North America Vegan Protein Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

3.77 Billion

USD

6.63 Billion

2024

2032

USD

3.77 Billion

USD

6.63 Billion

2024

2032

| 2025 –2032 | |

| USD 3.77 Billion | |

| USD 6.63 Billion | |

|

|

|

|

Segmentação do mercado de proteína vegana na América do Norte, por fonte (proteína de soja, proteína de ervilha, proteína de arroz, proteína de cânhamo, espirulina, proteína de quinoa, proteína de linhaça, proteína de chia, proteína de canola, semente de abóbora e outras), tipo de proteína (isolada, concentrada e hidrolisada), nível de hidrólise (intacta, levemente hidrolisada e fortemente hidrolisada), forma (seca e líquida), natureza (convencional e orgânica), função (solubilidade, emulsificação, gelificação, ligação de água, formação de espuma e outras), aplicação (produtos alimentícios, bebidas, nutracêuticos e suplementos alimentares, cosméticos e cuidados pessoais, ração animal, produtos farmacêuticos e outros) - Tendências do setor e previsão para 2032

Tamanho do mercado de proteína vegana na América do Norte

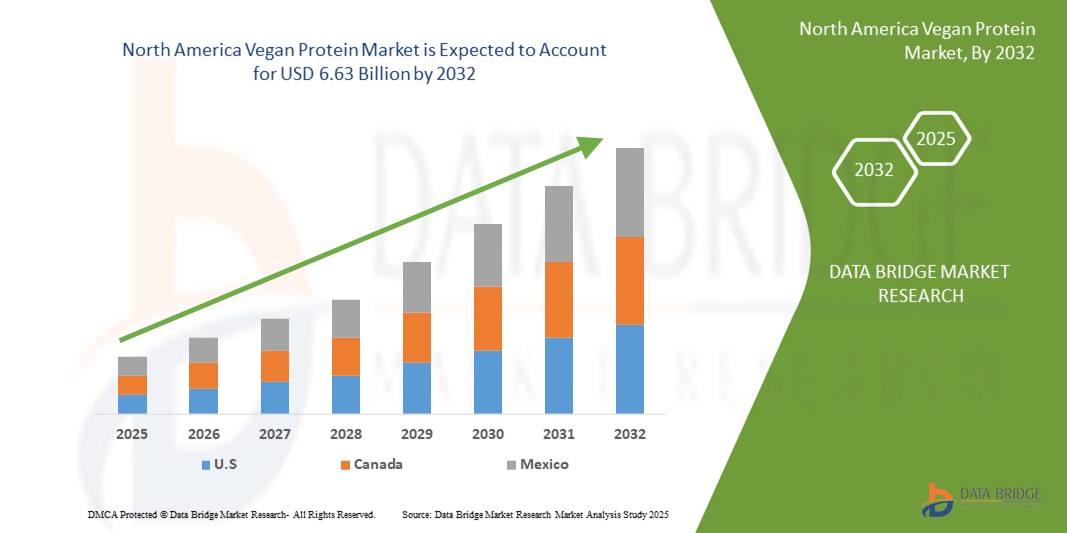

- O tamanho do mercado de proteína vegana da América do Norte foi avaliado em US$ 3,77 bilhões em 2024 e deve atingir US$ 6,63 bilhões até 2032 , com um CAGR de 7,30% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente adoção de dietas à base de plantas, pelo foco crescente do consumidor em saúde e bem-estar e pela crescente conscientização ambiental e ética.

- O aumento da demanda por alimentos funcionais, bebidas e suplementos alimentares enriquecidos com proteínas está impulsionando ainda mais a expansão do mercado

Análise do Mercado de Proteína Vegana na América do Norte

- A crescente adoção de dietas à base de plantas e a crescente conscientização sobre a saúde entre os consumidores estão impulsionando a demanda por produtos proteicos veganos. A crescente conscientização sobre os benefícios ambientais e éticos das proteínas vegetais está impulsionando ainda mais o crescimento do mercado.

