Mercado de diagnóstico de transplantes da América do Norte, por tipo de produto (instrumento de diagnóstico de transplante, software de diagnóstico de transplante, reagente de diagnóstico de transplante), tecnologia (ensaios moleculares baseados em PCR, ensaios moleculares baseados em sequenciação), tipo de transplante (transplante de órgãos sólidos, transplante de células estaminais, macio Transplante de Tecido, Transplante de Medula Óssea, Outros Transplantes), Aplicação (Aplicações de Diagnóstico, Aplicações de Investigação), Utilizador Final (Laboratórios de Investigação e Institutos Académicos, Hospitais e Centros de Transplantação, Prestadores de Serviços Comerciais, Outros), Canal de Distribuição (Concurso Direto, Vendas a Retalho, Outros) Tendências e previsões da indústria para 2029.

Análise e insights do mercado de diagnóstico de transplantes da América do Norte

O diagnóstico do transplante é um procedimento de diagnóstico geralmente dividido em procedimentos pré-transplante e pós-transplante. Ajuda a analisar o estado de saúde do doente. Se isto for evitado, a pessoa imunocomprometida corre o risco de desenvolver IRAS ou pior, o que pode levar à morte. O procedimento é uma colaboração harmoniosa entre profissionais de saúde e especialistas de laboratório, garantindo melhores resultados para os pacientes. Além disso, a correspondência estreita entre os marcadores HLA do dador e do recetor é importante. Isto aumenta a probabilidade de sobrevivência do enxerto e minimiza complicações graves do transplante imunológico. O aumento da prevalência de doenças crónicas entre a população mundial irá provavelmente impulsionar a expansão do mercado ao longo dos anos previstos. Além disso, o uso crescente de terapia com células estaminais e medicamentos personalizados está a ganhar popularidade. A utilização de novas técnicas de diagnóstico melhorou os resultados médicos dos transplantes de órgãos. A taxa de rejeição de órgãos pode ser reduzida combinando a compatibilidade do dador e do recetor antes do transplante.

No entanto, o elevado custo dos procedimentos associados aos instrumentos de diagnóstico PCR e NGS é um dos mais significativos. Como resultado, o crescimento do mercado pode ser prejudicado a longo prazo. O custo do equipamento médico é um elemento que pode desafiar os fornecedores críticos de dispositivos para o diagnóstico de transplantes.

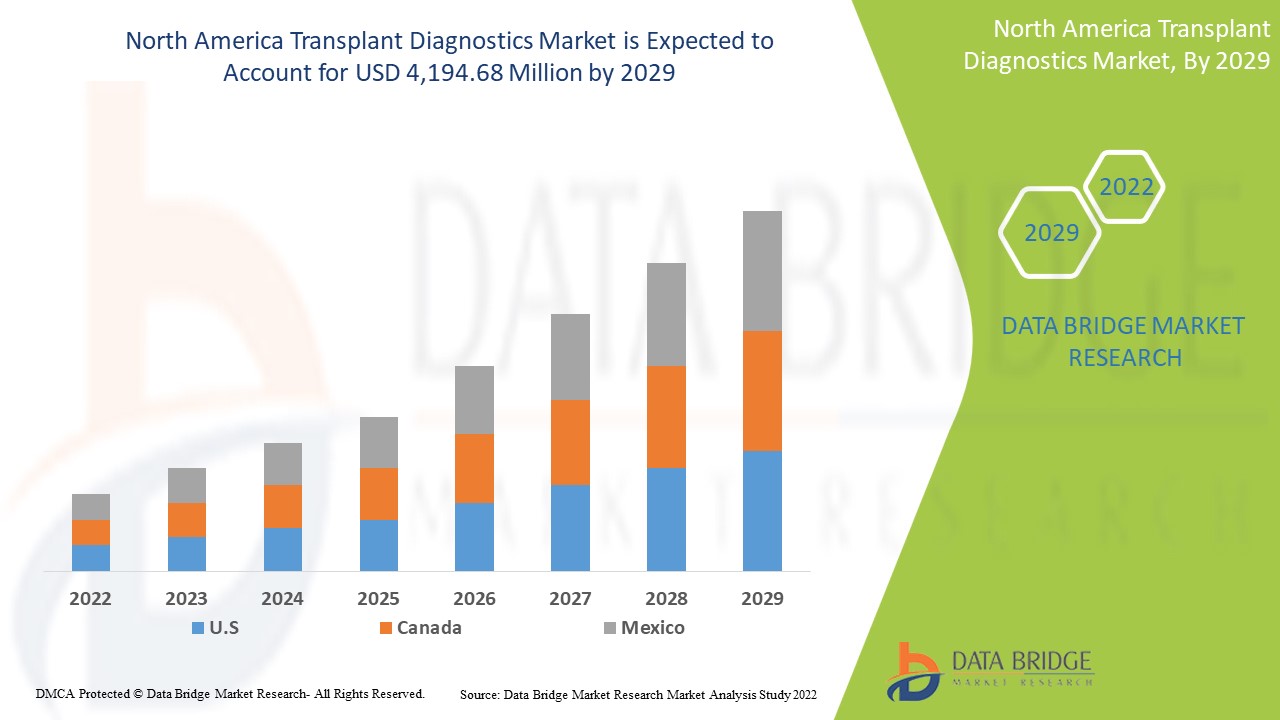

A Data Bridge Market Research analisa que o mercado de diagnóstico de transplantes da América do Norte deverá atingir um valor de 4.194,68 milhões de dólares até 2029, com um CAGR de 6,9% durante o período de previsão. Este relatório de mercado também abrange análises de preços, análises de patentes e avanços tecnológicos em profundidade.

