North America Walk In Refrigerators And Freezers Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

6.63 Billion

USD

10.18 Billion

2025

2033

USD

6.63 Billion

USD

10.18 Billion

2025

2033

| 2026 –2033 | |

| USD 6.63 Billion | |

| USD 10.18 Billion | |

|

|

|

|

Segmentação do mercado de câmaras frigoríficas e congeladores na América do Norte, por tipo (autônomos, com condensação remota, com condensação multiplex e outros), tipo de sistema (sistemas remotos, sistemas remotos pré-montados, sistemas de refrigeração padrão com montagem superior, sistemas de refrigeração com montagem lateral, sistemas de refrigeração com montagem em sela, sistemas de refrigeração tipo cobertura, sistemas de refrigeração com porta de enrolar e outros), tipo de porta (porta simples, porta dupla, porta tripla e outros), tecnologia (manual, semiautomática e totalmente automática), tipo de cortina (cortinas de tiras e cortinas de ar), canal de distribuição (vendas diretas/B2B, comércio eletrônico , lojas especializadas e outros), usuário final (comercial, residencial e outros) - Tendências e previsões do setor até 2033.

Qual é o tamanho e a taxa de crescimento do mercado de câmaras frigoríficas e congeladores na América do Norte?

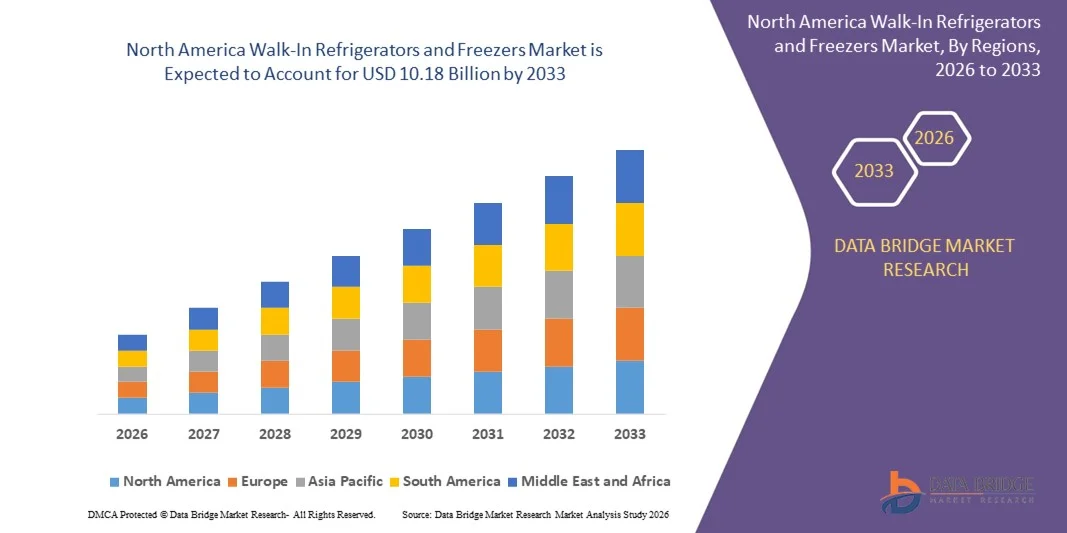

- O mercado de câmaras frigoríficas na América do Norte foi avaliado em US$ 6,63 bilhões em 2025 e deverá atingir US$ 10,18 bilhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 5,1% durante o período de previsão.

- Os avanços tecnológicos em compressores e sistemas de refrigeração estão impulsionando e aumentando a demanda no mercado de câmaras frigoríficas e congeladores na América do Norte.

- O elevado consumo de energia e a grande pegada de carbono estão a prejudicar a procura de frigoríficos e congeladores de grande dimensão no mercado da América do Norte.

Quais são os principais destaques do mercado de câmaras frigoríficas e congeladores?

- A urbanização e as consequentes mudanças no estilo de vida do consumidor representam uma oportunidade para o mercado de câmaras frigoríficas na América do Norte.