- O aumento nas tendências de condicionamento físico e bem-estar, juntamente com o uso crescente de proteína vegana em alimentos funcionais, nutracêuticos e suplementos alimentares, está contribuindo para a expansão do mercado

- O mercado de proteína vegana dos EUA conquistou a maior fatia da receita na América do Norte em 2024, impulsionado pela alta conscientização dos consumidores sobre dietas à base de plantas, saúde e sustentabilidade. Os consumidores priorizam cada vez mais alimentos, bebidas e suplementos alimentares enriquecidos com proteína, impulsionando a demanda por pós, barras e produtos funcionais veganos.

- Espera-se que o Canadá testemunhe a maior taxa composta de crescimento anual (CAGR) no mercado de proteínas veganas da América do Norte, devido à crescente demanda por alternativas alimentares sustentáveis, à expansão da população vegana e ao aumento dos investimentos em inovação em alimentos de origem vegetal. Políticas governamentais de apoio e a crescente adoção de proteínas veganas nos setores de varejo e foodservice estão acelerando o crescimento do mercado.

- O segmento de proteína de soja deteve a maior fatia de mercado em 2024, impulsionado por seu amplo uso em produtos alimentícios, bebidas e suplementos alimentares. A proteína de soja é favorecida por seu alto valor nutricional, aplicações versáteis e cadeia de suprimentos estabelecida em diversos países.

Escopo do relatório e segmentação do mercado de proteína vegana na América do Norte

|

Atributos |

Principais insights do mercado de proteínas veganas na América do Norte |

|

Segmentos abrangidos |

• Por fonte: proteína de soja, proteína de ervilha, proteína de arroz, proteína de cânhamo, espirulina, proteína de quinoa, proteína de linhaça, proteína de chia, proteína de canola, semente de abóbora e outros |

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de proteína vegana na América do Norte

Adoção crescente de soluções de proteína vegetal

- A crescente mudança para produtos proteicos veganos está transformando o cenário alimentar e nutracêutico, oferecendo alternativas proteicas sustentáveis e à base de plantas. Esses produtos permitem que os consumidores atendam às necessidades diárias de proteína, reduzindo a dependência de fontes de origem animal, contribuindo para objetivos de saúde e ambientais. O crescente interesse do consumidor por opções alimentares éticas e ecologicamente corretas impulsiona ainda mais a aceitação no mercado.

- A crescente demanda por suplementos, barras e pós proteicos práticos está acelerando a adoção de soluções proteicas veganas. Esses produtos são particularmente eficazes nos segmentos de fitness e bem-estar, onde os consumidores buscam opções rápidas e nutritivas. A disponibilidade de produtos prontos para uso e com sabor aumenta a conveniência do consumidor e incentiva o uso frequente.

- A acessibilidade, a variedade e a facilidade de incorporação de proteínas veganas na dieta diária tornam esses produtos atraentes para residências, academias e restaurantes. O consumo frequente aumenta a diversidade alimentar e contribui para tendências gerais de saúde e bem-estar. Além disso, a tendência por proteínas vegetais funcionais e fortificadas está expandindo suas aplicações na nutrição diária.

- Por exemplo, nos últimos anos, diversas marcas de nutrição relataram um aumento nas vendas após o lançamento de novos suplementos proteicos de ervilha, arroz e soja, voltados para consumidores veganos e flexitarianos. Esses lançamentos permitiram uma adoção mais ampla e um melhor engajamento do consumidor. Esforços de marketing que destacam sustentabilidade, nutrição e versatilidade ampliaram ainda mais o alcance do produto.

- Embora os produtos de proteína vegana estejam apoiando o consumo consciente da saúde e dietas sustentáveis, seu crescimento de mercado depende da inovação contínua dos produtos, da otimização do sabor e da acessibilidade. Os fabricantes devem se concentrar em formulações inovadoras, fornecimento de qualidade e marketing estratégico para capitalizar totalmente essa demanda crescente. Embalagens aprimoradas, formatos estáveis em prateleira e misturas de proteínas multifuncionais também estão contribuindo para o impulso do mercado.