|

Métrica de reporte |

Detalhes |

|

Período de previsão |

2022 a 2029 |

|

Ano base |

2021 |

|

Anos históricos |

2020 (personalizável para 2019-2014) |

|

Unidades Quantitativas |

Receita em milhões de dólares, preços em dólares |

|

Segmentos cobertos |

Por tipo de produto (instrumento de diagnóstico de transplante, software de diagnóstico de transplante, reagente de diagnóstico de transplante), tecnologia (ensaios moleculares baseados em PCR , ensaios moleculares baseados em sequenciação), tipo de transplante (transplante de órgãos sólidos, transplante de células estaminais , transplante de tecidos moles , transplante de ósseamedula |

|

Países abrangidos |

EUA, Canadá e México |

|

Participantes do mercado abrangidos |

Hologic, Inc., Biofortuna Limited, Takara Bio Inc., Abbott, Diagnóstica Longwood SL, Adaptive Biotechnologies, NanoString, Arquer Diagnostics Ltd, altona Diagnostics GmbH, ELITechGroup, DiaSorin SpA, Horiba Ltd, EUROFINS VIRACOR, CareDx Inc., Laboratory Corporation of America Holdings., Randox Laboratories Ltd., Thermo Fisher Scientific Inc., Preservation Solutions, Inc., TransMedics, Transonic, Stryker, Bio-Rad Laboratories, Inc., Zimmer Biomet, QIAGEN, F. Hoffmann-La Roche Ltd, BIOMÉRIEUX, Illumina, Inc., Luminex Corporation (subsidiária da DiaSorin Company), IMMUCOR, entre outras |

Definição de Mercado

O diagnóstico de transplante é a imunogenética e a histocompatibilidade dos transplantes de órgãos e das células estaminais hematopoiéticas. Estes diagnósticos ajudam os profissionais de saúde a determinar a compatibilidade entre os potenciais recetores e os dadores de órgãos. São utilizados em diversas disciplinas, como a imunogenética, a patologia e as doenças infeciosas, entre outras. O diagnóstico de transplante é utilizado para determinar se o dador e o recetor do órgão são compatíveis antes ou depois do transplante. Com a introdução do diagnóstico de transplantes, prevê-se que a prevalência de doenças que podem causar falência de órgãos, incluindo o rastreio pré e pós-transplante, aumente. O mercado tem despertado o interesse dos profissionais de saúde pelas inúmeras vantagens que estes exames oferecem para verificar a adequação para um procedimento de transplantação. O transplante de órgãos é uma das opções de tratamento mais populares para muitos doentes com doença renal terminal em diálise contínua.

Além disso, é possível investigar o transplante de órgãos para casos que envolvam o coração, o fígado ou a medula óssea. Embora em muitos casos exista uma forte associação entre a insuficiência renal e o transplante hepático, incluindo a doença renal terminal. Novos indicadores transcriptómicos, proteómicos e genómicos no diagnóstico molecular podem ajudar a adaptar melhor a terapêutica de transplante e a deteção precoce de eventos de rejeição. Além disso, as iniciativas estratégicas dos intervenientes no mercado, os progressos tecnológicos no diagnóstico de transplantes, a elevada garantia de esterilidade e o aumento do investimento em infraestruturas de saúde aumentam a procura de diagnósticos de transplantes.

Dinâmica do mercado de diagnóstico de transplantes da América do Norte

Esta secção trata da compreensão dos impulsionadores do mercado, vantagens, oportunidades, restrições e desafios. Tudo isto é discutido em detalhe abaixo:

Motoristas

- Número crescente de procedimentos de transplante

A procura de transplante de órgãos aumentou rapidamente em todo o mundo durante a última década devido ao aumento da incidência de falência de órgãos vitais e à melhoria dos resultados pós-transplante. A procura de transplantes de rim, coração, fígado e pulmões é muito elevada. O consumo de álcool, a falta de exercício e o abuso de drogas são as principais causas de falência de órgãos. O número de transplantes de dador vivo foi afetado pela pandemia de COVID-19. Mas os transplantes de dador vivo aumentaram 14,2% em relação a 2020.

- Além disso, o transplante de órgãos melhora a sobrevivência e a qualidade de vida dos doentes e tem um importante impacto positivo na saúde pública e no peso socioeconómico da falência de órgãos. A União Europeia (UE) tem uma abordagem relativamente uniforme e estruturada ao transplante de órgãos, programas nacionais bem desenvolvidos, sistemas internacionais para facilitar a partilha de órgãos e políticas de intercâmbio bem definidas, fazendo da Europa um líder neste domínio.

Assim, espera-se que o número crescente de procedimentos de transplante em todo o mundo e o aumento de transplantes bem-sucedidos impulsionem o mercado de diagnóstico de transplantes da América do Norte.

- Aumento dos avanços tecnológicos na área da transplantação

As novas tecnologias estão a mudar rapidamente as abordagens tradicionais ao transplante de órgãos. Os principais desafios no transplante de órgãos são a melhor forma de identificar e, se possível, eliminar a necessidade de imunossupressão ao longo da vida e como expandir o conjunto de dadores adequados para o transplante humano. Os investigadores desenvolveram um sistema avançado onde o tempo de transporte pode ser prolongado, enganando os órgãos doados, fazendo-os pensar que ainda estão dentro do corpo. Este sistema mantém o sangue oxigenado a fluir através dos órgãos para retardar a morte dos tecidos. Uma máquina de perfusão normotérmica imita o corpo humano, garantindo um fluxo sanguíneo constante para o órgão. A máquina também pode fornecer medicamentos ou outros nutrientes para manter o fígado em ótimas condições antes do transplante.