- A regulamentação governamental rigorosa em relação à emissão de CFCs representa um desafio que prejudica a demanda do mercado de câmaras frigoríficas e congeladores na América do Norte.

- Os EUA dominaram o mercado de câmaras frigoríficas e congeladores na América do Norte, com uma participação de 41,36% da receita em 2025, impulsionados por uma forte indústria de processamento de alimentos, alta penetração do varejo organizado, ampla adoção de infraestrutura de cadeia de frio e regulamentações rigorosas de segurança e armazenamento de alimentos em instalações comerciais, industriais e de saúde.

- Prevê-se que o Canadá registre a taxa de crescimento anual composta (CAGR) mais rápida, de 10,95%, entre 2026 e 2033, no mercado de câmaras frigoríficas da América do Norte, impulsionado pelo crescimento do consumo de alimentos congelados, pela expansão do varejo de supermercados e pelo aumento dos investimentos em infraestrutura moderna de armazenamento refrigerado.

- O segmento de equipamentos autônomos dominou o mercado com uma participação estimada em 42,3% em 2025, impulsionado pela facilidade de instalação, tamanho compacto e adequação para cozinhas comerciais de pequeno a médio porte e pontos de venda.

Escopo do relatório e segmentação do mercado de câmaras frigoríficas e congeladores

|

Atributos |

Principais informações de mercado sobre câmaras frigoríficas e congeladores |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marcas, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Qual é a principal tendência no mercado de câmaras frigoríficas e congeladores?

Crescente demanda por refrigeradores e congeladores de alta qualidade, com sabor aprimorado e especiais.

- O mercado de câmaras frigoríficas e congeladores está testemunhando uma crescente adoção de variedades premium, artesanais e com sabores naturais, projetadas para oferecer sabor autêntico e experiências gourmet para consumidores que buscam produtos lácteos de alta qualidade.

- Os fabricantes estão lançando refrigeradores e congeladores especiais com ingredientes de rótulo limpo, aditivos mínimos, processos de defumação natural e perfis de sabor regionais exclusivos para atender às preferências em constante evolução dos consumidores.

- O crescente interesse por alimentos gourmet, tábuas de queijos artesanais e aplicações culinárias especiais está acelerando a adoção de câmaras frigoríficas e congeladores nos canais de varejo, hotelaria e serviços de alimentação.

- Por exemplo, empresas como Arla Foods, Saputo, Sargento, Leprino Foods e Dairygold estão expandindo seus portfólios com queijo cheddar defumado, gouda, mussarela e misturas especiais premium.

- A crescente popularidade de refeições caseiras com estilo de restaurante, petiscos à base de queijo e ofertas de varejo premium nos EUA, América do Norte e Ásia-Pacífico está impulsionando a expansão do mercado.

- À medida que os consumidores priorizam sabores marcantes e experiências premium, as câmaras frigoríficas e congeladores continuam sendo um segmento crucial no mercado de queijos especiais.

Quais são os principais fatores que impulsionam o mercado de câmaras frigoríficas e congeladores?

- A crescente preferência do consumidor por laticínios saborosos e variedades de queijo premium está impulsionando significativamente a adoção de câmaras frigoríficas e congeladores.

- Por exemplo, entre 2024 e 2025, empresas como Saputo, Arla Foods e Sargento lançaram novos SKUs e formatos de embalagem adaptados aos segmentos de varejo, comércio eletrônico e foodservice.

- A crescente demanda por refeições prontas para consumo, sanduíches gourmet, culinária de fusão e petiscos à base de queijo está expandindo a aplicação de refrigeradores e congeladores walk-in em residências e estabelecimentos comerciais.

- A expansão de lojas de varejo modernas, lojas especializadas em queijos e plataformas de compras online aumenta a acessibilidade aos produtos e o alcance do consumidor.

- O aumento do consumo em cadeias de alimentação, restaurantes de serviço rápido e estabelecimentos de refeições casuais fortalece o crescimento do mercado.

