North America Vanilla Beans And Extracts Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

234.29 Million

USD

313.32 Million

2025

2033

USD

234.29 Million

USD

313.32 Million

2025

2033

| 2026 –2033 | |

| USD 234.29 Million | |

| USD 313.32 Million | |

|

|

|

|

Segmentação do mercado de baunilha em fava e extrato na América do Norte, por tipo de produto (Madagascar, México, Índia, Indonésia, Taiti, Tonga, Papua, Uganda e outros), graus de qualidade (grau A, grau B e outros), origem (natural e sintética), forma (líquida, em pó e em pasta), usuário final (alimentos, bebidas, produtos de higiene pessoal, indústria farmacêutica, culinária doméstica e outros), canal de distribuição (B2B e B2C) - Tendências e previsões do setor até 2033.

Tamanho do mercado de favas e extrato de baunilha na América do Norte

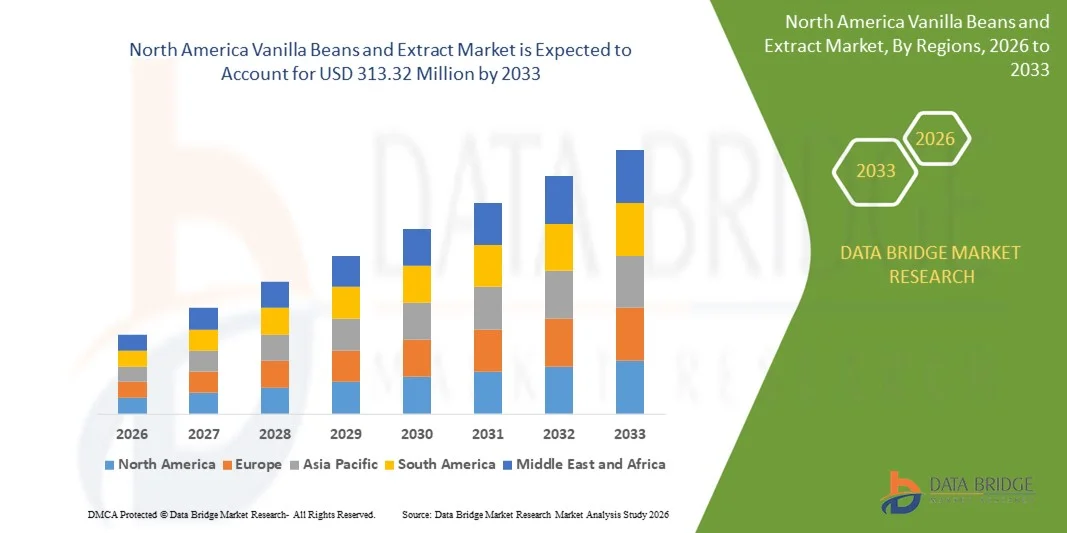

- O mercado de favas e extrato de baunilha na América do Norte foi avaliado em US$ 234,29 milhões em 2025 e deverá atingir US$ 313,32 milhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 3,70% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente demanda por sabores naturais em alimentos e bebidas, pela preferência cada vez maior do consumidor por produtos com rótulos limpos e à base de plantas, e pela crescente popularidade de sobremesas e confeitaria premium.

- A expansão nas indústrias de panificação, laticínios e bebidas, juntamente com o aumento do uso em cosméticos e produtos de higiene pessoal, está impulsionando ainda mais a adoção pelo mercado.

Análise do mercado de vagens e extrato de baunilha na América do Norte

- A crescente conscientização do consumidor em relação aos sabores naturais e autênticos está impulsionando a demanda por favas e extratos de baunilha de alta qualidade em diversos setores de uso final.

- A crescente adoção da baunilha em bebidas aromatizadas, chocolates, sorvetes e produtos de panificação está impulsionando o crescimento do mercado, sustentado pela expansão dos canais de distribuição no varejo e online.

- Os Estados Unidos dominaram o mercado de favas e extrato de baunilha, com a maior participação na receita em 2025, impulsionados pela alta demanda da indústria de alimentos e bebidas, bem como pelo uso crescente em produtos de higiene pessoal e farmacêuticos.

- O Canadá deverá apresentar a maior taxa de crescimento anual composta (CAGR) no mercado de favas e extrato de baunilha da América do Norte, devido à crescente conscientização sobre ingredientes naturais e de origem vegetal, à expansão dos setores de panificação e confeitaria, ao crescimento do comércio eletrônico e dos canais de varejo, e à crescente preferência do consumidor por produtos de baunilha premium e de origem ética.