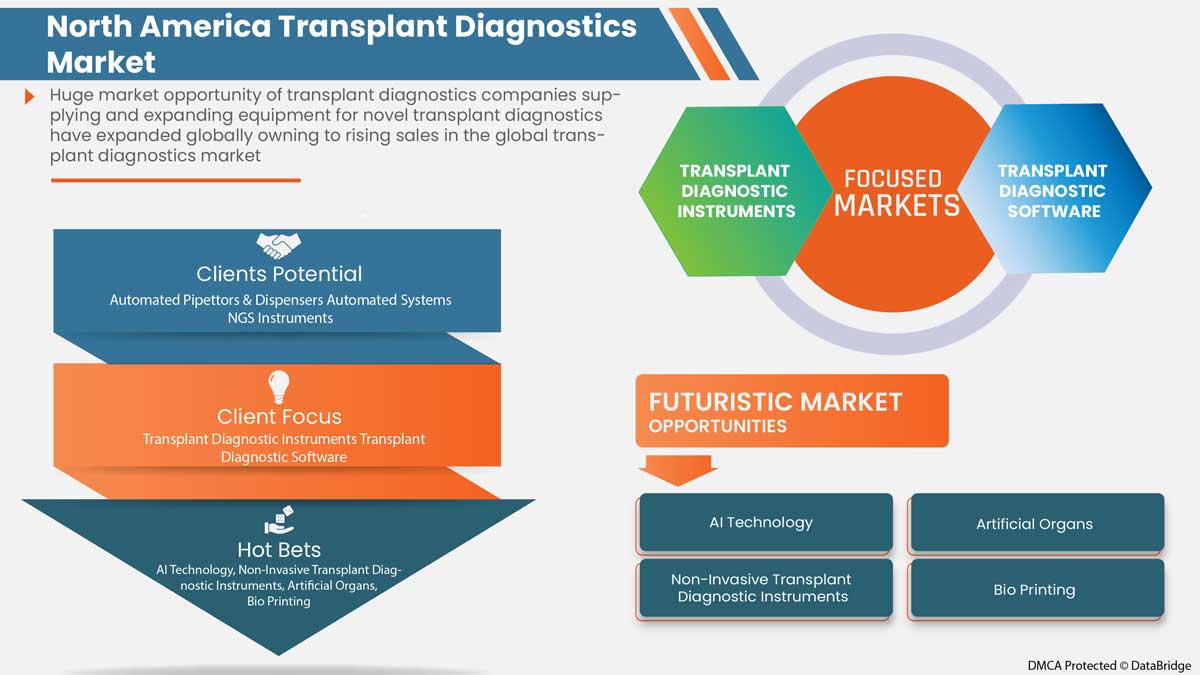

Além disso, as técnicas de produção de órgãos bioartificiais constituem uma gama de técnicas facilitadoras que podem ser utilizadas para produzir órgãos humanos com base em princípios biónicos. Nos últimos dez anos, foram feitos progressos significativos no desenvolvimento de várias tecnologias de fabrico de órgãos. A última década assistiu a enormes avanços em novas tecnologias, como a sequenciação de RNA unicelular, a nanobiotecnologia e a edição de genes CRISPR-Cas9. No entanto, as aplicações criativas destas novas e poderosas tecnologias para melhorar o transplante clínico apenas começaram. Com estas ferramentas, existem agora boas oportunidades para fazer grandes progressos na definição e prestação de cuidados optimizados e individualizados para todos os transplantes de órgãos.

Restrição

- Elevado custo do transplante de órgãos

A terapia de transplante de órgãos emprega produtos altamente avançados tecnologicamente. O desenvolvimento destes produtos envolve uma investigação e desenvolvimento rigorosos por parte dos players em desenvolvimento. Assim, o custo dos procedimentos e dos produtos mantém-se elevado, o que aumenta proporcionalmente o custo dos testes. Além disso, os transplantes de órgãos são dispendiosos porque consomem muitos recursos e envolvem médicos bem pagos, transportes e medicamentos dispendiosos.

- Além disso, as terapêuticas dessensibilizantes também têm sido utilizadas para conseguir o transplante de um dador incompatível. No entanto, tais procedimentos são muito dispendiosos e podem estar associados a complicações e a piores resultados a longo prazo.

Assim, o elevado custo do transplante e do tratamento utilizando modalidades avançadas e produtos tecnológicos atuará como um importante fator de restrição para o crescimento do mercado de diagnóstico de transplantes da América do Norte.

