durabilidade, tornando-os adequados para revestimentos industriais e especiais.

- Por setor do usuário final

Com base no setor consumidor final, o mercado de emulsões de cera da América do Norte é segmentado em Tintas e Revestimentos, Têxteis, Cosméticos, Adesivos e Selantes, Construção e Marcenaria, Indústria Alimentícia e Outros. O segmento de Tintas e Revestimentos detinha a maior participação de mercado em 2024, impulsionado pela crescente demanda por revestimentos protetores e decorativos em projetos de construção residencial, comercial e industrial.

Espera-se que o segmento da indústria alimentícia apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente adoção de emulsões de cera seguras para alimentos, aprovadas pela FDA, para aplicações de embalagem. A crescente demanda por revestimentos biodegradáveis e resistentes à umidade em produtos de papel de grau alimentício está impulsionando ainda mais o crescimento do mercado.

Análise regional do mercado de emulsões de cera na América do Norte

- O mercado de emulsões de cera dos EUA capturou a maior fatia de receita em 2024 na América do Norte, impulsionado pela rápida adoção de materiais sustentáveis em aplicações de embalagem, construção e marcenaria

- A crescente demanda por revestimentos de qualidade alimentar aprovados pela FDA e a mudança para emulsões de base biológica para embalagens ecológicas estão impulsionando a expansão do mercado

- Além disso, o mercado dos EUA beneficia de fortes investimentos em I&D, de estruturas regulamentares robustas e da preferência do consumidor por materiais sustentáveis e de alto desempenho.

Visão geral do mercado de emulsões de cera do Canadá

Espera-se que o mercado de emulsões de cera no Canadá apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente demanda por revestimentos sustentáveis e ecológicos nos setores de embalagens, construção e marcenaria. A adoção de emulsões de cera de grau alimentício, de origem biológica e aprovadas pela FDA, está acelerando, impulsionada pelo apoio regulatório e pela crescente conscientização dos consumidores sobre materiais ambientalmente responsáveis. Além disso, os investimentos em P&D, aliados ao uso crescente de emulsões de cera em adesivos, tintas e têxteis, estão contribuindo para o crescimento constante do mercado e os avanços tecnológicos no Canadá.

Participação no mercado de emulsões de cera na América do Norte

A indústria de emulsões de cera da América do Norte é liderada principalmente por empresas bem estabelecidas, incluindo:

- Hexion (EUA)

- Michelman, Inc. (EUA)

- A Lubrizol Corporation (EUA)

- PMC Group, Inc. (EUA)

- Henry Company (EUA)

- Micro Powders, Inc. (EUA)

- SHAMROCK (EUA)

- Paraffinwaxco, Inc. (EUA)

Últimos desenvolvimentos no mercado de emulsões de cera na América do Norte

- Em dezembro de 2023, a PetroNaft Co. destacou a aplicação de emulsões de cera em produtos de cuidados pessoais, demonstrando sua capacidade de aprimorar a textura, a estabilidade e as propriedades hidratantes em cremes, loções e formulações para cuidados com os cabelos. Essas emulsões também melhoram a maciez e a durabilidade de cosméticos como batons e sombras, garantindo melhor desempenho e experiência do usuário. A adoção de emulsões de cera em produtos cosméticos está impulsionando a inovação, apoiando a diferenciação de produtos premium e impulsionando a demanda no mercado norte-americano de cuidados pessoais e cosméticos.

- Em novembro de 2022, a Elsevier BV relatou que emulsões de cera finamente dispersas, homogêneas e submicrométricas ganharam importância significativa nos setores cosmético e farmacêutico. Essas emulsões avançadas permitem melhor absorção, estabilidade e consistência em pomadas e cremes cicatrizantes, aumentando a eficácia do produto e a satisfação do consumidor. Seu uso crescente está incentivando investimentos em P&D e expandindo as oportunidades de mercado para emulsões de cera de alto desempenho em aplicações de saúde e cuidados pessoais.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.