- O segmento de Madagascar detinha a maior participação na receita de mercado em 2025, impulsionado por seu perfil de sabor superior, qualidade consistente e ampla preferência entre fabricantes de alimentos e bebidas premium. A baunilha de Madagascar é amplamente utilizada em panificação, confeitaria e laticínios, tornando-se uma escolha preferencial para aplicações de sabor autêntico.

Escopo do relatório e segmentação do mercado de favas e extrato de baunilha na América do Norte

|

Atributos |

Principais informações de mercado sobre vagens e extrato de baunilha na América do Norte |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

• Nielsen-Massey Vanillas, Inc. (EUA) |

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marcas, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de vagens e extrato de baunilha na América do Norte

Crescente demanda por sabores naturais e com rótulo limpo.

- A crescente preferência do consumidor por sabores naturais e minimamente processados está moldando significativamente o mercado de favas e extratos de baunilha. Os consumidores favorecem cada vez mais ingredientes autênticos, não sintéticos e derivados de plantas. Os extratos de baunilha estão ganhando espaço devido à sua capacidade de realçar o sabor e o aroma sem aditivos artificiais, incentivando os fabricantes a inovar com novas formulações que atendam às expectativas de sabor em constante evolução em aplicações de alimentos, bebidas e confeitaria.

- A crescente conscientização sobre saúde, bem-estar e consumo sustentável acelerou a demanda por favas e extratos de baunilha em produtos de panificação, laticínios, bebidas e confeitaria. Consumidores preocupados com a saúde buscam ativamente produtos formulados com ingredientes de origem natural, o que leva as marcas a enfatizarem a rastreabilidade, o fornecimento ecologicamente correto e as práticas de produção sustentáveis.

- As tendências de rótulos limpos e sustentabilidade estão influenciando as decisões de compra, com os fabricantes destacando a transparência na origem dos produtos, as certificações orgânicas e a produção ambientalmente responsável. Esses fatores ajudam as marcas a diferenciar seus produtos em um mercado competitivo, construir a confiança do consumidor e impulsionar a adoção de produtos de baunilha premium.

- Por exemplo, em 2024, marcas líderes como Starbucks e Nestlé expandiram seus portfólios de produtos incorporando extratos naturais de baunilha em bebidas, sorvetes e doces. Esses lançamentos responderam à crescente preferência do consumidor por sabores autênticos e produtos com rótulos limpos, distribuídos em canais de varejo, lojas especializadas e online, reforçando a fidelidade à marca e as compras repetidas.

- Embora a demanda por favas e extratos de baunilha esteja crescendo, a expansão sustentada do mercado depende de pesquisa e desenvolvimento contínuos, produção com boa relação custo-benefício e manutenção da qualidade consistente do sabor. Os fabricantes também estão se concentrando em melhorar a escalabilidade, a confiabilidade da cadeia de suprimentos e desenvolver formulações inovadoras que equilibrem custo, qualidade e sustentabilidade para uma adoção mais ampla.

Dinâmica do mercado de vagens e extrato de baunilha na América do Norte

Motorista

Crescente preferência por sabores naturais e com rótulos limpos.

- A crescente demanda do consumidor por sabores autênticos derivados de plantas é um dos principais impulsionadores do mercado de favas e extratos de baunilha. Os fabricantes estão substituindo cada vez mais os aromatizantes sintéticos por baunilha natural para atender às expectativas de rótulos limpos, aumentar o apelo do produto e cumprir as normas regulatórias. Essa tendência também está impulsionando a inovação em métodos de extração natural e técnicas de concentração de sabor.

- A crescente aplicação em panificação, confeitaria, bebidas, laticínios e sobremesas congeladas está influenciando o crescimento do mercado. Os extratos de baunilha realçam o sabor, o aroma e a percepção do produto, mantendo a rotulagem como natural, permitindo que os fabricantes atendam às expectativas dos consumidores por produtos naturais e de alta qualidade.

- Os fabricantes de alimentos e bebidas estão promovendo ativamente produtos formulados com baunilha natural por meio de inovação, campanhas de marketing e certificações. Esses esforços são apoiados pela crescente preferência do consumidor por produtos voltados para a saúde e de origem sustentável, incentivando colaborações entre fornecedores de ingredientes e marcas para melhorar a qualidade funcional e a sustentabilidade.

- Por exemplo, em 2023, empresas como Ben & Jerry's e Häagen-Dazs aumentaram a incorporação de extratos de baunilha premium em sorvetes e sobremesas. Essa expansão acompanhou a crescente demanda por sabores com rótulos limpos, sem transgênicos e de origem sustentável, impulsionando a recompra e a diferenciação de produtos. Ambas as empresas destacaram o fornecimento ético e a rastreabilidade em suas campanhas de marketing para fortalecer a confiança do consumidor e a fidelidade à marca.