Dinâmica do mercado de proteína vegana na América do Norte

Motorista

Aumento da conscientização sobre saúde e mudança para dietas baseadas em vegetais

- A crescente base de consumidores preocupados com a saúde está pressionando fabricantes e varejistas a priorizar produtos proteicos de origem vegetal. Os consumidores buscam cada vez mais alternativas às proteínas animais tradicionais para a saúde cardiovascular, controle de peso e bem-estar digestivo. Essa mudança é ainda mais apoiada pela crescente popularidade de produtos alimentícios naturais e de rótulos limpos.

- A crescente conscientização sobre o impacto ambiental da criação de animais está levando os consumidores a optar por opções de proteína vegana. Essa tendência está levando as marcas a oferecer formulações mais diversificadas à base de plantas e a investir em práticas de abastecimento sustentáveis. A ênfase na redução da pegada de carbono e em embalagens ecologicamente corretas também está fortalecendo a preferência do consumidor por proteínas de origem vegetal.

- Governos, organizações de nutrição e programas de bem-estar estão promovendo dietas à base de plantas como parte de campanhas de saúde pública. Iniciativas educacionais e o apoio de influenciadores de fitness e saúde estão impulsionando ainda mais a adesão dos consumidores. Iniciativas que destacam a nutrição preventiva e os benefícios dos alimentos funcionais estão contribuindo para o crescimento consistente do mercado.

- Por exemplo, diversas marcas implementaram recentemente campanhas de conscientização enfatizando os benefícios nutricionais e ambientais das proteínas veganas, resultando em maior visibilidade do produto e interesse do consumidor. Campanhas promocionais cruzadas com plataformas de fitness, estilo de vida e bem-estar ajudaram a expandir o alcance do mercado.

- Embora a conscientização sobre saúde e a sustentabilidade impulsionem o crescimento, a inovação de produtos, a otimização de sabores e a expansão da distribuição continuam sendo cruciais para a expansão contínua do mercado. Além disso, o desenvolvimento de proteínas híbridas e misturas fortificadas está aprimorando o apelo funcional dos produtos proteicos veganos.

Restrição/Desafio

Alto custo de formulações de proteína premium e preferências de sabor

- Proteínas vegetais em pó, isoladas e misturas premium costumam ter preços mais altos do que as fontes proteicas tradicionais, o que limita a adoção entre consumidores sensíveis a preço. Isso restringe o uso generalizado em mercados emergentes e entre usuários casuais. A produção com boa relação custo-benefício e o fornecimento de ingredientes continuam sendo os principais desafios para os fabricantes.

- Em muitas regiões, os consumidores podem perceber as proteínas vegetais como menos palatáveis ou menos eficazes do que as proteínas de origem animal. Os desafios de sabor, textura e digestibilidade continuam a impactar o comportamento de compra recorrente. As marcas estão investindo em mascaramento de sabor, aprimoramento de textura e combinações de proteínas para superar essas barreiras.

- Restrições na cadeia de suprimentos, como o fornecimento de soja, ervilha, arroz ou outros ingredientes ricos em proteínas de alta qualidade, podem levar a gargalos na produção e preços de varejo mais altos, afetando a acessibilidade. Atrasos na disponibilidade de matéria-prima e flutuações no fornecimento global também podem prejudicar a estabilidade do mercado.

- Por exemplo, diversas marcas de proteína vegana revisaram recentemente suas embalagens, rótulos e informações nutricionais para garantir precisão e transparência, aumentando assim a confiança do consumidor e incentivando a compra recorrente. Essas iniciativas também incluíram campanhas educativas para esclarecer a qualidade e os benefícios da proteína.