Oportunidade

-

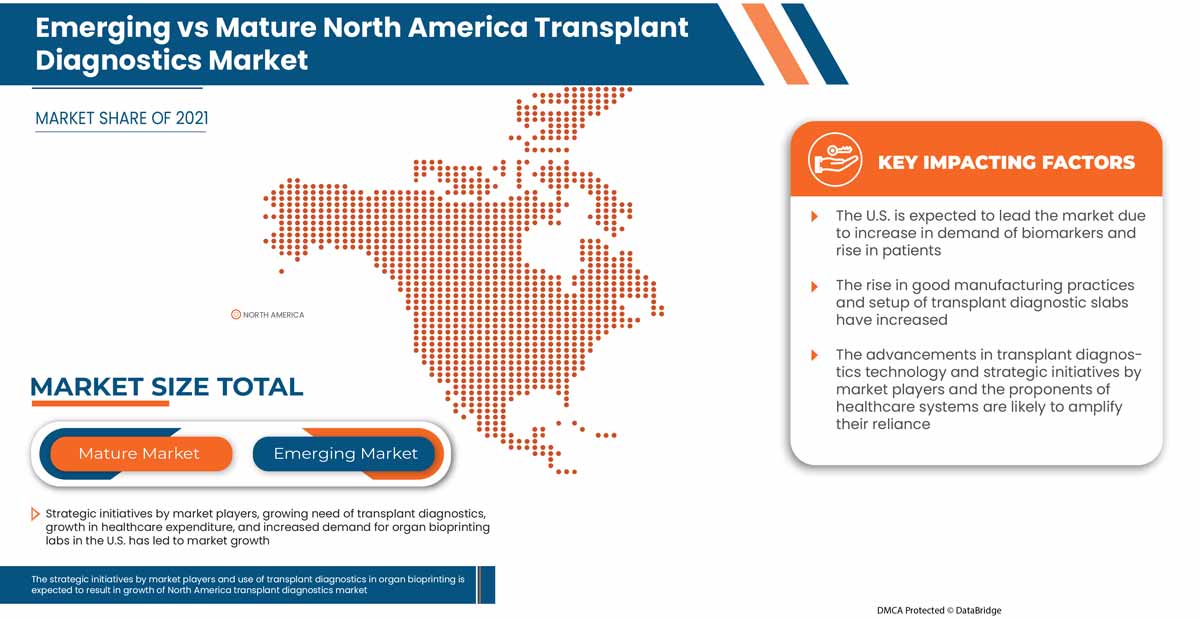

Iniciativas estratégicas dos players do mercado

A ascensão do mercado de diagnóstico de transplantes na América do Norte aumenta a necessidade de ideias estratégicas de negócio. Inclui parceria, expansão de negócios e outros desenvolvimentos. O aumento da procura de dadores de órgãos está a aumentar significativamente a procura de kits de diagnóstico para transplante. As estratégias planeadas permitem que os intervenientes no mercado se alinhem com as atividades funcionais da organização para atingir os objetivos definidos. Orienta as discussões e a tomada de decisões da empresa na determinação dos requisitos de recursos e orçamento para atingir os objetivos, aumentando assim a eficiência operacional.

Estas iniciativas estratégicas, tais como lançamentos de produtos, acordos e expansão de negócios pelos principais players do mercado, impulsionarão o crescimento do mercado e deverão funcionar como uma oportunidade para o mercado de diagnóstico de transplantes da América do Norte. Espera-se que as iniciativas estratégicas ajudem no crescimento e melhorem o portefólio de produtos da empresa, levando, em última análise, a mais geração de receitas. Assim sendo, estas iniciativas estratégicas dos participantes do mercado podem ser esperadas como uma oportunidade que os ajude a impulsionar o mercado de diagnóstico de transplantes da América do Norte.

Desafio

- Desafios éticos enfrentados durante o transplante de órgãos

O aumento da incidência de falência de órgãos vitais e o fornecimento inadequado de órgãos criou um grande fosso entre a oferta e a procura de órgãos. A questão resultou em longos prazos de aprovação para receber um órgão e num aumento do número de mortes. Os acontecimentos, ocorridos nos anos anteriores e que se mantêm no presente, levantaram muitas questões éticas, morais e sociais relativas ao fornecimento, aos métodos de atribuição de órgãos e à utilização de dadores vivos como voluntários, incluindo menores.

Falta de precisão nos relatórios, os órgãos doados não podem ser fornecidos e os procedimentos que não aliviam o sofrimento nem prolongam a vida são rapidamente identificados.

Questões como a falta de obtenção de órgãos, a aceitação religiosa, a morte cerebral e conceitos errados relacionados com a doação e transplante de órgãos ainda estão presentes em muitos níveis éticos pessoais e comunitários, mesmo dentro da comunidade médica. Os diversos aspetos de natureza ética, cultural e religiosa não devem ser uma barreira ao ato de doação e transplante de órgãos, todas estas são questões a resolver. Assim sendo, espera-se que os desafios éticos enfrentados durante o transplante de órgãos desafiem o crescimento do mercado.

Impacto pós-COVID-19 no mercado de diagnóstico de transplantes da América do Norte

O mercado de diagnóstico de transplantes da América do Norte foi gravemente afetado pelo COVID-19. As admissões hospitalares limitaram-se a tratamentos não essenciais e as clínicas foram temporariamente encerradas durante a pandemia. A implementação do distanciamento social, o bloqueio da população e o acesso limitado às clínicas afetaram muito o mercado. A desaceleração dos fluxos e encaminhamentos de doentes também afetou o crescimento do mercado. Contudo, o mercado continuará a crescer no período pós-pandemia devido ao relaxamento das restrições anteriormente impostas.

Os fabricantes estão a tomar várias decisões estratégicas para recuperar após a COVID-19. Os participantes estão a conduzir diversas atividades de I&D, lançamentos de produtos e parcerias estratégicas para melhorar a tecnologia e os resultados dos testes no mercado de diagnóstico de transplantes da América do Norte.

Desenvolvimentos recentes

- Em julho de 2022, a Horiba Medical lançou um novo produto na sua categoria Yumizen Hematology. O produto possui características novas e avançadas para satisfazer as necessidades de diversos requisitos clínicos e laboratoriais. Isto ajudou a empresa a diversificar as suas ofertas de produtos

- Em janeiro de 2022, a Hoffmann-La Roche Ltd lançou o Cobas Infinity edge, uma plataforma de ponto de atendimento baseada na nuvem e acessível. Com a sua tecnologia avançada, os profissionais de saúde podem lidar com os dados dos pacientes. Isto ajudou a empresa a diversificar a sua linha de produtos

Âmbito do mercado de diagnóstico de transplante da América do Norte

O mercado de diagnóstico de transplantes da América do Norte está segmentado em tipo de produto, tecnologia, tipo de transplante, aplicação, utilizador final e canal de distribuição. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

Tipo de produto

- Instrumento de diagnóstico de transplante

- Software de diagnóstico de transplante

- Reagente de diagnóstico de transplante

Com base no tipo de produto, o mercado de diagnóstico de transplante da América do Norte está segmentado em instrumento de diagnóstico de transplante, software de diagnóstico de transplante, reagente de diagnóstico de transplante.