- Embora as tendências crescentes de rótulos limpos e sabores naturais impulsionem o crescimento, uma adoção mais ampla depende da otimização de custos, da disponibilidade de matéria-prima e de processos de produção escaláveis. O investimento em eficiência da cadeia de suprimentos, fornecimento sustentável e tecnologia de extração avançada será crucial para atender à demanda global e manter a vantagem competitiva.

Restrição/Desafio

Custo mais elevado e maior volatilidade de fornecimento em comparação com os aromas sintéticos.

- O custo relativamente mais elevado das favas e extratos de baunilha natural em comparação com os aromas sintéticos continua sendo um desafio crucial, limitando a adoção entre os fabricantes sensíveis ao preço. Fatores como o cultivo complexo, os métodos de extração e as variações sazonais contribuem para os preços elevados e impactam a penetração no mercado.

- Os desafios na cadeia de suprimentos também afetam o crescimento, já que as vagens de baunilha exigem o fornecimento de regiões específicas e a adesão a padrões de qualidade rigorosos. A flutuação da produção devido ao clima, doenças ou fatores geopolíticos pode interromper o fornecimento, levando à volatilidade dos preços e à disponibilidade limitada de vagens de alta qualidade.

- O conhecimento do mercado e o saber técnico influenciam a adoção, principalmente entre os pequenos fabricantes. A compreensão limitada dos benefícios funcionais e de sabor da baunilha natural pode restringir a adoção em certas categorias de produtos e atrasar a inovação.

- Por exemplo, em 2024, os produtores de confeitaria relataram dificuldades em garantir o fornecimento consistente de favas de baunilha devido à escassez da safra e aos altos custos, o que afetou o planejamento da produção, a precificação e a visibilidade do produto.

- Superar esses desafios exigirá produção com custos eficientes, redes de fornecimento ampliadas e investimento em práticas de cultivo sustentáveis. A colaboração com agricultores, organismos de certificação e distribuidores pode ajudar a estabilizar o fornecimento e desbloquear o potencial de crescimento a longo prazo no mercado global de favas e extrato de baunilha, reforçando, ao mesmo tempo, o fornecimento ético e a reputação da marca.

Escopo do mercado de favas e extrato de baunilha na América do Norte

O mercado de favas e extrato de baunilha na América do Norte é segmentado em seis segmentos principais com base no tipo de produto, classificação, origem, forma, usuário final e canal de distribuição.

- Por tipo de produto

Com base no tipo de produto, o mercado de favas e extrato de baunilha da América do Norte é segmentado em Madagascar, México, Índia, Indonésia, Taiti, Tonga, Papua, Uganda e outros. O segmento de Madagascar detinha a maior participação na receita de mercado em 2025, impulsionado por seu perfil de sabor superior, qualidade consistente e ampla preferência entre fabricantes de alimentos e bebidas premium. A baunilha de Madagascar é amplamente utilizada em panificação, confeitaria e laticínios, tornando-se uma escolha preferencial para aplicações que buscam sabor autêntico.

O segmento mexicano deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente demanda por seu aroma rico e adaptabilidade em diversas aplicações culinárias e de bebidas. A baunilha mexicana está ganhando popularidade devido ao seu sabor equilibrado, custo-benefício e reconhecimento crescente nos mercados internacionais, incentivando os fabricantes a incorporá-la em linhas de produtos premium e convencionais.

- Por séries

Com base na classificação, o mercado de favas e extrato de baunilha na América do Norte é segmentado em Grau A, Grau B e outros. O segmento de Grau A detinha a maior participação na receita de mercado em 2025, impulsionado pelo seu alto teor de vanilina, aroma intenso e adequação a produtos alimentícios e bebidas premium. O Grau A é amplamente utilizado em panificação, confeitaria e laticínios, garantindo sabor autêntico e altos padrões de qualidade.

O segmento de Grau B deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela sua relação custo-benefício e versatilidade em produtos processados e extratos. O Grau B é cada vez mais preferido pelos fabricantes que buscam otimizar os custos de produção, mantendo uma qualidade de sabor aceitável, o que o torna adequado para aplicações em larga escala.

- Por origem

Com base na origem, o mercado de favas e extrato de baunilha na América do Norte é segmentado em natural e sintético. O segmento de baunilha natural detinha a maior participação na receita de mercado em 2025, impulsionado pela crescente preferência do consumidor por ingredientes de origem vegetal e com rótulo limpo. A baunilha natural é amplamente utilizada em produtos de panificação, bebidas e cuidados pessoais devido ao seu aroma e sabor autênticos.