- Impulsionado pelo aumento da renda disponível, pela evolução das preferências de sabor e pelas inovações no processamento de laticínios, o mercado de câmaras frigoríficas e congeladores deverá apresentar um crescimento constante a longo prazo.

Qual fator está dificultando o crescimento do mercado de câmaras frigoríficas e congeladores?

- Os elevados custos de produção associados à defumação natural, à aquisição de leite de alta qualidade e aos longos períodos de maturação limitam a competitividade dos preços de câmaras frigoríficas e congeladores.

- Durante o período de 2024–2025, a volatilidade nos preços do leite cru, da energia e da logística aumentou as despesas operacionais para os fabricantes globais.

- Prazos de validade mais curtos e requisitos rigorosos de armazenamento em cadeia de frio restringem a distribuição, principalmente em mercados emergentes.

- O baixo nível de conhecimento dos consumidores em regiões em desenvolvimento sobre refrigeradores e congeladores especiais de grande porte dificulta a adoção desses produtos.

- A concorrência de queijos processados, pastas aromatizadas e alternativas à base de plantas gera pressão sobre os preços e o espaço nas prateleiras.

- Para enfrentar esses desafios, as empresas estão se concentrando na otimização de processos, em soluções inovadoras de embalagem, na expansão das redes de distribuição e na educação do consumidor para acelerar a adoção global de refrigeradores e congeladores walk-in.

Como é segmentado o mercado de câmaras frigoríficas e congeladores?

O mercado está segmentado com base no tipo, tipo de sistema, tipo de porta, tecnologia, tipo de cortina, canal de distribuição e usuário final .

- Por tipo

Com base no tipo, o mercado de câmaras frigoríficas é segmentado em Autossuficientes, com Condensação Remota, com Condensação Multiplex e Outros. O segmento de Autossuficientes dominou o mercado com uma participação estimada de 42,3% em 2025, impulsionado pela facilidade de instalação, tamanho compacto e adequação para cozinhas comerciais de pequeno a médio porte e lojas de varejo. As unidades autossuficientes oferecem compressores integrados, manutenção simplificada e custos iniciais mais baixos, o que as torna populares entre cafés, restaurantes e lojas de conveniência.

O segmento de condensação multiplex deverá apresentar o maior crescimento anual composto (CAGR) entre 2026 e 2033, impulsionado pela crescente implantação em grandes supermercados, hotéis e instalações industriais de armazenamento refrigerado. Os sistemas multiplex oferecem escalabilidade, eficiência energética e recursos de gerenciamento centralizado, permitindo que os operadores gerenciem várias unidades de refrigeração simultaneamente, o que impulsiona a adoção em ambientes comerciais de alta capacidade.

- Por tipo de sistema

Com base no tipo de sistema, o mercado é segmentado em Sistemas Remotos, Sistemas Remotos Pré-Montados, Sistemas de Refrigeração Padrão com Montagem Superior, Sistemas de Refrigeração com Montagem Lateral, Sistemas de Refrigeração com Montagem em Sela, Sistemas de Refrigeração Penthouse, Sistemas de Refrigeração com Montagem em Rolo e Outros. O segmento de Sistemas Remotos dominou o mercado com uma participação de 38,7% em 2025, impulsionado pela eficiência de refrigeração superior, flexibilidade de instalação e adequação para câmaras frigoríficas de alta capacidade.

Prevê-se que os sistemas remotos pré-montados apresentem o crescimento mais rápido em termos de taxa composta de crescimento anual (CAGR) entre 2026 e 2033, impulsionados por uma instalação mais rápida, custos de mão de obra mais baixos e requisitos mínimos de montagem no local. A crescente adoção em redes de supermercados, cozinhas comerciais e estabelecimentos de serviços de alimentação acelera o crescimento das soluções pré-montadas.