Tecnologia

- Ensaios Moleculares Baseados em PCR

- Ensaios Moleculares Baseados em Sequenciação

Com base na tecnologia, o mercado de diagnóstico de transplantes da América do Norte está segmentado em ensaios moleculares baseados em PCR e ensaios moleculares baseados em sequenciação.

Tipo de transplante

- Transplante de órgãos sólidos

- Transplante de células estaminais

- Transplante de tecidos moles

- Transplante de Medula Óssea

- Outros transplantes

Com base no tipo de transplante, o mercado de diagnóstico de transplantes da América do Norte está segmentado em transplante de órgãos sólidos, transplante de células estaminais, transplante de tecidos moles, transplante de medula óssea e outros transplantes.

Aplicação

- Aplicações de diagnóstico

- Aplicações de investigação

Com base na aplicação, o mercado de diagnóstico de transplantes da América do Norte está segmentado em aplicações de diagnóstico e aplicações de investigação.

Utilizador final

- Laboratórios de Investigação e Institutos Académicos

- Hospitais e Centros de Transplantação

- Prestadores de serviços comerciais

- Outros

Com base no utilizador final, o mercado de diagnóstico de transplantes da América do Norte está segmentado em laboratórios de investigação e institutos académicos, hospitais e centros de transplantes, prestadores de serviços comerciais, entre outros.

Canal de Distribuição

- Concurso Direto

- Vendas no Retalho

- Outros

Com base no canal de distribuição, o mercado de diagnóstico de transplantes da América do Norte está segmentado em licitação direta, vendas a retalho, entre outros.

Análise/perspetivas regionais do mercado de diagnóstico de transplantes da América do Norte

O mercado de diagnóstico de transplantes da América do Norte é analisado e são fornecidas informações sobre o tamanho do mercado por país, tipo de produto, tecnologia, tipo de transplante, aplicação, utilizador final e canal de distribuição.

Alguns países abrangidos pelo mercado de diagnóstico de transplantes da América do Norte são os EUA, o Canadá e o México.

Espera-se que os EUA dominem o mercado de diagnóstico de transplantes da América do Norte devido à presença de importantes intervenientes no mercado no maior mercado consumidor com um PIB elevado.

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações na regulamentação nacional que impactam as tendências atuais e futuras do mercado. Dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, são considerados a presença e disponibilidade de marcas norte-americanas e os desafios enfrentados devido à concorrência grande ou escassa de marcas locais e nacionais e o impacto dos canais de vendas, ao mesmo tempo que se fornece uma análise de previsão dos dados do país.

Análise do cenário competitivo e da quota de mercado de diagnóstico de transplantes da América do Norte

O panorama competitivo do mercado de diagnóstico de transplantes da América do Norte fornece detalhes dos concorrentes. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em I&D, novas iniciativas de mercado, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, pipelines de testes de produtos, aprovações de produtos, patentes, largura e respiração do produto, domínio da aplicação, curva da linha de vida da tecnologia. Os dados fornecidos acima estão apenas relacionados com o foco da empresa no mercado de diagnóstico de transplantes da América do Norte.

Alguns dos principais players que operam no mercado norte-americano de diagnóstico de transplantes são a Hologic, Inc., Biofortuna Limited, Takara Bio Inc., Abbott, Diagnóstica Longwood SL, Adaptive Biotechnologies, NanoString, Arquer Diagnostics Ltd, altona Diagnostics GmbH, ELITechGroup , DiaSorin SpA , Horiba Ltd, EUROFINS VIRACOR, CareDx Inc., Laboratory Corporation of America Holdings., Randox Laboratories Ltd., Thermo Fisher Scientific Inc., Preservation Solutions, Inc., TransMedics, Transonic, Stryker, Bio-Rad Laboratories, Inc. ., Zimmer Biomet, QIAGEN, F. Hoffmann-La Roche Ltd, BIOMÉRIEUX, Illumina, Inc., Luminex Corporation (uma subsidiária da DiaSorin Company), IMMUCOR, entre outros.

Metodologia de Investigação: Mercado de Diagnóstico de Transplantes da América do Norte

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Além disso, os modelos de dados incluem uma grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise da quota de mercado da empresa, padrões de medição, América do Norte vs regional e análise da participação dos fornecedores. Solicite uma chamada de analista em caso de dúvidas adicionais.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 EPIDEMOLOGY

3.2 PESTEL_ANALYSIS

3.3 PORTER'S FIVE FORCE

3.4 TECHNOLOGICAL INNOVATIONS

4 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: REGULATIONS

5 KEY STRATEGIC INITIATIVES

6 INDUSTRIAL INSIGHTS:

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING NUMBER OF TRANSPLANT PROCEDURES

7.1.2 INCREASE IN THE TECHNOLOGICAL ADVANCEMENTS IN THE FIELD OF TRANSPLANTS

7.1.3 RISING HEALTHCARE SPENDING

7.1.4 ADOPTION OF CROSS-MATCHING AND CHIMERISM TESTING DURING PRE- AND POST-TRANSPLANTATION

7.2 RESTRAINTS

7.2.1 HIGH COST OF ORGAN TRANSPLANTATION

7.2.2 THE RISKS AND DIFFICULTIES OF ORGAN TRANSPLANTATION

7.3 OPPORTUNITIES

7.3.1 STRATEGIC INITIATIVES BY MARKET PLAYERS

7.3.2 RISE IN PUBLIC, PRIVATE, AND GOVERNMENT FUNDING FOR ORGAN TRANSPLANTATION

7.3.3 SURGE IN AWARENESS ABOUT THE IMPORTANCE OF ORGAN TRANSPLANTATION

7.4 CHALLENGES

7.4.1 ETHICAL CHALLENGES FACED DURING ORGAN TRANSPLANTATION

7.4.2 LACK OF ORGAN DONORS OR GAP BETWEEN ORGAN DONORS AND ORGANS NEEDED ANNUALLY

8 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 TRANSPLANT DIAGNOSTIC INSTRUMENTS