Espera-se que o segmento sintético apresente a taxa de crescimento mais rápida de 2026 a 2033, impulsionado por sua qualidade consistente, menor custo e adequação para aplicações industriais em larga escala. A baunilha sintética está ganhando espaço em alimentos e bebidas processados, onde o fornecimento de baunilha natural é limitado.

- Por formulário

Com base na forma, o mercado de favas e extrato de baunilha na América do Norte é segmentado em líquido, em pó e em pasta. O segmento líquido detinha a maior participação na receita de mercado em 2025, impulsionado pela sua facilidade de uso, melhor solubilidade e compatibilidade com produtos de panificação, bebidas e laticínios. A baunilha líquida é amplamente preferida pelos fabricantes para uma integração perfeita em receitas e formulações.

Espera-se que o segmento de baunilha em pó apresente o crescimento mais rápido entre 2026 e 2033, impulsionado por sua longa vida útil, facilidade de armazenamento e uso em aplicações especiais. A pasta de baunilha também está ganhando popularidade em produtos culinários e de confeitaria premium devido ao seu sabor concentrado.

- Por usuário final

Com base no usuário final, o mercado de favas e extrato de baunilha na América do Norte é segmentado em produtos alimentícios, bebidas, produtos de higiene pessoal, indústria farmacêutica, culinária doméstica e outros. O segmento de produtos alimentícios detinha a maior participação na receita de mercado em 2025, impulsionado pela alta demanda dos setores de panificação, confeitaria e laticínios. A baunilha é amplamente utilizada para realçar o sabor, o aroma e o apelo geral do produto.

O segmento de bebidas deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pelo aumento do consumo de bebidas aromatizadas, café e bebidas lácteas. Produtos de higiene pessoal e aplicações culinárias caseiras também estão registrando crescente adoção devido à demanda por ingredientes naturais e de alta qualidade.

- Por canal de distribuição

Com base no canal de distribuição, o mercado de favas e extrato de baunilha na América do Norte é segmentado em B2B e B2C. O segmento B2B detinha a maior participação na receita de mercado em 2025, impulsionado pelas compras em grande escala por fabricantes de alimentos e bebidas. As favas e os extratos de baunilha são amplamente fornecidos a fabricantes industriais para garantir um sabor consistente em produtos processados.

O segmento B2C deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente popularidade da culinária caseira, dos canais de varejo online e dos produtos de baunilha prontos para uso. Os consumidores estão comprando cada vez mais produtos de baunilha diretamente para uso culinário e aplicações especiais.

Análise Regional do Mercado de Baunilha em Fava e Extrato na América do Norte

- Os Estados Unidos dominaram o mercado de favas e extrato de baunilha, com a maior participação na receita em 2025, impulsionados pela alta demanda da indústria de alimentos e bebidas, bem como pelo uso crescente em produtos de higiene pessoal e farmacêuticos.

- Os consumidores do país preferem baunilha de qualidade premium para aplicações em panificação, confeitaria e bebidas, valorizando seu sabor e aroma naturais.

- Essa ampla adoção é ainda mais impulsionada pelo forte poder aquisitivo, pela crescente conscientização sobre ingredientes naturais e pela popularidade cada vez maior de produtos com rótulos limpos, consolidando a baunilha como um ingrediente privilegiado em diversos setores.

Análise do Mercado de Baunilha e Extrato de Baunilha no Canadá

O mercado canadense de favas e extrato de baunilha deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente preferência dos consumidores por aromas naturais e de alta qualidade em alimentos, bebidas e produtos de higiene pessoal. O aumento da demanda nos setores de panificação, confeitaria e laticínios está incentivando os fabricantes a expandirem suas redes de produção e distribuição. A crescente inclinação dos consumidores por ingredientes naturais e de origem vegetal, juntamente com os investimentos em formulações inovadoras à base de baunilha, está contribuindo significativamente para a expansão do mercado.

Participação de mercado de vagens e extrato de baunilha na América do Norte

A indústria de favas e extrato de baunilha na América do Norte é liderada principalmente por empresas consolidadas, incluindo:

• Nielsen-Massey Vanillas, Inc. (EUA)

• Beanilla, Inc. (EUA)

• Heilala Vanilla (EUA)

• Frontier Co-op (EUA)

• McCormick & Company, Inc. (EUA)

• Sonoma Syrup Co., Inc. (EUA)

• Republica del Cacao (EUA)

• Madison & Vine Natural Flavors (EUA)

• Vanilla Food Company, Inc. (EUA)

• Givaudan (EUA)

• Edlong Corporation (EUA)

• Rodelle, Inc. (EUA)

• Vanilla Ventures, LLC (EUA)

• David Michael & Co. (EUA)

• The Vanilla Company (Canadá)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.