- Por tipo de porta

Com base no tipo de porta, o mercado é segmentado em Porta Simples, Porta Dupla, Porta Tripla e Outros. O segmento de Porta Dupla dominou com uma participação de 44,1% em 2025, oferecendo melhor acessibilidade, eficiência energética e compatibilidade com cozinhas comerciais de alto tráfego.

O segmento de portas triplas deverá apresentar o crescimento mais rápido em termos de taxa composta de crescimento anual (CAGR) entre 2026 e 2033, impulsionado pela demanda de grandes restaurantes, hotéis e operadores de armazenamento refrigerado que necessitam de múltiplos compartimentos para acesso simultâneo e gerenciamento eficiente de estoque.

- Por meio da tecnologia

Com base na tecnologia, o mercado é segmentado em câmaras frigoríficas manuais, semiautomáticas e totalmente automáticas. O segmento semiautomático dominou o mercado com uma participação de 47,5% em 2025, oferecendo um equilíbrio entre controle operacional, confiabilidade e eficiência energética.

Prevê-se que os sistemas totalmente automáticos apresentem o crescimento anual composto mais rápido entre 2026 e 2033, impulsionados pela crescente adoção de refrigeração habilitada para IoT, monitoramento inteligente e controle automatizado de temperatura em instalações comerciais e industriais.

- Por tipo de cortina

O mercado está segmentado em cortinas de tiras e cortinas de ar. O segmento de cortinas de tiras detinha a maior participação de mercado, com 63,2% em 2025, impulsionado pela facilidade de instalação, economia de energia e prevenção da perda de ar frio em câmaras frigoríficas.

O segmento de cortinas de ar deverá apresentar o crescimento anual composto mais rápido entre 2026 e 2033, impulsionado pela demanda em lojas de varejo premium, redes de alimentação e instalações industriais de armazenamento refrigerado que exigem gerenciamento avançado de fluxo de ar e conformidade com as normas de higiene.

- Por canal de distribuição

Com base na distribuição, o mercado é segmentado em Vendas Diretas/B2B, Comércio Eletrônico, Lojas Especializadas e Outros. O canal de Vendas Diretas/B2B dominou com uma participação de 52,8% em 2025, impulsionado por pedidos em grande volume de supermercados, hotéis e cozinhas comerciais.

Prevê-se que o comércio eletrônico cresça à taxa composta de crescimento anual (CAGR) mais rápida de 2026 a 2033, impulsionado pelo aumento das compras online por pequenos restaurantes, varejistas especializados e empresas domésticas que buscam conveniência nos pedidos e entrega em domicílio.

- Por usuário final

Com base no usuário final, o mercado é segmentado em Comercial, Residencial e Outros. O segmento Comercial dominou com uma participação de 58,4% em 2025, impulsionado pelo uso extensivo em restaurantes, cafés, hotéis e armazenamento refrigerado industrial.

Prevê-se que o segmento residencial apresente o crescimento anual composto mais rápido entre 2026 e 2033, impulsionado pela crescente adoção da culinária gourmet em casa, cozinhas de alta qualidade e pela expansão da demanda por refrigeração residencial de grande formato em residências urbanas.

Qual região detém a maior participação no mercado de câmaras frigoríficas e congeladores?

- Os EUA dominaram o mercado de câmaras frigoríficas e congeladores na América do Norte, com uma participação de 41,36% da receita em 2025, impulsionados por uma forte indústria de processamento de alimentos, alta penetração do varejo organizado, ampla adoção de infraestrutura de cadeia de frio e regulamentações rigorosas de segurança e armazenamento de alimentos em instalações comerciais, industriais e de saúde.

- A crescente demanda de supermercados, hipermercados, redes de alimentação, fornecedores de armazenamento farmacêutico e grandes armazéns frigoríficos está impulsionando significativamente a adoção de sistemas de refrigeração e congelamento de alta capacidade e eficiência energética em toda a região.

- A forte capacidade de produção nacional, os avanços tecnológicos contínuos, a adoção precoce de sistemas de refrigeração inteligentes e os investimentos constantes de fabricantes globais e regionais continuam a reforçar a liderança da América do Norte no mercado de câmaras frigoríficas e congeladores.