8.2.1 AUTOMATED PIPETTORS & DISPENSERS

8.2.2 AUTOMATED SYSTEMS

8.2.2.1 NUCLEIC ACID EXTRACTION SYSTEM

8.2.2.2 PCR SETUP

8.2.2.3 OTHERS

8.2.3 NGS INSTRUMENTS

8.2.4 READERS & ANALYZERS

8.2.5 TRANSPLANT DIAGNOSTIC KITS

8.2.5.1 ASPERGILLUS SPP KITS

8.2.5.2 P. JIROVECII KITS

8.2.5.3 CMV KITS

8.2.5.4 EBV KITS

8.2.5.5 BKV KITS

8.2.5.6 VZV KITS

8.2.5.7 HSV1 KITS

8.2.5.8 HSV2 KITS

8.2.5.9 PARVOVIRUS B19 KITS

8.2.5.10 ADENOVIRUS KITS

8.2.5.11 ENTEROVIRUS KITS

8.2.5.12 JCV KITS

8.2.5.13 HHV6 KITS

8.2.5.14 HHV7 KITS

8.2.5.15 HHV8 KITS

8.2.5.16 TOXOPLASMA GONDII KITS

8.2.5.17 HEPATITIS E KITS

8.2.5.18 OTHER KITS

8.2.6 OTHER KITS

8.3 TRANSPLANT DIAGNOSTIC SOFTWARE’S

8.3.1 DNA SOFTWARE

8.3.2 NGS SOFTWARE

8.3.3 DATA MANAGEMENT SOFTWARE

8.3.4 OTHER SOFTWARE’S

8.4 TRANSPLANT DIAGNOSTIC REAGENTS

8.4.1 MONOCLONAL ANTIBODIES

8.4.2 CYTOTOXIC CONTROLS

8.4.3 HUMAN SERUM

8.4.4 OTHER REAGENTS

9 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 PCR-BASED MOLECULAR ASSAYS