- Embora os produtos de proteína vegana continuem evoluindo em formulação e sabor, abordar os desafios de custo, preferências sensoriais e da cadeia de suprimentos continua sendo vital. As partes interessadas devem se concentrar em soluções acessíveis, de alta qualidade e palatáveis para sustentar o potencial de crescimento a longo prazo. Investimentos em pesquisa, produção escalável e fontes alternativas de proteína podem aumentar a acessibilidade e a lucratividade.

Escopo do mercado de proteína vegana na América do Norte

O mercado é segmentado com base na fonte, tipo de proteína, nível de hidrólise, forma, natureza, função e aplicação.

- Por fonte

Com base na origem, o mercado de proteína vegana da América do Norte é segmentado em proteína de soja, proteína de ervilha, proteína de arroz, proteína de cânhamo, espirulina, proteína de quinoa, proteína de linhaça, proteína de chia, proteína de canola, semente de abóbora e outras. O segmento de proteína de soja deteve a maior fatia de mercado em 2024, impulsionado por seu amplo uso em produtos alimentícios, bebidas e suplementos alimentares. A proteína de soja é favorecida por seu alto valor nutricional, aplicações versáteis e cadeia de suprimentos consolidada em vários países.

Espera-se que o segmento de proteína de ervilha apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente preferência do consumidor por fontes de proteína vegetal e sem alérgenos. A proteína de ervilha é particularmente popular em proteínas em pó, lanches e alimentos funcionais devido ao seu sabor neutro, alta digestibilidade e adequação a formulações de rótulo limpo.

- Por tipo de proteína

Com base no tipo de proteína, o mercado de proteína vegana da América do Norte é segmentado em isolados, concentrados e hidrolisados. O segmento de isolados deteve a maior participação na receita em 2024 devido ao seu alto teor proteico, pureza e propriedades funcionais adequadas para bebidas e suplementos nutricionais.

Espera-se que o segmento de hidrolisados apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pela maior digestibilidade, rápida absorção e adequação para nutrição esportiva e aplicações clínicas. Os hidrolisados são populares entre consumidores que buscam utilização rápida e eficiente de proteínas.

- Por Nível de Hidrólise

Com base no nível de hidrólise, o mercado de proteínas veganas da América do Norte é segmentado em proteínas intactas, levemente hidrolisadas e fortemente hidrolisadas. O segmento intacto dominou em 2024 devido ao seu perfil nutricional equilibrado e custo-benefício para consumo alimentar regular.

Espera-se que o segmento levemente hidrolisado testemunhe a maior taxa de crescimento entre 2025 e 2032, impulsionado pela melhor solubilidade, desempenho funcional e digestibilidade, tornando-o ideal para bebidas fortificadas e formulações de proteínas especializadas.

- Por Formulário

Com base no formato, o mercado de proteínas veganas da América do Norte é segmentado em proteínas secas e líquidas. O segmento seco deteve a maior fatia de mercado em 2024 devido à sua facilidade de armazenamento, longa vida útil e aplicabilidade em proteínas em pó, barras e produtos de panificação.

Espera-se que o segmento de líquidos testemunhe a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente demanda por bebidas prontas para beber, smoothies e bebidas funcionais enriquecidas com proteínas entre consumidores preocupados com a saúde.

- Por natureza

Com base na natureza, o mercado de proteínas veganas da América do Norte é segmentado em proteínas convencionais e orgânicas. O segmento convencional liderou o mercado em 2024, apoiado por uma infraestrutura de fabricação bem estabelecida e preços acessíveis.

Espera-se que o segmento orgânico testemunhe a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente preferência do consumidor por proteínas vegetais de rótulo limpo, não transgênicas e de origem sustentável na América do Norte.

- Por função

Com base na função, o mercado de proteínas veganas na América do Norte é segmentado em solubilidade, emulsificação, gelificação, ligação de água, formação de espuma e outros. O segmento de solubilidade deteve a maior participação de mercado em 2024 devido à sua importância em bebidas, shakes e alimentos funcionais.