Análise do mercado canadense de câmaras frigoríficas e congeladores

Prevê-se que o Canadá registre a taxa de crescimento anual composta (CAGR) mais rápida, de 10,95%, entre 2026 e 2033, no mercado de câmaras frigoríficas da América do Norte, impulsionado pelo crescimento do consumo de alimentos congelados, pela expansão do varejo de supermercados e pelo aumento dos investimentos em infraestrutura moderna de armazenamento refrigerado. A adoção de refrigerantes ecológicos, a conformidade com as normas de sustentabilidade e a crescente demanda dos setores de serviços de alimentação e farmacêutico continuam a acelerar a expansão do mercado.

Quais são as principais empresas no mercado de câmaras frigoríficas e congeladores?

O setor de câmaras frigoríficas e congeladores é liderado principalmente por empresas consolidadas, incluindo:

- Lancer Worldwide (EUA)

- Haier Inc. (China)

- Refrigerador Foster (Reino Unido)

- BSH Hausgeräte GmbH (Alemanha)

- AB Electrolux (Suécia)

- Precision Refrigeration Ltd (Reino Unido)

- Corporação Hussmann (Panasonic) (EUA)

- Danfoss A/S (Dinamarca)

- Kolpak (Welbilt, Inc.) (EUA)

- Master-Bilt (EUA)

- Norlake, Inc. (EUA)

- Amerikooler LLC (EUA)

- Marrom Imperial (EUA)

- Thermo-Kool (EUA)

- Bally Refrigerated Boxes, Inc. (EUA)

- Refrigerador EUA (EUA)

Quais são os desenvolvimentos recentes no mercado global de câmaras frigoríficas e congeladores?

- Em agosto de 2025, a Everidge lançou sua linha de armazenamento refrigerado móvel Cool on the Move, oferecendo unidades em configurações de 6x8, 6x12 e 6x16 pés que funcionam tanto como refrigeradores quanto como congeladores e operam com tomadas padrão de 120V ou geradores. Projetadas para setores como alimentação, saúde e serviços de emergência, essas unidades permitem o armazenamento refrigerado confiável durante o transporte e operações no local. Este lançamento destaca a crescente demanda por soluções de armazenamento refrigerado flexíveis e móveis em diversos setores.

- Em junho de 2025, a Amerikooler lançou a AK Series 3 Quick Ship Walk-In, uma câmara frigorífica projetada para entrega e instalação rápidas, mantendo alta eficiência energética. Equipada com isolamento AK-XPS de grau compressor R-29, piso de aço resistente e sistema de monitoramento digital integrado, a solução atende clientes que necessitam de implantação rápida sem comprometer o desempenho. Este desenvolvimento reforça o foco do mercado em velocidade, eficiência e confiabilidade operacional.

- Em novembro de 2024, a KPS Global apresentou o DEFENDOOR, um sistema de proteção avançado projetado para aumentar a durabilidade das portas e reduzir os custos de manutenção de câmaras frigoríficas e congeladores em ambientes de alto tráfego. Ao minimizar danos às portas e prolongar a vida útil do produto, o sistema auxilia operadores de varejo e serviços de alimentação que buscam eficiência de custos a longo prazo. Essa inovação reflete a crescente ênfase na durabilidade e no valor do ciclo de vida em infraestruturas de armazenamento refrigerado.

- Em janeiro de 2024, a Hussmann, uma empresa da Panasonic, lançou a Evolve Technologies para apoiar soluções de refrigeração com baixo Potencial de Aquecimento Global (GWP), utilizando refrigerantes sustentáveis como o R-744 (CO₂) e o R-290 (propano). A iniciativa visa atender às pressões regulatórias e às preocupações ambientais, ao mesmo tempo que aprimora a sustentabilidade da refrigeração. Esse lançamento demonstra a mudança do setor em direção a tecnologias de refrigeração ecologicamente corretas e preparadas para o futuro.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.