9.2.1 REAL TIME PCR

9.2.2 SEQUENCE-SPECIFIC PRIMER-PCR

9.2.3 SEQUENCE-SPECIFIC OLIGONUCLEOTIDE-PCR

9.2.4 RESTRICTION FRAGMENT LENGTH POLYMORPHISM (RFLP)

9.2.5 OTHER-PCR BASED MOLECULAR ASSAYS

9.3 SEQUENCING-BASED MOLECULAR ASSAYS

9.3.1 SANGER SEQUENCING

9.3.2 NEXT GENERATION SEQUENCING

9.3.3 OTHER SEQUENCING-BASED MOLECULAR ASSAYS.

10 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE

10.1 OVERVIEW

10.2 SOLID ORGAN TRANSPLANTATION

10.2.1 KIDNEY TRANSPLANTATION

10.2.2 LIVER TRANSPLANTATION

10.2.3 HEART TRANSPLANTATION

10.2.4 LUNG TRANSPLANTATION

10.2.5 PANCREAS TRANSPLANTATION

10.2.6 OTHER ORGAN TRANSPLANTATIONS

10.3 STEM CELL TRANSPLANTATION

10.3.1 BONE MARROW TRANSPLANT (BMT)

10.3.2 PERIPHERAL BLOOD STEM CELL TRANSPLANT

10.3.3 CORD BLOOD TRANSPLANT

10.3.4 OTHER STEM CELL TRANSPLANTS

10.4 SOFT TISSUE TRANSPLANTATION

10.4.1 SKIN GRAFT

10.4.2 CARTILAGE TRANSPLANTATION

10.4.3 ADRENAL AUTOGRAFTING

10.4.4 OTHER SOFT TISSUE TRANSPLANTATION.

10.5 BONE MARROW TRANSPLANTATION

10.5.1 AUTOLOGOUS BONE MARROW TRANSPLANT

10.5.2 ALLOGENEIC BONE MARROW TRANSPLANT

10.5.3 UMBILICAL CORD BLOOD TRANSPLANT.

10.6 OTHERS

11 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 DIAGNOSTIC APPLICATIONS

11.2.1 TRANSPLANT DIAGNOSTIC INSTRUMENT

11.2.1.1 AUTOMATED PIPETTORS & DISPENSERS

11.2.1.2 AUTOMATED SYSTEMS

11.2.1.3 NGS INSTRUMENTS

11.2.1.4 READERS & ANALYZERS

11.2.1.5 TRANSPLANT DIAGNOSTIC KITS

11.2.1.6 OTHERS

11.2.2 TRANSPLANT DIAGNOSTIC SOFTWARE

11.2.2.1 DNA SOFTWARE

11.2.2.2 NGS SOFTWARE

11.2.2.3 DATA MANAGEMENT SOFTWARE

11.2.2.4 OTHER SOFTWARES

11.2.3 TRANSPLANT DIAGNOSTIC REAGENT

11.2.3.1 MONOCLONAL ANTIBODIES

11.2.3.2 CYTOTOXIC CONTROLS

11.2.3.3 HUMAN SERUM

11.2.3.4 OTHER REAGENTS

11.3 RESEARCH APPLICATIONS

11.3.1 TRANSPLANT DIAGNOSTIC INSTRUMENT

11.3.1.1 AUTOMATED PIPETTORS & DISPENSERS

11.3.1.2 AUTOMATED SYSTEMS

11.3.1.3 NGS INSTRUMENTS

11.3.1.4 READERS & ANALYZERS

11.3.1.5 TRANSPLANT DIAGNOSTIC KITS

11.3.1.6 OTHERS

11.3.2 TRANSPLANT DIAGNOSTIC SOFTWARE

11.3.2.1 DNA SOFTWARE

11.3.2.2 NGS SOFTWARE

11.3.2.3 DATA MANAGEMENT SOFTWARE

11.3.2.4 OTHER SOFTWARES

11.3.3 TRANSPLANT DIAGNOSTIC REAGENT

11.3.3.1 MONOCLONAL ANTIBODIES

11.3.3.2 CYTOTOXIC CONTROLS

11.3.3.3 HUMAN SERUM

11.3.3.4 OTHER REAGENTS

12 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS AND TRANSPLANT CENTERS

12.3 COMMERCIAL SERVICE PROVIDERS

12.4 RESEARCH LABORATORIES AND ACADEMIC INSTITUTES

12.5 OTHERS

13 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDER

13.3 RETAIL SALES

13.4 OTHERS

14 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 ABBOTT

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 THERMO FISHER SCIENTIFIC INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 F. HOFFMANN LA ROCHE LTD

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 TAKARA BIO INC.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 HOLOGIC, INC

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 ADAPTIVE BIOTECHNOLOGIES

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 ALTONA DIAGNOSTICS

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 ARQUER DIAGNOSTICS LTD

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 BAG DIAGNOSTICS GMBH

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 BIOFORTUNA LIMITED

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 BIOMÉRIEUX

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 BIO-RAD LABORATORIES, INC.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENT

17.13 BIOTYPE GMBH

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 CAREDX INC.

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 CLONIT SRL

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 DIAGNOSTICA LONGWOOD SL

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 DIASORIN S.P.A.

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENT

17.18 ELITECHGROUP

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 EUROFINS VIRACOR

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 HORIBA LTD

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENT

17.21 ILLUMINA, INC.

17.21.1 COMPANY SNAPSHOT

17.21.2 REVENUE ANALYSIS

17.21.3 PRODUCT PORTFOLIO

17.21.4 RECENT DEVELOPMENTS

17.22 IMMUCOR

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

17.23 LABORATORY CORPORATION OF AMERICA HOLDINGS.

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENTS

17.24 LUMINEX CORPORATION. (A SUBSIDIARY OF DIASORIN)

17.24.1 COMPANY SNAPSHOT

17.24.2 REVENUE ANALYSIS

17.24.3 PRODUCT PORTFOLIO

17.24.4 RECENT DEVELOPMENT

17.25 NANOSTRING

17.25.1 COMPANY SNAPSHOT

17.25.2 REVENUE ANALYSIS

17.25.3 PRODUCT PORTFOLIO

17.25.4 RECENT DEVELOPMENT

17.26 PATHONOSTICS

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENTS

17.27 PRESERVATION SOLUTIONS, INC.

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENTS

17.28 QIAGEN

17.28.1 COMPANY SNAPSHOT

17.28.2 REVENUE ANALYSIS

17.28.3 PRODUCT PORTFOLIO

17.28.4 RECENT DEVELOPMENTS

17.29 RANDOX LABORATORIES LTD.

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT DEVELOPMENTS

17.3 STRYKER

17.30.1 COMPANY SNAPSHOT

17.30.2 REVENUE ANALYSIS

17.30.3 PRODUCT PORTFOLIO

17.30.4 RECENT DEVELOPMENT

17.31 TRANSMEDICS

17.31.1 COMPANY SNAPSHOT

17.31.2 REVENUE ANALYSIS

17.31.3 PRODUCT PORTFOLIO

17.31.4 RECENT DEVELOPMENTS

17.32 TRANSONIC.

17.32.1 COMPANY SNAPSHOT

17.32.2 PRODUCT PORTFOLIO

17.32.3 RECENT DEVELOPMENT

17.33 ZIMMER BIOMET

17.33.1 COMPANY SNAPSHOT

17.33.2 REVENUE ANALYSIS

17.33.3 PRODUCT PORTFOLIO

17.33.4 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tabela

TABLE 1 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA TRANSPLANT DIAGNOSTIC INSTRUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA TRANSPLANT DIAGNOSTIC INSTRUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA AUTOMATED SYSTEMS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA TRANSPLANT DIAGNOSTIC SOFTWARE’S IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA TRANSPLANT DIAGNOSTIC SOFTWARE’S IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA PCR-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PCR-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA SEQUENCING-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA SEQUENCING-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA SOLID ORGAN TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA SOLID ORGAN TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA STEM CELL TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA STEM CELL TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA SOFT TISSUE TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA SOFT TISSUE TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA BONE MARROW TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA BONE MARROW TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA OTHERS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA DIAGNOSTIC APPLICATIONS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA DIAGNOSTIC APPLICATIONS IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA TRANSPLANT DIAGNOSTIC INSTRUMENTS IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA TRANSPLANT DIAGNOSTIC SOFTWARE IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA TRANSPLANT DIAGNOSTIC REAGENT IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA RESEARCH APPLICATIONS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA RESEARCH APPLICATIONS IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA TRANSPLANT DIAGNOSTIC INSTRUMENTS IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA TRANSPLANT DIAGNOSTIC SOFTWARE IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA TRANSPLANT DIAGNOSTIC REAGENT IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA HOSPITALS AND TRANSPLANT CENTERS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA COMMERCIAL SERVICE PROVIDERS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA RESEARCH LABORATORIES AND ACADEMIC INSTITUTES IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA OTHERS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA DIRECT TENDER IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA RETAIL SALES IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA OTHERS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA AUTOMATED SYSTEMS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA PCR-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA SEQUENCE-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA SOLID ORGAN TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA STEM CELL TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA SOFT TISSUE TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA BONE-MARROW TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA DIAGNOSTICS APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA RESEARCH APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 U.S. TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 U.S. TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 U.S. AUTOMATED PIPETTORS & DISPENSERS, BY PRODUCT TYPE, 2020-2029 VOLUME (UNITS)

