North America Tissue Paper Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

14.31 Billion

USD

20.51 Billion

2025

2033

USD

14.31 Billion

USD

20.51 Billion

2025

2033

| 2026 –2033 | |

| USD 14.31 Billion | |

| USD 20.51 Billion | |

|

|

|

|

Mercado de papel higiénico da América do Norte, por tipo de produto (papel higiénico, toalha de tecido, guardanapo de papel, toalhete facial, toalhitas e outros) Canal de distribuição (lojas de retalho, comércio eletrónico, vendas diretas e outros) Utilização final ( cuidados domiciliários , comercial , Cuidados pessoais, saúde, hotelaria e outros) por país (EUA, Canadá, México) Tendências e previsões do setor para 2028.

Análise de Mercado e Insights: Mercado de Papel Tissue da América do Norte

Análise de Mercado e Insights: Mercado de Papel Tissue da América do Norte

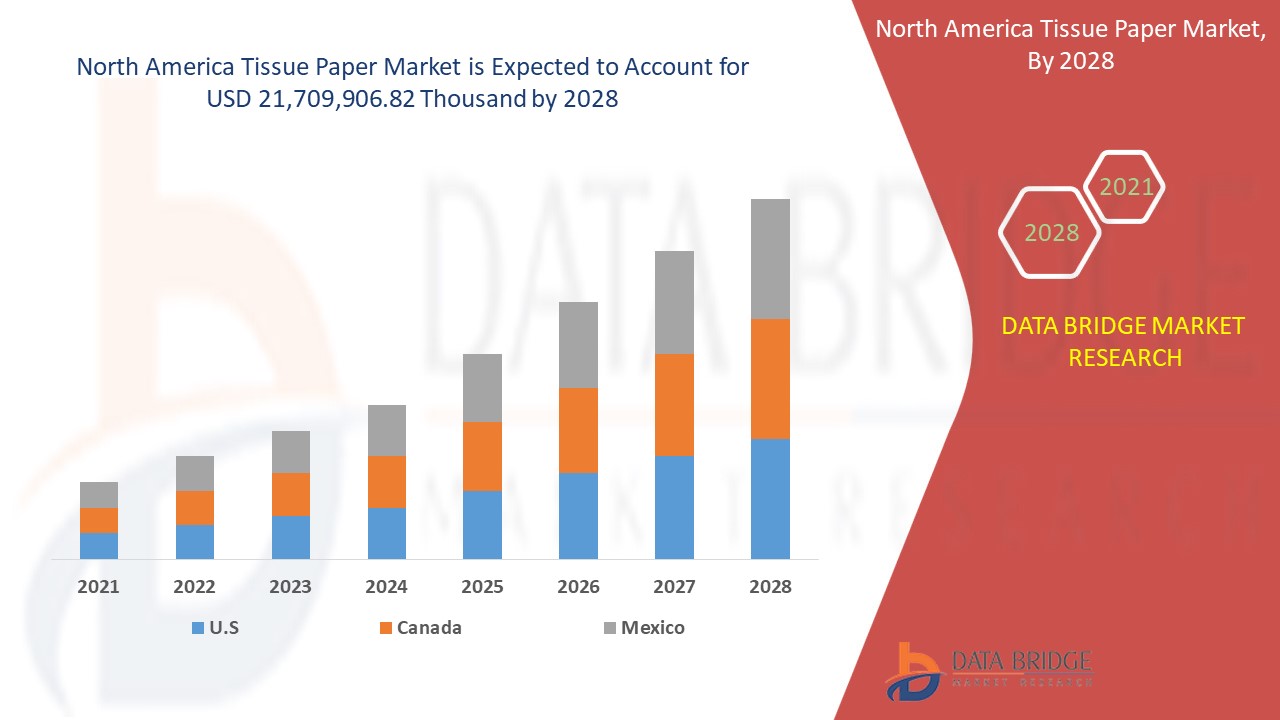

O mercado norte-americano de papel tissue deverá atingir os 21.709.906,82 milhares de dólares até 2028, face aos 16.387.472,49 milhares de dólares em 2020, crescendo a um CAGR constante de 3,4% no período de previsão de 2021 a 2028.

Tecido é um termo abrangente que se refere a um tipo de papel com uma textura transparente, pode ser esmaltado, não esmaltado ou crepado e tem diversas funções. Pode ser feito transformando as árvores em lascas de madeira e depois cozinhando-as para separar a fibra (celulose) da cola que mantém a árvore unida. Esta fibra é posteriormente transformada em folha e, eventualmente, em tecido. Os produtos de tecido são diversos e omnipresentes e ajudam diariamente a melhorar a qualidade de vida em todo o mundo.

O papel de seda é um papel leve com diversas propriedades, tais como absorção, gramagem básica, espessura, volume, brilho, elasticidade, aparência e conforto. Pode ser utilizado para diversos fins, principalmente para a manutenção da higiene. Os fatores que deverão impulsionar o crescimento do mercado são as mudanças nas prioridades dos secadores de mãos para toalhas de mão devido ao COVID-19, um aumento da sensibilização para a saúde e higiene e um aumento da procura de toalhitas faciais. Os fatores que deverão conter o crescimento do mercado são a flutuação dos preços das matérias-primas e o reforço das regulamentações contra a desflorestação.