Espera-se que os segmentos de emulsificação e gelificação testemunhem a maior taxa de crescimento entre 2025 e 2032, impulsionados pelo uso crescente de proteínas veganas em panificação, alternativas lácteas e aplicações de alimentos processados para melhoria de textura e estabilidade.

- Por aplicação

Com base na aplicação, o mercado de proteína vegana da América do Norte é segmentado em produtos alimentícios, bebidas, nutracêuticos e suplementos alimentares, cosméticos e cuidados pessoais, ração animal, produtos farmacêuticos e outros. O segmento de produtos alimentícios dominou em 2024 devido à alta incorporação de proteínas vegetais em panificação, salgadinhos e confeitaria.

Espera-se que o segmento de nutracêuticos e suplementos alimentares testemunhe a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente adoção de alimentos funcionais enriquecidos com proteínas, suplementos de bem-estar e bebidas fortificadas.

Análise regional do mercado de proteína vegana na América do Norte

- O mercado de proteína vegana dos EUA conquistou a maior fatia da receita na América do Norte em 2024, impulsionado pela alta conscientização dos consumidores sobre dietas à base de plantas, saúde e sustentabilidade. Os consumidores priorizam cada vez mais alimentos, bebidas e suplementos alimentares enriquecidos com proteína, impulsionando a demanda por pós, barras e produtos funcionais veganos.

- A presença crescente de marcas consolidadas de proteína vegana, aliada a redes de distribuição avançadas, impulsiona o crescimento consistente do mercado. O crescente interesse por produtos de rótulo limpo, livres de alérgenos e fortificados acelera ainda mais a adoção.

- Iniciativas de marketing que enfatizam os benefícios nutricionais e o impacto ambiental também contribuem para a preferência do consumidor e a expansão das vendas

Visão geral do mercado de proteína vegana do Canadá

Espera-se que o mercado canadense de proteína vegana apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente conscientização sobre saúde, tendências de fitness e crescente conscientização sobre dietas sustentáveis. Os consumidores buscam produtos de proteína vegetal convenientes, como pós, barras e bebidas prontas para consumo, para nutrição diária. A expansão do varejo, plataformas online e lojas especializadas estão facilitando melhor acessibilidade e penetração no mercado. A adoção de formulações sem alérgenos e com rótulos limpos está contribuindo para o rápido crescimento. Além disso, lançamentos de produtos inovadores e campanhas de marketing com foco em benefícios funcionais sustentam a expansão contínua do mercado.

Participação no mercado de proteínas veganas na América do Norte

A indústria de proteína vegana da América do Norte é liderada principalmente por empresas bem estabelecidas, incluindo:

- Além da Carne (EUA)

- Impossible Foods (EUA)

- SunOpta (Canadá)

- Vega (Canadá)

- Nutrição nua (EUA)

- Jardim da Vida (EUA)

- Bob's Red Mill (EUA)

- Orgain (EUA)

- NOW Foods (EUA)

- Manitoba Harvest (Canadá)

Últimos desenvolvimentos no mercado de proteína vegana da América do Norte

- Em março de 2023, a Biblioteca Nacional de Medicina publicou um artigo de pesquisa como parte de sua iniciativa de desenvolvimento de conhecimento, com foco no papel das dietas à base de plantas na melhoria da saúde e na redução dos impactos ambientais. O estudo destacou a crescente demanda do consumidor por proteínas veganas, impulsionada por seus benefícios nutricionais e vantagens em termos de sustentabilidade. Espera-se que esse desenvolvimento incentive a adoção de proteínas vegetais, criando novas oportunidades de crescimento para os fabricantes. A ênfase na saúde e no consumo sustentável provavelmente impactará positivamente o mercado de proteínas veganas, aumentando a conscientização e fortalecendo a confiança do consumidor em soluções à base de plantas.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.