TABLE 74 U.S. AUTOMATED PIPETTORS & DISPENSERS, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 75 U.S. AUTOMATED SYSTEMS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 76 U.S. TRANSPLANT DIAGNOSTIC INSTUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 77 U.S. TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 78 U.S. TRANSPLANT DIAGNOSTIC INSTUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 79 U.S. TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 80 U.S. TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 81 U.S. TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 82 U.S. TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 83 U.S. TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 U.S. TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 85 U.S. TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 86 U.S. TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 87 U.S. TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 88 U.S. PCR-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 89 U.S. SEQUENCE-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 U.S. TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 91 U.S. SOLID ORGAN TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 92 U.S. STEM CELL TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 93 U.S. SOFT TISSUE TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 94 U.S. BONE-MARROW TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 95 U.S. TRANSPLANT DIAGNOSTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 U.S. DIAGNOSTICS APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 97 U.S. TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 98 U.S. TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 99 U.S. TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 100 U.S. RESEARCH APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 101 U.S. TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 102 U.S. TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 103 U.S. TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 U.S. TRANSPLANT DIAGNOSTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 105 U.S. TRANSPLANT DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 106 CANADA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 107 CANADA TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 CANADA AUTOMATED PIPETTORS & DISPENSERS, BY PRODUCT TYPE, 2020-2029 VOLUME (UNITS)

TABLE 109 CANADA AUTOMATED PIPETTORS & DISPENSERS, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 110 CANADA AUTOMATED SYSTEMS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 111 CANADA TRANSPLANT DIAGNOSTIC INSTUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 112 CANADA TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 113 CANADA TRANSPLANT DIAGNOSTIC INSTUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 114 CANADA TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 115 CANADA TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 116 CANADA TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 117 CANADA TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 118 CANADA TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 119 CANADA TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 120 CANADA TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 121 CANADA TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 122 CANADA TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 123 CANADA PCR-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 124 CANADA SEQUENCE-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 125 CANADA TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 126 CANADA SOLID ORGAN TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 127 CANADA STEM CELL TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 128 CANADA SOFT TISSUE TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 129 CANADA BONE-MARROW TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 130 CANADA TRANSPLANT DIAGNOSTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 131 CANADA DIAGNOSTICS APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 132 CANADA TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 133 CANADA TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 134 CANADA TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 135 CANADA RESEARCH APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 136 CANADA TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 137 CANADA TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 138 CANADA TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 139 CANADA TRANSPLANT DIAGNOSTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 140 CANADA TRANSPLANT DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 141 MEXICO TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 142 MEXICO TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 143 MEXICO AUTOMATED PIPETTORS & DISPENSERS, BY PRODUCT TYPE, 2020-2029 VOLUME (UNITS)

TABLE 144 MEXICO AUTOMATED PIPETTORS & DISPENSERS, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 145 MEXICO AUTOMATED SYSTEMS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 146 MEXICO TRANSPLANT DIAGNOSTIC INSTUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 147 MEXICO TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 148 MEXICO TRANSPLANT DIAGNOSTIC INSTUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 149 MEXICO TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 150 MEXICO TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 151 MEXICO TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 152 MEXICO TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 153 MEXICO TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 154 MEXICO TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 155 MEXICO TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 156 MEXICO TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 157 MEXICO TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 158 MEXICO PCR-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 159 MEXICO SEQUENCE-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 160 MEXICO TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 161 MEXICO SOLID ORGAN TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 162 MEXICO STEM CELL TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 163 MEXICO SOFT TISSUE TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 164 MEXICO BONE-MARROW TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 165 MEXICO TRANSPLANT DIAGNOSTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 166 MEXICO DIAGNOSTICS APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 167 MEXICO TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 168 MEXICO TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 169 MEXICO TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 170 MEXICO RESEARCH APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 171 MEXICO TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 172 MEXICO TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 173 MEXICO TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 174 MEXICO TRANSPLANT DIAGNOSTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 175 MEXICO TRANSPLANT DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Lista de Figura

FIGURE 1 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 11 INCREASING USE OF TRANSPLANT DIAGNOSTICS IS EXPECTED TO DRIVE THE NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET IN THE FORECAST PERIOD

FIGURE 12 TRANSPLANT DIAGNOSTIC INSTRUMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET

FIGURE 14 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY PRODUCT TYPE, 2021

FIGURE 15 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TECHNOLOGY, 2021

FIGURE 19 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TECHNOLOGY, 2022-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TECHNOLOGY, LIFELINE CURVE

FIGURE 22 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TRANSPLANT TYPE, 2021

FIGURE 23 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TRANSPLANT TYPE, 2022-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TRANSPLANT TYPE, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TRANSPLANT TYPE, LIFELINE CURVE

FIGURE 26 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY APPLICATION, 2021

FIGURE 27 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 30 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY END USER, 2021

FIGURE 31 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 32 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY END USER, CAGR (2022-2029)

FIGURE 33 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY END USER, LIFELINE CURVE

FIGURE 34 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 35 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 36 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 37 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: SNAPSHOT (2021)

FIGURE 39 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY COUNTRY (2021)

FIGURE 40 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 41 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 42 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 43 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.