Este relatório de mercado de papel higiénico fornece detalhes de quota de mercado, novos desenvolvimentos e análise de pipeline de produtos, impacto dos participantes do mercado doméstico e localizado, analisa oportunidades em termos de bolsas de receitas emergentes, mudanças nas regulamentações de mercado, aprovações de produtos, decisões estratégicas, lançamentos de produtos, expansões geográficas e inovações tecnológicas no mercado. Para compreender a análise e o cenário do mercado contacte-nos para um Analyst Brief, a nossa equipa irá ajudá-lo a criar uma solução de impacto na receita para atingir o objetivo desejado.

Âmbito do mercado de papel de seda da América do Norte e dimensão do mercado

Âmbito do mercado de papel de seda da América do Norte e dimensão do mercado

O mercado norte-americano de papel higiénico está segmentado em três segmentos notáveis com base no tipo de produto, canal de distribuição e utilização final.

- Com base no tipo de produto, o mercado norte-americano de papel higiénico está segmentado em papel higiénico, toalha de tecido, guardanapo de papel, lenço facial, toalhitas, entre outros. Em 2021, prevê-se que o segmento do papel higiénico domine o mercado devido à propriedade de fácil eliminação do papel higiénico.

- Com base no canal de distribuição, o mercado norte-americano de papel higiénico está segmentado em lojas de retalho, e-commerce, vendas diretas, entre outros. Em 2021, prevê-se que o segmento das lojas de retalho domine o mercado devido ao elevado potencial de vendas e ao benefício do serviço oferecido aos clientes.

- Com base na utilização final, o mercado norte-americano de papel higiénico está segmentado em cuidados domiciliários, comerciais, cuidados pessoais, saúde, hotelaria, entre outros. Em 2021, prevê-se que o segmento dos cuidados domiciliários domine o mercado devido à crescente consciencialização em relação à higiene doméstica e à disponibilidade de maiores variedades de papel higiénico.

Análise ao nível do país do mercado de papel de seda da América do Norte

Análise ao nível do país do mercado de papel de seda da América do Norte

O mercado norte-americano de papel higiénico está segmentado em três segmentos notáveis com base no tipo de produto, canal de distribuição e utilização final.

Os países abordados no relatório sobre o mercado de papel tissue da América do Norte são os EUA, o Canadá e o México.

Espera-se que os EUA dominem o mercado devido ao aumento da procura de lenços faciais no país. Espera-se que o Canadá domine o mercado devido à crescente consciencialização sobre a higiene pessoal devido ao COVID 19. Espera-se que o México domine o mercado devido ao aumento da necessidade de cuidados pessoais e de artigos sanitários

A secção do país do relatório também fornece fatores individuais de impacto no mercado e alterações na regulamentação do mercado interno que impactam as tendências atuais e futuras do mercado. Dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade das marcas europeias e os desafios enfrentados devido à grande ou escassa concorrência das marcas locais e nacionais, o impacto dos canais de vendas são considerados, ao mesmo tempo que se fornecem uma análise de previsão dos dados do país.

Aumento da procura por papéis de seda

O mercado de papel higiénico da América do Norte também fornece análises de mercado detalhadas para o crescimento da indústria de cada país com vendas, vendas de componentes, impacto do desenvolvimento tecnológico em papel higiénico e mudanças nos cenários regulamentares com o seu suporte para o mercado de papel higiénico da América do Norte. Os dados estão disponíveis para o período histórico de 2010 a 2019.

Análise do cenário competitivo e da quota de mercado do papel higiénico da América do Norte

O panorama competitivo do mercado norte-americano de papel higiénico fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença global, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos , pipelines de testes de produtos, aprovações de produtos, patentes, largura e amplitude do produto, domínio da aplicação, curva de segurança da tecnologia. Os dados fornecidos acima estão apenas relacionados com o foco das empresas relacionado com o mercado de papel tissue da América do Norte.

Alguns dos principais players que operam no mercado do papel higiénico são a Procter & Gamble, KCWW, KP Tissue Inc., Cascades Inc., Irving Consumer Products Limited., Asaleo Care Limited, Lucart SpA, Georgia-Pacific, METSÄ TISSUE, SOFIDEL, von Drehle Corporation., First Quality Enterprises, Inc., Clearwater Paper Corporation, Gorham Paper & Tissue., Nova Tissue Company Ltd, Flower City Tissue Mills Co., Paloma, Global Tissue Group, Inc., Essity Aktiebolag (publ)., WEPA Hygieneprodukte GmbH entre outros.

O mercado norte-americano do papel higiénico é fragmentado, e os principais players têm utilizado diversas estratégias, tais como colaboração, reconhecimento, acordos, lançamento de produtos e outras para aumentar as suas pegadas no mercado do papel higiénico.

Por exemplo,

- Em julho de 2021, a KCWW concluiu a aquisição da SK Corporation de Taiwan. A sociedade SK detém os direitos de marca registada e de distribuição em Taiwan para marcas globais KCWW, como a Kleenex. Esta aquisição ajudou a adquirir os direitos de distribuição aumentando a sua quota de mercado.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.